Financial Freedom Update (Q2) 2021 – Portfolio All-Time High Edition

Welcome to the Million Dollar Journey 2021 (Q2) Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses.

Here is a little more detail on our passive income goals:

How it all started – Original Financial Goal

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

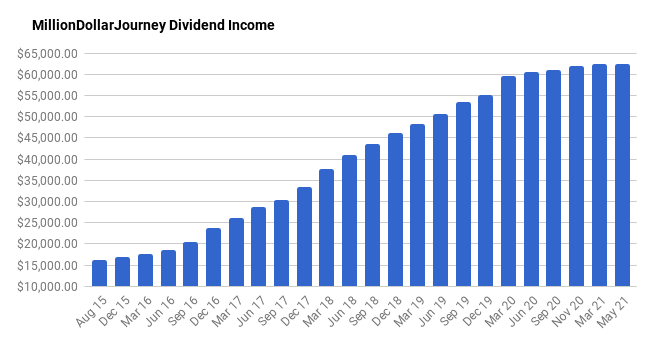

Major Financial Goal: To generate $60,000/year in passive income by end of the year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full-time salaries (we are currently a one-income family). At that point, I would have the choice to leave full-time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

I’m happy to report that we achieved this goal in 2020 – a little ahead of schedule. While the goal now is to continue building and reinvesting those dividends within the portfolio I’m finding that as the years go by, more focus is being put on indexing. Having said that, I haven’t sold any dividend positions in favour of index ETFs… yet.

One recent change is that I’m slowly phasing out of full-time salary income. So for the first time, I’m using dividend income and savings to top-up our cash flow to cover expenses. There is quite the psychological shift going from accumulating and building a portfolio to spending it – especially being a saver at the core! Despite the adjustment in mindset, the trade-off of having more time to do what I please is worth many times more.

The Previous Update

Here is a summary of the last update:

