RBC Direct Investing Review 2026: Fees, ETFs, Account Options and More

RBC Direct Investing Review Summary:

-

Online Broker Fees and Pricing

-

Account Options

-

ETF Trading Fees

-

User-Friendly Platform and Mobile App

-

Customer Service

-

Overall Banking Convenience

RBC Direct Investing Review Summary:

My RBC Direct Investing review below reveals why even though RBC DIY trading platform is fine, there are several better options amongst Canada’s best online brokers.

RBC Direct Investing does give Canadians access to all the major accounts and investment options, but it ultimately comes down to value for fees, and in this case, RBC’s brokerage comes up a bit short.

If you’re curious about how RBC’s online broker measures up against its big bank competitors (*spoiler alert, they’re all pretty similar), as well as top-rated brokerage at Qtrade, we’ve got you covered. Our in-depth RBC Direct Investing review looks not only at fees and account options, but also user experience, customer service, and the RBC Investing mobile app.

Pros

- User friendly, advanced platform

- Solid mobile app

- Easy to set up if you bank with RBC

- Practice accounts available

- Safe and trustworthy company

Cons

- Higher fees compared to leading online brokers

- No commission-free ETFs

- Falling levels of customer service

- Quarterly fees for smaller accounts

What is RBC Direct Investing?

The Royal Bank of Canada (RBC) was one of the first banks in the country to pioneer DIY investing for the everyday investor.

With RBC Direct Investing, you can trade Canadian and US stocks, ETFs, mutual funds and bonds. You can fund and manage your registered investment accounts (TFSA, RRSP, RRIF, RESP and more) and access a variety of investing tools to help you make informed decisions.

If you already have an account with RBC, then opening an RBC Direct Investing account might appeal to you, as it will make the process more seamless and efficient. You’ll also have the added benefit of redeeming your Avion for money you can use to trade using your investment account.

If you’re not already an account holder, then it’s definitely worth considering other options. As far as the Big Banks go, we prefer BMO’s InvestorLine. BMO offers the same reliability you’ll find with RBC – along with $0 trading commissions on select stocks and ETFs.

You can check out our full BMO InvestorLine Review for more information about why we prefer it over RBC Direct Investing.

Is RBC Direct Investing Safe and Trusted?

RBC is the biggesting company in Canada, with a banking history that stretches over 150 years. As the nation’s premier chartered bank and financial institution, it’s a name synonymous with trust, serving millions of customers globally with unwavering reliability. When we talk about trustworthiness in banking, RBC sets the gold standard.

Operating under the watchful eye of the Investment Industry Regulatory Organization of Canada (IIROC) and being a proud member of the Canadian Investor Protection Fund (CIPF), RBC Direct Investing is a fundamentally safe platform. Its digital fortifications include:

- 128-bit encryption for ironclad data protection

- Robust firewalls to guard against unauthorized access

- The option for multi-factor authentication, adding an extra layer of security

- Anti-virus protection and data verification programs to maintain the integrity of your investments

RBC Direct Investing’s dedication to online security is unparalleled, demonstrated by their promise of 100% reimbursement for losses due to unauthorized transactions—a testament to their confidence in their security measures (though, as expected, terms and conditions apply).

While any form of investment inherently carries some risk, RBC Direct Investing ensures that from a security standpoint, your ventures are as safeguarded as possible. The responsibility for investment choices remains yours, but with RBC, you’re operating within one of the safest platforms the Big Bank brokerages have to offer.

RBC Direct Investing Review: Trading Fees and Prices

When it comes to RBC Direct Investing’s fees and trading commissions, it’s important to understand that RBC (and all of Canada’s large banks, for that matter) rarely seek to be the cheapest option available.

They entice you with a great platform, the safety of being one of Canada’s most trusted companies, and the convenience of keeping all of your banking under one roof. Value isn’t one of their selling points.

While we don’t recommend choosing an online broker based solely on price, it does help to know which high-quality option saves you the most. There are a number of brokers that offer stock and ETF trading at a lower cost or even for free. Meanwhile, RBC Direct Investing charges $9.95 per trade.

Compare that to Qtrade and Questrade, which feature lower trading fee for stocks ($8.75 with Qtrade, and as low as $0.01 per share with Questrade) as well as $0 cost on many ETFs, and it’s clear where you’re going to keep more of your money and add to your bottom line.

RBC Direct Investing Review: Account and Transaction Fees

While RBC has a $0 minimum deposit (which is great!), it does come with other fees you may incur. RBC Direct Investing charges a quarterly maintenance fee of $25 ($100 annually). However, you can avoid this fee if you do any one of the following:

- Are a new client (opened your account less than 6 months ago).

- Have $15,000 or more in your combined RBC Direct Investing accounts.

