Investing in Canadian Airline Stocks 2025

Now that travel has opened up again, many MDJ readers have been asking us if now is the time to invest in Canadian Airline stocks.

Truthfully, we might be the wrong folks to ask about this one.

If you take a look at our best Canadian dividend stocks and/or Canadian Dividend Kings articles, you won’t find an airline stock amongst them.

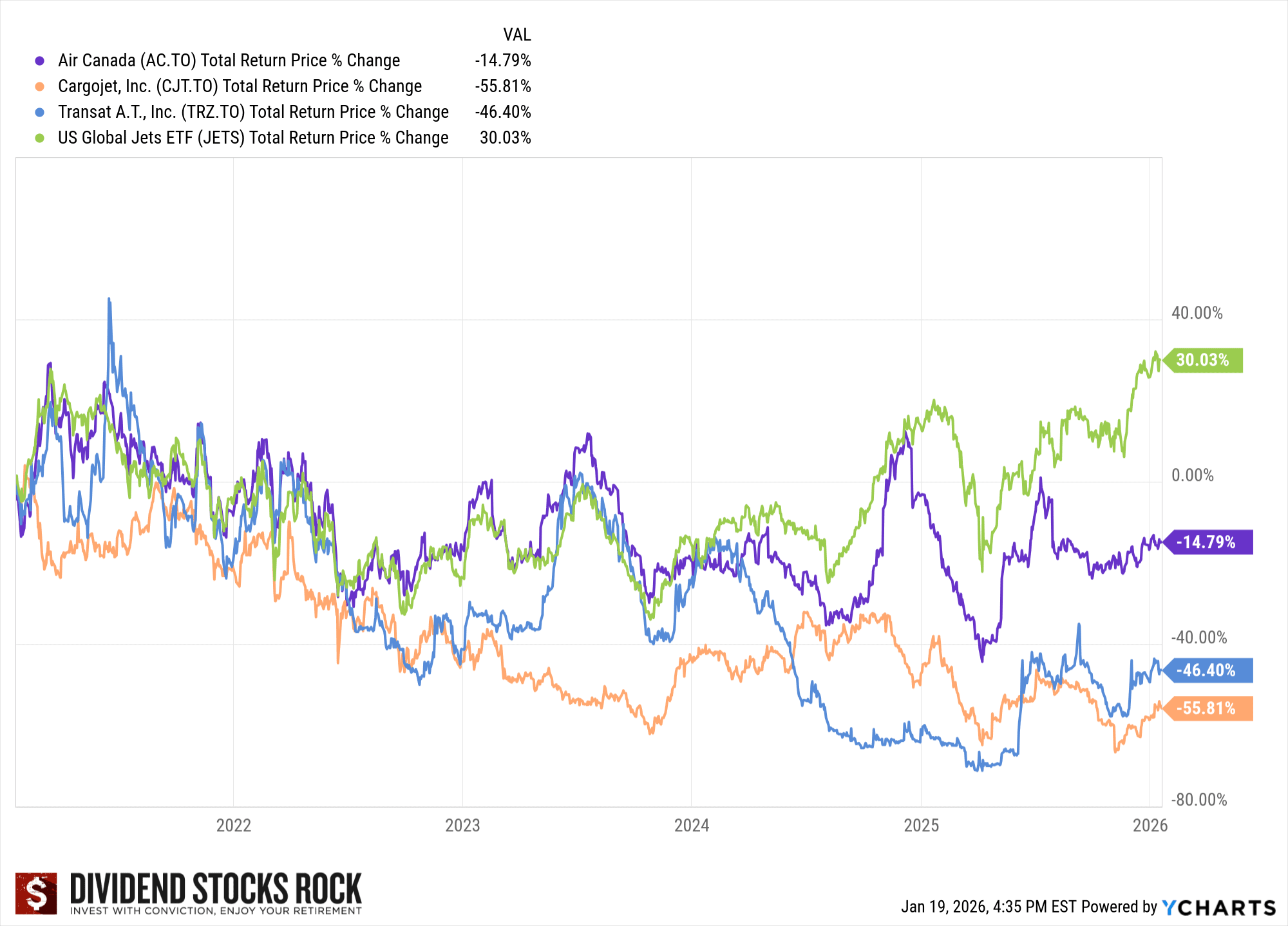

That said, as you can see in the chart below, due to their volatility over the past few years, there is no doubt that many investors made (and lost) a lot of money on Canadian airline stocks – it just isn’t our cup of tea.

Canadian Airline Stock Performance 2017-2025

What Are the Publicly Traded Airlines in Canada?

If you’re flown within Canada you know that generally speaking it comes down to Air Canada vs Westjet – and then there are a few minor players. So there isn’t a lot of choice when it comes in investing in Canadian airline companies.

To make matters even less competitive, Westjet is a private company. It is technically owned by a leveraged entity called Kestrel Bidco, which in turn is owned by Canadian conglomerate Onex. The deal was completed in 2019, and consequently Westjet is no longer a publicly traded airline.

