Financial Freedom Update (Q4) 2020 – Volatile Stock Market Edition ($61,850 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q4) Financial Freedom Update – Volatile Market Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses.

Here is a little more detail on our passive income goals:

How it all started – Original Financial Goal

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

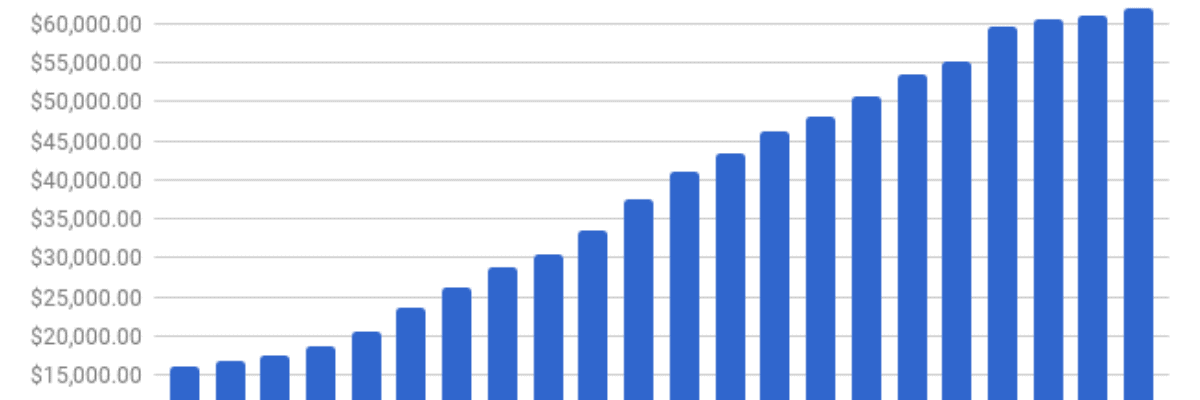

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

I’m happy to report that we have achieved this goal in 2020, slightly ahead of schedule. Right now, the goal is to continue building and reinvesting those dividends within the portfolio. I’d like to imagine that one day, our portfolio/dividend income will reach $100k/year which would be a $2.5M dividend portfolio.

The Previous Update

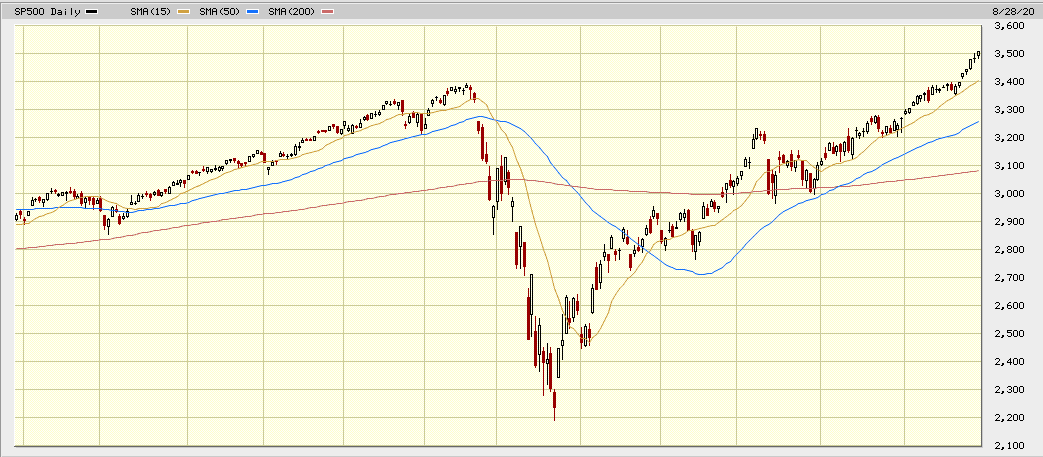

In the previous updates, I wrote about the stock markets v-shape recovery from the COVID19 sell-off back to all-time highs. The stock market has been a good representation of the craziness of 2020. From market all-time highs (first half of Q1 2020), to the fastest 35% correction in history (second half of Q1), then to one of the fastest recoveries recorded (S&P500)!

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Here is a summary of the last update:

Q3 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,700 | 4.32% |

| TFSA 1 | $4,250 | 5.16% |

| TFSA 2 | $4,000 | 4.86% |

| Non-Registered | $3,700 | 4.67% |

| Corporate Portfolio | $30,000 | 3.97% |

| RRSP 1 | $8,000 | 2.67% |

| RRSP 2 | $3,400 | 2.37% |

- Total Portfolio Value: $1,621,139

- Total Yield: 3.77%

- Total Dividends: $61,050/year

Current (Q4) Update

In the last update, the S&P500 (a basket of the 500 largest companies in the USA) was making all-time highs trading around 3,500 which is quite the feat considering what happened to the market earlier in the year (see chart below).

