Best Canadian Telecom Stocks 2026

Dividend earning stocks are appealing for a number of reasons. They can help you earn passive income, are generally more stable in a volatile market, and are a great hedge against inflation. If you are thinking about investing in Canadian telecom dividend stocks, now might be the right time.

Canadian Telecom companies have historically been a great choice when it comes to dependable dividends. They might not seem as exciting as some of the other options out there, but with all of us increasingly relying on telecom services, you can rest assured that they won’t be going anywhere. As we look ahead to 2026, that stability sounds great to many investors.

Read on to find out more about our top picks for the best telco stocks in Canada including why they made our list, what your anticipated returns are likely to be, and some things to look out for.

If you’d like to get up to date stock pick recommendations and market analysis, I suggest you check out Dividend Stock Rock who helped us compile MDJ’s list of Canada’s best dividend stocks. You can read my detailed Dividend Stocks Rock review first, or sign up immediately with MDJ’s 33% exclusive discount.

Telcos are a Modern Day Utility

As the pandemic reinforced, we are a society that relies on technology to connect, communicate, and work. It’s part of our entertainment hub as well. That has never been more clear than in the last 11 months. The pandemic also accelerated many trends such as work from home.

Telcos are the most modern utilities, as they are an everyday essential, and we send them money every month just as we would to our electricity and natural gas provider. Many would say (not shareholders, obviously) that we send them too much money.

It’s quite normal to hear of families sending their Canadian telecommunications company of choice some $400 or $500 per month once you factor in cell phones for the kids, Mom and Dad, the home internet hook up and perhaps a TV package such as Bell Fibe or full package such as Rogers Ignite.

The telco industry is highly regulated, and there is very little competition. OK, there’s no competition; they operate in an oligopoly situation. The regulatory protection and oligopoly situation give them a considerable moat.

No competition is wonderful for investors, but it does not always guarantee business success. There is always talk in Canada of opening up for more competition in the telco space. But to date, that has all just been chatter, and there does not appear to be any true political movement to bring in the big international competitors.

Real competition may come one day from complete disruption such as from SpaceX Starlink that will beam the internet to the world from satellites. That is another venture from Elon Musk the CEO of Tesla. Yes, telco investors might want to keep an eye on the skies… or space that is.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

The Best Canadian Telco Dividend Stocks

The Canadian telecommunications dividend stock space is dominated by BCE (BCE.TO), Rogers (RCI.B.TO), Telus (T.TO), Shaw (SJR.B.TO) and Cogeco (CGO.TO).

Check out how the top telco stocks compare in the table below:

Name | Ticker | Price | Dividend Yield | Payout Ratio | P/E | Market Cap |

Telus | T.TO | 28.51 | 4.92% | 103.38% | 19.65 | 40.47B |

BCE Inc. | BCE.TO | 61.45 | 5.97% | 114.69% | 19.89 | 55.75B |

Rogers Communications Inc | RCI.B.TO | 56.84 | 3.48% | 64.83% | 16.97 | 28.67B |

Shaw Communications Inc | TF.TO | 35.84 | 3.31% | 61.18% | 21.27 | 17.79B |

Cogeco Inc | CGO.TO | 56.95 | 5.18% | 26.51% | 6.09 | 0.80B |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ?.??% |

You can see that Telus claims the top spot on the list, and there’s good reason. In fact you’ll also find Telus in our Best Canadian Dividend Stocks for 2026 list:

I personally own Telus along with BCE. Telus is more of a pure play in wireless and many will see that as a strength, as there are reasonable growth prospects in that business line. Telus is also much more entrepreneurial than its Canadian telecommunications cousins.

It has Telus Health as part of Telus International and also Telus Ventures under its belt. Telus also has a very strong brand and some of the most-liked advertising in Canada. They use nature’s imagery almost exclusively. The future is friendly – If you’re a Telus dividend collector that is!

I was very fortunate to work on that brand in my previous life as an advertising creative, so I know a thing or two about how well the marketing has worked over the last few years.

As you can see Telus has a lot going for it, and so does its competition.

