Best Renewable Energy Stocks in Canada 2025

With all of the attention on Canadian energy stocks due to the recent run up in oil prices, many experts are arguing that now is the time to look into Canadian renewable or “green energy” stocks.

If you are a longtime MDJ reader, you’ll notice a few crossover companies from our best Canadian dividend stocks article that we update monthly. That’s obviously not an accident. While everyone wanted to buy renewable energy stocks a couple of years ago, they lost much of their steam in 2021.

From what I can tell, it looks like whether or not you believe that you should invest in clean energy stocks from an ethical standpoint, it appears that we’re going to need all the energy we can get our hands on for the foreseeable future.

With Canada being home to some of the biggest renewable energy companies in the world (we’re 6th overall in green energy production) there are several options for clean energy portfolio exposure.

Top Renewable Energy Stocks in Canada

Below are our choices for the best green energy stocks in Canada for 2025, in no particular order:

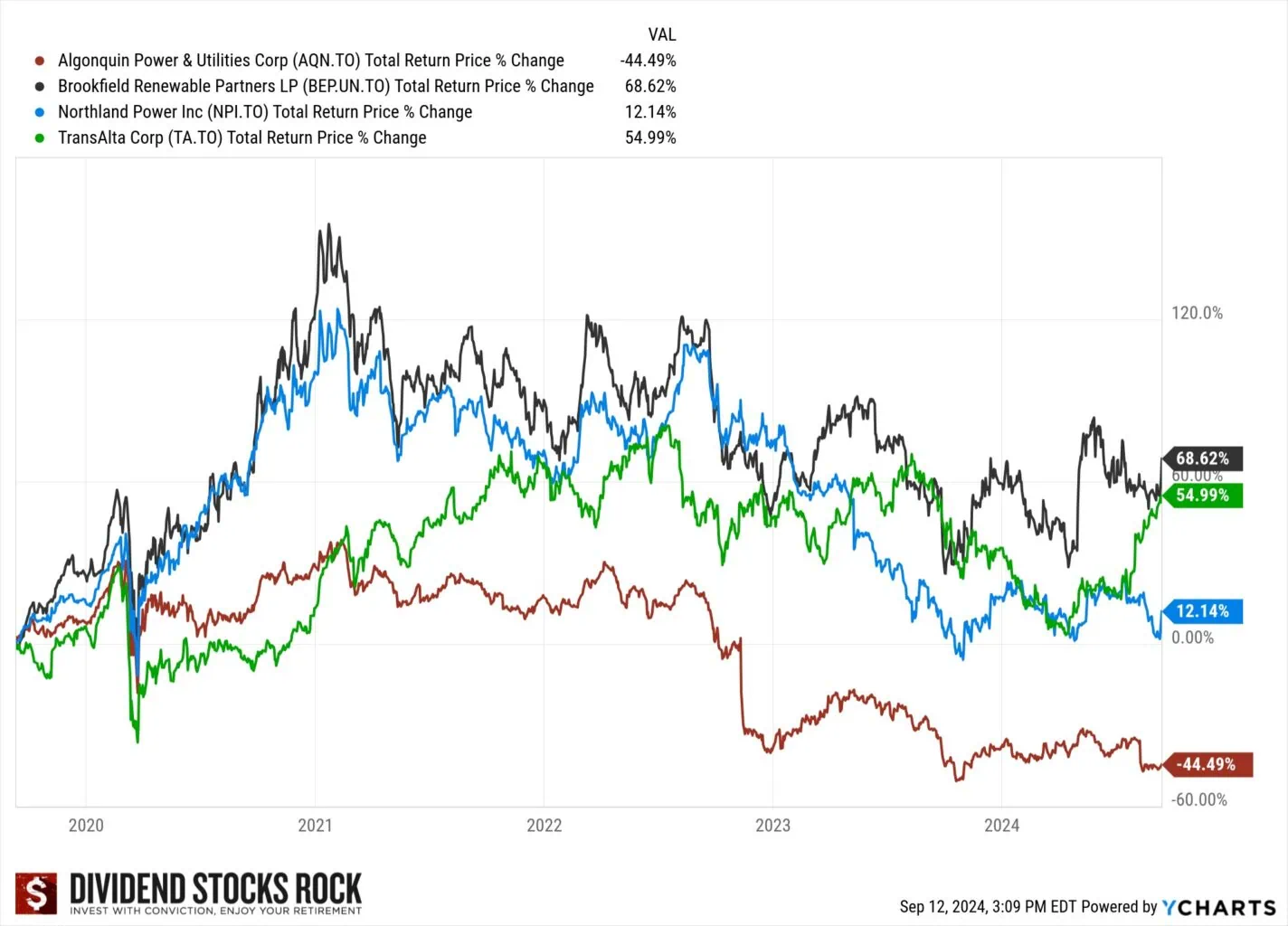

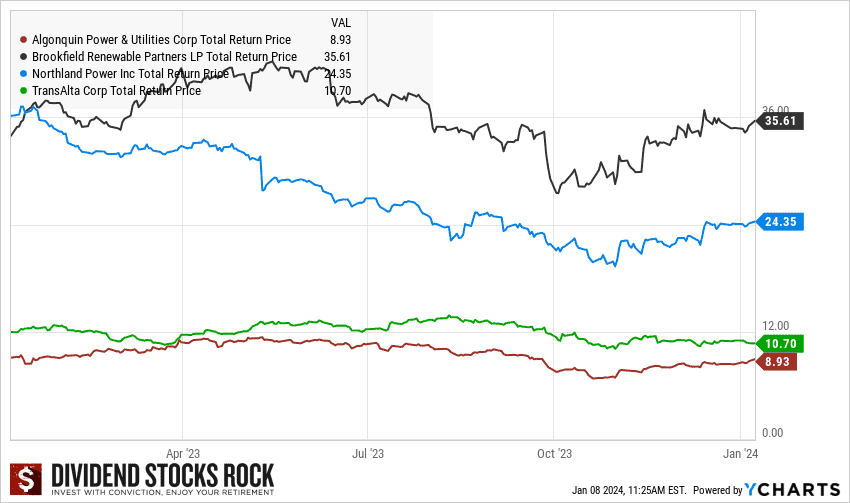

Algonquin Power and Utilities (AQN)

- $19.51 (Up 7.43% YTD)

- 4.37% Dividend Yield

- P/E 38

Algonquin Power and Utilities (AQN) is my favourite Canadian renewable energy stock – for the precise reason that it’s not just a renewable energy stock. Algonquin is actually more of a utility than it is a pure green energy play, but its growth vector is definitely in the clean energy space.

