Real Estate Investing vs Index Investing for Canadian Expats

In talking to dozens of Canadian expats over the last year, I’ve found four money truths that consistently emerge.

- Earning a low-tax or a tax-free salary is a lot of fun.

- People who earn low-tax salaries work with other people who earn low-tax salaries.

- “Other people” who earn low-tax salaries tend to spend a lot (all?) of their cash on luxurious lifestyles they probably couldn’t afford back in Canada, because luxurious lifestyles feel… luxurious. Because “other people” like luxurious lifestyles, it’s quite easy for you to fall in love with these simple pleasures as well. After all, if they deserve it, so do you, right?

- With so many financial institutions and “money experts” targeting Canadian expats, it is easy to feel overwhelmed by the pressure sales tactics and confusing jargon when it comes to investing.

Given the consistent pattern of those truths, is it any wonder that so many expats simply give up on investing (often seeing the whole thing as a glorified casino) and instead just focus on enjoying the good life?

Why Understanding Investing Is Even More Important for Expats

Working in low-tax countries like Qatar, the UAE, Bermuda, or Singapore can be financially rewarding, as well as culturally enriching. What it usually is not – is a great pension building experience.

In lieu of a pension, most expat compensation packages in these countries offer excellent salaries (usually superior to those found in Canada), along with great perks such as paid accommodation, tuition credits, and a retention/incentive bonus of some kind. Most expat packages do not emphasize a pension program in the way that Canadians think of a pension. Even if they do, most expats don’t stay in their new jobs long enough to build a substantial amount of pensionable time.

It is quite common for Canadian expats to have a glorious time while abroad, but come home to a retirement that is far less financially-stable than that of their peers who stayed at home and spent a career in a government-funded position, or within a large company that provided an attractive shared pension contribution plan.

If you don’t take care of your financial self as an expat – no one is going to do it for you!

Sure, OAS will likely still be there in some form, and you’re likely to have some CPP contributions locked in if you worked in Canada before/after moving abroad, but you should really take advantage of the incredible savings opportunities that exist when you live in a super tax-friendly territory like Hong Kong, or even places like Bulgaria, Malaysia, Estonia, or Switzerland, which represent a substantial tax savings when compared to Canada.

For investors, these low-tax countries represent a double-header of opportunity.

- You keep more of your salary & perks each year.

- Your non-registered investments are taxed at a much lower rate than they would be in Canada. (Although you do lose the ability to contribute to your RRSP and TFSA.)

The bottom line is that expat savers/investors can quickly gain a lot of ground in these countries.

What Can I Invest In?

A Canadian Expat can invest in any asset that anyone else around the world can invest in. Describing every single type of investment in the known world is beyond the scope of this article – but here are the most common examples.

- Stocks (aka: shares, equity)

- Bonds (aka: fixed income)

- Real Estate

- Precious metals such as gold/silver

- “Alternative Investments” such as cryptocurrency, art, etc.

I’m going to largely ignore the last two categories, because the average person simply does not need to worry about them, and they unnecessarily complicate things. The main takeaway for me, is that gold (despite the ridiculous fanfare it has received over the centuries) simply isn’t very good at making people money over the long term, and that putting money in cryptocurrencies is essentially placing a bet against the governments that control the planet.

I know, I know – your local investment guru at the water cooler told you that, “You’ll never lose with gold,” and your whip-smart niece told you that, “Bitcoin is the way of the future – get in now before it’s too late.”

Ignore them.

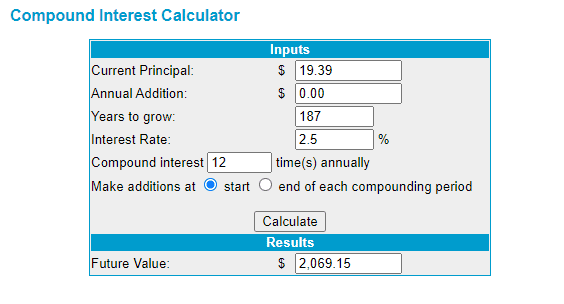

As I write this in mid-2020, gold is on an absolute tear and at all-time highs. If you had bought an ounce of gold back in 1833 (first of all congrats on the healthy living front!) for $19.39, it would be worth over $2,060 today. Not too bad! If you annualize that return out over the 187 years, you gained roughly 2.5% – or roughly what inflation runs each year. If you think about it, this makes sense, as gold isn’t a company that makes profits… or really produces anything at all. So looking shiny gives you basic inflation returns.

