Wealthsimple Review 2026

Wealthsimple Review

-

Fees & Costs vs Mutual Funds

-

Investing Performance

-

Account Options

-

Financial Advice

-

User Experience

-

Halal & Socially Responsible Investing Option

Wealthsimple Review Summary:

My Wealthsimple review is based on personal use as I was an early proponent of the company (but have now changed my views as the DIY investing landscape has evolved). One important starting point is that Wealthsimple actually operates two distinct platforms: Wealthsimple Managed Investing (their robo advisor) and Wealthsimple Self-Directed Investing (their DIY online brokerage).

Pre-2020, Wealthsimple was the premier option in Canada’s robo-advisor space. The value proposition was easy to understand and easy to recommend – simple portfolios, reasonable fees, and a clean, evidence-based indexing approach that aligned well with long-term investing fundamentals. That version of Wealthsimple is mostly gone at this point. You can read the details on why Wealthsimple did not take the #1 spot in our Best Robo Advisors in Canada rankings.

Over time, the company has shifted its focus toward trendier products like crypto and options trading. Investment performance has substantially lagged peers, and the overall direction feels increasingly product-driven rather than investor-first.

On the DIY side, the picture isn’t much stronger. With Qtrade and Questrade now offering $0 trading commissions, Wealthsimple’s self-directed platform has lost much of its pricing advantage. When stacked up against the current Best Online Brokers in Canada, it simply doesn’t stand out the way it once did.

Pros

- No account minimum

- Competitive fees

- Quick and easy to get started

- User-friendly platform and app

Cons

- Poor investment returns

- No longer focused on robo advisors

- Discount brokerage is not competitive with Canada’s Best Online Brokers

- Way too much focus on crypto trading

- Lacking financial advice options compared to leading robo advisors

- Only robo advisor portfolios to choose from

What is Wealthsimple?

Wealthsimple was founded in 2014 by Michael Katchen, Brett Huneycutt, and Rudy Adler. I’ll be upfront about my bias here. I liked the company a lot more in its early years than I do today. In fairness, the platform that I really fell for back in 2015 and 2016 wasn’t nearly as profitable as the one they’ve got today.

For roughly its first five years, Wealthsimple was focused on one thing. What we now call Wealthsimple Managed Investing. I refer to these types of platforms as robo advisors. Some companies like to call them automated wealth managers. The label didn’t really matter. What mattered was what the product actually did. Wealthsimple’s robo advisors was the first in Canada to:

- Invest client money in diversified, passively managed index ETFs.

- Charged far less than Canada’s mutual fund industry (way lower MERs).

- Make getting started (and sticking with investing) incredibly easy.

Those ideas sound obvious now, but I can assure you that at the time they weren’t.

For the average Canadian investor, that combination was powerful. Low costs. Broad diversification. Fewer behavioural mistakes. It quietly solved a lot of real problems.

And to be clear, Wealthsimple didn’t fail as a business. Quite the opposite.

The platform now serves more than three million Canadians. Assets under administration nearly doubled from roughly $64 billion at the end of 2024 to over $100 billion by October 2025. In an equity raise around that same time, the company enters into 2026 valued at about $10 billion. It also reached profitability in 2024 and remained profitable through 2025 (a feat that many fintech companies never manage).

Wealthsimple continues to have some of the best advertising and marketing in the business. They’re also pushing to become a fully fledged Canadian banking institution. That’s great for Power Corp investors (which own the bulk of Wealthsimple’s shares).

But business success and client outcomes are rarely perfectly aligned.

Things started to change once Wealthsimple began selling larger stakes to major Canadian financial players. With that came a very predictable shift in priorities. Robo-advising was never going to be a high-margin business. Low fees were the entire point. So instead of doubling down on the original model, Managed Investing was gradually pushed to the side while attention shifted toward higher-revenue products.

Investments such as crypto trading, private credit, private equity, and other alternative investments being added to portfolios that were once clean and simple. At the same time, portfolio construction became more complicated. Strategies were constantly tweaked and their message of simple, cheap, index investing got clouded. Ben Felix (amongst others) wrote about how these changes hurt Wealthsimple’s investment returns.

There were also ambitious expansion attempts into the U.K. and U.S. markets. Those didn’t work out, and both were eventually shut down. Another signal that focus had been stretched too thin. Consequently, these days I recommend folks check out our Best Robo Advisors in Canada Comparison to get a look at how Wealthsimple stacks up against their competitors.

Is Wealthsimple as Safe?

