CI Direct Investing Review 2026 (Formerly WealthBar)

CI Direct Investing Review Summary and Promo Offer Code

-

Expat Investment Options

-

Customer Service

-

Commitment to Excellent Financial Advice

-

Fees

-

Investment Strategy: ETF Portfolios

-

Investment Strategy: Private Portfolios

-

Safety

CI Direct Investing Review Summary:

CI Direct Investing, formerly known as Wealthbar, provides a variety of managed ETF portfolios tailored to Canadian investors. Notably, it is the only robo-advisor available to Canadian non-resident expat investors, making it an excellent choice for Canadians living abroad.

A subsidiary of CI Financial Group, one of Canada’s largest and most established investment firms, CI Direct Investing benefits from the credibility and resources of its parent company. This makes the company slightly different from newer robo-advisors like Wealthsimple and Justwealth.

In this review, we’ll explore why CI Direct Investing is considered one of the best robo-advisors in Canada, covering its fees, portfolio offerings, safety measures, and more. Keep reading to learn why CI Direct Investing stands out in the Canadian robo-advisor landscape.

Pros

- Best option for Canadian expats

- Automatic rebalancing

- Excellent service and financial advice

- Safe and trustworthy with no hidden fees

Cons

- Fees are higher than some other robo advisors

- Very high MER for the private portfolio

- High minimum investment of $25,000 for non-resident expats

What is CI Direct Investing and Is It a Robo Advisor?

