Best Tech Stocks in Canada For 2026

While Canadian technology stocks have seen impressive growth over the last decade – particularly during the pandemic – they remain a relatively small slice of the Toronto Stock Exchange.

We have a lot of great Canadian dividend stocks, Canadian bank stocks, Canadian energy stocks, Canadian utility stocks, etc.

But tech stocks account for just 8-9% of our publicly traded market, according to the FTSE Canada All-Cap Index. To put that into perspective, the financial sector dominates at around 34%, and energy contributes about 17%. South of the border, the contrast is striking: U.S. tech stocks make up a staggering 34% of the market by overall capitalization, claiming the largest sector share in their far more diversified S&P 500 index.

While my personal investment strategy leans heavily on Canadian dividend stocks, there is no question that some folks have made a lot of money by investing in tech stocks exclusively over the last few years. Most tech stocks, however, fit firmly in the “growth” category rather than “value.” This contrasts with the reliable, income-focused investments found in Canadian blue chip stocks and dividend kings.

It’s also not like Canada offers a ton to choose from on the tech side of things as well. You’re not going to find any Nvidias or Microsofts hanging around. That said, we should be proud of the tech companies we have, as they’re actually better than what a lot of the rest of the world (USA excepted obviously) is putting out there these days.

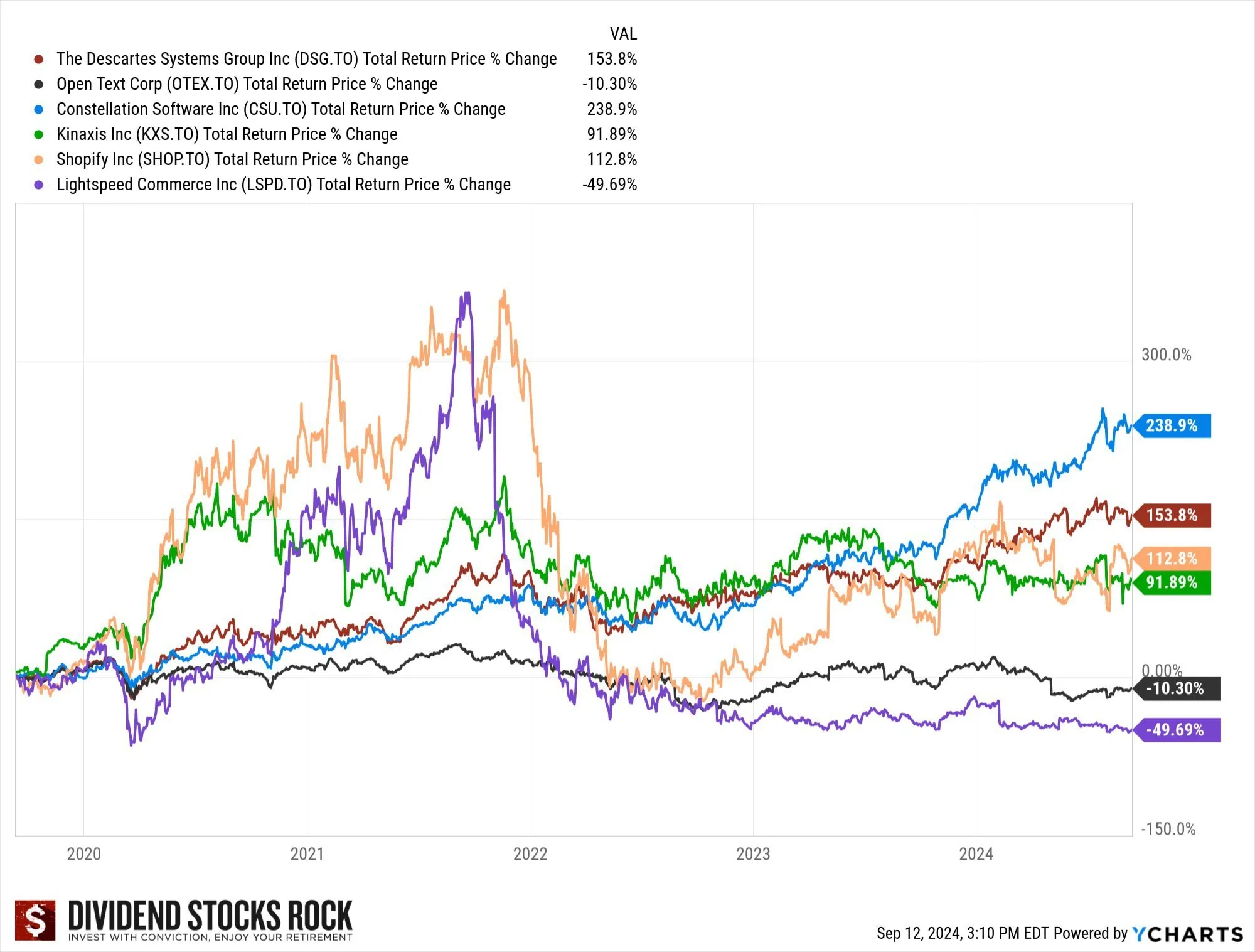

Canadian Tech Stocks Performance Chart

This chart was created by Mike Heroux at Dividend Stocks Rock – our go-to source for Canadian investing information.

