The Best Mutual Funds in Canada (and why you should avoid them)

Despite the fact that they’ve been proven over and over again to be a pretty lousy way to invest money, I still get a surprising number of questions about where to find the best mutual funds in Canada. It happens in the MDJ comments. It happens in emails. It definitely happens when I speak to audiences in person.

I’ll spend an hour explaining why low-cost ETFs, sensible asset allocation, and behaviour matter far more than product selection. People nod along. They take notes.

Then the Q&A starts.

“And what do you think of TD mutual funds?”

“Are RBC mutual funds better than BMO’s mutual funds?”

It’s almost always the same demographic. Folks getting close to retirement. Smart people. Hard workers. Canadians who’ve spent decades being gently coached by big financial institutions to believe two things:

1) Financial advice is free.

2) Mutual funds are just how investing works in Canada.

That combination is powerful. It’s reinforced by a wall of trust, branding, and repetition that’s been built up over a lifetime. Breaking through it is tough.

So, for today only, I’m going to pause the usual recommendation about pairing one of the best financial advisors in Canada with a simple, low-cost investment portfolio comprised of our top Canadian ETFs. Not because I’ve changed my mind. But because I know some readers aren’t ready to hear that yet.

Instead, we’re going to slow things down. We’ll start by clearly explaining what a mutual fund actually is in plain language.Then I’ll walk through why mutual funds are a particularly bad deal for Canadian investors. Finally, if you’re still unconvinced and absolutely determined to stick with mutual funds, I’ll point you toward the options that do the least damage.

Canadians had more than $2.5 trillion invested in mutual funds at the start of 2026. That much money signals just how many folks still hold the bulk of their retirement assets in traditional bank mutual funds. Pretending that’s not true doesn’t help anyone.

What Is a Mutual Fund?

A mutual fund is, at its core, a pool of money that is meant to purchase investments. You toss in your investment dollars, and so do thousands (sometimes millions) of other people. That money gets bundled together – and then handed over to a fund manager, who then uses it to buy a variety of investments. Most Canadian mutual fund managers use your money to purchase some assortment of stocks and bonds.

You don’t directly own the individual investments inside the fund. What you own is a proportional piece of the entire pool of investments. So if the mutual fund buys 100 shares of RBC, and your contribution represents 0.5% of the fund’s total assets, then you indirectly own 0.5 shares of RBC.

The idea is that by investing in a mutual fund, you get instant diversification. You’re not betting on just one stock or bond – you’re spreading your money across dozens or even hundreds of them. And you’re doing it with relatively little effort on your part. Sounds pretty good, right?

Well… that’s the sales pitch, anyway.

Mutual Funds: How the Sausage is Made

The mechanics of mutual funds haven’t changed much since they were first rolled out in Canada in the 1930s. Here’s how it typically works:

1) You invest in a mutual fund through a bank, credit union, insurance company, wealth management firm, or financial advisor. Those institutions will take your money and put it into a specific mutual fund.

2) The mutual fund manager decides what investments to buy and sell with the fund’s money.

3) You’re charged an annual fee, known as the MER (management expense ratio), which gets siphoned off whether the fund performs well or not. Let me reiterate – you pay the MER fee (which is a percentage of your entire portfolio) even if the mutual fund’s investments lose money that year.

4) You own units of the fund. The price of these units will go up and down depending on the value of the investments within the mutual fund.

5) Payments (referred to as distributions) such as dividends or capital gains, may be paid out (and would be taxable in non-registered accounts, but not in a TFSA or RRSP).

What Types of Mutual Funds Exist in Canada?

There are thousands of mutual funds in Canada, and they come in just about every flavour imaginable. There are sub-categories within sub-categories.

For the vast majority of Canadians, almost all of the mutual funds that will be recommended to them will be some combination of stocks and bonds. The word “stocks” essentially means the same thing as “equities,” or “shares.” The word “bonds” is often used interchangeably with “fixed income.” Here’s a quick breakdown of what funds you might hear about if you walk into a mutual fund salesperson’s office:

Equity Funds: Invests your money in stocks. You might hear about Canada-only equity funds (only investing in Canadian companies). Dividend-speciality equity funds (only investing in companies that pay high dividend yields). USA equity mutual funds, international equity mutual funds, emerging market equity mutual funds, tech sector mutual funds, energy sector mutual funds, etc. All of these are just groups of various types of stocks.

