Indexed Family Education Fund (RESP) Portfolio Update – 2022 Edition

Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s future education costs. Since we’ve been posting about these accounts since my kids were born (my oldest was born in 2008), it shows the power of long-term compounding of a no-fuss, easy to manage, and low-fee account.

What is an RESP?

At a high level, an RESP is an investment account for future post-secondary students and stands for Registered Education Savings Plan. It can be set up as an investment account (with a Canadian discount brokerage) that grows tax-free until the money is withdrawn towards education expenses and taxed in the student’s hands.

In addition to the tax-free growth, the icing on the cake is that the federal government matches 20% of RESP contributions up to a maximum of $500/child/year. In other words, you’ll max out government matching when you contribute $2,500/year/account.

Investing within an RESP

The RESP portfolios for our children are set up with TD e-Series mutual funds which provide a low-cost way to index the market (also check out some all-in-one ETFs). We contribute $2,500/account/year to get the maximum contribution from the government of $500/account/year. So basically $5,000 contributed to the two RESP accounts gives us $6,000 annually to invest.

So what are we doing with our RESPs during this time? Are we sticking to the strategy of buying through this crazy fed-induced bull market?

The original plan was to be aggressive for the first 10 years (90% equities 10% bonds) for each child with increasing fixed income as the University tuition nears. I copied the table from my original RESP strategy article.

I have since adjusted the first 10 years to have close to 75% equities and 25% bonds. I like to keep things simple, and having it set up this way will still provide solid long-term results, while enabling me to keep it simple with 25% in each of Canadian equity, US equity, International equity, and Bonds.

As of today, my oldest child is 13 and my youngest 10. My goal is to have a higher bond allocation for my oldest child but due to the bull run (and bonds falling due to anticipated higher interest rates), the equities portion has remained high (70% equities, 30% bonds/cash). Time to rebalance soon!

My youngest child is close to the 75/25 equities/bond allocation, but again, the year ended closer to 80/20, which I am comfortable with.

Our RESP Allocation Strategy

| Index | 0-10yrs | 10-14yrs | 14-17yrs | 18yrs + |

| Canadian Equity | 25% | 20% | 10% | 0% |

| US Equity | 25% | 20% | 10% | 0% |

| International Equity | 25% | 20% | 10% | 0% |

| Canadian Bonds | 25% | 40% | 35% | 0% |

| GIC’s | 0% | 0% | 35+% | 75% |

| Money Market Fund | 0% | 0% | 0% | 25% |

2022 Update – RESP Portfolio Started in 2nd Quarter 2008

| Investments | Units Held | Price Per Unit | Market Value | % Holdings | Book Cost |

| TD CDN Money Mkt | 409.568 | $10.00 | $4,095.68 | 5.00 | $4,095.68 |

| TD CDN Bond Index-e** | 1,746.981 | $11.77 | $20,561.97 | 25.09 | $20,290.52 |

| TD CDN Index-e** | 577.303 | $35.55 | $20,523.12 | 25.05 | $12,818.50 |

| TD US Index-e** | 194.041 | $106.26 | $20,618.80 | 25.16 | $5,963.66 |

| TD Int’l Index-e** | 1,023.993 | $15.76 | $16,138.13 | 19.70 | $11,080.32 |

| Total as of Dec 31, 2021 | $81,937.69 |

2022 Update – RESP Portfolio Started in 3rd quarter 2011

| Investments | Units Held | Price Per Unit | Market Value | % Holdings | Book Cost |

| TD CDN Money Mkt | 309.348 | $10.00 | $3,093.48 | 5.29 | $3,093.48 |

| TD CDN Bond Index-e** | 809.409 | $11.77 | $9,526.74 | 16.30 | $9,397.94 |

| TD CDN Index-e** | 445.846 | $35.55 | $15,849.83 | 27.12 | $9,896.86 |

| TD US Index-e** | 154.369 | $106.26 | $16,403.25 | 28.07 | $6,265.50 |

| TD Int’l Index-e** | 860.615 | $15.76 | $13,563.29 | 23.21 | $9,865.34 |

| Total as of Dec 31, 2021 | $58,436.59 |

As you may notice from the tables above, my rebalancing skills still need a bit of work! Alas, it all worked out in the end. The bull market continues to grow these accounts. Now it’s a matter of managing these gains as withdrawals are looming in the coming years – more on this below.

Withdrawing from an RESP

With my kids getting older, the reality of withdrawing from an RESP is approaching. As mentioned earlier, RESP contributions, grants and investment gains can all accumulate within an RESP account tax-free.

