Is Telus Stock a Good Buy in 2026?

If you’re considering investing in Telus stock in 2026, it’s crucial to assess the company’s performance, dividend growth, and recent developments in the telecommunications industry. Staying updated on Telus’ latest advancements is key in determining whether it is a smart investment choice in 2026.

If you’re seeking to diversify your portfolio with additional dividend stocks, we recommend exploring our article on Top Canadian Dividend Stocks. This valuable resource provides insights into reputable Canadian companies known for their consistent dividend growth.

Want To Buy Telus Shares? Price, Performance & Analysis

- T.TO Stock Price: 23.98

- Dividend Yield: 6.15%

- Price-to-Earnings (P/E) Ratio: 28.59

- 5yr Earnings Per Share Growth: -3.73%

- 5yr Dividend Growth: 6.60%

- Payout Ratio: 117.59%

Our Telus Stock Analysis

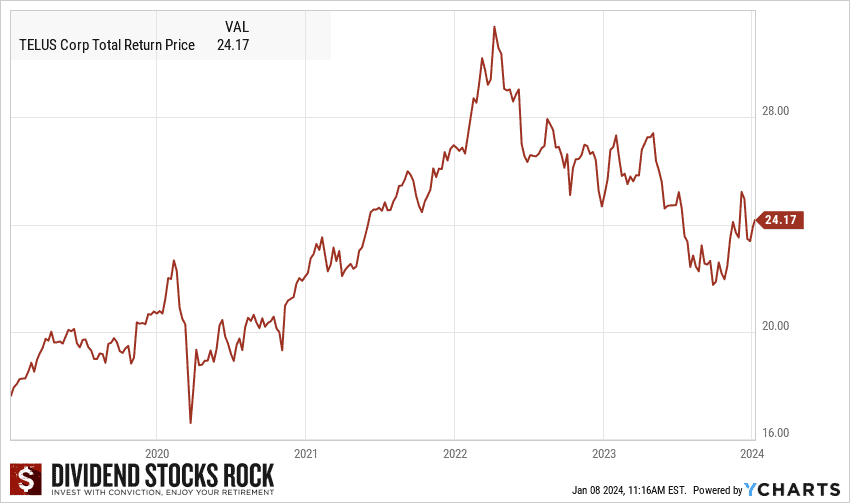

- Telus appears to be an undervalued stock at its current share price of $25.

- It currently sits at the pre-covid price level, indicating a prime buy opportunity.

- Dividend yield sits high at around 6%.

- 3 year dividend CAGR sits high at 11%, with the sector growth rate being only 3%.

Our Telus stock analysis indicates that Telus is currently undervalued and presents an attractive opportunity for long-term investment. With a strong position in the telecommunications sector, Telus is well positioned to benefit from the ongoing growth in the industry.

We believe that Telus shares will be ones to hold for the long run as the company has recently announced an expansion into the EV charging market in collaboration with Jolt. As someone who believes in the EV market’s growth potential, I see the benefit in holding Telus stock for quite a while.

It’s also worth noting Telus’s successful telehealth spin-off, Telus Health, which has been driving innovation in the healthcare industry.

Telus Health has developed a digital solution that enables remote consultations, electronic medical records management, and other telehealth services. This diversification demonstrates to me as an investor that Telus is able to adapt to evolving market trends and expand its revenue streams beyond traditional telecommunications services.

For detailed insights into long-term investment opportunities in Canada, we recommend referring to our comprehensive guide on the Best Long-Term Investments in Canada.

Should I Buy Telus Stock in 2026?

Owning shares in Telus is a highly advantageous investment for dividend-conscious Canadian investors, offering a reliable and well-established asset alongside dependable cash flow. Telus has a longstanding history of stable and conservative growth, making it a trusted choice for investors.

Telus has performed relatively well in 2023, outperforming the market by a small margin. Telus has also expanded its operations beyond telecommunications, including ventures in electric vehicle (EV) charging through its collaboration with New Zealand-based company, Jolt.

This diversification positions Telus as a promising investment opportunity, combining the stability of the telecommunications sector with the growth potential of the EV charging market.

Telus holds a strong position in the Canadian telecommunications oligopoly, which has contributed to its stock price consistently increasing over time. The limited competition and high demand for telecommunications services in Canada provide Telus with a favorable market environment and profitability. The company’s expansion into EV charging with Jolt further diversifies its revenue streams and aligns with the growing demand for sustainable transportation solutions.

Furthermore, Telus’s strategic decision to expand into EV charging and its commitment to long-term vision demonstrate its resilience and adaptability in a challenging economic climate. This move not only enhances the company’s growth prospects but also aligns with the broader shift towards cleaner and greener technologies.

For detailed information on green investment opportunities in Canada, we recommend checking out our comprehensive guide on the Best Renewable Energy Stocks in Canada.

How Can I Buy Telus Shares?

To buy Telus shares, you have the option to use any of the available Canadian online brokerage services. At MDJ, we prioritize providing guidance to our readers in selecting discount brokerages that meet their needs. We consistently update our list of Top Online Brokerages in Canada and offer the best recommendations.

