Investing in Annuities in Canada – Buying a Pension for Life

- What Is An Annuity?

- Is an Annuity a Good Investment in Canada?

- How Does An Annuity Help You Meet Your Retirement Income Goals?

- The Different Types of Annuities in Canada

- Comparing Current Joint and Single Annuity Rates in Canada

- Canadian Joint Annuity Rates

- How to Buy an Annuity in Canada

- Are Canadian Annuities Safe?

- RRIFs, RRSPs, and Annuities in Retirement

- Canadian Annuity Fees Explained

- Canadian Annuity Rates in 2023

- Is a Canadian Annuity Right for You?

As a former teacher you might think I’d be the last person who would want to learn more about investing in annuities in Canada.

But with Rob Carrick over at the Globe and Mail writing about how right now might be the best time to buy Canadian annuities for several years (maybe a decade-plus), I thought it would be be a good time to update our Ultimate Canadian Annuity Guide.

Now, it’s common knowledge that teachers enjoy a solid stream of pension income when they reach retirement. In fact, it’s so commonly known, that it can become a bit of a heated talking point.

If I have to listen to one more Canadian dinner party story about misinformed non-teachers telling teachers that they are sooooo lucky to have a pension, followed by misinformed teachers telling everyone else that they deserve the pension because of [fill in bad part of job here] – my neck might snap from shaking my head so vehemently.

Look – teachers – I’m one of you. Yeah, I know you pay into your pension from a young age. Yes, I know what it felt like to see so much of your paycheque disappear when you were in your early twenties and had just got out of five years of university study.

Just get over it – simply agree with everyone else that it’s really, really nice to have a defined benefit pension. It is the equivalent of retiring with something like $1-2M in the bank and all the logistics are taken care of for us.

Not to mention the fact that our employers (the provincial governments) range from good to excellent partners when it comes to helping our retirement savings. Very few people have these defined benefit (DB) privileges – just politely smile and say that you are thankful.

And for goodness sake Canadian dinner party guests – just accept the polite smile and move on. We all made our decisions in life. Every job has its perks and its drawbacks. Teaching is no different.

(You can imagine how much fun opinions like this – which somehow manage to offend all sides – make me at dinner parties. This is why I’m so fortunate my wife is good at making friends.)

Is Your Retirement Savings On Track?

Each year BMO does a retirement survey that asks Canadians a wide range of questions. You can see more details about how they got that figure here.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Get $50 Discount With Promo Code MDJ50

*100% Money Back Guarantee

*Data Source: BMO Retirement Survey

The problem is that most Canadian don’t really understand how their investment portfolio withdrawals and expenses wil interact in retirement. Check out my course – 4 Steps to a Worry-Free Retirement – to see if buying an annuity might be the right cost-benefit trade-off for you.

What Is An Annuity?

An annuity is a contract that lets you buy your own teachers pension.

I mean… there are some details to sort out within that, but that’s more or less the gist of it.

Canadian retirement expert Fred Vettese refers to annuities as a “transfer of risk” from your investment account, to the bank’s investment account. He’s a huge fan of them, as they are a super simple means of guaranteeing an income in retirement (like a pension).

Canadian author David Aston calls annuities, “maybe the best financial product that hardly anybody buys.”

Canadian professor of finance Moshe Milevsky was quoted in a MoneySense article as saying, “Just about every expert who has studied annuities believes they are the most effective safeguard against ‘longevity risk,’ or the possibility of outliving your wealth. That’s remarkable because you can’t get economists to agree on anything nowadays.”

Here’s a basic example of buying an annuity in Canada: The month before you turn 65, you hand BMO $100,000, and BMO promises to send you $524 each month until you go to that great tax haven in the sky.

I first became interested in annuities when I was skimming an article a few years ago in the hopes of easing some of the the pension envy that exists in Canada. Ever since I started really studying annuities, I’ve been fascinated by three truths that I’ve witnessed confirmed over and over again:

- All of the annuity surveys I’ve ever seen confirm my anecdotal Canadian dinner party experience: Canadians are cautious, generally dislike the idea of managing their own investments, and love the idea of a teacher’s pension – which everyone knows, arrives each month like clockwork.

- An incredibly high majority of experts agree that annuities are a great tool. One that should be used by many Canadians.

- Almost no Canadians want anything to do with an annuity – no matter how many experts tell them otherwise.

Number three might be a bit of an exaggeration – but not by much.

So what does it mean to invest in an annuity?

The basic idea is that you’re going to hand over a chunk of your money to a financial institution like BMO or Manulife, and in return they are going to send you a pension-like amount of money each month.

You can invest in an annuity that will pay you for the rest of your life – or a specific period of time. You can buy an annuity that kicks in immediately – or one that only kicks in later in life.