- Set up a minimum pre-authorized contribution plan of $100 per month or $300 per quarter.

- Pay for three trades during any quarter.

- Have an RBC student banking account (or have had one in the last five years).

- Have an RBC VIP banking package, or qualify for the RBC Direct Investing Royal Circle program (more on this later).

Below is a quick chart of the more common RBC Direct Investing transaction and account fees that you might run into.

| Possible Account Maintenance Fee | $100 Annually ($25 per quarter) |

| Inactivity Fee | $0 |

| Deposit Fee | $0 |

| Brokerage Account Withdrawal Fee | $0 |

| RRSP Withdrawals | $50 |

| TFSA Withdrawals | $0 |

| Home Buyers Plan & Life Long Plan Withdrawals | $25 |

| Wire Transfers (to North America) | $45 |

| Cheque Requests | $10 |

| Confirmation Replacement | $2 |

| Statement Replacement | $5 |

| Research Account Inquiries | $40 per hour (Min. $20) |

| Certificate Registration | $50 |

| Transfer Out | $150 |

| Internal Transfers (third party) | $25 |

| Estate Account Processing | $175 – $350 per account |

It is worth noting that if you are an RBC account holder, you may pay lower fees, or even no fees on certain transactions that non-RBC account holders pay full price for.

RBC Direct Investing Stock Trading Fees

As we’ve said, when it comes to the RBC Direct Investing trading fees, you’re going to pay $9.95 per transaction (including ETF trades). You can trade on any North American stock market and there are no ECN fees when using RBC Direct Investing.

ETF Trading Fees

Unlike Questrade, Qtrade, and a few big bank brokerages like BMO InvestorLine, Scotiabank’s Scotia iTrade and National Bank of Canada, RBC Direct Investing does not offer free ETF purchases or sales. Buying an ETF is treated exactly the same way as buying a stock/share, and incurs the same hefty $9.95 price tag (or $6.95 if you’re one of the day-trader types).

| Online Discount Broker | Per Transaction Cost to Buy ETFs | Per Transaction Cost to Sell ETFs |

| RBC Direct Investing | $9.95 | $9.95 |

| Qtrade | $0 | $0 |

| Questrade | $0 | $0.01, minimum $4.99 to maximum $9.95 |

Options Trading Fees

Options trading isn’t really my thing, but the RBC Direct Investing options trading fees follow the same philosophy as their stock trading fees. Most people are looking at $9.95 per trade + $1.25 contract fee.

Most options traders are substantially more active in their account than everyday ETF index investors, so these fees really add up in comparison to low-cost discount brokerages.

RBC Direct Investing Bond Trading Fees

When it comes to purchasing bonds, it’s not surprising thatRBC Direct Investing is not the most cost-effective option. You’ll be charged $18.80 for each US Treasury bond trade. For Canadian bonds, you’ll pay commission depending on the transaction amount, which starts at $25 per transaction.

RBC Direct Investing: RBC Active Trader Program

Like many of the Big Banks, RBC Direct Investing offers active traders special discounts and extra resources. Investors who make 30 or more equity or options trades each quarter automatically qualify for the Active Trader Program.

RBC Active Trader features include:

- Level 2 quotes with detailed insights into stock prices

- Premium research from Morningstar and RBC Capital Markets

In addition, traders who make 150+ trades per quarter qualify for a special lower commission on all trades ($6.95 instead of $9.95).

These perks can make a difference to active traders—but lower cost, fully featured online brokers would help even more.

RBC Direct Investing: Royal Circle Membership

The RBC Royal Circle is RBC Direct Investing’s special offer for large accounts and/or the most active traders. To qualify, you must have a month-end balance of $250,000 or more for 4 consecutive months or accumulate over $5000 in trading commissions annually.

RBC Royal Circle Membership perks include:

- Exemption from certain fees including quarterly maintenance fees, RRSP withdrawal fees, and statement/confirmation replacement fees.

- Priority service from the most experienced representatives for the member and any other investors in their family.

- Premium research from Morningstar and RBC Capital Markets.

- Preferred margin rates for your investment borrowing needs

RBC Direct Investing Account Types: TFSA, RRSP, Non-Registered

Like all of the leading Canadian discount brokers these days, RBC Direct Investing offers all of the usual accounts including:

- Non-registered accounts (both CAD and USD)

- Margin Accounts

- RRSP (both CAD and USD)

- TFSA

- RESP

- RRIF

- LIF

- LIRA

Make no mistake, you may pay a bit more with the RBC online broker vs some of the lowest-cost Canadian brokerages, but you will get the platform and the account selection that go with investing through one of Canada’s largest companies. Whether that trade-off is worth it is up to you.

