Market Predictions for 2025

It’s that time of the year when all the financial geeks submit their market predictions for the new year (usually far in advance so that they can start their break early). But I always wonder what happens to these orphaned articles and predictions…

Do they get put out to pasture?

Do they get sent to the glue factory?

Certainly, in the vast majority of cases, they are never heard from again! (Especially if the predictions didn’t come true.) “But I’m not like the other boys and girls”… Before we get to market predictions next week, I’m going to be accountable to dedicated MDJ readers. For clarity, I copy and pasted my exact predictions below (which you’ll see in italics) and then my self critique will be in regular text.

So without further ado, here are my 2025 market predictions revisited!

Prediction: Trump’s Tariff Threats Become a Reality

One of the most pressing questions for Canadian businesses in 2025 is whether the newly elected U.S. president will follow through on his promises of large tariffs on Canadian imports.

Trump’s fixation on trade deficits could lead to a significant shake-up in the global economy. He appears intent on generating tariff income to support the legislative groundwork for corporate tax cuts. His “national security” justification may lack substance, but it could still trigger sweeping trade policies.

I don’t actually believe that Mr. Trump understands how trade wars actually work, and he hasn’t cared to learn anything new in several decades. So the hopes better angels will talk him out of this are perhaps misplaced.

I believe even more strongly that the President-elect doesn’t understand how trade balances work, and consequently, he does not understand that in buying goods from Canada with a strong US Dollar, his constituents (US consumers) are winning! There is no “subsidization” of Canadian business going on here.

While a blanket 25% tariff on all Canadian goods seems unlikely, a more targeted 10-15% tariff on non-energy products feels probable. If that happens, Canadian businesses would face a challenging environment, and retaliatory tariffs from Canada could escalate tensions further.

My guess is that we’ll see some major disruption in Canadian manufacturing, with supply chains snarled, and some factory commitments being delayed indefinitely as companies decide to move more operations within the USA for the next few years at the very least. I’d also be pretty worried if I was a farmer and/or worked in the dairy industry. Some of these tariffs might come off when the overall North American trade deal is finalized in a couple of years (and once a new government resets relations with the Trump administration), but for now, Trump will get two things he wants:

1) More money in his budget to offset corporate tax cuts.

2) Leverage in the upcoming larger overall trade negotiations.

Maybe I’m wrong and some positive news headlines and photoshoots will be enough to shift the Trump team’s focus to taking over South America or something like that. But I wouldn’t bet on it.

Grade: A

I’m going easy on myself with this first grade. Remember, back in mid-December 2024, Trump hadn’t yet revealed his crazy tariff board, or threatened to conquer Canada yet. I would say the prevailing sentiment was that he would put some tariffs on China, and then one or two relatively minor tariffs on Canada like he did in the first administration. I thought it was going to be a lot more series than that…

…. And it was.

Trump didn’t waste much time turning his tariff threats into actual policy. Early in 2025, the White House announced a 25% tariff on most Canadian imports, alongside a 10% levy on energy products. The move was alternately referred to as a “national security measure” and as a “fentanyl tariff” – which is of course ridiculous. Canada responded with its own counter-tariffs within days, which set the tone for the rest of the year.

By mid-summer, the U.S. raised rates again, up to 35% on non-CUSMA goods and as high as 40% on goods routed through third countries. Companies didn’t have time to fully unwind supply chains, but they definitely paused expansion plans. Manufacturing groups in both countries told reporters that investment decisions were “on hold” until the political climate cooled.

Here’s the part most investors missed. A huge chunk of cross-border trade is CUSMA-compliant, and those goods stayed exempt. That blunted some of the worst-case scenarios you might have seen in headlines. But sectors without that protection such as lumber, autos, steel, and aluminum are getting hit hard. As we head into the holidays, it appears that potash is now in the crosshairs.

Overall:

- Supply chains around the world have been disrupted.

- Trump still doesn’t understand how economies work, as evidenced by the falling numbers of employees in US manufacturing (because of, not in spite of the tariffs).

- He did want leverage in CUSMA negotiations.

- He constantly references the tariff revenue and uses it for cover the absolutely massive tax break for rich people that was passed early in 2025.