Currently the company has two distinct business groupings. One is the Regulated Services Group and the other is the Renewable Energy Group. While they are a Canadian company, most of their revenue is from the USA – another diversification factor that I really like.

Long-term utility contracts give this company a stability factor that just doesn’t exist with other renewable energy stocks in Canada. In addition to its dependable utility revenue though, Algonquin does own and operate over four Gigawatts of installed renewable energy capacity, with plans to invest nearly $10 Billion through 2025. Management has proven to have a solid track record when it comes to external acquisitions and internal optimization strategies. Its portfolio of different types of green energy production shield the company from underfermance in any one area.

From my perspective, the best thing about AQN is its dependable dividend yield, plus dividend increases. You’re getting the best of both worlds when it comes to diversified utilities and renewable energy investment, with a relatively moderate leverage structure compared to competitors.

For a thorough analysis on AQN and all things dividend stocks, make sure not to miss the free webinars put on by Dividend Stocks Rock guru Mike Heroux.

Brookfield Renewable (BEP.UN)

- $51.29 (Up 15.03% YTD)

- 3.17% Dividend Yield

- P/E N/A

Next up on our top Canadian renewable energy stocks list is Brookfield Renewables (BEP) from the massive international behemoth of Brookfield properties. Brookfield Renewable Partners L.P. is a big bet on hydroelectric energy, along with a solid helping of wind, solar, and other green energy investments. The company is massive, with assets throughout North American, Brazil, Europe, and Colombia that produce nearly 20,000 megawatts of renewable energy capacity.

