Posts by Kyle Prevost

2026 Economic and Market Predictions

Before we get to my economic and stock market predictions for 2026, I invite you to check out last week’s report column to see how I did in my 2025 predictions. As usual, I’m going to offer a general disclaimer: This isn’t meant to be direct investment advice. It’s more for my own fun, with…

Read MoreWealth Management Companies in Canada 2026

When I first wrote about the best financial advisors in Canada it got some attention from Canada’s wealth management companies due to the news and social media attention it received. If you’re not sure what exactly the difference is between a wealth management firm and a financial planning company – don’t worry – there isn’t…

Read MoreBest Financial Advisors in Canada

In trying to do your homework and separate the best financial advisors in Canada from the rest, you’re going to run into a lot of highly-motivated sales professionals. Most people that call themselves financial advisors are great at using vague jargon and financial fears to steer you toward the products that pay them the most.…

Read MoreWorking After Retirement in Canada

More and more Canadians are now working after retirement in some capacity. The idea of the traditional final office party, gold watch, and chair on the beach appears to be less and less fulfilling than many had hoped. That doesn’t mean a lot of us want to work the same job OR the same hours…

Read MoreBest GIC Rates in Canada – January 2026

With the Bank of Canada signalling that rate cuts will be slow-if-at-all in 2026, it has become abundantly clear that the best GIC rates in Canada have already topped out. Inflation is cooling (with a relatively modest 2.2% annualized measurement in December of 2025), economic growth is softening, and bond markets have priced in a…

Read MoreMarket Predictions for 2025

It’s that time of the year when all the financial geeks submit their market predictions for the new year (usually far in advance so that they can start their break early). But I always wonder what happens to these orphaned articles and predictions… Do they get put out to pasture? Do they get sent to…

Read MoreQuestrade vs Wealthsimple – Which is Better in 2026?

Many Canadian DIY investors end up comparing Wealthsimple vs Questrade as they’re two of the biggest names in the game. Both brokerages built their reputations by hammering home the same message (largely through savvy Youtube campaigns): Canadians pay way too much at the big banks. Toss in free trades, easy-to-use platforms, and a race to…

Read MoreThe 11 Best Cash ETFs in Canada (Plus HISA ETFs and Money Market ETFs)

As we head into 2026, there is more and more interest in low risk investments such as the best Canadian Cash ETFs. You might also hear these called HISA ETFs (high-interest savings account ETFs). Cash ETFs aren’t identical to money market ETFs, but for most investors they serve a similar purpose. Both live on the…

Read MoreWill the AI Bubble Pop In 2025 or 2026? How About Nvidia and OpenAI?

Back in the spring I wrote about AI investing in Canada, and why I was pretty cautious about advising anyone to invest in the AI bubble. Well, so far, you’d have been right to completely disregard that advice and go 100% in on AI stocks like Nvidia! That said, I’ve been doing quite a bit…

Read MoreNew Wealthy Barber Book Review

All of the new Wealthy Barber (2025) reviews out this past week have been glowing. Roy Miller the all-knowing barber is back, as the 1989 Canadian classic got one heck of a modern upgrade. The Wealthy Barber reviews have been universally excellent partly because it’s a really great book. It’s also because David Chilton (the…

Read MoreCanada Federal Budget 2025: What It Means for You

Canada’s 2025-2026 federal budget came out this week, and while the general consensus seems to be “nothing major to see here,” there were a fair number of small details that are likely to impact specific groups of people. A lot of the new budget details had been previously announced, but that doesn’t make them less…

Read MoreQtrade Review 2026 – Canada’s Best Broker

Current Qtrade New Customer Promotion Qtrade currently has the best cash-back promo offer on the market in an effort to get you to try their platform. In brief: $250 – $5000 cash back on your first deposit. Just click the button below to take advantage of this offer (promo code will be automatically applied). That’s…

