Posts by FT

Canadian Dividend Kings & Aristocrats – February 2026

Investing in Canadian Dividend Kings (sometimes known as Dividend Aristocrats) tends to get more popular when low-risk investment yields start to go down. With safer assets generating so little income, dependable dividend payers begin to look more and more attractive. Of course, staying focused on dependable (but but boring) dividends can be a challenge when…

Read MoreBest Stock Trading Apps in Canada

After two decades of DIY investing, I’ve had a front-row seat to the evolution of stock trading apps in Canada. Canadian investors had very limited options when I first launched Million Dollar Journey. The big banks dominated the market, trading fees were high, and mobile trading platforms were clunky and felt unreliable. Executing a stock…

Read MoreWealthsimple Review 2026

What is Wealthsimple? Wealthsimple was founded in 2014 by Michael Katchen, Brett Huneycutt, and Rudy Adler. I’ll be upfront about my bias here. I liked the company a lot more in its early years than I do today. In fairness, the platform that I really fell for back in 2015 and 2016 wasn’t nearly as…

Read MoreBest USD Bank Accounts in Canada

Choosing the best USD bank account in Canada isn’t about convenience – it’s also about control. Control over when you convert your money. Control over how often you pay foreign exchange fees. And, in many cases, control over hundreds of dollars a year that quietly disappear through spreads and “small” bank charges most people never…

Read MoreInvesting in Canadian Bank Stocks 2026

As we look at the possibilities for investing in Canadian bank stocks in 2026, it’s important to realize just what an incredible year we’re coming off of in 2025. As you can see in the chart below, TD was the runaway winner, but all six Canadian banks rewarded shareholders handsomely. They were some of the…

Read More49 Best ETFs in Canada – January 2026

When I started writing about Canadian personal finance roughly two decades ago, choosing the best ETFs in Canada was pretty easy. You could basically count the number of options on your fingers. There were no Canadian all-in-one ETFs, no clever ticker symbols, and no glossy marketing pushing “new” leveraged fund strategies every quarter. ETFs were…

Read MoreDogs of the TSX Dividend Stock Picks

The “Dogs of the TSX” dividend investing strategy for Canadian stocks has been a focus of mine for the past 14 years. I don’t follow the “Dogs” strategy with a majority of my portfolio, but it is a key factor when I look at my relative weighting of Canadian stocks at the end of each…

Read MoreBest Canadian Robo Advisors 2026

As we head into the 2026 RRSP season, the best Canadian robo advisors are rolling their most competitive offers of the year. The idea is that companies want to put their best foot forward at the time Canadians are paying the most attention to their finances. Justwealth (our current 2026 top robo advisor) is offering…

Read MoreQuestrade vs Qtrade in 2026

When I started Million Dollar Journey twenty years ago the Questrade vs Qtrade rivalry was already a few years old. Today’s Canadian DIY investors still have these two brokerages at the top of their lists. Perhaps the biggest change over the last two decades is that these two independent Canadian online brokers have widened the…

Read MoreIs Robinhood Available in Canada?

When Robinhood first entered the online brokerage world, its “gamified” approach to commission-free trading changed the way many young investors engaged with the stock market. With its sleek mobile app and zero-commission trades, the platform quickly attracted a new generation of first-time traders. But, since going public – and especially after the release of the…

Read MoreBest Canadian Dividend Stocks – January 2026

As we start a new year, our January 2026 Best Canadian Dividend Stocks list needed a refresh. Last year was an excellent year for all Canadian stocks, with the TSX finishing up around 30%. Canadian dividend stocks specifically finished up around 20% (plus a 4% dividend) depending on which dividend stock index you use as…

Read MoreTop 6 Indexing Options for Your Portfolio in 2026

If you’ve been considering jumping into index investing and fully committing to a passive portfolio, but keep getting caught up in analysis paralysis, you’re far from alone. Many people stall before they even start, unsure of the first step, worried they don’t have enough money, or convinced they need a finance degree in order to…

Read MoreBest Low Risk Investments in Canada Right Now (January 2026)

After a volatile few years and with markets at all-time high valuations, it’s no surprise that many investors are heading into 2026 prioritizing low risk investments in Canada. Between interest rate uncertainty, economic slowdown chatter, and plenty of geopolitical noise, protecting short-term money matters more than squeezing out every last basis point of return for…

Read MoreBest Short Term Investments in Canada Right Now (January 2026)

With interest rates having fallen over the past couple of years, it’s more important than ever to get the most bank for your buck when researching the best short term investments in Canada. It looks like 2026 won’t see a lot of interest rate movement up or down – so the days of 5%+ GICs…

Read MoreBest Canadian High Interest Savings Accounts

While even the best high interest savings accounts saw their rates trend downward in 2025, the interest rate outlook for 2026 is mixed. GIC rates actually ticked up at the end of 2025, and markets seem to believe that the Bank of Canada is ready to sit pat for the medium term. That said, finding…

Read MoreBest Canadian Dividend ETFs for 2026 (And Why We Prefer Dividend Stocks)

Having written about dividend investing in Canada for close to twenty years, I regularly hear from readers wondering whether the best Canadian dividend ETFs are a better value than trying to do the research and select from the best dividend stocks in Canada. It’s clear that Canadian investors have a soft spot for reliable, tax-efficient…

Read MoreMaxed out RRSP and TFSA – Now What?

I recently received an email from a reader with a bright financial future. They have a maxed out TFSA and has recently maxed out her RRSP as well. Here’s a snippet of the email below (edited for brevity). First of all, thank you for sharing your wisdom and financial journey. I love reading your blog and…

Read MoreTFSA Contribution Room In 2026 + TFSA Rules and Limits

The TFSA contribution limit in 2026 is $7,000 (the same TFSA contribution room as we saw in 2024 and 2025). That means that going back to 2009, the total eligible TFSA contribution limit is $109,000. Contributing to your TFSA is one of the cleanest, least controversial moves in Canadian personal finance. No deductions to optimize.…

Read MoreEdward Jones Review (Canada)

After we published our recent article on the best financial advisors in Canada, my inbox lit up with variations of the same question: Should I use Edward Jones financial planners? What about the other big name advisory firms? It seems a lot of Canadians are wondering whether these well known brands actually deliver the value…

Read MoreWealthsimple vs BMO in 2026

While a sleek fintech company like Wealthsimple might have a completely different background than a long-established institution like BMO, they are overlapping to a significant (and increasing) degree as we enter 2026. One built its reputation on simplicity and online design, the other on stability and tradition. But the rise of DIY investing has pushed…

Read MoreThe Best Joint Bank Accounts in Canada

As recently as a few years ago any list of the best joint bank accounts in Canada was basically the Big Five trading places. RBC, TD, BMO, Scotiabank, CIBC, and maybe online upstart Tangerine getting a polite nod (with that online bank being purchased by Scotia). But let’s be honest here, not much separated the…

Read MoreBest All-in-One ETFs in Canada 2026

Canada’s all-in-one ETFs (also called “portfolio ETFs” or “asset-allocation ETFs”) represent arguably the biggest leap forward in investing for DIY Canadians since the first index funds showed up decades ago. They combine the simplicity of an index strategy, the diversification of a full portfolio, and the convenience of “buy once and forget” investing – all…

Read MoreThe Best Investments for Canadian Retirees: Stocks vs ETFs vs Robo Advisors

When we talk about the best investments for Canadian retirees, it’s worth saying upfront that this is a nuanced topic. There isn’t a simple one-size-fits-all answer here. There’s no perfect portfolio hiding out there waiting to solve retirement for all scenarios and tax brackets. I’d suggest starting with this retirement course that I helped out…

Read MoreVEQT ETF 2026 Review

As one of the best ETFs in Canada, as well as a featured contender for our best Canadian all-in-one ETF, VEQT has a lot to live up to. But as good as we thought it was before, VEQT recently got even better. Vanguard Canada recently announced that all of their asset allocation ETFs just got…

Read MoreWealthsimple Trade Review 2026

What is Wealthsimple Self-Directed Investing (Formerly Wealthsimple Trade)? Wealthsimple self-directed investing is an online brokerage that lets you buy individual stocks and other assets. It’s part of the Wealthsimple ecosystem – a financial company (primarily owned by the massive Quebec-based conglomerate Power Corp) that has over 3 million customers and oversees $100+ billion in assets.…

Read MoreCanadian Financial Summit 2025

It’s that time of the year… the leaves are falling, pumpkin spice lattes are brewing, and for MDJ’s Kyle Prevost – it’s back to the Canadian Financial Summit. **NEW** for 2025 is Canada’s original Wealth Barber (and part-time CBC Dragon) David Chilton is joining the Summit to talk about his upcoming launch of the completely…

Read MoreQuestrade Review 2026

Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through a Questrade online brokerage account safe? Is Questrade as safe as RBC, TD, CIBC, ScotiaBank, and BMO? – MDJ reader The answer: Yes! Questrade is a full member of (and…

Read MoreBMO InvestorLine Review 2026

Is BMO InvestorLine Safe and Trusted? In a word, YES. As one of Canada’s oldest and most trusted companies (founded in 1817) the Bank of Montreal is as safe, trusted, and legit as you can get. InvestorLine has been around longer than the internet – BMO introduced self-directed trading way back in 1988 before moving…

Read MoreInvesting on Behalf of my Kids

When looking to invest on behalf of your children in Canada, there are many competing ways to do so. If you’re fortunate enough to be in a financial situation that allows you to give your children a bit of a leg-up, then you likely want to make sure you get the most bang for your…

Read MoreCanadian Undervalued Stocks 2026

Undervalued stocks in Canada are usually identified as having a market value that is for one reason or another below their “true value.” The idea is that if you as an investor are able to identify these undervalued stocks while their purchase price is still low, then, someday in the future, when the rest of…

Read MoreThe Biggest Risk of Early Retirement (FIRE) – Sequence of Returns!

The dream of Financial Independence, Retire Early (FIRE) is everywhere these days (it wasn’t so common when I started my journey almost two decades ago). But here’s the thing most FIRE “influencers” don’t like to dwell on: retiring early comes with a unique headache – what’s known as sequence of returns risk. Sequence of returns…

Read MoreHow Do RDSPs Work in Canada?

A Registered Disability Savings Plan (RDSP) is a special long-term savings plan designed by the Government of Canada to help people with severe disabilities (and their families) save for the future. In essence, an RDSP is similar to other registered plans like an RRSP or RESP – you contribute after-tax money and it grows tax-free…

Read MoreBuying Fractional Shares in Canada

Buying fractional shares is an excellent way to get exposure to Canadian All-Stars like Constellation Software without having to toss down more than $4,000 just to buy a single unit of stock! Even if you could afford that single share of CSU, tying up that much of your portfolio in one stock probably isn’t the…

Read MorePassiv Review 2026 – Portfolio Management Tool

If you’re a Canadian DIY investor who prefers index ETFs – but prefers living life to dealing with rebalancing math and spreadsheets – then you might want to check out a tool called Passiv. The name is a play on the concept of passive investing (aka “index investing”). Passiv is most effective when used like…

Read MoreBest Defense or War Stocks in Canada

You know it’s not a great sign of the times when you start getting emails from Canadians about investing in war stocks. More politely referred to as defensive industry stocks, these are companies that sell weapons to governments around the world. You will sometimes hear them collectively referred to as the military-industrial complex. While the…

Read MoreUltimate Smith Manoeuvre Guide For Canadians

When I first started writing about the Smith Manoeuvre nearly two decades ago, I had no idea it would strike such a chord with Canadian DIY investors. What began as a niche topic on how to turn your mortgage into a tax-deductible investment loan has since become one of the most popular articles on this…

Read MoreBest Online Banks in Canada 2026

Canada’s online banks are innovating and stealing market share faster than most people thought possible a couple of years ago. According to the Canadian Bankers Association, 78% of Canadians now do most of their banking online – and that number just keeps climbing. This shift has proven to be a lot more than a short-term…