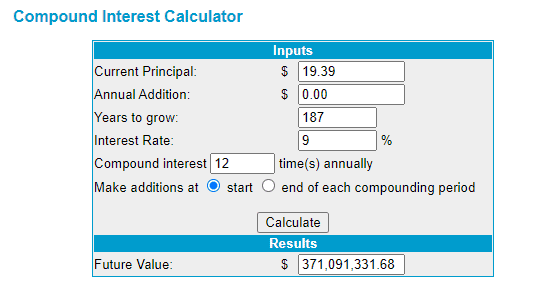

When Wharton University Professor Jeremy Siegel authored a master treatise on the historical returns of stocks called Stocks for the Long Run, he found that from 1802 to 2006, the stock market returned roughly 10% per year. Depending on what you count as the “stock market” in those early years, other experts have said that as a group, American stocks have averaged 8.5-9% over the years. The Canadian stock market has averaged just over 9% as an annual return going back to 1900 (according to the 2016 Credit Suisse Global Investment Returns Yearbook). We’ll split the differences and use 9% as our nominal (fancy word that means “before we take inflation into account”) long-term average for stocks.

If we invested in stocks with that same $19.39 that we put into gold back in 1833, it’d be worth more than $371 Million in 2020! (Assuming that you reinvested the dividends.)

That leaves investors with three broad categories of investments. Here’s a quick look at how they make you money:

Stocks: You buy a small piece of a company on a stock exchange. Hopefully the company will make a profit (aka: earnings). The company will then decide to take this profit and pay you (as an owner) a part of that money (called a dividend) or reinvest the money back into the company – thus making the company more valuable – and the price of the share that you purchased will now go up.

If you sell your stock for more than you paid for it (because the company is now more valuable than when you bought it), that is called a capital gain.

Capital gains and dividends are the two ways stocks can make you money.

Bonds: A government or company makes a trade with you. In return for your money today, they will pay you interest each year, and then give you your money back at the end of the period you agreed upon. Often 1 year, 2 years, 5 years, 10 years, etc.

Basically, you’re acting like a bank, and lending another institution the money.

There are many types of bonds, but most people only ever interact with government bonds, and bonds issued from the biggest companies in the world (collectively referred to as “investment grade”).

The money that you make from a bond is classified as interest.

Bonds can go up or down in value slightly, (depending on what current interest rates are) generating a small capital gain (or loss), but it’s often not enough to really worry about.

Real Estate: You own land and/or buildings. People pay you to use your land and/or buildings (usually called rent). Your land and buildings might also become more desirable in the future – if you sell your land and buildings for more than you paid for them, this is also called a capital gain.

It’s very important to understand one undeniable truth as we take a closer look at these investment options:

Tangible does NOT equal simple.

Real estate is tangible – you can reach out and touch it.

Stocks and bonds are not tangible – they exist on paper or in your online account – but loans and ownership of companies are impossible to touch.

You might think that because land and buildings are tangible, that making money from them is simple – IT IS NOT!

You might think that because stocks and bonds are intangible, that making money from them will forever confuse you – IT WILL NOT.

This doesn’t mean stocks and bonds are always better than real estate – or vice versa – it just means that being able to reach out and touch something does not make it a better investment or easier to understand.

Comparing Risk in Real Estate vs Risk in the Stock Market

If you had $10,000 to invest, and I told you that I had the inside track on buying a piece of a really great-looking company – would you then quickly borrow another $20,000 from the bank, and invest all $30,000 with me? What about if that great-looking company was a small one that only existed in one tiny little market that it relied on for all of its business?

Most people would think that sounded insane! Anything could happen to that little company, right?

Not only are you taking on a relatively risky investment (a company that relies on only one small city or town for all of its business) – but you’re going to borrow a ton of money (also known as “leverage”) in order to do it?

Sounds like a recipe for disaster.

Why then, are people so quick to believe using leverage to buy a house and/or land is such a great idea?!

A house (or an investment property like a fourplex) is an asset that puts all of your investment eggs in a single basket. You are tying up all of your savings – PLUS borrowing a bunch more money – in order to make an investment where the value entirely depends on the local real estate market.

