Should You Buy VBAL ETF? My VBAL Review

The Vanguard Balanced ETF (VBAL) represents the fulfillment of the original promise behind ETFs when they first emerged three decades ago: a simple, low-cost way to achieve diversification across an entire investment portfolio.

VBAL offers Canadian investors a convenient, all-in-one ETF solution that blends both stocks and bonds, making it an ideal choice for those seeking a balanced approach.

In this VBAL ETF review, we’ll break down everything you need to know — from fees and performance to potential alternatives worth considering.

The Vanguard Balanced ETF Portfolio

Vanguard’s Balanced ETF Portfolio (VBAL) is a relatively conservative portfolio with roughly a 60/40 stock to bond split.

VBAL is best for the long term passive investor who doesn’t want to worry about rebalancing and has a bit of a lower risk tolerance.

VBAL ETF Asset Allocation

The VBAL ETF is made up of 7 underlying Vanguard funds, with a conservative 60/40 stock-to-bond split.

This is a fairly conservative portfolio, so if you have a lower risk tolerance, this could be appealing to you.

The fund contains assets from markets worldwide across many sectors, giving investors a good range of market exposure.

Vanguard VBAL Fund Allocation

As of May 7, 2025 the VBAL ETF has the following underlying allocations of Vanguard Funds:

| Fund | Allocation |

| U.S. Total Market Index ETF | 26.32% |

| Canadian Aggregate Bond Index ETF | 23.98% |

| FTSE Canada All Cap Index ETF | 17.88% |

| FTSE Developed All Cap ex North America Index ETF | 10.48% |

| U.S. Aggregate Bond Index ETF (CAD-hedged) | 8.40% |

| Global ex-U.S. Aggregate Bond Index ETF (CAD-hedged) | 8.20% |

| FTSE Emerging Markets All Cap Index ETF | 4.35% |

VBAL ETF Market Allocation

While the VBAL ETF consists mostly of North American stocks and bonds, there is still geographic diversification, which is always something to aim for.

As of May 7, 2025 the VBAL ETF has the following fund allocations by country and region:

| Country | Region | Fund |

| United States of America | North America | 44.49% |

| Canada | North America | 30.56% |

| Japan | Pacific | 4.19% |

| United Kingdom | Europe | 2.59% |

| China | Emerging Markets | 2.37% |

| France | Europe | 1.70% |

| India | Emerging Markets | 1.57% |

| Germany | Europe | 1.56% |

| Switzerland | Europe | 1.54% |

| Taiwan | Emerging Markets | 1.32% |

| Republic of Korea | Pacific | 0.74% |

| Netherlands | Europe | 0.65% |

| Sweden | Europe | 0.61% |

| Italy | Europe | 0.55% |

| Total | 95.66% |

There is a good range of more mature markets, as well as room for potential growth in emerging markets. If you are more interested in the latter, read our best emerging markets ETFs guide.

VBAL Allocation by Sector

Just as smart investors know to look for geographic diversification, they know the best portfolio ETFSs also provide diversification across sectors. VBALs funds span a wide range of industries.

| Sector | Fund |

| Financials | 21.1% |

| Technology | 20.9% |

| Industrials | 12.3% |

| Consumer Discretionary | 11.4% |

| Energy | 7.8% |

| Healthcare | 7.2% |

| Basic Materials | 6% |

| Consumer Staples | 4.3% |

| Utilities | 3.9% |

| Telecommunications | 2.6% |

| Real Estate | 2.5% |

| Total | 100.0% |

VBAL ETF Top 10 Company Holdings

One of the best things about ETFs is that you hold shares of the world’s top performing companies without having to pay the price of a full share of the companies. Apple Inc stock, for example, one of the ETF’s main holdings, currently goes for around $198 per share. VBAL, on the other hand, is trading at a much lower $33.17.

