ZGRO ETF Review

All-in-One ETFs offer investors a simple and cost-effective way to buy stocks from thousands of companies through a single investment. Since their debut in Canada, these broadly diversified ETFs have soared in popularity. Naturally, brokerages have responded by launching a variety of all-in-one options to meet the growing demand.

These ETF portfolios have become a go-to choice for passive investors. Why? Because they take care of everything for you – from asset allocation to automatic rebalancing – making investing virtually hands-off for you.

The Bank of Montreal (BMO) has introduced its own lineup of all-in-one ETF portfolios. In this ZGRO review, we’ll dive into the key details of BMO’s ZGRO ETF, including its holdings, performance to date, and the associated investment costs.

Curious about other ETF portfolio options? Don’t miss our VEQT ETF Review, and be sure to check out our comprehensive guide to the Best All-in-one ETFs in Canada.

The BMO Growth ETF

BMO’s Growth ETF (ZGRO) is an all-in-one portfolio designed with the long term passive investor in mind. It’s got an 80/20 stock to bond split, making it ideal for growth.

ZGRO ETF Key Facts:

- MER: 0.20%

- Account Eligibility: RRSP, TFSA, RRIF, RESP, DPSP, Non-Registered, FHSA

- Assets Under Management: $385.71 Million

- Date Created: February 12, 2019

- Shares Outstanding: 8,752,000

- Price/Earnings Ratio: 22.27

- Price/Book Ratio: 2.64

- Dividend Yield: 1.93%

What is The ZGRO ETF?

The BMO Growth ETF Portfolio ETF is one that targets growth with an 80/20 asset allocation. You may already be familiar with this asset allocation of 80% stocks and 20% bonds because it is a popular allocation for growth. By having up to 80% in stocks, you have the potential to earn more over time, as historically, stocks outperform fixed income options like bonds.

ZGRO is professionally managed by BMO’s very own Global Asset Management Team, which means you will have their experience and expertise on your side. The bulk of ZGRO’s assets lie in BMO’s US and Canadian S&P composite ETFs, which generally fare very well over time.

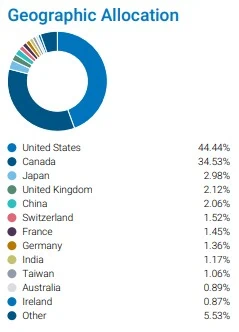

ZGRO also gives you geographic diversification, with holdings in North America, Europe, Asia, and beyond.

As far as fixed income assets, ZGRO contains bond ETFs such as BMO’s Aggregate Bond Index ETF and its Government Bond Index ETF.

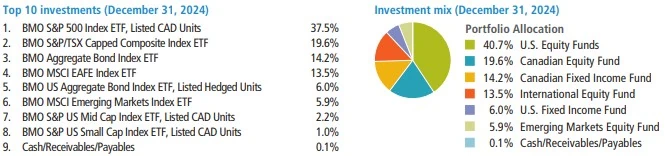

ZGRO Holdings

ZGRO has a total of 9 holdings. As of writing, ZGRO consists of 79.34% stocks, 20.26% fixed income, 0.33% cash, and 0.07% cash equivalents.

Each quarter, ZGRO is automatically rebalanced to achieve optimal balance in terms of its 80/20 weighting as well as to ensure that only the top-performing assets are included in the ETF portfolio. ZGRO also pays out distributions quarterly, which you can take out in cash or automatically reinvest.

Let’s take a look at ZGRO’s holdings and weightings of each of its ETFs.

As you can see, a bulk of ZGRO’s holdings consist of BMO’s S&P 500 Index ETF, which has a 5-year return yield of 18.86%. In addition, its S&P/TSX Capped Composite Index ETF has a 5-year return yield of 16.76%.

Those are some pretty solid returns! On top of great diversification in terms of asset allocation and sectors represented within ZGRO’s holdings, it also offers solid geographic diversification. This is always something to look for in any ETF investment because it helps to shelter you from potential losses you could incur if only investing in one geographic area.