It completely ignores one of the commandments of investing: Thou Shall Diversify.

I’m not saying you can’t make money investing in real estate – plenty of people have.

I am saying that making money with real estate – especially as an expat – is much more complex than people think. It’s worth repeating: Tangible is not the same as simple.

We’ll get into more detail about why the stock market has performed better than the real estate market in just a second, but first, I want potential Canadian expat real estate investors to understand a few complicating factors their proposed investment will have.

- There are massive transaction costs when you buy a home. Realtor fees, transfer taxes, GST, cleaning costs, lawyer fees, home inspections… the list goes on and on. Most experts estimate these closing costs to be 3%+ of a property’s value.

- The opportunity cost of having your money sitting in a savings account (earning almost nothing right now) as you build up a large enough nest egg to make a downpayment. Because non-residents have to come up with a 35% downpayment in order to get a mortgage from all Canadian-chartered banks (vs the 5-10% that residents can get away with for their own residence or 20% for a resident-owned rental property) it often takes them several years to sock away enough cash to get started.

- The considerable costs each year in land taxes and maintenance. Are you going to pay a property manager to take care of the daily headaches for you?

- If you sell a property as a non-resident expat, the capital gain on that property is fully taxable in Canada, whereas capital gains on stocks are not.

- It’s often hard to sell a property – whereas it’s easy to sell stocks. This concept is referred to as “liquidity”.

- It’s entirely possible to borrow a ton of investment cash, and use it to make money in real estate – but you need to understand the risk you are taking when you do that.

Now let me ask you – what is the more risky investment (even before we consider borrowing for leverage):

A) A massive company like RBC – which has grown consistently over decades in Canada, paying out dividends like clockwork every step of the way. RBC owns assets all over the world and is trusted by millions of Canadians for all of their daily banking needs.

B) A single investment property in one specific city, in one specific neighborhood, whose fortunes are largely tied to the factors that make people want to live in that specific area.

It’s pretty clear that option B is the much more risky investment, right? When you buy a share of RBC you’re buying a piece of a company that owns property all over the world – in addition to its ability to make money as a business.

Now, what if instead of just comparing RBC to our hypothetical investment property, we compared an investment in 60 of Canada’s biggest companies, including RBC? Obviously the difference in diversification is even more stark in that situation.

Tangible does not equal simple.

Leverage: A Story of Double Edges

Tangible Taylor was a Canadian expat who really wanted to get started with Real Estate. She had to save up for three years in order to sock away $150,000 (which she needed, because as a non-resident real estate investor, you’ll need 35% of a property’s price for the downpayment).

Her $150,000 down payment allowed her to “leverage” $278,571, for a total property price of $428,571 (we’ll ignore those pesky closing costs for the sake of simplicity).

Both the housing market and the stock market can go up or down in sudden – seemingly random – movements. Anyone who tells you differently is just flat out lying. If you lived in the USA in the 90s and early 2000s, it used to be popular to say, “real estate always goes up”. Look how that one turned out!

If the housing market took a 10% downturn in the area where Taylor has purchased her house, she is going to feel the sting a lot more due to the leverage. Here’s why:

Taylor’s initial investment = $150,000

Prior value of the property = $428,571

New property value after 10% downturn = $385,714

Loss = $42,857

$42,857 is 28.6% of $150,000 – Which means that Taylor’s investment is down a whopping 28.6% on a relatively minor market downturn!

Of course, the flip side of this mathematical reality is that if the market had gone up 10%, then Taylor’s gain would be 28.6% (before taxes).

The lesson here is that financial leverage is the sharpest of double-edged swords!

Which Has Been the Better Investment in the Past?

“My home is the best investment I ever made.” -Anonymous Canadian Parent

“That’s because it’s the only investment you ever made.” -Almost-Anonymous Canadian Business Teacher

It’s become fashionable over the last few years to question why school systems aren’t teaching more personal finance and investing principles. Consequently, I wasn’t surprised at the initial positive response that I received from parents when I created and began teaching a personal finance curriculum back in 2014.

What did surprise me was how many parents quickly grew upset when their children came home talking about how investing in the stock market for the long-term was a good idea. Parents would email me or march into my classroom and ask what in the world I was teaching their children. After all, anyone who watched the news in the evening knew that, “The people who had money in stocks, lost it in the crashes of 2000 and 2008/2009!”.