The catch is that a portion of RESP withdrawals is taxable. Which portion? The government grants and investment gains are taxable in the hands of the student (while contributions are not taxable). With that said, the goal is to spread out the taxation over the years that the student is attending post-secondary, for now, I’m estimating 4 years.

Indexing Investing Returns

The investment return for both portfolios has been fairly close throughout the years. I usually the numbers through Excel’s XIRR function (here’s how to use XIRR to calculate investment returns). This year, I’m going to do things a little differently and show you returns that come right out of the TD statement!

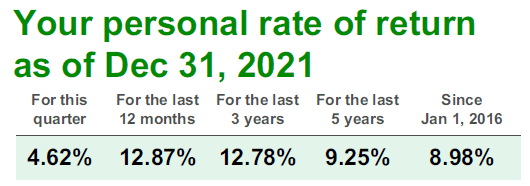

For the oldest child, we started the portfolio in early 2008 near the peak of the market so there was a point in early 2009 where the market value of this portfolio was significantly below book value. It’s comforting to see that re-balancing with new money every year has brought positive longer-term results. In 2021, this portfolio returned 12.87% and since Jan 1, 2016, it has returned 8.98%.

The second RESP portfolio was started near mid-2011, which fortunately was during a small market correction. In 2021, this portfolio, with a slightly higher equities allocation, returned 14.56%. Since Jan 1, 2016, this portfolio has returned 9.66% annually.

Final Thoughts

So in conclusion, indexing provides a steady, systematic, and low-stress way of investing. With another 4-5 years until post-secondary education for my oldest child and 7-8 years for my youngest, the accounts should have enough to cover most of their undergraduate degrees if they decide to move away from home, and perhaps even pay for post-graduate degrees should they stay home.

For new parents out there, if I were starting today, I would keep it simple with an all-in-one ETF, like VGRO/XGRO during the accumulation stage, and then switch to VBAL/XBAL as you get closer to withdrawals. That way, no need to rebalance equities/bonds every year, you just keep buying a single ETF!

That’s our RESP update for 2022. Even with volatile markets, indexing continues to provide a steady, hands-off, way to invest for lucrative long-term returns.

Stay safe out there!

Why haven’t you updated this since Dec 2021? I want to see how this portfolio handled the major market crash in 2022 when you”ll be withdrawing the money within the next couple of years?

Thank you for sharing your RESP strategy. My children’s accounts are also with TD eSeries, but I don’t see an option for purchasing GICs within the accounts. How do you do that?

I have set up my kids’ RESPs based on an article you (FT) had up at that time using the TD e-Series within EasyWeb.

A couple years ago, not exactly sure of time, TD stopped offering the TD e-Series from within their RESP on EasyWeb for new applications, existing holders of the TD e-series can still conduct transactions.

As of last year or year before, TD has made me take and update the risk questionnaire, via phone, before I am allowed to place any trades for the TD e-Series within my RESP in EasyWeb.

I was curious whether this is something you have also experienced as i do not see any mention made of this in your recent yearly updates.

Also, TD has pushed on me to convert my RESP account within EasyWeb to a TD Direct Investing account. They state I would not have to take and update their records of my risk tolerance yearly, as I have to do now.

I am hoping in your next RESP update or on a dedicated article you (FT) can speak to these two areas. Thanks

My child’s indexing RESP amount to be withdrawn is similar to yours over her 2-year program. I should spread the taxable withdrawals evenly over 2022, 2023 & 2024, as opposed to withdrawing the maximum $25,268 this year & $26,860 in 2023, correct? https://www.canada.ca/en/revenue-agency/services/tax/registered-plans-administrators/bulletins/resp-bulletin-no-1r1.html

Very interested in this as I have an almost identical setup for my kids. I’m just trying to figure out why your Total value is so much higher than mine. Oldest kid started Q1 2009 and middle child started Q1 2011. Same idea $2600 per year to get the max CESG. My returns are almost the same to within +/- 1%. My older kids portfolio value is $56309 and middle one is $53956. Granted you probably got the absolute low market value in late ’08 after the crash but it’s still a big difference. Kinda feels like TD is ripping me off somehow. The only thing I see is that your book value is so much larger than mine. My oldest is $40296 and middle is $35764. Which is close to ($2600 * 12 + $500 * 12) * years. But even then there were a few years where I did some lump sum deposits with money from grandparents etc. Maybe I’m just missing something in my calculations.