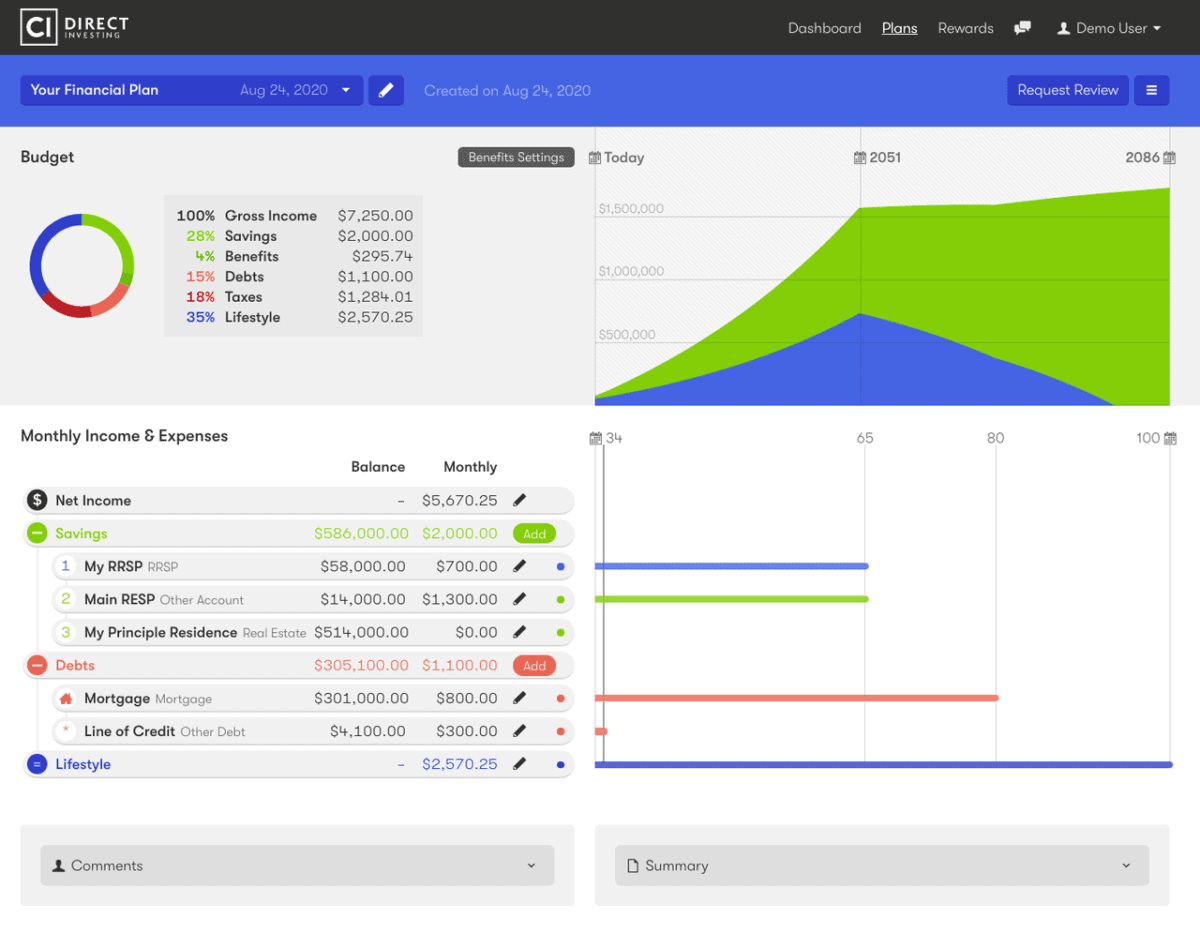

CI Direct Investing is a combination of an automated investing platform and a personal accessible financial advisors.

When it comes to taking a piece of your monthly pay cheque and turning it into a diversified investment portfolio – CI Direct Investing does that for you. That part of the business would be considered a “robo advisor model”.

What sets CI Direct Investing apart though, is the fact that right from Day 1, you will have access to excellent financial advice at your fingertips. This financial advisor will usually hold the credential of a Certified Financial Planner® professional. That’s an important distinction, because it carries legal responsibilities far beyond that of a “financial planner”.

As the precursor to CI Direct Investing, WealthBar took great pains to emphasize the utilization of sound financial advice relative to other FinTech companies (which were often lumped together under the generic title of “robo advisor”). In our JustWealth Review we explain how that robo advisor has really emphasized the financial planner’s role in the process as well.

If you’re someone who is actually looking for a financial planner, over a hybrid robo advisor/financial planner platform, you will want to check out our article of the Best Financial Advisors in Canada.

What Accounts Does CI Direct Investing Offer?

When you register with CI Direct Investing (you can get started in as little as ten minutes) you can open the following accounts:

- Basic Non-Registered Account

- Savings Account

- Joint Account

- TFSA

- RRSP

- Spousal RRSP

- RIF/RRIF

- RESP (including Quebec residents)

- LIRA

- LIF

- Corporate Investment Account

- Trust Accounts (Formal Trust Accounts and Informal Trust Accounts)

- Charitable Organization Investment Accounts

- Group TFSAs and RRSPs (for your employees if you own a company)

- Individual Pension Plans

- Personal Pension Plans

CI Direct Investing Review: Fees

Your portfolio is going to have two levels of fees when you invest through CI Direct Investing.

- The fees that your underlying ETFs will charge you.

- The fees that CI Direct Investing will take for helping you out on your investing journey.

The underlying ETF fees are going to cost between .16% and .30% for the passive ETF portfolios. The active ETF portfolios and the Socially Responsible Investment (SRI) portfolios will come with a higher ETF fee.

The ETF fees that we refer to are known as a Management Expense Ratio (MER) and are commonly shown as a percentage of your overall assets. Because MERs are an inherent part of the ETFs themselves, clients will not see this money deducted from their CI Direct Investing account.

CI Direct Investing’s fees are charged under the following annual structure:

.60% on your first $150,000 invested

.40% on $150,000-$500,000

.35% on anything over $500,000

So, if you had $100,000 invested, you’d owe CI Direct Investing about $600 for the year, and the internal costs of your ETFs would be around $180-$260 which would be reflected in your portfolio’s performance.

If you had $750,000 invested with CI Direct Investing, you’d owe:

$150,000 x .6 = $900

$350,000 x .4 = $1,400

$250,000 x .35 = $875

Total CI Fees = $3,175

ETF Fees = $1,350-$1,950

That’s it – pretty transparent and easy to calculate!

CI Direct Investing for Canadian Non-Resident Expats

At one time CI Direct Investing was the only robo advisor option available for Canadian citizens who are also non-residents for tax purposes (aka: expats). Given my expat journey to Qatar, this was obviously very pertinent to me! JustWealth has stated they would consider non-resident accounts on a case-by-case basis.

When doing my research, I did come across a couple of robo advisor-style platforms based out of Switzerland and Singapore – but they were prohibitively expensive and quite complicated to use. In my opinion, CI Direct Investing is by far the best option for Canadian expats.