Yes – Wealthsimple is safe, and its protection against fraud and cyber attacks are as solid as any bank, robo advisor, or brokerage in Canada.

Obviously, as an online financial service company Wealthsimple takes safety and security extremely seriously.

Wealthsimple uses Transport Layer Security (TLS) encryption. TLS is the successor to Secure Sockets Layer (SSL) encryption and is widely regarded as the gold standard for securing data transmitted over the internet. TLS encryption works by establishing a secure, encrypted connection between the user’s device and Wealthsimple’s servers.

This means that any information sent from your device to Wealthsimple, such as personal details, login credentials, and financial transactions, is encrypted during transit. Even if intercepted, this data would be extremely difficult for unauthorized parties to decrypt and understand.

Wealthsimple also offers two-factor authentication (2FA), an additional security measure designed to keep your account safe. With 2FA enabled, logging into your account requires not just your password but also a secondary verification code, typically sent to your phone or generated through an authentication app. It’s like having two locks on your front door, and the second key changes every time you need to get in. This makes unauthorized access exponentially harder and adds peace of mind for users.

Wealthsimple’s commitment to safety doesn’t stop at encryption and 2FA. The platform actively monitors transactions for suspicious activity. This ongoing monitoring greatly increases the chance that fraudulent transactions can be flagged and dealt with before they become an issue. Wealthsimple’s security systems are always working behind the scenes to protect your investments.

In addition to these layers of Cybersecurity, Wealthsimple Invest customer accounts are also protected by the Canadian Investor Protection Fund up to $1 million.

If you’re worried about the company as a whole you can rest easy knowing:

- Wealthsimple is owned by Power Corporation of Canada (one of the largest companies in Canada).

- Your assets are kept separate from Wealthsimple’s bank sheet. In other words, even if somehow, some way, Wealthsimple wanted to take your assets for their own use, that’s not possible.

- Finally, Wealthsimple falls under the purview of the Investment Industry Regulatory Organization of Canada (IIROC), ensuring they play by the rules (even if those rules could probably be made a bit better).

Of course, when discussing safety and investments, it’s worth pointing out that no brokerage or robo advisor can protect against bad investment performance. You need to understand the risks associated with specific asset classes as well as the specific securities that you choose to invest in. This is one of the most difficult aspects of investing – so don’t skip over it!

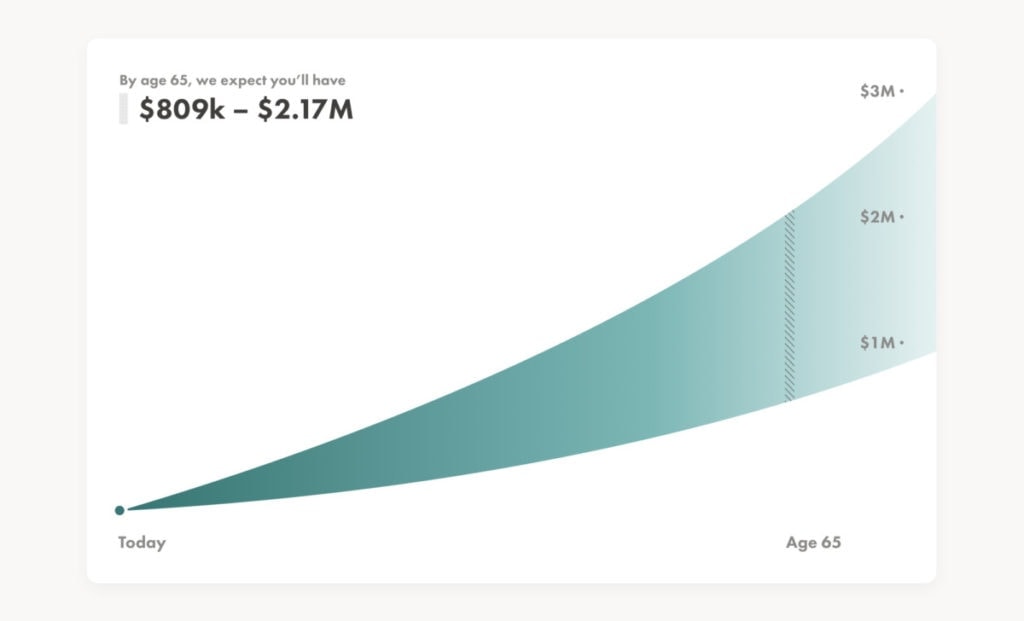

Wealthsimple Investing Performance

Wealthsimple’s portfolio returns have been perhaps its most noticeable Achilles heel over the last few years. In fact, it has become such a point of contention, that the company has quit showing its 5-yr returns on its website.