Read MoreBest Canadian Online Brokers – January 2026

As the temperatures start to dip downward, it’s clear that Canada’s best online brokerages are in a battle that just keeps heating up. The big news for Canadian DIY traders this past week was that Qtrade (our #1 rated online broker) just made stock and ETF trades 100% free. They’ve eliminated all charges on trades…

Read MoreBuying a House in Canada – Why I Can’t Wait To NOT Be a Homeowner

I originally wrote this article about buying a house in Canada back in 2021 – right as the price of housing was picking up. I thought I’d update for 2025 now that interest rates have knocked housing prices back a bit, and folks might be wondering if the fundamentals have changed! Editor’s Note: I still…

Read MoreUS vs Canada: Trump Tariffs Lead to Trade War

With so many Canadians plugged into the latest Trump Tariff news, I felt that I needed to get an updated trade war column out as soon as possible! So what I’m going to do today is update an article I wrote back when we were taking our first baby steps into Trump Tariff reality. Below…

Read MoreLong-Term Care Insurance In Canada: Do I Need It?

TL;DR: You probably should not buy long-term care insurance in Canada. For many Canadians who are entering retirement, one of the big fears is that in their final years they will not be able to live on their own – and that because they can’t afford private long-term care, their lives will become miserable. This…

Read MoreThe Best Countries for Canadians to Retire Abroad

A few years ago I never would have considered writing an article about the best countries for a Canadian to retire abroad. Why would anyone want to leave Canada, right? Then my wife and I moved overseas to accept teaching positions, and I became aware of a broad range of geography-inspired lifestyle possibilities. I was…

Read MoreThe Ultimate Tax Guide to Inheriting a Cottage in Canada

The worst time to worry about paying inheritance tax on the family cabin is after your parent(s) have passed away and your family is just learning about capital gains taxes on cottages. The tax intricacies and emotional strain involved with any inheritance is only magnified by the discussion now involving a property that is so…

Read MoreJustwealth Review 2026

Why Justwealth? As I’ve updated my Justwealth review over the years, they have risen from a solid-but-not-elite option to the best robo advisor in Canada. How did they do it? By focusing on what matters. Frankly, while Justwealth has made great strides in the way their website looks, they still aren’t the most aesthetically-appealing option…

Read MoreEQ Bank Review 2026

EQ Bank Account Options and Interest Rates Account Type Interest Rate Best For Daily High Interest Account 1%* (Plus 2% if you direct deposit your pay) People who want the highest consistent interest rate in Canada + free e-transfers + super cheap international money conversion + FREE BANKING + USD Accounts for Canadians EQ GICs…

Read MoreBMO adviceDirect Review: Investing Advice for a Low Fee

The jump from traditional investing using mutual fund + full service advisor model, to all-on-your-own DIY investing using a discount broker can be a big jump for a lot of Canadians. BMO adviceDirect offers a service that is somewhere in the middle of that jump. Our BMO adviceDirect Review breaks down if whether this unique…

Read MoreBest Canadian Finance Podcasts

The best personal finance podcasts in Canada don’t insult your intelligence or try to sell you something. They aren’t created by self-appointed “fin-fluencers” trying to gain followers while promoting the next “silver bullet” fad. The Canadian podcast and YouTube world is rapidly filling up with marketing fluff disguised as “money talk”. That said, there are…

Read MoreAI Investing in Canada: AI Stocks vs Tools

Canadian investors are increasingly faced with two related trends: investing in AI stocks (buying shares of companies benefitting from artificial intelligence boom) versus using AI to invest (leveraging AI-driven tools to make investment decisions). Personally, I’m instinctually suspicious of anything that gets this much press coverage and hype behind it. I should be clear –…

Read MoreThe Best Mutual Funds in Canada (and why you should avoid them)

Despite the fact that they’re a pretty bad way to invest money, I still get a ton of questions about where to go to find the best mutual funds in Canada. Whether it’s in the comments section here on MDJ, or when I speak to audiences in person, there is always a group of folks…