- Non-energy exports did get hit a lot harder.

- I don’t get the A+ because the actual real tariff rate today (after ALL goods are accounted for) is around 6-7%. And really, what is more 2025 than “6-7 tariffs”?

Prediction Inflation and Interest Rates Trickle Down

Inflation concerns dominated much of 2024, and they’re not going anywhere in 2025. A combination of tariff-driven price increases, corporate tax cuts, and a booming U.S. stock market could fuel spending, driving inflation higher once again.

If inflation climbs above 3%, mortgage rates will rise, and the U.S. dollar could continue strengthening – which is ironic, considering Trump’s tariffs are aimed at reducing trade deficits. The stronger dollar will partially offset those same tariffs Trump is so intent on. With inflation on the rise, the U.S. Federal Reserve is likely to hold off on the rate cuts some investors have been hoping for.

With the US keeping rates higher, that is going to pressure the BoC to not fall too far out of lockstep.

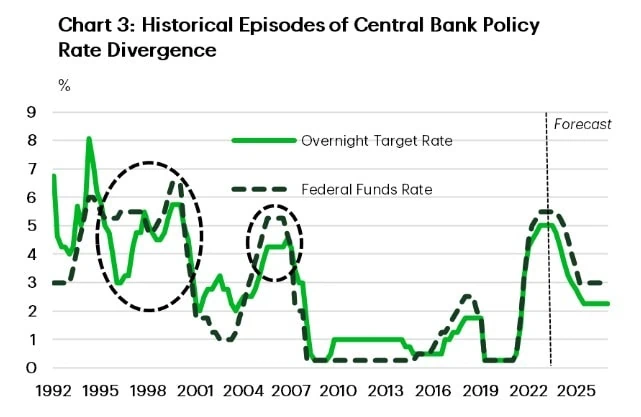

This chart from TD shows just how rare it is for the BoC and US Fed to diverge much on monetary policy. I don’t think high oil prices are going to save the loonie this time around – which means if the Canadian Dollar starts to free fall vs the USD there is going to be a ton of pressure on the BoC to lay off further interest cuts. That all could result in Canadian mortgages and interest rates staying higher for longer as well (but they would still be lower than down in the States).

Grade: B+

One big theme in my 2025 predictions was that inflation wouldn’t just roll over, and that for as long as prices stayed stubborn, central banks wouldn’t feel as free to cut rates. That part wasn’t off the mark (much to President Trump’s chagrin). U.S. consumer prices printed at around 3.1% year-over-year late in 2025. That’s obviously higher than most economists are comfortable with.

The Federal Reserve did end up cutting its policy rate a few times in 2025 as broader economic data softened, even if inflation remained above the long-run 2% target. It certainly doesn’t sound like Fed Chair Jerome Powell is eager to cut rates at the moment, and high mortgage rates have had a pretty big impact on the US housing sector.

In Canada, inflation stayed closer to target – around 2.2% – but still didn’t encourage the Bank of Canada to continue after a series of earlier rate cuts. By year-end, the BoC held its overnight rate at 2.25%, citing resilience in the economy and lingering uncertainty around trade and price pressures. That meant mortgage pricing stayed relatively elevated compared with pre-pandemic levels.

With the Canadian housing market feeling a pretty good pinch due to increased interest rates the last couple of years, I bet there are more than a few realtors out there hoping that inflation continues its downward trajectory sooner rather than later.

Prediction: A Split Year for Stock Markets?

The first half of 2025 could ride the momentum of post-election optimism. Both Canadian and U.S. markets might see gains as investors revel in the economic “sugar high” of a Republican sweep. Positive sentiment and AI-fueled enthusiasm could push valuations even higher, especially in the tech sector.

But the second half of the year might tell a different story. The combination of tariffs, a strong U.S. dollar, and stretched valuations could start to weigh on corporate earnings – particularly in the U.S. Tariff impacts could also ripple north of the border, dampening profits for Canadian companies reliant on exports.

Right now, large sections of the US stock market are priced for perfection. The valuations are high because expectations that earnings will grow are also quite high. If those earnings projections start to go south, investors could turn skeptical in a hurry. I think there is a pretty good chance this happens at some point in late 2025.

