Wealthsimple Trade Review 2026

Wealthsimple Trade Review

-

Fees and Commissions

-

Ease of Sign-up

-

Account Options

-

Investment Options

-

Platform and Mobile App

-

Customer Service

Wealthsimple Trade Review Summary:

Wealthsimple Self-Directed Investing, formerly known as Wealthsimple Trade, is one of the core offerings within the broader Wealthsimple ecosystem. If you’re looking for a full overview of everything Wealthsimple provides, including its original robo advisor and other key features, you can check out my comprehensive Wealthsimple Review.

With its intuitive mobile app, zero-commission trading, and no minimum account requirements, Wealthsimple Self-Directed Investing is an appealing entry point for beginners and for those curious about dipping into cryptocurrency (even if it’s not my preferred route).

In this Wealthsimple Self-Directed Investing review, we’ll explore what makes the platform “free,” the types of investments it supports, and how the mobile experience measures up.

The short version? Wealthsimple Self-Directed Investing can feel limiting for seasoned investors. Its stripped-down tools and features may come across as overly basic, and its minimalist philosophy extends to customer service, which can feel insufficient when problems arise.

For a broader comparison, see my updated guide to the Best Online Brokerages in Canada, where I break down how Wealthsimple compares to other leading trading platforms.

Pros

- No fees or commissions

- Easy to open an account

- $25 cash bonus on your first deposit

- Fractional stock trading

Cons

- 1.5% conversion rate on US trades

- ETFs, stocks, options, and crypto only

- No international markets

- Hit-or-miss customer service

- Next to no research tools available

What is Wealthsimple Self-Directed Investing (Formerly Wealthsimple Trade)?

Wealthsimple self-directed investing is an online brokerage that lets you buy individual stocks and other assets. It’s part of the Wealthsimple ecosystem – a financial company (primarily owned by the massive Quebec-based conglomerate Power Corp) that has over 3 million customers and oversees $100+ billion in assets. Wealthsimple itself kicked off in 2014, while the self-directed platform officially made its debut in 2019.

Unlike Wealthsimple Managed Investing (formerly called Wealthsimple Invest) and other Canadian robo advisors, Wealthsimple Trade is fully hands-on. That means you’re the one doing the research, choosing which stocks or ETFs to buy, and deciding when to sell. Sure, that can mean that you save a bit on fees by doing your own homework – but it also ramps up the risk factor.

If you’re wondering how robo-advisors differ from self-directed brokerages, you might want to check out our Wealthsimple vs Qtrade article, as well as our Wealthsimple vs Questrade guide.

In this Wealthsimple Trade review, we’ll walk you through all the ins and outs of the platform, lay out what’s great and what’s lacking, and then compare it to Qtrade – my personal favorite among Canada’s best online brokers, especially now with their free trades of both stocks and ETFs.

Finally, we’ll let you know who the Wealthsimple Trade platform makes sense for, and whether it’s worth your time and your money. (*Spoiler: probably not – unless dabbling in crypto.)

Is Wealthsimple Trade Safe?

Wealthsimple is, indeed, legit. Wealthsimple Trade is regulated by IIROC (Investment Industry Regulatory Organization of Canada) and has industry backing to the tune of $380 million from some of the world’s biggest banks. Their majority owner is Power Corporation of Canada, which has been around for more than 100 years.

Not only is Wealthsimple legit, it’s safe. Their custodial broker, Canadian ShareOwner (the company that holds your funds), is Canadian Investor Protection Fund (CIPF) protected up to $1 million per account. They use 2-factor authentication for their apps and browser interface and feature bank-level security, including a 128-bit SSL certificate and the backup programs and firewalls that are standard in the financial industry.

This may be obvious to you, but to be clear for our newer readers out there, none of this protects you from the risk of investing. Unfortunately, no one can ever guarantee that your ETF or stock won’t drop in value. To learn more about index investing and ETFs, check out our comprehensive article on Index Investing in Canada.