Read MoreWithdrawing From RRSP/TFSA to Fund Early Retirement

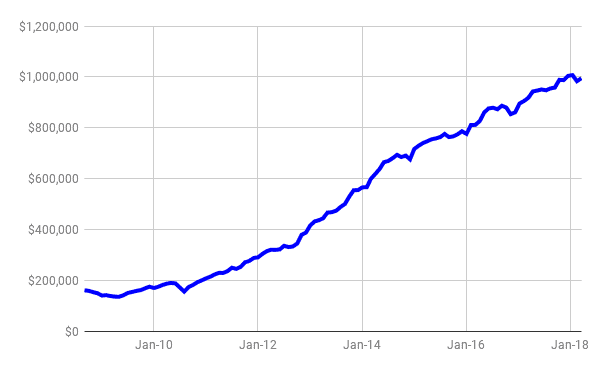

Moving from the accumulation stage of my professional career, to withdrawing investments in early retirement was more difficult than I would have predicted a few years ago. For those who haven’t been following me since I started writing Million Dollar Journey back in 2005, I have slowly-but-surely detailed my rise from a very average net…

Read MoreBest Options Trading in Canada 2026

Options are one of the best ways to capitalize on market trends and enhance profitability – if you get your prediction right. While buying options has a limited downside on a per contract basis, it is also one of the “best” ways to lose your money in the market – or as WSJ put it…

Read MoreQtrade Guided Portfolios Review

What is Qtrade Guided Portfolios? Qtrade Guided Portfolios is the robo advisor offering from Qtrade (which we’ve consistently ranked as one of the best online brokerages in Canada). It’s designed for Canadians who want a hands-off investing option, without handing everything over to a traditional advisor or paying mutual fund-level fees. At its core, the…

Read MoreXEQT ETF 2026 Review

Given that I recommend the XEQT ETF (and other Canadian all-in-one ETFs) quite often these days, I figured that it was time to give a 2026 update to my XEQT review. If you’ve checked out my Best ETFs in Canada comparison you’ll see that XEQT is at the top of the list – and it’s…

Read MoreAlterna Bank Review

What is Alterna Bank? Alterna Bank is a wholly-owned subsidiary of the credit union Alterna Savings, based in Ontario. Alterna Bank has brick-and-mortar locations within Ontario that can provide in-person services, but they also have online-only accounts. In this review, we will be focusing on Alterna Bank’s eAccounts, which are its no/low-fee online products. Alterna…

Read MoreWhy I Don’t Invest in Chinese Stocks

Technically, l I guess that I can’t say that I don’t invest in Chinese stocks at all, since I advocate for using Canadian all-in-one ETFs, and have ETFs such as VXC on my best Canadian ETFs list. That said, I would never advocate for investing directly in Chinese stocks. I didn’t like the idea when…

Read MoreBest Tech Stocks in Canada For 2026

While Canadian technology stocks have seen impressive growth over the last decade – particularly during the pandemic – they remain a relatively small slice of the Toronto Stock Exchange. We have a lot of great Canadian dividend stocks, Canadian bank stocks, Canadian energy stocks, Canadian utility stocks, etc. But tech stocks account for just 8-9%…

Read MoreBest Personal Finance Courses in Canada

I need to be clear right off the bat that I’m a bit bias when it comes to recommending the best financial literacy courses in Canada. Kyle Prevost has been a big part of Million Dollar Journey for many years now, so when he released the first ever DIY retirement planning course for Canadians, I…

Read MoreCanadian Financial Summit 2024

It’s that time of the year… the leaves are falling, pumpkin spice lattes are brewing, and for MDJ’s Kyle Prevost – it’s back to the Canadian Financial Summit. Kyle asked me to write something this week as he’s pretty busy putting the final touches on the Summit’s interviews, emails, etc. Click here for free registration…

Read MoreBMO SmartFolio Review 2026

I’m a huge fan of robo advisors, and BMO’s robo advisor: SmartFolio is no exception to that. If you’re not familiar with robo advisors the basic idea is that you will determine your overall risk tolerance, and that BMO will set you up with an automated portfolio using big broad index funds that spread your…

Read MoreBuilding a $1,000,000 RRSP Starting in your 30’s, 40’s, and 50’s.

When I initially wrote this article about building RRSP wealth in your 30s, 40s, and 50s, my goal was to create an easy visual that illustrates just how much you would have to begin saving today if you wanted to be a millionaire “tomorrow” (when you retired). Five years later, the data stands up pretty…

Read MoreOaken Financial Review

What is Oaken Financial? Oaken Financial is a digital bank owned by Home Trust Company, which is a subsidiary of Home Capital Group Inc. (one of Canada’s largest trust companies). Home Trust has been around since 1987 and founded Oaken Financial in 2013. While a digital bank, Oaken Financial has a few physical locations in…

