Questrade vs Qtrade in 2026

When I launched Million Dollar Journey back in 2006, the Questrade vs Qtrade battle had already been fighting for the attention of Canada’s DIY investors for a few years. Almost two decades later, and they’re still trading punches at the top of the leaderboard. The difference today is that both of these independent Canadian online brokers have widened the gap between themselves and the big-bank brokerages that haven’t ever caught up.

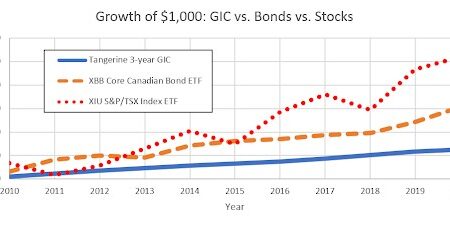

In 2025, the major news to report is that both Qtrade and Questrade now offer free trades of both stocks and ETFs. This is a gamechanger for small-scale DIY like yours truly. No more annual fees, account fees, or inactivity fees – plus $0 trades. It just doesn’t get any better.

I’ve been managing my own investments since I began writing on MDJ, and I have now opened up 11 separate brokerage accounts so that I can keep firsthand tabs on all the new developments. Add in the hundreds of reader emails that land in my inbox each year, plus insights from our MDJ writing team, and I like to think I’ve got a pretty holistic view of Canada’s DIY trading platforms.

1) You can’t go lower than free. With both Qtrade and Questrade offering free trading and no account fees, there is no advantage to be had here.

2) Qtrade is consistently ranked higher via third party media sources such as The Globe and Mail, Surviscor, and Moneysense.

3) Qtrade simply has the best customer service in Canada right now. That’s a major advantage for retail investors.

4) Qtrade’s current 5% instant cash back offer is WAY better than Questrade’s $50 in free trades. If you start an account (or move over an account from another brokerage) you can get a quick $750 just for investing $15,000. Eventually the earnout goes up to $2,000

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

The Qtrade vs Questrade Quick Comparison

If you are looking for a quick comparison of Questrade vs Qtrade, have a look at the somewhat visual chart below that touches all the main areas on our comprehensive broker reviews.

| ||

|---|---|---|

| Canadian ETFs | Yes! Free buying and selling of ETFs. | Free buying and selling of ETFs |

| User Experience | Consistently ranking #1, high availability and friendly to customers. | Has made big gains over the last three years, rated just behind Qtrade by most publications. |

| Trading Fees | 100% FREE |

|

| Research Tools and Education Materials | Has been at the top of Canadian brokerage rankings in this category for over a decade. | Made excellent gains in the last few years. |

| RESP Accounts | Available | Available |

| ECN Fees | None. | Up to $5 per trade. |

| Transfer Fees | Free Electronic Funds Transfer. Additional fee for transferring out. | Free Electronic Fund Transfers up to $50,000 CAD and $25,000 USD. Additional fees for wire transfers and transferring out. |

| promotion | 5% Cash Back + Unlimited Free Trades | $50 in Free Trades |

| Sign Up | Visit Qtrade | Visit Questrade |

Please see our full-length Qtrade Review or Questrade Review for more information on our two leading brokers.

Brokerage Investing Account Options

Back when MDJ started to compare online broker investing account options there were some big differences between the “haves” and the “have nots”. Thankfully, competition has essentially guaranteed that most brokers now offer all of the major Canadian account options.

When we specifically compare the account options for Qtrade and Questrade, we find that there isn’t much difference at all.

Both of our leading brokerages offer the main accounts that most Canadians will use: RRSP, TFSA, RESP, non-registered trading accounts, margin trading accounts, and joint investment accounts.

Additionally, both Qtrade and Questrade offer the following investing account options: USD accounts, spousal RRSP accounts, options trading accounts, corporate trading accounts, and basically any account that you’ll find anywhere else. RDSP accounts continue to be the forgotten account in Canadian personal finance.

February 2024 Update: Qtrade and Questrade were two of the first brokerages out of the gate when it came to offering FHSA accounts.