I am very impressed with what CI Direct Investing has put together for their expat clients. If you want the easiest way to get into index investing as a Canadian expat – this is far and away the best solution! You’re going to pay a bit more than you would if you were index investing using a Canadian discount brokerage, but depending on how big your portfolio is, it’s quite possible that you’ll pay less in overall fees than you would with an international discount brokerage – plus you get a ton of additional services in return for your money.

The one caveat here is that CI Direct Investing is not available in the USA or certain other countries such as North Korea, Iran, etc.

Here were the answers to my expat questions when I emailed CI Direct Investing.

What do Canadian Expats need in order to open up a robo advisor account with CI Direct Investing?

- $25,000 account minimum

- Your downloaded account statement for a Canadian bank account

- An electronic document issued by a Canadian government agency, or a cell phone company, or a utility company.

- Canadian SIN

- Any foreign tax ID numbers that have been assigned to you

- A signature (either electronic or old school)

Do I have to be in Canada at any point or have a Canadian address in order to open a non-resident account with CI Direct Investing?

Absolutely not.

What accounts can I open as a Canadian non-resident?

You should stick to a plain, vanilla non-registered account as a non-resident. However, you could also transfer over any existing RRSP and/or TFSA accounts you have in order to keep life simple and have all your investments under one roof.

What taxes will I have to pay with CI Direct Investing?

The same taxes you’d have to pay anywhere else as a Canadian non-resident. Namely, the withholding tax on Canada-sourced income. What you owe in your new country obviously depends on local laws.

How does having a CI Direct Investing account affect my non-resident status – and is it a strong resident tie?

Neither a non-resident CI Direct Investing account, nor a non-resident discount brokerage account is going to be a secondary residential tie to Canada. It will not be enough – by itself – for the CRA to consider you a factual resident. If you also own a car in Canada that you use when you come for the holidays, never cancel your provincial health insurance, and still have a provincial driving license… The combination of all of those things might start to tilt the scales toward being considered a factual resident.

How Does It Work? CI Direct Investing ETF Portfolios

When you first sign up with CI Direct Investing, you’ll be matched to the right investment based on your goals and risk profile. You can connect with an adviser how and when it works for you. Simply connect via email, phone, video or chat.

CI Direct Investing has four different investing paths: Passive Portfolios, Active (Private Investment) Portfolios, Socially Responsible Portfolios, and Cash Equivalent Portfolios. The Passive Portfolios are their ETF portfolios which is likely what you are looking for when reading this article.

Within the broad Passive/ETF Portfolios at CI Direct Investing, there are eleven asset allocation options:

- Essential Safety Portfolio

- Essential Balanced Portfolio

- Essential Aggressive Portfolio

- Conservative ETF Portfolio

- Growth ETF Portfolio

- Essential All Equity Portfolio

- Essential Conservative Portfolio

- Essential Growth Portfolio

- Safety ETF Portfolio

- Balanced ETF Portfolio

- Aggressive ETF Portfolio

Each of these all-in-one solutions is made up of the following ETFs – just held in different proportions depending on how much risk you want to take.

- iShares Core Canadian Universe Bond Index ETF (XBB) = Canadian bonds

- CI Canadian Aggregate Bond Index ETF (CAGG) = Canadian bonds

- CI Canadian Equity Index ETF (CCDN) = Canadian stocks

- Vanguard Global Aggregate Bond Index ETF (CAD-hedged) (VGAB) = Bonds from around the world, hedged to the Canadian dollar

- CI U.S. 500 Index ETF (CUSA.B) = US stocks

- CI High Interest Savings ETF (CSAV) = Canadian banks high interest savings accounts

- BMO MSCI EAFE Index ETF (ZEA) = Canadian and US stocks

- BMO High Yield US Corporate Bond Index ETF (ZJK) = US bonds from corporations

- CI U.S. 1000 Index ETF – Unh (CUSM.B) = US stocks

- CIBC Global Bond ex-Canada Index ETF C$ (CGBI) = Global fixed income

- iShares Core MSCI EAFE ETF (IEFA) = Developed market equities excluding the US and Canada

- iShares Core MSCI Emerging Markets ETF (IEMG) = Emerging market equities

- CI Emerging Markets Alpha ETF (CIEM) = Equity and Equity-related securities of companies in emerging markets, or serving customers in emerging markets

- CI Enhanced Short Duration Bond Fund (FSB) = Global Fixed Income

- CI Equity Asset Allocation ETF (CEQT) = Global Equity Securities

- CI Balanced Income Asset Allocation ETF (CBIN) = Global fixed income and equity securities

- CI Balanced Growth Asset Allocation ETF (CBGR) = Global equity and fixed income securities

For example, here’s a look at the balanced ETF Portfolio (as currently constructed at the time of writing).

