VEQT ETF 2026 Review

As one of the best ETFs in Canada, as well as a featured contender for our best Canadian all-in-one ETF, VEQT has a lot to live up to. But as good as we thought it was before, VEQT recently got even better. Vanguard Canada recently announced that all of their asset allocation ETFs just got 23% cheaper! The MER on VEQT got slashed from 0.22% to 0.17%, officially making it best in class.

VanguarD VEQT ETF

The Vanguard All Equity ETF Portfolio is one of the best deals going in Canadian personal finance. A super cheap, super efficient way to get instant global diversification.

VEQT ETF Key Facts:

- MER: 0.17%

- Account Eligibility: RRSP, TFSA, RRIF, RESP, DPSP, RDSP, FHSA

- Assets Under Management: $9.70 Billion

- Median Market Cap: $118 Billion

- Date Created: January 29, 2019

- Number of Stocks: 13,492

- Number of Bonds: 0

- Price/Earnings Ratio: 21.6

- Price/Book Ratio: 2.9x

- Dividend Yield: 1.35%

What is VEQT ETF – The Vanguard All Equity Fund?

The Vanguard All Equity ETF (VEQT) was created by Vanguard Canada in order to be a one-stop shop for an entire investing portfolio. Several MDJ authors own VEQT and Robb Engen over at Boomer at Echo has even stated that it is now the only new investment that he buys!

Are You Saving Enough for Retirement?

Answer your retirement savings questions with 4 Steps to a Worry-Free Retirement. The first online course for Canadian retirement.

Try Worry Free Retire with 100% Money Back Guarantee

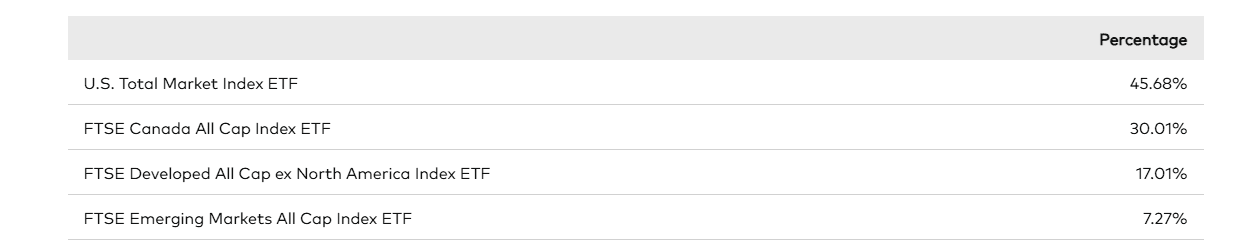

VEQT Holdings

So, what does this Portfolio ETF have inside of it – what are the VEQT holdings?

What Vanguard has done is squished together four of it’s other ETFs in order to create this all-in-one option. Here’s the rough breakdown.

Each of those ETFs then invests in some of the biggest companies from all around the world – giving you ultimate equity diversification. The biggest VEQT holdings are shown below, but you can see that when you split your investment dollar up in so many ways, even the biggest company in the world (Apple at the moment) is only 3% of your portfolio.