The only differentiator between Qtrade and Questrade FHSA accounts is that Qtrade currently has a promotional offer available where you can get hundreds of dollars in instant cash back (available for a limited time). Other than that, they are virtually identical.

You’ll need to have a minimum payment of $250 to get started and you can contribute up to $8,000 per year, to a lifetime maximum of $40,000. For more information, read our FHSA guide.

Customer Service Comparison

While Questrade continued to lead the pack when it comes to per-trade fees in Canada, the rush to DIY investing – combined with Covid-related logistics issues – led to customer frustration with Questrade throughout 2020 and 2021. With many commenters reporting wait times of 3-5 hours whether they used the call-in feature or online messaging, there was a premium to be put on customer service.

Now that’s not to say that Questrade won’t adapt and adjust to these new market realities in 2026, but for now, Canadians’ consistent expectation of solid customer service means that Qtrade has climbed to our #1 position when it comes to crowning the King of the Discount Brokerage mountain.

Questrade has reported that they’ve made an effort to substantially boost their customer service manpower, so we wait and see to what degree long-term improvements have been made.

All of that said, if you’re an experienced investor that rarely requires help when using your discount brokerage platform, then the consistent commitment to low fees might mean that Questrade is still the best fit for you.

Qtrade, on the other hand, has really doubled down when it comes to hiring enough customer service professionals, and making sure they are prepared to their high standards.

Don’t just take my word for it…

“Qtrade excels in every area – especially in customer service.”

MARK BROWN, INVESTING AND RANKINGS EDITOR FOR MONEYSENSE

“We congratulate Qtrade Investor for its convincing win…and for its commitment to innovation and unmatched service levels.”

Glenn LaCoste, President of Surviscor

Rob Carrick over at the Globe and Mail has given Qtrade the highest marks for several years now as well.

What it really boils down to is that Qtrade has a decade-and-a-half of experience when it comes to being the leader of online broker customer service.

There simply is no comparison if you’re looking for a long-term brokerage solution that you can trust to stay on top of the game.

Frugal Trader, MillionDollarJourney Founder

Questrade vs Qtrade ETFs

Qtrade and Questrade just made life a lot easier for Canadian ETF investors.

Both now offer $0 commission trading on stocks and ETFs listed in Canada on the Toronto Stock Exchange. That means you can buy, sell, and rebalance without paying trade commissions.

With so many different Canadian ETFs now listed, you can get exposure to any pretty much country, sector, commodity, or even specific types of investing strategies (like value or momentum) within an ETF that can be traded for free.

In fact, one could argue that there are too many choices and that most Canadians would probably be better off just buying and selling a basic all-in-one ETF (aka: portfolio ETF) – all of which are also now free to trade regardless of if you like the Vanguard, iShares, BMO, Horizons, or TD flavours.

Bottom line: if you are building a simple ETF portfolio, both platforms now make it painless to keep fees near zero.

Qtrade vs Questrade Fees and Commissions

Both Qtrade and Questrade have now gone all-in on $0 commissions and slashed all account fees. For Canadian DIY investors, this is huge. The days of being forced to pay $9.99 a trade are officially over. Here’s how the two leading discount brokerages now stack up on the fine print that still matters:

Trading Commissions: Both Qtrade and Questrade now offer completely free trading on Canadian stocks and ETFs. No catches, no minimums, no time limits. Whether you’re rebalancing monthly or investing a lump sum, you’ll never pay a per-trade fee again.

ECN Fees: Qtrade has confirmed that it does not charge any ECN (Electronic Communication Network) fees. Questrade still passes along tiny ECN costs when a trade removes liquidity from the market (usually fractions of a cent per share). Most investors will never notice the ECN fee Questrade charges.

Account Fees: Both Qtrade and Questrade have dropped their quarterly inactivity fees, so now both platforms have no annual account or maintenance fees. That means your account can sit untouched for months without eating into your returns.

ETF Trading: This one used to be Qtrade’s big differentiator, but now both platforms let you buy and sell ETFs completely free. No minimums, no time restrictions, and no sell-side commissions. It’s the perfect setup for Couch-Potato and index investors who rebalance regularly.

