Salary vs Dividends in Canadian Corporations: Paying Yourself as a Small Business Owner

In preparation for our dividends vs salary comparison for Canadian small business owners, we took a broad look at Canadian corporate taxes last week.

I admit – it wasn’t exactly light fare.

But the low-tax juice will be worth the squeeze!

Today, we’re going to focus on Canadian Controlled Private Corporations (CCPCs) with annual income below $500,000. So when I refer to a “corporation” we’re just going to keep it simple and say that we’re talking about a small business that has chosen to incorporate, is a CCPC, and that the CCPC earns $500,000 or less per year.

The goal here is to not simply help small business owners choose between salary and dividends in order to save the most tax money in any single year. It’s to help them understand both the short- and long-term trade-offs that occur when you choose to pay yourself with non-eligible dividends from your CCPC or pay yourself a salary from your CCPC.

I should also specify that for now, I have decided to focus on the dividends vs salary considerations when it comes to “operating income”. All that means is that we’re looking at the simple path of making money running your company, and then efficiently transferring that money from your corporation, to your personal accounts.

In my next article we’ll get into what happens when we decide to have a large investment portfolio within our corporation – but for now – let’s keep things simple!

This one hits particularly hard for me since my wife and I have been grappling with paying ourselves through salary and non-eligible dividends over the last couple of years. It’s not an easy one to wrap your arms around, but again – I think it’s worth it when you consider the thousands of dollars of tax savings that you can snap up if your corporation-to-personal-accounts cash flow is optimized every year.

- Salary vs Dividends: Quick Comparison for Small Businesses in Canada

- Tax Integration – Better Off Paying Dividends or a Salary?

- Paying a Salary to Get CPP (Probably a Good Idea!)

- Paying a Salary to Get RRSP Contribution Room & IPPs

- Dividends and Salary for Family Members

- Salary or Dividends If I Need to Get a Mortgage

- Dividends vs Salary for CCPCs – FAQ

- What is the Best Way to Pay Yourself from Your Corporation?

Salary vs Dividends: Quick Comparison for Small Businesses in Canada

The updated chart below compares paying yourself with a salary vs paying yourself through dividends. When we say “dividends” here, we’re talking specifically about the non-eligible dividends that are generated by a CCPC corporation with less than $500,000 in profit.

| Criteria | Salary | Dividends |

| Impact on Corporate Taxes | Reduces corporate taxable income, generally lowering corporate taxes. | Paid from after-tax profits, not reducing corporate taxable income. |

| Personal Tax Deductions | Subject to higher personal tax rates but allows for more personal tax deductions. | Subject to lower personal tax rates due to the dividend tax credit, but limits personal tax deductions. |

| Overall Tax Efficiency | Integration aims for parity in total tax paid no matter if you pay yourself with salary or dividends. That said, there is a slight overall tax edge (roughly 0.5% in most provinces, in most income brackets) for paying salary. | Generally taxed at rate due to the dividend tax credit, but integration aims to balance overall tax impact by forcing you to pay the corporate tax rate before dividends can be sent out to shareholders. You can avoid making CPP contributions by issuing dividends, but remember, CPP contributions are NOT a tax – and are a different trade-off altogether. |

| CPP Contributions | Mandatory contributions, providing future pension benefits. For many Canadians this is an excellent deal. More discussion on CPP below. | No contributions, offers more immediate income but no direct pension benefits. |

| Administrative Requirements | Requires payroll setup and compliance with remittance deadlines, potentially incurring penalties for delays. | Simpler, with the main requirement being the annual T5 filing. |

| Impact on Retirement Planning. | Generates RRSP room and allows for establishing an Individual Pension Plan (IPP). | Does not generate pension room or align with IPPs, potentially affecting retirement savings outside of the corporation. |

| Flexibility in Payments | Less flexible, given the need for consistent payroll management – but can always be altered if need be. | More flexible, allowing for payment adjustments based on corporate and personal financial needs. |

| Loan Qualification (Mortgages, etc) | Favored by lenders due to consistent income documentation. In other words, it’s easy to show the bankers that you can make a consistent payment (which is a big deal when it comes to all the bureaucratic paperwork). | Often seen less favorbly by lenders due to perceived income inconsistency. This is especially true in the early years of a business or if the business has substantial differences in differences in dividend payments from one year to the next. |

How to Pay Yourself a Salary from Your Corporation

We’re going to dive into each of these considerations in due time, but first let’s take a quick look at the basic mechanics of how to pay yourself a salary from your corporation.

