Is RBC Stock a Good Buy in 2025?

If you’re considering buying Royal Bank stock in 2025, then you need to be aware of not only the company’s individual performance, but also RBC’s current valuation, and the general prospects for Canadian banking as well.

For more information on comparable investments check out our article on the Best Canadian Bank Stocks, and to decide if you’d rather go with a passive investing strategy rather than picking individual stocks, take a look at the Best ETFs in Canada.

WANT TO BUY RBC SHARES? Price, Performance & Analysis

- RBC Stock Price: 127.06

- Dividend Yield: 4.13%

- Price-to-Earnings (P/E) Ratio: 12.17

- 5yr Earnings Per Share Growth: 7.63%

- 5yr Dividend Growth: 7.34%

- Payout Ratio: 44.68%

Our 2025 Royal Bank Stock Analysis

- At $130 per share RBC represents solid value – if not screaming “buy now”.

- It’s down from all-time highs.

- Most diversified Canadian bank by far.

- Most expensive valuation versus other Canadian banks.

- Stable dividend, days of meteoric growth are in the past.

- Small systemic risk of Canadian economy slowdown (specifically housing).

Overall, our RBC Bank stock analysis is that shares are currently fairly priced. The premium valuation is justified by the fact that Canada’s biggest company has massive brand equity and a proven track record of stable growth.

RBC Has been a very shareholder-friendly company for several decades, as they efficiently pass profits on via twice-per-year dividend increases.

Our stock recommendations are largely based off the information we get from Mike Heroux’s Dividend Stocks Rock. Mike offers free webinars, advanced tools and specific stock picks. You can read our full DSR review or visit them by clicking the button below.

Should I Buy RBC Stocks in 2025?

You know what you’re getting when you buy Royal Bank stocks. Your portfolio can always use shares of a company that has a multi-century track record of stable, conservative growth.

In our article on Canadian Dividend Kings and Aristocrats, we highlighted RBC competitor National Bank as perhaps a more risk-on alternative given its much smaller market cap and opportunity for growth.

Canadian banks have looked good in 2023 as they have weathered the storm of slowing GDP growth and increased taxation from the Trudeau government. RBC specifically continues to command the highest valuation of the Canadian banks, but there are good reasons that investors continue to love this company despite its premium valuation.

RBC’s ability to generate revenue from a wide variety of banking endeavors, as well as their excellent management team and large investing moat make it a very low-risk investment for 2025.

How to Buy Shares of RBC

You can buy and sell shares of RBC using one of Canada’s online brokerages.

We take discount brokerages seriously at MDJ, as it has been our most commented-on topic since I launched the site 16 years ago. Consequently, we update our discount brokerages comparison monthly, and always provide readers with not only the best overall recommendations, but also the best promo offers in the market at a given time.

Best 2025 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by November 26, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Once you sign up for a brokerage account, buying shares of RBC or any other stock is as simple as looking up the ticker symbol (RY.TO in this case) and then deciding how many shares you want to buy.

For example, if I want to invest $1,300 into shares of RBC, and the RBC stock price is $130, then I would type in “10” and “market limit”. My online broker would then prompt me by saying, “Do you want to purchase 10 shares of RBC at a price of $130, for a total of $1,300?”.

Once you confirm the order, the online broker will take care of the rest. You now own a piece of Canada’s biggest company – congratulations! Time to sit back and watch those capital gains + dividends roll in.

Does Royal Bank Stock Pay Dividends?

Canadian bank stocks are loved by dividend investors (for good reason). They are strong stable dividend payers that are conservative with their payout ratios and equally cautious with their investments for long-term growth.

RBC pays dividends each quarter (usually arriving near the end of February, May, August, and November).

The dividend is currently $5.28.