Options Trading: Qtrade charges $0.75 per contract, while Questrade comes in at $0.99. Still among the cheapest in Canada either way, but Qtrade wins by a hair.

Dividend Reinvestment (DRIP): Both platforms offer automatic DRIPs for Canadian and U.S. holdings for free.

Currency Conversion (Forex): Neither broker converts money for free. Expect a typical spread of 1.5%–2% when moving between CAD and USD. You can avoid this altogether by using Canadian-listed ETFs that track U.S. and international markets. I couldn’t detect a real difference between forex spreads charge by the two brokerages, but I assume they’d be competitive with one another – and likely slightly more than IBKR would charge.

Transfer Fees: Qtrade and Questrade will both reimburse up to $150 if you move your account over from another brokerage.

Bottom line: 2026 marks the first time Canadians can truly trade for free on major, full-service platforms. With no advantage to be hard on trading commissions or account fees, your difference-makers are likely to come from other points of comparison.

Are Qtrade and Questrade Safe?

Yes!

Both Qtrade and Questrade are extremely safe to use from a cyber security standpoint.

The two brokers stand as safe havens in the Canadian financial landscape, mirroring the security level of Canada’s renowned banks such as TD, RBC, BMO, CIBC, and ScotiaBank.

Their commitment to safeguarding investor assets is evident not just through advanced digital security measures but also through their membership in the Canadian Investment Protection Fund (CIPF). This government-backed initiative ensures that investments are protected up to $1 million CAD in various accounts, offering peace of mind to investors.

Note: That’s not $1 million in combined accounts, that’s $1 million in your RRSP, $1 million in a joint account, plus the money in a TFSA, RESP, etc.

However, it’s crucial to understand that this safety net guards against institutional risks like fraud or bankruptcy – not market volatility. Investment decisions, especially those involving high-risk assets, rest solely on the investor’s shoulders. The assurance provided by Qtrade and Questrade is about the security of your funds being held, not a guarantee against investment loss.