There are many options and many tweaks that one can look into, but the value proposition of an annuity is:

Hey – want to take a lot of risk and complexity away from your retirement planning? We can do that for you with an annuity – but it’s going to cost you.

Is an Annuity a Good Investment in Canada?

So, you want to know if an annuity is a good investment?

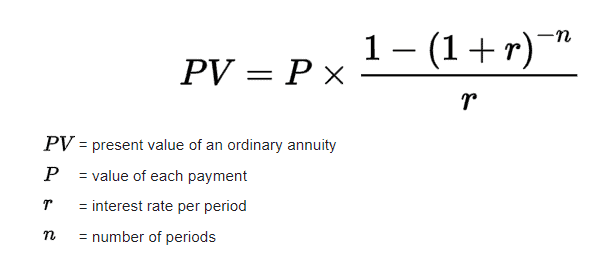

The formula for how much an annuity will pay out is a bit intimidating, but the good news is that other people have already created a spreadsheet to help with that.

Just tell me when you’re going to die and what the interest rates are going to be the entire time you’re alive. While you’re at it, let me know the future annual returns of the stock market, and I can then tell you if an annuity is a good investment.

In case my dripping sarcasm isn’t coming through, the truth is that there is absolutely no way to know in advance if using your money to purchase an annuity is better than investing it on your own.

Consequently, we can never truly know in advance if an annuity is the investment that will give you the highest total returns.

Let’s take a look at an example: Johnny is about to turn 65-years-old. He is considering buying an annuity and wants to know if it’s a good investment or if he should keep his cash in his online brokerage and manage his investments himself.

Due to high interest rates in 2024, Johnny’s monthly annuity payout has risen to about $600 per month. That’s an annual return of 7.2% on his investment – pretty not bad! That said, with interest rates going down, it likely won’t stay that high for very long.

But remember, that $100,000 belongs to BMO now – it isn’t sitting there in Johnny’s account “just in case”. So, for Johnny just to “break even” on the deal, he’s going to have to collect that monthly annuity payment for 16 years.

Even that 16-year mark doesn’t really do the details justice. In order to know for sure whether he should purchase the $100,000 annuity, Johnny would have to know how much money he could have made if he had kept the money and invested it himself in the stock market (or in a safer asset like GICs).

He would also have to know what the average inflation levels were going to be going forward. Because, while Johnny could keep his money in a high interest savings account earning 2% or so, 2023 proved that inflation can quickly soar above that number.

See, annuity companies are going to take Johnny’s money – and just like my teacher’s pension plan – they’re going to pool it along with thousands of other retirees.

They’ll employ a lot of really, really smart math gurus to figure out the average amount of time all of the retirees will be able to collect a monthly cheque (we can’t figure out how long you’ll live, but we’re surprisingly good at figuring out on average how long a group of people just like you will live), and then they’ll determine how much the pool of money can afford to pay all of the individuals for as long as they live.

After they take their cut of course.

Here’s the thing though:

While we can’t tell in advance if an annuity is the best future investment from a total returns perspective, we can determine if an annuity is the best investment for you – and your goals.

How Does An Annuity Help You Meet Your Retirement Income Goals?

Most retirees or soon-to-be retirees have a few simple goals when it comes to their money.

Some “well off” retirees have goals that involve complicated inheritances and trusts.

But most retirees just want to know that they can afford to live a certain lifestyle (leaving the cat food eating for the cats) until the day they pass away.

Statistically speaking, if your goal is to maximize the size of your net worth after you retire, you should not purchase an annuity. Check out our free eBook to see our suggestions on how to DIY invest in your retirement.

The thing is that most Canadian seniors that I know, don’t want to worry too much about probabilities and market outcomes. They don’t love the idea of trying to assess the risk of a 97% chance they will be just fine if they live to 95 vs the 5% chance they’ll deplete their nest egg before that vs the chance they’ll live to be older than 95. Let alone trying to determine the right stock/bond balance continuously during their 80s and 90s.

This is why a teacher’s pension causes so much envy!

As much as retirees may be envious of the actual amount of money getting deposited into former teachers’ bank accounts each month, I think what people are really after is the burden of retirement planning being lifted from their shoulders. The knowledge that no matter what happens in the stock or bond markets, that an automatic deposit will show up each month, is a powerful peace of mind.

Consequently, the question isn’t: Is a Canadian Annuity the Best Investment.

It’s: Is a Canadian Annuity the Best Investment for You and Your Goals.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Get $50 Discount With Promo Code MDJ50

*100% Money Back Guarantee

*Data Source: BMO Retirement Survey

The Different Types of Annuities in Canada

By far the most common type of annuity in Canada is the lifetime annuity. This is the product that we have been describing so far.