Q1 2021 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,780 | 3.85% |

| TFSA 1 | $4,200 | 4.48% |

| TFSA 2 | $3,900 | 4.14% |

| Non-Registered | $4,000 | 4.44% |

| Corporate Portfolio | $31,000 | 3.42% |

| RRSP 1 | $8,050 | 2.31% |

| RRSP 2 | $3,500 | 2.13% |

- Total Yield: 3.28%

- Total Dividends: $62,430/year

Current (Q2 2021) Update

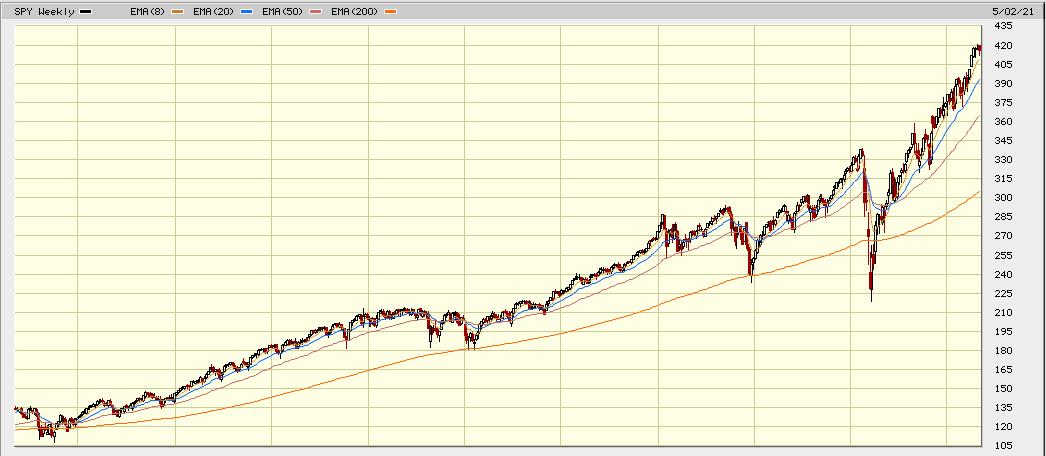

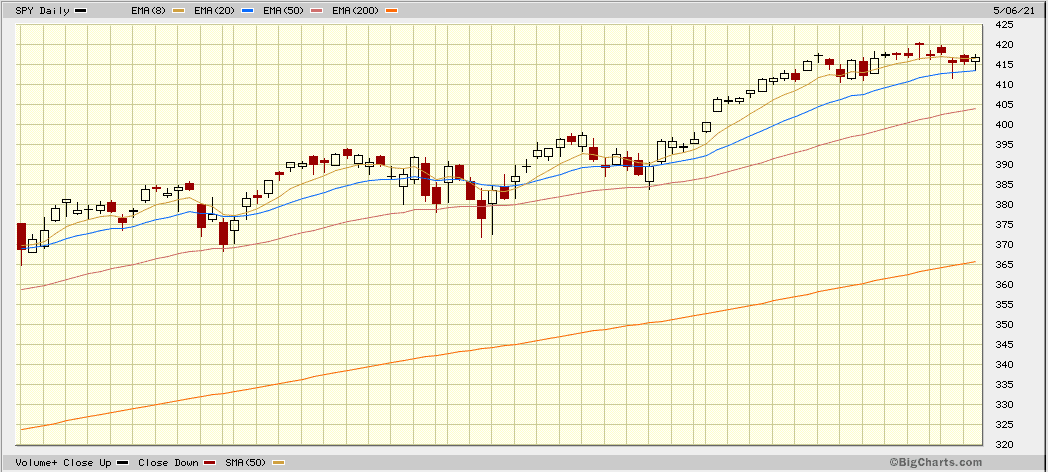

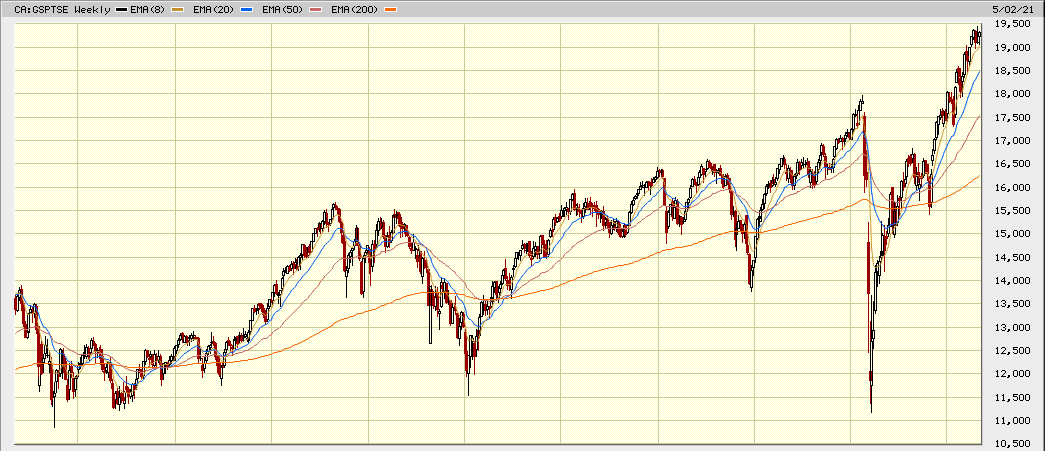

Not a lot has changed since the middle of March. As mentioned in the last update, 2020 finished with making all-time stock market highs (see 10-year S&P500 and TSX images below) and 2021 has kept the trend going. I don’t know about you, but I get a little suspicious when the index goes straight up (since COVID bottom) – so I expect that we’ll get some sort of pull-back in the coming months. It’s healthy for the market to take a breather as it can give long-term investors attractive entry points.

The bright side of these fed-induced markets going crazy? All-time highs for portfolio values! Check out the charts below.

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Thus far in 2021, I have deployed capital into the following positions:

- Waste Connections (WCN);

- Brookfield Infrastructure (BIP.UN/BIPC)

- iShares All-World Ex-Canada Index ETF (XAW)

- Algonquin Power & Utilities (AQN)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, despite the market volatility, this year has proven to be lucrative for dividend growth investors thus far.