Since then, the S&P500 has become choppy due to a number of factors like the growing number of global COVID-19 cases, uncertainty in the upcoming US election, and of course, frothy valuations of technology stocks which make up a large portion of the S&P500.

What happens next, in the short term, remains to be seen. On the other hand, the market has proven time and time again that over the long term, it will continue to chug along in an upward direction – and that’s what I’m betting on.

On the other hand, if you are building the Canadian allocation of your portfolio, the TSX has also been turning over since my last update. While the TSX has Shopify to represent technology stocks, it’s not quite enough to make up for the weak energy sector.

Having said that, the weaker TSX has turned some strong dividend stocks to be ripe for the picking!

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Thus far in the quarter, I deployed capital into the following :

- Algonquin Power & Utilities (AQN)

- TD Bank (TD)

- Brookfield Infrastructure (BIPC)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, despite the market volatility, this year has proven to be lucrative for dividend growth investors.

2020 Dividend Raises

So far in 2020, the Canadian portion of my portfolio received raises from:

- CU.TO (3% increase)

- MRU.TO (12.5% increase)

- CNR.TO (7% increase)

- XTC.TO (5% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (10.7% increase)

- GWO.TO (6.1% increase)

- TRP.TO (8% increase)

- RY.TO (3% increase)

- MG (9.6% increase)

- TD.TO (6.8% increase)

- CM.TO (3% increase)

- PWF.TO (10% increase)

- MFC (12% increase)

- ENB.TO (9.8% increase)

- TRI.TO (5.5% increase)

- TD.TO (6.8% increase)

- CM.TO (3.0% increase)

- ENGH.TO (22% increase)

- CNQ.TO (13% increase)

- POW (10% increase)

- EMP.A (8% increase)

- CP (14.5% increase)

- AQN (10% increase)

- CPX (6.8% increase)

- EMA (4.1% increase)

- WCN (10.8% increase)

- FTS (5.8% increase)

But what about dividend cuts? 2020 has been especially tough on dividend cuts. With an oil crash and many companies closed during this pandemic, struggling companies have made the decision to preserve capital by either suspending their dividend or cutting the dividend.

There have been a number of casualties so far in my portfolio namely positions in (mostly energy-related):

- High Arctic Energy (HWO)

- NFI Group (NFI)

- Inter Pipeline (IPL)

- CAE (CAE)

- Husky Energy (HSE)

- Suncor (SU)

- Ensign Energy (ESI)

- Mullen Group (MTL)

- Leon’s Furniture (LNF)

- Pason Systems (PSI)

For a more complete list of dividend cuts of 2020, you can see a full list here.

Top 10 Holdings

In our overall portfolio, here are the current top 10 largest dividend holdings:

- Canadian National Railway (CNR)

- Fortis (FTS)

- Emera (EMA)

- TD Bank (TD)

- Royal Bank (RY)

- CIBC (CM)

- TransCanada Corp (TRP)

- Canadian Utilities (CU)

- Bell Canada (BCE)

- Enbridge (ENB)

*not counting index ETFs (they are my largest holding).

Dividend Income Update

As you can see in detail below, we have increased our dividend income to $61,850 which represents a small increase quarter over quarter.

Here are the numbers.

Q4 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,800 | 4.58% |

| TFSA 1 | $4,250 | 5.42% |

| TFSA 2 | $3,900 | 4.94% |

| Non-Registered | $3,900 | 5.04% |

| Corporate Portfolio | $30,500 | 4.10% |

| RRSP 1 | $8,000 | 2.87% |

| RRSP 2 | $3,500 | 2.47% |

- Total Portfolio Value: $1,568,867

- Total Yield: 3.94%

- Total Dividends: $61,850/year

Final Thoughts

Deploying some cash this past quarter has resulted in a small bump in dividend income. Even though we have reached our passive income goal, we will continue to invest our savings and reinvest the incoming dividends.

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. Depending on taxation in your area, in ON, $60k in dividend income is about equivalent to an $80k salary, which is about $40/hr. Not a bad way to psychologically frame passive income.

To put dividend income in further context, I recently wrote a post about withdrawing from your RRSP or TFSA where, with no other income in retirement, you can make up to $50k in dividend income and pay very little to no income tax (depending on the province).

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all in one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cashflow and stick with a long-term plan. Your future wealthier self will thank you for it.

Congratulations again! Wow, $100K in dividend income- what are you going to do with all that money (other than reinvest it and use about $60K of it)?

I’m curious for your $61K in dividend income, do you treat the US dividends as 1:1 with CAD? Or do you convert it to CAD hypothetically?

Very solid progress Frugal Trader! It will be interesting to see what the stock market does in the short term. Like you, I’m betting that the market will continue to go upward in the long term.

We were aiming for $30k in dividends this year but that’s probably not going to happen due to some cuts. Regardless we should be close.