Dividend Stocks Rock Review 2026

Dividend Stocks Rock Review

-

Investment Track Record

-

Price

-

Layout and ease of use

-

Fresh Data and Information

-

Proven Results

-

"Shiny" Platform and Branding

DSR Review Summary:

After being an avid DSR user for more than five years, I like to think that I’m the perfect candidate to provide an in-depth Dividend Stocks Rock review. I use Dividend Stocks Rock mainly for its uniquely Canadian tools and constantly-updated sources of information.

Dividend growth investing isn’t for everyone, but after understanding some basic principles, DSR makes executing a dividend-growth strategy accessible to most Canadian investors. If you’re looking to build a portfolio that focuses on throwing off an ever-increasing stream of dividends, this is the service for you.

Limited time offer – MDJ’s readers get an exclusive discount on all DSR subscriptions by using the code MDJ33. This is your chance to get this premium service for only $11 per month.

Pros

- Great value for money, especially with MDJ’s unique promo

- Your portfolio is reviewed by the DSR team each quarter

- Free monthly webinars with unlimited live questions answered

- Very accessible stock report cards that are constantly updated

- A proven track record with fantastic long term results

- 33% discount on your subscription for MDJ readers

Cons

- No mobile app

- Requires more DIY knowledge than robo advisor investing

Investing on your own is not an easy task.

From mutual funds to robo advisors and individual stocks, there are a wide range of strategies, information services and trading platforms to choose from.

It can quickly become overwhelming.

This is where the simplicity of dividend investing really shines.

I started investing in mutual funds when I was 16-year-old. Since then, I evolved into a mix of ETFs and dividend growth investing strategies. This was the beginning of a long investing journey where I learned a great deal about the stock market and personal finance. Back then, information resources were limited. The best option was Yahoo! Finance stock screeners to research companies. (That’s how old I am!).

Today, investors face a completely different problem: information overload. Youtube investing channels, podcasts, financial news sites, and free investing blogs (like yours truly) all offer their two cents on what you should do with your money. Your research will often result in an overwhelming amount of information to digest. You may then get stuck in paralysis-by-analysis mode.

While I personally read a ton of online information about the markets (including several dividend newsletters), I know that I’m a a long-time financial geek and that not everyone has time for all of that. The truth is that a lot of these peoples’ opinions – are just that – opinions. Most of the writing is outdated by the time you read it, and was only based on “gut feeling” when it was typed in the first place.

The dividend source of information that has consistently stood about the rest and endured the test of time is Dividend Stocks Rock (DSR). The platform was created by Mike Heroux, a former private banker who now works online and enjoys a location-independent lifestyle. The platform has evolved over the years and now offers a ton of constantly-updated value, along with personal access to an absolute expert.

What I like most about Mike is his straight-to-the-point approach. This enables me to cut through the noise and focus on what really matters: my portfolio and my growing stack of dividend payments.

What is Dividend Stocks Rock?

Dividend Stocks Rock was created by Mike Heroux in 2013. This started as a “side-line” stemming from Mike’s passion: dividend growth investing. It rapidly grew into a complete platform for DIY investors who are looking for a “hiking buddy” while investing in dividend stocks.

Mike’s goal is to help people invest with more conviction, get rid of their buy/sell dilemmas about the market, and make sure they position themselves to enjoy their retirement.

How Does it Work?

When you login to the DSR website for the first time, you are immediately directed to their dashboard where Mike explains his investment process. There is a combination of written explanation and videos to teach you how to use DSR to its fullest extent.

DSR offers a straight-forward process containing three steps:

#1 Rethink your portfolio

Once you subscribe to DSR, you will be invited to review your portfolio and make comparisons with DSR portfolio models. You can either decide to mimic one of their portfolios (which is good if you are just starting to invest) or simply use the resource to modify your current portfolio.

Dividend Stocks Rock presents a specific point of view on each sector. They believe nobody should invest more than 20% of their money in any single sector. The more you add past that 20% level, the more volatile your portfolio may be.

