Financial Freedom Update (Q3) – Sept 2017 (+5.56%) – Major Milestone!

Welcome to the Million Dollar Journey September 2017 Financial Freedom Update – the third update of the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 5 3.5 years.

If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter (where I have been more active lately) and/or you can sign up for the monthly Million Dollar Journey Newsletter.

In my first few Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

Previous Update

To give you context for this update, here are the numbers in my previous financial freedom update.

June 2017 Dividend Income Update

Account Dividends/year Yield on Cost SM Portfolio $6,300 4.32% TFSA 1 $2,150 4.89% TFSA 2 $2,600 4.87% Non-Registered $210 1.37% Corporate Portfolio $11,000 3.69% RRSP 1 $5,800 3.70% RRSP 2 $700 2.80%

- Total Invested: $738,588

- Total Yield on Cost: 3.89%

- Total Dividends: $28,760/year (+9.73%)

Current Update

Since June, there has been a significant change to our financial position. In a recent post about retirement income sources, I hinted about job instability within the provincial government (NL). Well it happened, I was laid off, but accepted a lower paying temporary position which gives me an opportunity to apply for government jobs as they come up.

The whole situation has me pondering my career and life in general. I generally tend to look at things from a positive perspective where I firmly believe that when one door closes, at least two more open. When I look back at major turning points in my work life, things have always worked out for the better.

If I didn’t join my previous engineering employer (I had a choice of three employers), I wouldn’t have met a co-worker that pushed me in the direction of starting this blog. This site has been such a big part of my life that I honestly cannot imagine what my life would have been like without starting MillionDollarJourney.com.

So, now what? For now, I stick with the temporary job and look for opportunities that interest me. I’ve even contemplated early semi-retirement where we live off dividend income supplemented with part-time online and/or contract work. The laptop lifestyle with full autonomy does have a certain appeal to it. In fact, it’s how I imagine life when we hit our passive income goal. Whatever happens, I’ll keep you updated within these financial freedom update posts.

Now, let’s talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts. As an example, you may have heard about what happened to Home Capital Group (HCG). This is a secondary lender who had a very strong track record of dividend increases (18 years in a row). HCG funded their mortgages through client deposits into GICs and high-interest savings accounts. With the company under investigation, client essentially made a run at the bank and essentially wiped out HCG’s high-interest savings balance. To help stop the bleeding, HCG obtained a very expensive line of credit. The deal was so expensive that it could end up wiping out a full year of earnings. In light of this, the company suspended their dividends in May.

The goal of the strategy is to pick strong companies with a long track record of dividend increases. On the topic of dividend increases, 2017 is doing great so far. We’re three-quarters through the year, and there has been a large number of dividend increases in my portfolio. I have received raises from (there may be more that didn’t make this list):

- TD Bank (TD); Scotiabank (BNS); Magna (MG); Royal Bank (RY); CIBC (CM); Bank of Montreal (BMO); National Bank (NA); TransCanada (TRP); Great-West Life (GWO); Thomson Reuters (TRI); Manulife (MFC); BCE (BCE); Telus (T); Enbridge (ENB); Enbridge Income Fund (ENF); Canadian Utilities (CU); Canadian National Railway (CNR); Canadian Pacific Railway (CP); Exco Technologies (XTC); Suncor (SU); Thompson Reuters (TRI); Leons Furniture (LNF); First National Financial (FN); Power Financial (PWF); Transcontinental (TCL.A); Imperial Oil (IMO); George Weston (WN); Sun Life (SLF); CAE (CAE); Canadian Western Bank (CWB); Fortis (FTS); Empire (EMP.A); and, Metro (MRU).

In addition to the dividend raises, I’ve continued to deploy cash into dividend stocks. I’ve been a bit slower deploying corporate cash his quarter, but hope to continue moving forward this coming quarter. Since this is currently my largest investment account, it also adds the most weight to my overall holdings.

In my overall portfolio, here are my current top 10 largest holdings (besides cash):

- Bank of Nova Scotia (BNS);

- Fortis (FTS);

- Bell Canada (BCE);

- TransCanada Corp (TRP);

- Emera (EMA);

- Canadian Utilities (CU);

- Enbridge (ENB);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW) (mostly from my wife’s RRSP);

- CIBC (CM); and,

- Royal Bank of Canada (RY).

