National Bank Direct Brokerage Review 2026

National Bank Direct Brokerage Review

-

Trading Fees

-

Annual Fees

-

Account Options

-

Customer Service

-

Platform and App

-

Account Opening

National Bank Direct Brokerage Review Summary:

National Bank Direct Brokerage (NBDB) was the first of Canada’s major banks to introduce commission-free trading. Backed by the National Bank of Canada, it offers a strong level of security along with access to a broad range of investment products. Investors can trade stocks, ETFs, bonds, and more through its platform.

Since we began reviewing NBDB, they have made some notable improvements. They now have a well-rated app, account fees aren’t as high as they once were, and they offer some promotional incentives for certain groups.

Their significant advantage is their zero-commission trading. However, they are certainly not the only online brokerage offering free trades. Competing platforms such as Qtrade or Questrade, which are growing rapidly in popularity, generally deliver a more well-rounded experience.

In our updated 2026 National Bank Direct Brokerage review, we’ll examine fees, account types available, investment options, platform features, and more. Read on to determine whether NBDB meets your investing needs or if one of Canada’s top online brokers might be a better choice.

Pros

- No fee trades

- Good brick-and-mortar presence if you live in Quebec

- Safety and security

- App to trade securities and view portfolio details

- Benefits for ages 30 and under, newcomers to Canada, professionals, and students

Cons

- Poor overall platform rating

- Subpar portfolio analysis tools

- $100 annual administration account fee (if exemption criteria not met)

- Long customer service wait times

NBDB has made changes over the last few years to make their fee structure competitive among other discount brokers, and have now dropped their commission fees altogether for those trading on their online platform. It seems as though they have taken customer feedback to heart and made improvements to make those customers want to stay as well as attract new ones.

Just over half a decade ago, in 2019, they were ranked dead last, 8 out of 8, by J.D. Power, but merely one year later in 2020, they moved up considerably to 4th out of 8. By 2022, when NBDB moved to commission-free trading, it topped the J.D. Power Rankings. The Globe and Mail also took note of NBDB’s improvements awarding them a solid B+ in the 2025 Digital Brokerage Ranking.

We’ll take a deep dive into the details in our National Bank Direct Brokerage review and try to uncover the reasons behind their rankings and see if they just might be worth a second look.

NBDB vs. Qtrade Quick Comparison

Long time readers know we strongly recommend Qtrade, and for good reason. As of November 2025, their per-trade fees are now $0 (Free!), and they’ve also wiped out the annual account fees. Let’s take a look at how they compare to NBDB.

| ||

|---|---|---|

| Trading Fees | $0 for Canadian or US stock trades, $0 for ETFs, $0 for mutual fund purchases. | $0 for Canadian or US stock trades, $0 for ETF trades for purchases made online. |

| Account fees | $0 | $100 ($25 per quarter), waived for accounts holding less than $25,000 or that set automatic transfer of $100 into the account each month. |

| Mobile App | Best Canadian brokerage mobile app |

|

| Customer Service | One of the best in Canada/span> | Bad - very long wait times |

| promotion | $5,000 Cash Back + Unlimited Free Trades | None |

| Sign Up | Visit Qtrade | Visit NBDB |

While NBDB’s zero-cost trading is attractive, especially coming from a big bank, the table above clearly shows how Qtrade stands above NBDB. Qtrade has a strong dedication to excellence and innovation, paired with high-quality investor education tools and outstanding customer service.

For long-term investors serious about growing their wealth, Qtrade trumps NBDB. Read our Qtrade review to see exactly why we consider it the best broker in Canada.