Top 6 Best Tech Stocks to Buy in Canada

Name | Ticker | Price | Market Cap | P/E | Dividend Yield |

Constellation | CSU.TO | 4698.66 | 98.64B | 110.60 | 0.12% |

Descartes Systems | DSG.TO | 171.8 | 14.61B | 78.61 | N/A |

Shopify | SHOP.TO | 167.55 | 152.95B | 107.89 | N/A |

Open Text | OTEX.TO | 43.4 | 11.43B | 17.81 | 3.31% |

Kinaxis | KXS.TO | 185.48 | 5.21B | 246.206 | N/A |

Lightspeed POS | LSPD.TO | 24.49 | 3.71B | -2.64 | N/A |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ?.??% |

1) Constellation Software (CSU)

When you think of Canadian technology stocks, it’s hard to overlook the role of Constellation Software Inc. (CSU). As Canada’s second-largest tech stock, trailing only Shopify, Constellation has carved out a unique space in the tech world. This isn’t your typical story of a high-growth startup; instead, it’s about a company that has consistently delivered value through thoughtful acquisitions, operational excellence, and a methodical approach to expansion.

With approximately 45,000 employees and a market capitalization of about $100 billion, Constellation Software is far from being a speculative “tech stock on the verge of breaking out.”

Constellation Software’s success isn’t a tale of revolutionary products or flashy branding. It’s a story of how a founder-led company mastered the art of acquiring and improving software businesses. The company has developed expertise across dozens of products, encompassing over 1,000 software brands. This expansive portfolio is organized into six key operating groups, each focused on optimizing businesses within its domain.

By acquiring software firms with niche market dominance, Constellation creates value by improving operational efficiency, leveraging synergies, and applying its proven management playbook. This method has yielded remarkable returns, averaging over 30% annually since 2006, making CSU a long-time darling of growth-focused investors.

Unlike many tech companies that rely heavily on debt to fund growth, Constellation takes a more conservative approach. By using free cash flow as its primary funding source, the company maintains a strong financial position, even during periods of economic uncertainty. This strategy may mean slightly slower growth compared to more aggressive competitors, but it offers significant advantages in today’s high-interest-rate environment.

In fact, Constellation’s approach positions it to take advantage of industry downturns, scooping up undervalued assets when other companies are constrained by rising borrowing costs. This discipline has helped the company weather market volatility while continuing to expand

Constellation does offer a dividend, but don’t expect it to be the main attraction. With a current yield of around 0.12%, the dividend is more symbolic than income-generating. This isn’t a company focused on returning cash to shareholders—it’s laser-focused on reinvesting in growth.

That said, this strategy makes sense for Constellation’s business model. Balancing aggressive acquisitions with low debt levels leaves little room for substantial dividend payouts. Instead, shareholders benefit from the long-term capital appreciation generated by the company’s disciplined growth approach.

2) Descartes Systems (DSG)

Descartes Systems is a supply chain solutions company based out of the Mecca of tech in Canada – Waterloo, Ontario. It is actually a fairly old company (maybe ancient by tech standards) having been founded in 1981.

The company is world-wide with operations across the entire planet, and has managed to scale by creating a sustainable advantage in the field of transitioning traditional logistics systems to more modern cloud-based solutions, as well as acquiring competitors at reasonable valuations. Descartes operates on a global scale, serving clients in industries as diverse as retail, transportation, manufacturing, and healthcare.

Descartes boasts a market capitalization of about $10 billion, and has had a fantastic 2024. Boasting a 50% return so far this year, the current P/E of nearly 80 is the only reason I don’t have Descartes ranked higher on this list. In its latest quarterly earnings report, the company announced a year-over-year revenue increase of 18%, with earnings surging by 25%. These robust financials reflect Descartes’ effective growth strategies and operational efficiency.

While the current valuation may seem steep, Descartes’ long-term stability and prudent financial management make it a compelling consideration for investors seeking exposure to the supply chain solutions market. One thing I really like about the company is that it is subscription-based – meaning that clients tend to be “very sticky” once they’re committed.