These life annuities can be further broken down into the categories of single and joint annuities. Joint annuities are generally recommended for couples, as when one person passes, their annuity (or a portion of it) can continue to be collected by the remaining partner.

A less common type of annuity is what is known as a time-certain annuity. This annuity is set up for a predetermined period of years, and if you were to pass before the end date, the payouts would continue to your estate.

In addition to the broad category decision of joint/single lifetime annuities vs time-certain annuities, the following are common features or “tweaks” that can be added to your annuity contract. Just remember that, generally speaking, everytime you add a feature, your monthly payout will go down. The more complicated the annuity – the fewer dollars per month!

- A guaranteed money back annuity. This is to help alleviate fears of buying a large annuity, only to pass away a few years later – and “lose” all of that capital – which could have been bequeathed.

- A deferred annuity is one that doesn’t start paying out right away, but rather one that will begin paying out at a later date. It is useful for people who are really worried about extreme longevity.

- An indexed annuity. As time goes on your money buys less and less stuff. You can buy some annuities that track the inflation rate (as tracked by the Consumer Price Index), but most annuities experts instead recommend an annuity that goes up by a set rate – such as 2% per year.

- A cash-back annuity acts as almost a type of life insurance tied into your annuity contract in that it pays your estate if you die before the annuity has paid a certain amount. It’s similar to the guaranteed money back option.

- A variable rate annuity is a bit of a complicated product that is quite rare in Canada. The annuity company will guarantee you a minimum payout with a certain portion of your money, and then with the rest of it they will invest in mutual funds. You could get substantially more than you would with a regular annuity – or you might get less (as the minimum is substantially less than you’d get with a plain vanilla annuity) – depending on how the mutual funds do.

At the end of the day, these small tweaks are meant to ease certain fears that people have in regards to laying down a large sum of money up front. Every single expert that I’ve read or talked to recommended going with a very simple annuity – after shopping around for the best deal.

Comparing Current Joint and Single Annuity Rates in Canada

Given all of the different types of annuities in Canada, you need to be careful that you’re “comparing apples to apples” when it comes to shopping for the best annuity rates in Canada for 2024.

We’ll get into how to buy annuities in just a second, but here’s a look at a few different annuity types and what the monthly payout would be. Below are some Canadian annuity rates pulled from Cannex Financial Exchanges Limited at the beginning of 2024 and are for illustrative purposes only.

Canadian Single Life Female Annuity Rates

Company | Age 55 | 60 | 65 | 70 | 75 | 80 |

BMO Insurance | 485.02 | 521.00 | 572.44 | 643.75 | 701.17 | 852.12 |

Canada Life | 466.74 | 498.87 | 543.14 | 605.42 | 697.10 | 838.06 |

Desjardins Fin. Security | 487.51 | 521.76 | 568.70 | 634.62 | 727.28 | 854.19 |

Empire Life | 476.59 | 508.69 | 553.68 | 618.19 | 713.07 | N/A |

RBC Life Insurance | 487.31 | 545.09 | 533.57 | 599.58 | 699.05 | 856.61 |

Sun Life Insurance | 469.18 | 508.49 | 559.80 | 632.54 | 735.29 | 903.69 |

Canadian Single Life Male Annuity Rates

Company | Age 55 | 60 | 65 | 70 | 75 | 80 |

BMO Insurance | 508.02 | 548.29 | 606.35 | 693.75 | 794.16 | 968.25 |

Canada Life | 491.54 | 548.29 | 586.47 | 670.07 | 797.93 | 1,000.67 |

Desjardins Fin. Security | 510.68 | 550.45 | 605.66 | 685.35 | 799.15 | 942.11 |

Empire Life | 500.50 | 541.23 | 597.65 | 675.05 | 777.96 | N/A |

RBC Life Insurance | 473.57 | 511.53 | 564.97 | 644.50 | 766.46 | 962.57 |

Sun Life Insurance | 493.72 | 535.40 | 593.67 | 681.05 | 812.94 | 1,010.19 |

Canadian Joint Annuity Rates

Company | Age 55 | 60 | 65 | 70 | 75 | 80 |

BMO Insurance | 450.97 | 476.48 | 513.65 | 565.05 | 594.15 | 697.53 |

Canada Life | 439.62 | 463.44 | 497.68 | 547.23 | 620.62 | 734.47 |

Desjardins Fin. Security | 457.90 | 483.87 | 520.27 | 572.43 | 646.16 | 758.59 |

Empire Life | 450.38 | 473.72 | 506.71 | 554.08 | 623.60 | N/A |

RBC Life Insurance | 429.56 | 453.91 | 487.70 | 536.90 | 610.68 | 727.08 |

Sun Life Insurance | 439.71 | 465.36 | 501.50 | 558.05 | 635.72 | 751.52 |

(full lifetime payment to surviving partner)

How to Buy an Annuity in Canada

When you set out to buy an annuity in Canada, it’s important to comparison shop and make sure you get the best bang for your buck.

