TD Direct Investing Review 2026

TD Direct Investing Review Summary:

-

Trading Fees and Pricing

-

Account Options

-

ETF Trading Fees

-

Customer Service

-

Platform Options

-

Overall Banking Convenience

-

Portfolio Management Tools

TD Direct Investing Review Summary:

Amongst Canada’s Big 5 Banks, TD Direct Investing stands out as the best brokerage option. Even when including digital-only banks, TD Direct Investing still ranks highly in the Top Online Brokers in Canada.

In 2025, The Globe and Mail’s Rob Carrick awarded the platform an A+ in his TD Direct Investing Review, quoting, “TD fits you like your best pair of jeans. Comfortable, and just the thing for most purposes.”

Many Canadians appreciate the security of working with a bank that predates the country itself, and is a known household name. For those wishing to keep their banking, mortgage, and investments in one place, TD is a natural choice.

While TD Direct Investing isn’t the lowest-cost brokerage on the market, it delivers a full suite of features. Its customer service, platform capabilities, and overall user experience are consistently excellent.

Pros

- One of Canada’s most trusted financial companies

- Best of the Big Bank brokerages

- Easy and convenient if you already bank with TD

- Modern, excellent trading platform

- Many account options to choose from

- A+ rating from Rob Carrick

Cons

- Not the cheapest option in Canada

What is TD Direct Investing Brokerage?

The TD Direct Investing online brokerage is a solid option, even though it doesn’t quite make it to the top of my list of Canada’s best online discount brokerages. As Canada’s second biggest bank (and one of our largest companies, period) it’s probably not a surprise that the TD trading platform has evolved over the years and consistently gotten better.

The problem (and it’s a problem not unique to TD Direct Investing, as the other Big Bank brokerages have the same issue) is that the brokerage service provided just isn’t quite as good as the top online brokers out there – and it costs substantially more due to trading fees and account fees.

Furthermore, the rapid rate at which the online brokers are innovating and improving is only widening the gap. For example, in late 2025, Qtrade dropped its per-trade fee, as well as its annual account fees, thereby joining Questrade as another brokerage option that is free of trading fees!

TD Direct Investing’s Trading Fees and Prices

When discussing TD Direct Investing’s Trading and account fees, it’s important to consider that TD (and their major competitors at BMO, Scotia, CIBC, and RBC) are not known for trying to be the lowest-cost providers of banking and investing services in Canada. Instead, they seek to provide ultra-safe products, and user-friendly customer experiences, at a competitive price model.

TD Direct Investing certainly accomplishes that goal. They provide elite-level usability and user options, for a similar price point as their competitors.

That being said, there are a number of different fees you’ll encounter if investing with TD Direct Investing, and they vary depending on the particular platform you are using.

Now we’ll have a look at the options under the TD umbrella and the fees that come with each:

TD Direct Investing (The main DIY web brokerage platform) | TD Easy Trade App (The budget friendly - mobile only trading option) | TD Active Trader (Designed for active traders who trade options) | |

Best For | The vast majority of Canadian DIY investors. Ideal combination of features and pricing. | Investors who want a simple way to trade from their phone. Not likely to use any of the cool tools TD Direct Investing has. | Active traders who use multiple stock and options markets. |

Minimum Needed to Get Started | $0 | $0 | $0 |

Trading Fees for Stocks or ETFs | $9.99 per trade of full shares. Partial-share trades cost $1.99 | $9.99 (after you use up your 50 free trades per year) TD ETFs are all free | $7 |

Options Trading | $9.99 per trade + $1.25 per contract | $7.00 per trade + $1.25 contract fee | $7.00 per trade + $1.25 per contract |

Market Research | Daily, weekly, and special reports. | None | Financial statements, earnings estimates, ratio analysis and analyst ratings. |

Live Market Streaming Data | No | No | Yes |

Sign Up | ; | ; | ; |

As you can see from the chart above, the TD Direct Investing platform is by far the most widely applicable for the average DIY investor. I think that TD Easy Trade was created to compete with the old Wealthsimple Trade and Robinhood type of apps, but it’s not relevant for most folks. Active Trader is obviously for the very small slice of people that are making 150+ trades per quarter and trying to roll out options trading strategies.

Avoiding the TD Direct Investing Account Fee

While TD doesn’t technically have a minimum deposit amount – meaning that you can get started with any amount of money – there is a $100 per year account fee if you don’t meet one of two conditions.

The good news is that either of those conditions are relatively easy to meet.

1) The easiest way to avoid the TD Account Fee is to simply have $15,000 or more in your TD Direct Investing account. As long as you have that amount either sitting in cash or invested, you’re good to go.

2) The other way to avoid the $25 quarterly ($100 annually) fee is to enroll in TD’s Household Program. What this means is that if you have a combined amount of assets totalling $15,000 in all of your Canadian TD Bank accounts (chequing, investing, saving, etc) then you can also avoid the fee.