Bond Funds: Focus on fixed-income securities like government or corporate bonds. In Canada, the vast majority of bond mutual funds are a mix of federal government bonds at different durations, provincial government bonds, and sometimes bonds from utilities and major corporations.

Balanced Funds: A blend of stocks and bonds. You might hear, “This is a 60/40 mutual fund.” That means it’s a balanced mutual fund of 60% stocks (equities), and 40% bonds (fixed income).

Those are the main categories, but you might also hear about the following:

Money Market Mutual Funds: low risk investments that are similar to having your money in a high-interest savings account.

Index Mutual Funds: Passive investing options that track an index (usually a stock index). More on these later – some are okay-ish.

Target-Date Funds: These are basically balanced funds, but with a special feature where it gradually changes your mix of stocks and bonds as you get older. It’s meant to automatically shift your asset mix to a less risky portfolio as you approach retirement.

Specialty and Sector Funds: There is almost no end to the number of exotic niche mutual fund offerings that can be inserted into a lucrative sales pitch. These funds might be focused on precious metals like gold, real estate, tech stocks, private equity, private credit – and all manner of other things that you will never need to care about.

Are Canadian Mutual Fund Managers Good at Their Job?

Before I get to dunking too hard on Canadian mutual fund managers, let’s get one thing straight: It’s really really hard to pick stocks and bonds better than the folks that rule the world’s stock markets.

Every time that you – or a mutual fund manager – buys or sells a stock, you think you got the better end of the deal. But so does the person on the other side of the transaction! These days, the vast majority of stocks and bonds are bought and sold by supercomputers using instantaneous algorithms. These algorithms are created by NASA-level mathematicians, and informed by folks working at the biggest hedge fund firms and sovereign wealth funds in the world.

These people are geniuses, with access to insider information (look at how many former presidents and prime ministers are on their payrolls as “consultants”), and their paycheque depends on how well they do. So beating these hedge fund men and women at their own game is a pretty difficult proposition.

Most stock and bond market analysts will explain how a mutual fund manager has done by comparing the results of their investments (often referred to as investment returns) to the overall average of a specific group of investments. That group of investments is usually called a “benchmark.” If a mutual fund manager does better than this average (after subtracting their fees), they are commonly said to have “beat the market” or “beat their benchmark.”

So, for example, if I were a mutual fund manager that was responsible for handling the investments of “Big Bank Mutual Fund One – Canadian Equity,” then I would be buying and selling Canadian stocks on the Toronto Stock Exchange.

After all that buying and selling, I would compare my investment returns to the average of all of the stocks in the S&P/TSX Composite Index. That Index is a list of about 220 Canadian stocks, and it goes up and down every day. If I’m good at my job, then I should be able to beat the market average or “beat my S&P/TSX Composite Index benchmark,” most of the time right?

So how many mutual fund managers manage to pull this off… (Keeping in mind that at least a few should do it just by statistical luck right? Like if we asked one thousand monkeys to point to the team that will win the Stanley Cup, at least a few will do better than the experts over a given five-year period.)

Well… apparently somewhere between 0% and 10% of fund managers is the answer.

That’s right – it’s possible that there are actually NO mutual fund managers that are good at their jobs.

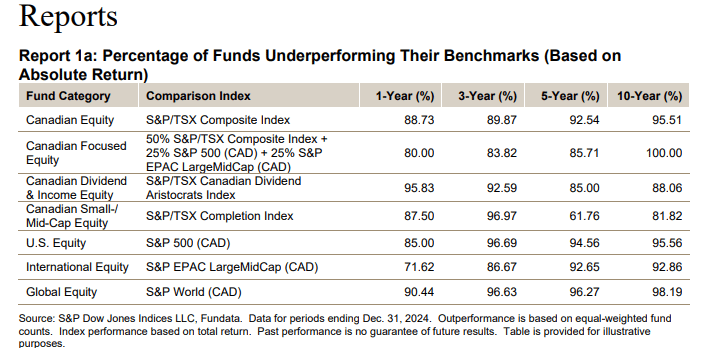

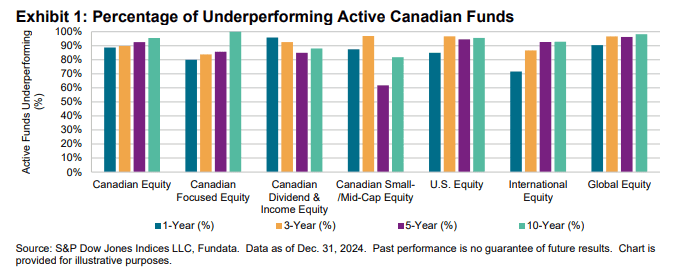

The long-term numbers below speak for themselves.