National Bank Direct Brokerage Fees and Pricing

In 2021, National Bank Direct Brokerage cut their per-trade fees down to $0, becoming the first big bank brokerage to do so. Here is a quick look at some of the fees we haven’t already covered.

| Item | Cost |

| Options Trades | $0 commission + $1.25 per contract (min. fee of $6.25), or for a value less than $2,000, $0 commission + $1.25 per contract (max. fee of $19.95) |

| RRSP3, RRIF or LIF withdrawal | $50 |

| Withdrawal from TFSA, RESP, RDSP or FHSA | $0 |

| Internal transfer between registered accounts | $100 |

| NSF cheque | $45 |

| Refund of excess contribution to RRSP | $150 |

| Wire transfer (non-NBC account) | $50 |

| Total or partial transfer to another institution (+ commissions if applicable) | $150/account |

| Portfolio statements by mail | $7.50 per quarter |

| Trade confirmations by mail | $2.50 per trade (billed monthly) |

| Administration of restricted shares (plus commissions if applicable) | $250/transaction |

| Custodial services for a client | $50/security/month |

| Donation or substitution of securities | $50/position to Max $150 |

| Registration/delivery of certificate (physical or electronic) | $150/operation |

| Deposit of a stock certificate (physical or electronic) | $150/operation |

| Estate settlement | $200/estate |

These fees can all add up over time, taking precious funds away from your bottom line.

Other brokers like Qtrade offer free services such as LIF, RIF and LRIF scheduled payments and electronic funds transfer. Another one of our top choices, Questrade, offers things like free CAD electronic fund transfer (EFT) up to $50,000.00.

In 2026, with so many online discount brokerages getting rid of their account fees, it just doesn’t make sense to pay for a DIY service. So, in terms of costs and fees there is some work for NBDB to do to catch up to the rest.

Interest rates for margin accounts

| Debit balance | CAD |

| CAD margin account | 6.25% |

| USD margin account | 8.50% |

There is no denying that with their $0 price tag for ETF and stock trading National Bank Direct Brokerage has set themselves apart from the Big Bank pack when it comes to pricing. It’s no standout from Canada’s online discount brokerages, however.

If you’re set on using a brick-and-mortar brokerage, the real question then becomes, is saving a few bucks per year in stock trading commissions worth the use of a sub-par platform? For some it might be, but for others, the sacrifice just won’t make sense.

Is National Bank Direct Brokerage the Cheapest?

There are plenty of discount brokers in Canada offering free ETF purchases, topped by no annual fees. View our entire selection below:

NBDB Review: Platform & Tools

The online platform is one area NBDB has had to consistently work on improving to stay competitive as a top online brokerage in Canada.

Over time, it has invested in developing a new online platform that is more user-friendly, as well as offers more bells and whistles than their former platform iterations.

Currently, NBDB’s platform offers customization, comparison tools, helps users easily track their top performing investments, allows for the creation of up to 10 watchlists, and provides access to a wealth of tools from their Trading Central section.

Trading Central offers customers 3 tools for no annual fee. You will have access to NBDB’s Value Analyzer, with which you can look at valuation and company data, which can give you insight into potentially undervalued companies.

The technical insight section allows you to screen stocks and create alerts so you won’t miss out on a potential opportunity. Finally, the Strategy Builder tool helps you decide what stocks will best fit your criteria, plus you will have access to model investment strategies created by experts.

Other tools, such as Market-Q for day traders, ETF Centre, and Decision-Plus allow for even more ways for you to learn, strategize, trade and earn. To see an overview of their various tools, check out their Accounts Tools Page.

