BMO SmartFolio Review 2026

BMO SmartFolio Review

-

Investment Strategy

-

Website and Mobile Usability

-

Fees

-

Socially Responsible Options

-

Big Bank Convenience

-

Safety/Security

-

Investor Education

BMO SmartFolio Review Summary:

For Canadian investors seeking a budget-friendly alternative to a managed portfolio, the BMO SmartFolio robo advisor service might be the solution. Canada’s oldest bank, BMO introduced its robo advisor service in 2016, becoming the first major bank to offer this modern fintech tool to its clients.

The appeal of BMO SmartFolio includes the added security of being backed by a prominent institution. It also offers the convenient option to do most or even all of your banking in one place. BMO SmartFolio is managed with the expertise of Nesbitt Burns, BMO’s full-service investment branch, meaning this service benefits from top-tier experienced, and proficient portfolio managers.

However, it’s worth noting that BMO SmartFolio may come at a higher cost compared to other options like Justwealth, which offers similar, or even superior services, at a lower price.

In this BMO Smartfolio Review, we’ll detail what this robo advisor service offers, its cost, its pros and cons, and how it compares to other Canadian robo advisors.

Pros

- Excellent long term investment strategy (Easy Indexing)

- Very low fees compared to mutual funds

- As easy as investing gets

- Best big bank robo advisor

- Great online platform and mobile app

- Can do all your banking “under one roof” with BMO

Cons

- Higher fees – Slightly more expensive than investing with BMO InvestorLine or Justwealth

- No socially responsible investing (SRI) options

- No direct control over weightings of index funds (like you’d have with a DIY Canadian online broker account)

I’m a huge fan of robo advisors, and BMO’s robo advisor: SmartFolio is no exception to that.

If you’re not familiar with robo advisors the basic idea is that you will determine your overall risk tolerance, and that BMO will set you up with an automated portfolio using big broad index funds that spread your investment risk out over thousands of companies and bonds.

For example, the average Canadian 45-year old investor might fit pretty well into a portfolio that is 60% equities and 40% bonds. BMO SmartFolio would let this investor quickly and easily send a chunk of their paycheque each month, and have it efficiently split up between Canada’s 60 biggest companies (a TSX 60 index fund), the 500 biggest companies in the USA (S&P 500 index fund), as well as hundreds of companies throughout the rest of the world.

Then 40% of that monthly contribution would get split up into bonds generated by the world’s biggest companies and countries. As the value of these assets grows or shrinks, SmartFolio will automatically sell some of what is doing best, and buy some of what is doing worst. (aka: “Buy low, sell high”).

What is BMO SmartFolio?

BMO SmartFolio is a “hands-free” digital portfolio management service. You can open an account with as little as $1,000 and based on your risk tolerance, you are aligned to the model portfolio that best suits your investing needs.

How it Works

First, you complete an investor profile by answering a series of personal and investment questions (10 multiple choice questions) and then you will be presented with a recommended model ETF portfolio (this is free). Each model ETF portfolio has an asset allocation of equity and/or fixed income that aligns with your investment objectives. There are 5 model ETF Portfolios (ranging from the least risky to the most risky, i.e. having the smallest percentage in equities to the largest).

- BMO SmartFolio Capital Preservation Portfolio;

- BMO SmartFolio Income Portfolio;

- BMO SmartFolio Balanced Portfolio;

- BMO SmartFolio Long Term Growth Portfolio; and,

- BMO SmartFolio Equity Growth Portfolio.

BMO expert portfolio managers monitor the model ETF portfolios every day. Where and when required, they rebalance the model ETF portfolio to keep the client on track with their investment objectives.

My Personal Investment Profile

To provide a more comprehensive review, I signed up for BMO SmartFolio to get a sample portfolio for my risk profile. I completed the 10 questions which started with some questions about income, investment knowledge, and investment timeline.