I got so used to explaining how stocks worked, that I kept a file folder of printed news articles in my desk to help explain what the actual numbers were, as opposed to the popular headline-news-generated perception of them.

Just when I would be making some headway in regards to explaining stocks, my students would go home and say, “Mr. Prevost told us that our house wasn’t an investment,” and then we’d start the whole outrage cycle over again. I remain quite confident in my statement that your house is a place to lay your head at night, a purchase that you should thoroughly enjoy the benefits of, and hopefully a fantastic place to create family memories – but your house is only an investment if you intend to sell it and/or you rent out part of it.

Canadians have a love of home ownership that is almost unparalleled throughout the rest of the world. We don’t look at home ownership rationally – we look at it emotionally. A Canadian doesn’t reach “true adulthood” until they buy a house. All of this is fine, as it’s not intrinsically worse to buy a luxurious house than any other form of luxury that brings joy to your life – but problems do arise when this attitude towards housing drastically impacts our sense of what a good investment is. Over the past couple of decades, dinner parties all across the Great White North have been dominated by easily-understood talk of how “home prices just keep going up”. Everyone knows someone whose house is now worth hundreds of thousands more today than it was when they bought it. The idea of the house gaining value is clearly understood – it’s an easily-observed building that goes up in value because people want to live there.

The stock and bond markets are not nearly as easy to understand. We don’t have any sort of background knowledge when it comes to buying and selling these types of assets, and the news reports are often full of hyperbolic headlines that don’t actually reflect long-term trends.

There have been massive books written when it comes to comparing real estate and stock investing, but here’s a few facts to chew on:

- It’s hard to compare apples-to-apples when it comes to long-term investment returns because most comparisons ignore the rent-minus-housing-costs aspect of real estate investment and just focus on capital gains.

- When measuring the overall rise in the price of houses in given markets, we usually ignore the fact that today’s houses are NOT yesterday’s houses. The National Association of Home Builders in the USA has stated that the average home in 1950 was 983 square feet, and by 2015 it had nearly tripled in size to 2,740 square feet! When you adjust for this fact, the actual increase in value per-square-foot of house is much smaller than the 4-5% number that is commonly tossed around in both Canada and the USA. Likely more in the 1.5-2% territory.

- The Case-Shiller Housing Index has stated that between 1928 and 2013, the average annualized rate of return for American housing was 3.7%. The average annual rate of return for American stocks was 9.5% during that time period.

- As Andrew Hallam points out, even in super-hot real estate markets like Vancouver over the last couple of decades, stocks have still done better than real estate by a considerable margin.

- If you think that the last few decades have been the “golden age of Canadian real estate” then you might be surprised to find out that since 1982, Canada’s house prices have only gone up an average of 1.7% per year (vs an average inflation rate of 2.46%).

It’s hard to get reliable housing data from around the world, but when we look at the last 80-100 years of data in Canada and the USA, it becomes pretty clear that housing returns basically equal inflation over the long term. Perhaps inflation +1% if we’re being charitable and ignoring some of the increase-in-housing size calculations.

Canadian and American stock markets on the other hand, have routinely returned 4.5-7% above inflation over the long-term. There is simply no denying that stocks rise in value at a much faster rate than real estate does, when we look at the average of the entire asset class.

Expats Don’t Get to Benefit From What Makes Real Estate So Special

While it’s clear that pieces of big companies (shares) from around the world have increased in value at a much faster rate than property has, that’s not the whole story when it comes to investments. These numbers ignore the rent-vs-expenses cash flow that can be generated as a real estate investor – but most importantly, it ignores the massive effect of leverage.

Many real estate investors have done better than their stock-investor peers over the years due to their ability to borrow up to $9 for every $1 of their own money. Tangible Taylor showed us that when you invest that much of the bank’s money, you can make big gains, or suffer big losses. I have never understood why all of society has decided that it is less risky to borrow to invest in an investment property than it is to borrow to invest in a broad portfolio of shares in the world’s biggest companies. There is no data that I’ve read to back that up – only the idea that somehow because a house is tangible, it must be safer. But we have now established that tangible does not equal simple, so perhaps we should add to that knowledge the fact that tangible doesn’t equal safe. Again, just watch The Big Short and think about highly-leveraged real estate investors in Florida circa 2008 for more details on just why real estate is not a magically de-risked investment, and why it is not simple.