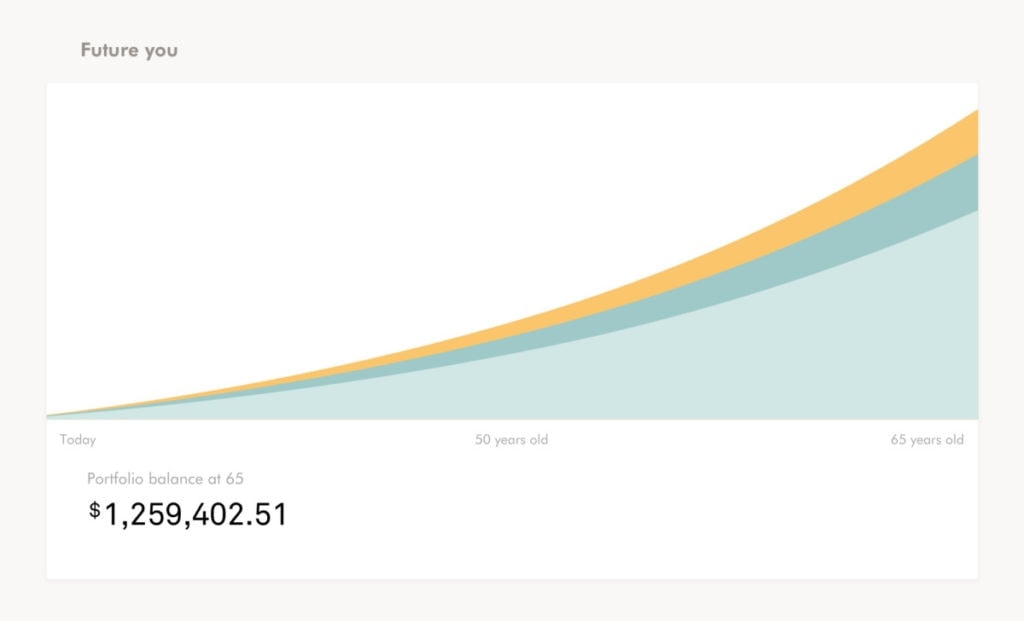

A robo advisor is designed to take the investing process off your plate. The robo advisor team is supposed to builds a passively-invested portfolio on your behalf. This portfolio is supposed to take advantage of efficient markets and rarely change its composition over the long term. This style is often referred to as “index investing” or “couch potato investing.”

Active investing is the opposite. You’re in charge of buying and selling, rebalancing, and choosing your own investments. The idea of stock picking being a classic example.

Wealthsimple made its early bones by sticking to a passive philosophy. But lately, they’ve regularly tweaked their portfolios and added different types of semi-exotic assets to their portfolios. Those changes have worked against them, leaving their long-term performance near the bottom of Canada’s robo advisor rankings.

The Globe and Mail has highlighted some of the bigger missteps:

- Heavy exposure to long-term bonds vs short-term bonds (which led to a big loss in 2021-2023).

- A preference for complicated ETFs focused on niche factors or low-volatility strategies instead of simple index funds.

- Adding gold exposure, which has historically been a weak performer for long-term growth.

All of these mistakes were somewhat preventable, as evidenced by the fact other robo advisors generated much better overall returns by sticking to simple index asset allocation strategies. Here’s a comparison of the Wealthsimple investment returns compared to our #1 robo advisor at Justwealth over a 5-year period. All returns are inclusive of fees.

| Portfolio Type | Justwealth | Wealthsimple |

| Moderate | 7.48% | 3.50% |

| Balanced | 10.14% | 6.60% |

| Aggressive | 11.21% | 8.80% |

*Wealthsimple returns are estimated given their last official tracking numbers in June 2024, and looking at approximated returns since then.

Best 2026 Canadian Robo Advisor Promo:

Up To $500 in Cash

Open an account with Justwealth and get the best robo advisor promo offer in Canada*.

Justwealth has the best portfolio performance out of all Canadian robo advisors + the best promo offer. Get it by clicking the button below:

* Based on investment amount ** Applies only to New clients who open and fund a new account. *** Justwealth Review: more details.

Wealthsimple Financial Advisors

Wealthsimple is a portfolio manager, and consequently has a legal fiduciary duty to provide you with financial advice that is in your best interest (even if it is counter to their commercial interest). This fact puts them one up on bank and credit union advisors.