If you don’t have the $15,000, there are other ways to enroll in the program. You must meet one of the following:

- register one or more of the accounts in your household in a Systematic Investment Plan (SIP), a pre-authorized deposit, or a pre-authorized contribution with a minimum of $100 a month, or

- complete three or more trades which incur a commission in the preceding quarter within household accounts, or

- hold a Registered Disability Savings Plan (RDSP) account within your household, or

- be in the initial six months of the first account opened within your household

All told, if you do any banking with TD at all, you’ll probably qualify for avoiding the TD Direct Investing fee.

Please note, the household program does not include the TD Active Trader Platform

TD Direct Investing Platform Comparison

TD Direct Investing has three four separate platforms, which can be a bit confusing, since there have been platform changes over the past few years, and there is an additional product known as TD Easy Trade, which is separate from TD Direct Investing.

Below is a chart summarizing the highlights of each TD Direct Investing platform, up-to-date as of December 2025, from TD.com.

Platform | WebBroker | TD Mobile App | Advanced Dashboard | TD Active Trader |

Best for | Investors and traders | Investors and traders | Active trading | Active U.S options trading |

Minimum deposit and account balance | 0 | 0 | 0 | $25,000 U.S. |

North American stocks and options trading | U.S Only | |||

Advanced order types: stop, stop limit, trailing stops (by price and %), trailing stop limit | ||||

Streaming market data | ||||

Market Research | Daily, weekly, and special reports Includes Morningstar and TD Economics Fundamentals Equity and mutual fund screeners Charting | High-level research including fundamentals and dynamic full-screen charting | Financial statements, earnings estimates, ratio analysis and analyst ratings | 100+ technical studies and 20 drawings, including eight Fibonacci tools Earnings analyzer and company fundamentals tools |

TD Direct Investing Account Types: TFSA, RRSP, Non-Registered

As a top-end online broker, TD Direct Investing offers all of the usual accounts including:

The bottom line is that while you might pay more in commissions to use TD Direct Investing, you’re going to absolutely have access to all of the accounts that you could ask for as a Canadian Investor.

TD Direct Investing Platform and Tools

TD Direct Investing offers four different platforms, all offering a variety of investment tools. TD Canada also offers a fifth, adjacent platform known as TD Easy Trade.

In this section of our TD Direct Investing Review we will dive into each one to check out what makes it unique.

TD WebBroker

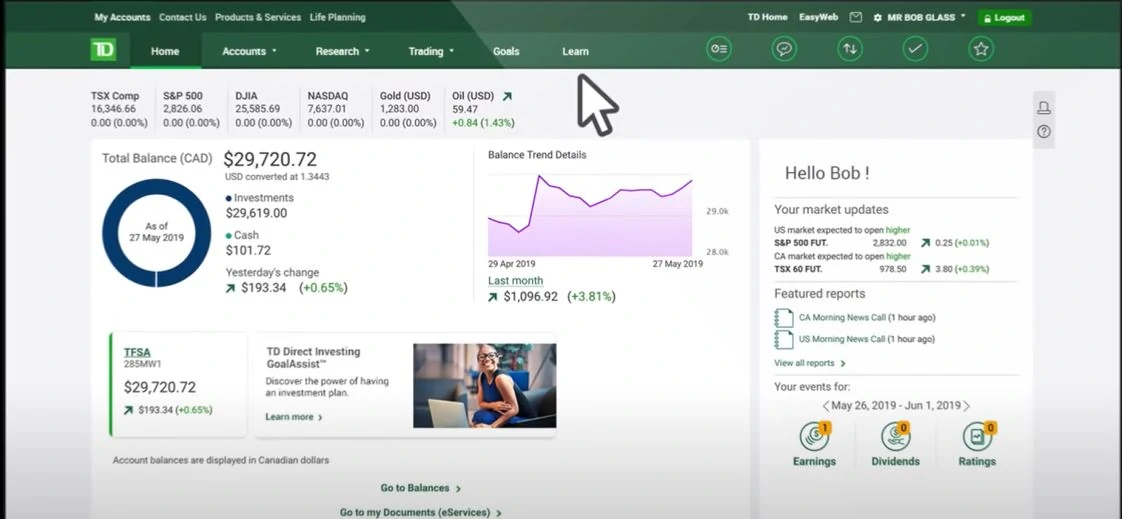

WebBroker is the web-based platform used by most TD Direct Investing customers, as it’s easy to use. It allows for customers to personalize their homepage with useful at-a-glance information and training videos, and even interactive master classes.

WebBroker also provides access to analytical tools, market data, and reports to help users make the most of their investment opportunities.

TD Mobile App

Designed for on-the-go investors, the TD app allows users to easily execute orders, access up-to-date news and reports and monitor portfolio performance all from their mobile device. The app is 100% integrated with the WebBroker, offering users flexibility.