Once you have successfully registered for an online brokerage account, buying Telus shares becomes a simple and straightforward process. All you need to do is use the search bar to find the ticker symbol “T” and determine the number of shares you wish to buy.

For example, if you intend to invest $2,500 in Telus shares and the current stock price is $25, you can enter “100” as the quantity and select the “market limit” option. The online brokerage platform will then present you with a prompt asking, “Do you want to buy 100 shares of TELUS at $25 each, totaling $2,500?”

Once you confirm the order, the online broker will take care of the rest. Congratulations! You are now a proud shareholder of one of Canada’s leading telecommunications companies.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

Telus Stock Past Performance

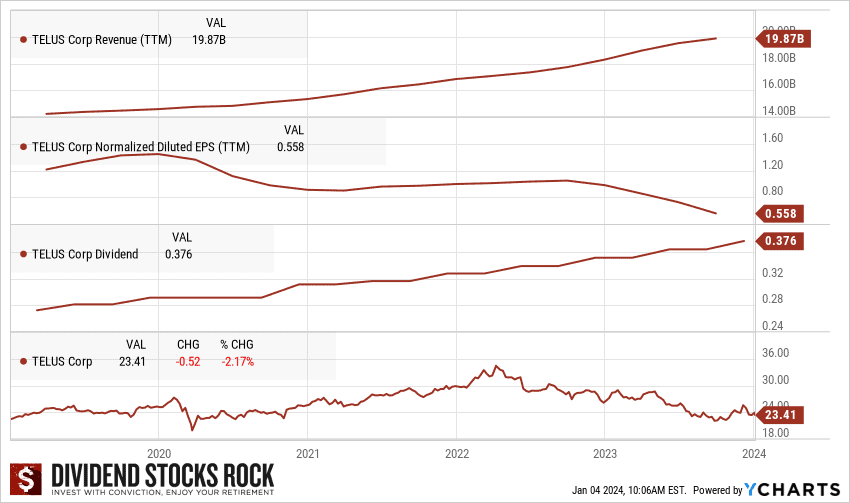

Over the past three years, Telus has shown consistent growth in both its dividend payouts and revenues, indicating a strong position in the telecommunications sector. I believe that Telus, along with other companies in the Canadian telecommunications industry, will consistently provide returns to its investors.

However, the company’s EPS has decreased significantly over the past 3 years, even though its revenues have increased in the same period of time. This shows me that their costs have increased significantly, which for me as an investor, is quite worrisome.

Despite this I am confident that Telus’ management will be able to overcome this as it is estimated that Telus has already installed roughly 90% of its footprint. This will allow for reduced capital intensity throughout 2023 which will allow Telus to increase its dividend, or invest into strategic acquisitions.

To explore more about dividend investing, I recommend checking out our updated list of Best Canadian Dividend Stocks.

As a long-term investor, I prioritize investments that offer both growing dividends and steady capital gains. Telus has demonstrated a decent dividend growth rate of 5% over the past five years, placing it higher than its peers in the industry which has a median growth rate of 1.66%.

If you’re seeking a thorough analysis and comparison of dividend stocks, along with advanced statistics and a diverse selection of stock options, look no more than Dividend Stocks Rock (DSR). This comprehensive resource offers valuable insights and information to assist investors in making informed decisions when it comes to dividend investing.

Telus Stock Forecast

Telus, despite the lower net income reported in the first quarter of 2023, remains an attractive choice for investors seeking opportunities in the telecommunications industry.

One key factor contributing to Telus’ appeal is its position within the profitable oligopoly of the Canadian telecom sector. Its recent lower net income is the main reason as to why the stock price is dropping, but for long term investors like myself I see this as a prime buying opportunity.

The Canadian telecommunications industry is characterized by 3 major players Telus, Rogers and Bell. This oligopoly structure provides these companies with a stable market environment and strong profitability. With limited competition and a high demand for telecommunications services in Canada, Telus enjoys a competitive advantage in the industry.

Recently, Telus has expanded its operations in Montreal, investing nearly $30 million in 2023 to deploy and update its 5G networks, connecting the city’s businesses to a fiber optic infrastructure. This will definitely put Telus in a strategic position, at least in Quebec, for more growth.

For investors interested in exploring other potential investment opportunities within the Canadian telecommunications sector, we recommend referring to our comprehensive guide on the Best Telecommunications Stocks in Canada. This resource offers valuable analysis on the Canadian telecommunications sector and the key players in that industry.

Telus operates in the telecommunications industry and, like any company in this sector, is influenced by various market factors. As a leading telecommunications provider, Telus’s success is closely linked to the growth and advancements in the telecom industry. However, it’s important to acknowledge that Telus is not immune to economic fluctuations and competitive pressures in the market.

If you prefer a passive investing approach and aim to reduce risk by investing in ETFs rather than individual stocks, we suggest referring to our comprehensive list of the Best ETFs in Canada for 2026. Exploring these ETF options can provide you with diversified exposure to various sectors and asset classes, allowing you to benefit from a broader market performance.