That said, you’d be right 65-75% of the time if you predict the stock market will go up every year (which is probably a much better shooting percentage than most prognosticators have)! So, if forced, I’d say that overall, the markets will be up in 2025. The more positive news we get on tariffs being a bluff, and US inflation coming down, the better it will be for stock markets and to a lesser degree, commodity markets as well.

Grade: B

I got it exactly right – just completely backward!

In all seriousness, I have no idea how to grade this prediction. I got the following right:

- There was an initial stock market sugar high.

- Tariff shock did absolutely lead to a market collapse.

- Stocks did ultimately recover and were positive for the year.

- The more tariffs were removed, and the lower inflation got, the better it was for stock markets.

- AI valuations continued to drive the main stock market narrative.

BUT!

- I didn’t come anywhere close to the 16%-ish gains of the S&P 500 or the 24%-ish gains of the TSX 60 up in Canada.

- Definitely didn’t see gold and silver going nuts.

Here’s what the Canadian and US stock markets looked like in 2025:

Prediction: The Return of Canadian Dividend Stocks

When anxiety creeps into the markets, cash-flowing companies such as Canadian moat stocks tend to shine. Canadian dividend stocks, like utilities and pipelines, could see renewed interest, especially if falling interest rates make their steady payouts look more attractive.

Investors may also turn to dividend-paying banks and insurance companies, which make up a significant portion of the Toronto Stock Exchange. Lower borrowing costs often translate into higher profitability for these sectors, offering reassurance to patient investors.

As Canadian GIC rates dip below the highs of 2024, yield-hungry Canadians may find it harder to replicate guaranteed returns, making dividend stocks an appealing alternative.

Grade: B+

It’s not like Canadian dividend stocks were that much better than any other stocks in 2025, but they held up pretty well. Canadian Dividend ETFs such as ZDV and XDIV were up over 20% in the year, while throwing off a 3% dividend. The NASDAQ (which is a pretty good bellwether of “flashy, non-Canadian dividend” stocks) was up by an almost identical amount in 2025 – without the benefit of a steady dividend stream.

Other low risk investments like high interest savings accounts and GICs did see their interest rates continue to get slashed as the year went on – but I don’t know if there was a real flight from safety-first to Canadian dividend stocks. With the big telcos in some trouble, it might have taken some shine off the dividend-specific talk for now.

Prediction: Canadian Housing Prices Under Pressure

Housing prices in Canada may face headwinds in 2025. While a 6.6% rise has been forecast by CREA, I’m skeptical. With bond rates not falling as quickly as the Bank of Canada’s rate cuts, fixed-rate mortgages may not drop to levels that entice buyers.

The CREA is always trying to come up with reasons why RIGHT NOW is the most advantageous time to buy a home. Unless rates keep falling, I don’t see why Canadians will feel a big rush to buy houses, or to sell homes that they have better mortgage rates on (or perhaps a completely paid off mortgage).

Add in decreased immigration targets and more negative consumer sentiment, and buyers will continue to hold the upper hand in major markets. The condo market, in particular, might feel the pressure as inventory levels remain elevated.

Grade: A

I pushed back pretty hard on CREA’s call for a 6.6% rise in Canadian home prices in 2025, and in hindsight that skepticism was proven entirely correct. Average home prices were down about 6% in 2025, with active listings up twelve months after I wrote my predictions. There was some regional variation to be sure, but overall, my call for stagnation was pretty bang on.

While the Bank of Canada did begin cutting rates, fixed mortgage rates never fell far enough to meaningfully improve affordability. Bond yields stayed elevated, and that kept borrowing costs high for anyone needing a new mortgage.

The other dynamic that mattered more than most forecasts acknowledged was psychology. Homeowners who locked in ultra-low rates years ago had very little incentive to sell, while buyers didn’t feel pressure to stretch at today’s prices. That standoff kept activity muted across much of the country, despite plenty of optimistic headlines predicting a rebound.

Condos were the clearest weakest spot. Inventory stayed high, investor demand cooled, and downward price pressure showed up faster than in detached homes.