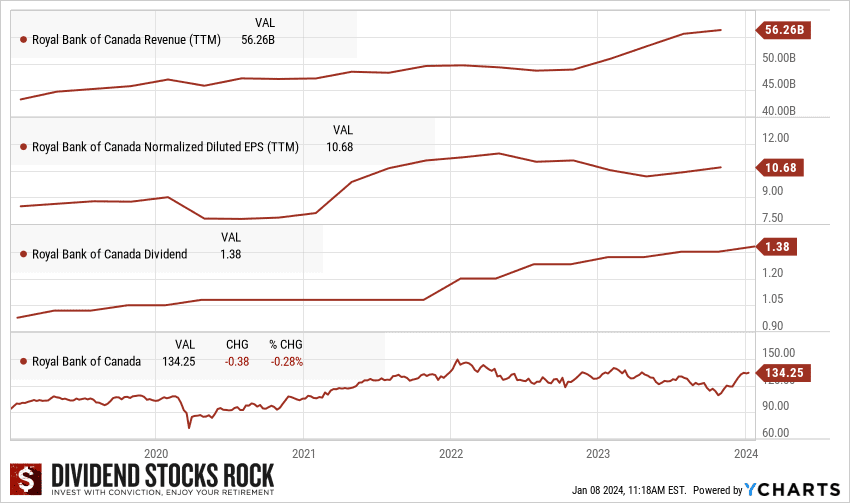

Royal Bank’s dividend yield is currently just over 4%.

RBC generally increases its dividend payouts twice per year. In the last year, it has raised the dividend by 10%, but over the last five years we see a substantial dividend growth rate of 7.35%. That’s music to the ears of dividend growth investors everywhere. Check out our other picks for Best Canadian Dividend Stocks here.

RBC Stock Forecast

The Royal Bank of Canada is the largest company in Canada for a reason: it has combined effective management with a privileged oligopoly market position.

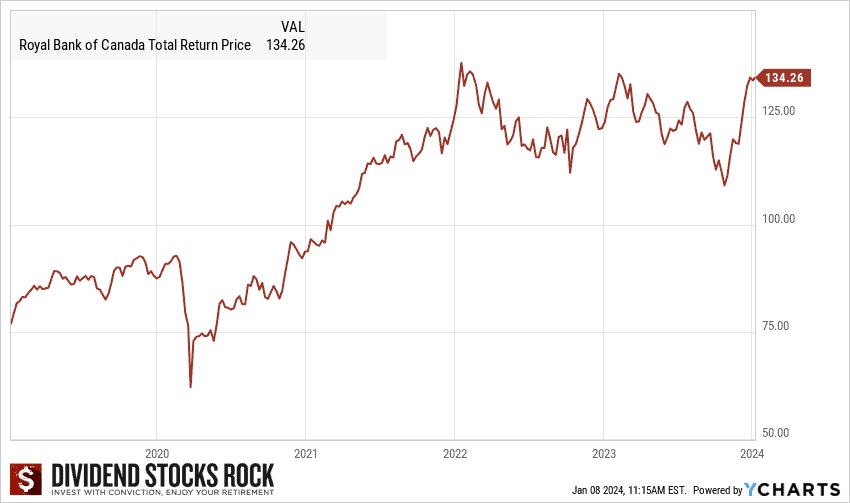

The result has been a pretty special mix of above-market-average gains, and unparalleled stability. Of course, past returns are not always indicative of future performance.

There is no question that RBC is a great company that is going to continue to make money and provide value to shareholders. The real question is, to what degree that growth and value are already priced into the value of the stock. RBC’s current price-to-book ratio is over 1.8, indicating that it is trading at a premium relative to other Canadian banks.

I wouldn’t let your personal RBC stock forecast be coloured by the negative banking headlines out of the USA. Mid-sized US banks are a totally different type of company than Canadian banks, and they are regulated quite differently. Given how diversified RBC’s earnings are, it likely deserves it’s premium valuation, and that’s why it’s a major piece of my portfolio.

Any RBC stock analysis for the next few years is going to chiefly depend on the state of the overall economy, and how well they are able to integrate their new HSBC acquisition. I feel pretty good about RBC’s ability to navigate both of those challenges.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?