Wealthsimple Trade Review: Trading Fees & Commissions

Wealthsimple Trade was the first online brokerage in Canada to charge no commissions at all. It has since been joined by National Bank Discount Brokerage, Questrade, and now, Qtrade. Most other online brokerages charge between $4.95 and $9.95 per trade.

Wealthsimple Trade gives you free access to thousands of stocks and ETFs on North America’s largest stock exchanges, as well as 140+ kinds of cryptocurrency if you add on Wealthsimple Crypto.

Now, any honest Wealthsimple Trade review has to note near the top that even though you are not paying upfront for your trade, you are paying through the selling of your market trade information to meta-buyers. These buyers pay Wealthsimple for your trading information so that they can then front-run trades using algorithms.

Basically, the phrase: If you aren’t paying for the product, you ARE the product – has never been more true.

Wealthsimple also makes substantial money on the currency conversion fees from when you purchase US stocks, as well as the cash balances sitting in your account.

You have no required minimum balance to begin investing, and you can purchase fractional shares as low as $1. This is helpful if you’re starting out and don’t have a lot to invest.

Note: not all shares are available for fractional share purchase.

Account And Transaction Fees

Wealthsimple Trade really means it when they say no fees for trading.

They do charge a 0%-1.5% conversion fee when making US trades without a USD account, so keep that in mind if you’re interested in cross-border investment. The conversion fee amount is dependent on the size of the transaction, with transactions over $100,000 having a currency conversion fee of 0%. If you plan to try strategies like Norbert’s Gambit, this is not the platform for you.

They also charge a hefty 0.50-2% fee for cryptocurrency transactions.

Currently, Wealthsimple has three tiers, based on client assets, which inform the fees they pay for certain transactions. For example, with the aforementioned cryptocurrency transaction fees, it is Core Clients who would be charged 2%, Premium Clients 1%, and Generation Clients just 0.50%.

Wealthsimple has been criticized in the past by the Globe and Mail for shifting customers away from their previous laser focus on low-fee investing to its much more profitable cryptocurrency trading arm, as well as its trading platform.

Wealthsimple Trade, however, is not the only platform to go fee-free for trading. In late 2025, Qtrade dropped its trading fees, as well as its annual account fees, further locking it in our top spot for an online brokerage.

Available Investments With Wealthsimple Trade

Wealthsimple Trade gives you access to thousands of US and Canadian stocks and ETFs that are listed on the following exchanges:

- Toronto Stock Exchange (TSX)

- TSX Venture Exchange (TSXV)

- New York Stock Exchange (NYSE)

- NASDAQ

- NEO

- Canadian Securities Exchange (CSE)

- BATS Exchange

Wealthsimple now offers Options and OTC securities on the self-directed platform, but Bond portfolios are available on the managed platform. This means that the following assets are not available for trading on this self-directed investing platform:

- Mutual Funds

- Preferred Shares

- Options

- Securities that trade over the counter (OTC)

- Forwards & Futures

- Rights and Warrants

- Bonds

- Investment Savings Accounts & Money Markets

- Non-North American ETFs and stocks

Wealthsimple Trade Review: Account Options

For a long time, Wealthsimple self directed investing only had basic non-registered accounts, RRSPs, and TFSAs. However, they have recently fleshed out a fuller range of options including:

- Personal / business

- TFSA

- RRSP

- RESP

- LIRA

- FHSA

- RRIF

- LIF

- USD accounts

- Joint, corporate, and trust options

- Margin accounts

- Non-registered accounts

Overall, while they don’t have quite as many options as some other brokerages, they can cover the vast majority of what the average Canadian investor would need.