Prediction: Oil Prices: Stuck Below $75 US

The global oil market isn’t showing signs of recovery anytime soon. With U.S. production continuing to rise and OPEC nations reluctant to slash supply further, a surplus could keep prices below USD $75 a barrel.

Meanwhile, sluggish demand from China means there’s little hope of soaking up the excess inventory. Unless there’s a major geopolitical disruption, we don’t foresee significant upward movement in oil prices.

As always, Saudi Arabia – and to a lesser degree, the rest of the OPEC+ nations – will largely control the price of oil. If they get sick of the US gobbling up their market share they could very easily decide to increase it.

Grade: B+

I know I’m coming across as an easy grader, but I think this prediction stands up pretty well too! While cruise did peak early in the year at around $80, it spent 97%+ of days below the $75 level that I felt would be the ceiling.

OPEC+ talked tough, but the reality is they never cut supply deeply or consistently enough to force a sustained price breakout. Saudi Arabia still controls the market, but only if it’s willing to give up market share for an extended period. In 2025, that simply didn’t happen. At the same time, demand growth from China failed to materialize at levels bulls were hoping for.

Prediction: Tesla Shares Will Collapse At Some Point

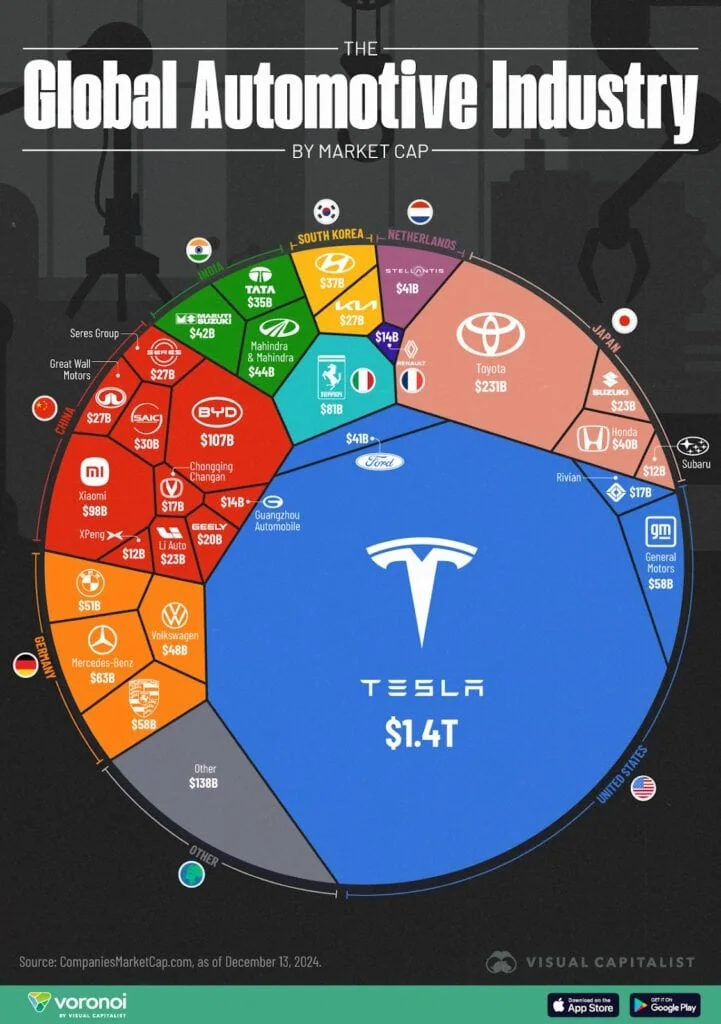

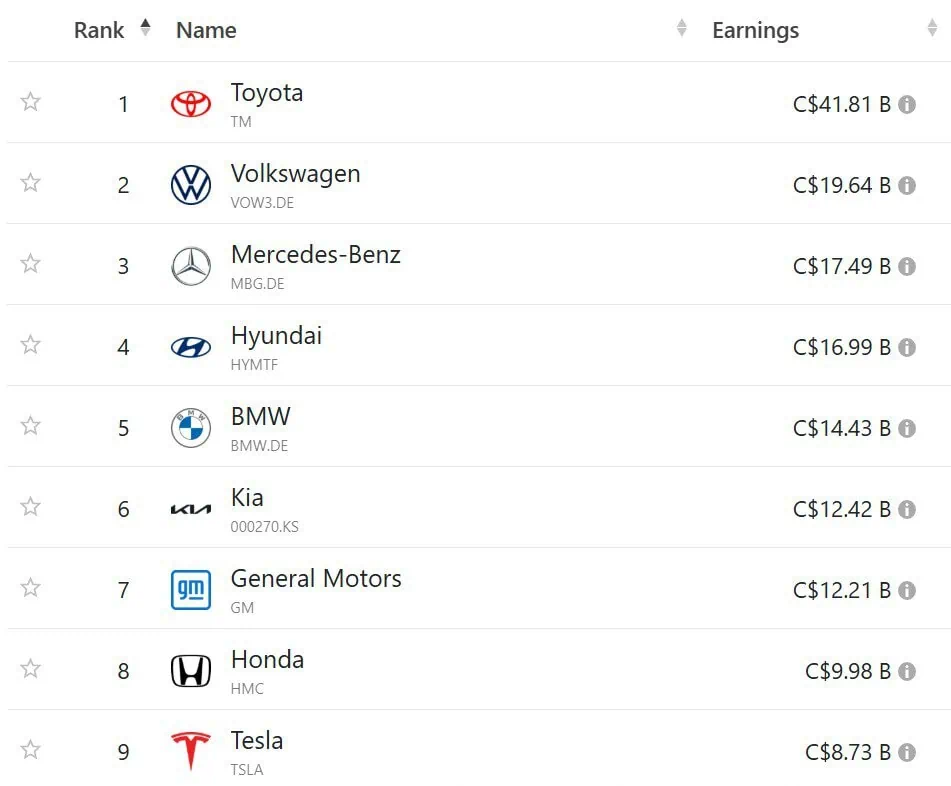

Look, I don’t know if investors will come to their senses in 2025 or another time in the next few years – but at some point, someone is going to ask if Tesla is worth more than all the other car companies combined. This is what the current map of vehicle manufacturers looks like when it comes to market capitalization.

Meanwhile, here is what the profits of those car companies looked like over the last 12 months.