Fund | Ticker | Breakdown |

iShares Core Canadian Universe Bond Index ETF | XBB | 28.5% |

CI Canadian Equity Index ETF | CCDN | 18.5% |

CI U.S. 500 Index ET | CUSA.B | 18.5% |

BMO MSCI EAFE Index ETF | ZEA | 15% |

Vanguard Global Aggregate Bond Index ETF (CAD-hedged) | VGAB | 6.5% |

CI Emerging Markets Alpha ETF | CIEM | 6% |

CI Enhanced Short Duration Bond Fund | FSB | 3.5% |

BMO High Yield US Corporate Bond Index ETF | ZJK | 3.5% |

Like JustWealth, CI Direct Investing offers Socially Responsible Investing (SRI) portfolios – – fifteen of them to be exact! Many of their SRI portfolios are simply their passive portfolios from above, but with a “Cleantech add-on”.

Here is how their Balanced Impact Portfolio breaks down (as currently constructed at the time of writing).

Fund | Ticker | Breakdown |

CI MSCI World ESG Impact ETF (CAD Hedged) | CESG | 55.0% |

NEI Global Impact Bond Fund | NWT8593 | 40.0% |

First Trust NASDAQ Clean Edge Green Energy Index ETF | QCLN | 5% |

Generally speaking, if you have longer term goals, and a higher risk profile, your ETF portfolio will be weighted more heavily towards stocks and less towards bonds.

CI Direct Investing has chosen the ETFs for their portfolios by using the following criteria:

- Tracking error minimization to mirror the index

- Higher trading volume ETFs selected for best pricing

- Priority given to funds with higher Assets Under Management

- All else equal, they choose the ETF with the lower share price

- Country of origin considered to reduce currency exchange charges

- Successful performance history verified

- Lowest MER possible

If you want to change your selected ETF portfolio, you can do that at any time – BUT – keep in mind that you were placed in a portfolio for a reason. Has your risk tolerance really changed, or are you simply chasing recent performance? These are great conversations to have with your CI Direct Investing advisers.

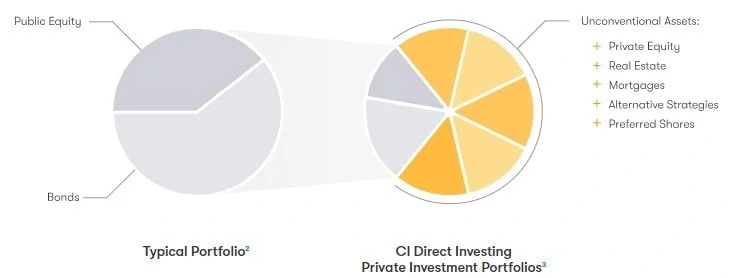

How Does It Work? CI Direct Investing Private Investment Portfolios

To understand the difference between CI Direct Investing’s ETF portfolios and their Private Investment Portfolios (also referred to as Active Portfolios), it helps to get a quick refresher on active vs passive investing.

Active Investing Mindset: Whomever I pick to manage my investments is smarter than the average person who invests in assets in the stock/bond/real estate/commodity markets. Because they’re smarter, they can pick investments that are currently worth more than what people are paying, or that will do better in the future than most people think. The ability to pick those better investments will lead to better overall returns on my investment money and/or my portfolio will have much less volatility (i.e. “big ups and downs”). Because the investment professionals will be working really hard to select these better-than-average investments, the people who will manage my investments will need to get paid and will charge me a percentage of my entire portfolio each year.

Passive Investing Mindset: There is no statistical evidence that we can identify which investment people or funds are going to be better-than-average when it comes to picking the best stocks/bonds/real estate/commodity investments. It’s really, really hard to pick investments that beat the average, because a lot of incredibly smart people are trying to do precisely that every day. Because it’s really, really hard to pick investments that beat the average by even a small amount, that extra that I’m paying in fees means that they have to be a super-duper All Star in order for me to pay their extra fees, and still have enough investment returns leftover to beat the average.