Wealthsimple Trade Plans and Benefits

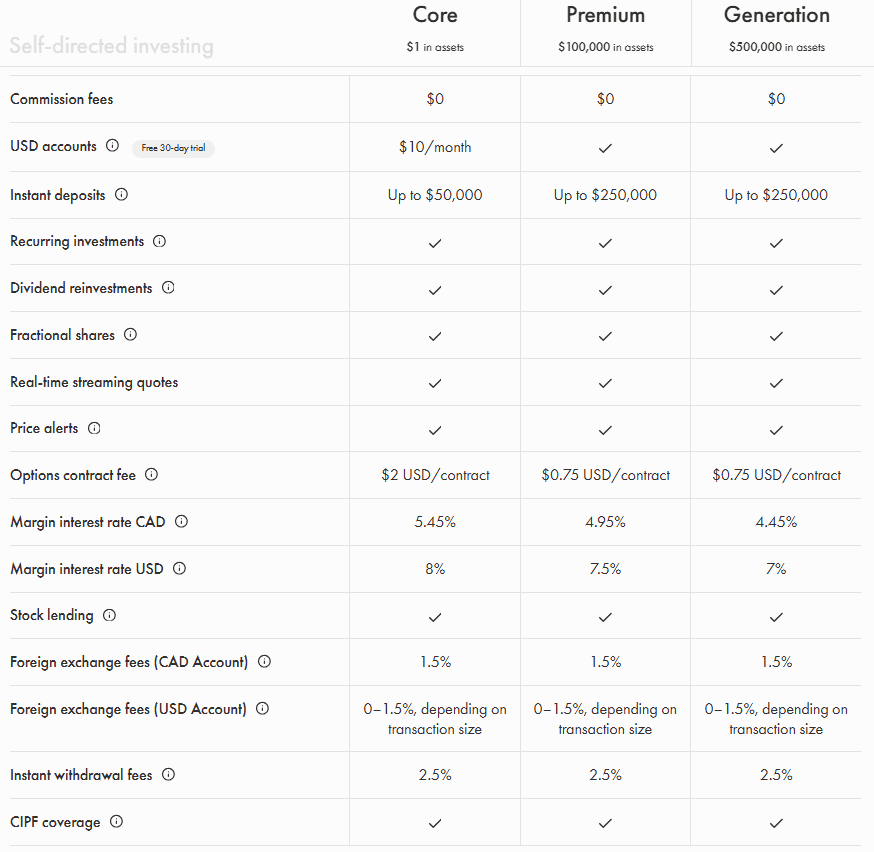

Once upon a time, you could register and pay for a service called “Wealthsimple Trade Premium”. This has changed slightly in that you now earn your way to receive benefits, based on the value of your assets. Once you have over $100,000 in assets, you become a Premium Client and unlock benefits.

At over $500,000, you become a Generation Client and your rewards increase further. For those with under $100,000 in assets, they are a Core Client and have the highest fees and the least benefits.

For further information on the perks available with each level of membership, check out the comprehensive table from Wealthsimple.

On the one hand, we’re happy they offer these options for a reasonable price… but on the other hand, if you’re serious about trading, there are other platforms that give you much more data and analytics, plus more asset and account options, as part of their basic package. Time and time again, we hear from experienced traders that the Wealthsimple platform is lacking in the data and analytics they are seeking.

You can learn more about what other trading apps have to offer in our collection of The Best Stock Trading Apps in Canada.

How To Sign Up For Wealthsimple Trade

To open a Wealthsimple account, you must be a Canadian resident at the legal age of majority for your province (18 or 19, depending on where you live).

Signing up is easy. First, download the app or go to their website. Then enter your personal information and banking info. Wealthsimple will ask for your:

- Full Name

- Social Insurance Number (SIN)

- Date of Birth

- Address

- Phone Number

- Employment information

Once you’ve linked a bank account, you can move money into your account (you should be able to deposit up to $1500 instantly, but larger transactions can take up to 5 days) and then begin investing.

If you have a Wealthsimple Invest account you can use your existing credentials to open an account, but your accounts will be separate. You can have separate TFSAs, RRSPs, personal accounts, and more with both Wealthsimple Trade and Wealthsimple Invest.