BCE and Rogers are unique telecommunications stocks in that they own and produce their own media content. Rogers also owns The Toronto Blue Jays (the Rogers Centre where they play their home games). They also own and operate Rogers Sportsnet and many other TV and radio outlets.

Bell Media operates many stations that includes TSN (The Sports Network and RDS in Quebec) plus CTV. In 2019, Bell Media successfully rebranded specialty channels The Comedy Network, Space, Bravo and Gusto as CTV Comedy Channel, CTV Sci-Fi Channel, CTV Drama Channel and CTV Life Channel.

In a joint venture, BCE and Rogers own a 75% interest in Maple Leaf Sports, the holding companies whose most prized possessions are the Toronto Maple Leafs, the Toronto Raptors and Toronto FC.

While these media operations deliver alternative revenue streams, they can also bring additional risks. The media and sports arms have put a strain on the earnings of BCE and Rogers over the past few years. Of course, the pandemic put a halt to many professional sports, and then they were attempting to operate with limited regular seasons and modified playoff schedules. Also, many advertisers were feeling the ill effects of the pandemic and reduced their advertising budgets. BCE and Rogers had to accept a lot less for their commercial air time.

For example, Bell Media reported $628-million in operating revenues during the third quarter, down 16.4 per cent, or $123-million, from the same period last year.

However, as a sense of normalcy has returned, and professional sports have come back in full force, Bell’s quarter four earnings reached 99% of what they were pre-covid. With this in mind, as well as the fact that Bell plans to expand their 5G network and reach up to 900,000 new customers in 2022, things are looking up.