I’m likely better off just cutting my fees as low as possible and taking the average of the asset class. I can do that by using the ETF portfolios to own nearly every large company in the world.

Active Investing + Different Asset Classes

CI Direct Investing’s Private Portfolios use actively managed Nicola Wealth Funds to build clients a portfolio of investments that include “unconventional assets” as shown below.

There are three different Private Portfolio options available.

- Safety Private Portfolio

- Balanced Private Portfolio

- Aggressive Private Portfolio

Here’s an example of what your asset allocation would look like if you chose the “Aggressive” option (accurate at the time of publishing).

Asset Class | Breakdown |

US Equities | 30% |

Real Estate | 21% |

International Equities | 10% |

Private Equity | 9% |

Mortgages | 7% |

Private Debt | 7% |

Fixed Income | 6% |

High-Yield Bonds | 5% |

Canadian Equities | 4% |

Fund | Ticker | Breakdown |

Nicola Core Portfolio Fund | NWM254 | 70.0% |

Horizons S&P 500 ETF | HXS | 30.0% |

Portfolio MER | 1.20% |

Personally, I remain unconvinced that the Private Portfolios offer any extra utility to the average investor. I understand the theory of trying to diversify into asset classes that are not correlated to stocks/equities, but those high MER fees that go with active management scare me.

The Private Portfolios do have a relatively good track record over their short lifespan, but as with all things investing, “Past results are not indicative of future performance.”

I recommend keeping it simple and staying away from these more complicated options.

Is CI Direct Investing Safe?

Yes!

CI Direct Investing is as safe as any banking and investment option in Canada!

Of course, one has to remember that when it comes to investing, “safe” means different things to different people. There is no company that can guarantee investment returns. CI will make sure your information stays safe, and that your investments are protected from certain / some fraud or corporate bankruptcy – but your investments can still go down in value. If any company claims that they can guarantee the “safety” of your investment returns – I’d walk away immediately.

CI Direct Investing is the robo advisor arm of a massive company that manages over $280 Billion worth of assets. Companies this large employ the latest in online security and encryption standards. I would hesitate to say that any website or online platform is “hack-proof”, but at the very least, you’re as safe with CI as you would be anywhere online.

Some people ask, “What happens if my robo advisor goes bankrupt?”

No worries on that front. First and foremost, there are all kinds of laws that prevent financial companies from dipping into your investment assets to pay their expenses. So that’s one level of protection.

The second level of protection is actually just the free market! You’re a fee-paying customer, and so if for some crazy reason CI Direct Investing decides that their robo advisor branch of the company isn’t pulling its weight, it’s quite likely the company would be sold to another robo advisor platform, and your assets would stay nice and safe while new management took over.

The final layer of protection is perhaps the one that inspires the most confidence. When you use CI Direct Investing your investments are automatically insured by the Canadian Investor Protection Fund (CIPF) up to $1 Million per account through a 3rd party provider they partner with. This gives your investment portfolio the full protection of the Canadian government, and consequently is about as solid a guarantee as you can find.