RBC Direct Investing Platform & Tools

RBC Direct Investing offers both a web-based and app-based platform, both of which come with solid tools and resources.

For example, users can access information from sources such as Morningstar and RBC Research through either platform. These industry-standard tools are great, but may not be of great use to less experienced investors.

An excellent resource for RBC Direct Investors is the analyze and rebalance tool. This tool can save users the guesswork of trying to make sure they have the best balance for their investment strategy, and even give them suggestions of how to improve it if needed.

In 2018, RBC launched RBC InvestEase, a robo-advisor that compliments its banking and brokerage services, offering a cost-effective tool to its customers who want the benefits of having an advisor without the high cost. We’ve got more information for you over at our RBC InvestEase Review if you’d like to learn more about this service.

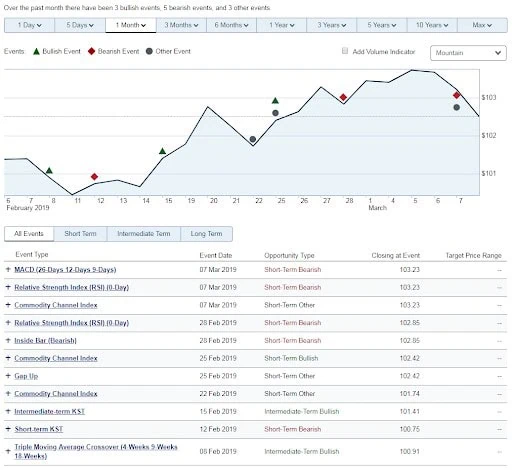

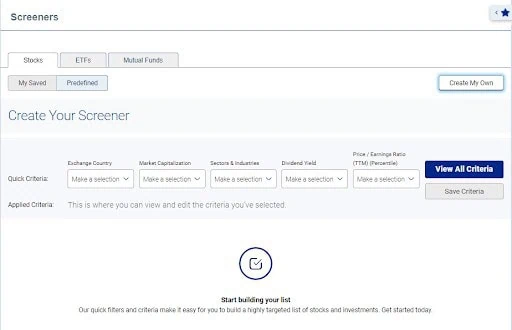

RBC Direct Investing also offers analyst-built screeners by Refinitiv, which are screening tools that can help investors find specific stocks that fit their criteria in terms of risk, industry, potential dividend earnings, and more.

RBC Direct Investing Practice Accounts

RBC Direct Investing is one of a handful of brokers that offer practice investment accounts. RBC’s practice account is integrated into the actual investing site, which means that you get a realistic trading experience with $100,000 in fictional assets.

You can “buy” and “sell” ETFs, stocks, and options, all risk free. You can also try out RBC Direct Investing’s tools and resources and track your performance over time before you invest a cent of your own money.

RBC Direct Investing practice accounts are available to all RBC clients, regardless of whether they have an investment account, which means you can give the service a real test drive before committing (and can track your fees to see how much of a difference RBC’s pricing would make for your bottom line).

Overall, RBC has made a solid attempt to keep up with industry standards when it comes to its online platform, its functions and its tools.

RBC Direct Investing Mobile App Review

These days, most investors expect a mobile app from their online broker, and RBC Direct Investing delivers on that front. The app is available for both iOS and Android.

The RBC Mobile app has received a spectacular 4.8 stars from over 206,000 ratings on the Apple App store. Over on the Google Play store, its rating fares a bit lower at 3.5. It seems like newer android versions have become more buggy than previous versions. That’s definitely not something you want when your investment app updates.

Through the app, you can access all of your RBC accounts as well as use it for your investment needs. It has all of the features you would expect from a decent investing app, such as:

- Safety and security with biometric sign-in

- Easy to navigate system

- Access to market information

- Clear and simple account monitoring interface

- Fast transactions

- Tracking of your investment performance

Want to see how RBC’s mobile app measures up to the competition? Check out our full Best Stock Trading Apps Review for a list of the apps we prefer.

RBC Direct Investing Review: Customer Service

While RBC prides itself on strong customer service, we’ve received an alarming number of negative comments here on our RBC Direct Investing Review in the last few years. We understand that people who have negative experiences are more likely to tell other people about it – but still, it’s concerning.

While all of Canada’s brokerages have experienced some growing pains recently, it appears that RBC has had an especially difficult time. We’ll continue to keep tabs on this trend moving forward, but it doesn’t appear to have improved since our last update.

You can reach RBC customer services from 7AM-8PM ET during the work week at 1-844-208-0258.

RBC Direct Investing vs. Qtrade

Now that you have a good idea of what RBC Direct Investing has to offer, let’s look at it in comparison to other self-directed investing option – Qtrade, our top recommended online broker. We’ve mentioned them both throughout this article, but it’s helpful to see their information side by side.