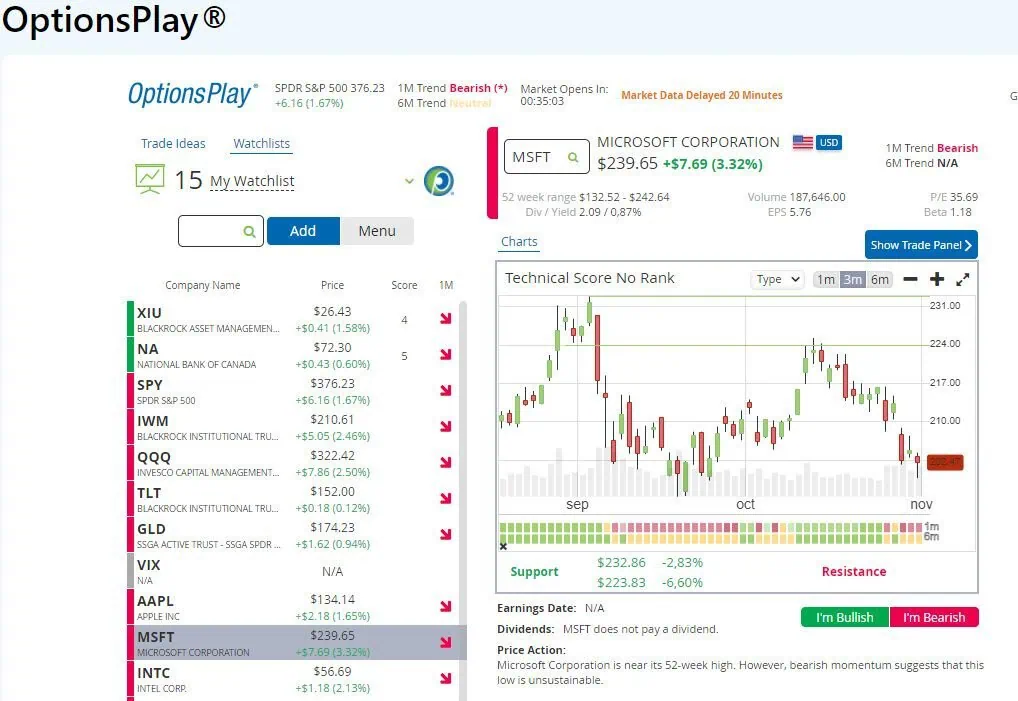

NDBD has also partnered with OptionsPlay, which could be an attractive add for options traders. It allows users to compare 3 strategies according to their market forecast.

National Bank Direct Brokerage: Customer Service

NBDB was having a difficult time keeping up with customer service requests before they went to their $0 trading model. This was evidenced by their consistently low scores on the Globe and Mail rankings by Rob Carrick year after year, as well as the general emails and comments that we’ve anecdotally received here at MDJ complaining about wait times).

Despite the lost revenue with their current free trades model, it seems they have made some improvements with customer service over the past few years. Perhaps their Big Bank resources have made it possible. One addition to support a subset of users is the addition of Mandarin and Cantonese customer service phone lines. Only time will tell if they can stay on top of this satisfactory service.

In 2025, National Bank Financial was #1 in the “Advised” category for Investor Satisfaction in the Overall Customer Satisfaction Index Ranking. We have to admit, that is a pretty impressive accomplishment given where they stood only a few years ago.

National Bank Direct Brokerage TFSA, RRSP, and Other Accounts

As with the other big names in discount brokerages in Canada, National Bank Direct Brokerage offers a variety of different accounts including the following:

- TFSA

- RRSP/RRIF

- Spousal RRSP/RRIF

- RESP

- FHSA

- Non-registered accounts (cash, margin, and short selling)

- Individual Pension Plan

- LIRA

- LRSP

- LIF

- Estate accounts

- In trust account

- Investment club account

National Bank Direct Brokerage also offers accounts for corporate entities.

National Bank Brokerage Mobile App Review

The National Bank Mobile App came out in late 2022 for Apple users.

As of 2026, there is one combined app for NBC and NBDB, known as the “NBC Wealth App”. It is available to both Apple and Android users.

The app allows users to view portfolio and investment details anytime, access detailed information on Canadian and U.S. stocks, ETFs, and mutual funds, retrieve account statements and tax slips, and personalize how they view and manage their investment portfolios.

Furthermore, self-directed mobile brokerage clients can:

- Trade securities anytime using market and limit orders

- Transfer funds and contribute to registered accounts

- Manage alerts and watchlists

- Communicate securely with an agent

It is rated 4.7 stars on the Apple Store with 4.4K ratings, and 4.5 stars on Google Play with 1.3K reviews.