Advanced Dashboard

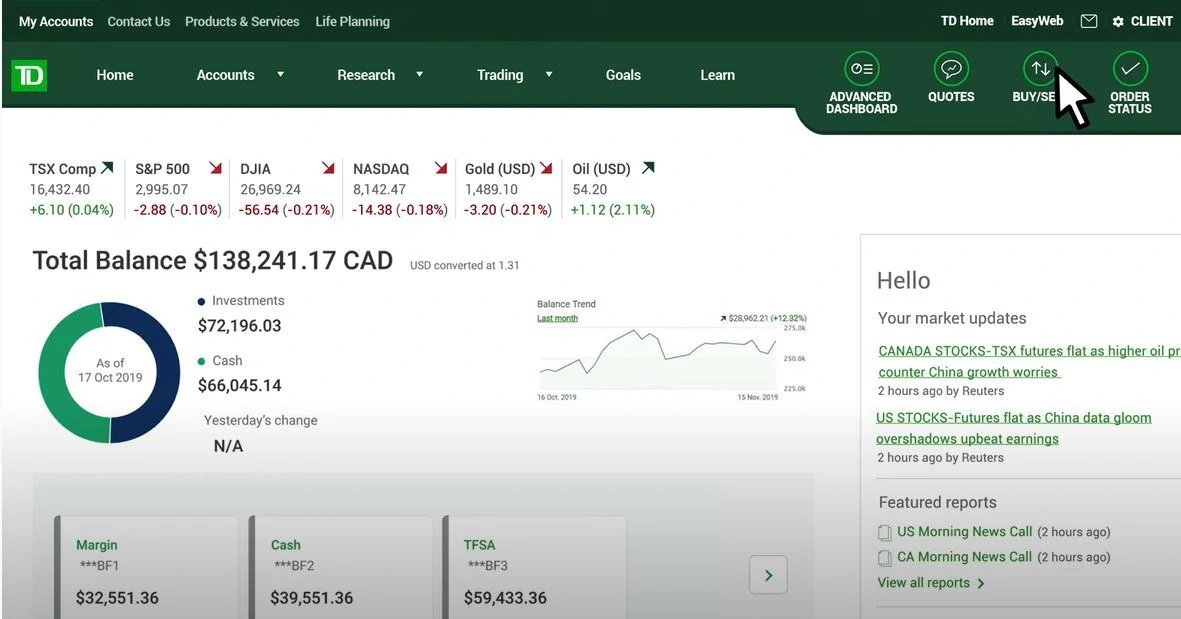

Active traders will have access to the Advanced Dashboard, which allows users to view real-time streaming data, and use features such as customizable research tools and charts, as well as access to both Canadian and US markets.

TD Active Trader

The TD Active Trader is designed for the most active of TD traders and is their most powerful trading platform to date. Users benefit from personalized and customizable streaming of market data, advanced charting and robust feature sets.

TD Easy Trade (Formerly TD GoalAssist)

The platform for TD Easy Trade is known as TD Easy Trade App, and the idea is to help DIY index investors through the use of TD’s in-house ETF portfolios. The TD “one-click” portfolios (you can see how they compare to the rest of Canada’s all-in-one ETFs) are available through the app commission-free.

On top of offering free TD ETFs, TD Easy Trade doesn’t charge you for the first 50 stock trades per year. You won’t pay account maintenance fees either.

There are no monthly fees or account minimums.

Paul Clark, the President of TD Direct Investing introduced the product by stating:

“We know investing can be intimidating and many Canadians may simply put off getting started as a result. We believe you shouldn’t need a lot of money or expertise to start building your investing journey, which is why we created TD GoalAssist. This new mobile-only investing service is straightforward, uses plain language and is grounded in what our clients have told us they’re looking for – goal planning, education and low cost.”

Clark then went on to add:

“We know a lot has changed in our lives this year as a result of the COVID-19 pandemic. From an investing perspective, we’ve seen a significant increase in demand for online investing and more people trying investing on their own. TD GoalAssist could not come at a better time as Canadians are looking for an easy and affordable way to invest.”

TD Easy Trade is a great place for beginners to learn about investing, but in our opinion, once you learn the ropes, there are better options out there.

First, you won’t want to be limited to only TD ETFs as your portfolio grows. You also won’t want to start paying $9.99 for stock trades if you make more than 50 per year when you can get them for free elsewhere.

Since TD Easy Trade launched its app, it has received mixed reviews, with users commenting on negative aspects such as customer service issues, updates that caused major login complications, and trading limitations. Some of the positive comments were related to its ease of use as well as the fact that it offers so many educational resources to really help new investors learn about investing. Users also seem to appreciate the goal tracking function to help investors track their progress, which can be really motivating for newer investors.