That said, real estate investors commonly point to leverage as the reason why real estate can beat stocks in the long-term. Except, in the case of expats, the ability to leverage your money has significantly decreased because you have to come up with such a large down payment.

I think it’s fair to assume that being an overseas landlord is going to be more expensive than it would be if you were on the ground back home and able to help take care of your own properties. Increased costs of property management are going to eat away at that juicy rental income.

Some other expat-specific real estate notes:

- Many lenders will charge you a higher interest rate – so it pays to shop around.

- You cannot get a home equity line of credit.

- You cannot refinance.

- If you have a rental property that sits empty for a length of time, it can be interpreted as having a residence available in Canada, and could impact your non-resident tax status. (If you can show that it was advertised for rent at market rate, you should lessen your chances of a non-favourable tax status ruling.)

Finally, due to some fun quirks in the Canadian tax code, Canadian expats can basically invest in the stock market and enjoy returns without paying any Canadian taxes (using our most recommended ETFs). Real estate does not enjoy this protection from the taxman. Your rental profit and your capital gain will be taxed by the Canadian Revenue Agency – and your overall returns reduced substantially.

The bottom line is that while it is certainly possible for Canadian expats to make money in real estate, you are facing many headwinds in trying to make (and keep) money in that asset class compared to a portfolio of stocks and bonds, plus it is a whole lot more paperwork and variables to keep track of then your investing account will be.

How Should a Canadian Expat Invest in Stocks and Bonds?

So, if stocks and bonds are the best type of investment for most Canadian expats – what is the best way to go about actually getting money from your paycheque to purchase these assets?

It’s probably easier than you imagine. I personally spent less than an hour per year buying my investments when I was a resident Canadian, and I don’t plan on changing now that I’m an expat.

See, the financial industry makes a lot of money off of you being too intimidated to try to select your own investments. They use vague terms like “portfolio” and “risk-adjusted returns” in order to justify their fees. Portfolio is just a fancy name for “all of your investments”, and risk-adjusted returns refers to how much money would have historically gone into your pocket compared to the investment risk you’d have to take when you owned that asset.

We’re going to get into the very specific options that Canadian expats can choose in a follow up article (as well as a peak at how my expat portfolio looks), but for now I think it’s worth understanding a few broader points about investing in stocks and bonds. I have found it useful when beginning to dive into this topic to look at what an investor actually has control over – and consequently what they should focus on.

CAN Control or Predict w/ Accuracy | CAN’T Control or Predict w/ Accuracy |

Fees/Costs: You can 100% understand and control how much you pay for financial advice and access to the investing platforms that let you buy and sell investments. | Short-term stock market returns: If someone tells you that they know what any stock or bond market is going to do in the next few years, then move on immediately. There have been dozens of long-term market prediction studies done by university professors, investment companies, and brilliant Nobel Prize winners. They all confirm that it’s essentially impossible to predict the short-term gyrations of the stock and bond markets. I know that it’s tempting to think that you can “time the market” and get in while it’s good, and out when it’s bad – or to only pick the good stocks – but our brightest investment minds tell us that it’s incredibly difficult for full-time professionals to accomplish this consistently, nevermind amateurs. |

Asset allocation and diversification: Asset allocation is a fancy way of saying “How much money should I put in each type of stock and how much in each type of bond?” While trying to pick the best stocks or bonds is a fool’s errand, you can decide what your risk tolerance is, and then build a portfolio that fits your risk profile. You can also cut back on the overall risk to your nest egg by easily diversifying your investment dollars across thousands of companies and bonds. |

Currency fluctuations: Wondering if now is the best time to transfer your money back into your home currency? You can quit wondering because the answer is that nobody knows. Just transfer your money systemically and don’t drive yourself crazy trying to predict the market. |

Your psychology and long-term discipline: When it comes to investing we are often our own worst enemy. Many experts like Daniel Kahneman have detailed why human beings are hard-wired to be bad at investing. Understanding these biological impulses and recognizing them in yourself can allow the more logical & math-oriented part of your brain to control your actions. The ability to control emotions has historically had a large impact on overall investment returns | Pandemics & Politics: Don’t radically respond to daily news cycles. You can’t control these events, but you can control your response to them. Ignoring the noise is almost always the best answer. |