Comparing Questrade and Qtrade Desktop and Mobile App Platforms

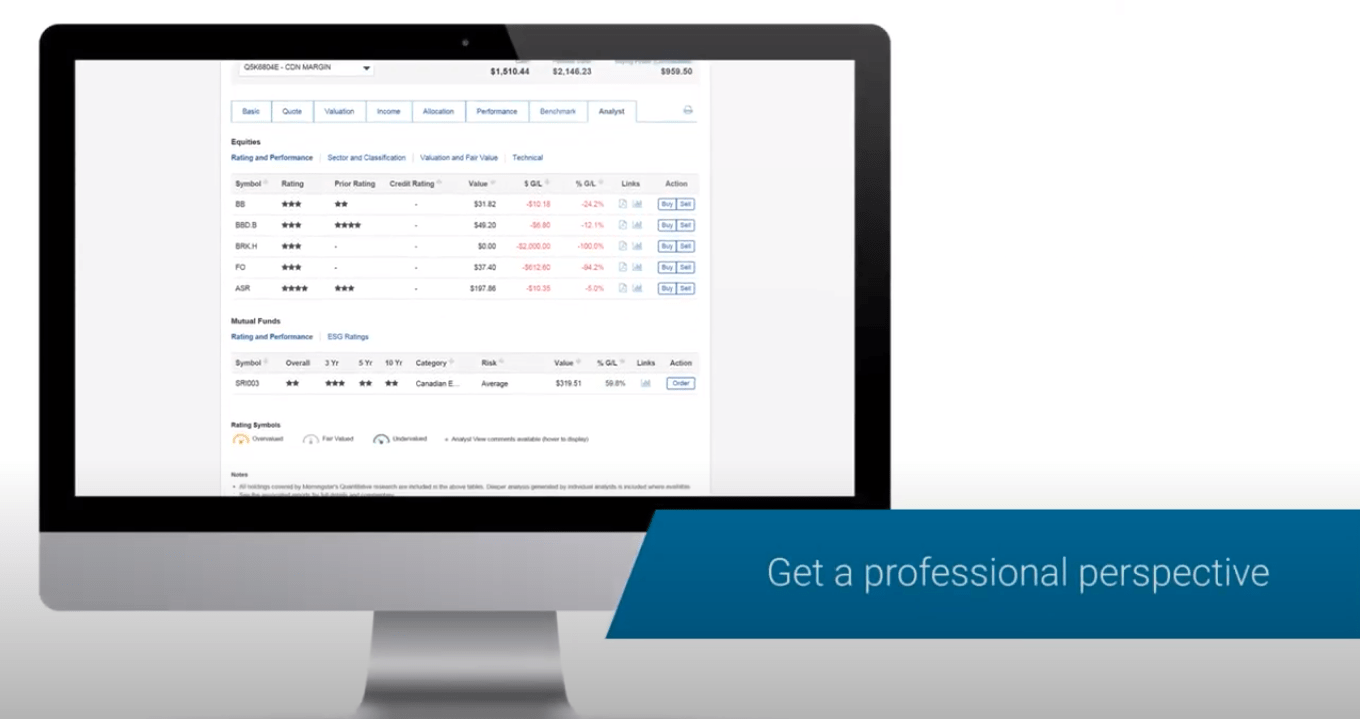

You can see from our displays below that both Qtrade and Questrade have really created and refined excellent desktop and mobile app platforms.

That said, the Qtrade app has higher ratings in both the Apple App Store and the Google Play Store.

Overall you can’t go wrong with either option as far as their newest desktop rollouts go. Personally, I think the user experience is excellent for both Questrade and Qtrade’s desktop platforms (which is why I use them and usually stay off of investing mobile apps altogether).

That said, I think the Qtrade platform is a little more beginner-friendly.

Globe and Mail Qtrade vs. Questrade Comparison

We were happy to see that Rob Carrick over at the Globe and Mail agreed with our Qtrade vs Questrade take, with Qtrade taking home the highest rating, but Questrade coming in right behind with a solid B+.

In his 2022 broker comparison Carrick wrote:

“As has often been the case in this ranking over the years, Qtrade Direct Investing is the broker that does it best. Other brokers beat Qtrade in specific areas like commission costs, but Qtrade’s overall goodness becomes apparent as soon as you log in and find a neat little dashboard to get you up to speed on your investments.”

Qtrade’s consistently strong showing in this ranking speaks to another of its virtues, constant improvement. Other brokers get better in fits and starts, while Qtrade moves ever forward.

There are huge amounts of embedded value, starting the moment you log into your account and see a dashboard that is second to none in showing what you need to know about your portfolio.”

To be fair, he does leave our favourite broker some room for improvement when it comes to showing analyst research (my personal least important factor when choosing a broker as I prefer to do my own research).

When it comes to Questrade, Carrick writes:

“What is it with the “Q” brokers, Qtrade and Questrade? Both are outstanding in the way they never let up on making improvements. A big add for Questrade lately is instant deposit, which lets you transfer money, typically as much as $3,500 a day, into your account in real time. Questrade has a sharp mobile app and a crisp, all-business website for clients.”

Ultimately, it’s always good when our own conclusions on the two top brokers in Canada are confirmed by Canada’s top personal finance columnist!

Surviscor 2025 Rankings: Qtrade vs Questrade

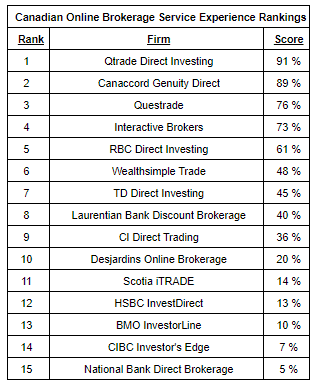

Each January for the past two decades a company called Surviscor releases Canadian broker service experience rankings. These rankings are the end result of over 100,000 points of data being collected on user experience via desktop and mobile, as well as a variety of customer service and investor education efforts.