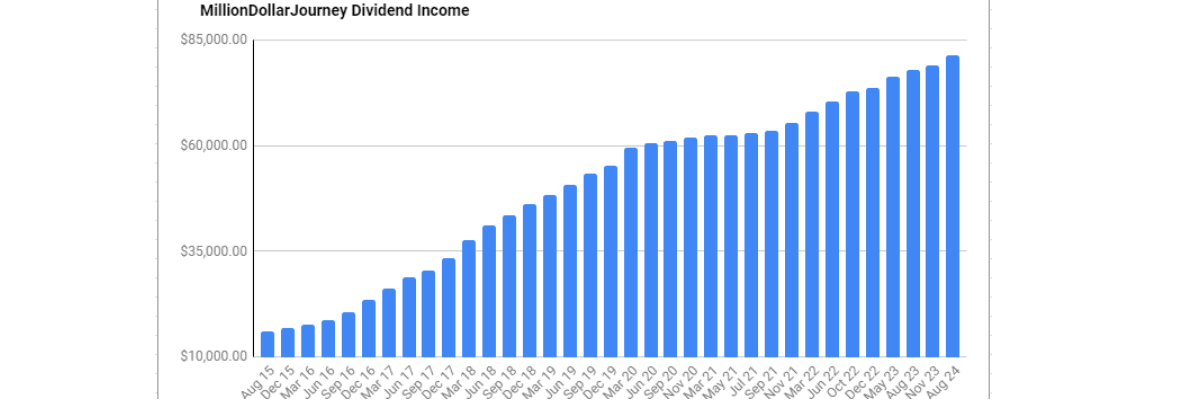

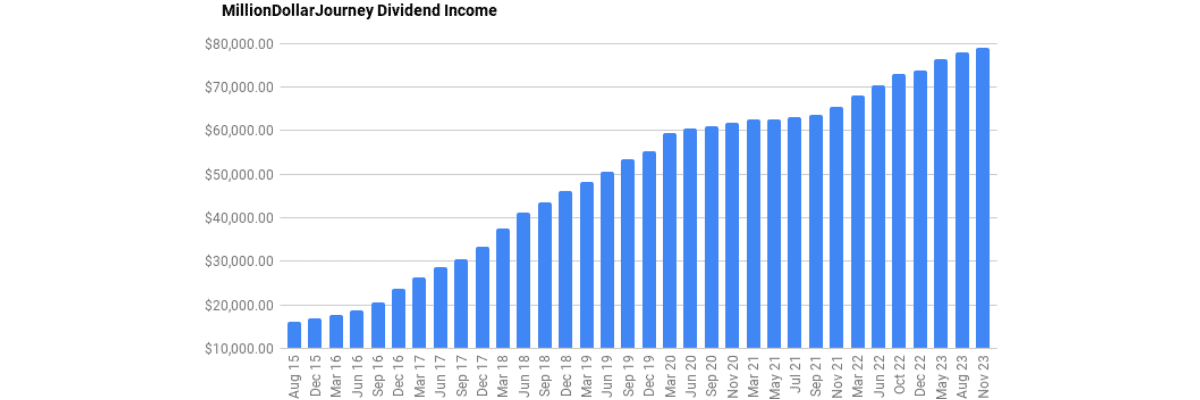

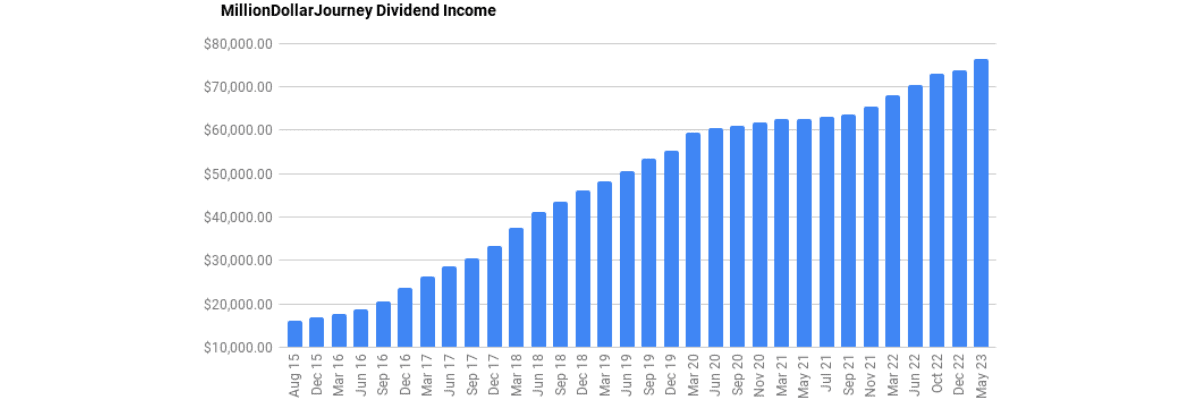

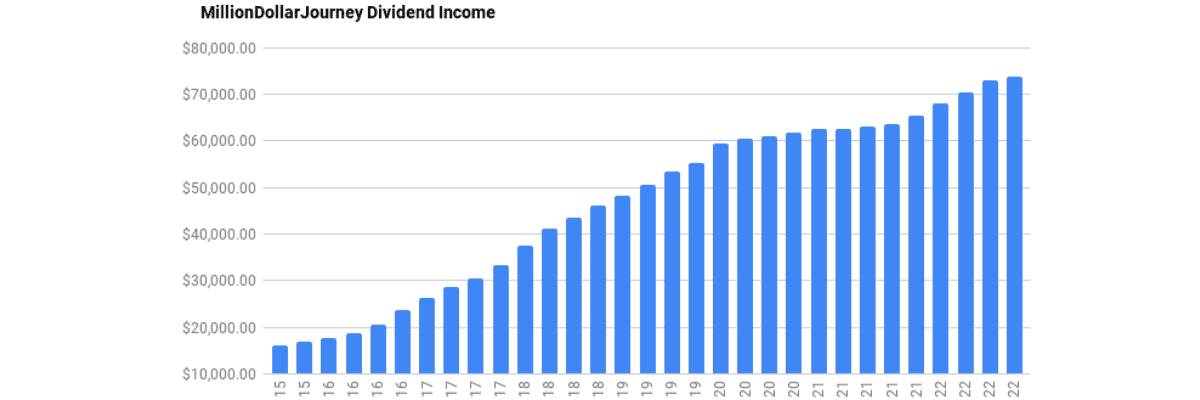

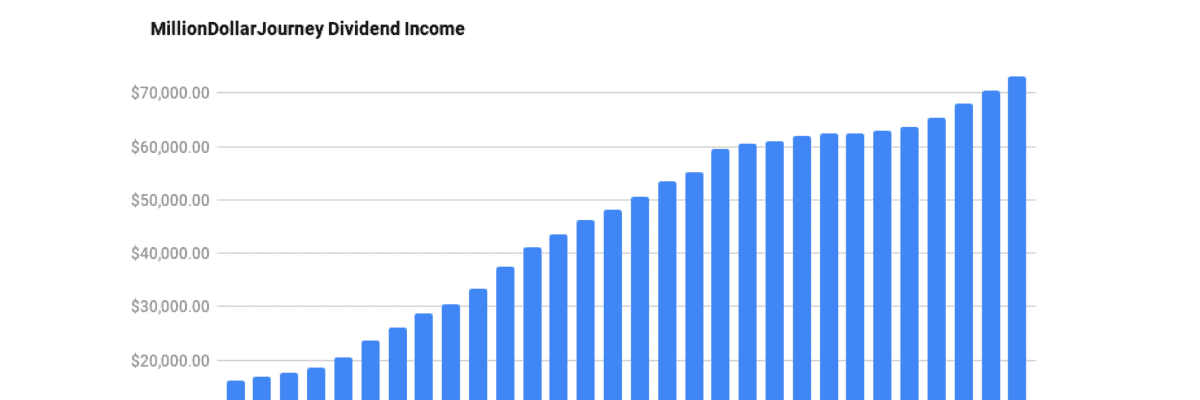

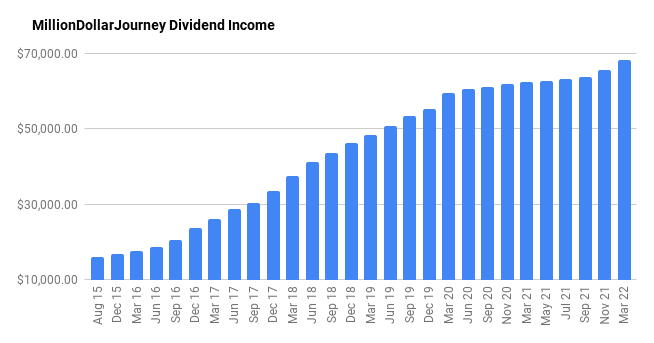

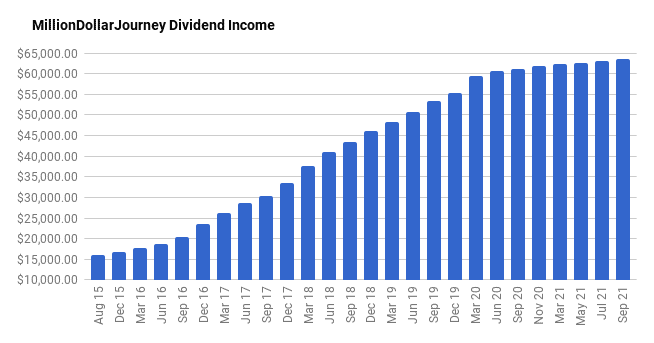

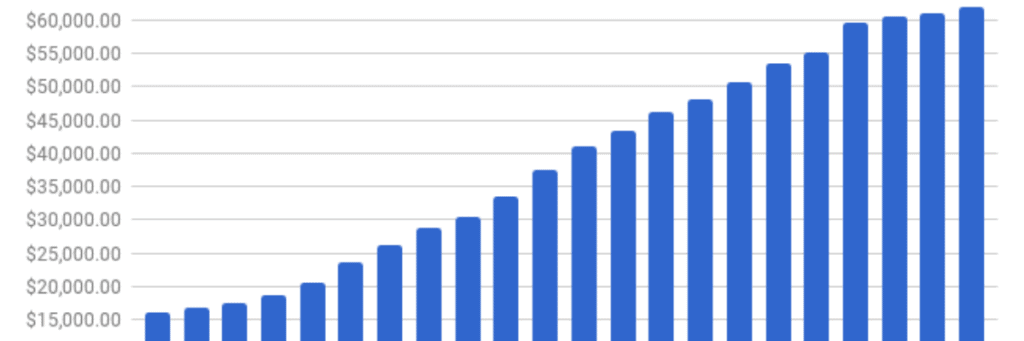

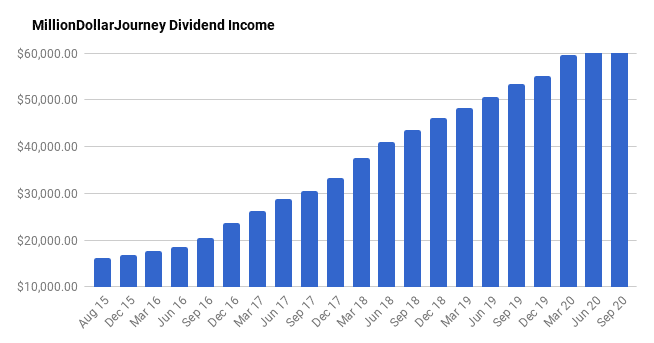

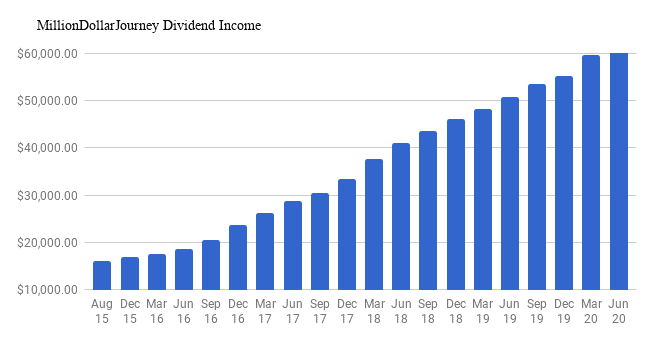

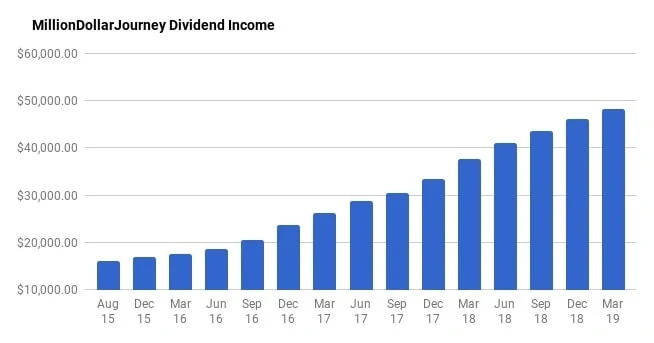

Read MoreFinancial Freedom Update August 2024 – $81.5k in Dividend Income!

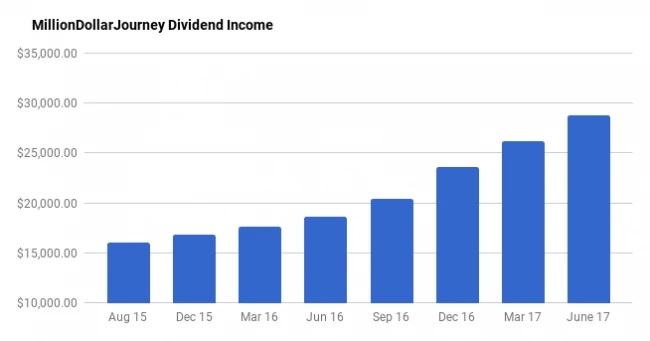

Welcome to the Million Dollar Journey August 2024 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to achieving…

Read MoreBest Recession Stocks in Canada for 2026

With Canadian dividend stocks facing significant pressure this year, many readers are asking me what are the safest stocks in Canada right now. Given the volatility affecting traditional favorites like bank stocks and telecoms, are they really the right play for investors that are focused on not losing capital? As recession and bear market concerns…

Read MoreThe Real MER on ETFs – Foreign Withholding Taxes on ETFs

Because I’ve written a lot about the Best Canadian ETFs and the top dividend ETFs, I tend to get a lot of questions and comments asking me about the MER and taxes on ETFs that hold equities from other countries. Obviously when you’re asking those types of in-depth questions you already understand the value of…

Read MoreHSBC Expat Bank Account for Canadians Abroad and Internationals in Canada

What is HSBC Expat? HSBC Expat banking is a British-headquartered bank that tailors its services to folks who aren’t living in Canada and seek to manage their finances across multiple currencies – or expats from other countries living in Canada. If you are living outside of Canada and find yourself wanting to hold currencies from…

Read MoreEQ Bank vs Neo Financial

EQ Bank continues to hold its place as our top rated online bank in Canada, but have you ever heard of Neo Financial? In the field of online banks in Canada, Neo offers one of the top Canadian high interest savings accounts available. For those seeking high-interest saving accounts with everyday spending capabilities, both Neo…

Read MoreEQ Bank vs Wealthsimple Cash

We throw the name EQ Bank around here quite frequently as it is our top rated online bank in Canada. And most people have heard of Wealthsimple or know someone who uses one of their many products. So, an EQ vs Wealthsimple matchup of elite savings account options is likely to determine the take the…

Read MoreStocktrades ETF Insights Review

What Is Stocktrades ETF Insights? ETF Insights is a platform that wants to help you cut through the noise, and select the best ETF for your RRSP, TFSA, or other accounts. It’s that simple. Twenty years ago there were only a few Exchange Traded Funds (ETFs) out there to choose from, and they were basically…

Read MoreScotia iTRADE Review 2026

What is Scotia iTRADE? In 2008, Scotia iTRADE was launched when Scotiabank acquired E*Trade Canada and promptly rebranded it. This purchase was a smart move as it essentially doubled the online client base of Scotiabank overnight. Scotia iTRADE initially gained popularity among active day traders because of its discounted flat rate commissions for active traders.…

Read MoreTD Direct Investing Review 2026

What is TD Direct Investing Brokerage? The TD Directing Investing online brokerage is a solid option, even though it doesn’t quite make it to the top of my list of Canada’s best online discount brokerages. As Canada’s second biggest bank (and one of our largest companies, period) it’s probably not a surprise that the TD…

Read MoreBest Canadian Chequing Account 2026

With more and more options available, choosing the best chequing account in Canada isn’t as easy as you might assume. When was the last time you wrote a cheque anyways? You’re probably not pulling out a cheque book at the grocery store or using it to settle monthly bills. I’d reckon you’re paying most bills…

Read MoreEQ Notice: NEW Account from EQ Bank

What is the EQ Notice Account? There are three things you need to know about the NEW EQ Notice Account: 1) It’s a brand new product in Canada – no other bank has it. It’s based on a model that has been around for decades over in the UK. 2) Your money will be fully…

Read MoreHow to Become a Millionaire in Canada

Most of us have wondered what it takes to reach millionaire status in Canada. We certainly don’t advise getting involved in any “get rich quick” schemes, but we do have practical steps to share that you can take to start your journey to become Canada’s next millionaire. The majority of millionaires in Canada didn’t get…

Read MoreRESP in Canada – Rules, Eligibility & Optimal Strategy

An RESP, or Registered Education Savings Plan, is a registered tax-deferred investment account designed to help pay for a child’s education. In other words, RESPs are the best possible way to pay for your child’s eventual college and/or university bills! RESPs are eligible for government grants (re: Free Money) of up to $7,200. In this…

Read MoreBest High Yield Canadian Stocks 2026

Many people love investing in dividend stocks for their predictable income stream. One of our most popular articles is our best Canadian dividend stocks list. Many investors are looking in particular for the best high yield Canadian stocks, so each year we provide the updated list below. You may notice we haven’t picked the stocks…

Read MoreWays to Maximize the Canada Child Benefit (CCB)

Most Canadian parents don’t understand how they maximize their Canadian Child Benefit (CCB) and get paid thousands of government dollars every year! We’ve been receiving this benefit since the Trudeau administration has been in power (2016), and I’m always tinkering with ways to max out this benefit. It’s worth my time since the CPP clawback…

Read MoreWhat is Income Splitting?

Income splitting is a tax-saving strategy that divides a stream of income between family members (usually two spouses). The goal is to apportion as much of the higher-earning family member’s income to other family members, in an effort to get that higher-earning spouse into a lower tax bracket. Some economists and policy wonks have made…

Read MoreIs National Bank Stock a Good Buy Right Now?

National Bank of Canada has demonstrated its resilience in the face of market challenges, standing out as a great investment opportunity in the coming years. Its historical performance reflects a commitment to stability and growth, with recent advancements reflecting its proactive approach to evolving market dynamics. However, it’s essential to consider the broader context of…

Read MoreIs BCE Stock a Good Buy Right Now?

If you’re considering investing in BCE stock in 2026, evaluating the company’s performance, dividend growth, and the latest developments in the telecommunications industry can help you make your decision. Being informed about BCE’s recent advancements is crucial in determining whether it is a wise investment choice, and comparing it with its fellow Canadian telecommunication competitors…

Read MoreIs CNR Stock A Good Buy Right Now?

If you’re considering investing in Canadian National Railway (CNR) stock in 2026, it is important to evaluate the company’s performance, dividend growth, and recent developments in the railway industry. Staying informed about CNR’s recent advancements and industry trends is crucial in determining whether it is a wise investment choice. Additionally, comparing CNR with other Canadian…

Read MoreWebull Canada Review

When I sat down to take a close look at Canada’s newest brokerage for my Webull review, I realized a couple of things pretty quickly. 1) Webull had higher prices for Canadian customers than it did for its American clients. 2) Webull doesn’t have TFSA, RRSP, and other Canadian investment accounts available. Consequently, this US…

Read MoreDo I Need an Accountant To Do My Taxes?