The good news is that it’s relatively easy to comparison shop for annuities. Each province in Canada has its own regulations when it comes to the precise definition of who is allowed to sell annuities, but basically it boils down to people who are licensed to sell insurance can generally also sell annuities.

As an interesting aside, it has long been speculated that because many Canadian “advisors” are incentivized to sell mutual funds in Canada, but are not allowed to sell annuities, most Canadians are never made aware of the positive teachers pension-like benefits annuities bring to the table.

In any case, when it comes to buying an annuity in Canada, your only real move is to go see an insurance professional that is licensed to sell them. They will in all likelihood use a company called Cannex (by far the biggest annuity quote comparison site in Canada) to see what the latest offers are from each of the big annuity providers in Canada (there aren’t that many). From there it’s simply a matter of determining exactly what type of annuity you want, and then selecting the best payout.

Are Life Annuities in Canada Legit?

From the several academic studies and books that I read, life annuities in Canada are a pretty good deal in terms of offering a fair transparent product at an attractive price.

Do I wish that more competitors would enter the Canadian market in order to increase competition?

Definitely.

But I think it’s a bit of a chicken-egg argument. Canadians have to decide that they want annuities and make it worth companies’ time to compete within the Canadian annuity market.

In an OECD study titled “National Annuity Markes: Features and Implications”, author Rob Rusconi presents the following information on Canadian annuities.

- The UK is presented as the world leader in annuities, given their history and how common they are. Canada is said to have “broadly similar characteristics, but smaller annuity markets.”

- The Canadian market is described as being quite competitive and transparent.

- The “value for money” is quite good when it comes to annuities in developed markets such as Canada’s.

It’s worth noting that Canadian annuity companies such as Canadalife (owned by Great-West Lifeco Inc.) are very competitive in foreign markets such as the UK and USA, so the options available to Canadians are solid.

Make sure that your insurer is a member of Assuris, and that they can explain all aspects of the annuity contract to you. Ask for a list of all contract restrictions, penalties, and administration fees to be explained in writing. As long as those conditions are met, you should be on pretty firm ground.

When to Buy an Annuity in Canada?

You tell me what interest rates are going to do and I’ll tell you when you buy an annuity in Canada.

That’s a sarcastic way of saying, there is no real way to determine the best time to buy an annuity. The payout that annuities are able to provide are heavily tied to that of the “risk free rate of return” – in other words, it largely depends on the key interest rate set by the Bank of Canada.

Much like when you buy bonds, if you invest in an annuity, you would be hoping for inflation to stay very low, and for interest rates to remain close to zero. That way, your annuity payment would maintain its maximum purchasing power.

If interest rates rise quickly after you purchase your annuity, then you might be a bit upset because you could have gotten a better payout if you waited.

Here’s the thing though – there is absolutely no way to know ahead of time what interest rates are going to do. Just look at what all the expert economists were saying back in December of 2022. It usually went something along the lines of, “inflation is transitory, we need to keep interest rates low so we don’t sink the economy”.

Before 2021 we hadn’t talked about inflation in years, and the dominant theme was actually that we should be worried about deflation!

Then in 2023 we saw interest rates go up at the fastest rate in decades. If I HAD to guess, I’d say that if you were considering an annuity, early 2024 is likely to be a massive sweet spot. If inflation rates go back up again, interest rates might stay “higher for longer” (as the Bank of Canada keeps talking about), but my bet would be they’re going to come down fairly steadily starting in April or May. That lowered interest rate is going to put downward pressure on annuity payouts.

But I want to make it clear that I have a very low level of conviction in my ability to predict short-term interest rate moves!

Annuity expert Moshe Milevsky has spoken/written on several occasions about the most logical way for consumers to approach buying an annuity. Your goal should be to spread the risk out and thus it makes sense to buy your annuities “in pieces”.

For example if you have $300,000 that you want to annuitize, you might decide to buy a $100,000 annuity at age 65, again at age 68, and again at age 71 (before you are forced to sell some investments from your RRIF).

This should protect you from a “worst case scenario” where you could theoretically put down your initial $300,000 all at once, only to see interest rates go up, and the value of your new annuity contract go down. Of course, it would be just as likely that you could “lock in” a great annuity rate with your initial $300,000, and smile as interest rates went down from there. It’s all about spreading risk – not “picking the winning horse”.

Are Canadian Annuities Safe?

Yes!