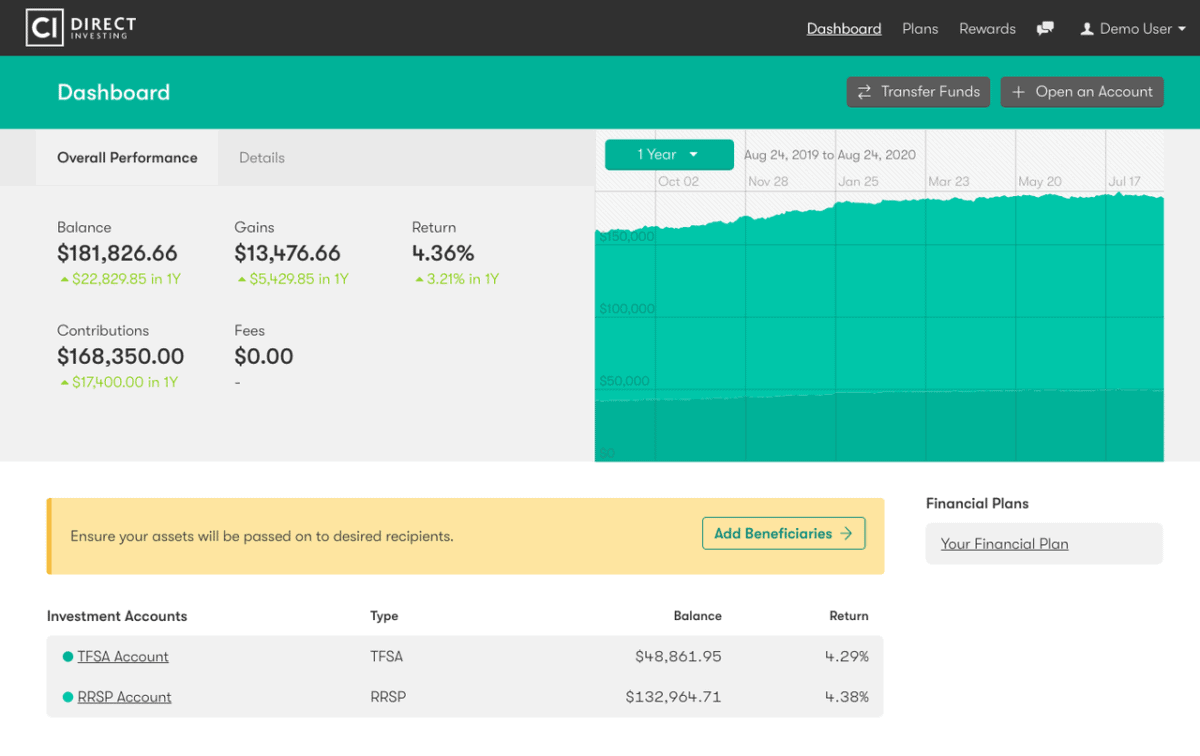

CI Direct Investing Mobile App Review

With CI Direct Investing’s app you can access all of your CI Investment Accounts in one place. Its sleek interface is easy to navigate, allowing you to fund your accounts, track your investments, and even open an interest earning savings account as well as access financial advice.

The app has a solid 4.6 star rating on both the Google Play store and the Apple App Store. Users reviews include comments on its excellent functionality, and easy access to real financial advisors. Having access to financial advisors through their app definitely sets CI Direct Investing apart from other mobile platforms.

When Did WealthBar Become CI Direct Investing?

In 2019 CI Financial purchased Wealthbar and merged the company into their large umbrella of Canadian investment companies. They also purchased the discount brokerage company Virtual Brokers.

In August 2020 the Wealthbar brand officially became CI Direct Investing – but the company took great pains to make it crystal clear that while the name had changed, the commitment to excellent customer service and financial advice had not.

Wealthbar was founded back in 2014 by Tea and Chris Nicola. In a Globe and Mail interview, Tea explained, “I felt like finance needed a boost of benevolence to be honest, I wanted to be Robin Hood, in my own way.” With a solid background of working at Nicola Wealth, the duo hit the ground running, quickly building what would become known as the Canadian robo advisor option that most emphasized sound financial planning.

CI Direct Investing vs Justwealth

When evaluating a robo-advisor option like CI Direct Investing, we always compare it with our top recommendation, Justwealth, to give you a clear picture of how they stack up.

Both CI Direct Investing and Justwealth offer a range of appealing features:

- Simple application process

- Multiple investment account options

- Personalized ETF portfolios based on your financial goals and preferences

- Lower fees compared to traditional Canadian mutual funds

To help you better understand the differences between these two platforms, we’ve put together a comparison table:

CI Direct Investing | Justwealth | |

Number of ETFs Available | 11 Passive ETF Portfolios, 15 SRI Portfolios, and 3 Active/Private Portfolios | 80 portfolios with 50 different ETFs |

Personalized Financial Advisor | No | Yes |

Company Management Fee | 0.35% to 0.60% depending on portfolio value | 0.40% to 0.50% depending on portfolio value |

Management Expense Ratios (MERs) | 0.16% to 0.30% (for passive ETF portfolios) | 0.15% to 0.25% |

Account Types | RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA, Corporate Investment Account, Trust Accounts, Group TFSAs and RRSPs, Individual and Personal Pension Plans | RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA |

Account Minimum | $100 for select portfolios, some are as high as $50,000 – Account minimum for Canadian expats is $25,000 | $5,000 (although there are exceptions for RESP and FHSA accounts) |

Promo | No Available Promo | $100-$500 Instant Cash Back |

Sign Up |

Fee structure: CI Direct Investing has a fee of 0.51% to 0.90% (management fee of 0.35% to 0.60% plus an ETF fee between 0.16% to 0.30%). Justwealth’s fee is on the lower end of this range: 0.55% to 0.75% (management fee of 0.40% to 0.50% plus an ETF fee between 0.15% and 0.25%).