You don’t have to be an investing genius to figure out those two graphics don’t make a lot of sense when considered together. Sure, I get it, Elon is best buddy to the guy in charge. I just don’t see how that adds up to folks buying more Teslas. In fact, I’d argue that it is an awful branding move with the exact demographic of folks who want to buy Teslas!!!

With Musk splitting his time between several companies and leading government departments that aren’t actually official government departments, I don’t see a lot of reasons to believe Tesla is going to continue to grow earnings exponentially.

I’m not saying the company will go bankrupt or anything. I think their cars are still an excellent product and their charging system is an incredible asset. I’m excited about their commitment to producing a lower-priced model in 2025. I just don’t think the company is going to make more money than the rest of the world’s car makers put together! Right now, Tesla’s P/E is about 120x. That’s just way too high – and it’s pretty simple math.

In fact, I’d argue that Tesla isn’t even the most promising of the new car makers out there stealing market share from the traditional leaders. Over at my Moneysense column, I’ve been writing about how great the BYD (Build Your Dreams) car company is for a couple of years now. They first got on my radar when I found out Warren Buffett owned a substantial part of the company.

I think BYD is a massive threat to Tesla’s worldwide sales – in fact, it’s already bringing in more revenue than Musk’s baby. The 100% North American tariffs on Chinese EVs will ensure Tesla keeps their dominance in our market (and ensures we pay more than we have to for EVs), but the rest of the world is quickly waking up to the fact that Tesla isn’t the only EV-maker in town. And that doesn’t even account for the increasing competition in the EV market, the reluctance of many consumers to switch to EVs, AND the fact EV subsidies are likely to go out the window in many countries in the next couple of years.

Grade: D

So I was doing pretty well…

You know what the funny thing is? I feel more confident than ever about this prediction going forward!