At their most recent market call their CEO convincingly stated: “Looking ahead, decarbonization is now firmly established as an objective of the global economy and as one of the pre-eminent global clean energy companies with deep operating capabilities and scale, we are uniquely positioned to execute on the most attractive decarbonization investment opportunities around the world.”

As one of the largest renewable energy stocks in the world, BEP is about as diversified as you can get, and certainly has the scale and experience to benefit from the current transition to green energy that we’re seeing.

The two main questions I have when I look at Brookfield Renewables is:

1) Is it a good value at its current price?

2) Can management keep their debt level under control? It’s currently about $20B USD, and this could start to impact cash flow as interest rates rise.

Regardless, in terms of a long-term clean energy play on the Toronto Stock Exchange (TSX), it doesn’t get much more comprehensive than Brookfield. Dividend lovers are attracted to management’s commitment to raise dividends 5-9% per year. (Talk about a great inflation hedge!).

Northland Power (NPI)

- $41.60 (Up 11.86% YTD)

- 2.88% Dividend Yield

- P/E 50.94

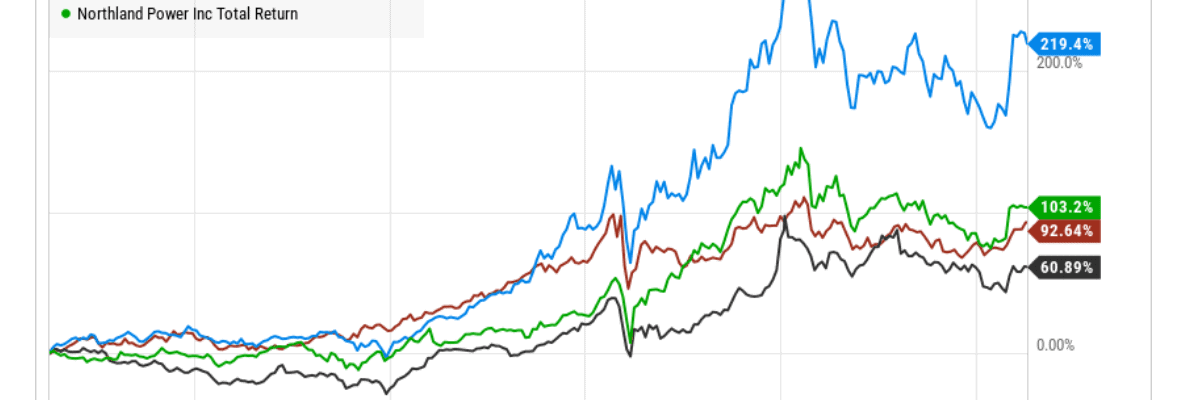

Northland Power (NPI) is often compared to its Canadian cousin Algonquin when it comes to Canadian renewable stocks. While AQN is unquestionably a more conservative play due to its utility revenue, Northland Power may have potential for stronger long term returns as it is more of a pure green energy company.

Northland’s management has shown a real talent for diversified growth over the last few years, with a special emphasis on wind energy. It owns and operates assets in North America, Central America, Europe, and Asia, that toal over 3,200 megawatts of renewable energy. Perhaps its most notable recent expansion has been the investment in Taiwan’s wind energy portfolio.

Make no mistake, while Northland’s management has proven quite adept at managing considerable leverage, its long-term debt balance sheet is still a bit worrisome. With nearly $8B in long-term debt, and substantial expansion plans going forward, there is a lot of exposure to increased borrowing costs – especially if wind energy gets surpassed by other renewables.