Asset Allocation

Market Allocation

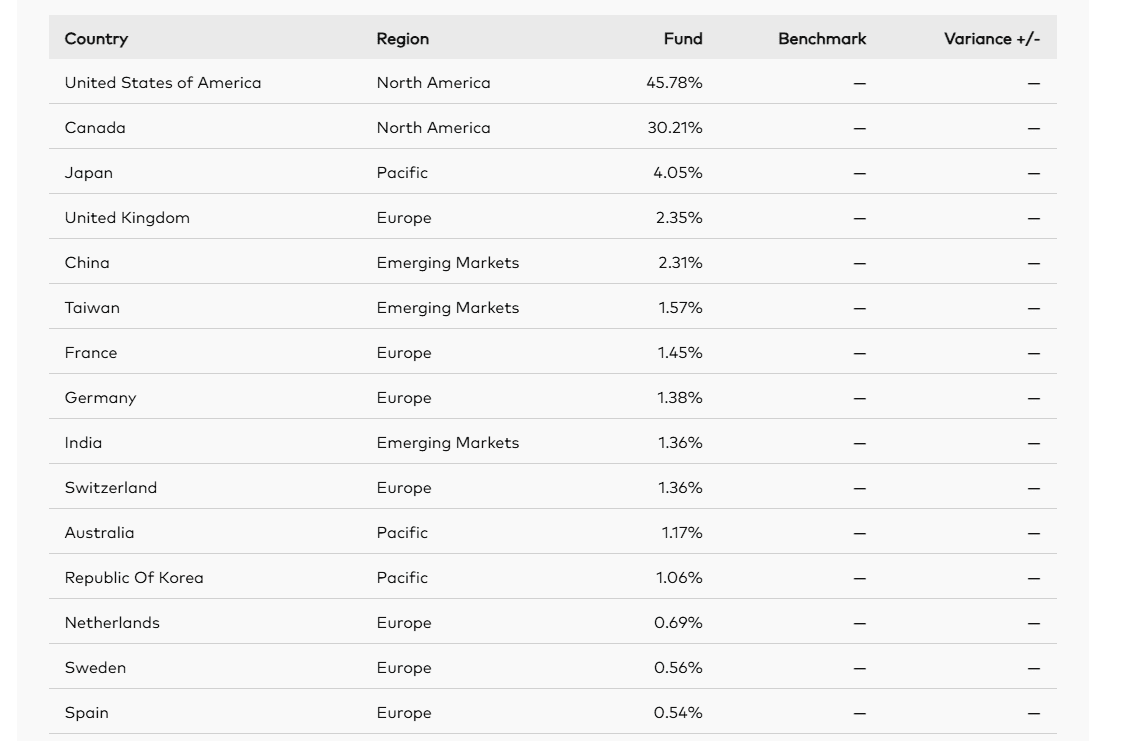

VEQT ETF Performance & Returns

The VEQT ETF is built to deliver the average return of global equities. It’s not a “hot stock” bet or a guess about which sector will crush the next quarter. It’s simply the world’s stock market in one click.

Because of that, there’s not much point in watching VEQT month-to-month. It’s a long-term, passive investing tool that’s designed to compound quietly in the background while you get on with your life.

Over time, some companies surge, others stumble, and a few disappear altogether. But on the whole, the world’s largest publicly traded companies are remarkably good at producing profits year after year. VEQT just packages that reality into a straightforward all-equity portfolio.

If you look at the performance history since VEQT launched in early 2019, you get a pretty clear picture of how this works in real life. Yes, the pandemic crash hammered markets in early 2020, and yes, 2022 was an ugly year for stocks around the world. But the rebound since then has been strong, and VEQT has delivered a solid long-term result for patient investors.

Since inception, VEQT has returned roughly 15% per year. That’s well above the average stock market returns in Canada over the years, and has produced excellent compounding for anyone who stuck with the plan. More importantly, those returns came from simple global diversification rather than stock-picking heroics.

Of course, this is still a 100% equities portfolio, which means volatility is part of the deal. VEQT will go up and down from year to year, and there will be stretches where the ride feels bumpy. Market corrections and bear markets aren’t bugs in the system – they’re the cost of owning an asset class that builds wealth over decades.

If you can live with the swings, VEQT continues to be one of the easiest ways to own the entire global stock market and let long-term compounding do its work.

VEQT ETF Investment Accounts for Canada

Like all of Vanguard’s all in one portfolio ETFs, the Vanguard all-equity ETF (VEQT) can be purchased in your:

- RRSP

- RRIF

- TFSA

- RESP

- Non-Registered Account

- RDSP

- DPSP

- FHSA

If you’re just getting started with investing, don’t worry about what this alphabet soup of Canadian investment accounts means – just scroll down and read our section “How to buy VEQT ETF”.

VEQT ETF Fees

When comparing VEQT ETF fees to other investment types, it’s important to understand how different products charge you in different ways – so that you can “compare apples to apples”.