Read MoreCanadian Election: Taxes, Tariffs, and Housing

With Canada’s federal election just days away, the headlines have been dominated by taxes, tariffs, housing strategies, and party leaders throwing shade at each other. For many of us, one of the key considerations will be what each platform has to say about pocketbook issues. From income taxes and retirement savings, to homeownership incentives and…

Read MoreTangerine vs EQ Bank Comparison 2026

If you’re looking for the Best Online Bank in Canada in 2026, the competition really boils down to Tangerine vs. EQ Bank. With interest rates of 4% and beyond, each of the two digital banks offer a great place to reliably grow your money. They also both stand out for their variety of accounts/products, user-friendly…

Read MoreRebalance My Investment Portfolio: How, Why, and When

With all of the recent volatility in the stock market, I’ve been getting a lot of inquiries about rebalancing investment portfolios. Other inquiries have read something along the lines of: “This is all crazy, should I sell everything?!!” You almost assuredly shouldn’t “sell everything,” but when I wrote about the Canada-USA Trade War back at…

Read MoreSafe Retirement Withdrawal Rate Strategies in Canada

The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you don’t have a general withdrawal plan, how can you know how much you need to save in the first place? If you have been reading MDJ for years, you already…

Read More36 Years of Stock Market Returns in Canada (TSX)

What is the average stock market return? It’s one of the most common questions that I get when I talk to an audience that is relatively new to investing. What they often want to know is not the average stock market return, but a worst-case scenario stock market return. You can click here to skip…

Read MoreBest Investments for a Canadian Recession

Over the last couple of weeks I’ve been getting a ton of emails and comments asking about the best stocks for a recession or how to prepare an investment portfolio for a recession. The truth is that it’s a bit of a bad-news, good-news story. The good news is that it’s probably not as bad…

Read MoreCheap International Money Transfer (Cheaper than Wise*)

The cost of transferring money internationally to a bank account abroad – or just exchanging one currency for another – is likely to be higher than you think. The true cost of an international transfer from Canada can be shockingly high for those who don’t understand how those type of fees are structured (as the…

Read MoreTax-Loss Harvesting in Canada

Tax-loss harvesting helps Canadians minimize the taxes that they pay on investment gains made outside of their RRSP and TFSA. What Canadian doesn’t want to save money on taxes Am-I-Right?! That said, getting the details correct is important, as there are a few trip wires that can ruin your overall plan, and have you leaping…

Read MoreCI Direct Investing Review 2026 (Formerly WealthBar)

What is CI Direct Investing and Is It a Robo Advisor? CI Direct Investing is a combination of an automated investing platform and a personal accessible financial advisors. When it comes to taking a piece of your monthly pay cheque and turning it into a diversified investment portfolio – CI Direct Investing does that for…

Read MoreLife Insurance for Seniors in Canada

Is permanent life insurance a good investment for Canadian retirees? Is whole life insurance the secret to building “infinite banking wealth” as I keep seeing on Facebook? What does term-to-100 mean anyway? Why is everyone trying to sell life insurance to older Canadians anyway??!! As hundreds of students have taken my course on how to…

Read MoreTrump, Tariffs, and the Canadian Economy

Here we go again… the Trump economy rollercoaster is full speed ahead. Many Canadians are anxiously glancing at their portfolios and trying to parse the ramblings coming from Trump world in order figure out what it all means for their investments. Before we get too deep into the specifics, I wanted to point out that…

Read MoreCanada Personal Pensions: Defined Benefit vs Defined Contribution Plans

Two of our most well-read articles here on MDJ cover the “government pension” that consists of CPP and OAS. In order to give the most accurate view of the pension landscape in Canada, I thought I’d take a look at defined benefit pensions plans and defined contribution plans as well. Both defined benefit (DB) and…

Read More13 Top Tax Breaks for Seniors in Canada

There are a ton of tax breaks for seniors in Canada compared to other age groups. It’s almost like our tax code tells us the story of who votes most consistently in our elections! The tax credits and tax breaks for retirees who are no longer earning their full-time income are an excellent way to…

Read MoreNeo Financial Mastercard Review 2026

The new Neo Financial Mastercard or “Neo MastercardTM” is the next big thing in Canadian credit cards. We’ve seen tech companies disrupt everything from vehicles to space travel and investing. Now the new Neo credit card is coming for the old market standbys. Three massive advantages for the Neo Mastercard immediately stand out to me:…

Read MoreHow Much Do Canadians Spend In Retirement?

