Quick Tip: Questrade Currency Settlement

I’ve made a lot of mistakes along my personal finance journey. Let me tell you about one of these mistakes.

Rhymes with “nasal”

The year is 2010, I was fresh out of university and was embarking on this thing called a career. I needed to figure out what to do with pay cheques showing up regularly in my account. Luckily, there was, and still is, a wealth of personal finance blogs and publications available. Million Dollar Journey being one of them (throwback to a 2010 article). I soaked up all the great advice and started a path towards financial independence through investing.

Having read FT’s Questrade review, I opened a Questrade account and began my index investing journey. I started with low fee Canadian equity ETFs, but soon wanted to diversify into U.S. equities – and I wanted to hold those U.S. equities efficiently in U.S. dollars. A great choice at that time (and still is to this day) was the ultra low-fee Vanguard ETF VTI. I wanted to buy $2,000 USD worth of VTI shares.

The easiest thing would have been to just let Questrade handle the currency conversion within my trading account, but I was a penny pinching new grad and a fussy optimizer (or, more accurately described by a different word, one that rhymes with nasal). I decided to buy USD as cheaply as I could manage outside of Questrade then transfer the funds into the Questrade account. In order to do that, I had to first open a USD chequing account to hold cash in USD, then link it with the Questrade account so I could make USD transfers into Questrade.

Foreign currency contribution to registered accounts

An additional complication was that my Questrade account was a registered TFSA. I had to figure out how to work out TFSA contributions in a foreign currency. Of course, we know it’s important to accurately track one’s TFSA contribution to avoid over contributing. But if I contribute USD into my TFSA, how much of my contribution room got used up? Which exchange rate should I use to calculate that contribution? I wasn’t sure, so I called the CRA for clarification.

Bonus tip: I found out that, for tracking purposes, foreign currency contributions to TFSA accounts are converted to CDN using the Bank of Canada exchange rate on the day of the contribution. This applies to RRSP contributions as well. Be careful with your record keeping, don’t over contribute to your registered accounts due to a miscalculation or misuse of the exchange rate.

The Transfer

The stage was set, I bought $2,000 USD at the cheapest exchange rate I could find. I opened a USD chequing account and linked it with Questrade. I even called the CRA and made sure I knew how my contribution should be recorded. I was ready to fund my Questrade account, buy my first VTI shares, and start diversifying my investment outside of Canada!

I made the transfer and quietly congratulated myself for navigating a complicated process and for being just one step away from international diversification.

The next day, I was excited to buy my first U.S. listed ETF and eagerly logged into my Questrade account.

And…

The USD balance showed zero.

Okay, I thought, the transfer hasn’t gone through yet. Funding transfers into Questrade usually clear very quickly, but I guessed that I was unlucky and had to wait the full two business days. Then I glanced at my CAD balance and saw a higher number than I expected. My mind raced to figure out what happened. Was there a distribution that I didn’t know about? No, the amount was too much to be a distribution from my few meager Canadian ETF shares.

Did I forget about selling some shares? I don’t think so, my holdings didn’t change. Or did I forget about an earlier fund transfer? Nope, I was sure the only transfer I made was the $2,000 USD transfer from my external USD account.

Wait.

My CDN balance looks suspiciously close to what $2,000 USD would be in CDN dollars.

Questrade had converted my USD transfer into CDN dollars.

What the heck!

I did everything correctly. The funds somehow ended up converted back to Canadian dollars in Questrade, costing me some money in the unnecessary currency conversions.

I picked up the phone and angrily dialed customer support. I readied a string of swear words and unkind sentiments. I was ready to complain furiously!

But…

It turns out that Questrade had done nothing wrong. The mistake was all mine.