Here’s what the year looked like for Tesla shareholders:

So at one point when the stock went from $379 to $225 in three months, I looked pretty smart.

I look less smart today when the stock is up over $480 again (a 27%+ YTD return).

One thing is for sure: If I didn’t like the stock at a P/E ratio of 120x, I hate it at P/E ratio of 323x!

I correctly called the demise of Tesla as a car company. What I didn’t anticipate was the rise of Tesla as some vaguely-defined artificial intelligence + robotics company. Musk remains an elite salesman. I just don’t see where the profits are going to come from now that the USA has turned so anti-EV AND Elon has pissed off the rest of the world to the point where they won’t buy his cars.

As predicted, politics and increased competition have led to massive sales declines in much of the world.

It’s equally true that it hasn’t mattered a bit to Tesla’s stock price. It’s no longer a car company, it’s now a futuristic tech company that can change its story and plans whenever it wants to. I’m more and more sure the math is eventually going to catch up to Tesla – but it didn’t happen in 2025!

Stay Tuned…

Looking back at these 2025 market predictions, I’m pretty comfortable with how they held up. Not because everything was perfect (it never is), but because the underlying thinking was proven mostly correct. That’s been true not just here on MDJ, but over the last few years of writing market outlooks at MoneySense as well (they’re still on the web if you want to see my track record). When I’ve been right, it’s usually because I focused on what actually moves outcomes, not because I have some ability to see the future.

That said, let’s be very clear about something. A lot of this is luck. Forecasting markets over a single year is a dangerous game, and anyone who tells you otherwise is selling something. I don’t take responsibility for active stock picking, and I don’t think readers should be building portfolios around yearly prediction pieces. These exercises are about understanding market forces and probabilities, not about making heroic bets.

If there’s one consistent lesson from reviewing these predictions, it’s that boring still works. Diversification, reasonable expectations, and an understanding of incentives beat clever forecasts every time. Markets don’t reward activity… they reward patience.

I’ll be back next week with my 2026 predictions. Not because I think I’ve cracked the code, but because it’s a useful way to stress-test assumptions, challenge popular narratives, and remind ourselves how messy this stuff really is!

Every blogger or so-called expert should do a predictions recap. Love it! I finally ditched my advisor this year. He predicted 5% growth. Happy to report 17% growth in a ‘volatile’ market. And no more silly advisor fees.

I share the same observation about Tesla. At the end of the day, an EV is a car that moves people from A to B. Sooner or later, traditional car manufacturers and EV-centric new comers (like BYD and many other out of China) are going to figure out many versions of EVs that has good enough mileage and various functions and features that cater different demographic. And Tesla’s well-designed models are but a limited choices of cars among the sea of EVs. It is NOT like the Apple’s iPhone vs. the rest of the phone world kind of situation. iPhone has a true first-mover advantage, which lies in their proprietory OS and well-gardended and highly “addictive” ecosystem, and they have not stopped (although to me they are also slowing down) leading the smartphone innovations. What is really critical to Apple’s success is, a phone is a device that gets all your attention. A car, on the other hand, is first and foremore a piece of “tool” that moves people. It is against the core function of this tool to have too much smart, IT features as that will at some point serve as “distraction”, sometimes even fatal distraction, of the main function. I personally value my safety much much higher than some fancy feastures offered by the Tesla. I even dislike its big touch screen because there are reduced mechanical controls and too much touch-only funtions that take my eyes off the road too much to be good on safety.

In any case, Tesla will become less and less of the only game in town, and people tend to value more choices, difference choices, due to the differetn asthetic tastes and function preferences from people. Tesla may continue to be a very profitable car company, but at current P/E ratio, it means buying its stock at current price will take 120 years to get back your money’s worth. It just really does not make much sense from an investment point of view and sooner or later investors are going to realize that. Must may be the president-elect’s darling right now but even if he is the president himself, it is only going to be 4 years right? 120 years are a lot longer than that!

A very well written piece. Thanks I enjoyed it immensely. Canadian immigration policy has taken what seems to be a 180 degree turn & future demand has to be affected for residential real estate. It will be very interesting for me to watch over the next couple years

Excellent article. Thank you for a balanced picture.