Qtrade Guided Portfolios Review

Qtrade Guided Portfolios Review

-

Investment Strategy

-

User Experience

-

Fees and Costs

-

Safety

-

Socially Responsible Investing

-

Mobile App

-

Customer Service

-

Simplicity & Ease of Use

Qtrade Guided Portfolios Summary:

My Qtrade Guided Portfolios review takes a look at one of Canada’s top robo advisors.

To avoid confusion right out of the gate, this is not a review of Qtrade’s self-directed online brokerage platform. If you’re looking for more information on Qtrade’s $0 trades platform, check out our in-depth Qtrade Review.

Qtrade Guided Portfolios relaunched in 2023, and took major steps forward in terms of portfolio construction, user experience, and overall polish.

Qtrade Guided Portfolios are used by credit unions across Canada, many of which have deep roots in their communities and tend to be conservative when it comes to investment partners. That kind of institutional buy-in doesn’t automatically make a product great, but it does suggest a certain level of trust and due diligence behind the scenes.

In my 2026 Qtrade Guided Portfolios review, I’ll cover the fees, features, account types, and investments options available. I’ll also break down how they compare to other Canadian robo advisors.

Pros

- Excellent use of index investing

- 75% cheaper than Canadian mutual funds

- Very user friendly – simple interface

- Quick and easy setup

- Elite customer service

- Trusted by credit unions across Canada

- Free trial available

Cons

- Slightly more expensive than using the Qtrade online broker

- Not a “trader app” – you’re looking for an online brokerage if that’s what you want. Qtrade Guided Portfolios is a robo advisor product designed for easy hands-off investing

What is Qtrade Guided Portfolios?

Qtrade Guided Portfolios is the robo advisor offering from Qtrade (which we’ve consistently ranked as one of the best online brokerages in Canada). It’s designed for Canadians who want a hands-off investing option, without handing everything over to a traditional advisor or paying mutual fund-level fees.

At its core, the philosophy is familiar — and sensible.

Like most modern robo advisors, Qtrade Guided Portfolios is built around a few straightforward ideas:

1) Use low-cost index investing (often called passive investing) rather than trying to beat the market.

2) Make it easy to get started and even easier to stay consistent by investing automatically over time.

3) Keep fees well below what most Canadian mutual funds still charge.

4) Match portfolios to a client’s risk tolerance, time horizon, and comfort with market ups and downs (not just their age or income).

In practice, that means answering a short questionnaire, getting placed into a diversified ETF portfolio, and having the day-to-day decisions handled for you – including rebalancing as markets move.

One thing Qtrade emphasizes more than many competitors is investor confidence. That might sound vague, but in this case it shows up in fairly practical ways: Clear explanations of how portfolios are built, plain-language descriptions of risk, and educational material aimed at helping newer investors understand why they’re invested the way they are. The platform itself is clean and intuitive, which lowers the barrier for people who find investing platforms overwhelming.

Behind the scenes, Qtrade Guided Portfolios is powered by Aviso Wealth, a national financial services firm with deep roots in Canada’s credit union system. Aviso brings together Qtrade’s self-directed investing experience, portfolio management expertise from NEI Investments, and decades of working directly with everyday Canadian investors through credit unions.

That combination matters. It helps explain why Qtrade Guided Portfolios has been widely adopted by credit unions across the country – institutions that tend to be cautious, relationship-driven, and slow to recommend products they don’t fully trust.

The end result is a robo-advisor that sits comfortably in the middle of the Canadian investing landscape: More guided and structured than DIY investing, but far simpler and cheaper than the traditional mutual fund model many Canadians are still stuck in.

How is Qtrade Guided Portfolios Different from the Qtrade Discount Brokerage?

The difference between the Qtrade Invest Discount Brokerage platform and Qtrade Guided Portfolios is that one is a DIY online broker, while the other is a robo advisor.

The two platforms share the following characteristics:

- Low Cost

- Much better than advisor + mutual fund models

- Available to Canadian investors

- Perfect for ETF investors

But there are some key differences as well. Robo advisors are aimed at customers who want the following:

1) A super easy hands-off way to invest their money.

2) No need to look at stock market reports or learn confusing investing terminology.