Two of the most common questions that I have gotten in our MDJ inbox over the years are: Do I need an accountant to do my taxes or can I DIY it? Do I need an accountant for my small business in order to do bookkeeping, tax preparation, and general financial advising? And then most…

Read MoreDividend Stocks Rock Review 2026

Investing on your own is not an easy task. From mutual funds to robo advisors and individual stocks, there are a wide range of strategies, information services and trading platforms to choose from. It can quickly become overwhelming. This is where the simplicity of dividend investing really shines. I started investing in mutual funds when…

Read MoreIs Algonquin Power Stock A Good Buy in 2026?

When considering an investment in Algonquin Power stock, it is essential to evaluate the company’s performance, market trends, and recent developments in the renewable energy sector. Keeping yourself informed about Algonquin Power’s recent advancements and industry dynamics is vital in making an informed investment decision. If you’re interested in diversifying your portfolio with dividend-paying stocks,…

Read MoreCIBC Investor’s Edge Broker Review 2026

What Is CIBC Investor’s Edge? If you are already a CIBC customer, you might already know that it has been around for a long time, over 100 years in fact. As a result, it offers an array of choices when it comes to how you save and invest your money. It offers the basics, such…

Read MoreFinancial Freedom Update Nov 2023 – $78.8k in Dividend Income!

Welcome to the Million Dollar Journey November 2023 Financial Freedom Update – the third update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to achieving…

Read MoreInvesting Taxes: Dividends, Interest & Capital Gains

Are you curious about how investing taxes are calculated on capital gains, dividends, and interest in Canada? I’m not a tax expert, but with tax loss harvesting season coming out, I figured it might be a good time to review some of the basics between how Canadian investment returns are taxed in your RRSP, TFSA,…

Read MoreIs Air Canada Stock A Good Buy in 2026?

If you’re considering investing in Air Canada stock in 2026, it is important to understand the company’s performance, market trends, and recent developments in the airline industry. Staying informed about Air Canada’s recent advancements and industry dynamics is crucial in determining whether it is a wise investment choice in 2026. As an investor, it is…

Read MoreIs Rogers Stock A Good Buy in 2026?

If you’re considering investing in Rogers stock in 2026, it is important to understand the company’s performance, dividend growth, as well as its recent merger with Shaw. Staying informed about Rogers’ recent advancements and industry developments is crucial in determining whether it is a wise investment choice in 2026. This also allows you as an…

Read More4 Steps for a Worry Free Retirement Course Review by Frugal Trader

It’s not every day that one of your co-writers pens the first online course for retirement in Canada. Naturally, it only felt right that the first review of 4 Steps to a Worry Free Retirement was posted on Million Dollar Journey! If you want to skip my review and see what the course is all…

Read MoreIs Telus Stock a Good Buy in 2026?

If you’re considering investing in Telus stock in 2026, it’s crucial to assess the company’s performance, dividend growth, and recent developments in the telecommunications industry. Staying updated on Telus’ latest advancements is key in determining whether it is a smart investment choice in 2026. If you’re seeking to diversify your portfolio with additional dividend stocks,…

Read MoreIs BNS Stock a Good Buy in 2026?

If you’re thinking about investing in Bank of Nova Scotia stock in 2026, you must consider the bank’s individual performance, its recent developments, and the future outlook for not just the Canadian banking sector, but the global financial services industry . For additional perspectives on alternative investment choices, you can explore our article highlighting the…

Read MoreInvesting In Gold In Canada 2026

As one might expect in a market pullback (and geopolitical crisis) we’re getting many requests about how to invest in gold in Canada, as well as how to invest in commodities (which we covered not so long ago). The awkward truth is that while you’d think this would be gold’s time to shine (see what…

Read MoreInvesting in Flow Through Shares in Canada

Since writing my original “How to Buy Flow Through Shares in Canada” article over a decade ago, I’m consistently surprised at how many people are interested in this uniquely Canadian investment idea. Early on in my Million Dollar Journey, I’d written about not what flow through shares were, but also on my personal experiences, as…

Read MoreFinancial Freedom Update Aug 2023 – $77.8k in Dividend Income!

Welcome to the Million Dollar Journey August 2023 Financial Freedom Update – the second update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to achieving…

Read MoreIs Shopify Stock a Good Buy in 2026?

If you’re considering investing in Shopify stock in 2026, it’s important to assess the company’s performance and the latest developments in the e-commerce industry. Staying informed about Shopify’s latest financial and innovation updates are essential in determining whether it is a favorable investment choice. If you are looking to diversify your tech investment dollars, we…

Read MoreCanadian Value Stocks – Top 10 Picks 2026

Finding the best value stocks in Canada isn’t an easy task. The truth is that the criteria for what makes an excellent value stock is a bit nebulous, and not as easy to define as when value stock Godfather Ben Graham was writing his treatise on investing. This is the second article in our Million…

Read MoreIs Enbridge Stock a Good Buy in 2026?

If you’re considering buying Enbridge stock in 2026, then you need to be aware of the company’s individual performance, its dividend growth rate, and recent developments in the energy industry. These indicators pretty solidly show why Enbridge has historically been an excellent investment, and will continue to be going forward. If you’re looking for more…

Read MoreIs Suncor a Good Stock to Buy in 2026?

If you’re thinking about buying Suncor stock in 2026, it’s important to consider how the company has been performing, its dividend growth, and any recent changes in the energy industry. It’s also important to keep up with the company’s latest developments, all of which show that Suncor is a good buy right now. If you’re…

Read MoreBest Utility Stocks in Canada 2026

There is a reason why so many of Canada’s best utility stocks are also on our overall list of best dividend stocks in Canada: They are natural oligopolies/monopolies, meaning that can pass along increasing costs almost instantly, and have really solid yields for income-seeking investors. This combination makes them a natural fit for Canadian investors…

Read MoreThe Best Low Cost Ways to Convert CAD to USD

Any Canadian who’s traveled to (or ordered something from) the US knows about converting CAD to USD. It’s never fun to watch every dollar of your hard-earned money suddenly turn to $0.75 (or less!), and with additional foreign exchange fees, it can really add up. And exchange rates aren’t going anywhere. The cost of one…

Read MoreWhen to Buy Dividend Stocks in Canada

Dividend stock investing is a great strategy for those looking to invest primarily in mature, stable companies with a history of spinning off free cash flow. Whether or not someone chooses to take the dividend payout out of their brokerage account in order to pay for life, or to reinvest any dividend income depends on…

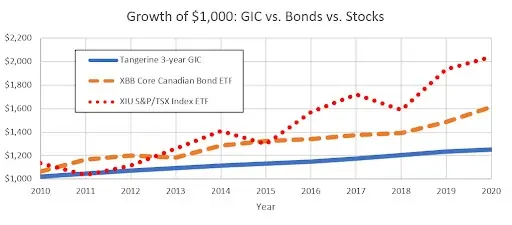

Read MoreBond ETFs vs GICs vs High Interest Savings Accounts

For income-oriented Canadian investors the choice between a Bond (or Bond ETF), a GIC, or a high interest savings account has become more important than ever. With interest rates at historic lows (for a little while longer anyway) choosing the best option for the “safe, low risk investing” part of our portfolio can make a…

Read MoreIs TD Bank Stock a Good Buy in 2026?

If you’re considering buying Toronto Dominion (TD) Bank stock in 2026, then you need to be aware of the bank’s individual performance, its abandoned merger with First Horizon, and the long term prospects for Canadian and American banking as well. For more insights on comparable investment options, check out our article on the Best Canadian…

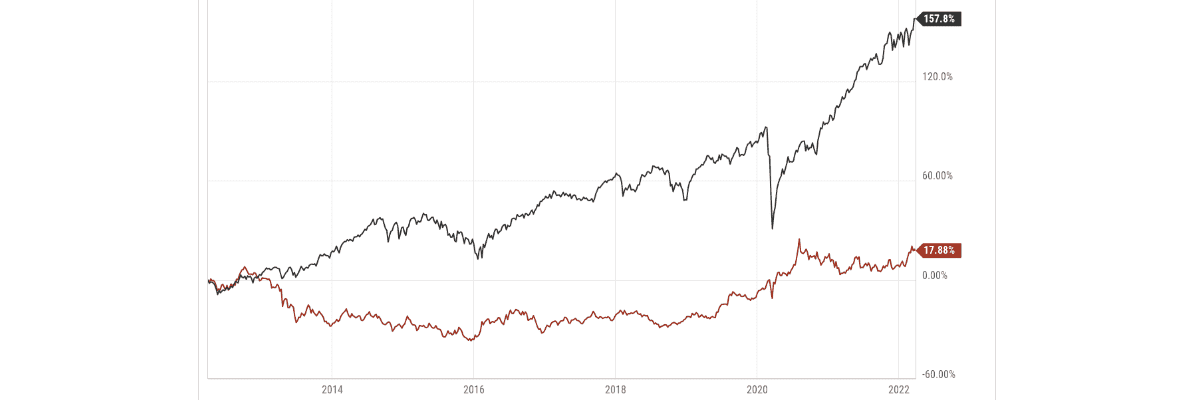

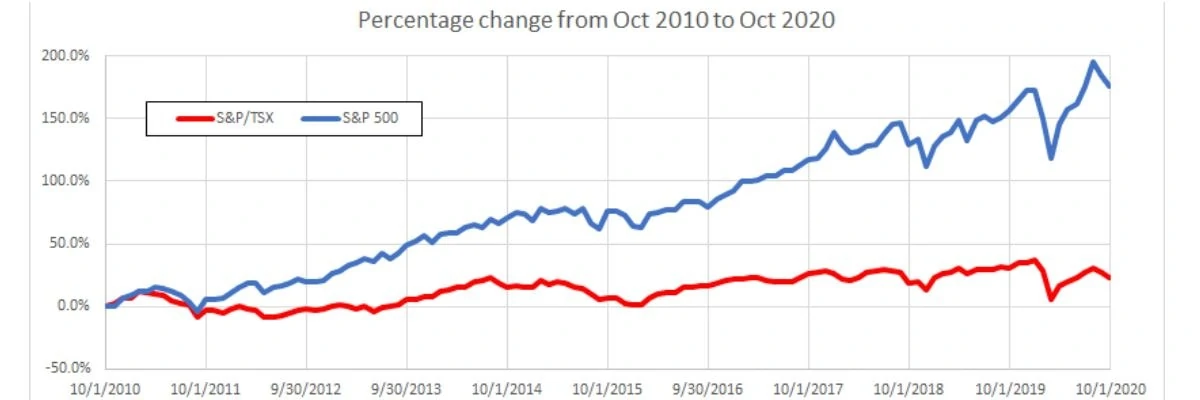

Read MoreCanadian Stock Market vs U.S. Stock Market in 2026

We Canadians might like to argue with our U.S. neighbours about who makes better beer or who plays better hockey but when it comes to your portfolio, the real argument is who gets the better returns, the Canadian stock market vs the U.S. stock market? Both Canada and the U.S. are wealthy developed countries with…

Read MoreIs RBC Stock a Good Buy in 2026?

If you’re considering buying Royal Bank stock in 2026, then you need to be aware of not only the company’s individual performance, but also RBC’s current valuation, and the general prospects for Canadian banking as well. For more information on comparable investments check out our article on the Best Canadian Bank Stocks, and to decide…

Read MoreFinancial Freedom Update May 2023 – First Update of the Year ($73.8k in Dividend Income!)

