What To Do When the Stock Market Crashes

We’re getting a lot of semi-predictable questions via email and article comments that ask some version of: “Is the stock market crashing and what should I do after stocks or bonds crash?”

Read a book.

Watch a new TV series.

Spend time with your family.

Just don’t panic.

Sure, if you’ve got a really strong investing stomach, you could consider buying even more investment assets than you normally do, but for most of us, the key thing to understand is that this happens, it’s normal, and you don’t need to feel high levels of anxiety.

If it makes you feel any better I’ve got a pretty good recent track record on this stuff.

Look, market downturns happen. We just had a pretty incredible two-year run, and really, going back, the last ten years in the world’s stock markets have been pretty phenomenal.

A lot of people have seen their investment portfolios skyrocket in value as more and more human beings around the world decided that they wanted to pay more and more to own assets like stocks over the last few years.

At some point a considerable amount of those people were going to decide, “Hey, even if Shopify/Tesla/Netflix are good companies that will make some really nice profits in the years to come, I’m just not paying that much money for a single share of their stock.”

The real problem isn’t that some people look at companies and decide that they just aren’t worth as much as many people were willing to pay for them.

The real problem is that so many people don’t see the stock market (or any asset market) for what it is: A way to allocate capital to where it will be the most productive (re: make the most money).

If you see the stock market as a slot machine (albeit a slot machine with way better odds than one in a casino) then when things start to re-price and values go down, there are no underlying reasons to continue to own stocks. If it’s all just a big gamble, then when the big gamble is failing, you should logically get out ASAP. It’s even more imperative to get out immediately if you are gambling with borrowed money (aka leverage) like much of the stock market is these days.

If you’re a long time reader of MDJ, you might find this article a bit boring, but try to keep in mind that it has been a really long time since we’ve seen a sustained downturn in stock market prices (not to mention bonds getting crushed for the first time in decades).

People need “Rational Reminders” (shout out to PWL and Co.) that this too will pass. If this is the first time you’ve seen 20% of your portfolio’s value evaporate, then the stress that you’re feeling is very real, and there is a very good chance that it will fuel bad long-term decision making.

Why Is the Stock Market Crashing?

Because I’m a curious person, and because I teach business and economics, I’ve done quite a bit of reading and podcast listening the last couple of weeks.

When it comes to determining why the stock market is crashing right now there are only three things that I’m absolutely sure of.

1) It’s far more nuanced than most people would have you believe. It isn’t just one silver bullet answer like: The Bank of Canada is run by idiots. Resist the human urge to make sense of the world around us through simple narratives.

2) Inflation and investor behavioral considerations are probably at the root of it.

3) For the average investor, it doesn’t really matter why the stock market is crashing. All that matters is that the large companies that make up stock market indexes continue to make money in the long term.

That’s it.

All of that said, just for argument’s sake, here’s my take on it:

- Governments can’t ignore inflation anymore. Inflation is being caused by some combination of many governments’ fiscal policies, monetary policies, Covid-related supply chain bottlenecks, shifting consumer choices during the pandemic, and the war in Ukraine.

- Because governments can’t ignore inflation, most of them are going to choose to raise interest rates. No one knows the degree to which raising interest rates will even help the inflation issue – but decision makers around the world do know that they need to look like they’re doing something, and that raising interest rates will probably slow down inflation.

- When interest rates go up, safer investments such Bonds, GICs, and High Interest Savings Accounts look more attractive.

- When interest goes up, companies that have a lot of debt on their books will see their cash flow decrease because they have to pay interest on loans before they can pay out dividends, buy back shares, or reinvest in the business.

- Due to the last two points above, a lot of people are less willing to buy stocks at high prices than they were before.

- Because it will be more expensive to borrow money, companies and individuals will probably buy less stuff, and demand for goods and services will go down. Many businesses will find it harder to increase profits in that environment. (Although many companies are still making a ton of money.)

- Many stocks had reached very high valuation levels (as determined by metrics such as P/E ratios and P/B ratios). In order for investors to be happy that they paid so much for a share of a company, the profits the company makes would have had to continue to skyrocket. If that profit growth simply goes down (they don’t have to lose money or enter bankruptcy or anything so dramatic) then investors can logically decide that it’s not worth it to pay so much.

- A large part of the stock market is people speculating on where stocks will move – not simply putting money to work in profitable companies. Consequently, when they see their stock price go down, speculators panic and sell. This creates a supercharged feedback loop of panic, that is further exacerbated by sensationalized news headlines competing for clicks and views. Trying to quantify the “animal spirits” of any given move in the markets is impossible to know in advance, and probably has more to do with prices than we care to admit.

- The large number of algorithmic trades and investors purchasing assets with borrowed money means that our markets today are prone to large swings – especially when combined with the panic feedback loop described above.