You’d think it’d be a relatively easy quest to answer the question: How much will a Canadian spend in retirement? When I set out to create the first retirement course for Canadians looking to retire in the next 25 years (or in the early stages of retirement) I figured that determining how much the average…

Read MoreRRSP vs IPP for Canadian Business Owners

In my recent articles about paying yourself in salary vs dividends from a CCPC, as well as investing within a Canadian corporation, we explored the tradeoffs involved in trying to optimally manage both your personal and business’s finances. The final step in that journey is deciding whether to set up an Individual Pension Plan (IPP)…

Read MoreScotiabank Review: Chequing, Banking & Credit Cards

What is Scotiabank? Scotiabank, officially known as the Bank of Nova Scotia, is one of Canada’s Big Five banks. Established in Halifax in 1832, it has grown to be considered as Canada’s most international bank, serving over 25 million customers worldwide. It is one of Canada’s oldest and most trusted banks with a full range…

Read MoreSelling a Business to Retire in Canada

I’ve been on a real small business/CCPC kick here at MDJ over the last month, and my end goal was always to get to a place where we could make an informed decision on how to best sell a business before we retire – or create an alternative exit plan for our retirement. But as…

Read MoreInvesting Inside a Corporation for Retirement in Canada

Before you jump into the details of investing inside of a corporation for your retirement, it’s likely worth taking a few minutes to read my articles on paying yourself from your corporation with salary vs dividends, as well as how corporate taxes work in Canada and how to use Horizons Swap ETFs to lower your…

Read MorePolicyMe Review (Term & Critical Illness Insurance Online)

Solid term life insurance and critical illness insurance are essential parts of disaster-proofing your life. This PolicyMe review shows how to get the best deal when it comes to comparing these types of insurance policies in Canada. While PolicyMe began as an insurance comparison and brokerage site, its core mission to focus people on getting…

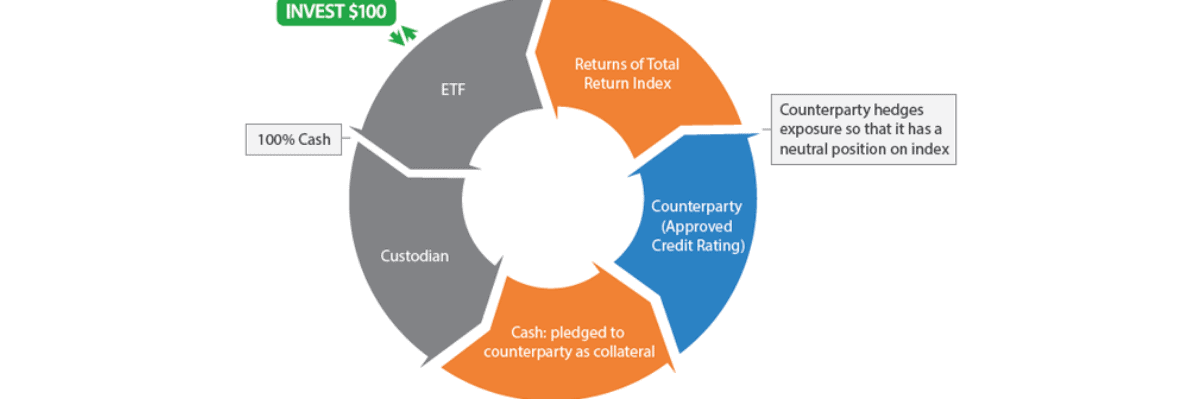

Read MoreBest Swap ETFs in Canada: Horizons Total Return Funds

In writing about corporate and expat investing over the past couple of years, I’ve come to realize just what an advantage using Canadian swap-based ETFs from Horizons can provide certain groups. Horizons calls these exchange traded funds “Total Return ETFs” and there are three main groups of investors that really need to be paying attention…