Over time, we expect the app’s functionality to improve, but only time will tell. We’ll keep you updated here with any developments.

TD Direct Investing Improves Customer Service and Platform

After experiencing massive growth in 2020 and 2021, many of Canada’s discount brokerages sought to find solutions to their customer service delays.

TD has been at the front of the pack (as one would expect from a well-funded full service big bank brokerage). In a recent article, TD Direct Investing Raymond Chun revealed that TD’s discount brokerage business had added 35% more licensed investors since March of 2020.

Additionally, they have majorly upgraded their overall platform so that it can perform across various devices. Chun highlighted this work saying, “We’re at a place now where the majority of our customer transactions are being done through a mobile device… right from account opening to actual trades.”

TD’s focus on arming online DIY investors with a full toolbox of options resulted in the brokerage also offering online GIC purchases for the first time.

As part of their effort to reach out to more investors in 2022, TD launched MoneyTalk Live. They billed it as a “new live investing news program” that appeared on their TD WebBroker trading platform.

Kim Parlee, Vice President of TD Wealth, and Host of MoneyTalk on Bloomberg stated, “MoneyTalk Live is an empowering program for clients who want help investing with confidence, bringing daily news and exclusive financial insight to help them uncover, evaluate, and act on their investment goals.”

Then, in fall 2024, they added TD Active Trader Live for more frequent traders or those using advanced strategies.

Personally, I’m not a fan of these talking heads investor programs as they are always under pressure to fill the time slot with something “new and exciting”. The truth is that successful investing is usually a boring process that follows the same principles year-in and year-out. Consequently, I don’t think I’ll be tuning in any time soon.

TD Direct Investing Review FAQ

Who Is TD Direct Investing Discount Broker Best for?

We’ll be honest: Rob Carrick isn’t known for handing out easy grades. He’s a tough evaluator. So, when he gives TD Direct Investing an A+ in his 2025 review, you know the platform is doing a lot right.

Carrick highlights several strengths, including TD’s addition of fractional shares and its overall steady pace of improvement. Like us, he’s also a fan of the clean, intuitive portfolio snapshot that appears as soon as you log in, giving you a clear overview of your entire investing picture.

I also share Carrick’s view when he describes TD Direct Investing as “The most adroit among the bank-owned firms that dominate the DIY investing business.” In simple terms, if you want the stability and security of a major Canadian bank brokerage, TD is the top choice. It outperforms competitors like BMO InvestorLine, RBC Direct Investing, Scotia iTRADE, and CIBC Investor’s Edge.

The reason I can confidently say that MDJ offers the most accurate TD Direct Investing review online isn’t just because I use TD or because I follow what independent journalists publish. It’s because every year, dozens of you readers share their real-world experiences with these platforms.

So, please jump into the comments and let us know how TD’s online brokerage has been working for you lately!

Moved some of my accounts over from Scotia iTrade last year to take advantage of the promotional offer since I already bank with TD. While I do like some of the features. I absolutely hate that I have to call customer support each and every time I want to either activate, or deactivate a DRIP. A complete waste of time. Activating or deactivating DRIPs at iTrade is done seamlessly with a click of the mouse. Thinking of going back to iTrade since I still have some of my accounts there.

Buyer beware. They locked my trading account because of an address change that threw a flag. After calling them and getting everything sorted out, they told me it would take 2 BUSINESS DAYS to unlock the account. In an industry where seconds can make the difference in a trade, you have wait 2 days? That’s completely unacceptable. I’m sure it didn’t take them 2 days to lock the account. This just shows that the company has serious issues starting at the top… my advice.. avoid it at all costs… unless you can go 2 days without trading.

Terrible to work with, difficult to get online banking done. Shannon Rowe

TD Direct Investing does not support USD LIF (locked in RIF) accounts, but does allow the old fashioned “autowash” method to support trading in USD stocks.

Strangely, they do support USD LRSPs (locked in RRSP accounts – aka LIRAs) – just not LIFs.

Many other brokerages do support USD LIF accounts.

Are Webbroker and Advanced Dashboard proprietary solutions to TD or to a partner company? Where can I find more information about the features?

TD Goal Assist no longer exists. It has recently been replaced by TD Easy Trade. TD Easy Trade offers the same free purchases of TD ETFs that Goal Assist did. However, TD Easy Trade also offers TD clients the ability to make 50 free trades a year – a $499.50 value year after year after year. Long standing TD Direct Investing clients still pay full freight – no free TD ETF purchases and no commission free trades. I have spoken to several long term TD Direct Investing clients who are rather upset by TD’s actions this month.

I agree with the evaluations of the BMO Investorline and TD Direct Investing platforms provided on this site. Investorline is now the better platform – especially for those who employ ETFs.

Yes but are you a BIPOC? Look at the photos in TD promotions. Only BIPOCs need apply.