2021 Dividend Raises

So far in 2021, the Canadian portion of my portfolio received raises from:

- CU.TO (1% increase)

- MRU.TO (11.1% increase)

- CNR.TO (7% increase)

- XTC.TO (5.3% increase)

- BIP.UN/BIPC (5.2% increase)

- MG (7.5% increase)

- CNQ (11% increase)

- NTR (2% increase)

- BCE (5% increase)

- TRP (7.4% increase)

- ENGH (18.5% increase)

- NTR (2% increase)

Top 10 Holdings

Our top 10 holdings have moved around quite a bit since 2020, but very little since my last update in March. The big banks have been on a tear and it shows in my top Canadian dividend holdings.

In our overall portfolio, here are the current top 10 largest dividend holdings:

- TD Bank (TD)

- CIBC (CM)

- Royal Bank (RY)

- Scotia Bank (BNS)

- Bank of Montreal (BMO)

- Fortis (FTS)

- Canadian National Railway (CNR)

- Emera (EMA)

- Enbridge (ENB)

- TransCanada Corp (TRP)

*not counting index ETFs (they are my largest holding).

Dividend Income Update Q2 2021

In Q2, there have been a number of healthy dividend increases and we managed to deploy some capital into our AQN position. While these factors added to our dividend income, there was a factor that took away from our income, and that is the current foreign exchange rate (FX).

With the Canadian dollar currently gaining strength vs the US dollar, my US dividends have lost a little value over the past year. In March, I reported about $8,000 in dividend income from my RRSP, but in this current update, the account is paying out $7800 after the FX adjustment.

As you can see in detail below, we have increased our dividend income to $62,530 which is a small increase quarter over quarter.

Here are the numbers.

Q2 2021 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,830 | 3.68% |

| TFSA 1 | $4,200 | 4.14% |

| TFSA 2 | $3,900 | 3.97% |

| Non-Registered | $4,100 | 4.24% |

| Corporate Portfolio | $31,200 | 3.24% |

| RRSP 1 | $7,800 | 2.20% |

| RRSP 2 | $3,500 | 2.07% |

- Total Yield: 3.13%

- Total Dividends: $62,530/year

Final Thoughts

While we did lose some dividend income due to a strong CAD vs USD this quarter, deploying some cash along with dividend raises has resulted in a small bump in dividend income. As mentioned earlier, instead of purely accumulating and building my portfolio, I’ve made the shift to spending some of those dividends. While I believe in investing for the total return of your portfolio (not just dividends), there’s a psychological comfort in getting paid regardless of how the market is performing.

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. Depending on taxation in your area, in ON, $60k in dividend income is about equivalent to an $80k salary, which is about $40/hr. Not a bad way to psychologically frame passive income.

To put dividend income in further context, I recently wrote a post about withdrawing from your RRSP or TFSA where, with no other income in retirement, you can make up to $50k in dividend income and pay very little to no income tax (depending on the province).

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all-in-one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cashflow and stick with a long-term plan. Your future wealthier self will thank you for it.

Hello.

I’m thinking of selling some of my holdings due to the delta variant coming soon.

Are you planning to just staying the course or would you be doing any selling?

Could you share where in the top 10 your ETFs would rank?

Hi Jason! If you a long time frame before you plan on withdrawing from your assets, I would just stay invested – at least that’s what I plan on doing. I didn’t sell during the financial crisis, nor the latest COVID crisis. We will see large dips in the market at least every decade or so and the best course of action from my experience is to do nothing at all. Sure, my number 1 position (by a large margin) in my overall portfolio is: XAW which is an ex-Canada (outside Canada) global ETF.

Congratulations. I have watched you on your journey and really admired what you have achieved.

We have also achieved our number of target for financial independence end of last year. I am shifting to more focus on growth instead of dividends now, but will have my Canadian dividend stocks as the core to cover our basic expenses when the time comes. Don’t want to invest in index right now though as I feel the market is too high overall. Trying to pick up good quality companies which are not over expensive.

Thanks May and congratulations on your financial success!

Nice, your combined financial asset portfolio is about to breach (or maybe it has already) the $2MM mark. About the same size as what we have. Nice milestone to hit.

Continued success !

Thanks Martin – you as well!