VGRO ETF 2025 Review

If you’re looking for a simple way to diversify your portfolio, ETFs are a great place to start. New to ETF investing? Check out our comprehensive guide to the Best All-in-One ETFs in Canada. Already familiar and just want our top recommendations? Head over to our list of the Best ETFs in Canada for 2025.

One standout option is VGRO, which offers a 80/20 stock-to-bond split between high-performing equities and bonds. This mix has grown in popularity in recent years when compared to the 60/40 split, offering strong growth potential while still managing risk. In our VGRO ETF 2025 review, we break down why this fund continues to be one of our top picks for a well-rounded portfolio.

Vanguard VGRO ETF

The Vanguard All-in-One Growth Portfolio ETF is a great alternative to robo advisors because it allows for a really hands off approach at an incredibly low price.

VGRO ETF Key Facts:

- MER: 0.24%

- Account Eligibility: RRSP, TFSA, RRIF, RESP, FHSA, DPSP, RDSP, Non-Registered

- Assets Under Management: $6.56 Billion

- Date Created: January 25, 2018

- Number of Stocks: 13,400

- Number of Bonds: 19,377

- Price/Earnings Ratio: 20.4x

- Price/Book Ratio: 2.5x

- Dividend Yield: 2.2%

What is The Vanguard Growth ETF Portfolio?

The Vanguard Growth ETF Portfolio (VGRO) was created by Vanguard Canada and was built for growth, as the name implies. The VGRO portfolio holds thousands of diverse Vanguard ETFs, including assets from all over the world.

VGRO is low cost and super simple in that if you own VGRO shares, you won’t need to worry about rebalancing. If you have a passive investment strategy, this will be right up your alley.

How to Buy VGRO ETF

If you already have an account with an online brokerage, you’re ready to buy the VGRO ETF!

First, you’ll need to log in, and select the account you would like to purchase from. Remember, it’s always a good idea to max out your registered accounts first so you’ll save on tax later. You can purchase any Vanguard all-in-one ETF with your registered account.

Once you have selected the account, you can head over to the buy ETF section, enter in the ticker symbol VGRO, and input the number of shares you want to purchase. If you are not sure how many shares the money you have will get you, you can use the dollar to shares calculator.

Once you know how many shares you would like, you’re ready to finalize your order! Select market order and submit. Review your order on the next page, and if everything looks good, submit the order, and then you are ready to go!

Want to buy VGRO, but don’t have an online brokerage account yet? Sign up for an account with Qtrade, which takes the top place in our up-to-date list of the Best Canadian Online Brokers.

VGRO Holdings

ETFs are a great investment option because they allow you to essentially invest in thousands of stocks from top performing companies. With the VGRO ETF, you will be investing in US, Canadian, and international stocks as well as bonds.

The VGRO ETF is more on the aggressive side in terms of growth as it consists of 80% equities and 20% bonds. So, if you have a longer time horizon on this investment, it could be a good choice for you. Although it is heavier in equities, it’s considered a low-to-medium risk EFT, so you may find some comfort in that depending on your investment strategy and timeline.

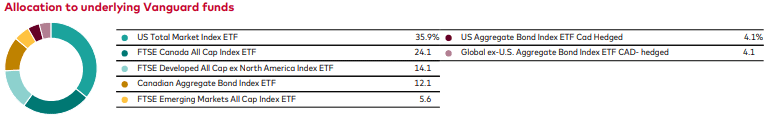

Check out the chart below to see exactly how the funds are allocated.

As you can see, when you invest in a VGRO ETF, you are getting access to 7 different ETFs, each one offering geographic and industry diversification. Having bonds included also rounds it out well and hedges your risk.