Core clients do not have access to advice. Premium and generation clients have access to advice and priority support. Your tier will determine the level of service you get and if you have access to free advice. Some people are very happy with the advice they get on specific questions, while others felt it left a lot to be desired. The company’s 1.5/5 star rating on TurstPilot.com shows that there is a lot to be desired when it comes to the company’s customer service.

Once you reach $100,000 in assets and can be moved to the “Wealthsimple Premium” category you get access to “financial check-ins with an advisor.” Once you get to the $500,000 mark you become a “Wealthsimple Generation” member, and at that point you get a dedicated Canadian financial advisor.

Notably, CI Direct and Justwealth provide you with dedicated financial advisors right from the first day you open an account with them.

Wealthsimple Invest Accounts

Wealthsimple invest offers Canadians the ability to easily put money into the following types of accounts:

- RRSP

- TFSA

- RESP

- RRIF

- LIRA

- FHSA

- Personal

- Joint

- Corporate

- Cash Savings

- Joint Savings

No matter the size of your account, you’ll receive a free portfolio review of any non-Wealthsimple brokerage accounts, reap the benefits of automatic tax-loss harvesting (which aids in minimizing your tax liability), access to fractional share investing, options for making Socially Responsible Investments (SRIs),

reimbursement of transfer fees for transfers over $25,000 to your Wealthsimple account from another investment account, and free money saving tools.

Wealthsimple Core vs Premium vs Generation

As you can see below, Wealthsimple Invest places you into one of three tiers – Core, Premium, Generation – based on the amount of money that you invest with them.

| Feature/Service | Core | Premium | Generation |

| Assets Required | $1+ | $100,000+ | $500,000+ |

| Management Fees | 0.5% | 0.4% | 0.2% – 0.4% |

| Cash Account Interest | 4% | 4.5% | 5% |

| Options Trading Fee | $2 USD/contract | $0.75 USD/contract | $0.75 USD/contract |

| Crypto Trading Fee | 2% | 1% | 0.5% |

| Financial Advice | – | Financial check-ins | Dedicated financial advisor |

| USD Accounts | – | Included | Included |

Wealthsimple Core

Wealthsimple Core is the entry point to their managed investing platform, and it’s designed to be as frictionless as possible. You can start with as little as $1, complete a short risk questionnaire, and get a globally diversified portfolio that’s automatically managed on your behalf.

Once you’re set up, Core is largely hands-off. Contributions can be automated, portfolios are rebalanced as needed, and dividends are reinvested automatically. It’s a true “set it and forget it” structure, which makes it appealing for new investors or anyone who doesn’t want to be involved in day-to-day decisions.

The management fee at the Core level is 0.5%, plus the underlying ETF costs. It’s important to note what’s not included here, though. Core does not offer tax-loss harvesting, and access to financial advice is limited to general support and guidance rather than personalized planning.

Wealthsimple Premium

Once your household balance reaches $100,000, you’re upgraded to Wealthsimple Premium automatically. At this level, the management fee drops to 0.4%, and a few meaningful features are added.

Premium clients gain access to tax-loss harvesting, along with more tax-aware portfolio management. You also receive a one-time session with a Canadian financial planner.

Premium members are also eligible for partner perks, including a discount on estate planning through Willful and access to health and wellness benefits in certain provinces. These extras change from time to time, so I wouldn’t base an investing decision on them, but they’re a nice add-on if you qualify.

Wealthsimple Generation

Wealthsimple Generation is aimed at higher-net-worth households with $500,000 or more invested. The management fee remains 0.4%, with a further reduction available for ultra-high balances of over $10 million.

At this tier, the experience becomes more personalized. Clients have access to a dedicated advisory team, more customized portfolio construction, deeper tax planning support, and more detailed reporting. Estate planning discounts and enhanced wellness benefits are also included, depending on location.

This is the version of Wealthsimple that comes closest to what a traditional Canadian wealth management company would put out, while still maintaining a largely passive, ETF-based approach.

Additional Wealthsimple Products

Wealthsimple has expanded well beyond robo advisors (which might be a big part of the issues they have) and now positions itself as a one-stop financial platform. Wealthsimple also offers free trading on its platform Wealthsimple Trade for DIY investors, as well as Wealthsimple Crypto for those keen on getting their foot into the cryptocurrency game.

Wealthsimple also offers a Wealthsimple Cash account, a high interest savings account that is currently paying 1.25% (slightly higher if you have more than $500,000 with Wealthsimple and qualify as a Wealthsimple Generation client).