All ETFs have what is called a “management fee” – and then a Management Expense Ratio (MER). They’re almost the same, and the MER actually includes the management fee. The MER is always expressed as a percentage of all the money that you have invested in the ETF. It is charged annually, and it is automatic (you never have to worry about doing anything or tracking anything in order to pay it).

The VEQT ETF management expense ratio (MER) is 0.17%.

That means that for every $10,000 you have invested, you’ll pay $17each year in fees – a pretty great deal considering you’re instantly invested in over 13,000 stocks!

By comparison, a similar equity mutual fund in Canada (how most Canadians were told to invest over the years) would be 2.5%+.

Even one of Canada’s best robo advisors – while being much cheaper than a mutual fund – is still significantly more expensive to own at around .70% MER.

While some brokerages do charge a small trading fee to buy or sell VEQT ETF, our top Canadian online broker recommendations do not.

How to Buy VEQT ETF

So now you know what the VEQT ETF is, let’s take a look at how to buy units of VEQT ETF.

Step 1: Find The Right Broker

Check out our Best Canadian Online Brokerage article to find out what an online broker is, and our quick comparison on how to choose the best broker for you.

Step 2: Open an Account

Apply to open an RRSP, TFSA, and/or Non-registered account with the brokerage provider that you choose. Applications can now be done online. While you may only use one account at the moment, just open these three all at once as you’re likely to use them in the future.

Step 3: Find the VEQT ETF

Go to the “trade” option. Type “VEQT” into the search box. These four letters are called an ETF’s ticker symbol.

Step 4: Decide How Much to Invest

Decide how much money you want to invest at the current time. Then look up the current price of VEQT. Divide the overall amount of money by VEQT’s price in order to figure out how many shares you should buy.

Example: If I have $5,000 to invest, and the price of VEQT is $33.45, then I would type 5,000/33.45 into my calculator to get 149.47. I’d round down because I don’t have quite enough money to buy 150 units.

Step 5: Execute a Market Order

Select “Market Order” as the order you want to make. A market order just means that you’d like to buy units at the current stock market price. (As you get more advanced you can learn about “Limits Orders” and all sorts of other purchases that you can make using an online broker but for now just keep it simple.)

Final Step: Confirm Your Order

Your broker will show you something that says, “Would you like to confirm the purchase of 149 shares of VEQT for $4,984.05?” You select yes, and then you’ll see your cash balance go down by that amount. You are now the proud owner of 149 shares of VEQT ETF. When you come back in 10+ years, you’ll be able to sell them for more than you bought them!

VEQT Pros vs Cons

When it comes to digging into the pros vs cons of VEQT it’s not really like comparing specific stocks from two separate companies. Because you’re passively investing using an index fund, it’s more of question of fees and diversification.

VEQT Pros:

- Instant worldwide diversification in one easy purpose

- Low MER of only .17% (vs 2.5% for an equivalent Canadian mutual fund)

- 30% Canadian stock allocation is consistent with expert recommendations for Canadian residents

- Instant re-balancing based on geographical distribution

- Incredibly easy portfolio-wide solution

- Even lower overall fees than a robo advisor (roughly half as expensive)

- Automatically allows investors to enjoy worldwide market returns

VEQT Cons:

- Can’t micromanage your portfolio if you’re the active management type

- In taxable non-registered accounts, dividends are taxed immediately (unlike HXT)

- 100% stocks can be a lot of volatility to handle – especially for new investors

Overall, VEQT’s cons are a pretty easy tradeoff to make relative to the massive convenience factor on the pros side of the equation.

Is VEQT a Good Buy Now?

If you’re wondering whether now is the perfect time to buy VEQT, you’re starting from the wrong premise.

Active investors have to worry about valuations, earnings surprises, and whether a stock looks “cheap” or “expensive.” VEQT investors don’t. When you buy VEQT, you’re basically saying, “I don’t need to outsmart the market. I just want the average return of the biggest, most profitable companies on Earth.” And historically, that’s been a pretty solid long-term bet.