3) Shopify (SHOP)

The elephant in the room when it comes to discussing Canadian tech stocks is Shopify (SHOP).

I mean really, there is SHOP – and then there’s everyone else.

The software giant was briefly Canada’s largest company by market cap as the tech darling of the pandemic (remember when online shopping was going to become “the only shopping”?) before crashing back to Earth. Here are just a few numbers to try and put this unique company into context.

- Share price is up 60% YTD.

- SHOP is once again the second biggest company in the country, right in between TD and RBC.

- With a market cap of over $200 billion, SHOP is about as large as every other Canadian tech stock put together.

- Its total return since going public in 2015 is over 4,400%!

- Nearly 5 million online stores run Shopify.

- Revenue is up nearly 25% year over year.

- Shopify is now firmly in the black most quarters – a rarity for many software companies.

What a crazy company to try and place a value on! I don’t think anyone really knows just how much profit this company will produce when it fully matures.

Shopify quickly established a niche for themself as the “friendly alternative to Amazon” when it came to selling stuff online. It has heavily invested in both organic growth and acquisitions, and has created a really solid long-term competitive advantage with its creative new ideas and economies of scale.

Morningstar analyst Dan Romanoff recently stated, “Shopify should build on success in attracting larger brands to the platform, especially given the rash of recently launched features and products, including Markets Pro, Shopify Magic and Commerce Components. GMV [Gross Merchandise Value] accelerated to 24% year-over-year growth to USD$69.7 billion, while gross payment volume processed through Shopify Payments was USD $42.9 billion, or 62% of GMV.”

I think long-term Shopify will continue to succeed as a company, and that its business model places it smackdab in the middle of the online retail growth trend. That said, as with everything in tech, the question is just what is the right price tag for this company that still has so much of its story left to write?

Shopify’s pivot from growth-at-all-costs mode, to more of a streamlined company that is focused on its core value proposition has made a lot of sense to me.

Clearly I’m not the only one when you look at the growth the company has had. I’m also not entirely sure that Shopify isn’t a takeover target for the massive tech companies down in the States. Can you imagine the premium the company could get – even as the second biggest company in Canada?

4) Open Text (OTEX)

Open Text Corporation is headquartered in Waterloo, Ontario, and calls themselves a leader in enterprise information management solutions. Serving businesses of all sizes, OpenText offers a suite of services designed to optimize supply chains and enhance overall operational efficiency. Founded in 1991, the company has grown to employ approximately 22,900 individuals as of June 2024.

OpenText has pursued an aggressive growth strategy through acquisitions, integrating over 80 companies in the past decade. Despite this rapid expansion, the company has maintained a debt-to-equity ratio of about 1.60, reflecting a balanced approach to leveraging debt for growth. (Especially within the context of the risk-taking nature of most tech competitors.) The history of solid free cash flow further underscores financial stability. Dividend investors have taken note, with experts like Mike Heroux forecasting annual dividend growth of 12% in the near- to mid-term.

However, OpenText operates in a highly competitive industry, facing formidable American counterparts. The intensity of this competition presents ongoing challenges, requiring continuous innovation and strategic agility. Conversely, the company’s unique strengths make it an attractive acquisition target. With a price-to-earnings (P/E) ratio of about 17x.

OpenText is valued more conservatively than many peers. Its commitment to shareholder value is evident in a dividend yield of approximately 3.50%, making it one of the few tech stocks to also fall into Canadian dividend stock lists.

5) Kinaxis (KXS)

Kinaxis Inc., headquartered in Ottawa, Ontario, has quietly emerged as one of Canada’s most prominent supply chain management software providers. Founded in 1984, the company has built a strong reputation by helping businesses navigate the increasingly complex world of global supply chains.

Last year, Kinaxis reported total revenue of $426.97 million USD, representing a year-over-year increase of 16.38%.

You’re going to have to pay up for that revenue growth though. Kinaxis is trading at a price-to-earnings (P/E) ratio around 185! While this is a far cry from its previous P/E ratio of over 500 during the peak of the pandemic, it still places Kinaxis in the realm of high-growth tech stocks with premium valuations. Many other Canadian tech stocks trade at significantly lower multiples, raising questions about whether Kinaxis’s stock is currently overvalued.

Kinaxis has been active in pursuing growth through acquisitions, a hallmark of its strategy over the past few years. Since 2020, the company has completed four major acquisitions, including its purchase of MP Objects NV, a Dutch supply chain technology firm. These acquisitions have helped Kinaxis expand its capabilities, broaden its product offerings, and strengthen its presence in international markets.