Wealthsimple Trade Welcome Bonus

Wealthsimple’s self-directed investing’s latest welcome bonus is $25.

In addition, if you have an account with another brokerage, and transfer your account to Wealthsimple, they will automatically reimburse the fees. Frankly, that pales in comparison to the deal that our top-rated online discount brokerage, Qtrade has going.

Check out my Qtrade promo code article for more details. But long story short, you can get up to $2,000 cash back, depending on the size of the transfer (plus free trades, plus free account transfer).

Features, Tools, And Ease of Use

Wealthsimple’s trading platform is not our favourite (to say the least).

It’s streamlined to the point of oversimplification. Also, the browser version is relatively new and prone to being buggy.

The Wealthsimple site has some video resources like an investing master class that “will turn you into a financial genius in less than 45 minutes.” [Spoiler alert: it doesn’t]. They have added many articles to the Educational page of their website, and while it’s a start, it’s nothing groundbreaking.

Wealthsimple Trade Mobile App

Wealthsimple Trade was Canada’s first free trading app. Now, they’ve conglomerated all their products into one app, simply called “Wealthsimple”. So, whether you are using self-directed investing as outlined in this article, or managed/robo-investing, or everyday banking actions, it is all done within the one app.

Wealthsimple prides itself on a clean design and intuitive user interface… which is why we were surprised when we tried it and found it clunky and confusing. However, as per online reviews, many clients love the simplicity of it. Some more advanced traders find it to be limited in functionality.

While it does provide basic performance information for assets, the Wealthsimple interface doesn’t provide you with the analysis tools or in-depth information that many investors look for. It’s definitely tailored for the new or casual investor.

They have certainly made improvements to the app since our last review, however. You can now buy and sell ETFs through the app and get real-time quotes for all securities.

Another downside for Wealthsimple Invest customers who want to try their hand at active investing: your Wealthsimple Invest (robo advisor) and Wealthsimple Trade accounts aren’t linked. You can transfer funds between them, but only as cash, and it can take up to 5-7 business days while you wait for them to sell your holdings.

While we find the overall functionality of the Wealthsimple app to be limited when it comes to self-managed investing, especially when compared to leading mobile apps, most users are happy with the app. It is rated 4.2 stars by Android users and 4.6 stars by Apple users.

Keep in mind, however, these ratings are dictated by those using different functions of the app. It is hard to gather data specific to the self-directed investing actions of the app!

Wealthsimple Trade Review: Customer Service

Wealthsimple Trade is designed for investors who want to do it themselves – and they took that to heart with their customer service! However, improvements have been made over the years. Also, the more money you have with Wealthsimple (ie, for Generation Clients), the better service you’ll receive, such as a direct line to call when you need help.

On the “Contact Us” page of their website, they list their 24/7 chat (AI virtual assistant), 24/7 phone line, and refer people to their Help Centre “for quick answers to common questions”. That all sounds pretty good, but it doesn’t quite align with what we hear from clients.

The MDJ editorial team was unanimous in saying that we had received more complaints about the Wealthsimple Trade platform in 2025 than any other broker-related issue from any of the platform options. Currently, it has a 1.4 star customer service rating on TrustPilot Canada.

Wealthsimple Trade or Wealthsimple Invest?

Wealthsimple offers two ways to invest. In this section of our Wealthsimple Trade Review, we’ll look at the pros and cons of each.

Wealthsimple Trade

Through Wealthsimple Trade, ie, Wealthsimple Self-Directed Investing, investors will take on a more hands-on approach. They will trade their own stocks and ETFs, and will need to make sure to rebalance them regularly.

When you use Wealthsimple Trade, you will have access to:

- Commission-free trading

- North American Stock Exchanges (but will need to pay a 0%-1.5% currency exchange fee in order to trade US stocks without one of their USD accounts)

- Crypto trading

- Canadian savings accounts such as TFSA, RRSP, RESP, FHSA, and many more.