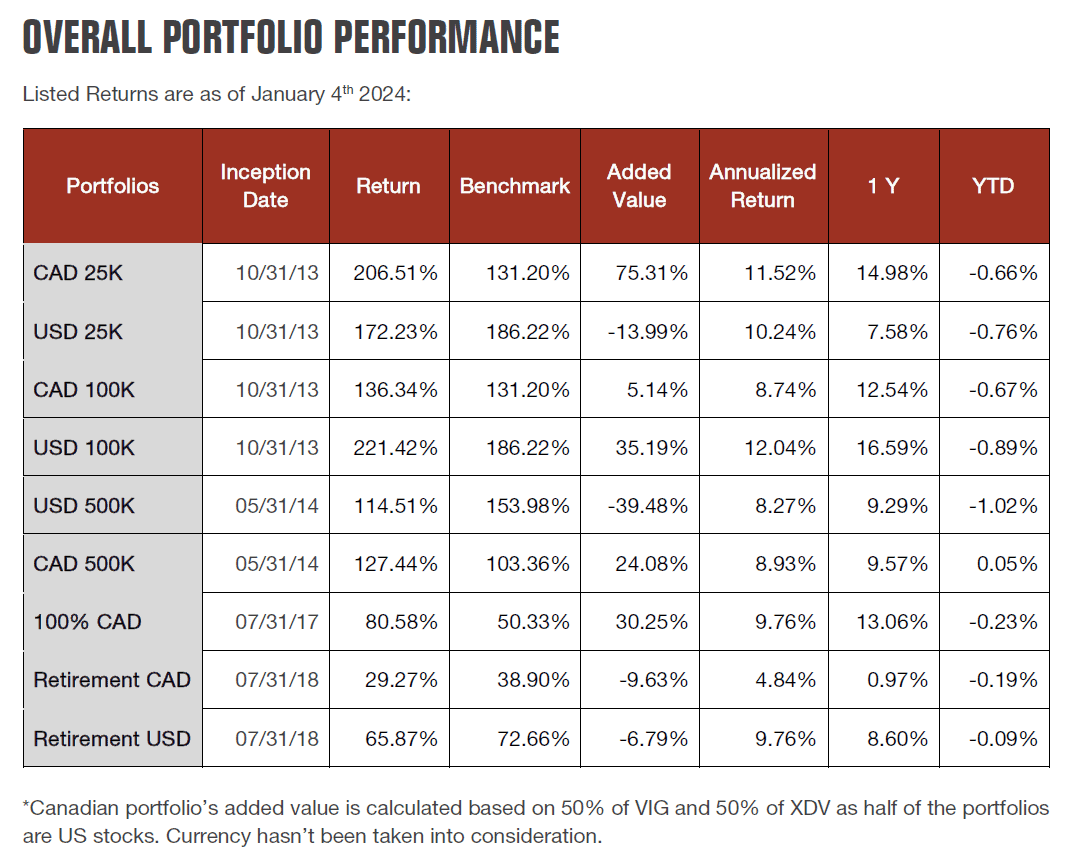

My favourite thing about Mike is that he is 100% transparent with his dividend stock picking track record. Here is how his model portfolios have performed as of early 2024.

DSR has 9 portfolio models covering both Canadian and U.S. markets. They have solutions for growth and income seeking (retirees) investors too! Most importantly, most of their portfolio models (7 out of 9) have beaten their respective benchmarks since inception (2013-2014).

Now is always the right time to change your sector allocation. DSR Portfolio Models will help you get the work done!

#2 Buy The Right Assets

Once you have picked the portfolio style you wish to follow, it’s time to hunt for the stocks to populate your growing nest egg. New investors often get intimidated by trying to gain a thorough understanding of every single dividend-paying stock across several markets.

That can be a recipe for overload. DSR explains what to look for, and how to use stock screeners (amongst other tools) that really cut down on the amount of in-depth research that needs to be conducted.

On the other hand, if you’re a number-crunching nerd like me, the impressively-updated stock library has full analyses on over 400 dividend-paying stocks, covering both Canadian and U.S. dividend-paying stocks!