Look – I get it. You put down $100,000+ to “buy your own teachers pension” – you want to make sure that thing is air tight!

The first line of defense your annuity will have is the fact that the vast majority of annuities are sold by massive publicly traded companies. It’s not impossible that the Bank of Montreal could go bankrupt – but I mean the company was already fifty years old when Canada became a country.

BUT – even if somehow the Canadian government decided that it was going to let such a massive Canadian financial institution declare bankruptcy – your annuity would have a second line of defense known as Assuris.

Assuris is a non-profit entity regulated by the Government of Canada. It was created in 1990 to make sure that products such as life insurance and annuities could be safely guaranteed to Canadians.

The long and short of it is that the first $2,000 per month you receive in annuity payouts is 100% protected no matter what. Over and above $2,000, Assuris guarantees a minimum of 85% payout in a worst case scenario.

The great thing about this Assuris “insurance” or guarantee is that you don’t need to do anything to get it – it’s automatic (as long as your insurance company is covered) and doesn’t cost anything extra.

RRIFs, RRSPs, and Annuities in Retirement

When it comes to choosing how to draw down an individual’s or couple’s retirement nest egg, there are obviously many things to consider.

When should OAS and CPP be taken?

How much investment risk is one comfortable with?

Are you comfortable handling your own investments?

How much value do you place on simplicity of income vs mathematical probability of a larger net worth?

What level of assets do you have in your RRSP/TFSA/Non-registered accounts?

Do you have any debts? If yes, what are the interest rates?

Is leaving an inheritance of high importance to you?

Do you have a history of longevity in your family gene pool?

Do you prioritize making daily health choices?

What type of retirement spending do you see yourself doing over the next few decades?

+ Several More

It’s impossible to explain the full context of all of these choices in one article, but here are some really great reasons to “buy your own pension” using an annuity.

- The simplicity of knowing exactly what you will get, when you will get it, and how you can use it to plan your budget is incredibly valuable to a lot of people.

- If you eat right, exercise often, stay away from smoking, and generally do more things right than not – then you are quite likely to get your money’s worth when it comes to an annuity.

- Most people don’t know how to properly manage their own investments. If you want to read our free eBook ‘Can I Retire Yet’, and then put those low-fee strategies into play – awesome. But most people get quite intimidated by the idea of building a flexible game plan for retirement spending – and then consequently pay way too much money to misincentivized advisors who fail to give good advice.

- If you’re going to have a portion of your retirement nest egg in “safe” investments like GICs or bonds anyway – might this same amount be allocated to an annuity and give you more spending over the long term?

- The worry of passing away soon after buying an annuity and “losing” all that hard-earned money can be assuaged by using a guaranteed-for-ten-years option, and/or by realizing that the intent of that money was to provide a better life for you. If it did that by reducing stress – then even if it was a bad mathematical decision – then perhaps it’s not that large a “loss”.

Personally, I’d stay away from annuities under the following conditions.

- I had investable assets of over $2.5M – and spending needs less than $90,000 per year. (In other words – High Net Worth folks).

- I was entering retirement without any investable assets.

- I already had a pension.

- I was unhealthy and/or had poor health prospects.

Everyone else should at least consider annuitizing a portion of their assets.

It’s worth noting that the government is going to force you to draw down your RRSP assets after you turn 71 anyway (after you convert to a RRIF). You can convert your RRSP or TFSA into one type of registered annuity, while using any non-registered assets to convert into a separate annuity stream.

The tax man forces us to keep those two pools of retirement funds separate because (just like if you left the money in an RRSP or RRIF) there is still tax owing on money coming from the registered annuities.

If you had a defined contribution (DC) plan from one of your jobs, chances are that it will be converted to a Locked In Retirement Account (LIRA) when you retire, and you can choose to annuitize some or all of this money – just like an RRSP.

Long story short:

1) If the pot of money that you use to purchase an annuity is outside of your RRSP – in a non-registered account – then your annuity payments each month will likely have very little tax on them. The only part of this payment that will be taxed will be the interest portion of the payment. In practice, given that most retirees are in fairly low tax brackets, there is very usually very little tax paid on annuities bought with funds from a non-registered account.

In order to keep your taxable income consistent throughout the lifetime of your non-registered annuity, make sure that you look at “prescribed annuities”. Non-prescribed annuities will pay you more taxable income on the front end of payments, which might lead to a higher tax bill.

2) If the pot of money that you use to purchase an annuity is inside your RRSP, then you will be taxed at your marginal tax rate – just as if you had withdrawn funds from your RRSP or RRIF. You got a tax refund when you put money into the RRSP, so now the tax bill will come due.