Tax efficiency: You can control (to some degree) the different types of income you will receive from your investments (dividends, capital gains, or interest) – and what type of accounts that money will be stored in. Choosing the type of income that has the lowest accompanying tax rate can make a substantial difference in how much money ends up in your pocket. You can also incorporate taxation rates into the country you choose to live and work in. | Tax rates: You can’t control what Canada or your new country of residence will ask you to pay on certain types of income. |

Setting savings/investment rate goals: Creating measurable goals – and writing them down as part of an overall plan – has been proven to significantly raise success rates across a large number of fields – investing is no exception. Don’t just “invest whatever is left” at the end of the month, but instead come up with goals, and a plan to meet them, such as saving 20% of your pay the day after you receive it each month. |

|

Study after study has proven that long-term investment success is directly correlated to focusing on what you can control – and largely ignoring what you can’t.

Unfortunately, it’s way more fun to fantasize about a world in which you can control how the stock markets perform, and just how much money you can make by outsmarting the other investors in the market. Let’s take a look at why that approach is almost certainly doomed to failure.

Index Investing – Beat Professionals With 1 Hour Per Year

If you spend any time reading financial articles from around the web, you’ll start to notice two things pretty quickly.

- People who get paid to recommend a certain type of investing strategy ALWAYS recommend that investing strategy. It will clearly be the best one in their eyes (whether it’s mutual funds, hedge funds, stock picking, etc).

- Roughly 99% of the people who don’t get paid to recommend any specific type of investing strategy will recommend some form of “index investing”. Index investing is often referred to as couch potato investing, passive investing, or ETF investing.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” – Upton Sinclair

There is a massive industry out there that depends on you trusting other people to pick your investments for you. They are held up by gargantuan amounts of marketing dollars and have well-rehearsed talking points designed to deflect your pointed questions. Mutual funds and various types of insurance-backed pension investment schemes are the best examples of these types of “wealth management platforms”.

Almost anyone who is not getting paid to promote mutual funds or wealth management hocus pocus will tell you that mathematically speaking, those options are awful. They will then start talking about how to get the average returns of the stock and bond markets – while cutting your investment fees to the absolute minimum.

Before I give a brief summary of why index investing is great, I just want to point out that you shouldn’t just take my word for it. I’ve already mentioned Andrew Hallam’s excellent work in this area, but please see what the Globe and Mail’s Rob Carrick or personal finance commentator Preet Banerjee have to say on the topic. There are many excellent books (written by Canadian authors) out there from Wealthing Like Rabbits by Robert Brown to The Value of Simple: A Practical Guide to Taking the Complexity Out of Investing by John Robertson. I also recommend checking out anything written by Dan Bortolotti – the Godfather of Canadian index investing or Jason Heath – one of Canada’s leading independent fee-only advisors. If you want to add some international flavour to your index investing coffee, The Little Book of Common Sense Investing by investment legend John Bogle is a super accessible way to understand the math behind what makes index investing great.

There are many more authors – who are not paid to recommend any specific type of investing – who have written about why index investing is by far the best way to invest for the average person. Just because you happen to be a Canadian expat doesn’t mean that the math changes that much for you!

Index Investing In a Nutshell

Here’s the basic principles behind index investing.

- Stocks and bonds have made a lot of money over the years. If your investments were to have received the average return of these entire asset classes (Ex: Every stock in Canada, or bonds from every country) then you would have done very well.

- There is an easy way to guarantee that you will get the average amount of an asset class – simply own a little bit of every share or bond in the entire group of assets. I know this sounds like a ton of work, but in the last twenty years, some excellent options have emerged that allow you to do this quickly, efficiently, and are super inexpensive.

- Every day millions of professional investors wake up all around the world. Many of them are qualified to build rockets for a living, or design computer programs based on complex mathematical equations most of us will never understand. They log into supercomputers and read not only the latest official reports from companies and countries around the world, but they also have access to insider tips from former politicians and elite professionals. (Just Google what types of “consulting” former Prime Ministers and Presidents from around the world do after they leave office.) These investment professionals are then promised millions of dollars in bonuses depending on how well they do, and how hard they are willing to work.