Wealthsimple Fees

As mentioned above, the account fees depend on what level of account you have, as well as the type of portfolio you end up with. Check out the key facts below.

- Core, holding up to $99,999: 0.5%

- Premium, holding more than $100,000: 0.4%

- Generation, holding above $500,000: 0.4% (0.2% for investors with over $10M in assets)

If you decide to go the robo advisor route, which is definitely a wise choice, there will be additional fees for each of the ETFs in your portfolio. The fees come in the form of MERs, or Management Expense Ratios. These fees are again straightforward and very low.

- Regular ETF MERs: Approximately 0.12-0.15% annually

- Socially Responsible Investing (SRI) MERs: 0.21-0.23% annually

Wealthsimple Portfolio Options

Wealthsimple Invest has three portfolio options. Within these three portfolios – called: Conservative, Balanced, and Growth – your money will actually be put into several ETFs. There are also Halal and SRI portfolios, which will discuss in just a second.

For now, we’ll look at the three main types of portfolios and how they have performed since inception.

Conservative Portfolio

With Wealthsimple’s Conservative Portfolio, your portfolio will be made up of approximately 35% equities and 62.50% bonds – with 2.50% gold allocation tossed in as well. This means you’ll be somewhat shielded from market volatility, but will likely experience slower growth. This is a good choice if you have a very low risk tolerance.

This portfolio has grown at an average annualized return of 1.20% since its inception on January 1st, 2016.

Balanced Portfolio

Wealthsimple Invest’s Balanced Portfolio is designed for both safety against volatility while providing a greater opportunity for growth. This portfolio is made up of 60% equities, 37% bonds, and 3% gold. This is suitable for investors with a medium risk tolerance.

This portfolio has grown at an average annualized return of 3.60% since its inception on January 1st, 2016.

Growth Portfolio

With Wealthsimple’s growth portfolio, the asset allocation heavily favors equities. The portfolio is made up of 80% equities, 17.5% bonds, and 3% gold. As there will likely be more market volatility experienced by investors in this portfolio, this is best suited for the investor with a higher risk tolerance, as well as a longer time horizon.

This portfolio has grown at an average annualized return of 5.70% since its inception on January 1st, 2016.

Wealthsimple Socially Responsible and Halal Investing

Investors may also be interested to know that Wealthsimple offers Socially Responsible Investing (SRI) as well. Socially responsible investing is becoming more and more popular these days, especially among millennials.

To clarify, socially responsible investing is a type of investing that allows you to put your money towards companies and businesses that align with your environmental and social values. A Wealthsimple SRI portfolio will include Wealthsimple’s own socially responsible ETFs:

- WSRI (US and Canadian stocks)

- WSRD (European, Asian, and Australian stocks)

- WSGB (Green and social bonds that provide fixed income while funding projects that further social and environmental causes)

As well as BMO’s Long Federal Bond Index ETF (ZFL) and the SPDR Gold Minishares Trust ETF (GLDM).

on top of socially responsible investing, Wealthsimple also offers Halal Investing. This portfolio is optimized for performance by using companies that align with Islamic law. This means no businesses that profit from gambling, weapons, tobacco, or other restricted industries.

Additionally, this type of investing will not include any businesses that obtain a significant percentage of their income from interest on loans. All investments are screened by a group of Shariah scholars to ensure that they are up to the expected standards.

Wealthsimple RRSP Accounts and TFSA Accounts

For most Canadians, investing success has very little to do with clever tactics. It starts with using registered accounts properly and then staying out of your own way.

Opening an RRSP, TFSA, RESP, or FHSA is almost frictionless. Everything is quick and done online. Setup takes minutes. Linking a bank account and automating contributions is easy enough that there’s very little excuse not to do it. That convenience matters more than people like to admit.

The biggest benefit here isn’t just a few minutes saved. It’s the investment behaviour robo advisor platforms encourage. When contributions happen automatically throughout the year, RRSP season stops being a panic-inducing deadline and becomes mostly irrelevant. You’re not guessing at the market. You’re not rushing decisions. You’re just funding the plan and letting time do the heavy lifting.

From an account coverage standpoint, Wealthsimple checks the obvious boxes. RRSPs and TFSAs handle most long-term investing needs. RESPs are great for families saving for education. The addition of the First Home Savings Account rounds things out for younger Canadians who are juggling investing and a future home purchase.

A 2026 registered accounts update: The RRSP contribution limit is $32,490. The TFSA added another $7,000 of room, bringing the total lifetime limit to $109,000 for anyone eligible since 2009 who hasn’t contributed yet. Unused room in both accounts carries forward, which makes steady, automated investing far more powerful than last-minute lump sums.