Welcome to the Million Dollar Journey May 2023 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to…

Read MoreSmith Manoeuvre Calculator/Spreadsheet

By now, most people here know that I’m interested in the Smith Manoeuvre. If you are new to this concept, you can read more about them in my article “Mastering The Smith Manoeuvre“. Originally, I discovered the Smith Manoeuvre, through a great thread on RedFlagDeals.com that talks exclusively about the strategy. This includes the tax…

Read More46 Ways to Save Money in Canada

Editor’s Note: This article was originally written by FT back in 2017. Due to its popularity, we have asked FT to update it for 2023 with more relevant advice. As always, we encourage you to comment below and tell us how you save money in your day to day life. If you are looking for…

Read MoreVanguard vs. iShares All-in-One ETFs

All-in-one ETFs are giving robo advisors a run for their money with their ease of use and low fees. All-in-one ETFs contain multiple ETFs, which means in one single purchase, you are essentially getting an entire well-balanced and hugely diversified portfolio at the tap of a button. There are many Canadian all-in-one ETFs to choose…

Read MoreThe Best REIT ETFs in Canada For 2026

A Real Estate Trust (REIT) ETF is the most straightforward way to invest in real estate without becoming a landlord yourself or spending time researching the 30+ individual REITs on the Toronto Stock Exchange. This article will give you all the details about REIT ETFs: Top REIT ETFs in Canada: Quick Comparison Name Ticker Number…

Read MoreThe Best No-Fee Cash Back Credit Cards in Canada 2026

If you’re not using the best free cashback credit cards in Canada, then you’re missing out on free money! We published our no-fee cashback credit card list back in 2007 and we’ve been updating it regularly ever since, so you always know which no-fee cashback cards to consider. We start our list with a quick…

Read MoreTop 10 Wealthiest Canadians in 2026

It’s been over a decade since we first wrote about the richest Canadians, and we thought it was a good time to update the list! While some have remained on the top 10 wealthiest Canadian list for years, some have not been able to maintain that title. Others have been able to retain their top…

Read MoreSimple Low Cost Diversified Index ETF Portfolios 2026

We’ve been writing about low-cost ETFs in Canadian index portfolios since 2008. Below is our 2026 update. ETFs, or exchange-traded funds, first entered the Canadian market over a decade ago. From day one, they impressed us as an excellent tool to help you build a low-cost, diversified portfolio. As time has passed, ETF providers have…

Read MoreTop Blue Chip Stocks in Canada for 2026

A blue chip stock refers to stocks of high value companies. Think companies that are household names, have a widely recognized brand and are so big that they are unlikely to fail. The top blue chip stocks in Canada include companies from a wide range of sectors; utilities, industrial, financial and consumer staples. These companies…

Read MoreHow to Build a Dividend Growth Portfolio

If you’ve been following MDJ for a while, you will come to learn that I’m a fan of two investing strategies, index investing and investing for income through Canada’s best dividend stocks. I like index investing (also known as passive investing) for its ease, low cost, and ability to beat most active mutual fund returns…

Read MorePre and Post Market Trading in Canada

Most Canadian investors are content to buy and sell stocks when the main North American stock markets are open. What that means is that you can buy and sell shares of companies and ETFs if they appear on the Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE), and the NASDAQ, between the hours of 9:30am…

Read MoreBest Canadian Dollar (CAD) ETFs for U.S Equities

A reader recently emailed me about my thoughts on the best US Dollar USD ETFs vs CAD ETFs when it comes to getting portfolio exposure to the American market. You may already know that I’m a fan of index investing using the best ETFs available. Whether that’s all-in-one ETFs, Canadian dividend ETFs, or in this case,…

Read MoreNational Bank Direct Brokerage Review 2025

NBDB has made changes over the last two years to make their fee structure competitive among other discount brokers, and have now dropped their commission fees altogether for those trading on their online platform. It seems as though they have taken customer feedback to heart and made improvements to make those customers want to stay…

Read MoreFinancial Freedom Update Dec 2022 ($73.8k in Dividend Income!)

Welcome to the Million Dollar Journey December 2022 Financial Freedom Update – the final update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreSmith Manoeuvre Portfolio – 2022 Update

For those of you just joining us, this is an update (it’s been a while!) on my portfolio that is leveraged with money borrowed from my home equity line of credit (HELOC) – otherwise known as the Smith Manoeuvre. What is the Smith Manoeuvre? The Smith Manoeuvre, in its simplest form, is a leverage investment…

Read MoreTax Efficient Index ETF Portfolio for Non-Registered Account

There may come a point during the year that you max out your registered Canadian investment accounts, or if you are living abroad, there might be certain restrictions on what you can contribute to tax-advantaged accounts. The great news is that no matter what your situation is, you can still open a non-registered tax efficient…

Read MoreFinancial Freedom Update Oct 2022 Update ($73k in Dividend Income!)

Welcome to the Million Dollar Journey Oct 2022 Financial Freedom Update – the third update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreLow Cost Currency Conversion with DLR/DLR.U ETF

With foreign exchange fees as high as 2.5% for discount online brokers, low-cost currency conversion methods are a great way to keep a little extra money in your portfolio. If you’re dealing with larger trades, those FX fees can really add up! For example, say I wanted to purchase $10,000 worth of Walmart stock with…

Read MoreNorbert’s Gambit – Save Money With USD to CAD Foreign Exchange

If you’re looking to save money on foreign exchange, you’re in luck. There is a simple and effective way to convert your CAD to USD so you can make US stock purchases. It’s called Norbert’s Gambit, and it can save you hundreds of dollars on trading fees. Smart investors know that investing in US stocks…

Read MoreBest Real Estate Stocks in Canada 2026

I like the idea of owning real estate – but I don’t want the headaches of being a landlord. If that sounds like you, then you basically have two options: Invest in Canadian Real Estate Investment Trusts (REITs) Or Invest in Canadian real estate stocks. Personally, I’m a massive fan of investing in Canadian bank…

Read MoreBest Cannabis Stocks in Canada 2025

In October of 2018, Canada became the first North American country to completely legalize marijuana, opening the doors for the cannabis industry to expand into new territory, and for Canadian cannabis stocks to begin trading on the TSX. While in the US, weed isn’t Federally legal, the majority of states allow the purchase of marijuana…

Read MoreBest Emerging Market ETFs to Buy in Canada 2025

I have to admit that due to my focus on Canadian dividend stocks, I am guilty of having a bit of an overall home country bias in my portfolio. I’m fine with that, as I really like Canada’s current valuations and long-term prospects. That said, when I want quick diversification, I tend to look for an…

Read MoreBest Pipeline Dividend Stocks In Canada 2026

It’s no secret that we’re big fans of Canadian dividend stocks here at MDJ, and while we have given some shine to Canadian energy stocks over the last couple of years, we have always just sort of tossed the Canadian pipeline stocks in alongside those big energy producers. The fact is the Canadian pipeline stocks…

Read MoreFinancial Freedom Update June 2022 – Q2 Update ($70.5k in Dividend Income!)

Welcome to the Million Dollar Journey June 2022 Financial Freedom Update – the second update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreBest Industrial Stocks in Canada For 2026

With the market shifting to defensive mode, Canadian industrial stocks are back in style. Investors are clearly in the mood for solid (boring?) dependable earnings that can keep up with an inflation-heavy environment. While Canadian railroad stocks and Canadian airline stocks are technically considered Canadian industrial stocks, we decided that they needed their own articles. While…

Read MoreInvesting in Canadian Airline Stocks 2025

Now that travel has opened up again, many MDJ readers have been asking us if now is the time to invest in Canadian Airline stocks. Truthfully, we might be the wrong folks to ask about this one. If you take a look at our best Canadian dividend stocks and/or Canadian Dividend Kings articles, you won’t…

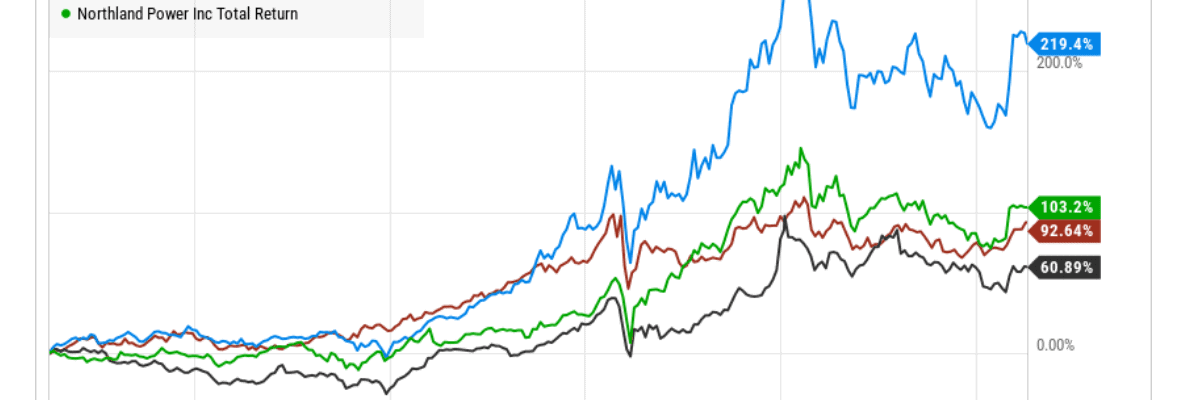

Read MoreBest Renewable Energy Stocks in Canada 2026

With all of the attention on Canadian energy stocks due to the recent run up in oil prices, many experts are arguing that now is the time to look into Canadian renewable or “green energy” stocks. If you are a longtime MDJ reader, you’ll notice a few crossover companies from our best Canadian dividend stocks…

Read MoreFinancial Freedom Update March 2022 – First Update of the Year ($68,100 in Dividend Income!)

Welcome to the Million Dollar Journey March 2022 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreIndexed Family Education Fund (RESP) Portfolio Update – 2022 Edition

Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s future education costs. Since we’ve been posting about these accounts since my kids were born (my oldest was born in 2008), it shows the power of long-term compounding of a…

Read MoreHow To Track Your Net Worth

This post was originally published in early 2009, but brought to the forefront as I believe it’s one of the more important strategies for growing wealth. For those of you who have been following my journey, you’ve probably noticed that I’m a big believer in tracking and managing progress to help achieve desired goals. I…

Read MoreTop Premium Cash Back Credit Cards in Canada 2025

A premium cashback credit card with an annual fee is a great way to maximize your cashback rewards – especially if you make most of your purchases on credit cards. The best paid cashback credit cards in Canada feature high earn rates and some truly excellent perks – significantly better than Canada’s best no-fee credit…

Read MoreShould I buy Whole Life Insurance for my Children?

A reader, Arlene, recently asked a question in my article “investing on behalf of kids” about obtaining “Whole Life Insurance” for their young children. A financial planner suggested that obtaining permanent insurance for their children is a good idea to invest in their future. Here is the question: Hello! A financial planner thinks it’s a good idea…

Read MoreFinancial Freedom Update Nov 2021 – Big Dividend Raises Edition

Welcome to the Million Dollar Journey November 2021 Financial Freedom Update – Big Dividend Raises Edition! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial…

Read More5 Ways to Get Your Credit Score and Credit Report for FREE

It’s now easier than ever to get a credit score check in Canada for free! I mean… a credit score check is only really important if you hope to: Get a mortgage Purchase a car Rent an apartment Get a great credit card Qualify for certain types of insurance Even gain specific types of employment…

Read MoreTop No Fee Rewards Credit Cards in Canada

I’ve written about the top free cash back credit cards in Canada before, and even modified my top pick to be Neo Financial in 2021, which is also the overall best credit card in Canada in my opinion. However, there are an abundance of other rewards based credit cards out there that deserve a look.…

Read MoreHow To Pay Off Your Mortgage In 3 Years

In the October 2010 net worth update, I briefly mentioned that I was planning on paying of the mortgage balance this month and I’m happy to say that we officially became mortgage free in 2010! As this is a significant milestone in any financial journey, I thought that it deserved a post all on its…

Read MoreFinancial Freedom Update Sept 2021 – Market Highs Edition

Welcome to the Million Dollar Journey September 2021 Financial Freedom Update – Market Highs Edition! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence.…

Read MoreFinancial Freedom Update (Q3) 2021 – Sequence of Returns Risk Edition

Welcome to the Million Dollar Journey 2021 (Q3) Financial Freedom Update – the third update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my…

Read MoreHave I Given Up on the Smith Manoeuvre?