- 3 levels of accounts with varying services and fees: Core, Premium and Generation

What you will not be able to do with a Wealthsimple Trade account is purchase Mutual Funds, or jump onto an IPO purchase.

While Wealthsimple Trade began as an app-only platform, it is now accessible from your PC, Mac or laptop. The interface is similar to the app in terms of simplicity and ease of use.

Wealthsimpl Invest

Wealthsimple, also called Wealthsimple Invest, is a robo advisor service that offers a diverse range of portfolio choices for clients to choose from, making it easy to start investing.

When you use Wealthsimple Invest you will have access to:

- In addition to more traditional ETFs, you’ll be able to choose from a selection of 3 standard portfolios, plus socially responsible investing (SRI) portfolios and halal portfolio options.

- Rebalancing will be done automatically. Purchasing and selling of stocks and bonds needed for a well–balanced portfolio will be made without you needing to worry about it.

- 3 levels of accounts with varying services and fees: Core, Premium and Generation

While Wealthsimple does offer a range of unique offerings, it comes at a cost with a management fee of 0.4% – 0.5% depending on account balance. This is higher than most other Canadian robo advisor services. In addition, the platform doesn’t offer some of the tools and resources many other platforms do.

Wealthsimple Trade vs Qtrade

Our Wealthsimple Trade review wouldn’t be complete without putting it head-to-head with Qtrade, our most recommended discount broker. You can find the basic details and some general comments here, but be sure to check out our Qtrade vs Wealthsimple article as well.

| ||

|---|---|---|

| Canadian ETFs | Free to buy and sell | Free to buy and sell |

| User Experience | Excellent - consistently ranked #1 in Canada. Built for Canadian users exclusively. | Average. Customer service can be difficult to reach, and there have been complaints about order processing times. |

| Account Options | Personal / business, RRSP, RESP, TFSA, LIRA, RRIF, LIF, LIRA, FHSA, USD accounts. Joint, corporate, and trust options. Cash accounts, margin accounts, and non-registered accounts. |

|

| Safety | CIPF Member, IIROC regulated | CIPF Member, IIROC regulated |

| Mutual Fund Purchases | Available, Free of charge | Not Available |

| Investment options | Stocks, ETFs, mutual funds, bonds, new issues (IPOs and secondary/treasury offerings), GICs, options. | Stocks, ETFs, crypto, and options. |

| Promotion | $5,000 Cash Back + Unlimited Free Trades | $25 Cash Bonus |

| Sign Up | Visit Qtrade | Visit Wealthsimple Trade |

We have a full Qtrade review in addition to our comparison article, so you can dig deeper if you want all the details…but here’s the gist: If you want to do more than scratch the surface of DIY investing, Qtrade is the clear choice. We used to see an advantage in Wealthsimple Trade in that it was free, but as of late 2025, Qtrade has free trades as well!

Wealthsimple Trade Review FAQ

Should You Use Wealthsimple Trade?

Cost is usually one of the first factors investors consider when choosing a brokerage, and rightfully so when costs amongst brokerages differ, and you are trying to grow your money. Low or zero-commission trading is attractive, but it’s worth asking a deeper question: What are the hidden costs?

With Wealthsimple Trade, the price you pay may not always be monetary. Instead, it can come in the form of your personal data. For some investors, that trade-off may feel uneasy. On top of that, the platform’s minimalist design, limited tools, and very basic customer support can leave you without the guidance you seek at crucial moments.

If you value a more robust experience, there are other options, and they don’t necessarily come at a higher cost! For investors who want more than what Wealthsimple Self-Directed Investing (Wealthsimple Trade) provides, check out our guide to the Best Online Brokers in Canada. And to learn of Qtrade’s recent improvement and why they consistently earn top marks, read our full Qtrade Review.