Investing In Canadian Wide Moat Stocks

I am a cautious investor given that I am in the semi-retirement stage. While I would acknowledge that growth is important for a retiree or near-retiree, I want most of our equity positions to be in the quality or high-quality camp so that I can sleep easy at night.

That’s why a portfolio that invests in wide moat stocks such as grocers, railways, and utilities – plus a couple of semi-wide moat stocks – are a great fit (and one that I have a lot of confidence in). This low-risk mix has offered me greater returns with less volatility.

Basically, I am looking to ‘win’ by having less stocks fail. I am looking to limit poor performing stocks or stocks that fail outright. This quest led to me researching how to invest in Canadian undervalued moat stocks. Obviously there is quite a lot of overlap with the top Canadian dividend stocks as well.

For high quality US dividend moat stocks, I largely use the Dividend Achievers Index as my filter. By browsing stocks in that index, I know I’m automatically looking at companies that have raised their dividend for ten years. I also generally skew towards large cap, as those companies are inherently more stable, with the trade-off being slightly less expectancy of outsized returns.

Our preferred service for doing that is Dividend Stock Rocks (DSR). It’s a subscription based service, specializing in dividends and improving portfolio performance. You can read our DSR review, or sign up and get 33% off by clicking the button below.

Finding Quality Moat Stocks in Canada

Canada is unique in that there are many very good dividend-paying companies that operate in an oligopoly situation. There is little competition and they are often protected by government regulators to boot. This is essentially the definition of a “moat stock”.

Here is a simple explanation of what moat stocks are courtesy of investopedia.

“A wide economic moat is a type of sustainable competitive advantage possessed by a business that makes it difficult for rivals to wear down its market share. The term economic moat was made popular by the investor Warren Buffett and is derived from the water-filled moats that surrounded medieval castles.”

Essentially, when someone says they are interested in investing in moat stocks, they are looking for companies that have a durable competitive advantage over the long term. While a technology company might very well get disrupted by another newer technology company, it’s much harder to supplant Enbridge’s pipeline, or CNR’s railway!

For moat dividend investments in Canada, think Canadian bank stocks, Canadian Dividend Telco stocks, Canadian Railway stocks and we touched on the Canadian pipeline stocks in that post that covered investing in Canadian energy stocks.

For moats you can also look to the grocers in Canada. In this post on Canadian retail stocks I suggested that you could certainly build your retail stock component around the grocers that dominate the Canadians landscape. Our top Canadian utility stocks would also fit under the general category of moat stocks in that they are essentially sanctioned monopolies.

Taking Dividend Investing to the Next Level

Dividend Stocks Rocks (DSR), is a highly recommended newsletter and product if you want to take your dividend investing to the next level . It has been managed by my fellow blogger Mike from the Dividend Guy Blog since 2013.

DSR is not just a weekly newsletter with stock picks. It’s a program that will help you manage your portfolio and improve your results. You can first read our detailed DSR review, or sign up now by clicking the button below.

The Canadian Wide Moat 7

Personally, for my RRSP portfolio (and the core Canadian equity component) I hold a concentrated portfolio of dividend moat/wide moat stocks. I do shade in some Canadian energy, and other commodities for inflation protection.

Here are the holdings for my personal Wide Moat 7.

Banks: Royal Bank of Canada, Scotiabank and Toronto-Dominion Bank

Telecommunications: Bell Canada and Telus

Pipelines: Enbridge and TC Energy.

| Canadian Moat Stock | Current P/E | Current Dividend Yield | Last 5 Years Share Price Performance |

| RBC Bank | 12.60 | 4.18% | 9.92% |

| Scotiabank | 11.00 | 6.64% | 2.07% |

| TD Bank | 14.30 | 5.08% | 6.49% |

| Bell | 21.00 | 7.81% | 4.91% |

| Telus | 41.70 | 6.25% | 4.71% |

| Enbridge | 16.50 | 7.81% | 6.87% |

| TC Energy | 19.60 | 7.12% | 4.90% |

I landed on this portfolio as I had held these stocks for quite some time. I realized that my core moat big dividend-paying companies were my best performing group. I am a big fan of passive index investing, don’t get me wrong, but I decided to mix that with this conservative, long-term conservative focus on Canadian dividend moat stocks that had a durable competitive advantage.

I did not purchase these stocks only based on the generous and growing dividends, but that is a welcome by-product of investing in very profitable companies that are able to grow earnings and free cash flow over time. The dividends come along for the ride. We can thank the moats (and the protected Canadian market) for that benefit.

Total Returns for My List of Canadian Wide Moat Stocks

While the dividends are wonderful (we’ll get to that next), in the end it will come down to the total returns. How much income can I create by way of dividends and selling shares? That is, total return. While dividends feel good, retirement funding success comes down to the total return and the risk level.

I get some nice yield and stability with my Wide Moat 7, but the portfolio growth engine is my U.S. stocks.