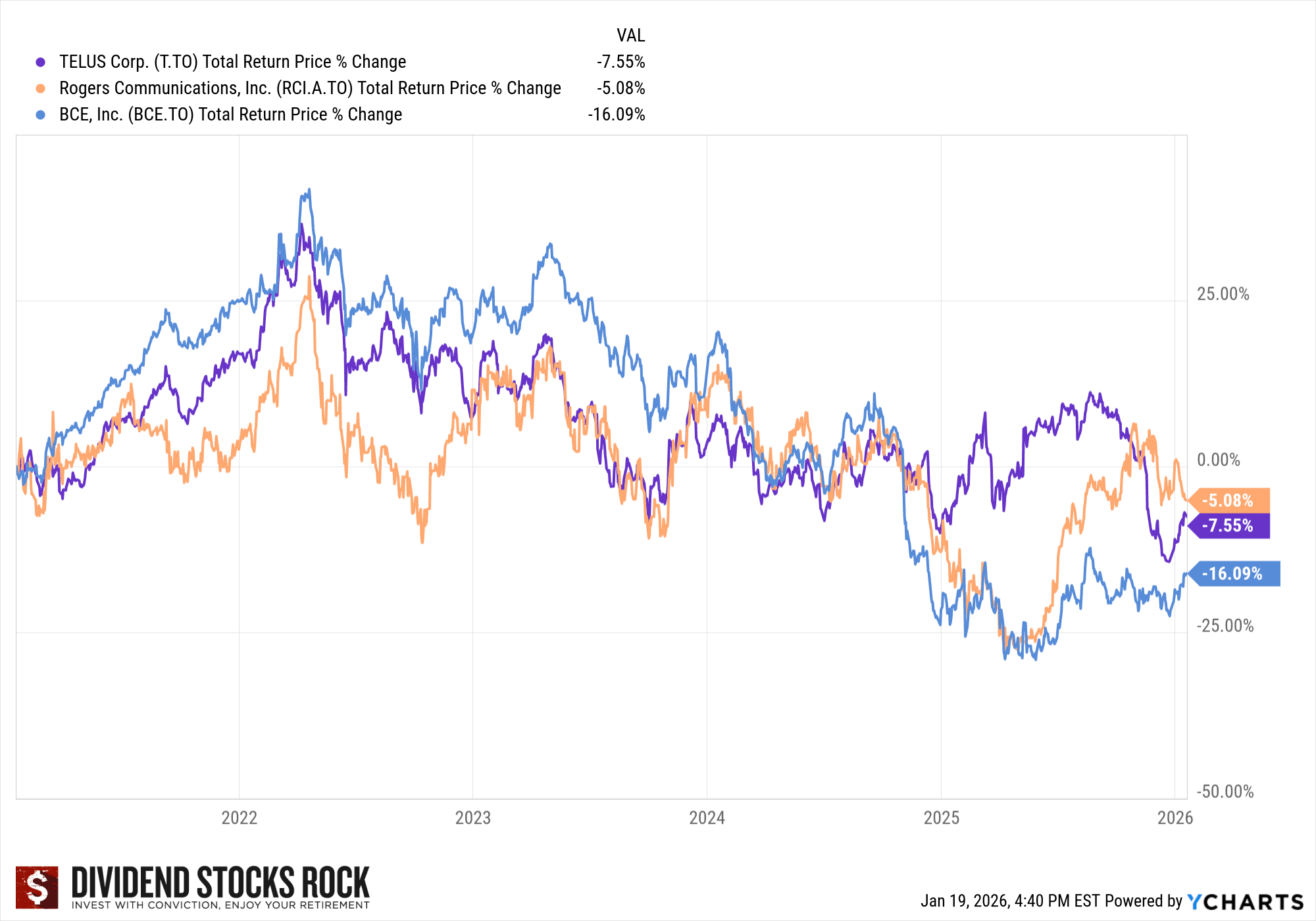

A Surprising Total Return performance

And while we may think of these Canadian telco dividend stocks as being somewhat boring , we can see the value of the reinvestment of the generous dividends. Here’s a 15-year chart showing the big 3 of Telus, BCE and Rogers.

And speaking of those big juicy dividends, here’s the yield history. The chart is courtesy of Mike The Dividend Guy, who runs Dividend Stocks Rock.

We see that BCE and Telus are offering some very generous current dividends.

Earlier this year, Mike published a video where he explained why he is still a big believer in BCE even though some investors are shying away from the stock. The stock’s yield is solid at 5%, and its dividend payout ratio has increased upwards of 115%, which may be alarming to some.

However, BCE does have the cash available to payout those dividends, and plans to expand their 5G network, which is going to help increase revenue. So, worry not, BCE is still a good dividend investment at the moment.

Here was an example of the earning hit to Rogers, for the period ending June 30, 2020.

While the Canadian economy and the sports and entertainment industry is recovering, there are still scars and challenges.

Not Pandemic Proof

And while we were told to stay at home and work at home (requiring connectivity) the telco business was not pandemic proof. Roaming charges were almost eliminated as we were staying put, at home. And of course, the telco’s sales outlets were closed when parts of Canada went under lockdown or restricted store openings. These companies were not able to sell as many new devices.

Here’s a look at the long-term growth that the top telco dividend players have enjoyed.

BCE:

Telus:

Rogers:

Shaw:

Telus is a favourite telco of many investors including Mike from Dividend Stocks Rock. You can add my name to that list as well. Here’s a table showing more of the financial framework and history. The tables are courtesy of Morningstar.

Telus offers a very good growth story for a telco utility. In the latest quarter, reported on November 6, 2020, Telus delivered a 7.6% revenue increase year or year, and a very slight boost in earnings.

Telus offers a very good growth story for a telco utility. Recently, the company published its Q3 earnings, which are up 10% from the same time last year. Much of this growth has been driven by an increase in new customers across the board, 347,000 to be exact. Telus also announced a 7.2% increase in quarterly dividends compared to last year, which is good news for investors.

The Dividend Growth Story

The Canadian telco stocks are known to offer very generous dividends and solid dividend growth. When I run the four stocks of BCE, Telus, Rogers and Shaw as an equal weight portfolio, they would have increased their dividend income by 280% over a decade to the end of 2020 – with dividend reinvestment.

In the above chart, starting with a hypothetical $10,000 portfolio, the yield started at 5.0% (delivering just over $500) and increased to $1,428 according to portfoliovisualizer.com. Now imagine the income growth you can create when adding new monies on a regular schedule? Those generous dividends certainly can drive that total return.

Even if you don’t see generous total returns, if history repeats, (and it doesn’t look like competitors are on the horizon) you would build an incredible income stream. That can be more than useful when you reach that retirement stage. While stocks are not bonds, we might think of telcos as very good bond substitutes.