The fact there are essentially no mutual fund managers that are good at their jobs is the only conclusion you can draw after reading these numbers.

The funny part is that these conclusions don’t change much from year to year. We’ve known for a while now that most mutual fund managers are bad at their jobs! This data is put together annually by SPIVA – S&P Indices Versus Active. It’s a long-running, data-heavy series of reports published by the team behind the S&P Dow Jones Indices, one of the world’s most respected financial analytics and indexing firms. It is widely quoted by experts throughout academia and the media.

There are many reasons why there are almost no examples of Canadian mutual fund managers that can claim to beat their benchmark over a 10-year period. There are a lot of fees to consider, as well as the fact that they are competing against bigger fish than themselves – and they’re just not going to win that battle in the long term.

But – maybe the best Canadian mutual funds can be selected ahead of time and we can avoid all of these bad mutual fund managers right?

Index Mutual Funds (Active vs Passive)

If you’ve ever sat through a bank advisor’s pitch about a “balanced mutual fund with top-tier active management,” chances are you’ve heard the story: “Our experts hand-pick the best investments to outperform the market.”

Admittedly that sounds intuitively appealing.

The problem is that the story rarely holds up (as we can see in the data above). To fully understand why getting mutual fund managers to pick your investments for you is a bad idea, you have to understand the difference between active and passive investing.

Active mutual funds try to beat the market by buying and selling specific stocks or bonds based on research, forecasts, and the manager’s instincts.

Passive mutual funds – also known as index mutual funds – don’t try to outguess the market. Instead, they simply aim to track the performance of a particular index (like the S&P/TSX Composite or the S&P 500), investing in the same companies in the same proportions as the index. In other words, they will get the exact same return as their benchmark.

Passive investing using index mutual funds is just statistically very very likely to beat any particular active mutual fund managers stock or bond picks. A few managers are bound to beat their benchmark in any given year – but almost none beat it over the long-term.

Here’s the real kicker: Out of the few that do outperform, we really don’t know if it was skill, or just luck that allowed them to do so. Remember Maggie the gambling monkey TSN used back in the day? If we have enough Maggies picking stocks, there is bound to be one or two that beat their benchmark.

The Best Mutual Funds in Canada

Given the proof above that actively managed mutual funds are a bad idea, my list of the best mutual funds in Canada is going to be dominated by index mutual funds, and then a few funds who have a very good track record (mostly due to very low fees). I’m going to go into more detail below about the inner workings of Canadian mutual funds, but I thought we’d get this list out of the way.

| Fund Name | Provider | Benchmark Index | Management Expense Ratio (MER) |

| TD Canadian Index Fund – e-Series | TD Asset Management | Solactive Canada Broad Market Index | Approximately 0.33% |

| BMO Canadian Equity ETF Fund | BMO Investments Inc. | S&P/TSX Composite Index | Approximately 0.50% |

| NBI Canadian Index Fund | National Bank Investments (NBI) | S&P/TSX Composite Index | Approximately 0.50% |

| Scotia Canadian Equity Index Fund | Scotia Global Asset Management | S&P/TSX Composite Index | Approximately 0.56% |

| RBC Canadian Index Fund | RBC Global Asset Management | S&P/TSX Composite Index | Approximately 0.66% |

| CIBC Canadian Index Fund | CIBC Asset Management | S&P/TSX Composite Index | Approximately 0.89% |

| Steadyhand Canadian Equity Fund | Steadyhand Investment Funds | 60% Morningstar Canada Index; 40% Morningstar Developed Markets Index ($Cdn) | 1.10%-1.42% |

| Steadyhand Global Equity Fund | Steadyhand Investment Funds | Morningstar Developed Markets Index ($Cdn) | 1.10%-1.78% |

| Mawer Canadian Equity Fund | Mawer Investment Funds | S&P/TSX Composite Index | 1.16% |

| Mawer International Equity Fund | Mawer Investment Funds | Various International Indexes | 1.39% |

| Mawer Balanced Fund | Mawer Investment Funds | Various International Indexes | 0.91% |

As you can see from my Canadian mutual fund rankings above, I basically just selected the index funds from the major banks, and then when it came to selecting active management mutual funds, I selected a few from the Mawer and Steadyhand companies.