Let’s have a look at the top 10 company holdings of VBAL.

| Holding Name | % of Market Value |

| Apple Inc. | 1.62152% |

| Microsoft Corp. | 1.35613% |

| Nvidia Corp. | 1.22080% |

| Royal Bank of Canada | 1.19141% |

| Amazon.com Inc. | 0.88183% |

| Shopify Inc. | 0.86143% |

| Toronto-Dominion Bank | 0.79332% |

| Enbridge Inc. | 0.72296% |

| Meta Platforms Inc. | 0.61334% |

| Brookfield Corp. | 0.58359% |

VBAL Top 5 Bond Holdings

Luckily for Canadians, the top fixed income securities in VBAL are in CAD, which is good news tax-wise.

Here are the top 5 VBAL ETF bond holdings.

| Holding Name | % of Market Value |

| Canadian Government Bond | 0.34201% |

| Canadian Government Bond | 0.32873% |

| Canadian Government Bond | 0.32066% |

| Canadian Government Bond | 0.30151% |

| Canadian Government Bond | 0.28993% |

VBAL ETF Fees

When it comes to fees, ETFs have always been a good way to cut down on your fees, perhaps even more so with all-in-one ETFs.

But how do VBAL fees compare to other portfolio ETFSs out there? How about when compared to other low-cost options like choosing a robo advisor?

Find out how VBAL compares to other popular ETFs and robo advisors by checking out the fee table below.

| ETF or Robo Advisor | Asset Allocation | MER | Fees |

| Vanguard VBAL ETF | 60/40 stock to bond | 0.24% | Account and trading fees will depend on the brokerage you use. |

| iShares XBAL | 60/40 stock to bond | 0.20% | Account and trading fees will depend on the brokerage you use. |

| BMO ZBAL | 60/40 stock to bond | 0.20% | $0 to trade with your BMO Investorline online brokerage account, $0 annual account fee |

| Wealthsimple Robo Advisor | While it does not offer a portfolio of ETFs in the same sense as the abovementioned funds, customers can choose a 60/40 asset allocation when they create the account. | 0.12%-0.15% Annually for regular ETFs and 0.21%-0.23% for SRI portfolios | Tiered fees: 0.5% for Core accounts and 0.4% for Premium and Generation |

| RBC InvestEase | 0.11%-0.14% for standard portfolio ETFs and 0.18%-0.23% for SRI portfolios | 0.5% Annual management fee, based on your investment balance | |

| BMO SmartFolio | 0.20% to 0.35% | There is a $1,000 minimum account balance and an annual fee of 0.4% to 0.7%. |

As you can see, all-one-ETFs like VBAL are substantially cheaper than robo advisors – and cost investors roughly 10% as much as the traditional Canadian mutual fund model.

VBAL Currency Exposure

VBAL doesn’t do anything fancy for foreign currency exposure. You’re going to buy this ETF on the Toronto Stock Exchange, and it will be priced in Canadian Dollars. When you sell it, you’ll get Canadian Dollars back into your account.

There are some inherent foreign currency conversions that will occur in VBAL in order to determine CAD-priced profits – but that’s all done automatically before you see it in your brokerage account

VBAL ETF Performance

Gauging performance on these newer portfolio ETFs is a bit tricky because:

1) They have only been around for a few years

2) They launched shortly before the economy went into a pandemic induced tailspin.

