Index Investing

All Categories

What is Wealthsimple? Wealthsimple was founded in 2014 by Michael Katchen, Brett Huneycutt, and Rudy Adler. I’ll be upfront about my bias here. I liked…

Current Qtrade New Customer Promotion In 2026, brokerage promotions only matter if they put real money in your pocket. Free trades don’t count anymore since…

If you’ve been considering jumping into index investing and fully committing to a passive portfolio, but keep getting caught up in analysis paralysis, you’re far…

Canada’s all-in-one ETFs (also called “portfolio ETFs” or “asset-allocation ETFs”) represent arguably the biggest leap forward in investing for DIY Canadians since the first index…

Because I’ve written a lot about the Best Canadian ETFs and the top dividend ETFs, I tend to get a lot of questions and comments…

Most Recent

Qtrade vs. Wealthsimple in 2026

If you’re on the hunt for the top-rated discount brokerages in Canada in 2026, you’ve probably come across the Wealthsimple vs. Qtrade comparison more than…

TD Direct Investing Review 2026

What is TD Direct Investing Brokerage? The TD Direct Investing online brokerage is a solid option, even though it doesn’t quite make it to the…

Best Stock Trading Apps in Canada

After two decades of DIY investing, I’ve had a front-row seat to the evolution of stock trading apps in Canada. Canadian investors had very limited…

Free Stock Trading in Canada 2026

Canada’s best free stock trading apps are giving DIY investors more control over their investments than ever before. With zero-commission stock and ETF trades, investors…

Wealthsimple Review 2026

What is Wealthsimple? Wealthsimple was founded in 2014 by Michael Katchen, Brett Huneycutt, and Rudy Adler. I’ll be upfront about my bias here. I liked…

Questrade vs Interactive Brokers

If you last compared Questrade and Interactive Brokers a few years ago, the key thing that changed as we head into the 2026 RRSP season…

The Best Mutual Funds in Canada (and why you should avoid them)

Despite the fact that they’ve been proven over and over again to be a pretty lousy way to invest money, I still get a surprising…

49 Best ETFs in Canada – January 2026

When I started writing about Canadian personal finance roughly two decades ago, choosing the best ETFs in Canada was pretty easy. You could basically count…

EQ Bank Review 2026

EQ Bank Account Options and Interest Rates Account Type Interest Rate Best For Daily High Interest Account 1%* (Plus 1.75% if you direct deposit your…

Best Canadian Robo Advisors 2026

As we head into the 2026 RRSP season, the best Canadian robo advisors are rolling their most competitive offers of the year. The idea is…

Qtrade Review 2026 – Canada’s Best Broker

Current Qtrade New Customer Promotion In 2026, brokerage promotions only matter if they put real money in your pocket. Free trades don’t count anymore since…

Top 6 Indexing Options for Your Portfolio in 2026

If you’ve been considering jumping into index investing and fully committing to a passive portfolio, but keep getting caught up in analysis paralysis, you’re far…

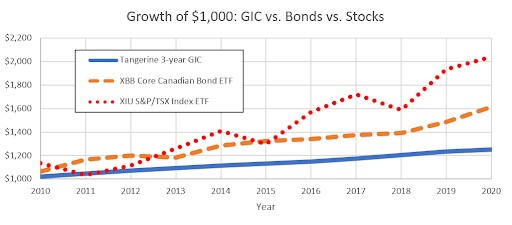

Best Low Risk Investments in Canada Right Now (January 2026)

After a volatile few years and with markets at all-time high valuations, it’s no surprise that many investors are heading into 2026 prioritizing low risk…

Wealthsimple Trade vs. TD Direct Investing

The Wealthsimple vs TD Direct Investing comparison usually comes down to: Do you want rock bottom pricing and a simple mobile-first experience, or do you…

Questrade vs BMO InvestorLine – 2026 Comparison

The BMO vs Questrade battle takes place amongst a quickly growing field of Canadian online brokers. With more options than ever, Canadian DIY investors have…

Best All-in-One ETFs in Canada 2026

Canada’s all-in-one ETFs (also called “portfolio ETFs” or “asset-allocation ETFs”) represent arguably the biggest leap forward in investing for DIY Canadians since the first index…

The 11 Best Cash ETFs in Canada (Plus HISA ETFs and Money Market ETFs)

As we head into 2026, there is more and more interest in low risk investments such as the best Canadian Cash ETFs. You might also…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.