Out of many investing topics written about on Million Dollar Journey, the Smith Manoeuvre was one of the first and among the most popular investment strategies discussed. What is the Smith Manoeuvre? But, what is the Smith Manoeuvre and why is it so popular? This investment strategy was named after Frasier Smith, a financial advisor who…

Read MoreFinancial Freedom Update (Q2) 2021 – Portfolio All-Time High Edition

Welcome to the Million Dollar Journey 2021 (Q2) Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my…

Read MoreFinancial Freedom Update (Q1) 2021 – First Update of the Year

Welcome to the Million Dollar Journey 2021 (Q1) Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my…

Read MoreIndexed Family Education Fund (RESP) Portfolio Update – 2021 Edition

Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s future education costs. What is an RESP? At a high level, an RESP is an investment account for future post-secondary students and stands for Registered Education Savings Plan. It can…

Read MoreFinancial Freedom Update (Q4) 2020 – Volatile Stock Market Edition ($61,850 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q4) Financial Freedom Update – Volatile Market Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to…

Read MoreMy Favorite Free Personal Finance Apps

Readers often ask what my favourite personal finance apps are. It’s not an easy question to answer, as the apps we choose are highly personalized to our particular needs, goals, habits and more. The good thing is, there are so many apps out there, that anyone can find exactly what they are looking for. But…

Read MoreThe Pros and Cons of the New Aeroplan

The new Aeroplan was just announced and there were a lot of changes. This wasn’t a minor refresh, it’s a complete redesign that will benefit most people, but there’s no denying that some travellers will be disappointed. To give you some context, Air Canada was going to cut ties with Aeroplan (owned by Aimia at…

Read MoreFinancial Freedom Update (Q3) 2020 – New Market High Edition ($61,050 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q3) Financial Freedom Update – New Market High Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving $1M…

Read MoreCalculating Your Adjusted Cost Base (ACB)

If you’ve invested in a non-registered portfolio you’ve likely come across the tax-preparation question: How to calculate your adjusted cost base (ACB). It’s certainly a pain in the portfolio, and can be tedious and complicated at times. But it’s a necessary ‘evil’. You need to know your ACB in order to calculate the capital gain…

Read MoreThe Hot Potato Investing Strategy

If you’ve been following this blog for a while, you’ll know that most of my wealth is in the stock market for the long-term. While there are many short term stock trading strategies, many of these strategies just don’t work out for regular investors. In fact, the initial losses often turn beginner investors away from…

Read MoreFinancial Freedom Update (Q2) 2020 – V-Shape Recovery Edition ($60,550 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q2) Financial Freedom Update – the V-Shape Recovery Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving $1M…

Read MoreIndexed Family Education Fund (RESP) Portfolio Update – 2020 Edition

During this time of uncertainty, many readers have contacted me for continued portfolio updates. One group in particular – parents – are asking me what I’m doing with my RESPs. What is an RESP? At a high level, an RESP is an investment account for future post-secondary students and stands for Registered Education Savings Plan. …

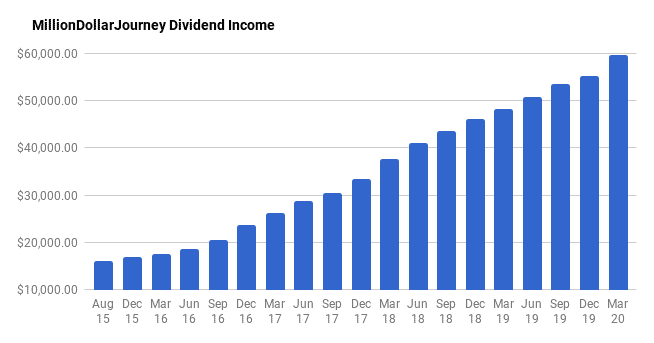

Read MoreFinancial Freedom Update (Q1) 2020 – Bear Market Edition ($59,500 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q1) Financial Freedom Update – the Bear Market Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving $1M…

Read MoreWill a Mini-Split Heat Pump Save You Money? Our Results After the first Year!

In late 2018, we installed a mini-split heat pump for the purpose of reducing our electricity bill. Around here in the most easterly parts of Canada, most of the houses use electric baseboard heating as the primary source of heating. While baseboard heating is a lower cost option during installation, the operating costs can rack…

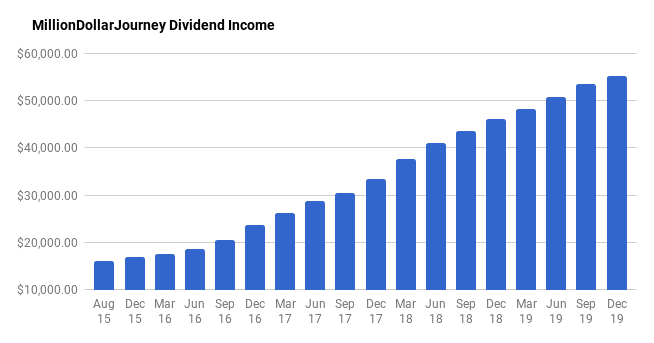

Read MoreFinancial Freedom Update (Q4) – 2019 Year End Update ($55,200 in Dividend Income)!

Welcome to the Million Dollar Journey 2019 (Q4) Year-End Financial Freedom Update. If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving $1M in net worth in June…

Read MoreWhat to do if Run out of HELOC Space with the Smith Manoeuvre

If you’ve been following the blog for a while, you may have heard about the Smith Manoeuvre. At a high level, it’s a long-term investment strategy for investors with high risk tolerance. Essentially, it’s where an investor borrows against his home (using a HELOC) to invest in the stock market, business, and/or real estate. The plan…

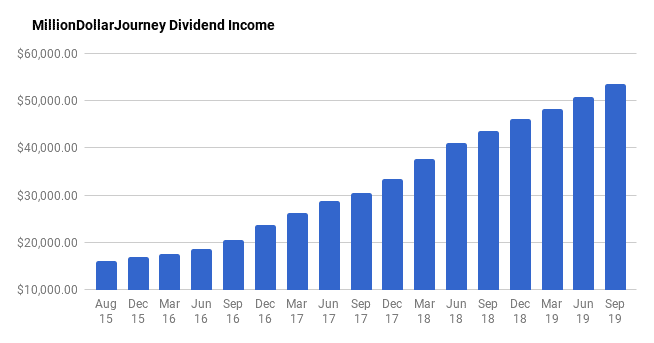

Read MoreFinancial Freedom Update (Q3) – September 2019 – Reaching the Cross Over Point ($53,400 in Dividend Income)!

Welcome to the Million Dollar Journey September 2019 (Q3) Financial Freedom Update – the third update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving…

Read MoreCan You Have Too Much RRSP?

Since I’ve written about how much you need to save to reach $1M in your RRSP starting in your 30’s, 40’s, and 50’s, I’ve been getting questions from readers who have significant RRSP contributions. More specifically, can you have too much in an RRSP? I haven’t been able to find any good articles online that…

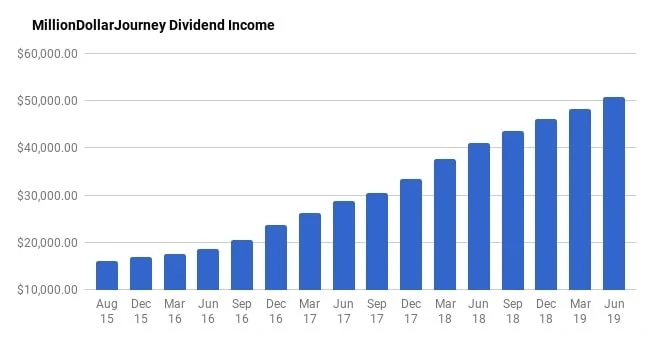

Read MoreFinancial Freedom Update (Q2) – June 2019 ($50,660 in Dividend Income)!

Welcome to the Million Dollar Journey June 2019 (Q2) Financial Freedom Update – the second update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving…

Read MoreBuilding a Simple Low-Cost Indexed ETF Portfolio in USD

With recent articles about all-in-one ETFs and withholding taxes on ETFs in registered accounts, I’ve been getting questions about if there are USD based all-in-one ETFs, and if not, what are the most efficient USD ETFs to own? There are a number of readers who make their money in USD, and there are some advantages…

Read MoreRetirement Calculators – How Much Do You Need to Retire?

This popular article was originally written in 2017, but since then, a couple of the calculators have gone offline. I have updated this article with a couple of new additions. Enjoy! A reader recently asked me if she had saved enough for retirement. While it seems like a challenging question to answer, it can be roughly calculated…

Read MoreWhat Happens to your RRSP and TFSA after you Die?

Last week, I wrote about the most efficient way to withdraw from your accounts during retirement. Within the article, I mentioned that while the general rule of thumb is to keep your RRSP as long as possible, there are some situations where drawing down on your RRSP first makes the most sense. This is particularly…

Read MoreFinancial Freedom Update (Q1) – March 2019 ($48,200 in Dividend Income)!

Welcome to the Million Dollar Journey March 2019 (Q1) Financial Freedom Update – the first update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving…

Read MoreThe Mini-Split Heat Pump Experiment – Will it Save You Money?

Way back in 2008, we completed a custom home that we still live in today. In that same year, I wrote a post about my regrets of not going with a heat pump to save money on energy bills. I’m not sure if you use electric heat where you are from, but if you do,…

Read MoreIndexed Family Education Fund (RESP) Portfolio Update – 2019 Edition

It has been about a year since my last RESP portfolio update which is probably an appropriate time span since it’s a fairly steady portfolio that is 100% indexed. 2018 was certainly a test for equity portfolios and although stocks were pounded, these indexed RESP accounts performed a little better than I expected. The RESP portfolios for…

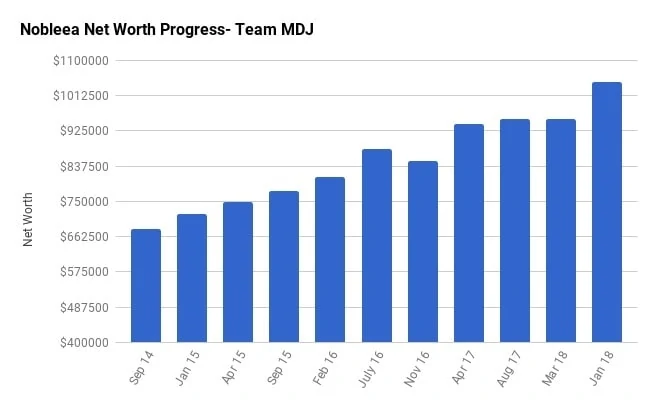

Read MoreNet Worth Update January 2019 – Nobleea the Engineer and Millionaire!