These two companies are kind of the “best of the worst” when it comes to Canadian mutual fund options. I don’t think they’ll be able to beat their benchmarks over the long term, but due to their low fees and consistent manager performance, they’re the most likely to come closest.

Mutual Fund Fees in Canada: Highest in the World?

Historically, Canada has been recognized for having some of the highest mutual fund fees globally. In the 2010s, the average Management Expense Ratio (MER) for Canadian mutual funds was well over 2%. This was significantly higher than the global average, where many countries offered mutual funds with MERs well below 1%.?

Many Canadian mutual funds included embedded commissions, compensating advisors through trailing commissions, which were part of the MER.? The Canadian mutual fund industry has been dominated by a few large institutions, reducing competitive pressure to lower fees.?

Over the past decade, there has been a concerted effort to reduce mutual fund fees in Canada. The Canadian Securities Administrators (CSA) implemented regulations to enhance fee transparency and eliminate certain embedded commissions.?

That said, many of the largest mutual funds in Canada still have MERs that are higher than 2%. It comes down to the Series of the specific mutual fund that you’re invested in. The basic idea here is that the same investment manager is going to manage different “series” within a fund. Usually a Series A mutual fund is the one that will get sold to most Canadians. It has commissions built in that include the management fee, operation fee, and the advisors fee – all in one. This is why financial advice is definitely NOT FREE!

The Series F funds on the other hand, usually have much lower fees, as compensation for the financial advisor is generally not included in these fees.

The biggest and most popular mutual fund in Canada is the RBC Select Balanced Portfolio Series A mutual fund. That’s likely due to RBC’s large network of branches and the accompanying client base. It has an MER just under 2%. The fund itself is actually a collection of other RBC mutual funds. Some of these mutual funds look at Canadian stocks, others look at corporate bonds.

There is a lot of overlap between the 10 different mutual funds wrapped inside this bestseller. Despite all that, you’re actually still getting less exposure than you would by investing in the best Canadian all in one ETFs.

Pretty much of the worldwide stock (aka “Global Equity”) mutual funds still have MERs in the 2.1-2.5% range. Overall, Canadian mutual fund fees are still amongst the very highest in the world. By comparison, the average MER for mutual funds in the USA is about 0.50% and in the UK it’s about 0.75%.

Why Invest in Mutual Funds?

So, with all of the above taken into consideration, why do mutual funds remain such a popular choice for Canadian investors?

Here’s the polished argument for why mutual funds are supposed to be a smart choice for Canadian investors – at least according to the people selling them.

1) Change is scary – and you’ve been with us for years. More and more young investors are looking at alternative means of managing their money. They’re opening an online brokerage account, or checking one of Canada’s robo advisors. But the fact is that the older generations still retain the vast majority of wealth in Canada – and many of them built that wealth through mutual funds. The path of least resistance is simply to leave them there.

2) You should really let a professional manage your money. The biggest selling point for mutual funds is professional management. The idea goes like this: why try to pick stocks or bonds on your own when you could hire a team of highly educated experts to do it for you? While mutual fund managers as a group aren’t very good at their jobs, their returns do beat the majority of Canadians who try to pick their own stocks. For investors who don’t want to be glued to stock screens or pouring over financial statements, this “leave it to the pros” messaging is very appealing.

3) Don’t put all your eggs in one basket – it’s all about diversification. A nother pillar of the mutual fund pitch is diversification. Rather than betting your money on one or two companies, mutual funds automatically spread your investment across dozens – or sometimes hundreds – of different stocks, bonds, or other assets. This diversification is sold as a critical way to lower your investment risk.

Mutual fund companies often point out that it would take a ton of time and money for an individual investor to recreate the same level of diversification by buying individual securities one by one. While all of that is technically true, the wealth management firms often leave out the fact that you can instantly get even better diversification through a Canadian ETF.

4) It’s all about making it easy on yourself. One of the mutual fund industry’s best features is sheer convenience. Mutual funds are marketed as easy to buy. You don’t need a brokerage account or any trading experience. You can walk into your familiar local bank branch, sit down with a “financial advisor,” and within an hour have an RRSP, TFSA, RESP, or FHSA fully invested in a portfolio of mutual funds.

Automatic investment plans are often highlighted too – allowing you to set up monthly contributions that are withdrawn directly from your bank account. No need to lift a finger after the initial setup. Again, the part that is left out is that we now have the same convenience through robo advisors and all-in-one ETFs.