There will be a mandatory withholding tax applied to annuities purchased from within an RRSP. This isn’t an “extra tax”, it’s more like a prepayment on the taxes you will owe at the end of the year when you file your taxes with the CRA.

Annuity payments purchased from your RRSP are also likely to qualify for pension splitting purposes, and the pension income tax credit – further reducing your overall tax bite.

Canadian Annuity Fees Explained

When it comes to Canadian annuity fees, it’s a good news, bad news story.

The bad news is that as an overall product around the world, annuities generally have fairly high fees – and they’re not easily understood.

The good news is that Canada has some of the better annuity companies in the world, and the annuities are easily comparable because the payouts are almost always inclusive of fees. This means that when you compare Canadian annuity rates, those fees have already been baked in for the vast majority of products. Consequently, it’s pretty easy to determine what the best deal is, and if it is a good deal for you.

While the final effect of Canadian annuity fees are transparent, how those fees are arrived at is not. Here’s a quick rundown of the fees that an insurance company is likely to charge:

- By far the biggest cost or fee for most Canadian annuities is the up-front commission of sales charge. The Ontario Securities Commission estimates that this commission can be up to 3% of your initial investment.

- Annual administrative fee that covers the record-keeping and basic management of the annuity.

- Penalties – if you’re allowed to get out of your annuity contract at all, it’s going to come at a massive penalty (usually called a surrender fee). You should view an annuity purchase as irreversible.

- Rider fees are often charged as part of the whole, “The more options that you add to the annuity contract, the more it’s going to cost” principle.

The website by the Ontario Securities Commission advises customers to negotiate with the financial institution that they’re purchasing an annuity from, as it may be possible to waive the sales commission annuity fee.

Canadian Annuity Options: Ten Year Guaranteed Annuities

One of the big issues that many people have when it comes on whether deciding whether or not to buy an annuity in Canada is that it feels like such a big “waste” if one were to pass soon after buying the product.

There is just something instinctually repulsive about handing a bank $200,000, and then passing away a few months later – while that “greedy bank” gets to keep “your money”.

In order to offset that fear, annuity companies have put out a product called a “ten-year guaranteed annuity” in which if you were to pass away in the first ten years of the annuity paying out, your estate would get a portion of your upfront payment back. The longer you had already collected annuity payments, the less the estate would get.

While I understand the psychological allure of this type of ten-year Canadian annuity option, I personally wouldn’t recommend it. The bottom line continues to be that the more bells and whistles you add to your annuity, the less you will get each month. You’re buying the annuity to ease your fears of longevity risk – which it will do no matter how long you live.

If you were to pass before you got “good value” on the annuity, you might rest more comfortably knowing that the vast majority of your money isn’t in fact going to a faceless bank, but to other Canadians who also bought annuities in that company. It’s also worth considering that you won’t really care about too many earthly problems at that point in time!

Canadian Annuity Rates in 2024

As a result of rising interest rates, Canadian annuity rates in 2023 rose considerably. This is only logical when you think about the fact that a large percentage of annuity companies’ investments would be in fixed income products like government bonds. So as interest rates go up, payment yields can go up as well.

In a perfect world, it’s more beneficial to purchase an annuity when interest rates are high. Like other types of fixed income such as bonds, the value of those payouts rises as interest rates go down. Of course, it’s impossible to tell where interest rates will go in the future, so I wouldn’t put a lot of effort into trying to “time the market”.

If you purchase an annuity rate, and interest rates subsequently come down – congratulations. You hit it lucky, and the value of your annuity contract went up. It’s like purchasing a 5-year bond for 5%, and then in 18 months, the government decides to massively cut interest rates. Your bond would now be worth more than what you paid, because you wouldn’t be able to find that guaranteed low-risk 5% return anywhere any longer.

The flip side is, if you purchase an annuity and interest rates increase, then you will have gotten a bit unlucky, and in hindsight, it would have been better for you to wait. This is why Milevsky recommends spreading out your annuity purchases over a few years – so that your exposure to interest rate risk covers a broader time period.

That’s why when we look at Canadian annuity rates in 2024, it’s tough to predict what will happen. A lot of smart people are predicting that interest rates will gradually trend downward, but the Bank of Canada seems pretty adamant that they’ll keep interest rates “higher for longer”.

For what it’s worth, if I were personally looking at buying an annuity, I’d be pulling the trigger ASAP. That said, if I knew for sure where interest rates were headed, I’d be making a ton of money, and living in a mansion somewhere! No one can tell you where annuity rates in 2024 are headed with any sort of certainty.

Investing in Canadian Annuities – FAQ

Is a Canadian Annuity Right for You?

Canadians appear to love the idea of a teacher-pension-esque monthly automated deposit being transferred into their bank account – they just hate the idea of paying for it.