- You need to set up a payroll account with CRA as part of your bookkeeping.

- You can use a payroll service to calculate remittances or just use a ledger with basic e-transfers or cheques (but then you have to manually calculate the remittances).

- Decide on the amount per month that you wish to receive in salary.

- Factor in that you will have to pay personal tax rates and CPP on this salary amount.

- Decide if you want to contribute to Employment Insurance (EI) – discussed in full later in this article.

- Confirm that you are remitting your payroll taxes, as well as both the employer and employee amounts of your CPP.

- Issue a T4 slip for yourself at the end of the year (as you will obviously need this for personal tax preparation).

- You can then deduct your salary as a business expense. Some CCPC owners pay themselves a salary that “uses up” pretty much of all of the earnings for their company – thus eliminating the need to pay any corporate tax at all.

How to Pay Yourself a Dividend from Your Corporation

Some business owners opt to get at least some of the money out of their corporation by paying themselves a dividend. In the case of CCPCs with less than $500,000 in profit, the dividends you will pay yourself will always be referred to as non-eligible dividends.

Here’s the step-by-step for how you would pay yourself a non-eligible dividend from your corporation.

- Make a profit (duh).

- Pay corporate tax to both the provincial and federal governments.

- Create a board of directors resolution that states the amount of the dividend, that the money is an non-eligible dividend, and the date it is to be dispersed. (This sounds like a bigger deal than it is, for most small business CCPCs the board of directors is simply one director – the owner.)

- Record the dividend declaration in your corporate minutes.

- Issue the cheque or e-transfer for the agreed-upon dividend amount.

- Issue T5 slips at the end of the year.

- If you intend to use income sprinkling strategies amongst your family members, make sure that you review the rules regarding Tax on Split Income (TOSI).

I should also note that when you pay yourself a salary, you can automate a lot of the process, including setting aside your taxes each month. This makes it relatively easy to keep track of what you actually have to spend after-tax every month and overall for the year.

On the other hand, if you pay yourself non-eligible dividends during the year, then you have to make sure to be setting aside enough money as you go, so that you can pay the lump sum tax bill that occurs when you remit the corporate tax, and are then subsequently hit with a potentially large personal income tax as well.

Corporations and individual taxpayers often end up paying tax installments over the course of the year to prepay the expected tax owing for the year ahead. Although these are not required payments, if you don’t pay and you owe tax, CRA will assess you with installment interest.

Tax Integration – Better Off Paying Dividends or a Salary?

As we discussed in last week’s article, the whole point of the corporate tax code in Canada – and the confusing twists and turns it takes with “gross ups” and tax credits – is that you will end up with the same amount of money in your pocket no matter if you pay yourself a straight salary (with the full amount of the payment now subject to income tax), or if you first pay corporate tax, then pay yourself a non-eligible dividend, and then finally pay income tax on the non-eligible dividend amount.