Read MoreCanada’s 2024 Budget – New Taxes on Capital Gains

Canada’s new tax rules on capital gains mean that you’re now likely to pay more taxes if you own a cottage, pass away with an unregistered online brokerage account, or investing inside of your corporation. Of course, right when I’m in the middle of writing a series on corporate taxes for CCPCs and am writing…

Read MoreSalary vs Dividends in Canadian Corporations: Paying Yourself as a Small Business Owner

In preparation for our dividends vs salary comparison for Canadian small business owners, we took a broad look at Canadian corporate taxes last week. I admit – it wasn’t exactly light fare. But the low-tax juice will be worth the squeeze! Today, we’re going to focus on Canadian Controlled Private Corporations (CCPCs) with annual income…

Read MoreCCPC Taxation: Canadian Corporations for Small Business Owners

I’ve been getting a lot of questions recently in regards to Canadian corporations and taxes for small business owners that have a CCPC (Canadian-Controlled Private Corporation). Most of these inquiries want seemingly simple questions answered – something along the lines of, “Ok, so if I made this much profit in my company this year and…

Read MoreHome Equity in Retirement – Reverse Mortgages vs HELOCs vs Downsizing

Many retiring Canadians have a huge chunk of their net worth tied up in their housing equity. Deciding whether to tap into that housing equity through a reverse mortgage or a home equity line of credit (HELOC) as they transition through different phases of retirement can be a tricky decision. The alternative option of selling a…

Read MoreLegal Wills Review: Canada’s Best Online Will Kit

When I was asked if I wanted to write a Canadian Legal Wills review in exchange for a free trial of Canada’s best online will kit, I have to admit that I was embarrassed. You see… Until yesterday I didn’t even have a will. I know, statistics show that roughly half of Canadian adults don’t…

Read MoreManaging Money In Retirement – Investing with Cognitive Decline

Since writing Canada’s first online course that looked at how to create a DIY financial plan for your retirement, I’ve gotten a few inquiries about a topic that is quite delicate, and generally isn’t much fun to talk about. (By the way, you can see what the course is all about by clicking here.) I’m…

Read MoreOAS in Canada: Clawbacks, Eligibility and Payment Dates

Old Age Security – better known as OAS – is one of the least understood aspects of Canadian retirement planning that I’ve come across. In order to full wrap your head around OAS and how you can get the most out of it for your particular situation, this deep dive is going to cover: (use…

Read MoreCPP Ultimate Guide – Eligibility, Payment Dates, Withdrawals & More

Most Canadians know the Canada Pension Plan as a government account they pay money into every month when they are working, and then when they retire, CPP means a cheque or automated deposit that arrives every month. Sounds simple enough right? Well… There are many layers to CPP! It’s one of those topics in Canadian…

Read MoreRetirement Planning in Canada (RRSP Season)

With “RRSP season” and annual financial goal setting in full swing, Canadian retirement planners are out there in full force ready to “help”. Honestly, the whole idea of “RRSP season” has always confused me a bit. It seems like we’ve collectively decided as a nation that we’ll squish “New Year’s resolutions” and “caring about money”…

Read MoreInvesting in Annuities in Canada – Buying a Pension for Life

As a former teacher you might think I’d be the last person who would want to learn more about investing in annuities in Canada. But with Rob Carrick over at the Globe and Mail writing about how right now might be the best time to buy Canadian annuities for several years (maybe a decade-plus), I…

Read MoreFHSA: Canada’s Tax-Free First Home Savings Account

With the government having launched the First Home Savings Account (FHSA) in 2023, more first-time home buyers should really be looking to take advantage of the tax-free benefits of the FHSA in 2024. The idea is obviously to make it easier for Canadians to buy their first home. In addition to the more straightforward benefits,…