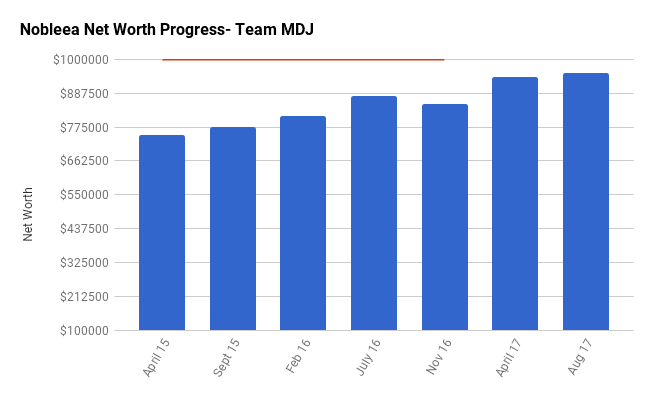

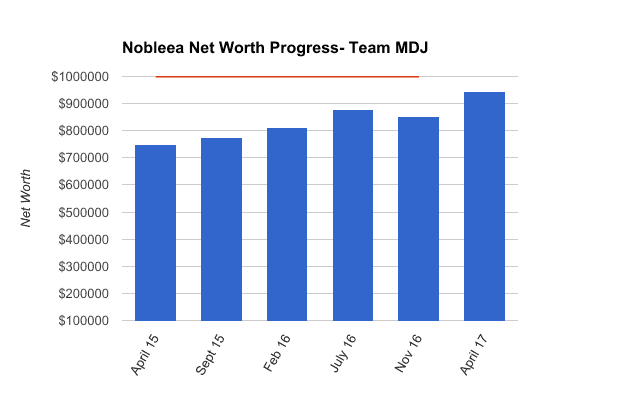

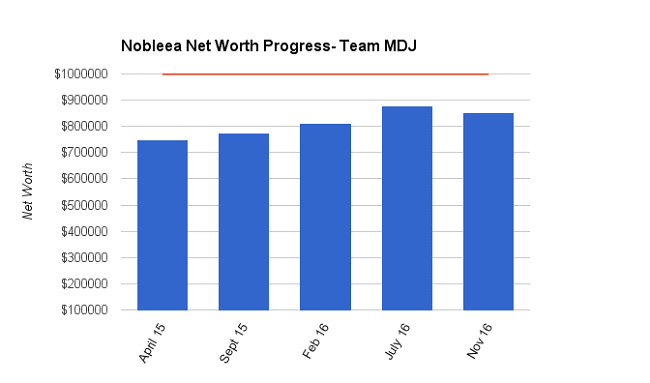

Name: Nobleea Age: 40 Net Worth: $1,049,416 Day Job: Engineering manager at oilfield services company, Teacher (wife) Family Income: $140,000 (main job), $20,000 (part-time job/rental income), $85,000 (wife main job) Goals: Million dollar family net worth before 40 (Complete), Retirement from the primary job at 50 (for me) We live in Edmonton where incomes are…

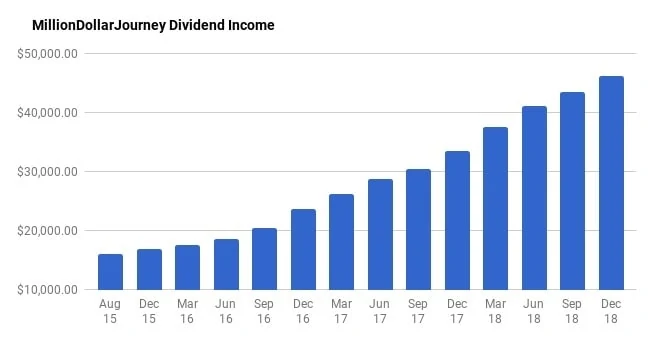

Read MoreFinancial Freedom Update (Q4) – December 2018 – Did we Reach our Goal?

Welcome to the Million Dollar Journey December 2018 Financial Freedom Update – the final update for 2018! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter. For those of you new here, since achieving $1M…

Read MoreRogers World Elite MasterCard – Best Free Cash Back Card in Canada?

In a recent post announcing the new Simplii Financial Cash Back Visa (4% at restaurants), I hinted that the Rogers World Elite MasterCard may be a top contender for the best free cash back credit card in Canada. My post comparing the best free cash back cards in Canada is a popular one with the…

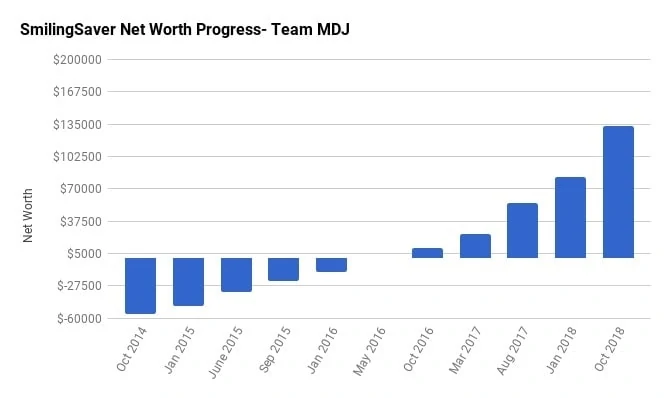

Read MoreNet Worth Update October 2018 – SmilingSaver (+63.2%)

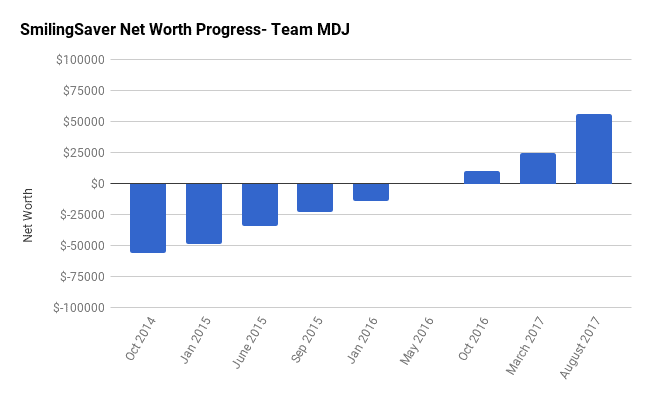

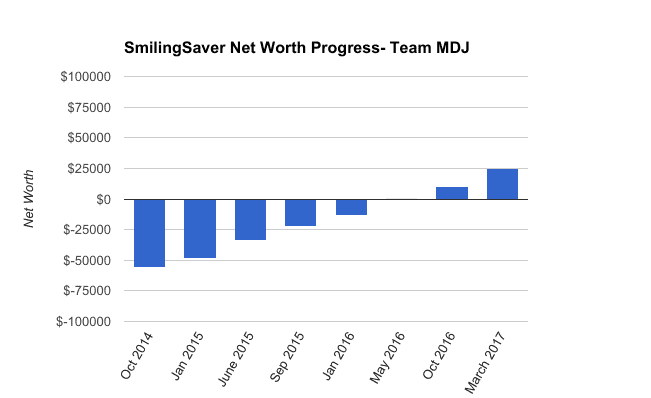

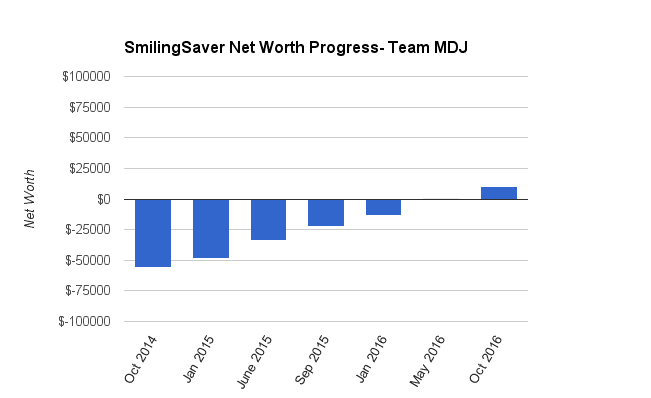

Welcome to the Million Dollar Journey October 2018 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth…

Read MorePaying Property Tax and Utilities with a Credit Card

Recently, a reader asked about my monthly expenses and how I flow all my expenses through a credit card. If you’ve been following MDJ for a while, you’ll know that I am a big fan of some loyalty programs and cash back credit cards. The best is when the stars align that combine a generous…

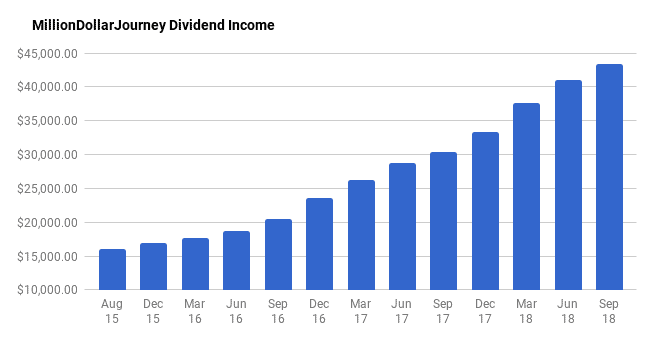

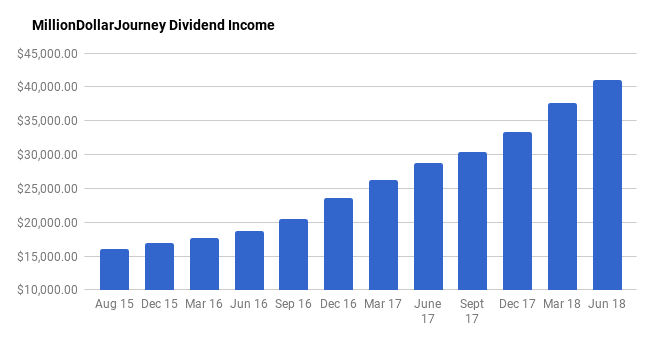

Read MoreFinancial Freedom Update (Q3) – Sept 2018 ($43,450 in Dividend Income)

Welcome to the Million Dollar Journey September 2018 Financial Freedom Update – the third quarter update! For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough…

Read MoreCanadian Financial Summit 2018 – All Online and FREE!

The bloggers behind Young and Thrifty have organized a virtual Canadian Financial Summit (CFS) starring 28 personal finance experts in the country. Some of these experts include: Jon Chevreau (author of Findependence day and former editor of MoneySense Magazine); Preet Banerjee (CBC’s The National Commentator); Ellen Roseman (Columnist at Toronto Star); Rob Carrick (Columnist…

Read MoreFinancial Freedom Update (Q2) – June 2018 ($41,050 in Dividend Income)

Welcome to the Million Dollar Journey June 2018 Financial Freedom Update – the halfway mark of the year! For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they…

Read MoreWhere to Put your Investments for Maximum Tax Efficiency

I’ve been getting a number of emails from readers about dividend investing and which type of investment account to use for maximum tax efficiency. This article should help clear up some of those questions. This post has been modified and expanded but was originally written in 2009. Efficiency is the name of the game not only…

Read MoreTop Premium Credit Cards with No Foreign Transaction Fee

Credit cards with no foreign transaction fees seem to be a hot area these days with new products popping up in recent months. Since the demise of the popular Amazon Visa, there have been a number of new cards that have popped up. In a recent post listing the best travel credit cards, I wrote about…

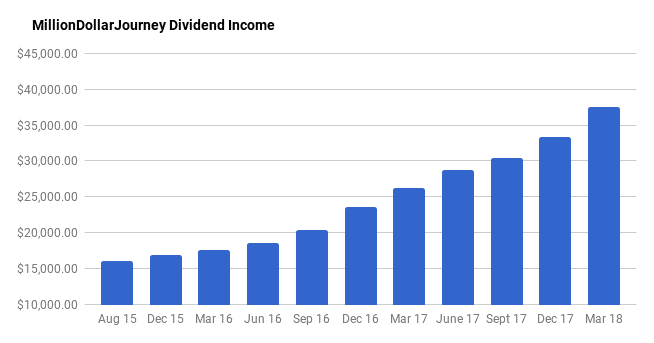

Read MoreFinancial Freedom Update (Q1) – March 2018 ($37,550 in Dividend Income)

Welcome to the Million Dollar Journey March 2018 Financial Freedom Update – the first update of the year! For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they…

Read MoreNet Worth Update March 2018 – Nobleea the Oil and Gas Engineer (+4.2%) ($995,244)

Welcome to the Million Dollar Journey March 2018 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team…

Read MoreOfficial Passive Income Rules for Canadian Small Business

In the Summer of 2017, the Canadian government dropped a tax bomb on Canadian small business owners with proposed changes to how they are able to split their income and their ability to invest excess cash flow into passive investments. While they had some vague guidelines, they did not have concrete rules to wrap our heads around. …

Read MoreIndexed Family RESP Portfolio Update – 2018 Edition

It has been about a year since my last RESP portfolio update which is probably an appropriate time span since it’s a fairly steady portfolio that is 100% indexed. The RESP portfolios for our children are set up with TD e-Series mutual funds which provide a low-cost way to index the market (some other ways to index your portfolio). …

Read MoreNet Worth Update January 2018 – SmilingSaver (+46%)

Welcome to the Million Dollar Journey January 2018 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth…

Read MoreFinancial Freedom Update (Q4) – December 2017 (+9.82%) – Year End Update