- These extremely bright professionals who have access to incredible informational and technological advantages over the everyday investor, are going to spend 70+ hour work weeks trying to outsmart each other by picking the best stocks or bonds. You can either decide that you’re smarter and better prepared than they are, by buying and selling individual stocks/bonds, or you can decide that the average return at the end of all of their buying and selling is good enough for you.

- The average mutual fund person that non-millionaires have access to might be a “professional” in that they work in the investment industry – but they are considered complete jokes by the sharks at the top of the investment food chain. Most mutual funds will charge you super high fees to do a worse-than-average job. If people understood how investing worked, mutual funds in Canada would almost certainly cease to exist.

- The idea that average investors are best off focusing on cutting fees and having the best balance of investment assets for their specific risk profile – as opposed to trying to pick stocks and time the market – is generally attributed to Nobel Prize winner and University of Chicago professor Eugene Fama. His basic idea was that every day investors around the world try to put their money where it will grow the most. They learn everything they can, and try to get the best price possible. At the end of the day, the total effect of all of these people doing their best to maximize their investment returns, leads to a market that has more-or-less set prices where they should be for each stock or bond. This idea is called the efficient market hypothesis, and while there is some argument as to just how efficient the market is over short periods, over the long-term it has proven to be quite effective at pricing assets.

- Places generally considered to be pretty smart, such as Harvard and Yale – plus the largest pools of money in the world like the Norwegian Sovereign Wealth Fund – all use index investing to invest the billions of dollars under their control. Don’t trust me – trust Harvard, Yale, and the rich Norwegians!

Finding the Right Index Investing Option for You

Alright – you’re convinced that getting the average returns of the stock and bond markets are your best bet.

If you’re not – please go ahead and read more on the topic. You’ll come across quotes such as:

“A low-cost index fund is the most sensible equity investment for the great majority of investors. By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.” -Warren Buffett

Don’t look for the needle in the haystack. Just buy the haystack! – John Bogle

“Building a portfolio around index funds isn’t really settling for the average. It’s just refusing to believe in magic.” – Bethany McLean

There’s something to be said for the dart-board method of investing: buy the whole dart board.” – Peter Lynch

Eventually I’m confident that you’ll come to the same conclusion I did: Index investing is the only logical way for the average investor – and the average Canadian expat – to try to build their wealth.

The next two decisions that we have to look at are:

- How much investment risk is appropriate for you?

- What platform should I use to carry out my index investing strategies?

The idea of investment risk and risk tolerance is super important and probably the most complicated part of this whole investing thing. Getting it right is not something to be taken lightly.

The basic idea is that if you are not comfortable with your investments, you won’t sleep at night (which is kind of a drag), and statistically-speaking, you’ll be very likely to sell your investments at the worst possible times.

There are various online tests and questionnaires that can help you decide what your investment risk tolerance is. Answering questions such as:

“If I saw my investment portfolio go down by 35% in one month, would I get very scared and sell the rest, hang on and remember my long-term investment plan, or get excited at the thought of buying more assets at very low prices?”

can help you to determine what balance of stocks and bonds you should have in your portfolio. Ultimately though, risk tolerance is a tricky concept and it can evolve over time. For example, it’s much easier for me to accept risk as a young person who is fairly early in their investing career, than my parents who just recently retired and are quite sensitive to seeing their investments go down in value.

When it comes to investing, there is a direct relationship between risk and return. This makes logical sense when you think about it. If there was an investment that offered excellent returns with very little risk, investors would flood into that market, destroying the supply-and-demand balance.

When a company looks like a great investment, shares of that company go up in value quickly, until it is quite expensive to buy shares of that company. At the point, the company won’t be as good an investment any more.

If a country like Canada or the USA looks very likely to repay its debt (as we have for the entire history of our countries) then people will continue to lend them money at very low interest rates by purchasing their bonds. Whereas countries that look “shaky” and might fail to repay their debts (such as Greece back in 2009/2010 or modern-day Argentina) will have to promise investors a much higher interest rate to tempt them into lending money.

Risk and return are joined at the hip – so anyone who tells you that they can get you increased returns with a low risk – is probably trying to sell you snake oil.

When it comes to picking investments, your risk tolerance is going to decide how much money you should place in bonds and how much you should place in stocks. Over the long-term, there is much debate over just how risky stocks actually are (they have done quite well over 30-year stretches) – but in the short term there is no doubt that stocks are very temperamental. They rarely behave in the neat linear way we like to pretend they do when we say, “Ok, let’s assume 8% annual returns.”