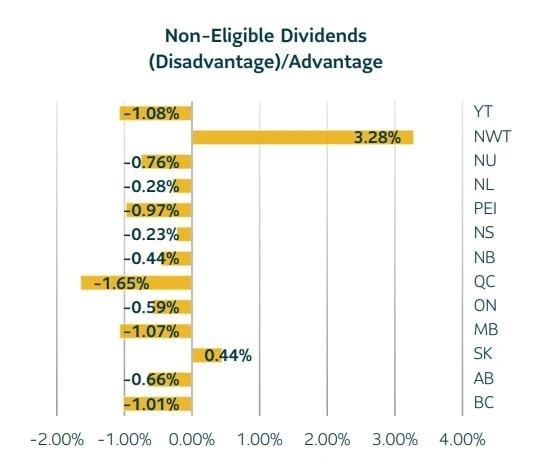

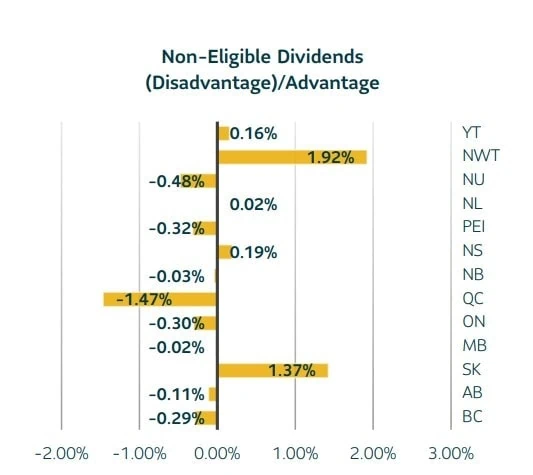

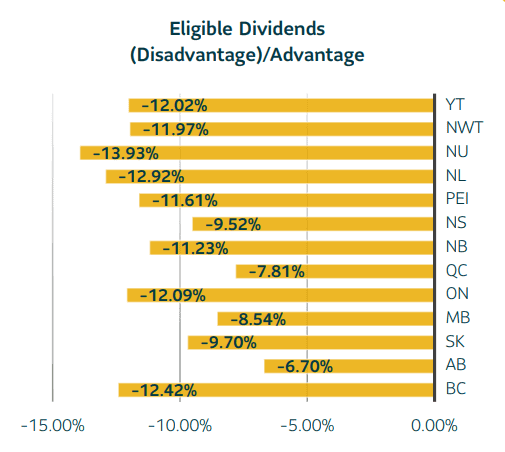

The government has gotten pretty good at reaching this goal, but as we can see below you’re likely slightly better off paying a salary over paying dividends out of your small business.

A smaller salary advantage at the $50,000 tax brackets (results are very similar at $100,000).

Now – just for context – it should be pointed out that if you own a CCPC with profits over $500,000 – and consequently are hit with the higher corporate tax rate on everything over the half-million mark – you are still likely better off paying salaries.

Overall, while there is likely (depending on your province) a small tax advantage from paying salary over dividends, the tax considerations are not likely to be the main factors in your decision.

Paying a Salary to Get CPP (Probably a Good Idea!)

So if taxes aren’t that big a deal due to tax integration by the government – what do most salary vs dividend decisions ultimately come down to?

For most small business owners, it comes down to how they feel about the Canadian Pension Plan (CPP).

Notice how I specifically stated, “how they feel” and did not mention the actual math.

The vast majority of small business owners who I talk to have an opinion about CPP that is either 100% dependent on short-term thinking, or is based on a complete disregard for the math involved. Many of these business owners opt to take money out of their corporation using mostly dividends because it completely avoids paying CPP. Amongst this crowd you will often hear confident statements such as:

“Why would I pay tax when I don’t have to? With the new CPP rates I’m paying an extra 12% tax if I pay myself a salary! That’s ridiculous – and I don’t believe that the CPP will even be around in 50 years when I need it! Plus, I’m pretty sure I can do better just investing the money myself – maybe I’ll even do that within the corporation and then it’s like my corp is one big RRSP!”

A lot of those statements feel true in a very powerfully-emotional way.

But alas, almost the entire statement is wrong. Here’s a quick correction of these common myths:

1) The CPP is not a tax. The Canadian Pension Plan is sort of like a private investment account that the government manages for you. Your specific contributions are noted each year, and you will be paid back a corresponding amount when you choose to begin receiving CPP. I provide the full CPP details here.

The CPP is not paid out of general tax revenues and your CPP payments are definitely not a tax. If you were under the impression that the CPP was paid out of general tax revenues, then you might be thinking of the Old Age Security (OAS) program, which is a very different kettle of fish.

2) The “new CPP” means that both the employer and employee will each pay an amount of 5.95% of their salary into the CPP up to a certain threshold known as the Year’s Maximum Pensionable Earnings (YMPE). For self-employed individuals that means an 11.9% non-negotiable CPP payment if you pay a salary.

3) The CPP will most certainly be around in 50+ years. See my article for more details. This isn’t a debate.

4) Statistically speaking, you’re unlikely to do better investing on your own than paying into CPP. This is especially true if you’re doing it within a corporate account where taxation will slowly chew away on your returns. We’ll get fully into this debate next week when we discuss passive income in your corporation.