This distaste for engaging with an uncommon money solution – one with a high price tag – is likely leading to some poor outcomes in the future.

Annuitizing a part of your retirement nest egg and taking some of the longevity risk off the table is a really sound move when it comes to lowering stress levels while helping meet retirement goals.

Dr. Wade Pfau, Professor of Retirement Income at the American College of Financial Services, has advised clients to consider replacing the fixed income portion of their portfolios with an annuity. Similarly, Canadian retirement expert Fred Vettese has suggested a guideline of 30% of your overall nest egg. I think if you don’t have a private work pension, these are very good recommendations.

Alternatively, for a solution that offers some degree of short-term liquidity, while effectively annuitizing much of your income over the long-term, I’d compare annuity options to simply delaying your OAS and CPP.

If you think about it the tradeoffs involved with delaying your OAS/CPP vs buying an annuity are quite similar. You’re trading full control of your assets in the short term for a guaranteed buffer against not having enough money if living to an advanced age.

The advantage of delaying your OAS and CPP (and using your personal savings/investments to fund your retirement before age 70) is that those two benefit programs are inflation-adjusted. In order to get an inflation-adjusted annuity, you’re going to pay quite high fees in Canada.

My personal “decision tree” when it comes to whether someone should consider investing in an annuity would be:

1) Do I already have a guaranteed employer pension that will cover most of my necessities in retirement?

2) Do I have less than $100,000 in total investable assets when I enter retirement?

3) Am I generally unhealthy, or have a rather unfortunate family longevity record?

If you answered yes to any of the above, I wouldn’t bother looking into an annuity.

If you answered no to all three, then I’d consider the following:

- How confident are you in handling all of your investments in an online broker account and minimizing investment fees? How confident are you that your abilities to maintain these investments will continue when you are 80?

- How important is it to you to leave behind the maximum estate vs how important it is to have safe, simple, reliable cheque coming for the length of your retirement – no longer how long that lasts.

- How comfortable are you handling your own investments from when you retire to age 70 – to when you can max out your OAS and CPP?

Basically, the more comfortable you are with risk, handling your own investments, and wanting maximum control over everything – the less value an annuity will have to you.

I cannot emphasize enough that while I’m still a fan of handling my own nest egg retirement spending strategy, a Canadian annuity is an excellent option for folks who don’t want to worry about the minutiae of rebalancing a portfolio, and/or don’t want the stress of watching the stock market collapse huge amounts of their net worth in their golden years.

In other words, the more jealous you are of a teacher pension, the more value you will get out of an annuity!

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Get $50 Discount With Promo Code MDJ50

*100% Money Back Guarantee

*Data Source: BMO Retirement Survey

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi Kyle, thank you for publishing such an informative and well balanced article.

You advise that, if you already have a pension or health issues, an annuity would not be a good investment for you. I have both and certainly would not consider a single life annuity. With about $70,000 in pension income annually (with 100% to spouse on my death), I don’t personally need an annuity, and my life expectancy is likely significantly lower than average.

However, my wife has no pension and at age 65, is healthier than average. She has about $1 million in retirement savings, not including $100,000 that I have invested in my own RRSP.

Would it not make sense for me to purchase a simple no-option joint life annuity for my wife and me, with my $100,000 RRSP? (I turn 71 this year, so I will be making this decision very soon.)

I am attracted by the current monthly annuity payouts, my wife is very risk adverse, and the annuity would be only about 10% of the value of her portfolio.

It makes sense to me Don, but given your situation you might also want to consider an annuity for only your wife (single person)?

After all, if you were to pass, I’m assuming only a 50-75% of your pension cheque would be sent her way right? Whereas you get 100% of that benefit for the duraction of your life. With a single-person annuity you’ll also get a better rate – currently about 6.7% I believe. For a very risk averse person, I would think 30-40% of the $1M nest egg might make a lot of sense? Perhaps even more if the money would just be sitting in GICs or a HISA anyway?

Hi Kyle:

Thank you for the detail. I’ve been researching Annuities for a while. I am a 65 year old female who hasn’t been able to find much work since age 59. I have lived off my savings (collapsed my RSP) and am selling my house to retrieve the equity. I think I’ll have about $400,000. when all debts are cleared & I’m planning to put all of it into a lifetime annuity. I don’t have children so I’m not worried about leaving anything & I hope to have my house sold in early spring 2024. Questions:

How do I go about researching where I can get the highest monthly payout on my annuity?

Do LifeCos pay more than banks?

How do I negotiate the upfront sales commission down (or out),

(every penny I get will be important).

Once I get the annuity set up I may go live in a warmer (cheaper) place than Canada. Will my annuity payments be affected if I move abroad?

thank you.