September 2017 Dividend Income Update

| Account | Dividends/year | Yield on Cost |

| SM Portfolio | $6,400 | 4.35% |

| TFSA 1 | $2,400 | 4.90% |

| TFSA 2 | $2,750 | 4.87% |

| Non-Registered | $210 | 1.37% |

| Corporate Portfolio | $11,700 | 3.62% |

| RRSP 1 | $5,850 | 3.72% |

| RRSP 2 | $1,100 | 2.36% |

- Total Invested: $795,071

- Total Yield on Cost: 3.82%

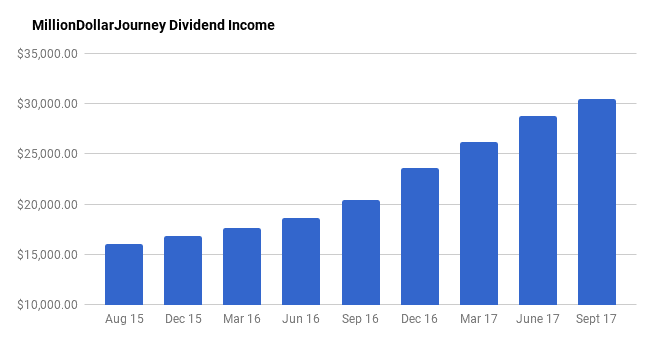

- Total Dividends: $30,410/year (+5.74%)

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been decent with a 5.74% bump in dividend income. While the growth is good, at this point, it’s looking less likely that I’ll hit $35,000 in dividend income by the end of the year.

We still have a long way to go to hit $60k, but for the most part, we are moving in the right direction in hitting the midway point of my longer term goal. There is still cash available to deploy in most of our accounts. In particular, the lump sum of cash from the commuted values of the pensions has started to be invested but still a lot left to deploy.

We are also in the process of ramping up our non-registered account to invest in more dividend stocks (setting up another account with MDJ reader favorite Questrade). That’s in addition to the dividends that are constantly being churned out which gets deposited as cash and reinvested again (the power of compounding).

The biggest risk or uncertainty right now is the coming changes to the way that passive portfolios will be taxed within private corporations. The good news is that existing portfolios will get grandfathered rules, but this will require some further tax planning down the road.

If you are also interested in the dividend growth strategy, here is a recent post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios. If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio.

Let me know if you have any questions by leaving a comment.

Oh, and don’t forget to check out my presentation at the Canadian Financial Summit starting September 13. It’s is 100% free for the first 48 hours after the video goes live.

Sucks about your job but i believe whatu said sometimes it opens better opportunitys. We just got denied our house insurance after putting solar panels on it. Now shopping around for our house and insurance theres better prices out there. Worked out for the better. Great progress on fi. You guys are doing great.

Nice read! Can you explain what a corporate portfolio is? Is it a cash account or a cash account held by a private corporation you set up? Thank you!

Hi Jonathan, this article could help: https://milliondollarjourney.com/official-passive-income-rules-for-canadian-small-business.htm

Hi there,

Just wanted to say I just came across your blog in my research and am so happy to see a blog on FI out of NL! I am also a prov gov employee and the past few months have not been fun so I can emphasize with you there.

My husband and I (31/32) have been pursuing a FI/RE strategy and just started DIY investing via TD e-series to get our feet wet with the couch potato strategy.

Just curious what your thoughts are around your own provincial pension. I was just looking at it today and it seems retiring early makes the pension amount very very small. I’ve felt kind of trapped in gov but I’m now thinking finding something in the private sector might not be a bad idea if I’m planning on retiring early anyway and will be actively investing.

I would love to reach $1M by 34 – wish I had the knowledge earlier. Right now we’re on track for 41. Looking forward to following the blog and maybe bump into you in the building without even knowing! Lol

Hello FH, thanks for stopping by and introducing yourself. I’m happy to see someone in the same building working towards FI at a very young age. Have you worked out your ideal retirement age? What is your strategy for building wealth? I suspect that you have a high savings rate?

About your question, I wrote about taking the commuted value of my wife’s provincial pension today.

Hope to see you around!

I wish you all the best in whatever you decide to do next. Layoffs suck – my wife was laid off yesterday. We’re in the fortunate position of having a healthy reserve of FU money. So, F**k em.

Now to my questions: in your post “How to Transfer a Work Pension to a LIRA” you made the transfer, but where is it listed in your dividend income list? Also, what did you decide to do with the DB Pension Plan money and why?

Thanks in advance.

Hi Bob thanks for the comment. With regards to the LIRA that would be under my wife’s rrsp. My wife’s rrsp is 100% indexed with low-cost ETFs.

Sorry to hear about the job loss. I am a firm believer that one job forever doesn’t exist nowadays. I have had to be involved in a number of layoffs and I always work as if I have to prove myself and stay in touch with the job market for what skills are needed (even at 43). Something for all readers to learn from the new business reality. Based on your business acumen, I trust you will settle for the better.

With respect to your portfolio, seems like you are very Canadian focused. The Canadian market is so limited, any reasons why you did not load up with US stocks when the dollar was at par in your RRSP accounts? My US portfolio outperforms the Canadian one by nearly 5% and my Canadian portfolio has nearly the same stocks you hold.

+1 on yield on cost not being a good metric. I would be curious to see the current yield.

@dividend earner, thanks for the comments. I agree with you, layoffs are a fact of life and yet another reason to reach for financial independence so that these speed bumps don’t hurt as much. Yes, I loaded up on US divvy stocks starting when CAD was at par. My RRSP is 100% US divvy stocks.