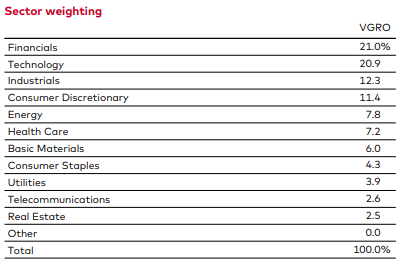

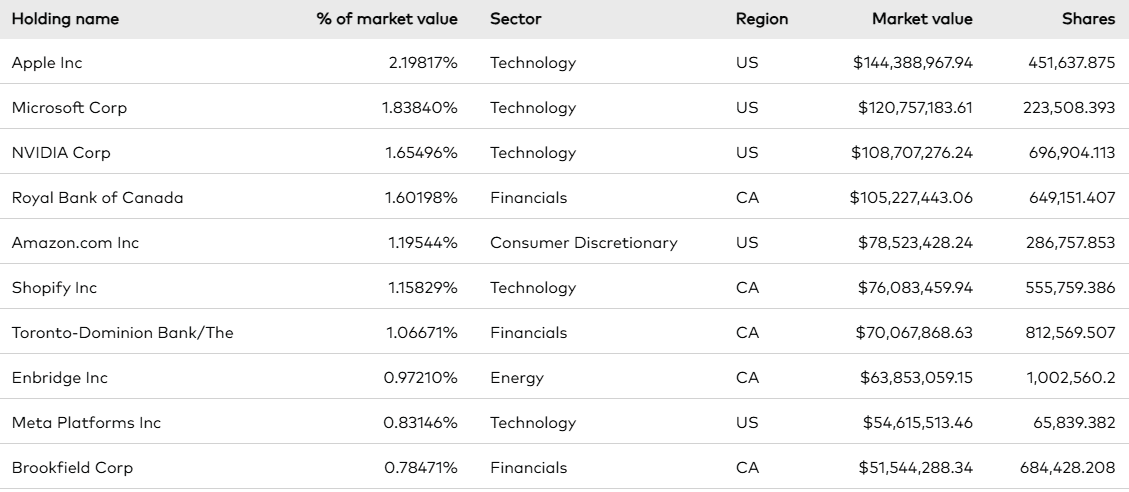

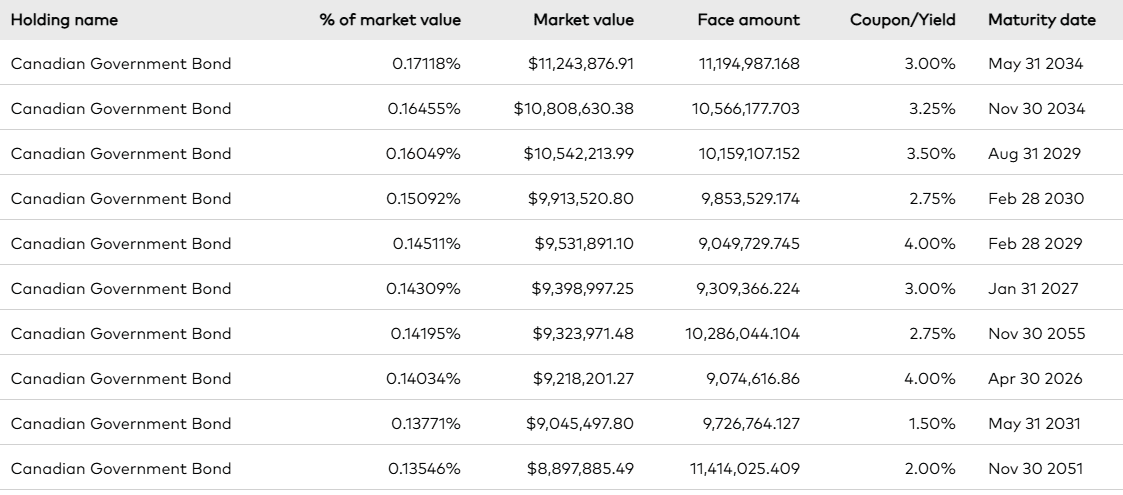

Check out the asset allocation by sector, top equity holdings, and fixed income holdings below to see how the funds are allocated.

VGRO ETF Performance

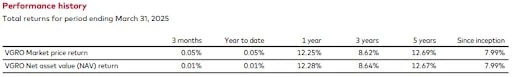

As VGRO has only been around for several years, the performance data is limited. What we can see so far is promising and in the long run, VGRO could continue to produce greater returns.

Another bonus of VGRO is the quarterly dividend payout of 2.2%.

ETFs are part of a long-term investment strategy, so you’ll want to consider holding onto this one for a while for maximum returns.

Because VGRO is an indexed fund, its holdings will track the market, so it is likely that if one or more of the assets are not performing well, they will be replaced with another, better-performing one.

You can see that so far, VGRO’s performance has seen consistent growth since its inception.

Again, don’t let the recent lower performance put you off, as markets are down worldwide. History has shown us that over time, the markets will rebound, and you’ll still be able to earn a great return in the future.

VGRO ETF Investment Accounts for Canada

Like all of Vanguard’s all-in-one portfolio ETFs, the Vanguard All-in-One Growth ETF (VGRO) can be purchased in your:

We recommend checking out our best long term investments in Canada article to get an overview of account types and which you should be using to grow your wealth and when.

VGRO ETF Fees

When it comes to ETFs, the fees are much lower than other actively managed funds, or even robo-advisors. It’s still good investment practice to understand how the fees are calculated though.

With the VGRO ETF, you will have a management fee of 0.22%. There is also a Management Expense Ratio (MER), which is 0.24%. The good news is that with VGRO, the MER includes the management fee. It will be charged annually as a percentage of the total amount you have invested in the ETF. The payment is made automatically, so you might not even notice it at all if you’re not paying attention.

Given that the VGRO ETF management expense ratio (MER) is 0.24%, if you’ve invested $10,000 in VGRO, you’ll only pay an MER of $24 each year.

This is much lower than you would pay for a Canadian equity mutual fund or even one of Canada’s best robo advisors, which charge around 2.5% and 0.70% MER respectively.

To get the ultimate benefit of investing in the VGRO ETF, trade with one of our top Canadian online brokers, and do it for free!

VGRO ETF Review: FAQ

VGRO ETF Review: Final Thoughts

Vanguard has long been a trusted name among U.S. investors, and since 2011, Canadian investors have increasingly come to value its straightforward, cost-effective investment options.

VGRO stands out by offering broad exposure to global markets across multiple sectors—all at a low cost and with relatively low risk. It’s a strong contender for anyone building a long-term, passive investment portfolio.

In our VGRO ETF review, we’ve explored why this fund deserves a spot in your portfolio. While it may not be the ultimate one-size-fits-all solution, it’s certainly a solid option worth considering.

And for those curious about another popular Vanguard ETF with a higher equity-to-bond ratio, don’t miss our VEQT ETF Review.