General Finance

All Categories

If you prefer to do all your banking from the comfort of your home and don’t mind not having access to face-to-face help if required,…

Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through…

An RESP, or Registered Education Savings Plan, is a registered tax-deferred investment account designed to help pay for a child’s education. In other words, RESPs…

Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s…

Readers often ask what my favourite personal finance apps are. It’s not an easy question to answer, as the apps we choose are highly personalized…

Most Recent

Qtrade Guided Portfolios Review

What is Qtrade Guided Portfolios? Qtrade Guided Portfolios is the robo advisor offering from Qtrade (which we’ve consistently ranked as one of the best online…

RBC InvestEase Review 2026

What is RBC InvestEase? Some people prefer to stick with the familiar and trusted, especially when it comes to choosing a robo advisor – and…

Best Stock Trading Apps in Canada

After two decades of DIY investing, I’ve had a front-row seat to the evolution of stock trading apps in Canada. Canadian investors had very limited…

Free Stock Trading in Canada 2026

Canada’s best free stock trading apps are giving DIY investors more control over their investments than ever before. With zero-commission stock and ETF trades, investors…

Best USD Bank Accounts in Canada

Choosing the best USD bank account in Canada isn’t about convenience – it’s also about control. Control over when you convert your money. Control over…

Questrade vs Interactive Brokers

If you last compared Questrade and Interactive Brokers a few years ago, the key thing that changed as we head into the 2026 RRSP season…

The Best Mutual Funds in Canada (and why you should avoid them)

Despite the fact that they’ve been proven over and over again to be a pretty lousy way to invest money, I still get a surprising…

49 Best ETFs in Canada – January 2026

When I started writing about Canadian personal finance roughly two decades ago, choosing the best ETFs in Canada was pretty easy. You could basically count…

EQ Bank Review 2026

EQ Bank Account Options and Interest Rates Account Type Interest Rate Best For Daily High Interest Account 1%* (Plus 1.75% if you direct deposit your…

Justwealth Review 2026

Why Justwealth? As I’ve updated my Justwealth review over the years, they have risen from a solid-but-not-elite option to the best robo advisor in Canada.…

Best Canadian Robo Advisors 2026

As we head into the 2026 RRSP season, the best Canadian robo advisors are rolling their most competitive offers of the year. The idea is…

Is Robinhood Available in Canada?

When Robinhood first entered the online brokerage world, its “gamified” approach to commission-free trading changed the way many young investors engaged with the stock market.…

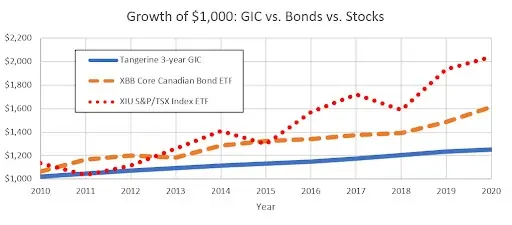

Best Low Risk Investments in Canada Right Now (January 2026)

After a volatile few years and with markets at all-time high valuations, it’s no surprise that many investors are heading into 2026 prioritizing low risk…

Best Short Term Investments in Canada Right Now (January 2026)

With interest rates having fallen over the past couple of years, it’s more important than ever to get the most bank for your buck when…

2026 Economic and Market Predictions

Before we get to my economic and stock market predictions for 2026, I invite you to check out last week’s report column to see how…

Wealth Management Companies in Canada 2026

When I first wrote about the best financial advisors in Canada it got some attention from Canada’s wealth management companies due to the news and…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.