tfsa

All Categories

With GIC rates shrinking as quickly as Canada’s economic prospects, finding the best Canadian high interest savings account in 2025 is more important than ever.…

Read Full Article >>There’s an overwhelming amount of investment advice out there. While some of it requires careful research and planning, some tips -like contributing to a TFSA…

Read Full Article >>I recently received an email from a reader with a bright financial future. They have a maxed out TFSA and has recently maxed out her…

Read Full Article >>After writing a deep dive article on whether the 4% safe withdrawal rate still works for retirement at various ages, I received a lot of…

Read Full Article >>I’ve been getting a number of emails from readers about dividend investing and which type of investment account to use for maximum tax efficiency. This…

Read Full Article >>Most Recent

New Wealthy Barber Book Review

All of the new Wealthy Barber (2025) reviews out this past week have been glowing. Roy Miller the all-knowing barber is back, as the 1989…

Best Canadian High Interest Savings Accounts

With GIC rates shrinking as quickly as Canada’s economic prospects, finding the best Canadian high interest savings account in 2025 is more important than ever.…

Best Canadian Finance Podcasts

The best personal finance podcasts in Canada don’t insult your intelligence or try to sell you something. They aren’t created by self-appointed “fin-fluencers” trying to…

Best GIC Rates in Canada – December 2025

With the Bank of Canada hinting at possible rate cuts in 2025 – and with Trump’s tariffs lurking on the horizon – it’s looking more…

Best Short Term Investments in Canada Right Now (May 2025)

With interest set to fall, the best short term investments in Canada continue to evolve as we move toward the second half of 2025. As…

Canadian Election: Taxes, Tariffs, and Housing

With Canada’s federal election just days away, the headlines have been dominated by taxes, tariffs, housing strategies, and party leaders throwing shade at each other.…

Tangerine vs EQ Bank Comparison 2025

If you’re looking for the Best Online Bank in Canada in 2025, the competition really boils down to Tangerine vs. EQ Bank. With interest rates…

TFSA Contribution Room In 2025 + TFSA Rules and Limits

There’s an overwhelming amount of investment advice out there. While some of it requires careful research and planning, some tips -like contributing to a TFSA…

Best Online Banks in Canada 2025

Canada’s online banks are innovating and stealing market share faster than most people thought possible a couple of years ago. According to the Canadian Bankers…

Rebalance My Investment Portfolio: How, Why, and When

With all of the recent volatility in the stock market, I’ve been getting a lot of inquiries about rebalancing investment portfolios. Other inquiries have read…

Maxed out RRSP and TFSA – Now What?

I recently received an email from a reader with a bright financial future. They have a maxed out TFSA and has recently maxed out her…

Alterna Bank Review

What is Alterna Bank? Alterna Bank is a wholly-owned subsidiary of the credit union Alterna Savings, based in Ontario. Alterna Bank has brick-and-mortar locations within…

EQ Bank vs Simplii Financial

EQ Bank is one of our most frequently recommended banks; we’ve even granted it first place in our list of top-rated Canadian online banks. Simplii…

Oaken Financial Review

What is Oaken Financial? Oaken Financial is a digital bank owned by Home Trust Company, which is a subsidiary of Home Capital Group Inc. (one…

FHSA: Canada’s Tax-Free First Home Savings Account

With the government having launched the First Home Savings Account (FHSA) in 2023, more first-time home buyers should really be looking to take advantage of…

Best Long-Term Investments in Canada 2025

Long-term investing is one of the most powerful ways to grow your wealth. As the name implies, long-term investing means that an investor buys an…

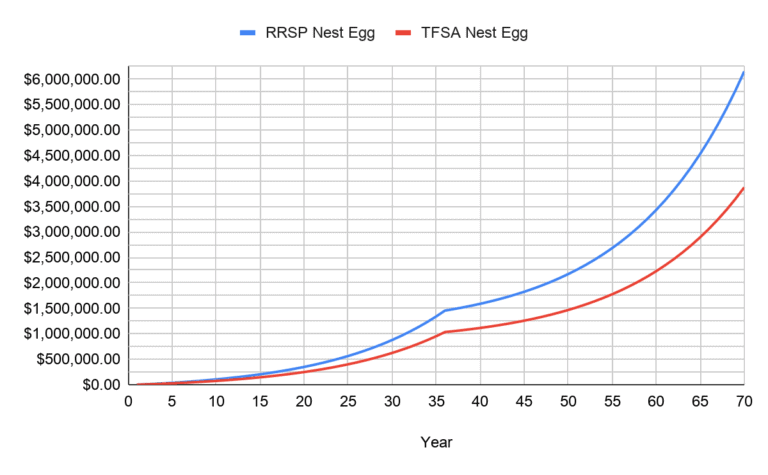

TFSA vs RRSP- Which One is Better?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax…

Withdrawing From RRSP and TFSA For Retired Canadians in 2025

After writing a deep dive article on whether the 4% safe withdrawal rate still works for retirement at various ages, I received a lot of…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.