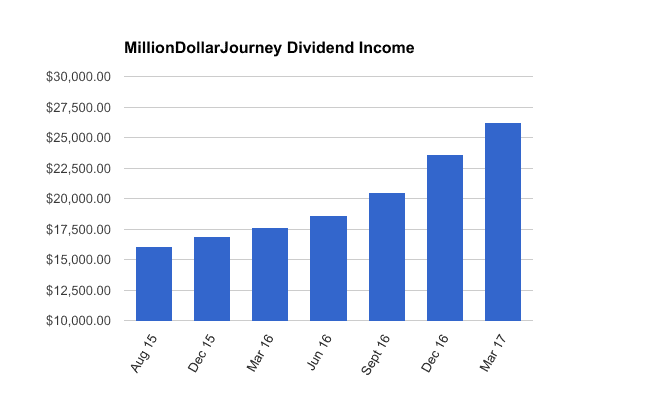

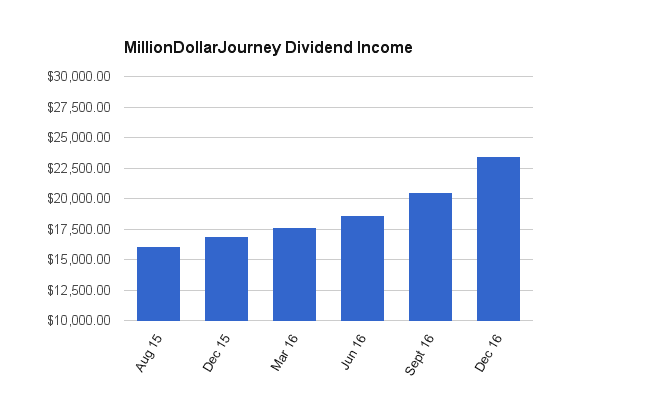

Welcome to the Million Dollar Journey December 2017 Financial Freedom Update – the final update of the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point…

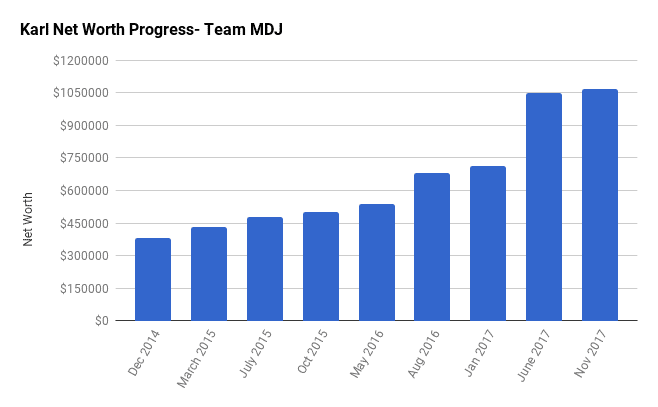

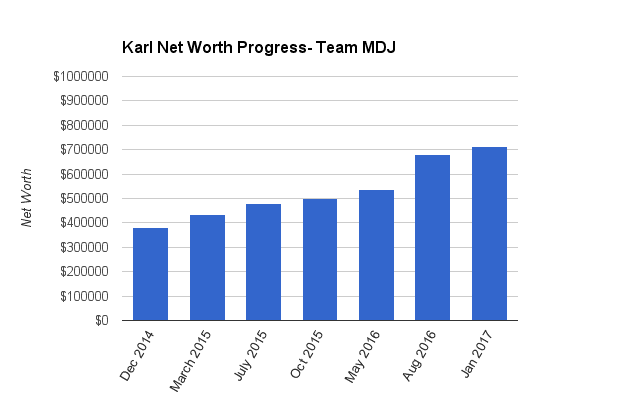

Read MoreNet Worth Update Nov 2017 – Karl the Real Estate Agent Millionaire (+1.8%)

Welcome to the Million Dollar Journey November 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after my million dollar net worth milestone was achieved in June 2014. Karl the Real Estate Agent was selected as a team member and…

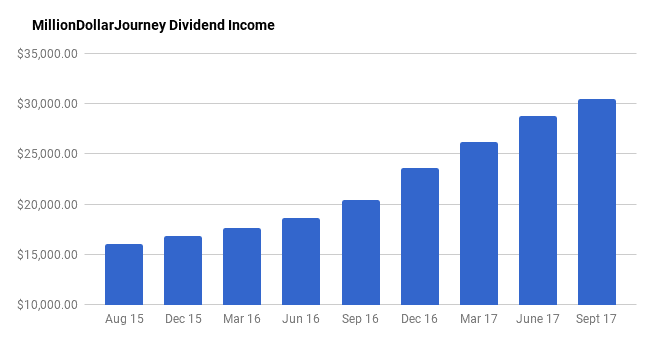

Read MoreFinancial Freedom Update (Q3) – Sept 2017 (+5.56%) – Major Milestone!

Welcome to the Million Dollar Journey September 2017 Financial Freedom Update – the third update of the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point…

Read MoreCanadian Financial Summit – All Online – and FREE!

The bloggers behind Young and Thrifty have organized a virtual Canadian Financial Summit (CFS) starring 25+ personal finance experts in the country. Some of these experts include: Andrew Hallam (Author of Millionaire Teacher); Jon Chevreau (former editor of MoneySense Magazine); Peter Hodson (CEO of 5i Research Inc); Preet Banerjee (CBC’s The National Commentator); Ellen…

Read MoreRRSP Deadline & Contribution Limit 2018/2019

RRSP Deadline/Contribution Limit For those of you coming here through Google search looking for the RRSP deadline for tax year 2018, the deadline is: March 1, 2019. Basically 60 days into the new year. There is an abundance of choice out there for RRSP accounts, but here is a review of the best online brokers for…

Read MoreNet Worth Update August 2017 – Nobleea the Oil and Gas Engineer (+1.3%)

Welcome to the Million Dollar Journey August 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team…

Read MoreNet Worth Update August 2017 – SmilingSaver (+121%)

Welcome to the Million Dollar Journey August 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth…

Read MoreFinancial Freedom Update (Q2) – June 2017 (+9.73%)

Welcome to the Million Dollar Journey June 2017 Financial Freedom Update – the second update of the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point…

Read MoreGlobal ETF ex-Canada (XAW/VXC) or 3 Individual ETFs?

If you’ve been following my financial freedom updates, you’ll see that I’m a fan of global index ETFs (ex-Canada). Two of my favorites are XAW from iShares and VXC from Vanguard. I like them because they provide diversified exposure to the largest companies in the world (outside Canada) through a single ETF, they are on…

Read MoreNet Worth Update April 2017 – Nobleea the Oil and Gas Engineer (+10.8%)

Welcome to the Million Dollar Journey April 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team…

Read MoreNet Worth Update March 2017 – SmilingSaver – The Big Move (+140%)

Welcome to the Million Dollar Journey March 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth…

Read MoreFinancial Freedom Update (Q1) – March 2017 (+10.89%)

Welcome to the Million Dollar Journey March 2017 Financial Freedom Update – the first update for the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point…

Read MoreNet Worth Update January 2017 – Karl the Real Estate Agent (+4.74%)

Welcome to the Million Dollar Journey January 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after my million dollar net worth milestone was achieved in June 2014. Karl the Real Estate Agent was selected as a team member and…

Read MoreFinancial Freedom Update – December 2016 (+15.5%)

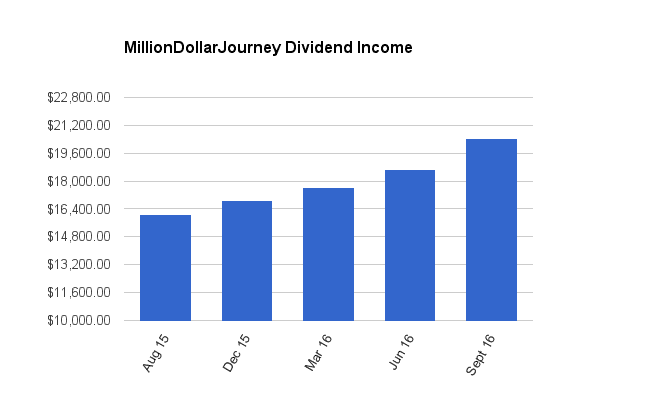

Welcome to the Million Dollar Journey December 2016 Financial Freedom Update – the final update for the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point…

Read MoreNet Worth Update Nov 2016 – Nobleea the Oil and Gas Engineer (-3.2%)

Welcome to the Million Dollar Journey November 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team…

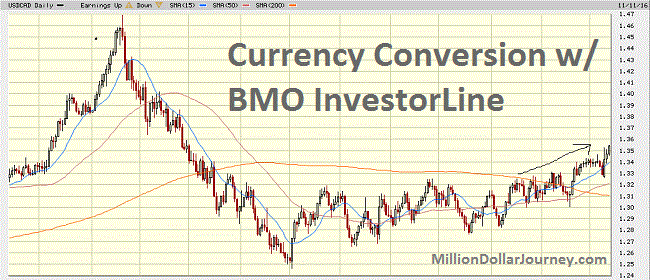

Read MoreReal Life Example of Norbert’s Gambit and Foreign Exchange w/ BMO InvestorLine

The continued strength of U.S Dollars (USD) has made it more expensive for Canadians to purchase US goods. As of this week, $1 CAD = 0.73856 USD, in other words, it would cost you $1.354 CAD to purchase $1 USD. This is a great situation if you already own USD, and perhaps now is a…

Read MoreHow to Transfer a Work Pension to a LIRA

When my wife recently left her career in health care, there was a bit more administrative work than expected. One of these administrative items was to decide what to do with her accrued pension with her work place. Technically, there are two pensions that we have to deal with. The first was a “defined benefit”…

Read MoreNet Worth Update October 2016 – SmilingSaver – New Goal Edition (+9729%)

Welcome to the Million Dollar Journey October 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth updates on a regular basis. Here is more…

Read MoreFinancial Freedom Update – September 2016 (+9.7%)

Welcome to the Million Dollar Journey September 2016 Financial Freedom Update. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family…

Read MoreNet Worth Update August 2016 – Karl the Real Estate Agent (+27.02%)

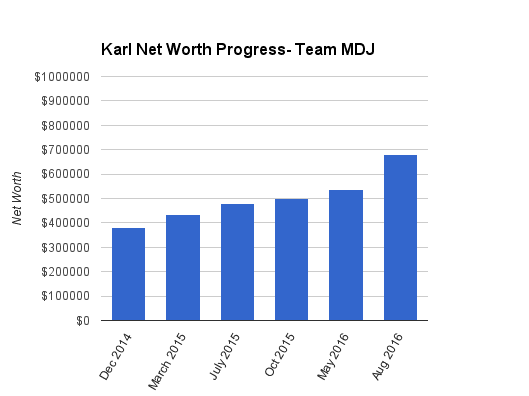

Welcome to the Million Dollar Journey August 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after my million dollar net worth milestone was achieved in June 2014. Karl the Real Estate Agent was selected as a team member and…

Read MoreNet Worth Update July 2016 – Nobleea the Oil and Gas Engineer (+8.38%)

Welcome to the Million Dollar Journey February 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team…

Read MoreFinancial Freedom Update – June 2016 (+5.78%)

Welcome to the Million Dollar Journey June 2016 Financial Freedom Update. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family…

Read MoreNet Worth Update June 2016 – Sean Cooper (+2.76%)

Welcome to the Million Dollar Journey June 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Sean Cooper was selected as a team member and will post net worth…

Read MoreHow to Create a Stock Watchlist with Google Spreadsheets

I brought this post out of the archives due to a number of recent emails about how to track stock holdings. I still use Google spreadsheets today to track my dividend holdings. With the market volatility, there is a heightened interest in dividend stocks and how to buy stocks in general. Within my article on…

Read MoreNet Worth Update May 2016 – Smiling Saver – Student Loan Edition (+100%)

Welcome to the Million Dollar Journey May 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth updates on a regular basis. Here is more…

Read MoreNet Worth Update April 2016 – Karl the Real Estate Agent (+6.9%)

Welcome to the Million Dollar Journey April 2016 Net Worth Update (a little late, sorry!) – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after my million dollar net worth milestone was achieved in June 2014. Karl the Real Estate Agent was selected as a team member…

Read MoreBreakdown of Our Expenses in 2015

Back in 2008, I wrote my initial post about our monthly expenses. It’s always interesting going back in time to see what the circumstances were. Back then, the update was compiled just before we had our first child, and we had a mortgage on our principal residence (a new build). Our annual recurring outlay was around…

Read MoreFinancial Freedom Update – March 2016

Welcome to the Million Dollar Journey March 2016 Financial Freedom Update. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our…

Read MoreNet Worth Update March 2016 – Sean Cooper – Mortgage Free @ Age 30 (+10.39%)