Because stocks tend to jump up and down like a jackrabbit after seven shots of espresso, they can really scare a lot of investors. After all, it’s no fun to see a third or more of your hard-earned investment dollars “evaporate” during a crazy month, and have all the news headlines screaming at you that the end is near! When we’re scared we make really bad investment decisions – this is where bonds come into play.

Bonds are the safety net of your portfolio. They calm down that expresso-bunny. By allocating a certain percentage of your portfolio to purchase bonds, you limit the potential highs and potential lows that you will see in the short- and medium-term. The idea here is to use the steady-as-she goes nature of the world’s lowest-risk bonds (essentially loans to countries like Canada, USA, Germany, as well as massive companies like Apple, IBM, etc) to even out the up-and-down movement that you’ll see from your stock market index when you log into your discount brokerage account.

Bonds won’t go up or down in value very much in the short-term. For example, one of Canada’s popular bond index ETFs has vacillated between $24.00 per unit and the recent high of $27.75 per unit over the last nine years. (Each unit is just a bunch of Canadian government bonds that have been chopped up to have a little bit of a whole bunch of bonds in each piece that is sold as a unit of an ETF – more on this later.)

Over that entire nine-year stretch, the bond index has consistently paid out between 2.6% and 3%. This basically means that various governments and huge businesses across Canada have paid out roughly 2.8% in interest payments over the last nine years in order to entice you to lend them money.

In order to get the most benefit from bonds, investors need to decide what percentage of their overall portfolio should be in bonds, and what percentage they want in stocks – then stick to those percentages no matter what’s “doing good” at the time. In practice, what this means is that if stocks are having a booming year, they’ll quickly become too large a part of your portfolio. In that situation you’ll have to sell some, and use the money to buy bonds in order to stick to your target percentages.

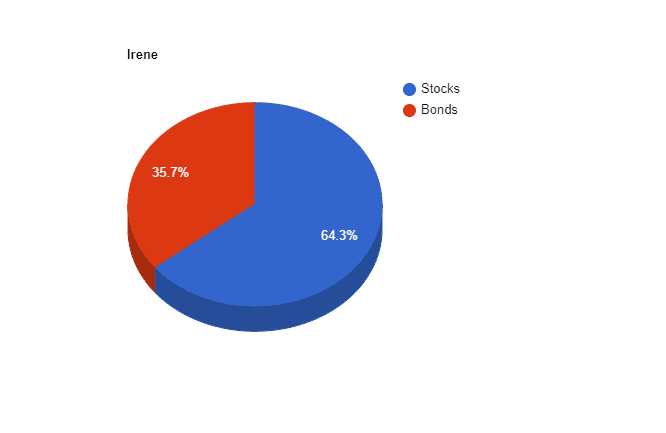

For example: If Index Irene has decided that she wants a portfolio of 60% stocks and 40% bonds, she would use her $400,000 to purchase $240,000 worth of stock index funds and $160,000 worth of bond index funds.

If the stock market has a great year and our bonds stay roughly where they are, Irene could easily end the year with $280,000 worth of stocks, and $155,000 worth of bonds. Her investment portfolio at the end of the year would be worth $435,000, and her new portfolio pie chart would look like this:

So in order to get back to her 60/40 split and keep her investment money right where her carefully examined risk tolerance says it should be, Index Irene will have to sell $19,000 of her stocks (leaving her with $261,000 in stocks) and use that money to buy $19,000-worth of bonds (bringing her bond total to $174,000).

Irene might not be ecstatic about her moderated portfolio when the stock market had a great year, but if the opposite happened, and stocks had fallen 18%, her bond portfolio would have saved her a ton of pain.

Deciding how much risk you should take in your portfolio shouldn’t be a quick decision. Think hard about how you might react in various situations and be honest with yourself. Have some conversations with investors who have been through some shocking losses over the years, or pay a fee-only financial advisor to help you think it through. Once you have figured out how much you should have in stocks and how much you should have in bonds, you’re ready to move on to deciding how you’ll actually purchase your investment portfolio – and that’s what we’ll be looking over the next couple of months as I dive deeper into the expat investing world.

Thank you for another great post, Kyle!