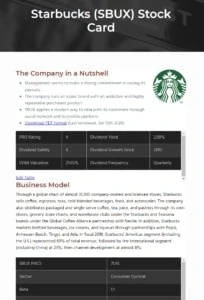

For folks that suffer from the aforementioned paralysis-by-analysis, DSR’s resources and webinars will make it easy for you to make decisions. They provide an easy-to-understand stock rating system (from 1 to 5) along with a dividend safety score (1 to 5 as well). Using both ratings to filter the list will help you pick the best of stocks for each sector.

Each stock card is published on their website with current metrics. Their analysis includes a summary of the company’s business model, the DSR investment thesis, potential risks, and the dividend’s safety.

You can also download the analysis in a pdf format. Their easy-to-read stock cards are printed in two pages and include all the important metrics. The best part of the service is that you can request any dividend paying stocks to be analyzed by the DSR team! They call it “stock card on demand”.

#3 Manage your portfolio throughout market cycles

The market throws us curve balls all the time. Financial crises, oil busts, and of course, the recent pandemic – all add to the noise in the market.

At DSR, they not only care deeply about investing and the investing process, but they also care deeply about their members! DSR weekly newsletters cover everything you need to know and provide you with clear, actionable intelligence on opportunities and threats in real time.

During times of crisis, DSR has offered private webinars to assist their subscribers to stay the course. I’ve attended many of these webinars and I really like how Mike stays around often for over 60 minutes to be sure to answer all his subscribers’ questions. Those private webinars have become so popular that it has now become a monthly thing!

Hundreds of Million Dollar Journey readers have emailed over the last couple of years to tell me that Mike’s free webinars helped steer them through the market turmoil at the start of Covid, and then again in 2022 and 2023 when high interest rates sent the markets spiraling downward. My personal favourite was the emergency webinar on Algonquin’s dividend cut.

When other investors were panicking because they just saw a bunch of scary news headlines, Mike was able to answer all subscriber questions in real time.

When we send out the webinar replays, hundreds of people download them each time. The investment returns that DSR clients enjoyed as a result of those webinars alone will pay for the next decade of their subscription costs.

Dividend Stocks Rock’s List Of Top 10 Growth Dividend Stocks

Ticker | Sector | Div Streak | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio | P/E | |

Fortis | FTS.TO | Utilities | 51 | 3.59% | 6.15% | 5.26% | 4.81% | 74.53% | 21.19 |

Canadian National Railway | CNR.TO | Industrials | 28 | 2.61% | 4.47% | 8.70% | 9.07% | 48.07% | 18.48 |

Canadian National Resources | CNQ.TO | Energy | 23 | 5.06% | 17.98% | 4.76% | 22.55% | 74.30% | 14.71 |

Telus | T.TO | Communications | 20 | 9.37% | 5.89% | -7.60% | 6.89% | 233.03% | 23.06 |

Emera | EMA.TO | Utilities | 18 | 4.34% | 8.37% | -4.87% | 3.07% | 167.81% | 18.28 |

National Bank | NA.TO | Finance | 14 | 2.86% | 9.96% | 10.53% | 10.79% | 45.77% | 17.20 |

Alimentation Couche-Tard | ATD.TO | Business | 14 | 1.15% | 10.73% | 2.15% | 21.88% | 19.58% | 19.82 |

TD Bank | TD.TO | Finance | 13 | 3.33% | 9.11% | 12.20% | 6.01% | 36.19% | 11.26 |

Brookfield Corp | BN.TO | Finance | 12 | 0.52% | 3.93% | -28.67% | -5.59% | 104.65% | 96.42 |

Sun Life | SLF.TO | Finance | 8 | 4.29% | -0.91% | 5.11% | 9.86% | 61.50% | 16.31 |

?????? (Hidden, click for access) | (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ?.??% | ?.??% | ?.??% | ?.??% | ???.??% | ??.?? |

Another Powerful Tool

Between market news, volatility, and quarterly earnings, it’s easy to get swamped by a tsunami of papers to read – whether you’re new to DIY investing or you’ve been doing it for a while.

How can you make good decisions when you are overwhelmed with data? This often translates into difficulty buying or selling at the right time. DSR, however, tells you where to look. Their team can track companies in your portfolio for you.

Dividend Stocks Rock offers a “PRO” version where their team even reviews your portfolio quarterly.