As you can see from the results above, Qtrade was fairly dominant in the 2025 rankings. The only comparable online brokerage was the very niche CGD – which is not really an option for much of the country.

Questrade still pulled in a very respectful 3rd place and Surviscor gave them high marks for their much improved customer response times, chat services, and the beginner-friendly nature of their mobile app. Some work still to be done in the areas of ETF fees, service experience, and ECN Fees.

Glenn LaCoste, the Preside of Surviscor Group stated, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interaction choices for all types of digital investors.”

Christine Zalzal, the Head of Online Brokerage and Digital Wealth over at Qtrade was happy to accept the award stating, “What makes a great online brokerage firm for investors is not only a great online trading experience but also being supported by a great service team. At Qtrade, we’re always listening to our customers. A strong customer-focused culture is embedded into our DNA. As more Canadians explore the world of self-directed investing, we’re continuing to invest in our people and our platform to help build their confidence to build their wealth.”

In late 2024 Surviscor once again highlighted Qtrade as being best in class. This time, they had Qtrade ranked #1 in their online brokerage desktop rankings. Questrade finished in a respectable 4th place. As all of my interactions with my online brokerage account are on my desktop, this is actually the most consequential ranking for me personally.

The Surviscor rating is based on user navigation experience, seamless transactions, and high-quality educational resources. Qtrade’s 2024 innovations to their “My News” (an AI-drive personalized news feed) and “Options Lab” tools were highlighted as aspects that put them over the top.

The Surviscor data continues to support my anecdotal experiences with both companies, as well as the combined wisdom of our editorial team.

Questrade vs. Qtrade: Frequently Asked Questions

Comparing the Qtrade vs Questrade Promo Offers

At the moment, there is really no comparison between the Qtrade and Questrade promo offers.

Questrade will give you and a friend fifty bucks if you refer them. Oh, and they’ll pay your fee to transfer out of another brokerage and come on over to them.

Qtrade is not only going to pay those transfer fees. They’re going to give you up to $2,000 in cash back!

It’s the best promo offer going in online brokerages right now.

Now, to be fair, you have to invest a lot of money to get to the full $2,000. BUT – you get 5% cash back on the first $15,000 you deposit (generating a quick $750). That’s a pretty great sweet spot in the deal.

What makes this even better is how flexible Qtrade is when it comes to letting you take part in this deal. You can reach that $15,000 mark across multiple accounts. For example, $5,000 in an FHSA, $2,000 in a TFSA, and $8,000 in an RRSP can all be combined to hit the $15,000 total.

Already a Qtrade user? You can still qualify by opening a new account and adding fresh funds.

Qtrade clearly wins when it comes rewarding both new and existing DIY investors!

Questrade and Qtrade: Investor Education

Both Qtrade and Questrade have made a real effort to upgrade their investor education tools and resources over the last few years. Questrade has a slight edge when it comes to practice accounts, offering a 90-day option vs Qtrade’s 30-day practice account. That said, Questrade’s practice is oddly difficult to find.

Qtrade’s various platform tools and portfolio visualizer are just substantially ahead of what Questrade has to offer. Both platforms offer a learning center that allows customers to go over the basics, and answer any terminology questions that they might have.

They also both have substantial 3rd-party research and analysis options available to read if one is so inclined. Since I mostly invest using index funds, these features don’t have a lot of value for me. All the same, they make for interesting reads once in a while. I think I’d have to give a slight edge to Qtrade just based on the content they have available for beginning investors.

Qtrade Refines Real-Time Account Opening

Over the last few years Qtrade has made serious strides in simplifying and speeding up the account opening process, making it easier than ever for new investors to get started.

Gone are the days of time-consuming paperwork and multi-day processing delays. What used to take hours (if not days) can now be completed in under five minutes. If you’re opening an account today, you’re getting a much smoother experience than investors did even just a few years back.

This seamless onboarding process fits perfectly with Qtrade’s recent digital-first rebranding, reinforcing its focus on making online investing as accessible and intuitive as possible.