Hi,

Just for fun, what is your current amount in your TFSA’s? Why I ask is that my broker tells me I should put fixed income into them instead of Divi paying stocks! Thx

Doug

Doug, between the two TFSA accounts, we have about $120k total.

Hi,

What are your thoughts on the various split corps offered by Quadravest, which currently pay dividend yields up to 15%? My plan is to put a significant portion of my HELOC/SM into DFN or DF.

Regards,

Frank

First time commenter here, lured into speaking up by someone mentioning Quadravest. I’ve had a chunk of RRSP money split between DFN and FTN for a couple of years now and have mixed feelings. On the one hand, it makes up the bulk of my dividend earnings, due to the high, monthly dividend payouts (~10% and 15% on my cost); on the other hand, I don’t really have a clear idea what they do – something with writing covered calls – and that makes me nervous. A couple of times when the market has stumbled, shares in both have straight up plummeted – like 40 – 50% – which has been unnerving, although fortunately (so far) I’ve used those opportunities to add modestly to my stack. They haven’t missed a payment so far since I’ve bought, so in 2-3 years of periodically adding blocks of shares, I’ve received about 25% back in dividends. Very interested to hear if anyone else has thoughts on these funds/companies, as I’m a newbie but they have been good to me.

It sucks when you are so close to your early retirement goal and gets laid off. I hope that you can find a better opportunity soon and get your plan back on track.

With the current employment trend, I don’t believe that there is job security anymore. This is one of the reasons why I also try to become financially independent as soon as possible like you.

Once we hit our FIRE financial goals, the fear and impact of being laid off will no longer be there as working for money is optional. Good luck on your job search and stay motivated.

Thanks Leo! It’s not the first time I’ve been laid off, so while it’s a bit of a shock, it really could be worse. The toughest thing about it is that now I am forced to decide what I want to do next!

I must say you have captured the attention of a newish investor. I eagerly await new content from your site. I turned 34 this year and decided a few months back it’s never to late to regain control of my financial future. My wife pokes fun at my excel sheets (in good fun), but supports my financial decisions.

I do plan on reading more on the Smith Maneuver and if it’s still an option for my future. I know i believe i read the the gov. made some changes a while back. Just wondering if you have a short answer if its worth my research.

Cheers

I get a HELOC with prime + 0.2% recently and am thinking about doing SM too. Once the HELOC is a done deal, I will not reserve any emergency fund in cash any more, as I can always withdraw from HELOC if I need. And hopefully emergency never happens. Regarding to SM, I feel that there is more risk right now with the interest trending to increase for next while. I am on the boarding line for SM right now. My excel sheet concludes that I get 3.5% dividend yield from the portfolio, with my current tax bracket, I will get even with interest at 4.7%. It doesn’t sound too bad. It will take some time for the prime to increase to 4.5%. But with the market so high, the risk is huge. If I eventually decide to go with SM, I think I will begin with a small amount, maybe only 10% of the available heloc.

By the way, it is quite encouraging to see FT began the SM portfolio before the market crash and pulled through with good results. Thanks for the good example, FT.

Thanks May. I will admit that it was a bit concerning to see a huge drop right off the bat, but holding on (and even adding a little) really did pay off.

Hi Curtis,

Yes the gov made some changes to the way that you can access your HELOC. You can read more here:

https://milliondollarjourney.com/use-smith-manoeuvre-tax-deductible-dividend-investing.htm

Thanks for the comments and feedback everyone.

@GYM – yes, I’m hoping the portfolio compounding will have a mind of it’s own soon!

@Ian – I’m hoping for around $60k in passive income which gives us a little wiggle room in terms of our annual spending (family of 4). I may look at increasing bond allocation during retirement, but I’m thinking that retiring at a younger age will require a high equity allocation. I’m ok with a maintaining a high percentage of dividend stocks and holding.

@nobleea – I did get a package but not enough to buy me too much time.

Instead of yield on cost, would you guys prefer to see market yield? What else would you like to see in these updates?

I think market yield makes much more sense. I am OK also with a higher equity allocation but early retirement is risky. Obviously, if you had a gov DB pesion providing your $60k income or it was coming 100% from a bond fund like VAB, you would be in a much safer position then holding stocks. There are many ways to get to $60k and some are safer then others. I am looking forward to the discussion in the blog about risks and mitigation strategies.

Just adding: In the case of VAB above, only safer if VAB was also not the entirety of your portfolio as you would need equities in order to provide growth.

Good points Ian. I believe that over the very long term, the broad market goes up. I have my dividend portfolios structured so that I have most of the large blue chips covered, which cover most of the North American index anyways. I also use MSCI ETFs to cover the rest of the world. I also believe that while a dividend cut is possible, companies that have a history of increasing their dividend will do whatever it takes to keep that going. Generally, those companies have a competitive advantage thus the ability to continually increase earnings over the long term.