Support is generally adequate for what most users actually need. Chat and phone help work well for basics like contribution room, auto-deposits, and account setup. Where things get thinner is on more technical questions like foreign withholding taxes or how Canadian REIT distributions are treated. That’s not unique to Wealthsimple, but it’s worth knowing.

Where Wealthsimple starts to feel more limited is customization. You don’t get much flexibility to fine-tune portfolios inside registered accounts. Asset mixes are largely fixed, and meaningful personalization isn’t really the point. That simplicity helps some investors. It frustrates others.

Compared to Justwealth =, Wealthsimple gives you fewer options to tailor your investments within an RRSP, TFSA, or FHSA. And when it comes to RESPs, the gap gets even wider. Justwealth is the only robo advisor in Canada offering RESP target-date portfolios – meaning your investments gradually shift to lower risk as your child gets closer to needing the funds for tuition. It’s a smart feature, and you can read more about it in my full Justwealth Review.

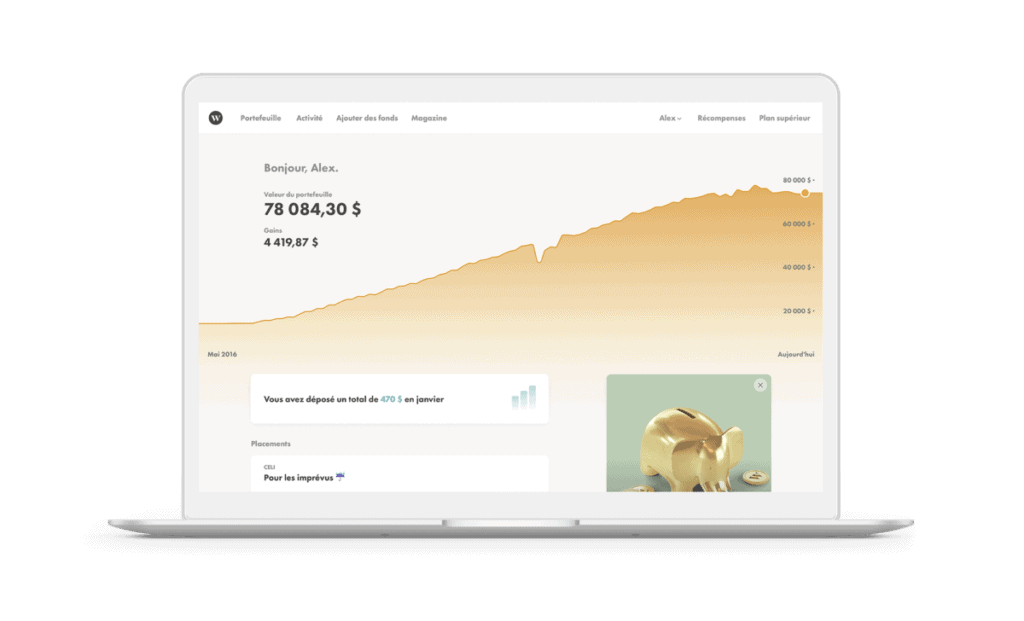

Wealthsimple User Experience

To get started with Wealthsimple you can have an online, email, or phone discussion with a Wealthsimple

support representative or a Business Development Representative (BDR) to discuss what they think is the best option for you taking into consideration your goals and risk tolerance.

Don’t be afraid to ask questions, remember that the Wealthsimple representative you are speaking to is an advisor and while they may not be able to answer everything off their head (mainly when it comes down to the more detailed, complex questions), they will answer your questions with your best interests at hand.

After getting started, you can execute everything through their site or through the Wealthsimple mobile app.

Wealthsimple Mobile App

Speaking of the Wealthsimple App, it’s actually pretty amazing. Launched in December of 2014, it was the first app of its kind; an app designed with the specific goal of making investing easier.

In 2019, Wealthsimple launched a separate Trade app for self-directed trading, but in 2022 they combined their Invest and Trade apps into a single Wealthsimple app yet again. (Want to know the differences between Wealthsimple Trade and Wealthsimple Invest? we’ve got all the details on our Wealthsimple Trade Review if you are keen to learn more about how they compare.)

Wealthsimple describes their app as having a ‘financial advisor in your pocket’. The app allows you to get in touch with your wealth concierge at the tap of a finger, plus you can easily add funds, keep an eye on your asset allocation, and view your performance.