But… here’s what we don’t know

- How much of all that stuff above was known several months ago and already “baked in” when it comes to asset prices?

- How high will we have to raise interest rates in order to tame inflation? (We’ll never know for sure, but it’s entirely possible inflation was going to come down without us raising rates at all).

- How will investor sentiment react to the barrage of “recession” and “all-time drop” types of headlines? Predicting how humans will feel about something – especially over a specific time period – is pretty darn tough.

Throughout all of this, it’s important to keep in mind that at the moment, the big picture doesn’t look particularly bleak. I mean, there are way more jobs than people to fill them (in Canada and the USA anyway), people are enjoying spending money (despite the inflation complaints), and many companies are still posting record profits!

How Worried Should I Be About This Stock Market Crash?

Probably not worried at all.

Logically, the closer you are to needing your money for day-to-day spending needs the more worried you could be about the stock market crash. I say “could” because if you had planned for the inevitable stock market crash, then even if you were approaching retirement or already in retirement and depending on your portfolio to generate income, then you probably wouldn’t be that worried.

If you’re 10+ years away from needing to touch your portfolio, you shouldn’t be worried at all. As author Andrew Hallam always says, “Who gets mad about buying stuff on sale?”

Of course, we’re humans – not logic machines. There is no denying it hurts to login to our online brokerage accounts and see that big overall asset number get lower and lower. I think it helps some people to continuously remind themselves of just what investing is all about, and why they have decided that their investment plan is their best long-term bet.

What Stocks to Buy Right Now When the Market Crashes

The best stocks to buy when the market crashes are also the best stocks to buy when the market is doing well: Shares of companies that are making a lot of money, and that people don’t want to pay a lot of money to own a piece of.

If you think that statement is simplistic to the point of idiocy, you’re likely right.

Whether the market is crashing or not, it doesn’t change the fact that every day that the stock market is open, hundreds of thousands of really smart, really motivated people get out of bed and try to make money by determining which companies should be worth more money, and which companies should be worth less. It’s really hard to do the job better than those people for any given moment in time.

Sure, energy companies look like great companies now, but just two years ago everyone only had eyes for FAANG stocks and Ark funds – oil was “dead”. The truth is that the potential for these companies in any given climate is almost instantly factored into their price.

So the most pertinent question isn’t actually which stocks to buy right now when the market crashes, but rather: Which investments will allow me to relax and ignore the current crash?

This is a big part of the reason why we’re so big on Canadian dividend stocks and all in one ETFs. We’ve seen over and over again that investors who embrace these types of investments are consistently able to weather the psychological storm when the market crashes.

When Will the Stock Market Recover?

There is no way to know how long it will take a specific stock price or a broader company market to recover their price drop. It would stand to reason that stocks that had higher P/E ratios and that were more sensitive to interest rate increases might take a bit longer to recover.

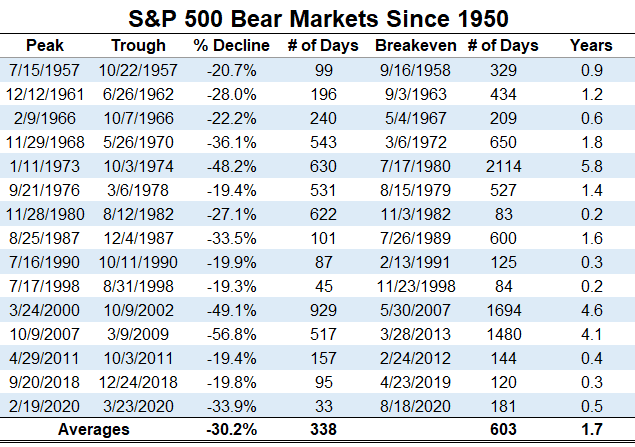

Depending on your definition, the Canadian stock market hasn’t even officially entered a “bear market” yet, but just for discussion, here’s a look at how long it takes stock markets to recover from past crashes. Personally, while the last few crashes and recoveries have been pretty rapid or “V shaped”, I’d be careful with extrapolating those expectations.

What Are My Next Moves?

1) Do something fun. Ignore the stock market noise.

2) Stick to the investment plan that you created before you thought you might have reason to panic.

3) If you have some extra money, consider putting a little extra in (the more negative headlines you hear the better), but if not, no worries, just stick to your automated plan.

4) Remember to focus on what you can control – not on what you can’t. You can’t control people’s animal spirits in regards to market prices, wars, China’s covid response, etc. You can control how much you pay in investment fees and whether to stay tax-efficient.

5) Ignore the temptation to check your balance daily, it will do far more harm than good!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

thank you for this no nonsense advise..

Hi Kyle. This line, “Resist the human urge to make sense of the world around us through simple narratives” made my day. We like to explain things using simple reasons but it’s far from simple. Great article.

Thanks Anita