Alterna Bank Review

Alterna Bank Review

-

High Interest Savings Account Rate

-

GIC Interest Rate

-

Banking Fees

-

Ease of Use and Customer Service

-

Mobile App

-

ATM Withdrawals

-

Account Options

Alterna Bank Review Summary:

Alterna Bank is an online Canadian Bank offering no-fee Chequing accounts and Savings accounts, as well as a few registered account options. They have competitive interest rates for Guaranteed Income Certificates (GICs), but their high interest savings account rate falls in the middle of the pack.

While they do offer the Alterna Bank Mobile App, I have seen in reviews that many users have difficulty logging in and accessing its features. For those for whom it works, it is a diverse and useful app that allows clients to bank anywhere, anytime.

One thing we love about Alterna Bank is its partnership with Qtrade, our top-recommended online broker. They frequently have a generous sign-up promotion.

Despite Alterna Bank’s strong points, EQ Bank continues to take first place in our rankings. EQ Bank consistently offers the highest interest rates to Canadians at the lowest cost. They also have a superior online platform and a top-notch mobile app for easy online banking.

In this Alterna Bank Review, we will highlight the pros and cons of choosing Alterna as an online bank.

Pros

- No-fee Chequing and Savings Accounts available

- No monthly account fees

- Debit Card for transactions

- Partnership with QTrade

- Available in Quebec

- CDIC Insured

Cons

- Low-rated mobile app

- Low-rated customer service

- Limited physical presence (Ontario-only)

- No promotional offers or bonuses for accounts

- No RESP or FHSA accounts

What is Alterna Bank?

Alterna Bank is a wholly-owned subsidiary of the credit union Alterna Savings, based in Ontario. Alterna Bank has brick-and-mortar locations within Ontario that can provide in-person services, but they also have online-only accounts. In this review, we will be focusing on Alterna Bank’s eAccounts, which are its no/low-fee online products.

Alterna Bank’s commitment to being a solid online bank option is highlighted in their statement, “As a digital bank for the 21st century, we champion our customer’s financial well-being and help them navigate a self-serve, rapidly changing world when and where it’s convenient for you.”

Is Alterna Bank Safe?

We understand your need to ensure that your bank of choice, especially an online bank, is a safe and secure option. Fortunately, Alterna Bank is a member of the Canadian Deposit Insurance Corporation (CDIC) so your savings are covered up to $100,000 per account.

Beyond the standard CDIC coverage, Alterna Bank has secured websites, various login options for online banking and the mobile app, and text/email security notifications.

Despite all these security measures in place by Alterna Bank, always remember to be prudent with your personal financial information.

Also, we’d be remiss if we didn’t briefly explain that Alterna Bank is not responsible for the investing decisions that you make within your account, so we aren’t talking about “safety” from that perspective.

Alterna Bank Fees

Alterna Bank’s eChequing and High Interest eSavings Accounts do not have a monthly fee or a fee for day-to-day transactions, and the accounts do not have minimum required balances. This is what we like to see – and at this point – expect to see from online banks!

Unfortunately, they’re not 100% fee-free, however. Personal cheques will cost you, and there are some hefty fees if you have non sufficient funds when writing a cheque or making a pre-authorised payment. There are also increasingly high fees if you allow your account to become inactive.

| CHARGEABLE ITEMS | FEE |

| Monthly Fee | None |

| Day-to-day Transactions | Unlimited |

| Interac® ATM Withdrawals | $1.90 per withdrawal (withdrawals from THE EXCHANGE Network in Canada and the Allpoint Network in USA are free) |

| All-on-One Paper Statement | $2 per statement |

| Cheque Images in Statements | $2.00 |

| Personalised Cheques | Fees vary |

| Nonsufficient Fund (NSF) Fee | $50 |

| Inactive Account Fee | $20/year for years 2 to 4$30/year for years 5 to 8$40 for year 9 |

Alterna Bank’s “Full Service Accounts” ie. the non-eAccounts, all come with many more fees. For those accounts, monthly fees alone can cost you $4 – $16 per month. This is why we chose to focus on Alterna Bank’s online account options.

Account Types

As previously mentioned, Alterna Bank has both a line of eAccounts with low or no-fees, as well as Full Service Account Packages. Under the umbrella of eAccounts are both non-registered and registered account options. For registered accounts, they offer TFSAs, RRSPs, and RRIFs. Unfortunately, they do not offer RESPs or FHSAs.