The main concerns from users are that the app is buggy, slow, and crashes frequently. People also have trouble logging in.

National Bank Direct Brokerage FAQ

Who is National Bank Direct Brokerage Best For?

NBDB deserves credit for entering the zero-commission trading space as a Big Bank and for continuously improving its platform, mobile app, and customer service. For existing National Bank of Canada clients, its brokerage offering may be a convenient and logical choice.

That said, choosing the best brokerage in Canada requires a close look at the fine print. When you dig into the details of NBDB’s offering, such as their fees, you may find more competitive options available elsewhere, especially amongst our list of Canada’s top online brokers.

If you’re looking for the best all-around brokerage in Canada, consider our top pick, Qtrade. In our Qtrade review, we explain why it stands out compared to NBDB and other online brokers.

worst customer service… extremely rude to clients.. not sure how they manage to survive all these years..

bad feeling on opening an account with NBDB. most sfaffs of nbdb are working inefficiently, and lacking of knowledge about what they are doing in nbdb. rude to clients, neglecting the emailing and processing the client’s need. i have struggled to open an account in two months and still failed to build fund-trans link. it took really long time to get my phone calls through. overall, i made up my mind to close all accounts with nbdb. it is waste my time and their loss at business reputation. byebye.

Android app now available.

Have anyone tried to transfer USD in their trading account either RRSP or Cash/Margin? Do they allow to transfer USD from your USD currency from other bank or you have to convert CAD to USD in order to trade US stocks?

On Options: i was looking for multi-leg options order entry but didn’t see anything mentioned on that. Have anyone checked if National Bank have multi-leg options strategy execution on Market – Q or regular web interface?

I have BMO and Questrade but BMO is expensive to trade and there is no multi-leg options. Questrade has multi-leg options but that’s only on cash or margin account. They both do allow to transfer USD from US currency account, so that part is good about both of them.

I am just looking for cheaper trading fee, if that’s still available in Canada.

Thanks in advance,

I opened an account last July and a few complaints 1)their sign up process was confusing for me but it seems even more confusing for the employees working there who had no idea on how to sign me up. I had to go to a branch because their online signup process wouldn’t work after numerous attempts 2)their app is a disaster and you cant trust it to do anything without crashing 3)And whatever you do. DO NOT use market orders with them. I’ve got several other brokerage accounts and all market orders dicey but here its a recipe for disaster. Its like they are just stealing from you. They never get orders in the spread. Always outside. 4)I was signed up for market Q as well as im a day trader and its isn’t anywhere near as sophisticated missing many basic options for day traders as others. Compared to other banks id have to say its the best platform but the bar is set so low because they all really really suck. Trade zero which has no commission fees now and Interactive brokers which has a far better platform are far better options if your a day trader. If your just investing and holding for longerterm periods this might work for you

National Bank Direct Brokerage now has an iPhone app. Still appears to have some kinks to work out though.

I also had a similar experience signing up, bit of a clunky experience. Others stated they signed all sheets and sent digitally, but I was asked to go in branch in the end.

I see they had a posting on their website as of August 2022 stating they are working on the app and it will be done by end of 2022. That is a nice bonus. I currently use the website in my phone’s browser.

I just opened a “joint” account with NBC Direct Brokerage account and the sign up process is clunky. You need to fill out forms and send them by snail mail. I signed up with a National Bank line of credit, but when I tried to use this account, my transfers got rejected with no information as to why. I had to call customer service to get an answer that only a checking account can be used to transfer funds. In order to add a new account, you need to once again fill out a form and send it by email including a void cheque. After 2 days, I still have no information as to how long it will take for this account to be linked so I can start using the NBC Direct Brokerage platform to do trades. The customer service call agents are a very pleasant and helpful. I have both a Wealthsimple and Questrade account and linking a new account is a piece of cake and they both accept my National Bank line of credit to transfer money to/from. I would have expected the process to be much simpler, especially considering that I am already and National Bank customer. Also in order to create a user/pw to access your account online you need to call customer service for joint accounts.