Dividend Growth Streak

- Telus 16 years

- BCE 11 years

- Shaw 0 years

- Rogers 0 years

Dividend Growth – Last 5 years

Here’s the total dividend growth from 2016 through 2020.

- Telus 28.6%

- BCE 22.0%

- Rogers 4.1%

- Shaw 0.0%

If we look at Cogeco, we see a 55% dividend growth for the period. In addition to the “Big 3” or “Big 4” you might also consider this regional (Quebec and US Atlantic) telecommunications superstar. They recently reported very strong results. Revenue increased 4.5% year over year for their Q1 ending.

Telcos Near Term Recovery

Here’s the analysts earnings projections for BCE. They are still fighting back. The table is courtesy of Nasdaq.

Net, net we might think of Canadian telco stocks as dividend income plays with some potential for capital appreciation over time. If you like that idea, you might buy the group. Or you might be more selective. I am happy with my one-two punch of BCE and Telus, but I also like the idea of Cogeco.

The Risks are Still Present

The risks are present. This is a very capital intensive business line. It takes enormous sums to build out and maintain the networks. They do carry considerable debt. There is the risk of rising rates that will increase borrowing costs over time, but these days they are able to feast on cheaper debt.

I always keep in mind that if rates do rise, I have those Canadian bank dividend stocks that might prosper in a rising rate environment. It’s about that portfolio balance and teamwork when it comes to my investment team!

Morningstar analyst Mathew Dolgin suggests they are undervalued, and was correct when he predicted that they would not get back to 2019 revenue levels until 2022. That is a very good 8 minute interview and worth a watch. BCE and Rogers will continue to benefit now that sports and sports broadcasting are back to more normal levels.

Mathew also notes that Telus and BCE are his top picks. He saw BCE as the most undervalued from that November 2020 interview. The stock has recovered from the time of that post, but still (possibly) represents good value.

That might be a good call, and perhaps it’s not time to hang up on your Canadian telco dividend stocks (bad puns are certainly intentional).

Taking Dividend Investing to the Next Level

Dividend Stocks Rocks (DSR), is a highly recommended newsletter and product if you want to take your dividend investing to the next level . It has been managed by my fellow blogger Mike from the Dividend Guy Blog since 2013.

DSR is not just a weekly newsletter with stock picks. It’s a program that will help you manage your portfolio and improve your results. You can first read our detailed DSR review, or sign up now by clicking the button below.

How Canadian Telco Companies Compare to Other Sectors?

You might be wondering how telco stacks up to other mature sectors in Canada, such as banks, utility companies, and energy stocks.

Comparing your options is always a smart move to make before making your final decision. In the end, it comes down to a few things: cost, potential for returns and potential for risk.

Investors should also keep in mind that a healthy portfolio is a healthy one. So, purchasing stocks from multiple sectors, especially ones that pay dividends, is a wise move.

Here is how some of the top bank stocks, utility stocks, and energy stocks stack up to telco stocks.

Name | Ticker | Sector | Price | Dividend Yield |

Telus | T.TO | Communications | 28.51 | 4.92% |

BCE Inc. | BCE.TO | Communications | 61.45 | 5.97% |

Bank of Nova Scotia | BNS.TO | Finance | 66.48 | 6.22% |

CIBC | CM.TO | Finance | 62.41 | 5.31% |

Enbridge | ENB.TO | Energy | 53.91 | 6.39% |

Algonquin Power and Utilities | AQN.TO | Utilities | 14.95 | 6.73% |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% |

The Bottom Line For Investing in Canadian Telco Stocks

With the current market volatility other sectors are experiencing at the moment, telco stocks seem like a strong bet. In our review of the best Canadian telco dividend stocks, we chose companies that have a well established history, the capacity to ride out any inevitable storms, have a healthy cash flow and the strong potential for future growth.

Dividend stocks are a great choice in particular because they offer you long term earning potential on the stock, as well as the option to cash out your dividend earnings or reinvest them for greater future returns.

If you would like to know more about our top recommended dividend earning stocks, head over to our Canadian Dividend Kings List.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.