One thing I love about the following eAccounts from Alterna Bank is that there are no monthly fees and no minimum balance required.

Chequing Account

The Chequing Account offered by Alterna Bank is called the No-Fee eChequing Account. It has an interest rate of 0.05%. This account can be freely used with the Alterna Bank Debit Card for day-to-day transactions and to send and receive eTransfers.

You can also withdraw cash for free from THE EXCHANGE Network ATMs within Canada or from the Allpoint Network in the USA. You can also get personalized cheques, although these will come with a fee.I

f you’re specifically seeking a chequing account, take a look at our list of the best chequing accounts in Canada.

Savings Account

Alterna Bank’s High Interest Savings Account is called the High Interest eSavings Account. Within this account you have free, unlimited bill payments, transfers, and debits, as well as free, unlimited Interac e-Transfers.

Its interest rate is 2.00% which is neither high nor low in the landscape of online high interest savings accounts in Canada. We do like how it is an ongoing rate and doesn’t require setting up a payroll deposit, but there are certainly many other online options for a much better rate.

If you’re looking to maximize interest earned in a savings account check out our up-to-date list on the Best High Interest Savings Accounts in Canada.

Tax Free Savings Account (TFSA) + RRSP Account

The TFSA eSavings account provides an interest rate of 2.00%. While the interest rate isn’t that high, you are able to easily transfer your funds through online and mobile banking.

For more information on TFSAs in general, check out our 2024 TFSA Contribution Room, Rules and Limits article.

You’ll also receive 2.00% for the RRSP eSavings Account. Again, not the best rates available but if it’s what gets you started with opening a RRSP that’s a win!

Additional Products

Alterna Bank has partnered with QTrade Investor to provide online investing. You can choose to self-manage your investments, or you can access QTrade Guided Portfolios for a low-cost, professionally managed portfolio. We recommend QTrade as Canada’s #1 Online Broker. You can read more in our Qtrade Review.

Alterna Bank also offers mortgages. They have Fixed Mortgages for periods of 1, 2, 3, 4, 5, 7, and 10 years, and Variable Rate Mortgages for 3 or 5 years, with rates ranging from 5.09% up to 7.70%.

And, as previously mentioned, Alterna Bank also offers All-In-One Account Packages which you can read more about on their website. For anyone looking for an all-inclusive banking package, we recommend Scotiabank for its promotional welcome bonuses and great rewards programs.

Alterna Bank GICs

As you saw in the previous section outlining Alterna Bank Account Types, they are big on dropping the letter e in front of their various products to signal that they are online products. You’ll find the same thing when searching their website for Guaranteed Income Certificates (GICs); they’re referred to as eTerm Deposits.

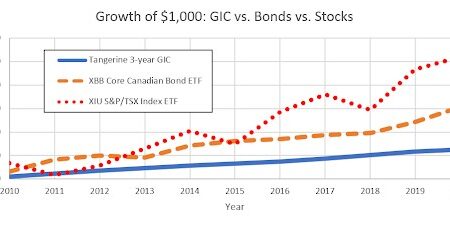

GICs are a great place to safely stash your cash with a guaranteed interest rate for a predetermined period of time. They are great for upcoming anticipated expenses such as a new vehicle.

I can’t talk about secure places to hold onto and grow your money without mentioning the new EQ Bank Notice Account. This is where you’ll find the best interest rate (currently 5.00%) and you only have to give 30 days notice before withdrawing your money. For a full overview of how it works, check out our EQ Notice Account Review.

The table below outlines term length and rates for GICs available from Alterna Bank. The rates are the same whether held in a registered or non-registered account. They tend to have a minimum deposit of $500 and a maximum deposit of $500,000.

| GIC/eTerm Deposit Length | Rate |

| 1 Year | 3.45% |

| 2 Year | 3.30% |

| 3 Year | 3.25% |

| 4 Year | 3.30% |

| 5 Year | 3.35% |

Alterna Bank Credit Cards

Alterna Bank does not offer an enticing credit card, but they do have a debit card for day-to-day use with the eChequing account. This Interac® Debit Card can be used at point-of-sale (POS) terminals including for contactless payments ie. “tap”.

Clients can access thousands of ATMS for free through THE EXCHANGE Network in Canada, and the Allpoint Network in the USA. Unfortunately, there are no points or perks such as cash-back with this card.