The account size dictates the management account fee with both Justwealth and CI Direct Investing. After $500,000 Justwealth’s management fee drops to 0.40% and CI Direct Investing’s management fee drops to 0.35%.

Of course, you also need to take into account the ETF fees for your chosen portfolio. All things considered, you’re going to come out ahead with JustWealth overall from a pure-fees perspective until your overall portfolio tops about $1.25 million.

Account minimums: CI Direct Investing’s minimums take a bit of digging to uncover. The account minimum to open a CI Direct Investing account is only $100. However, each portfolio has a different minimum that is required before your money is invested in that recommended portfolio. When I was looking around on their website I saw numbers varying from as low as $100 to as high as $50,000! Canadian expats have an account minimum of $25,000.

Justwealth has an account minimum of $5000, although there are exceptions for RESP and FHSA accounts.

ETF options: CI Direct Investing has close to 30 ETF portfolio options. Meanwhile, Justwealth has access to around 50 ETFs which leads to over 80 diverse portfolios. Both CI Direct Investing and Justwealth provide responsible investing (RI) options, allowing investors to align their portfolios with their personal values and social or environmental priorities.

Range of services and accounts: CI Direct Investing is part of CI Financial Group, which is one of Canada’s largest and most established investment firms. Justwealth is focused only on robo-advising, but it does a fantastic job with this focus, offering a wide range of account options including FHSAs and target-date RESPs. While both platforms have financial advisors, with Justwealth you will have a personally dedicated financial advisor.

Mobile App: Both Justwealth and CI Direct Investing have mobile apps that allow you to add funds to your account, view investment activity, and track your portfolio’s progress. Justwealth’s mobile apps haven’t been around for long, but the CI Direct Investing app is highly rated by both Android and Apple users (4.6 stars).

Our conclusion: While CI Direct Investing is an excellent option for Canadian expats, it falls short when compared to other industry leaders in the robo-advisor space, particularly for the average Canadian investor seeking low-fee solutions.

Justwealth continues to be our top recommendation for a reason – it offers exceptional account options, low fees, and personal advisors for everyday investors. On top of that, Justwealth is currently offering a generous sign-up bonus of up to $500. To learn more about why we highly recommend Justwealth, check out our in-depth Justwealth Review.

Frequently Asked Questions

Setting Up an Account: A Peek Inside CI Direct Investing

Here’s what your screens will look like when you sign up, in addition to some of the more prominent advertising that CI Direct Investing is currently running.

CI Direct Investing Review: Who Is It Best For?

CI Direct Investing’s hybrid robo-advisor service is particularly appealing to passive investors, especially those living abroad. Simplifying the complexities and paperwork associated with being a Canadian non-resident is a big draw. While you’ll need a minimum of $25,000 to open an account, the benefits, such as the convenience and accessibility at a low cost, make it worthwhile for many expats.

However, for Canadians living in Canada, CI Direct Investing may not be the best choice for a few reasons. The high minimum investment balance for many portfolios is a significant barrier, especially when compared to competitors like Wealthsimple, which has no minimum, or Justwealth, which requires just $5,000 (with lower minimums for RESPs and FHSAs). Additionally, platforms like Justwealth, which takes top place in our list of Best Canadian Robo Advisors, offer a broader range of financial services, including access to personalized advisors.

If keeping costs low is your top priority, you may want to consider DIY investing instead of using a robo-advisor. DIY investors can reduce costs even further by choosing one of the Best Canadian Online Brokers, which offers low fees and greater flexibility for self-directed investors.

Check out our interviews with Wealthbar co-founder and CI Direct Investing CEO Tea Nicola.

Thanks for the article, unfortunately seems CI Direct don’t consider anyone residing in the EU/EEA

https://help.cidirectinvesting.com/non-residents/what-type-of-accounts-can-i-open