As of late 2025, VEQT’s overall price-to-earnings ratio is hovering around 22x. That’s mostly driven by the U.S. market – and especially the mega-cap tech names – which have had an incredible run since the 2022 downturn. Maybe those companies are priced too richly and we’ll see valuations cool off. Maybe their earnings will keep growing at a ridiculous pace (and make today’s valuations look reasonable in hindsight). The honest truth is that no one really knows how the next few years of innovation, competition, and interest rate shifts will play out.

That’s exactly why VEQT exists. You’re not trying to guess whether Nvidia, Apple, Microsoft, or any other giant is “overvalued” this week. You’re buying the entire global stock market and letting the winners pull up the average over time.

So there’s no need to obsess over “buy low, sell high.” With VEQT, it’s more like, “Buy consistently and trust that companies around the world will keep figuring out how to make more money.” Today’s price doesn’t matter much when your goal is multi-decade compounding.

VEQT ETF Review: FAQ

VEQT ETF Review: Final Thoughts

I will always be a fan of Vanguard, as you might have guessed from my glowing VEQT ETF review. It certainly deserves a spot on my personal list of best Canadian all in one ETFs.

The VEQT all-in-one (aka: “portfolio ETF”) is really the culmination of what the company (under legend Jack Bogle) started years ago.

It is the ultimate way for investors to capture the returns of the stock market in the simplest, cheapest method possible.

Pre-2019, I really liked what Canadian Robo Advisors brought to the table when it came to an easy investing solution that worked for the majority of Canadians. There is still a place for the hand-holding nature of a robo advisor. At .6% MER, it’s still not a bad deal at all compared to insanely-expensive Canadian mutual funds.

But, that all changed when Vanguard released their all-in-one ETFs in 2019. The success of products such as VEQT spurred other fund companies to follow suit, and we may well look back on 2019 as one of the most important years in history for Canadian DIY investors. There is simply no better deal in investing today than getting an automatically rebalanced portfolio for an MER of .17%.

Now that said, you need to make sure that you select the right all-in-one ETF for your goals and risk profile. As an all-equity ETF, VEQT isn’t for the faint-of-heart. There will likely be years where it is down 40%. But, as you’ve seen over the last five years, there are likely to be many more years when the returns are excellent.

A number of places in this article, you state that the MER is reduce to 0.17%. It is the management fee that was reduced. The new MER is unknown, but will likely be reduced from the previous 0.24%.

On the Vanguard page, it says: “Effective November 18, 2025, Vanguard reduced the management fee for this ETF from 0.22% to 0.17%. The MER does not yet reflect this fee cut as it is calculated at the fund’s fiscal year end.”

My concern is that VEQT is almost 50% U.S. equity. I’d rather see a similar product with say 33% US, 33% CAN and 33% global. Is there one?

Hi Steve, not that I’m aware. The easiest way to do this would be to buy VEQT, and then buy some extra VCN so that it came close to evening out. Obviously you’d have to buy some VIU or something similar to get ex-Canada and ex-USA equity exposure.

Hi,

I’m retired and starting to draw down my portfolio. In a non registered account, is it better to hold VEQT and twenty percent in a combo of bonds and HISA’s, or would it be easier just to hold VGRO?

For tax purposes does VEQT separate Canadian dividends, from the distributions, for the canadian dividend tax credit?

Great article!

Geo

In a non-reg account you will have to track your ACB – which is pretty manageable with online brokerage account records these days I think. You should get a T3 slip for tax time that automatically shows your Canadian dividends, other dividends, capital gains, and other income. Foreign witholding taxes will be done by Vanguard before your dividend is sent out. I could get more detailed here, but to directly answer your questions, you’re not going to get “extra tax” taken off by losing your Canadian dividend tax advantages. It’s just going to mean a little extra work at tax time for either you or your accountant.

.24%. my question – how does the tax situation work out on this in non-registered eg dividend tax credit compared to a stock like td bank? and taxes on any other of the distribution made

Hi Rondaldo. All dividends would be eligible for the dividend tax credit. The very small amount of other distributions are where it gets more complicated. You will have to report that seperately on your tax form when you settle up with the CRA. It’s why some people prefer to stick with ETFs in their registered accounts.

Quick question: is the MER 2.4% or 0.24% ?

.24%!