On top of creating an easy and streamlined app, Wealthsimple also prioritizes privacy in their app. They go above the simple ‘create a password’ and allow users to use either a biometric login like FaceID or TouchID or set a unique 4 digit passcode (for iPhone) or lock pattern (for Android).

Currently the Wealthsimple app is rated a 4.5 on the Google Play store and a 4.6 on the Apple App store. Wealthsimple is constantly updating their app to try and improve functionality, which is great, but as with most apps, it can sometimes get buggy as a result.

How To Sign Up With Wealthsimple?

Just like the name indicates, signing up for an account on Wealthsimple is…simple. In just a few minutes, you’ll be set up, logged in, and ready to start building your investment fund.

First, make sure you qualify for a Wealthsimple Invest account (must be a Canadian citizen, Canadian resident, or have a Canadian visa, meet the age requirements of your province, etc.). If you meet the requirements, head over to the sign up page and fill in the required information.

Once you are logged in, you will provide a few more personal details as well as complete a questionnaire so your robo advisors can understand what portfolio allocation would be best for you.

Once your plan of action has been chosen, you’ll need to choose the account type, registered, non-registered, or transfer from another account.

Finally, you will choose whether or not to set up automatic contributions.

That’s it! You can make your first purchase and start seeing your wealth grow.

Is Wealthsimple the Best Robo Advisor? Our Expert Comparison

Justwealth | WealthSimple | |

Number of Portfolios Available | Over 80 different portfolios engineered to either grow your wealth, generate income, or preserve wealth. | 3 standard portfolios, plus SRI and Halal options. |

Personalized Financial Advisor | ||

5-year returns (balanced portfolio) | 8.48% | 4.70% |

Fees | 0.40%-0.50% | 0.40%-0.50% |

Target-Date RESP Funds | ||

Account Minimum | $5,000 (With exceptions for RESP and FHSA accounts) | None |

SRI Options Available | ||

Promo Offer | $100-$500 Instant Cash Back | $50 Sign-up Bonus |

Sign Up |

Robo advisors are excellent choices for folks who want the most simple approach to taking a piece of their paycheque and turning it into a diversified investment portfolio. Check out our Justwealth Review for more on why they are currently our pick over Wealthsimple when it comes to the current Robo Heavyweight Title Belt.

That said, Wealthsimple is currently sitting at #2, and you might get more out of it if you prioritize the following areas:

- Tech Excellence – Wealthsimple’s website wins awards for a reason. Is it beautiful and the user experience is elite.

- No Minimums – You can get started with just a few bucks.

- Complex Portfolios w/ Exotic Assets – Wealthsimple has decided that their portfolios should include gold.

- Crypto – Wealthsimple will prompt you to use their cryptocurrency trading setup as well (it’s one of their big growth areas). Personally, I hate this, but others are fans.

You can see some of the other options out there by checking out our Ultimate Guide to the Best Canadian Robo Advisors.

Is Wealthsimple the Best DIY Online Brokerage?

| ||

|---|---|---|

| Free ETFs | Yes | Yes |

| Trading Fees |

|

|

| Account Fees | $25 per quarter - WAIVED IF you hold more than $25,000 in the account. | $0 - but very limited account options. |

| Customer Service | Truly elite customer service. The #1 reason to go with Qtrade. | You get what you pay for… and it’s a free app. Enough said. |

| User Experience | Excellent - consistently ranking #1 in the country for two decades. | Worst in Canada. Only began rolling out a desktop platform in late 2020. Many bugs on both desktop and app platforms. |

| Research Tools | Very solid variety and depth. | None. |

| Full Review | Qtrade Review | Wealthsimple Trade Review |

| promotion | $5,000 Cash Back + Unlimited Free Trades | $25 Bonus |

| Sign Up | Visit Qtrade | Visit Wealthsimple |

Wealthsimple DIY investing is a fine choice for Canadians who want a simple place to start investing. Zero-dollar trades, a clean interface, and easy setup make it approachable.

That said, once you compare it directly with a more complete platform like Qtrade, the trade-offs become obvious. Where Wealthsimple starts to fall behind is once you want more control. Qtrade offers more account types, better research tools, stronger order functionality, and a deeper overall platform for serious DIY investors.

Now that Qtrade has embraced $0 trades in 2026, Wealthsimple’s cheaper fees advantage is gone as well.

When you look at the fact Qtrade is going to give you up to $5,000 cash back in comparison to Wealthsimple’s $50, it’s literally 100x more attractive to DIY your money somewhere other than WS.

If you prioritize crypto trading, I’d say that put Wealthsimple ahead of Qtrade on your leader board.

