Dividend Investing

All Categories

As we look at the possibilities for investing in Canadian bank stocks in 2026, it’s important to realize just what an incredible year we’re coming…

The “Dogs of the TSX” dividend investing strategy for Canadian stocks has been a focus of mine for the past 14 years. I don’t follow…

As we start a new year, our January 2026 Best Canadian Dividend Stocks list needed a refresh. Last year was an excellent year for all…

Having written about dividend investing in Canada for close to twenty years, I regularly hear from readers wondering whether the best Canadian dividend ETFs are…

When I first started writing about the Smith Manoeuvre nearly two decades ago, I had no idea it would strike such a chord with Canadian…

Most Recent

Investing in Canadian Bank Stocks 2026

As we look at the possibilities for investing in Canadian bank stocks in 2026, it’s important to realize just what an incredible year we’re coming…

49 Best ETFs in Canada – January 2026

When I started writing about Canadian personal finance roughly two decades ago, choosing the best ETFs in Canada was pretty easy. You could basically count…

Dogs of the TSX Dividend Stock Picks

The “Dogs of the TSX” dividend investing strategy for Canadian stocks has been a focus of mine for the past 14 years. I don’t follow…

Best Canadian Dividend Stocks – January 2026

As we start a new year, our January 2026 Best Canadian Dividend Stocks list needed a refresh. Last year was an excellent year for all…

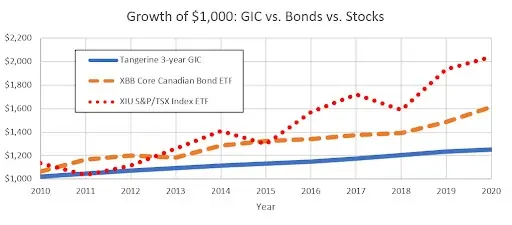

Best Low Risk Investments in Canada Right Now (January 2026)

After a volatile few years and with markets at all-time high valuations, it’s no surprise that many investors are heading into 2026 prioritizing low risk…

Best Canadian Dividend ETFs for 2026 (And Why We Prefer Dividend Stocks)

Having written about dividend investing in Canada for close to twenty years, I regularly hear from readers wondering whether the best Canadian dividend ETFs are…

Questrade vs BMO InvestorLine – 2026 Comparison

The BMO vs Questrade battle takes place amongst a quickly growing field of Canadian online brokers. With more options than ever, Canadian DIY investors have…

Investing in Canadian REITs in 2026

Investing in Canadian Real Estate Investment Trusts (REITs) is one of the easiest ways to add real estate to your portfolio without turning your life…

The Best Investments for Canadian Retirees: Stocks vs ETFs vs Robo Advisors

When we talk about the best investments for Canadian retirees, it’s worth saying upfront that this is a nuanced topic. There isn’t a simple one-size-fits-all…

New Wealthy Barber Book Review

All of the new Wealthy Barber (2025) reviews out this past week have been glowing. Roy Miller the all-knowing barber is back, as the 1989…

Canadian Undervalued Stocks 2026

Undervalued stocks in Canada are usually identified as having a market value that is for one reason or another below their “true value.” The idea…

The Biggest Risk of Early Retirement (FIRE) – Sequence of Returns!

The dream of Financial Independence, Retire Early (FIRE) is everywhere these days (it wasn’t so common when I started my journey almost two decades ago).…

Buying Fractional Shares in Canada

Buying fractional shares is an excellent way to get exposure to Canadian All-Stars like Constellation Software without having to toss down more than $4,000 just…

Best Defense or War Stocks in Canada

You know it’s not a great sign of the times when you start getting emails from Canadians about investing in war stocks. More politely referred…

Ultimate Smith Manoeuvre Guide For Canadians

When I first started writing about the Smith Manoeuvre nearly two decades ago, I had no idea it would strike such a chord with Canadian…

36 Years of Stock Market Returns in Canada (TSX)

What is the average stock market return? It’s one of the most common questions that I get when I talk to an audience that is…

Best Investments for a Canadian Recession

Over the last couple of weeks I’ve been getting a ton of emails and comments asking about the best stocks for a recession or how…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.