3) Embrace “index investing” (aka “couch potato investing” or “passive investing”) and just want a simple way to diversify their investments.

4) Just need a little help getting everything set up so that it is quick, stress-free, and efficient.

Meanwhile, DIY Canadian online brokers are aimed primarily at investors who want to cut costs to the bone, trade individual stocks, and are ready to go their own way without additional help.

Qtrade Online Broker | Qtrade Guided Portfolios | |

Best For | DIY Investing | Hands-off Index Investing |

Time Commitment and Effort Level | High | Low |

Cost |

| 0.35% to 0.60% company management fee (charged as a percentage of your portfolio), plus approximately 0.15% MER (compared to 2.5% MER for comparable mutual funds) |

RRSP + TFSA + RESP + Non-registered accounts | Available | Available |

Investing Style | Requires more knowledge but can yield much better returns | The easiest way to turn part of your pay cheque into an excellent investment portfolio.

|

Promo | $5,000 Cash Back | Free Trial + $150 in Transfer Fees |

Sign Up | ; | ; |

Is Qtrade Guided Portfolios Safe?

Yes, Qtrade Guided Portfolios are very safe. They are part of the Credential Qtrade Securities Inc. This corporate entity is a member of the Canadian Investor Protection Fund (CIPF), which regulates Canadian banking entities. In other words, Qtrade has to play by the same rules as RBC, BMO, TD, CIBC etc.

The CIPF has a coverage policy that protects each account an investor has up to $1 Million.

Of course, it’s worth mentioning that no coverage exists for poor investment decisions. Qtrade Guided Portfolios are safe in terms of protection from fraud, or anything business-wise happening to the company – but no investment platform can guarantee investment returns.

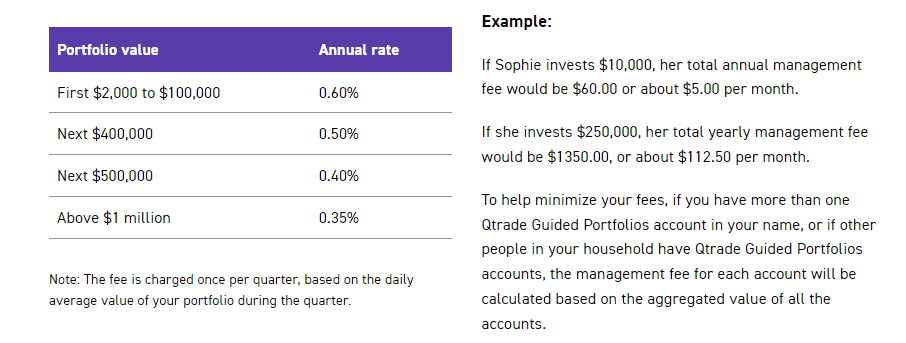

Qtrade Guided Portfolio Costs and Fees

One thing I really like about Qtrade Guided Portfolios is the simplicity of their fee structure.

Qtrade Guided Portfolios charges you a fixed percentage of your portfolio. Here’s how Qtrade explains it in their own words:

A few additional points to note about Qtrade Guided Portfolios costs and fees.

- GST is of course added.

- If you use Guided Portfolios as a non-registered account, the fees are tax deductible.

- There are no transaction costs when your account is automatically rebalanced.

- Admin fees to apply to unique requests such as transferring out or closing an account.

Overall, these costs are very competitive with Canada’s other robo advisors.

How do The Qtrade Guided Portfolios Invest with ETFs?

Qtrade Guided Portfolios use a nobel-prize winning strategy known as passive investing. Some experts have also called this type of investing “couch potato investing” or “index investing”.

The idea behind the strategy is essentially: Look, it’s really hard to pick stocks that do better than average. There are so many rich smart people with supercomputers that are trying to pick the better stocks – you’re better off not trying to compete with them.

Instead, you’re way better off to just spread your money out across a bunch of companies in the world – in fact, why not ALL the publicly listed companies in the world?

Once you have done that, you can take away some of the risk of your portfolio by purchasing government bonds. These are ultra-safe investments that pay small amounts of interest. The ETF VAB for insurance is packed with municipal bonds, provincial bonds, federal bonds, and a few blue chip company bonds (think RBC or Bell). You get all of these bonds in one convenient package.