5) No minimum investment requirements. Unlike private investment opportunities or direct stock purchases that might require large sums of money, mutual funds typically allow you to get started with as little as $25. This makes mutual funds sound like an accessible option for younger investors, people just starting out, or those who want to build a nest egg gradually over time. You’ll notice a pattern here when I say that now with fractional shares common amongst our best online brokers, there is no real advantage to be had here.

6) Emotional security/manipulation. Banks and investment companies know that money decisions are emotional. They emphasize trust, security, and “doing the right thing” because they know it resonates more deeply than dry data about returns or fees. They’re really, really good at this stuff as they have been selling mutual funds for decades!

It’s also worth noting that brand trust is deeply powerful for many people, especially those who aren’t super comfortable navigating finance on their own. There are no stronger brands in Canada (aside from maybe Tim Hortons and Canadian Tire – and I don’t even know if they measure up) than Canadian banks. There is certainly something to the idea of having a financial planner there to reassure you when things go awry – it’s just much better if they don’t make their money from selling you a specific investment product!

How to Invest in Mutual Funds in Canada?

If you’ve decided you want to invest in mutual funds (even after all my earlier warnings!), you basically have two different paths you can take.

One is easy but expensive – and the other takes a little more work but saves you thousands of dollars over time.

Let’s walk through both.

The Expensive Way (Through a Financial Advisor or Bank Representative): For most Canadians, the default option is to invest through a financial advisor. Here’s typically how it works:

- You walk into your bank branch or call up an independent advisor.

- They ask you a few questions about your goals, income, and risk tolerance.

- Based on your answers, they recommend a “portfolio” of mutual funds.

- You sign the paperwork, set up automatic contributions, and… that’s it.

Sounds easy, right?

Well, it is — but you’re paying a steep price for that convenience.

Most advisors in Canada are paid commissions by the mutual fund companies whose products they sell. This creates a conflict of interest: they have a huge incentive to recommend the funds that pay them the most, rather than the funds that are the best deal for you.

And those commissions aren’t obvious. They’re baked into the Management Expense Ratios (MER) that we discussed earlier. In Canada, it’s completely normal for mutual fund MERs to be 2%+ per year, with 1% or more going straight to the advisor’s pocket. Over 30 years, that 2% fee can easily eat up 30 – 40% of your total investment growth.

That’s not a typo. You could be handing over a third of your retirement nest egg just to pay fees.

The Lower-Cost Way (Choosing Mutual Funds Yourself): If you want to keep more of your money growing for you – instead of paying it to someone else – you can skip the advisor and invest directly. Here’s how you do it:

i) Open a Self-Directed Investment Account

There are a bunch of online brokers in Canada that make it easy to open a self-directed account. If you’re brand new, Qtrade and TD Direct Investing are my top picks for beginner-friendly platforms.

ii) Fund Your Account.

Once your account is open, transfer some cash from your regular chequing or savings account.

Pro tip: Set up an automatic contribution – even a small one – so that you keep investing regularly without having to think about it.

iii) Choose a Low-Cost Mutual Fund.

Instead of paying 2%+ in fees for an actively managed mutual fund sold by a bank or advisor, you can buy index mutual funds directly.

iv) Click buy – then ignore the noise.

Once you’re set up, resist the temptation to tinker too much. As with all types of sustainable investing, the magic happens over time, not through constant trading. You don’t need to try and “time the market” or chase the hottest sectors.

Mutual Funds in Canada – FAQ

Mutual Fund Series Explained (and Why It Matters)

One thing that almost never gets explained clearly is that Canadian mutual funds usually come in different series.

Multiple series of a mutual fund means: Same fund name. Same underlying investments…

Very different fees.

And those fee differences can quietly eat away at your returns for decades.

Here’s the basic idea – Mutual fund companies slice the same fund into multiple versions, often called Series A, Series F, Series T, Series D, and so on. Each one pays people differently. The most common series that you’ll run into when looking up Canadian mutual funds include:

Series A: This is the default version sold at most bank branches. It typically includes built-in trailer commissions that pay the advisor every year. You don’t see the bill. You just earn less within your portfolio.

Series F: This version strips out the built-in commission and usually has a lower fee. Advisors who use Series F charge you directly instead of hiding their compensation inside the fund.

Other series exist, but the pattern is the same. Different labels. Different fees. Same fund.