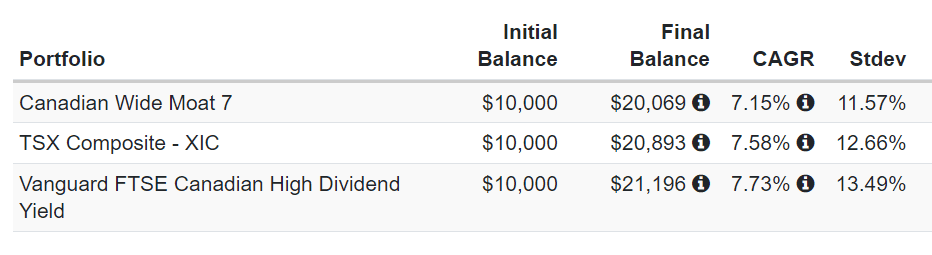

Here’s the Canadian Wide Moat stocks vs the Vanguard High Dividend Yield ETF (VDY) and the TSX Composite (XIC) as benchmarks. 10-year annual (CAGR) to the end of January 2024:

We see that the Wide Moat stocks have slightly trailed Vanguard VDY and the TSX Composite over the last 10 years. The high dividend stocks were outperforming for quite some time. But it should be no surprise that the high dividend space came under great pressure when inflation was unleashed and the Bank of Canada went on the most aggressive rate hike cycle in decades.

Higher yielding stocks can underperform in these conditions as they often carry higher debts (increased debt servicing costs) and they then compete with high interest savings accounts and the best GICs in Canada. Money leaves the space for those other risk-free options.

Best 2026 Canadian Bank Offer:

2.75% Everyday Interest Rate

Open an account with EQ Bank & get the best interest rates in Canada - 1% + 1.75% interest rate if you direct deposit your pay.

For a limited time, you also get $200 in cash when you add net new deposits to your registered savings accounts.

The best daily interest rates in Canada* and great rates for GICs - up to 3.85% guaranteed in your registered account. Get it by clicking the button below:

* Rates are subject to change ** Applies to both New and Existing clients who open a new account. ***EQ Bank Review: more details

Here’s the returns of the individual assets:

The Dividend Record

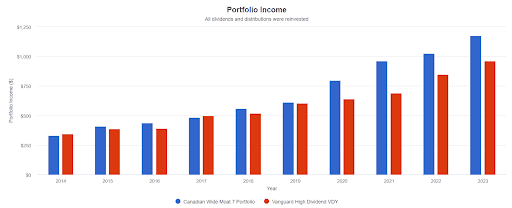

I’ve experienced no dividend cuts within the Canadian wide moat portfolio. We even had a perfect record moving through the pandemic. Most companies have continued to increase dividends. Here’s an analysis with a hypothetical $10,000 starting value.

In the above chart we see the starting yield of 3.45%. Over a decade that portfolio has thrown out a yield over 10% based on the initial purchases, with no reinvestment other than throwing those divvies back at each company that delivered them. The Wide Moat 7 has been superior to VDY for dividend growth.

Imagine that compounded growth over decades? That’s why you’ll see a lot of crossover between my personal Canadian Moat examples and our list of top dividend stocks in Canada.

Other Canadian Companies With Large Moats

I’ll be the first to acknowledge that there is certainly considerable concentration risk in a portfolio of 7 stocks. And that’s why I suggest Million Dollar Journey readers look to those aforementioned sectors if they choose to embrace the Canadian Dividend Wide Moat Investing approach.

You might add:

Grocers (they also offer pharma exposure): Metro, Loblaws, and Empire

Railways: CP Rail and CN Rail

Utilities: Fortis, Canadian Utilities, Emera, Northland Power,

As a unique add-on to these moat portfolio options, you might consider Nutrien and Cameco. These companies operate in very niche oligopoly-esque sectors (potash and uranium production) and both have long-term durable competitive advantage.

Canadian Moat Stocks FAQ

Better Total Returns and Even Better Risk-Adjusted Returns

I’ve long suggested to readers that they consider the wider moat route. To be brutally honest, I wish I had eaten my own cooking a little earlier in the game on that one.

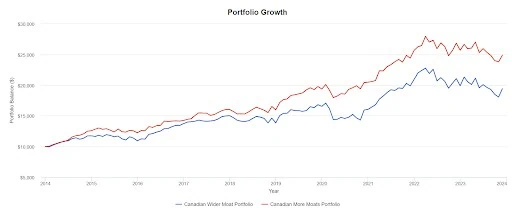

When I run the math, I find that there are better returns that have been offered with less volatility. That makes sense, as there are more sub-sectors to help with volatility and drawdowns in corrections. And while there are smaller dividends in the rails and grocers, there has been more dividend growth.

Certainly we give up some dividend yield by going the wider moat route, but the total returns would allow you to create even greater income in retirement by the combination of dividends and share harvesting.

And keep in mind that in retirement we would have to manage the sequence of returns risk. Here’s the performance of the “More Moats Portfolio” after we add in those grocers, railways and utilities. Perhaps I should have written, here’s the ‘outperformance’. It is substantial.

The More Moats also outperformed VDY and the TSX Composite. And the portfolio offers less volatility. Who doesn’t want greater returns with less risk?

Of course, this is a good time to add that past performance does not guarantee future returns. I like investing in Canadian moat stocks in our home market due to the strong oligopoly structures in place. It’s not great for consumers, but it’s tough to beat for risk-adjusted shareholder returns.

Is there a list of us stocks that would mirror this Canadian list of stocks?

Great article Dale, I hold your same 7 stocks and I love the total return on them yet i haven’t had the gut to pull the trigger on the low yield ones like CN or MRU , I know total return is the goal but I’m to addicted watching those juicy divis landing in my account monthly :)

For someone who doesn’t really want to spend the effort of maintaining a portfolio of individual stocks, is there an ETF that uses this approach?