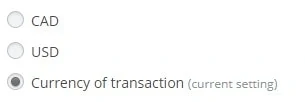

That day, I learned about the “currency settlement” setting on my account. You see, there are three currency settlement options: CDN, USD, or Neutral. Upon opening the account, the currency settlement option defaults to CDN. That is, Questrade forces every transaction to be settled in CDN dollars. For example, if I sell a U.S-listed stock, my proceeds would be paid out in USD, but those proceeds would then be automatically converted to CDN dollars at the end of the day. Of course, any USD funds transferred in is automatically converted to CDN. I should have set my currency settlement option to neutral. That way, any transactions will settle in the currency of that transaction. If I sell U.S-listed stocks, my proceeds stay in USD, and USD transfers add to the USD side of my account balance.

Of course I asked the customer support rep to change my currency settlement option to neutral but it was too late for my USD fund transfer. The currency conversion already happened and I already lost money through the spread. Lesson learned, I didn’t set my account settings correctly and paid the price for that lesson.

Don’t make the same mistake I made

Here is how you can set your currency settlement option:

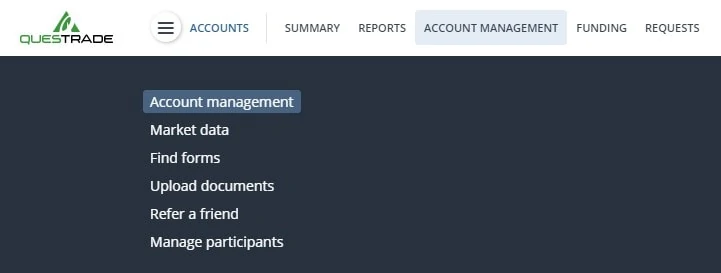

Log into your Questrade account and find the “ACCOUNT MANAGEMENT” tab within the “ACCOUNTS” section. Then find the “Currency settlement” option and click on “Change.” Select the “Currency of transaction” as the current setting and you’re set! Your future transactions will stay in the currency of the respective transaction. No surprise currency exchanges.

Stubbornness costs money

The story should have ended with me accepting my mistake, buying shares in a Canadian listed ETF, and waiting to hold U.S. equities in USD another day. But I am often stupidly stubborn. I had my heart set on buying VTI using USD and damn it, I was going to buy VTI using USD!

So I bought some VTI shares…

And incurred another currency exchange. I didn’t have the heart to calculate how much money I wasted unnecessarily changing between USD and CAD, and back again. So here is a bonus mistake on top of the mistake cake: I let my stubbornness rule the day.

By the way, my bank (TD) has since discontinued the option to pay a bill payee from a USD chequing account, so I currently don’t have an easy way to transfer USD into my Questrade account. However, other institutions might still offer this option.

Additional resources

Now that you’ve set your Questrade currency settlement settings correctly, you must be eager to start investing in U.S. Dollars. Let me point you to the many articles on this website that can help with currency exchange and foreign investment:

- Here are three ways to convert between CAD and USD. One option is to use a money transfer company like Transferwise.

- The cheapest way to convert between CAD and USD is through Norbert’s Gambit. Here is a real life example to follow along.

- Finally, here is a quick article on building a simple low-cost indexed ETF portfolio in USD.

Keen eyed viewers and long term Million Dollar Journey readers, did you spot the hidden mistake in my story? Holding VTI in my TFSA exposed me to foreign withholding tax. The most efficient container for U.S. equities like VTI would have been my RRSP account.

Yang is a mechanical engineer by day and an avid learner by night. He has a wide range of interests and hopes to turn his interest in personal finance into helpful articles for other Canadians along their path to financial freedom.

Honestly, questrade owns a part of this as well. It would be very simple (and customer friendly) to add a field in the transfer process that asks you what currency you want the funds deposited in. But questrade doesn’t mind making a few extra bucks off of you…

Normal learning experience

So I can’t figure it out, what rhymes with Nasal then?

It’s easy to beat yourself up, but a wise man once told me “learning costs money.” You never forget some lessons. Besides, a big lesson in the beginning is better than a big lesson in the end.

Norberts Gambit for currency conversion works nicely.

Thanks for your insight.