TransAlta Renewables (RNW)

- $18.44 (Down 1.55% YTD)

- Dividend Yield 5.10%

- P/E 35.17

So far in 2025 the market has spoken when it comes to TransAlta Renewables. It is the only stock down on the year and shows very little sign of “finding bottom”. While the current 5%+ yield is juicy, I’m worried about the company’s ability to grow versus my top two chooses on this list.

TransAlta (RNW) is a subsidiary or “Yield Co.” of its TransAlta (TA) parent company. TA holds a controlling interest, and RNW does appear to be a better holding than its bigger parent at the current time.

RNW has 20 wind farms throughout Canada and the USA totalling 1,446 megawatts of capacity, along with 13 hydroelectric properties in Canada (112 MW), and seven gas facilities in Canada and Australia (949 MW).

The company’s balance sheet has firmed up over the last two years as they’ve looked at paying down debt, but the company just hasn’t looked as efficient as its competitors, and doesn’t have the prospects of other Canadian renewable stock heavyweights.

Innergex, Boralex, and Polaris Infrastructure

Technically there are three other companies that often get classified as renewable energy stocks on the Toronto Stock Exchange. Innergex, Boralex, and Polaris Infrastructure are relatively small companies that don’t operate at anything close to the scale of BEP, AQN, or NP.

While one of these companies may end up offering outsized returns, taking the sort of risk needed to invest in these types of stocks just isn’t my style. I’ll stick to Canadian Dividend Kings such as Algonquin with long-term proven track records of dividend increases as opposed to these more volatile companies.

Best Renewable Energy ETFs in Canada

If you want more of a worldwide exposure to clean energy stocks (as opposed to direct Canadian investment) then a renewable energy ETF from the Toronto Stock Exchange is probably your easiest/best bet.

When looking at exchange traded funds, the main comparison points are the diversity of exposure combined with the Management Expense Ratio (MER).

There are really only two real “pure clean energy ETFs” currently in Canada.

BMO Clean Energy Index ETF (ZCLN) – Started in January 2021, tracks S&P Global Broad Market Index. Largest holdings include Enphase Energy Inc., Vestas Wind Systems, Consolidated Edison Inc, and Solaredge Technologies Inc. It has a .40% MER.

Harvest Clean Energy ETF (HCLN): Very similar to ZCLN, HCLN began in January 2021 and also tracks the same S&P Global Broad Market Index. Because of different weighting caps, HCLN is more diversified and gives more exposure to companies such as Brookfield Renewables, and Ameresco, Inc. They also have a .40% MER.

iShares Global Clean Energy ETF (ICLN): If you don’t mind converting your money to USD and looking at the New York Stock Exchange then the iShares Global Clean Energy ETF (ICLN) is certainly worth a look as well.

Why Invest In Clean Energy Stocks?

The investment thesis behind investing in clean energy stocks (also called green energy stocks by some experts) is that as corporations face more and more political pressure from a global population that is increasingly traumatized by natural disasters, clean energy companies would be the natural beneficiaries.

Personally, I’m not sure to what degree the world is ready to embrace clean energy at a cost to overall profitably, but I’m more sure about the fact that as we transition to needing more and more electricity, all forms of energy are going to be sought after. Clean energy stocks appear to be a less risky bet than non-Saudi oil companies from that long-term perspective.

As with all things investing, the question is about value as much as long term prospects. Most people agree that clean energy companies are going to make more money than they currently do as they expand. The question is – how much money exactly – and consequently, is the current share price justified?

Renewable Energy Stocks Frequently Asked Questions

Am I Buying Renewable Energy Stocks In 2025?

Sort of…

I am definitely looking to add to my position in AQN, but as I mentioned above, this is a hybrid play on a strong utility dividend all star. You can read more about why Algonquin is a top pick in my Dogs of the TSX for 2025 article or our top utility stocks in Canada article.

Brookfield has had an incredible run and is obviously worthy of consideration, it’s simply a matter of current valuation for me. I’m waiting to see just how consistent profits are in the wind and solar spaces before committing more of my portfolio in this direction.

We’ll see which way the wind blows ;)