What Qtrade Guided Portfolios does is take the following ETFs:

- FlexShares STOXX Global Broad Infrastructure Index ETF (NFRA)

- iShares Core S&P Total U.S. Stock Market ETF (ITOT)

- iShares Core MSCI Total International Stock ETF (IXUS)

- iShares Core MSCI Emerging Markets ETF (IEMG)

- iShares Core MSCI EAFE IMI Index ETF (XEF)

- iShares Global REIT ETF (REET)

- Vanguard Canadian Aggregate Bond Index ETF (VAB)

- Vanguard FTSE Canada All Cap Index ETF (VCN)

- Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) (VBU)

- Vanguard Global ex-U.S. Aggregate Bond Index ETF (CAD-hedged) (VBG)

And it uses them to quickly and efficiently diversify your retirement savings into buckets of stocks and bonds from around the world. You will get exactly the average of the return from these assets – minus the small fees.

Qtrade will decide how much of each ETF you should get based on an initial questionnaire, and possible follow up conversations in regards to your risk level. If one ETF is doing a lot better than another, Guided Portfolios will automatically rebalance your portfolio so you sell some of what is “at the top” and buy some of “what is at the bottom”. In other words – buy low and sell high.

Depending on your risk tolerance and unique investing goals, Qtrade will recommend one of the following portfolios:

- Income

- Income & Growth

- Balanced

- Growth & Income

- Growth

- Maximum Growth

These portfolios are just different combinations of stocks and bonds.

For example, the Balanced Portfolio would give you a portfolio of 50% bonds and 50% stocks. So half of your money would go to buy bond ETFs, and half would go to buy stock ETFs.

The Maximum Growth portfolio would have no bonds, and be fully (i.e 100%) invested in stocks from around the world – using the ETFs listed above.

Investment Account Options

Qtrade Guided Portfolio Account options include most of the usual accounts that a Canadian investor would wish to use including:

- RRSP

- TFSA

- RESP

- Non-Registered (also known as “cash accounts”)

- Spousal RRSP

- LRSP/LIRA

In just about any way you want to save and invest, they have you covered. The only account type that we are waiting on is a First Home Savings Account (FHSA).

Qtrade Direct Investing online brokerage offers FHSAs so we are hoping to see this account type available with Qtrade Guided Portfolios in the near future.

Qtrade Guided Portfolios Mobile App

While the Qtrade Guided Portfolios Mobile App is still too new to have many ratings in the app stores, it appears that the same elite user experience which characterizes their brokerage app is being used here as well.

Overall, the Guided Portfolio mobile app is minimalist and clearly communicates your index investing portfolio’s performance.

Qtrade Guided Portfolios Review: Responsible Investing

Qtrade Guided Portfolios offers a responsible investing option through their RI portfolios. These portfolios are crafted by taking into account companies’ environmental, social, and governance (ESG) performance.

Because Qtrade’s parent company Aviso Financial owns a wide range of financial brands, they have chosen to use their sister company, NEI Investments, to supply the ETFs for the Qtrade Guided Responsible Investing Portfolios.

The ETFs they use are:

- NEI Canadian Bond Fund

- NEI U.S. Equity RS Fund

- NEI Global Total Return Bond Fund

- NEI International Equity RS Fund

- NEI Canadian Equity RS Fund

Because of the extra calculations needed to create these unique ETF products, there is a higher MER of .72%-.96% associated with ESG-related portfolio products.

In 2024, Money Sense ranked Qtrade Guided Portfolios as the best robo-advisor for socially responsible investors.

Qtrade Guided Portfolios vs Justwealth

When we evaluate a robo-advisor such as Qtrade Guided Portfolios, we always like to compare it with our top recommended robo-advisor, Justwealth.