Read More4 Steps to a Worry-Free Retirement in Canada

I’ve been writing about personal finance in Canada for 15 years now. This week I launched the project that was by far the best resource that I’ve ever created. It’s hands down what I’m most proud of in my career. I’m talking about the first ever online course about Canadian retirement. It’s called 4 Steps…

Read MoreBest Canadian Inflation Stocks for Hedging Investments

Should you worry about re-working your whole portfolio around the idea of choosing the best Canadian inflation stocks? Probably not. Of course that’s easier said than done as we proceed through stubborn inflation trends in 2026. When we started 2022, inflation was only being mumbled about by a very small cohort of market experts (shout…

Read MoreFinances After The Death of a Spouse – Creating a “Just In Case” Checklist

Preparing for the death of a spouse has got to be one of the worst personal finance tasks out there. I think it might be slightly easier for us to prepare for our own demise than it is to place that burden on our spouse. That statement is especially true if your household division of labour…

Read MoreQuestwealth Portfolios Review for 2026

What is Questwealth Portfolios? Questwealth Portfolios, formerly Portfolio IQ, provides a unique hybrid model of investing to customers that you won’t find elsewhere. They offer investors a passive way to invest, along with services such as automatic rebalancing and tax-loss harvesting. This is definitely appealing for investors who are looking to keep costs low all…

Read MoreFive Years into the Vanguard All-In-One Revolution

There are very few new financial products that really move the needle all that much. Vanguard’s Asset Allocation ETFs are one of the exceptions to that rule by becoming one of the more popular ETFs in recent memory. We’re celebrating the fifth anniversary of Vanguard’s launch of the first Canadian “all-in-one ETFs.”. You might also see…

Read Moremotusbank Review 2026

What is motusbank? Online banking has become the norm for younger Canadians, and motusbank, a part of Meridian Credit Union wants a piece of the action. While motusbank is a relatively new online bank, launching in 2019, it’s done well in offering a wide range of services and keeping interest rates high. It needs to…

Read MoreRRSP vs RRIF: Conversion, Ages, Penalties, Withdrawal Minimums

One of the main decisions that every Canadian retiree has to make is in regards to at what age they want to convert their RRSP to a RRIF. Consequently, questions such as: Are some of the most common ones that we get in regards to retirement planning. Ultimately the RRSP vs RRIF debate comes down to…

Read MoreWithdrawing From RRSP and TFSA For Retired Canadians in 2025

After writing a deep dive article on whether the 4% safe withdrawal rate still works for retirement at various ages, I received a lot of questions basically asking: “Ok, so 4% is a good rule of thumb, but when I actually go to withdraw money from my various investment accounts, to put into my chequing…

Read MoreBest Business Credit Cards for Canadians in 2025

A business credit card is a credit card that’s designed specifically for company spending, as opposed to personal use. Other than giving you access to additional money, they can give you a number of corporate benefits. Overall, it’s a great way to grab a few additional perks on money that you’d flowing in and out of…

Read MoreWhat To Do When the Stock Market Crashes

We’re getting a lot of semi-predictable questions via email and article comments that ask some version of: “Is the stock market crashing and what should I do after stocks or bonds crash?” Read a book. Watch a new TV series. Spend time with your family. Just don’t panic. Sure, if you’ve got a really strong…

Read MoreVanguard Canada Index ETFs vs Mutual Funds

When Vanguard Canada first approached me about doing an interview in regards to their two new mutual fund products, I have to admit that my response was: “Wait, Vanguard still has mutual funds? They’re introducing new ones? Are we sure that’s a good idea?” What followed was an interesting back and forth email interview with…

Read MoreBook Review – Balance: How to Invest and Spend for Happiness, Health, and Wealth