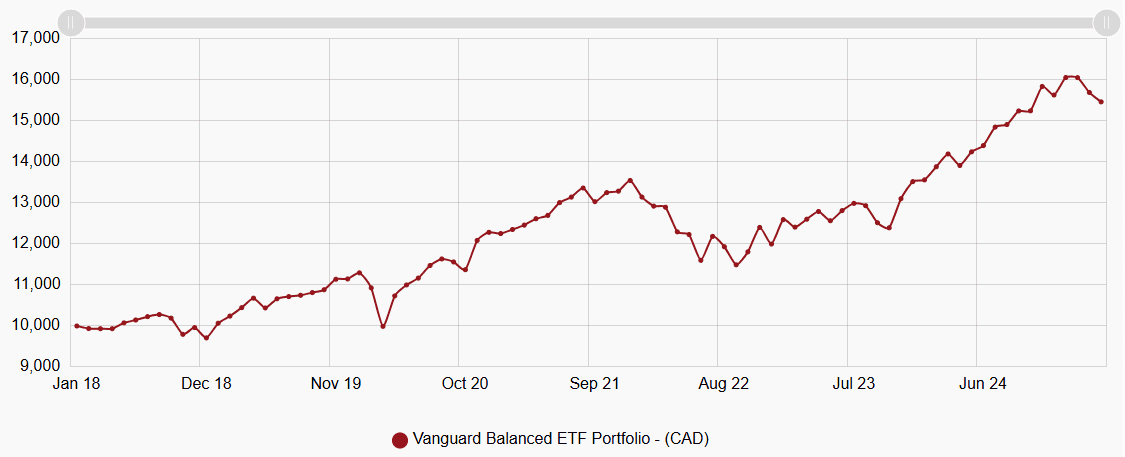

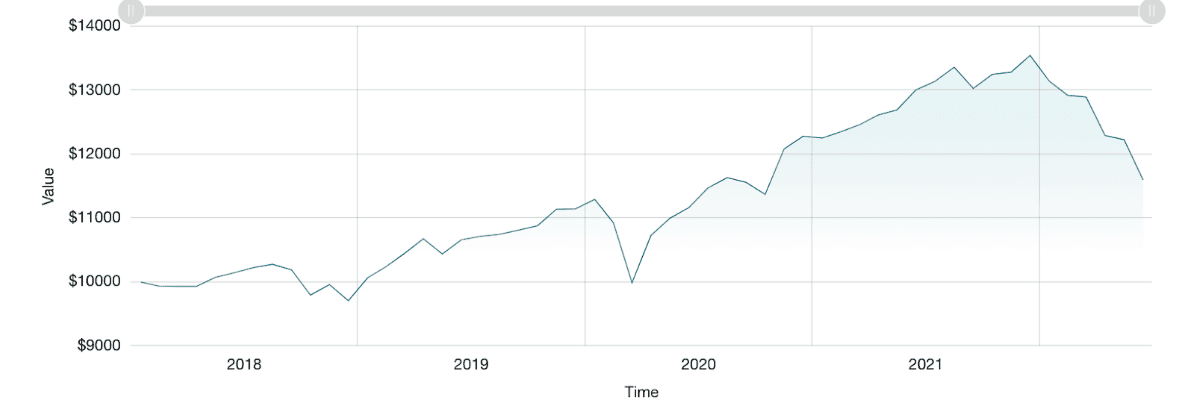

That being said, the initial gains VBAL made are promising. Since its inception, its annual average return is 6.35% as of writing. With VBAL, you’re also getting quarterly distribution payments, which are currently yielding 2.31%.

If you were to have invested $10,000 when VBAL first launched in 2018, you would still be in good shape, with now having $15,466.Of course, when discussing returns in an index investing all-in-one ETF, the main thing to keep in mind is that performance will always be equal to the average of the underlying index. There is no “active trading” going on, and investors should be looking for more of a “set it and forget it for the long term” approach.

Want to know how VBAL compares to Vanguard’s more stock heavy VEQT and VGRO all-in-one portfolios? Have a look at our VEQT ETF Review and our VGRO ETF Review.

VBAL vs. Robo Advisors

Robo advisors and all-in-one ETFs are similar in that they offer a wide range of funds in one portfolio with your desired asset allocation – along with generally low fees and automatic rebalancing.

As we shared in our fee table above, when it comes to saving money, choosing the VBAL ETF will be more cost effective than a robo advisor service.

However, with most robo advisor services, you will have access to a financial advisor who can answer questions and help to guide you in choosing an investment strategy.

While the advisors will be able to help you answer most basic questions, they won’t be able to help with more advanced topics like corporate taxes and income trusts. For most investors, this won’t be an issue.

So, should you choose VBAL ETF over a robo advisor?

It all comes down to how much control you want over choosing your investments and whether or not having someone to turn to if you have questions is important to you. The idea is that with VBAL and other all-in-one ETFs, you won’t need to worry about those aspects as it’s all done for you, and at a lower cost.

You can see a more detailed comparison of products like VBAL vs robo options, when you check out our best all-in-one ETFs in Canada article. And if you’re interested in learning more about robo options, read more in our Best Canadian Robo Advisors article.