So, is it always a slam dunk to pay yourself a salary in order to pay into CPP and get the slight tax integration benefits?

Not always… but probably.

Here’s a few relevant thoughts for small business owners when it comes to the CPP and contributing 11.9% per year.

- Remember that the employer portion (5.95%) of CPP is a pre-tax deduction to the corporation. That means the employer doesn’t have to pay corporate tax on the amount of CPP that they pay – plus, you (as the employee) don’t have to pay immediate taxes on the money like you would have to if you took it out as a non-eligible dividend. So, it can be argued that the “net employer + employee CPP amount” is substantially less than it first appears.

- The employee portion of the CPP generates a tax credit – and if the salary is high enough to generate an enhanced CPP amount, it also generates a tax deduction. That tax deduction becomes more valuable the higher your marginal tax rate is, but ballpark savings on this tax credit + tax deduction is $800-$1,000.

- If we simplify the above considerations as much as possible, we could say something like, “On paper it looks like the CPP is going to cost you about $8,000 per year, but once we take into account all of this tax stuff, it’s as if you’re investing $8,000-worth of future CPP benefits – but actually only paying about $5,300.”

But will you be able to beat the CPP by investing the money on your own?

Like I said… probably not. Here’s why:

- Human beings are just really bad at investing. Read my article on the best all-in-one ETFs in Canada for proof that generally we do pretty badly investing on our own.

- The CPP Investment Board (CPPIB) is actually pretty good at investing. They’ve achieved a 9.4% return over the last 10 years, while investing in less volatile (less risky) assets than a 100% stock portfolio. The investment performance of the CPP isn’t actually that relevant to how much you will get paid, but it’s comforting to note that this performance blows away what the average investor in Canada gets (and certainly blows away the average mutual fund return).

In order to know what your personal return on your CPP contributions is going to be, we’d have to know the exact date that you’re going to pass away. We also have to know if you deferred your CPP and how much you personally contributed each year. Ben Felix recently wrote about how to measure the Internal Rate of Return (IRR) for your specific situation. Long story short, you’re likely to end up with a real IRR of somewhere between 2 and 3.25%.

Remember – that’s a real return (which means that it’s the return over and above inflation). If we assume an inflation rate of 2.5%, that’s a nominal return (“nominal” is how most people think about these things – it means we’re not factoring in inflation) of up to 5.75%. Financial planners’ expectations for a portfolio split between stocks and bonds is about a 3% real return. You could get a higher number than the average CPP IRR by going with an all-stock portfolio with low fees, but that’s also a much riskier proposition when you consider sequence of returns risk.

- Felix is only the most recent Canadian commentator to point out that CPP is an automatic hedge against inflation risk (what if inflation skyrockets?), sequence of returns risk (what if I retire right before the market collapses?!), and longevity risk (what if I live WAY longer than the average person?). Because the CPP can protect against those three big-time risks – that makes it a pretty great overall product.

- The CPP also provides disability and death benefits – plus, depending on you and your spouse’s unique CPP contribution details – a significant amount of your monthly CPP payment could be transferred to your partner upon your death.

- CPP is likely to be more tax-efficient than taking the money out when you are in your prime working years simply because you’re likely to be making less money in retirement, and consequently be in a lower tax bracket.

Against all of those advantages, you have the counterpoint that it is certainly possible to take every penny of the 11.9%-of-your-salary-CPP-contribution that you avoided paying, and gainfully invest it on your own.

If you were to pass away at a young age, you would most definitely be further ahead to have been ignoring CPP and investing the money on your own.

BUT

Given all of the above, I think it’s very logical to say that from a planning perspective (where future date of death is unknown) 90%+ of Canadian small business owners (probably 98%+ of those in good health) are better off taking at least $73,200 in salary and paying the full amount of CPP in 2024. This is especially true if your CPP contributions help you feel secure enough to take more risk in your personal investment portfolio.

I know that I personally feel much safer with my 100% equities portfolio due to my relatively small teacher pension (I taught 10 years in Canada) and past CPP contributions. If I didn’t have these government-backed assets in place, my risk tolerance would be decisively lower.

Paying a Salary to Get RRSP Contribution Room & IPPs

Where the owner of a corporation should invest the money they are saving for retirement is a complex discussion.