Huh… this guy really gets it – I remember thinking to myself when I picked up Andrew Hallam’s first book Millionaire Teacher back around 2011. I mean, it was never going to be a hard sell. There’s preaching to the choir… …and then there’s one money-nerd personal finance teacher preaching to another money-nerd personal finance…

Read MoreTeaching, Saving, and Investing – 5 Takeaways On Our 1-Year Expat-aversary

When I wrote about my new adventure becoming a Canadian Expat last year, I was quite surprised at the positive reception MDJ readers gave it. Frankly, I wasn’t sure what to expect given how niche the idea of becoming a Canadian expat was. So, as we start our second school year in Doha, I thought I’d…

Read MoreCanada’s Purpose Longevity Pension Fund: Is It a Guaranteed 6.15% Pension for Life?

For many years Canadians had some excellent options when it came to determining where they were going to get money from in retirement. You had your Sturdy Canada Pension Plan that you had paid into. Then you had the Old Age Supplement (OAS) to look forward to receiving each month. Finally, many Canadians got to…

Read MoreTravelling to Tbilisi Georgia: Bougie on a Budget

I’ve never been a travel blogger. I’m not well travelled enough to be an authority on how to do it well, or which places are best relative to other options. (Hence the whole international teaching adventure I’ve been embarking on.) But I thought that perhaps I’d dip my toe into the travel writing waters, seeing…

Read MoreSnag Your Free Canadian Expat eBook

Want to get paid a tax-free salary while working in a place where you don’t need to own a jacket or winter boots? Here’s the nuts-and-bolts behind how my wife and I are enjoying deduction-free salaries, and watching our tax-free investment portfolios grow, while living in a world-class city. If you’re a longtime reader of…

Read MoreInsurance and Wills for Canadian Expats

When I talked to several non-resident tax and investment specialists during my Covid quarantine-induced expat research frenzy, the topic that kept coming up as “the most common mistake amongst expats” was insurance. As the least sexy topic in a field of study not known for being particularly sexy, insurance has long been the forgotten dance…

Read MoreShould You Bet Your House on Blackberry?

January 25th – 29th, 2021 is the week the stock market embraced full insanity – PhD theses will eventually be written about what just occurred in the stock market this week. One day smart people will be able to explain to what degree various factors contributed to the illogically hilarious/fun/dangerous ride that stocks such as Gamestop (GME), Blackberry (BB), NOKIA (NOK), and AMC (AMC) took us on over the past few days

Read MoreThe Best ETFs for Canadian Expats Around the World

When my wife and I decided to move to Qatar, I wanted to check and make sure that my index investing strategies could still be carried out through my discount brokerage account, and what sort of expat-specific considerations there might be. After checking with my usual sources (all things Andrew Hallam, Dan Bortolotti, and Jonathan…

Read MoreYour Canadian Expat Investing Toolbox: DIY Discount Brokerages and Robo Advisors

Once you have taken a hard look in the mirror and decided what your target asset allocation should be (with some help if you need it), it’s time to look at just how you should go about actually getting money from your paycheque into an indexed investment. An index fund is a general term that…

Read MoreReal Estate Investing vs Index Investing for Canadian Expats

In talking to dozens of Canadian expats over the last year, I’ve found four money truths that consistently emerge. Given the consistent pattern of those truths, is it any wonder that so many expats simply give up on investing (often seeing the whole thing as a glorified casino) and instead just focus on enjoying the…

Read MorePC Money Account Review – Loblaws Resurrects a New PC Financial No Fee Account

Note: We’ll be updating our PC Money Account Review as the details get fleshed out and the introduction promo offer codes get created. For many years, the options for no-fee chequing accounts in Canada were limited to two competitors: PC Financial and ING/Tangerine. When Loblaws decided they didn’t want to worry about daily banking accounts…

Read MoreMy Canadian Expat Taxes, Budget, and Savings Rate In Qatar

Can I really go work in Qatar and not pay Canadian income taxes as an expat? This was one of my first thoughts when I started looking into teaching abroad. I mean, when you make a decision to move to the desert, adventure has to be the primary consideration, but let’s be honest here: If…