When someone shows you a mutual fund’s long-term performance, they’re usually talking about the fund before your specific series-level fees are fully felt. Two investors can own the same fund, at the same time, and end up with noticeably different outcomes just because they were put into different series.

If you’re dead set on owning mutual funds, the series you’re in matters as much (or more in some cases) as selecting the best mutual fund.

Are Canadian Mutual Funds Worth it?

Look, I get it. Mutual funds are familiar. They feel safe.

For a long time, they were basically the only game in town if you wanted to invest without selecting individual stocks and bonds.

But at this point, the evidence is overwhelming – and frankly, a little depressing.

The reality is that Canadian mutual funds, especially actively managed ones, are among the worst deals in the entire investment world. High fees – often north of 2% per year – quietly bleed away your hard-earned returns, year after year. Andrew Hallam has been pounding the table about this for over a decade, showing just how much even “small” fees can cost you over a lifetime of investing. And it’s not just the fees – it’s the fact that almost nobody running these funds can consistently beat the market in the first place.

Study after study (including the gold-standard SPIVA reports) shows that more than 90% of Canadian mutual fund managers fail to outperform their benchmark over a 10-year period. And the few that do beat the market? There’s no way to know if it was skill or just blind luck – a fact that even many fund managers would admit after a couple of beers.

And while mutual fund companies love to tell you that their managers are professionals who “navigate volatility” and “manage risk” for you, the truth is that human behavior often gets in the way. Behavioral biases like chasing trends, panicking at market drops, or stubbornly clinging to losing positions make mutual fund managers just as vulnerable as the rest of us. Add in conflicts of interest – where fund companies prioritize fat commissions and complicated fee structures over actual investor outcomes – and you’ve got a system that simply isn’t built to put your best interests first.

Oh, and let’s not forget survivorship bias. The funds you hear about? The “award winners”? They’re just the lucky survivors. Meanwhile, hundreds of underperforming funds get quietly shut down or merged away, disappearing from the marketing brochures like they never existed. This impacts all of the “averages” because it’s not really a true average of past performance if we took all the worst performers and then just erased their records right?

At the end of the day, the best mutual funds in Canada should offer an easy, affordable, diversified way to invest. Instead, most offer mediocrity at a premium price. If you’ve read this far, my hope is that you walk away better informed – and maybe a little less trusting of the glossy brochures and friendly smiles at the local bank branch.

If you have any questions, or a horror story (or success story!) about your own experience with mutual funds, let me know in the comments below. I also wanted to highlight a great Marketplace segment from Preet Banerjee that I saw years ago in regards to the shocking tactics used by the mutual fund industry to sell their products. It’s worth a few minutes if you’re considering walking into your local bank to ask for financial advice!

As a Financial Planner who sells mutual funds to clients I would challenge parts of this article. Yes a large percentage of people can invest on their own and do just fine. Working with a “good” financial advisor is more than just about managing your money and fees. A good advisor also helps you with planning and making the best financial decisions on more than just investing such as help with financial decisions and estate planning. Investing isn’t just about putting money in an account and watching it grow and hoping you have enough when you need it. It is much more complex than that such as which type of account you should be investing in that makes the best sense for your particular situation. E.g. Many people believe that they should be investing in an RRSP so if a 20 year old that lives at home and makes $30000 per year, reads your article and starts investing in an RRSP on their own because the fees are lower than working with a financial planner then there is a big chance that it will cost them more than if they had gone to a good advisor and got advice based on their current situation. Maybe a TFSA or a FHSA (First Home Savings Account) might work better for this client based on their current income being in the lowest tax bracket. Not ALL advisor’s are shady or incompetent like the ones in the video.

Hi Brian,

Maybe re-read the article again? I’m not against financial advice. I’m against paying for financial advice through commissions generated by awful investment options. If you want to defend yourself as a “good advisor” why not switch to an advice-only model where you can provide the same advice in a much more transparent manner? BTW – the example you provide is covered in-depth in other articles on this site (which is free to DIY investors).

Back in the 90’s I used to invest with a major Canadian mutual fund company. Once our sales representative was going on about his most recent sales “conference/junket” and how they had former president George W. Bush as their keynote speaker, His story bothered me and I asked him point blank when his fees would be going down. He had the cojones to look me in the eye and say “Never!”. I pulled all my money out the next day and went fully self-directed and have never looked back. Currently retired with a 2 smallish DB pension and a $1M portfolio between my wife and I.