Ease of Use

As an online bank, much of the ease of use falls on the client’s ability to self-manage their money. Fortunately, Alterna Bank offers you the option to complete your banking on their website or through the mobile app.

For day-to-day use, the debit card is a great perk to doing business with Alterna Bank as it allows you access to over 3,300 ATMs nationwide. The allowance of free and unlimited incoming and outgoing eTransfers and electronic funds transfers also makes banking with Alterna a hassle-free option.

If you happen to be in the province of Ontario, you can pop into an Alterna Bank branch.

It is quick and easy to open an account online with Alterna Bank, taking less than 5 minutes.

Customer Service

Alterna Bank offers a multitude of ways for customers to get in touch.

They have 2 Contact Centres: one for personal accounts and one for business accounts. The Personal Contact Centre is staffed Monday to Friday 8am to 8pm ET, and Saturday to Sunday 9:30am to 4pm ET. The Business Contact Centre lines are open Monday to Friday 9am to 5pm ET, and are closed Saturday and Sunday.

Alterna Bank also has an online chat – staffed by live agents during the above contact center hours.

Additionally, there is always the option to contact via email which will be responded to in 2 business days. When I emailed them during business hours I was pleasantly surprised to receive a response within 1 hour.

While this sounds like a good variety of options, online reviews show many clients are dissatisfied with the customer service provided by Alterna Bank.

Mobile App

Alterna Bank has mobile apps for both Android and Apple users. The app allows for paying bills (instant, future-dated, or recurring), transferring funds (between Alterna Bank Accounts, or to and from accounts with other financial institutions), and checking your balances. You can deposit cheques and send eTransfers for free using the app.

Log-in can be completed using a password or Touch or Face ID. They take app security seriously, having it use the same level of secure protection as their full Online Banking. Additionally, you can set up security notifications to either your mobile phone or email.

When I looked up Alterna Bank app reviews, I was surprised at the low number of reviews and downloads. On Google Play they have a rating of 2.4 stars. Apple users rated the app a bit higher at 3.0 stars. However, each average comes from less than 50 reviews.

Both Android and Apple Users highlighted issues with logging in which meant that they couldn’t access any of the app features. Many users reported having trouble with uploading cheques. There are also multiple one-star reviews from people who began to have problems following an app update/overhaul.

Reviews, whether negative or positive, have all been responded to by developers so we hope to see improvements made over time.

Alterna Bank vs EQ Bank

EQ Bank is consistently recommended by MDJ as the #1 choice for online banks for Canadians. Check out the table below to see how Alterna Bank and EQ Bank compare:

| ||

|---|---|---|

| Products |

|

|

| ATM/Interac transactions? | Free & Unlimited | Free & Unlimited |

| Account transaction fees | $0 |

|

| Savings Account Interest Rate | 2% | 3% and 3% with the EQ Notice Account. |

| GIC 1-Year Interest Rate | 3.35% | 3.40% |

| Sign Up | Visit Alterna | Visit EQ Bank |

Frequently Asked Questions About Alterna Bank

Alterna Bank Review – Is Alterna a Good Bank?

Is Alterna a good bank?

Sure.

But is it the best bank if you’re looking to maximize the growth of the money sitting in your accounts?

Probably not.

While we loved the no monthly fee and no minimum account balances across the online accounts, you can most certainly find a higher interest rate elsewhere. Our list of the Top Online Banks in Canada will give you an idea of other rates and what it takes to receive them.

You can come close to receiving Canada’s Best GIC Rates for both registered and non-registered accounts with Alterna Bank, but EQ Bank’s Notice Account beats current GIC rates and can be withdrawn in a shorter window of time. Furthermore, EQ Bank continues to come out as the leader due to its superior platform and even lower fees.

If you’re not chasing the highest available interest rates you may find that Alterna Bank suits your needs. If you’ve got any firsthand experience that I could add to this Alterna Bank review then please let me know in the comments below what you think of this online credit union option. The more data points we get the better!

Best 2026 Canadian Bank Offer:

3% Everyday Interest Rate

Open an account with EQ Bank & get the best interest rates in Canada - 1% + 2% interest rate if you direct deposit your pay.

The best daily interest rates in Canada* and great rates for GICs - up to 3.85% guaranteed in your registered account. Get it by clicking the button below:

* Rates are subject to change ** Applies to both New and Existing clients who open a new account. ***EQ Bank Review: more details