RBC Direct Investing | Qtrade | |

ETF Fees | $9.95 | $0 – $8.75 |

Mutual Fund Trade Fee | $9.95 | $0 |

Account Fees | $100 per year (can be avoided) | $0 |

Tradable Assets | Stocks, ETFs, Mutual Funds, Options, Fixed Income Securities | ETFs, Equities, Exchange-traded Debentures, Fixed Income, Mutual Funds, Options |

User Experience | Excellent platform | Elite, rated the best in Canada |

Customer Service | Above average, better than most big banks | Elite, rated the best in Canada |

Promo | 100 commission-free trades when you open your first account | 5% Cash Back + Unlimited Free Trades |

Sign Up |

RBC Direct Investing Review: FAQ

Who Is RBC Direct Investing Discount Broker Best for?

All things considered, unless you are not a current RBC customer who likes to keep everything under one roof, it just doesn’t make financial sense to do your investing with RBC Direct Investing. The high trading fees just are not justified, not to mention the quarterly account fees.

Sure, you’re protected by the IIROC and the CIPF, which definitely offers peace of mind. However, the fact is that many other Canadian online brokerages offer the same coverage, but at a much lower price tag and better customer service.

If you are one that values the quality of service and the availability of brick and mortar locations that a Big Bank can offer, you’re much better off with BMO InvestorLine. If having access to a physical location isn’t as important to you, but you still value quality service, we recommend Qtrade as Canada’s best online brokerage.

I do not recommend RBC Direct and I have been using it for over 20 years but now gradually switching out to Questrade. It has a nice easy to use platform for research and screens but it is just not keeping up with the times by keeping commissions that high.

Its ETF commission free list is paltry, given how many it excludes. One big problem with RBC Direct not mentioned is that the DRIP list is exclusive for many ETFs. Meanwhile, many other brokers (eg Questrade) allow every dividend distributing stock or ETF to be DRIPable , as long as you enough of a dividend amount to buy a share. With RBC Direct, many very reputable BMO, Vanguard, ishare etc ETFs are not eligible for DRIP – it definitely favours RBC ETFs

Another problem is that if you get caught with a partial fill and want to modify your price to sell the rest, it will charge you an extra $9.99 .

Quite frankly if you are even a moderate trader (ie more than 10 trades), you are rather foolish to stick with RBC Direct – at 9.99/trade compared to $0 for Questrade that is an extra $100/year

FYI, RBC has a list of 50 commission free ETFs as of fall 2025.

https://www.rbcdirectinvesting.com/accounts-investments/etfs/commission-free-etfs.html.

Details claimed:

– Buy and sell select ETFs commission-free

– Buy, sell and switch all mutual funds commission-free

– No account maintenance fee, no matter your balance

It is actually a very small list compared to the many ETFs out there and many of the BMO, Vanguard and ishares are not included. There is a strong weight towards RBC ETFs and fixed income ETFs

You didn’t mention the Trading Dashboard – excellent tool for seeing the market, portfolios, activity etc.

Important to note that RBC’s foreign exchange spreads are massive. If you want to convert CAD to USD, for example inside a registered account, RBC will take 2% or more of your money!

RBC direct investing customer service wait time is always more than one hour. I sent beneficiary information few times. Accounts did not get updated. I would give two stars to Customer Service.

I do not recommend RBC. I have been a client for more than 25 years. I tried to open an account, 1 week went by and finally I get an email saying call them. I tried for 4 days their line so busy it actually says you cannot hold. I message them. Two weeks goes by and I get a response (finally) saying take a day off work and go into the bank to fill out a form to prove its me. I do that and they send it in. A week goes by and I message them and say what is going on, its been 5 weeks. My partner opened one with TD in less than an hour. That was almost 3 weeks ago and still no response and no account. Go with TD because anyone that cannot get their crap together in this long cannot manage our money.

If I am not mistaken RBC Direct Investing doesn’t allow holding Mawer mutual funds any longer. I was with them at one point and this made me move. Not sure if other mutual funds are in that situation with them. Everyone else allows Mawer. Mawer is one of the few decent mutual funds left, and that sucked.

I wouldn’t give RBC Customer Service 4.5 stars. Over the years, they have missed getting my kids RESP government match, US dividend tax withholding forms, and they often buy at the highest price on my stock purchases. Overall they have a lot of improvement to be done.

Really happy to see a review of one of the less popular brokerages (well, less popular in the DIY community). I use Questrade, but it’s interesting to see how it compares to RBC and others. I’m suprised RBC doesn’t pass along discounts if you have your banking or mortgage with them. Seems like it would be a great opportunity. For example, free ETF trading if you had a chequing account with them.