It is made even more tricky by the fact that there are a lot of people out there who want to use this tax complexity to say, “Hey, here’s some random scary tax stuff – please be very afraid – now here’s the cure for this fear… it’s permanent life insurance and the insurance company pays me [the seller] a LOT of commission when I sell it to you.”

We’re going to really dig into the topic of whether to invest your retirement savings (inside vs outside your corporation) next week. But for now, let’s focus on the fact that you don’t get the option to invest within an RRSP or an Individual Pension Plan (IPP) if you don’t pay yourself a salary.

Since it’s impossible to know the future for certain, we don’t know how much money your company will make, or what portion of that you’ll save and invest. Because of that inherent variability, financial planners usually advise people to take at least some money out of the corporation each year and invest in their RRSP (if they take salary) and TFSA (just because TFSAs are the flexible swiss-army knives of financial planning).

There are many reasons for this, but the basic idea is that getting some money and investments on “your side” of the corporate fence (with your CCPC being on the other side) gives you a lot more options when you begin taking money out to fund your retirement.

The RRSP contribution limit for 2025 is 18% of earned income up to $32,490. This means that if you are in the fortunate financial position of being able to max out your RRSP, you would have to pay yourself a salary of $180,500 in 2024. Then there’s the option of a spousal RRSP to consider as well.

An Individual Pension Plan (IPP) is often held up as an alternative to an RRSP (especially for folks over 40). Again, we’ll get more into this next week, but for now, just know that much like the RRSP, you can’t use this tax-deferred account without paying yourself a salary.

Dividends and Salary for Family Members

If you’re like most business owners, you’re looking to pay the least amount of overall taxes for your family as possible. This often involves some version of income splitting, and in the past it was often referred to as “income sprinkling” in regards to shifting business income to multiple family members.

In 2018, the Canadian government made substantial changes to the rules around business owners paying dividends to family members. You’ll want to pay specific attention to the Tax On Split Income (TOSI) rules.

That said, if planned correctly, it can still be very advantageous to shift business income into the hands of a spouse, or even children, if they have very little income coming in from other jobs.

The idea here (as with all income splitting) is that if your company is making enough money where you’re getting into those relatively high tax brackets (right around $100,000) then you can save a substantial amount of money by having other family members declare that income (and pay a much lower tax rate) as opposed to claiming it all yourself. This “income planning” is true whether we’re talking about payment with dividends or salary.

When it comes to developing a long-term strategy for corporate compensation, saving, and investing, I definitely recommend getting a second opinion on your plan from a fee-only financial planner with experience in working with business owners. The rules around corporations and sprinkling profits to family members are still being interpreted and you don’t want to fall on the wrong side of that. It can make a big difference depending where you save your extra cash flow and how much you put aside.

Here are a few rules to keep in mind when you start planning how to best allocate small business income to family members:

- A salary paid to a spouse or child can be a great deal for your company, as it is a business expense. BUT – you must make sure that salary is being paid to the family member (with specific payroll records to back this up), that the work is necessary for the business to earn income, and that the salary paid is at the market rate.

- With the new TOSI rules in 2018, splitting a corporation’s income through dividends to family members has become more difficult. Now, in order to send dividends to a family member, if the business owner is under 65, in most cases that family member has to work at least 20 hours per week for the company, in addition to owning shares in the company – or else those dividend payments will get taxed at the highest rate.

- Paying yourself a salary and then contributing to a spousal RRSP might make more sense (and be less risky in terms of tax planning aggressiveness) than worrying about TOSI-compliant dividends. Be mindful of the spousal RRSP attribution rules if your spouse withdraws from a spousal RRSP and you have contributed to it in the past 3 years.

Salary or Dividends If I Need to Get a Mortgage

It can be easy to overlook the more practical considerations of day-to-day life when you’re up to your eyeballs in running your company, and then working your way through the salary vs dividend tradeoffs that we discussed.

One area that has tripped up many entrepreneurs is getting approved for loans (especially mortgages). This has to do with how risk-averse financial institutions are, and the potential variability of your income when you run a small business.

My wife and I are teachers. Lots of people aren’t big fans of teachers – but one place that loves us is the mortgage department at the bank.

See, teachers are boring – banks love boring.