The survey then finished with a few questions on the amount of volatility you can tolerate. The survey took under 10 minutes and didn’t require me to sign up or pay for anything. Based on my information, SmartFolio determined that I should have an Equity Growth Portfolio consisting of 90% equities and 10% fixed income. When the actual portfolio came out, it was actually 95.99% equities and 4.01% fixed income. Here are the positions that they recommended for me:

Equities 95.99%

- BMO S&P/TSX Capped Composite Index ETF (ZCN) 29.82% (MER: 0.05%)

- BMO MSCI EAFE Index ETF (ZEA) 10.25% (MER: 0.20%)

- BMO Emerging Markets Equity Index ETF (ZEM) 8.11% (MER: 0.25%)

- BMO MSCI USA HIGH QUALITY INDEX CAD UNITS ETF (ZUQ) 10.19% (MER: 0.30%)

- BMO LOW VOLATILITY CANADIAN EQUITY ETF (ZLB) 19.49% (MER: 0.35%)

- BMO Global Infrastructure Index ETF (ZGI) 7.87% (MER: 0.55%)

- BMO S&P 500 Index ETF (ZSP) 10.26% (MER: 0.10%)

Fixed income 4.01%

- BMO Mid-Term US IG Corp Bond Hedged Index ETF (ZMU) 4.01% (MER: 0.25%)

While I’m comfortable with the equity exposure and some of the chosen ETFs, it’s still a bit too complex. For my real indexed portfolios, I basically hold four positions, Canadian equity, US equity, International equity, and a bond index. So if I were to put together a portfolio of this nature, I would keep: ZCN, ZEA, ZEM, ZSP, ZMU and dump the rest. This would also reduce the overall MER as well.

BMO SmartFolio Fees

This is the big question that always comes to mind when evaluating services like BMO SmartFolio. Let’s take a look at what they charge for their service.

- Minimum account size: $1,000

- First $100,000: 0.70%

- Next $150,000: 0.60%

- Next $250,000: 0.50%

- $500,000 and greater: $0.40%

So what does this all mean in dollars and cents? Let’s look at some portfolio size examples:

| Account Size | Advisory Fee Paid Annually |

| $5,000 | $60 |

| $10,000 | $70 |

| $25,000 | $175 |

| $50,000 | $350 |

| $100,000 | $700 |

| $250,000 | $1,600 |

| $500,000 | $2,850 |

| $1,000,000 | $4,850 |

Note that the annual advisory fee does not include the management expense ratio (MER) that ETFs charge. Although most BMO ETFs are reasonably priced, their website states that the anticipated weighted average MER of a portfolio will be between 0.20% and 0.35%.

BMO SmartFolio Performance

So, how does the BMO SmartFolio perform? This is a valid question many ask when deciding whether or not to invest.

When it comes to passive investing, which is the type of investment you are making with a financial product like SmartFolio, past performance is not the best indicator of what your future returns might be.

When you take the passive investment route, which usually means you are investing in ETFs or mutual funds, looking at past performance can be misleading. The market can be volatile, and just because a fund did well in the past when the market was performing at its peak, does not mean we can count on it staying the same in the future.

In fact, research has found that stock pickers for some funds are quite often wrong when choosing what they believe may be star performers. This is another reason to carefully consider the type of ETF you invest in.

If you take the active investing route, which is where you commit to buying and selling securities on a regular basis, then past performance could be a bit more important for you to consider.

However, keep in mind that the same rule applies, past performance does not guarantee future outcomes.

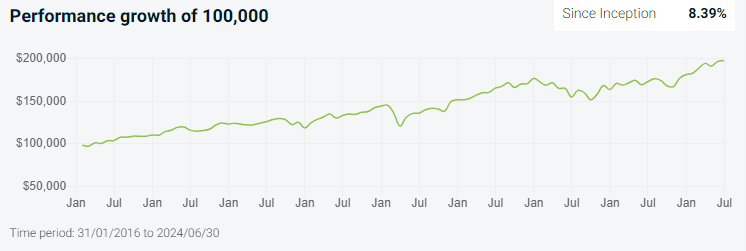

That being said, you still might be curious about how SmartFolio’s ETFs have performed over the years, and how they compare to other comparable portfolios, such as those offered by our top-recommend robo advisor, Justwealth.SmartFolio’s Equity Growth Portfolio, has performed fairly well since its inception in 2016.

This portfolio currently allocates 94.1% of its assets to equities and 4.6% to fixed income securities. Its total return percentage since the inception of the fund is 8.39%.