The other two publicly traded airline stocks in Canada are CargoJet and Air Transat. A recent proposed merger for Air Transat recently failed to go through. The almost-deal saw Air Canada offer $190 million for the smaller airline, but European regulators nixed the deal in 2021. Given the cash flow problems at Air Canada, I don’t see that deal getting resurrected any time soon.

Is Investing in Air Canada Stock a good idea?

Investing in Air Canada might turn out ok in the long term. I mean, it has some pretty solid competitive advantages in terms of the Canadian domestic market, and it has proven itself pretty capable in the international sphere as well. The government basically admitted that Air Canada was essential during the pandemic, and consequently, the chances of the stock “going to zero” are virtually nil.

On the other hand… man the airlines industry is just tough. There is a reason that Warren Buffett got out and vowed never to return after all!

On their last quarterly announcement, AC stated that while revenues are up and brighter skies are in sight, they still lost almost a billion dollars over the prior three months!

Looking forward, there are a lot of headwinds to consider, including a drum-tight labour market, increased fuel prices, an altered business travel market, and geopolitical turmoil. Plus, the hub of Pierson airport has been called out as one of the worst in the world at the moment when it comes to delays. Not exactly encouraging to potential fliers.

If Air Canada is able to raise ticket prices (they should have substantial room to do this in the short-term given their duopoly status), and control their costs (this is likely the bigger problem) they could see their way to increased earnings in the future. The current valuation is just way too high for a company with so many question marks at the current time.

Best Place To Buy Airline Stocks in Canada

The best way to buy Airline stocks is through Qtrade, our top rated Canadian online brokerage. It not only offers the best welcome promo, but has the best customer service, competitve fees and 100% free ETF trading. Read our Qtrade review for more details, or visit their site by clicking the button below:

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

Investing in Cargojet and Transat – Canada’s Small Airline Stocks

Investing in CargoJet (CJT) back in the early days of the pandemic was a great move. With everyone deciding to shop from home, and retailers willing to pay for speedy logistics, CargoJet’s services were in incredibly high demand. While the low-hanging fruit is now gone, e-commerce isn’t going anywhere.

The company has produced some very credible long-term plans to purchase more aircraft and take advantage of its partnerships with massive e-commerce retailers. It is the only Canadian Airline stock to pay a dividend, which at the moment has a yield of 75%.

The only fly in the ointment when it comes to CargoJet is that everyone has realized that it’s a really solid company with bright prospects. That has resulted in share prices surging to a P/E ratio of 120x.

Personally, if I were going to invest in Canadian airlines in 2025 (I’m not) then CargoJet would be the bet for me – despite its relatively high valuation and 7.5% decline YTD.

Air Transat is in many ways the opposite of CargoJet. Shares of the small Canadian airline have been so beaten up that there might be some value there – but the company has a high hill to climb to get back to profitability.

With both Air Canada and Quebecor failing in their acquisition attempts over the past few years, share prices could stir again on buyout speculation, but that’s too risky for my portfolio.

Founded in 1987, Air Transat is based out of Montreal and specializes in holiday travel. Just to give some idea of how bad the corporate carnage was during Covid 19, Air Transat posted just under $125 million in total revenue, whereas the company saw a healthy $2.9 billion revenue burst in 2019.

While AT is ready to start increasing its international travel routes, and recently announced some new codeshare partnerships, the same issues that constrain Air Canada are present when looking at the much smaller Air Transat.

Best Airline ETF for Canada and USA

If you’re looking for a quick way to get exposure to the airline industry in North America, the most efficient way to do this is with the JETS airline ETF. The only potential issue for some folks is that it trades in US dollars, and is on the New York Stock Exchange.

The JETS airline ETF was launched in 2015, and has over $3 billion in assets. While the expense ratio is a relatively steep .60%, it’s the only way that I’m aware of to get instant diversification with the North American airline space. While JETS includes 51 different airlines, the “Big 4” in the USA make up nearly 50% of the ETF.

Top ten holdings include:

Name | Percentage of Portfolio |

UNITED AIRLS HLDGS INC | 12.44% |

DELTA AIR LINES INC DEL | 11.31% |

AMERICAN AIRLS GROUP INC | 11.21% |

SOUTHWEST AIRLS CO | 10.14% |

ALLEGIANT TRAVEL CO | 2.98% |

SUN CTRY AIRLS HLDGS INC | 2.94% |

AIR CANADA | 2.85% |

SKYWEST INC | 2.81% |

SPIRIT AIRLS INC | 2.72% |

ALASKA AIR GROUP INC | 2.70% |

Airline Stocks Canada FAQ

Investing in Canadian Airline Stocks – Our Conclusion

At the current time, I just don’t see the risk-adjusted potential being there to justify airline stocks at all. The industry is notoriously difficult to predict, and there is simply too much uncertainty. When you have solid dividend options such as Canadian bank stocks or Canadian utilities stocks, you have to be a pretty risk-seeking investor to want to dip your toe in Canadian airline stock volatility.