Hi Charlotte,

This is a detialed question. I’m going to email you with some information that I think will help answer all of this.

Stay tuned!

I’d love to hear your response to that last question, as I’m pondering the same thing: does it make sense to buy a Canadian annuity if you are retiring abroad? It would seem that the tax benefits evaporate, no?

Hi Doug,

The best place to go for annuity research is to talk to a fee-only advisor and/or a fee-only insurance person (often you can find a reputable company such as Objective Financial that has it all under one roof). They can compare annuities for exactly the situation that you want.

In terms of annuity payments abroad, the annuity can still be paid to you, but then it will likely get witholding tax applied – however, many countries have tax agreements with Canada that would lower your net tax paid. It really depends a lot on what country you’re moving to. If I were to move to the UK for example, I’d be tempted to bring my cash with me over there, and buy a UK annuity.

Thanks so much for your response!

If I may, I have an unrelated question. Why precisely do you say this: that you would not purchase an annuity if you “had investable assets of over $2.5M – and spending needs less than $90,000 per year”?

What changes in this scenario? If you inherited 3 million dollars, would it not still provide security to put, say, a third of this into an annuity? Then perhaps a third into stocks that generate income via dividends, and a third into growth stocks?

Great article Kyle

wondering if you could buy an annuity for someone

in their 30s rather than leaving a lump sum inheritance.i worry

my daughter will not manage a lump sum very well and I read it’s protected

from divorce

hmm… that’s an interesting question Giselle. I’m not aware of any straight up annuity that a person could buy for someone so young. But there are various types of income trusts that a person can set up that would function in the way you want. I recommend you check in with the team at Objective Financial in regards to this option.

Kyle, much enjoyed your detailed and helpful annuity article. I am a 69 year old 5 years into retirement and my wife is planning to retire next summer. We have high 6 figure RRSP/RRIF/TFSA assets with a mortgage free fully renovated home and two paid up vehicles we typically keep for 10 years or more. Our main retirement decumulation costs will be travel related as we are active and in good health. Our assets are split 60/40 into lower volatility equity income generating ETFs and fixed income ETFs. Given the current interest rate environment, I am contemplating taking a portion of our fixed income assets and purchasing a joint guaranteed life cash back annuity next fall when I turn 70. What are your thoughts on that and if I pull the trigger will the annuity withholding tax be based on my marginal tax rate or my wife’s which is lower?

Hi Wally. First of all – kudos to you for getting that nest egg so well built!

Secondly, there are a lot of moving parts there that probably require a full financial plan in order to answer in detail. Depending on what your spending needs are, there is a strong chance you’re unlikely to ever spend down your assets right? In that case, you probably don’t need an annuity. However, if you decide it make sense for you, prescribed annuities are eligble to income split, so you could split it 50/50 with your partner. Remember, the witholding tax isn’t really relevant right? You’re going to go “settle up” or “even out” on that when you file taxes at the end of the year anyway.

Thanks Kyle.

Much appreciate your annuity comments

The financial plan has been in place for a while so here’s hoping we continue to enjoy good health so we can make a substantial drawdown on our travel bucket list

Finally, a crystal clear, unbiased, informed explanation of annuities. Thank you very much for such a thorough analysis. It is very much appreciated.

You must be a great teacher, Mr. Prevost. This is the best article explaining the reason & how to about the Canadian annuity I have read, thanks so much. I am planning to retire within two years and would like to convert some of my LIRA to annuity as interest rate is very favorable, but I am still in my 50’s, would you recommend deferred Annuity? I also hear some professor recommend annualized first 10 years of retirement income to address the sequence risk, is there such a product exist in Canada? Thanks again for a great article.

Hey Wei – I haven’t officially launched this yet, but you’ll find an exhaustive discussion of annuities and their place within your plan here: https://worryfreeretire.com/ There isn’t much for a deferred annuity right now in Canada (I’m assuming you hear Moshe Milevsky talk) but the government recently approved the idea of degerred annuties, so it might be worth keeping an eye on.

Thanks for the kind words!!

Just gotta thank you for crystal clear presentation. Appreciated especially points on when (or not) annuity purchase is advisable and notes on basic annuity types and add-ons. (If your class teaching is anything like the article in substance and clarity, your students are lucky).

Alex – what a spectacular comment! Thanks for making my day!

Why do you recommend that a retiree not invest in an annuity if they have less than $100,000 in investable assets?

It’s not an absolute rule Patricia, it’s simply of matter of most annuity contracts are for at least $100,000.

Excellent article. Thank you.

Annuities seem expensive, but give you something the “4% rule” cannot: truly guaranteed income. Certainly worth considering for many people close to retirement.

Exactly AL – it simply takes some of the risk off of the table.