While this is a decent return, we should also mention Justwealth’s Global Maximum Growth Portfolio when talking about equity portfolios. Since its inception, also in 2016, it has had a total return percentage of 10.25%. This is almost 2 full percentage points above BMO SmartFolio’s equity portfolio.

If you are an investor with a long time horizon, equity funds could be a promising choice. They carry more risk since they are heavily weighted in stocks, but that may be acceptable if you’re planning on holding on to it for a long period.

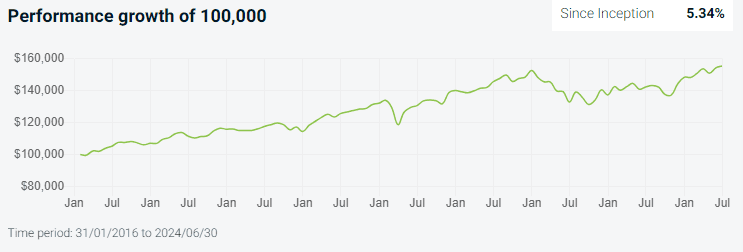

However, if you have a shorter time horizon for your investments, then you will likely consider a portfolio like BMO SmartFolio’s Balanced Portfolio option. This option has an asset allocation of 49% equities and 49.5% fixed-income assets. Since inception, it has a total rate of return of 5.34%.

Compare this to the Justwealth Global Balanced Growth Portfolio which has had a total rate of return of 8.52%. This is far beyond the BMO SmartFolio Balanced Portfolio – over 3%! Again, the fact that Justwealth isn’t limited to a small number of ETFs, as BMO is, has allowed it to perform better over time.

| 1 year | 3 year | 5 year | Since inception | |

| BMO SmartFolio Balanced Portfolio | 9.26% | 2.22% | 4.37% | 5.34% |

| Justwealth Global Balanced Growth Portfolio | 10.31% | 4.97% | 6.95% | 8.52% |

While all of the above portfolios have given investors a decent return since their inception, Justwealth had much higher rates of return. And again, it does not mean this performance will continue to increase indefinitely in this way with any robo advisor. It just might give you peace of mind to know that at least it has been going up and not down!

The Benefits

Here are some of the benefits of BMO SmartFolio:

- You have access to constructed portfolios comprised of BMO’s reasonably priced ETFs based on your own risk profile;

- Portfolios managed by BMO experts and effortless investing on your part;

- Relatively affordable compared to mainstream active management;

- Active monitoring and rebalancing; and,

- Full transparency into holdings, performance and transaction history;

Downsides

- Clients are forced to use BMO ETFs. I’m not saying that it’s a deal breaker as most have reasonable MERs, but it would be nice to have some choice.

- Costs overall are higher than Justwealth’s.

- Doesn’t offer the equivalent basket of perks for high-net-worth investors that Justwealth does.

- Doesn’t offer dedicated financial advisors like Justwealth does.

- Doesn’t have the best overall returns over the past few years.

- No current promotional offers.

BMO Smartfolio vs. Justwealth

We’ve laid out the pros and cons of BMO Smartfolio for you here, but how does it compare to our top-rated robo advisor, Justwealth?

You’ll notice that Justwealth offers many more choices of portfolios and personalized guidance. And, this all comes at a lower cost to you, with higher returns! These higher returns are partly due to the fact that they are not affiliated with a specific ETF company, like BMO is.

Take a look at the table below for a side-by-side comparison of BMO SmartFolio and Justwealth.

BMO Smartfolio | Justwealth | |

Number of Portfolios Available | 5 | Over 80 different portfolios designed to grow your wealth, generate income, or preserve your wealth. |

Personalized Financial Advisor | Advisors available, but are not assigned to clients personally | Yes |

5-year returns (balanced portfolio) | 4.37% | 8.48% |

Fees | 0.40%-0.70% | 0.40%-0.50% |

Target-Date RESP Funds | No | Yes |

SRI Options Available | No | Yes |

Account Minimum | $1,000 | $5,000 (although there are exceptions for RESP and FHSA accounts) |

Promo | No Available Promo | $100-$500 Instant Cash Back |

Sign Up |

BMO SmartFolio Review FAQ

Who is BMO Smartfolio Good For?