Read MoreTransferring Money Back From Qatar and Using Currency Exchange as an Expat

The average expat looking to transfer money from Qatar to Canada, the UK, the Euro zone, New Zealand, or Australia is likely paying a voluntary tax of $1,000 every single year! When I first started researching the options in Qatar for exchanging currency online or in-person, I was stunned by how few people even understood…

Read MoreTeaching In Doha, Qatar – Expanding Our Horizons

“Actually, we won’t be around next year, we’re going to teach in Qatar.” “Where???!” “Doha, the capital city of Qatar. Think Dubai, but slightly smaller, slightly slower-paced, and a few years behind – but quickly catching up – in terms of infrastructure and eye-catching skylines. Oh – and they’re hosting the FIFA World Cup in…

Read MoreIs Hello Fresh Worth It?

Reviewing the Cost of Meal Kits During the Pandemic Over the last few weeks, several of my neighbors have been eyeing my weekly meal kit delivery service, and asking for my Hello Fresh Review. This new trend makes sense given how many of us are cooking from home more these days – while trying to…

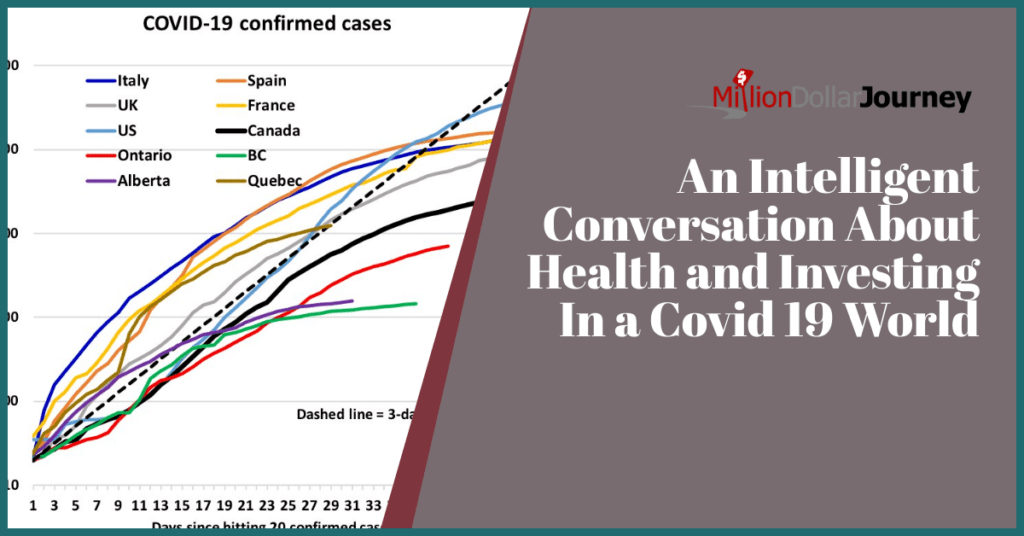

Read MoreAn Intelligent Conversation About Health and Investing In a COVID-19 World

We’re going to try something a bit different today. In a bid to learn more about Covid-19 and what it means for our day-to-day lives, as well as our investment portfolios, I’ve read a TON of stuff. (All of the folks who are taking care of children during this quarantine are cursing me right now.) …

Read MoreA Serious Look at Canadian Finance and Investing AC (After Covid)

Nearly 500 people died in Spain yesterday. Humour and money are not the most important topics at the moment. People using war analogies to describe the fight against this nasty bug don’t seem to be exaggerating when you see numbers like that. My attempt to distract people with gallows humour in our Covid-19 article last…

Read MoreCoronavirus (Covid-19): Sell It All

Just Do It. You know you’ll feel better after you scratch that itch… SELL IT ALL! Who knows where this will end? Your brother-in-law who took a biology class twenty years ago said that we might all go to the great tax haven in the sky – so it must be true! We could wake…

Read More