DSR PRO is a customized quarterly report tracking each company’s earnings, and you receive a portfolio summary along with crucial information about all your holdings. You tell them what to follow and they keep you in the loop.

Dividend Stocks Rock Review: Cons

While I really enjoy DSR services, there are a few things that must be taken into account before subscribing.

This is not a “buy this stock and make 100% return overnight” kind of service. Mike and his team focus on long-term investing and don’t brag about flashy monthly quick-buck returns. While their stock selections and portfolio models outperform the market in general, he always (correctly) emphasizes that dividend growth is a long-term game.

Dividend growth investing requires a little time and effort. Although DSR does a great job in simplifying stock analysis and makes financial lingo more understandable, you will still need to spend some time doing research on their website. Mike’s stock screener and other resources make things much easier, but the power is still ultimately in your hands (it’s not a mutual fund after all).

DSR doesn’t provide target prices. Most investment services will give you a target price in their stock analysis. They will basically tell you if TD trades at a good price right now, then what’s the upside or downside potential. DSR doesn’t do that. They believe in buying quality dividend growers and give little attention to the current price. The truth is that most financial analysts are wrong 80%+ of the time when they predict stock prices anyway. Nobody knows the future to that minute degree. Mike subscribes to the same long-term ideas as guys like Warren Buffett – simply buy quality mature companies, and then reap the rewards over the long term. (While Ignoring all of the noise.)

Finally, it takes some time to get your arms around all that DSR has to offer. Mike does a good job in providing videos explaining each of his tools, and is very responsive, but just know that you’ll likely need a couple of weeks to get used to the DSR features.

Dividend Stocks Rock Review – FAQ

How Much Does Dividend Stocks Rock Cost?

When you subscribe to DSR, you get access to many things:

Portfolio Models: Rethink your portfolio using 1 of their 9 US or CAD models. Each one comes with its own booklet and is updated quarterly. Stop overthinking by having a strong sector allocation.

Stock Cards: Buy the right assets and pick among the best stocks only with their 425+ stock reports. Focus on quality over quantity to build your portfolio with conviction.

Stock Cards on Demand: Ask them to review any stocks in your portfolio! Get instant access to their investment thesis, potential risks, dividend growth perspectives, valuation and key metrics. It’s like having your own personal stock research assistant.

Newsletter: Stay the course and grow in confidence with their weekly newsletter. DSR covers everything you need to know and provides you with clever intelligence including buy and sell ideas.

Exclusive Webinars and Videos: Focus on what matters and ask all your questions! Benefit from the power of a community of over 1,500 investors.

Customized Quarterly Portfolio Report (DSR PRO only): Track each of your companies’ earnings in no time. You will never miss news that may directly affect your investment performance.

Risk-free Investment: Try DSR for 60 days and get your money back if it’s not working for you.

Best Deal: Your price will never increase once you become a member.

DSR offers three payment options:

- Monthly ($19/month)

- Yearly ($247/year)

- DSR PRO ($497/year)

Since I partnered-up with Mike, I can offer you a special discount! Million Dollar Journey readers only pay $167/year for DSR (Coupon Code MDJ80) and $347/year for DSR PRO (Code MDJ150).

Is Dividend Stocks Rock Worth it?

I’ve been writing about dividend investing for nearly two decades now, and I can honestly say the DSR has been the best source of information to come around during that time. Mike is a completely impartial guide to the markets, and he is 100% transparent about when he is right and wrong.

No Dividend Stocks Rock review would be complete without mentioning that you can try the service risk-free for 60 days. Mike offers a 100% no questions asked guarantee that if you pay for the product and don’t think it’s worth it, he’ll refund you your money right away. He’s in this thing for the long haul and doesn’t want any dissatisfied customers walking around. There is literally nothing to lose by trying the service.

I’ve had dozens of MDJ readers come back to me after trying Mike’s service over the last few years, and by far the most common sentiment was:

“The best part was just the removal of paralysis-by-analysis. Mike not only provided excellent information and analysis. He also personally answered my one burning question during a live webinar, and has helped me build the confidence to make my decisions and not second-guess myself. I used to procrastinate and delay clicking that buy button wondering if there was a better option – now I make my analysis and act on it.”

With a risk-free trial available, why not lock-in today’s price forever?