VBAL vs. Other Popular ETF Options

VBAL vs. VGRO

VBAL has been designed as a balanced portfolio with a conservative 60/40 stock to bond split. This makes it a good choice for investors who may have a shorter investment timeline. It also makes sense for those with a lower risk tolerance, as the split can hedge against market volatility.

VGRO on the other hand, is Vanguard’s growth portfolio ETF, which has an 80/20 stock to bond split. This means that there could be more potential for higher returns, but equal potential for loss during market volatility. If you have a longer time horizon and a higher risk tolerance, VGRO could be a better choice.

VBAL has a 0.22% management fee and a total Management Expense Ratio (MER) of 0.24%. This is similar to the fees you pay for VGRO and VEQT as well.

Learn all about VGRO in our full VGRO ETF Review.

VBAL vs. VCNS

VCNS is Vanguard’s Conservative ETF Portfolio. It has a 60/40 bond to stock asset allocation. In terms of underlying funds, it’s identical to VBAL, however the allocation for each fund is weighted more heavily on the fixed income security funds. VCNS’s MER is the same as VBAL’s at 0.24%.

If you tend to value low risk investments, and like the idea of getting regular dividend payouts, VCNS could be a better choice for you.

VBAL vs. VEQT

If you are excited by the idea of going all in on stocks in the form of an ETF, then Vanguard’s All Equity VEQT ETF could be the right choice for you. VEQT’s market allocation mirrors that of VBAL, and the MER is also the same at 0.24%. To date, VEQT has outperformed VBAL by over 5%.

Find out more about VEQT in our full VEQT ETF Review.

How to Buy VBAL ETF in Canada

For Canadians, you will need an online brokerage account to purchase VBAL, as you won’t be able to create a Vanguard Brokerage Account directly. Not to to worry, there are plenty of great online discount brokerages for the self directed investor in Canada.

As of writing, VBAL is selling at $33.17 per share. That’s a pretty good deal considering it gives you exposure to over 13,400 stocks and 19,377 bonds in a single share.

If you don’t already have a brokerage account, there has never been a better time than now to open one! Our top recommended brokerages, Qtrade and Questrade, make it easy to buy and sell VBAL and other all-in-one ETFs.

1. Buy VBAL on Qtrade

With Qtrade, you can quickly and easily open a brokerage account. Once you fund the account, you will be able to search for the ticker symbol, select the number of VBAL shares you would like to purchase, choose the order type, and you’re good to go.

Qtrade is safe, reliable, and offers excellent customer service. It will cost you $8.75 per purchase of VBAL shares, however, over 100 other ETFs can be purchased for free.

Head over to our full Qtrade Review to find out more about why we’ve named them Canada’s Best Broker.

2. Buy VBAL on Questrade

Another one of our top rated online brokerages, Questrade, allows you to buy ETFs like VBAL for $0, but you will pay anywhere from $4.95-$9.95 to sell them.

The process will be the same as outlined above for Qtrade. Simply open and fund your Questrade account, search for the VBAL ticker symbol, enter the number of shares and select your order type. Once confirmed, your new VBAL shares will be on the way.

Find out more about what Questrade can offer beyond VBAL in our Questrade Review.

VBAL ETF Review: FAQ

VBAL ETF Review: Is It Right For You?

If you’re a more conservative investor with a long-term outlook and want broad market exposure and diversification in a simple, efficient package, VBAL may be a great fit for your portfolio.

VBAL is a low-cost option designed to help you reach your investment goals, backed by Vanguard, a trusted name with decades of experience in the ETF space. Even respected voices in the investment community, like Dan Bortolotti, are strong advocates for all-in-one portfolio ETFs such as VBAL.

One of VBAL’s key advantages is that it automatically maintains your target asset allocation. You will not need to rebalance your portfolio once a year or more. This is a major plus for passive investors.

For more insights, be sure to check out our full article on the Best All-in-One ETFs in Canada, or browse our comprehensive list of the top ETFs in Canada to explore a broader range of options.

At 51, I’m planning to retire at 55. My wife and I have VBAL across all accounts (TFSA’s, RRSP’s, Non Registered) for the ultimate in simplicity. We will be doing a monthly variable withdrawl approach using a spreadsheet that lays this out for us in order to maximize retirment income. OAS/CPP will be taken at 70.