Wealthsimple Review – FAQ

Is Wealthsimple The Best Choice For Me?

There was a time when the name “Wealthsimple” was synonymous with hands-off passive investing. The entire company revolved around being the go-to robo advisor in Canada (if not the world at one point) by making investing simple, affordable, and streamlined.

Most importantly, they were 100% committed to the philosophy of index investing, including the execution of “set it and forget it”.

But as the company expanded, they carved out “Wealthsimple Invest,” (which later rebranded into “Wealthsimple Managed Investing) and lately, it feels like that core robo advisor service has been pushed to the back burner.

Gone is the single-minded focus on index-based, passive investing. These days, the emphasis is on pushing crypto services, earning payment-for-order flow via its discount brokerage platform, branching into mortgages, and more.

It’s clear that the pursuit of additional revenue streams has profoundly shifted the company’s DNA. Wealthsimple now risks morphing into a jack-of-all-trades, but master of none. I’m even more worried about that as we start 2026 and it appears that Wealthsimple’s focus on becoming a full-services bank has become the new shiny object.

If what you want is a superior robo advisor, give our Justwealth Review a look. If you’re in the market for a better DIY online brokerage, check out my Qtrade Review. To be fair, Wealthsimple still excels at user-friendly design, marketing savvy, and building a visually appealing interface. Plus, Wealthsimple Tax remains a handy tool within their suite of products.

However, the pivot to exotic niche asset classes such as gold, private credit, private equity, and especially crypto – seems to undermine what made Wealthsimple special in the first place. The asset allocation issues in their managed portfolios have become too significant to ignore. As a result, their position on our Canadian robo advisor rankings has slipped noticeably.

I will be updating my 2026 Wealthsimple Review throughout the year, so any firsthand information from recent users would be great to see in the comments, or through email if you prefer. All comments can be kept anonymous if you’re worried about blowback.

I have to proof ownership of my crypto account and it takes 5 business days to resolve on their end. That is an unacceptable long time.

On the flip side, they never ask me to proof ownership of my cash account?!? I was unable to transfer $200k of BTC into my Wealthsimple crypto account because if took 5 business days to unlock my account. Not sure why it was locked. If you guys are serious players in the crypto game, you are doing a lousy job at it. They also do not disclose the % of crypto assets they store in cold storage.

Why on Eath are they difference between the web site and the mobile app? Some features are only offered on the app. This is sooo stupid. Also you cannot realy see what’s going on in your account until the monthly statement that only shows up 10 days after the end of the month. You cannot see ex-dividend date and payment date (no biggie right? nobody does dividend investing…) No search tools for stocks. The whole experience is so piss poor. The problem with Wealthsimple is that their simplicity is that their managers are simple minded.

Wealth simple now requires you to send in your drivers license just a heads up.

is Wealth Simple Investments considered a valid “bank”/Financial Institution recognized by the Canadian Payments Association for PAD/EFT?

Biggest drawback for me is you can’t execute Nordbert’s Gambit in WS. I transferred my accounts for the 1% bonus (and was already using them for RESP and cash accounts). Once the bonus is paid in full I’ll move my RRSP and LIRA back to Questrade. TFSA will likely stay with WS because I’ll probably hold mostly Canadian assets there.

Would love to switch to this but wondering how hard / easy it is to execute the Smith Manoeuvre with Wealthsimple. I’m thinking specifically of the tax preparation required to drive the refunds out of the leveraged HELOC. I hate being in mutual funds but those MERs pay for the service that makes the SM doable for me. I don’t have the time to manage the accounts and returns myself.

As far as I am aware Michael, Wealthsimple does not to the adjusted cost basis for you like a lot of mutual funds do. This would make running the the SM quite difficult I believe. This is a good question for them though. Would you be so kind as to ask them on their online chat and let us all know what they say? I’ll try to get a hold of them for an answer as well. I wonder if you moved your entire portfolio over to them, if that would warrant the type of attention needed to make the SM run smoothly.

WealthSimple parks (your) HISA money in an EQ Bank Savings account which offers 2.3%.

Thanks for the review. However, you wrote the money invested in the Wealthsimple’s Savings Account is protected by CDIC, and yet on their website they specifically say they are NOT a member of CDIC. Can you clarify on this point please?

https://help.wealthsimple.com/hc/en-ca/articles/360033892993-What-s-the-difference-between-CIPF-protection-and-CDIC-insurance-

Hi Cindy – just the HISA are CDIC regulation. Investment accounts are a different type of insurance all together (as noted in the article).