Christine Zalzal, Head of Qtrade and VirtualWealth®, highlighted the motivation behind this shift:

“More Canadians than ever want to make their own investment decisions. Whether they are new or experienced investors, Qtrade is focused on empowering them to execute on their decisions quickly and with confidence. We know Qtraders will appreciate getting their account opened almost instantaneously when they apply.”

It’s this kind of constant innovation that has kept Qtrade in the top tier of Canadian online brokers since day one. While many platforms get complacent after gaining market share, Qtrade continues to push forward, improving not just their technology, but also the overall user experience. There’s no reason to expect this push for excellence to change any time soon!

Why Qtrade Is Our Top Canadian Broker For 2026

I’ve been writing about Canadian online brokerages for about two decades now (time flies). In those 20 years, the Qtrade vs Questrade comparison has been at the forefront of the discussion as they were consistently the two best brokerage options available to Canadian DIY investors.

Qtrade’s current 5% cash back promotional offer is far and away the best one going right now. It’s perfect for new investors, but also good for long-time clients if they can open a new account (even something like a spousal RRSP) in order to take advantage of the offer.

When you combine that offer with the recent news that Qtrade has moved to $0 trades, and completely slayed their account inactivity fees – there just isn’t a comparable value to be found.

Qtrade’s consistent excellence over the years includes winning the battle for the #1 spot in the Globe and Mail rankings in 2024, 2023, 2022, 2021, 2020, 2019, 2018, 2016, 2014, 2011, 2010, 2009, 2008, 2007, and 2006.

I personally hate paperwork. So one of my biggest considerations when choosing a product such as an online trading platform or bank account is their long-term track record. I don’t want to have to invest hours into switching services at some point.

Qtrade has consistently proven itself to be at the very top or (worst case) 2nd place in Canadian discount brokerages when it comes to innovation and constant upgrades over the years.

As customers become more cost-conscious during this inflation-heavy time, the Qtrade vs Questrade rivalry for your DIY dollars has led to an increasingly innovative final product (delivered at lower price points) for both brokerages.

I will move my holdings over to one of these brokers as soon as they offer a 1%+ offer to switch. So far, haven’t seen that with either for a while.

It’s there now with QTrade

Had a security breach with Questrade with 1 of my 3 accounts. No cash withdrawn (phew), but there were unauthorized sales of over half my holdings before Questrade locked the account. Questrade kept all 3 of my accounts locked for 2.5 weeks while they did an investigation and refused to open new accounts and transfer assets there until investigation complete, unless I agreed to take responsibility for any further unauthorized activity (uh, no!). Means I was unable to manage my investments during 2.5 weeks of high market volatility. At end Questrade claimed I was phished but refused to provide evidence or indeed any details from their investigation. Will only release to law enforcement via a production order (in process). Account uses multi-factor authentication and there is no text or email around time of breach activity. Questrade has refused to return account to what it was before the breach. Losses to date are $7000-8000, representing increase in market value of the investments that were sold. Prior to this I was a huge fan, recommending Questrade to friends and family.

One more benefit: QTrade supports BC education grant (BCTESG), while Questrdate not.

Good to note Anatolik, thanks for pointing that out!

How painful & time consuming is it to switch from Questrade to Qtrade?

I like the no fee’s whe selling with Qtade.

I like the free Passive account with Questrade to keep track of my family’s accounts.

Anyone else find withdrawing funds from Questrade a slow manual process? They do not allow for automated withdrawals which is disappointing.

The quarterly or annual fees are for quest wealth (questrades robo-invester), not questrades self directed investment account, right?

“Does Qtrade or Questrade require a minimum amount of money to open an account?”

Questrade certainly does require a minimum of 1000$ to be able to make to trade.

Questrade converts to USD and charges fee once and money stays as USD after you sell. Now you can buy and sell US stocks without paying any further conversation fees. This is the Reason I want to switch from Wealth simple. What about Qtrade?

Qtrade definitely allows what you’re looking to do Kinni (in most accounts).

If you’ve ever tried to call Questrade for assistance or even to ask the simplest question you will quickly realize you don’t want to invest your hard earned money with them. The absolutely worst customer service in North America, anywhere.