Both Qtrade Guided Portfolios and Justwealth boast several impressive features:

- Easy application process

- A variety of investment account options

- Customized ETF portfolios tailored to your preferences and goals

- Significantly lower costs compared to Canadian mutual funds

To help you see how they differ, we’ve created a comparison table:

Number of ETFs Available | 10 ETFs for the regular portfolios, an additional 5 ETFs | 50 ETFs from 9 different providers which result in over 80 |

Responsible Investing (RI) Options Available | Yes | Yes |

Account Types | RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, LRSP/LIRA, RLSP | RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA |

Company Management Fee | 0.35% to 0.60% depending on portfolio value | 0.40% to 0.50% depending on portfolio value |

Management Expense Ratios (MERs) | 0.15% | 0.15% to 0.25% |

Account Minimum | No minimum, although a $2,000 cash balance is required to be invested in a portfolio | $5,000 (although there are exceptions for RESP and FHSA accounts) |

Personalized Financial Advisor | No | Yes |

Promo | Get $150 in Transfer Fees | $100-$500 Instant Cash Back |

Sign Up |

Fee structure: Justwealth charges a fee of 0.55% – 0.75% on all accounts (management fee of 0.40% – 0.50% plus an ETF fee ranging from 0.15% – 0.25%), while Qtrade Guided Portfolios charges approximately 0.50% – 0.75% (management fee of 0.35% – 0.60% plus an ETF fee approaching 0.15%).

The management account fee with each depends on the account size. We found that Justwealth’s fee structure has a lower management fee until you surpass 1 million dollars in investments.

Account minimums: Qtrade Guided Portfolios have no account minimum but they do have an “investment minimum” of $2000. If you have less than $2000, your account sits in cash, but once you have more than $2000 your account will be invested in a portfolio that meets your goals and risk tolerance. Justwealth has an account minimum of $5000, although there are exceptions for RESP and FHSA accounts.

ETF options: Qtrade Guided Portfolios offers a selection of 10 ETFs, while Justwealth provides access to significantly more ETFs with a count of around 50. With Justwealth this allows for the creation of over 80 diverse portfolios designed to grow wealth, generate income, or preserve capital. Both platforms also offer responsible investing (RI) options, enabling investors to align their portfolios with their values.

Range of services and accounts: Qtrade Guided Portfolios offers its investors robo-advising only, although their parent company offers Qtrade Direct Investing if you are looking to take your investments into your own hands with an online brokerage. Justwealth specializes in robo-advising only, but it provides clients with a broader range of account options, including FHSAs and target-date RESPs. Most notably, clients benefit from the support of a dedicated personal financial advisor.

Mobile App: Both Justwealth and Qtrade Guided Portfolios have relatively new apps with simple interfaces that allow you to add funds to your account, view investment activity, and track your portfolio’s progress.

Our conclusion: While Qtrade Guided Portfolios is a solid choice for a low-cost Canadian robo-advisor, it falls short in several areas compared to industry leaders. Justwealth remains our top recommendation for good reason, offering unmatched benefits for everyday investors.

Plus, Justwealth currently features a generous sign-up bonus of up to $500. You can find out more about why we love and recommend Justwealth in our detailed Justwealth Review.

Qtrade Guided Portfolios Review: FAQ

Qtrade Guided Portfolios Review: Final Word

Qtrade Guided Portfolios (and robo advisors in general) are aimed at Canadians who want to grow their investments, but don’t want investing to become a second job.

The platform itself is a clear improvement over the old VirtualWealth offering. The portfolios are diversified, the process is easy to follow, and the experience feels thoughtfully designed rather than bolted together. It does what a good robo advisor should do: Keeps costs reasonable, removes behavioural mistakes, and helps people stay invested through market noise.

That said, robo advisors are not interchangeable.

Some platforms still offer lower fees, more customization, or access to a broader range of account types and portfolio tweaks. Others lean more heavily into human advisor access.

And that’s the real decision point.

If you value ease, structure, and peace of mind, a robo advisor like Qtrade Guided Portfolios can be a very sensible middle ground – far better than high-fee mutual funds, and far less demanding than managing everything yourself. If you’re willing to learn, rebalance, and stay disciplined on your own, a DIY option that makes use of a Canadian online broker will always be cheaper over the long haul.

Because in the real world, the best investment strategy isn’t the most optimized theoretical model that some finance geek with their own website puts together.

It’s the one that quietly works in the background (because you believe in the process) while you get on with your life.