While BMO SmartFolio performs well compared to other Canadian Big Bank robo advisor services, it doesn’t earn the title of best robo advisor in Canada.

For existing BMO customers who value the security of a major bank, the higher management fee might be justifiable. However, alternatives like Justwealth offer lower management fees – saving you 0.20% to 0.30% – while still providing regulatory oversight and CDIC insurance through partnerships with other banks.

Another important consideration is the flexibility in choosing ETFs for your robo advisor portfolio. BMO SmartFolio exclusively offers BMO ETFs, which is limiting if you are someone who values choice. Furthermore, not being stuck with a specific ETF company can lead to higher returns. We see this in how Justwealth has greatly outperformed BMO SmartFolio since its inception.

In summary of our BMO SmartFolio Review, while BMO SmartFolio is a solid robo advisor, it falls short of being the top choice. Justwealth offers much greater cost efficiency and flexibility and also outshines BMO SmartFolio by other metrics. For a deeper look into why Justwealth stands out as the best robo advisor in Canada, check out the full Justwealth review.

The community of the disabled is not well served. BMO Investorline does not offer the Registered Disability Savings Plan. Too bad. Other discount brokers do- TD and NBDB.

This might make sense when setting up monthly rrsp contributions?

At $10 per trade on investor line – if I scaled the number of etfs down to 4 (canadian, usa, global, fixed) per month – that amounts to $40 per month = $480 per year.

Anyone have any suggestions on how to DIY monthly contributions on the cheap? I suppose I could just do lump sum contributions 1-2 times per year but then I’d lose out on dollar cost averaging benefits.

Any tips?

Use the TD e-series funds: TDB900, TDB902, TDB909, TDB911. Every year, sell the funds and buy ETFs.

Not too sure about the other robo type advisors but BMO could not, at this time, transfer my RRIF into their SmartFolio even though my RRIF was comprised of BMO funds. ‘Perhaps later in the year’, they said.

I don’t like how it only allows BMO ETFs. That being said, I wonder when the other banks are going to copy BMO on this

National Bank Direct Brokerage also has a system like that. I looked at it about a year ago and decided it wasn’t a good deal.

It looks like your recommended portfolio is 50% canadian. That is way too much.

why would anyone want to pay an advisor to buy and administer

ETF’s, ? It appears to be a vehicle for BMO to peddle their ETF’s

and for advisors to collect fees for doing very little, if anything.

Perhaps you can review Larry Berman’s Two BMO Tactical (Dividend and Global) funds. I like the fact that he seems to be actively balancing the allocation according to market conditions, not just risk profile, etc.

Does this tool eliminate trade-commission fees?

If yes – with a monthly contribution distributed evenly among the predetermined allocation – the annual fees seem well worth it for those starting out.

If no – yowsers!

It appears total cost would be about 1% for a $100k account or 0.78% for a $1million account. Charges like that are why I left a Full Service Broker. But at least the FSB wasn’t investing in ETFs.

One way to reduce cost if this sort of thing interests you, is to open a $100k account. Then if you have $1million, invest the other $900k your self in exactly same way. That would reduce cost to 0.1%.

The fixed income part of this plan would be invested in bond etfs. Not in actual bonds or GICs with fixed interest and maturity. Not a way I would want my fixed income invested.

So even although, as we age, I am interested in partly moving to a less hands on approach, I consider this just a money grab that is aimed at taking advantage of those without the knowledge or inclination to manage their own affairs.

Your suggestion to “invest the other $900K yourself” makes it seem like you are totally missing the point of these robo-advisor services. They are an alternative to DIY, not meant to be used in conjunction with DIY. The idea behind them isn’t solely to just get someone else to pick your ETF allocation for you, it’s to completely manage all the buying, selling, and rebalancing, so that the investor doesn’t need to do anything or make any decisions. It’s not targeted at those who are smart enough to do their own purchasing and rebalacing, it’s as you say: a money grab aimed at those who don’t have the knowledge or inclination to manage their investments. I disagree that it’s “taking advantage” of them, it’s simply a service you can opt to pay for if you don’t feel comfortable doing it yourself. Look it as more like changing the oil on your vehicle. People pay a very high premium to have someone else do it, but it’s actually quite easy to do yourself, if you have the knowledge and inclination!