ZGRO ETF Performance

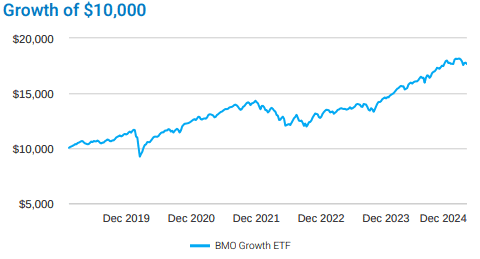

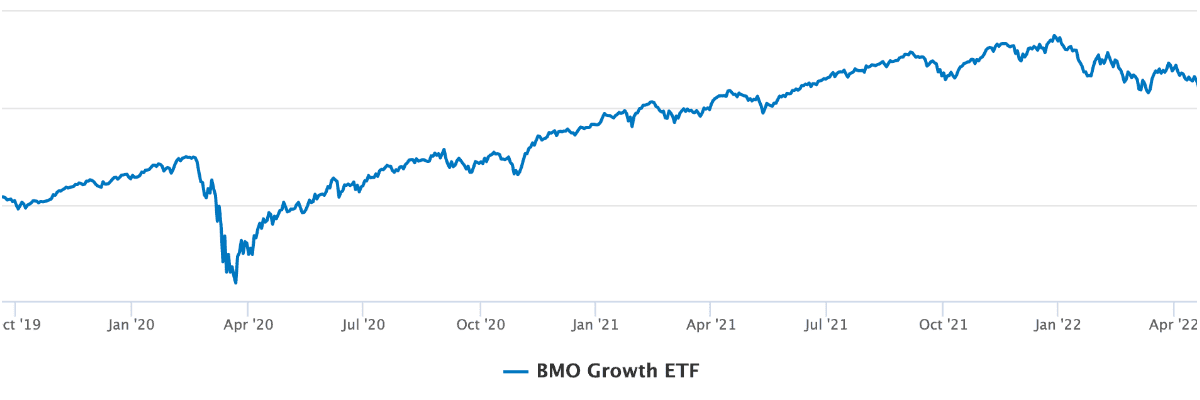

Like most all-in-one ETFs in Canada, this one hasn’t been around long enough for a full picture of how it might perform in the future. However, based on the performance of its current assets, and understanding that ETFs in general have a solid track record, our bet is that this investment will pay off in the long run.

Since its inception in 2019, even through a time of worldwide economic trouble, ZGRO has produced gains. If you had invested $10,000 when it first launched, you’d still be in the black because of its 9.72% return since inception.

Check out the chart below to see how well your 10 grand would be doing so far:

To see how ZGRO’s performance compares to other popular all-in-one ETFs, check out our VGRO ETF Review as well as our VEQT ETF Review.

ZGRO ETF Investment Accounts for Canadians

ZGRO is eligible for a number of account types:

Although BMO’s ZGRO does offer geographic diversification, the fact that the bulk of its holdings are largely Canadian-based could reduce your tax liability in the long run, which could work in your favor. Always check with your accountant to understand how your earnings will be taxed, and discover how to maximize tax savings.

ZGRO ETF Fees

Like many of its ETF and all-in-one ETF counterparts, ZGRO has a low Management Expense Ratio (MER) of 0.20%. It’s pretty impressive that they are able to keep costs so low, considering that it is, in fact, actively managed by BMO’s own expert asset management team.

You might think that a robo advisor, which also offers a wide selection of low cost services and automatic rebalancing, would come at the same price as an all-in-one ETF. In fact, a Canadian robo advisor option ends up costing you more for a comparable service.

As a comparison, Wealthsimple’s robo advisor service will cost you double in fees, at their tiered MER rates of 0.40% and 0.50%.

So, for what it offers, ZGRO is definitely a good bargain.

How to Buy ZGRO ETF

You can easily purchase shares of ZGRO from any online brokerage. If you have an InvestorLine brokerage account with BMO, you can trade ZGRO for free. Read our full BMO InvestorLine review first.

If you don’t have a BMO account, it’s not a problem. You can use your current brokerage account to purchase shares of ZGRO, which at the time of writing are trading at $43.13.

If you’re in the market for the best low cost discount brokerage in Canada, we recommend our top pick Qtrade. Check out our full Qtrade Review to discover why we think it’s Canada’s Best Broker. Ready to invest with Qtrade? Follow the link below to take advantage of their current promo – get up to $150 cash back.

ZGRO ETF Review: FAQ

ZGRO ETF Review: Final Thoughts

BMO has built a strong reputation in asset management, consistently delivering solid returns for its investors over the years. With that track record, choosing to invest in ZGRO means you’re likely in good hands.

For those who value a bit of stability in their portfolio, ZGRO’s 80/20 split between stocks and bonds strikes a balance between growth and risk management, offering both peace of mind and a cushion against market volatility.

So while investing in BMO’s ZGRO ETF is a smart move, if you’re new to all-in-one ETFs or wondering whether relying solely on ETFs is a smart long-term strategy, we’ve got you covered in our deep dive: Can You Invest Solely in ETFs?

And if you’re ready to explore ETF portfolios further, don’t miss our in-depth review on the Best All-in-One ETFs in Canada—we’ll walk you through everything you need to know to get started with confidence.

Please check the YTD performances. I believe you have used end of Septemebr numbers for I-shares and end of October numbers for Vanguard. Royal Bank is always slow to publish end of month numbers.b