Kinaxis’s solutions are trusted by some of the world’s largest and most well-known companies. Its client base includes Ford, Unilever, and Merck, among others. These partnerships not only highlight the company’s credibility, but also provide a steady stream of recurring revenue, a crucial element for sustaining long-term growth.

The company’s software, including its best-selling RapidResponse® platform, enables businesses to anticipate disruptions, optimize supply chain performance, and make data-driven decisions in real time. This level of functionality is especially critical in today’s unpredictable economic climate, where agility and precision can mean the difference between success and failure.

With mega competitors like SAP and Oracle all vying to most efficiently incorporate AI into their product line, Kinaxis has its work cut out for them – but so far their management team has mostly lived up to the hype. That premium valuation does have me a bit worried though if I’m being honest.

6) Lightspeed POS (TSX: LSPD)

Up until 2020, Lightspeed was kicking butt. As an all-in-one solution for small- and medium-sized businesses (SMEs) who wanted to collect payment at the Point of Sale (POS), Lightspeed’s organic growth and growth by acquisition attracted a ton of investor attention.

Then the pandemic hit – and most folks figured that a company specializing in person-to-person interactions might be in for tough sledding… only for Lightspeed to prove them dead wrong. As part of the tech-driven bull market during 2021, Lightspeed stock went through the roof.

The company has numerous subsidiaries including Ecwid Inc., Vend, ShopKeep, iKentoo SA, and Kounta. It has a seamless work in with the SaaS platform, and sells the POS hardware SMEs need as well. It was founded in 2005, and was founder-ran until 2022. Headquartered in Montreal, the company has offices in New York, Ottawa, Amsterdam, and Ghent.

Following a brilliant run up to 2021, the ground underneath Lightspeed started shaking. A company named Spruce Point Capital decided to:

a) Bet that Lightspeed stock would go down (aka: short the stock)

b) Release a bunch of information that accused Lightspeed of presenting false information at numerous points in its development.

Lightspeed immediately responded saying that information released by Spruce Point had many inaccuracies, and pointed out the obvious conflict of interest. Obviously this caused many shareholders to grow nervous right around the time when a general tech sell-off was about to occur in 2022.

As a consequence of this sequence of events, Ligthspeed stock has dropped more than 80% from it’s all-time highs. Critics of the company cite the fact that Lightspeed needs to produce more free cash flow ASAP, and claim that they overpaid for acquisitions in order to grow their market share.

For now, this Canadian tech stock is stuck in a wait-and-see holding pattern. It has maintained its $3.5 billion market cap, but I don’t have a lot of faith that it’s going to break out any time soon.

Where to Buy Canadian Tech Stocks?

You can buy all these tech stocks (and the ETFs mentioned below) through any Canadian brokerage. Currently, we rate Qtrade as the best option – check out our Qtrade Review to see what we think of their fees, customer service, account options, and user experience. Notably, you can buy and sell the iShares Global Tech ETF (IXN) and the iShares US Technology ETF (IYW) completely free on the Qtrade platform.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

Best Canadian Tech Stock ETFs

If you want instant diversified exposure to the Canadian tech sector, the BlackRock iShares S&P/TSX Information Technology Index ETF (XIT) is probably your best bet.

Now, given the relatively small number of tech companies in Canada, I’d be more inclined to recommend the US or Global markets if you’re looking to “overweight” on the technology sector. There are several different tech stock ETFs in the US, but the most applicable one for Canadians would be the QQQ CAD Index ETF(QQC-F).

This ETF is the Canadian version of the QQQ Nasdaq-tracking index in the USA, and includes many of the biggest companies in the world today such as Alphabet (Google), Netflix, Meta (Facebook), Amazon, Microsoft, Apple, etc.

While there is a layer of withholding tax added to dividend distributions in this time of “US ETF inside of a Canadian ETF” structure, these tech stocks don’t offer much on the dividend side of things anyway, so it’s not like it’s a big sacrifice.

It’s also worth checking out our Best ETFs in Canada article for more diversified portfolio options.

Final Word on Canadian Tech Stocks

When it comes to valuing and investing in Canadian tech stocks, I’m just not the right demographic. I like companies with long-term track records, lots of free-cash flow, and sustainable durable competitive advantage. Even better if I can find those type of companies at a discount – which is why I’m a fan of the Dogs of the TSX strategy.

With rising interest rates affecting discount tables, and low liquidity biting into the “growth at all costs” business models these tech companies pursue, I’m just a skeptic until proven otherwise.

Now that said, if we’re looking at the tech sector more broadly, I’m a big fan of the more mature US companies in the space. It’s just really hard to compare the US tech stocks given their massive scale and competitive moat, to our relatively small world of Canadian tech stocks.