We check all of those bureaucratic lending boxes when it comes to easily-verifiable income, and once we have a permanent gig, it takes something pretty drastic to prevent those paycheques from coming in. It’s not like our employer can go bankrupt after all.

Business owners are often the exact opposite. They can have good years, bad years, or years where they put a fair amount of money in their pocket – but due to deductions, it doesn’t appear like they made much profit on paper.

If you intend to purchase a house in the next few years (or plan on borrowing for another large purpose), you’re likely going to want to prioritize creating a steady salary. The lenders will love this steady cash flow, and it will clearly show that you can pay the bills over the long term.

That’s not to say that there isn’t a lender somewhere that will work with small business owners, or even that the owners who prefer to receive dividends instead of salary can’t get a mortgage.

It’s possible – and it depends on many other variables. Does your significant other have a “T4 job” with easily-verifiable income? How is your credit rating? The bigger your downpayment is the more flexible the lender can be with you.

But all things being equal, what you should aim for in the situation where you’re a small business owner saving up to buy a house, is to consider how much money you’ll be needing for the down payment, and then begin taking that money out of your corporation in a tax-efficient way. You want to avoid taking it all out the month before you need the cash, as you’re going to end up paying much higher tax rates versus what you would have had you taken it out over several years.

Dividends vs Salary for CCPCs – FAQ

What is the Best Way to Pay Yourself from Your Corporation?

The truth is that there are so many different variables to take into consideration when it comes to optimizing the payment of salary or dividends to your private accounts, that it’s difficult to even give rules of thumb.

To be 100% honest with you, that’s why I work with an accountant despite writing articles about personal finance! If you read my article on the best financial advisors in Canada then you know I’m a big fan of Jason Heath and his team at Objective Financial.

I’ve sent dozens of small business owners his way (everyone from plumbers to doctors, carpet cleaners to lawyers) and for a transparent price – quoted upfront – all of them have been very happy with the impartial advice that they have received. You can schedule a chat with Objective Financial (and have them optimize a salary vs dividends strategy for your small business) by clicking here.

If I were to to describe a good place to start the dividend vs salary discussion, I would probably go with the following principles:

- If you’re still early in your career and/or you haven’t saved $50,000+ to invest within your corporation, then I would default to paying myself through salary.

- Paying CPP will hurt in the short run, but for the majority of small business owners it will be a great decision. Even for expert DIY investors who are comfortable cutting costs, riding out the volatility of an all-equity portfolio, and aren’t intimidated by trading in a brokerage account, I still think there is a ton of value to having such a safe inflation-protected asset that is so easy to put in place.

- On balance – especially early in a career – I really like the flexibility that comes with taking a salary and putting money into an RRSP and TFSA as opposed to investing passive income within the corporation. This will make more sense after next week.

- Paying a family member a salary is a much easier way to income split company profits than trying to get to the 20-hours of work per week needed for dividend income splitting.

- If you need a mortgage in the next few years, this alone might be enough to tilt to salary over dividends.

- Paying salary means all your personal tax is taken care and you may get a tax refund at year end if you contribute to your RRSP or have other tax deductions or credits. If you pay yourself dividends, you are more likely to owe personal tax and get into the loop of having to pay CRA quarterly tax instalments.

Based on those principles, I think it’s fair to say that as a baseline assumption, I lean towards advising most Canadian small business owners to go with a salary over dividends. Now, it’s not an either/or decision, and the more money your company makes, the more complicated this decision gets. But it’s very important not to allow a lot of the myths around CPP contributions to cloud your overall judgement about the salary vs dividend decision.

If you are fortunate enough to have a company that is producing substantially more profits than you need to fund your lifestyle every year, then the dividend vs salary comparison is going to require more squeezing for the full glass of less-taxed juice.

Tune in to my next article to explore how to get really creative with dividends and salary once you start retaining a lot of profit within your corporation and aren’t taking out most of your earnings every year to pay the bills.

Great summary – looking forward to next week’s installment as I’ve always grappled with this question. I did pay myself a salary and contribute 2X to CPP based on advice from an accountant years ago. I still think it’s the right decision because the CPP is “guaranteed” and adjusted to inflation. It’s a good hedge down the road when my DIY capabilities might wane.