Passiv Review 2026 – Portfolio Management Tool

If you’re a Canadian DIY investor who prefers index ETFs – but prefers living life to dealing with rebalancing math and spreadsheets – then you might want to check out a tool called Passiv. The name is a play on the concept of passive investing (aka “index investing”).

Passiv is most effective when used like an overlay on your Canadian online brokerage account.

I’ve been investing passively for nearly two decades now. I’ve run the spreadsheets. I’ve built the formulas. I’ve done the mental gymnastics to figure out what to buy with every new dollar. It works – but it takes time. And while it might be manageable for the long term if you’re the Excel-loving type, eventually the novelty wears off, and the friction starts adding up. Friction can equal a lack of rebalancing, and eventually, a portfolio that doesn’t really reflect your target asset allocation and overall risk profile.

Passiv is designed for folks who are long-term investors and are building wealth with consistent contributions and minimal drama. If you’re investing for retirement and using platforms such as Questrade or Wealthsimple Trade, then Passiv might save you a lot of time and math energy.

What is Passiv?

Passiv is a portfolio management tool created by a team of Canadian fintech minds with one simple goal: make DIY investing easier. The company was founded by Brendan Lee Young and Brendan Wood when they found themselves looking for a solution that “freed them from monotonous tasks” associated with rebalancing a DIY portfolio.

Passiv remains privately held, with its operations based out of New Brunswick. Over the last few years, Passiv has quietly grown from a niche tool for spreadsheet haters into one of the most useful apps for hands-off investors in Canada.

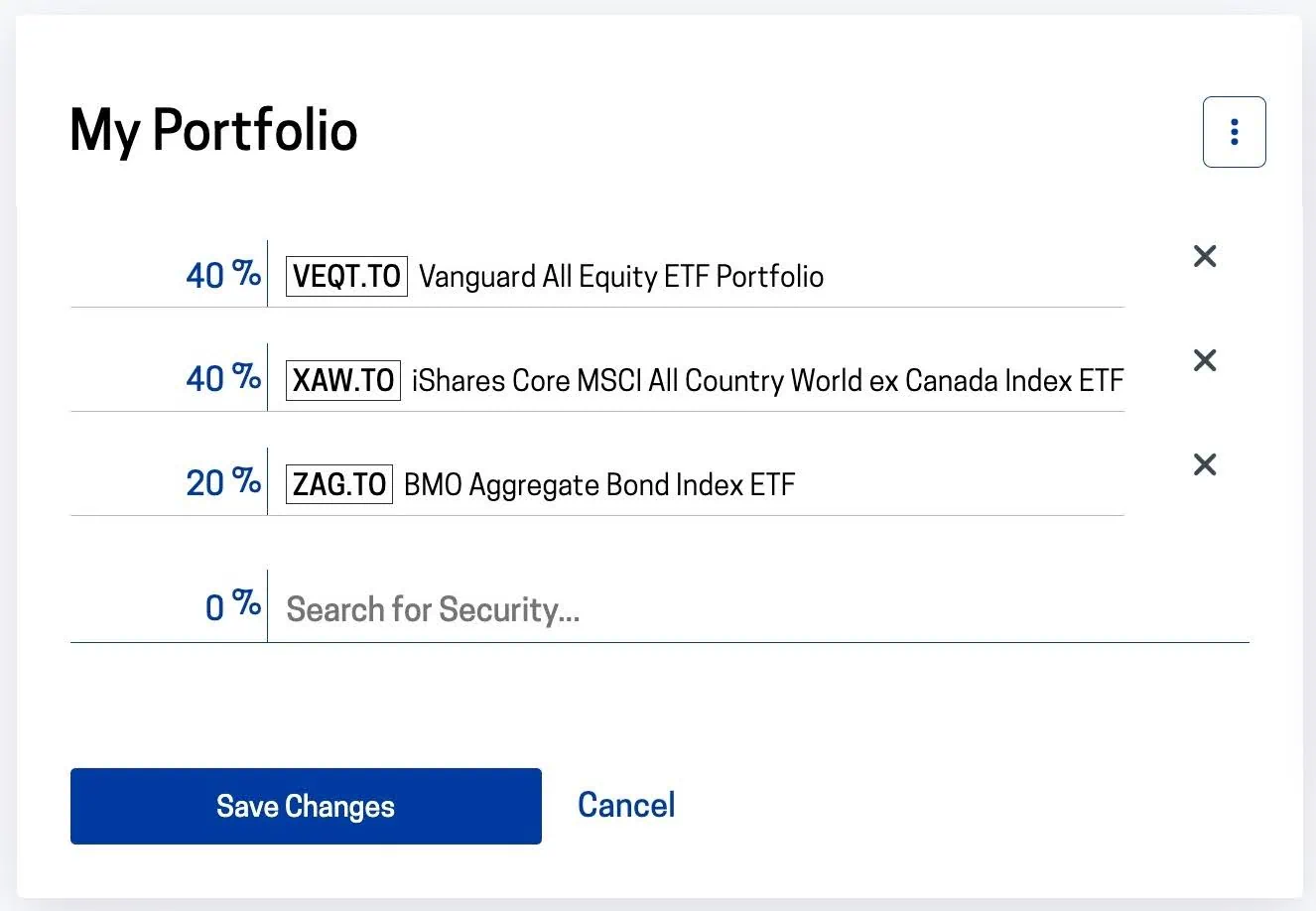

Think of it like a personal portfolio assistant that integrates directly with your brokerage account. You tell Passiv what your ideal portfolio looks like – say, 40% VEQT, 40% XAW, and 20% ZAG – and then every time you have cash in your account, it tells you exactly what to buy to stay on target. No more guessing. No more drift. No more rebalancing stress.

Just set up your portfolio once, and Passiv will take care of the rest – showing you exactly what to buy to stay on track with your target allocation.

To be clear – Passive is not a Canadian robo advisor, and it’s not an online brokerage. The Passiv tool doesn’t hold your money, make investing decisions for you, or change your strategy. You’re still fully in control, but now you’ve got a customized calculator to help with the heavy lifting.

If you’re already a passive investing convert, I’d recommend comparing Passiv’s rebalancing solutions (and the lowest-possible MERs for underlying ETFs) to the Canadian all-in-one ETFs. I think the comparison gets really interesting when you have enough funds to invest outside of your TFSA and RRSP – thus making tax considerations more prevalent.

Who is Passiv For?

If you’re the type that really wants to dig into Canadian dividend stocks and pick individual winners, then Passiv probably isn’t for you. Passiv is built for – wait for it – passive investors who believe in index investing and low fees.

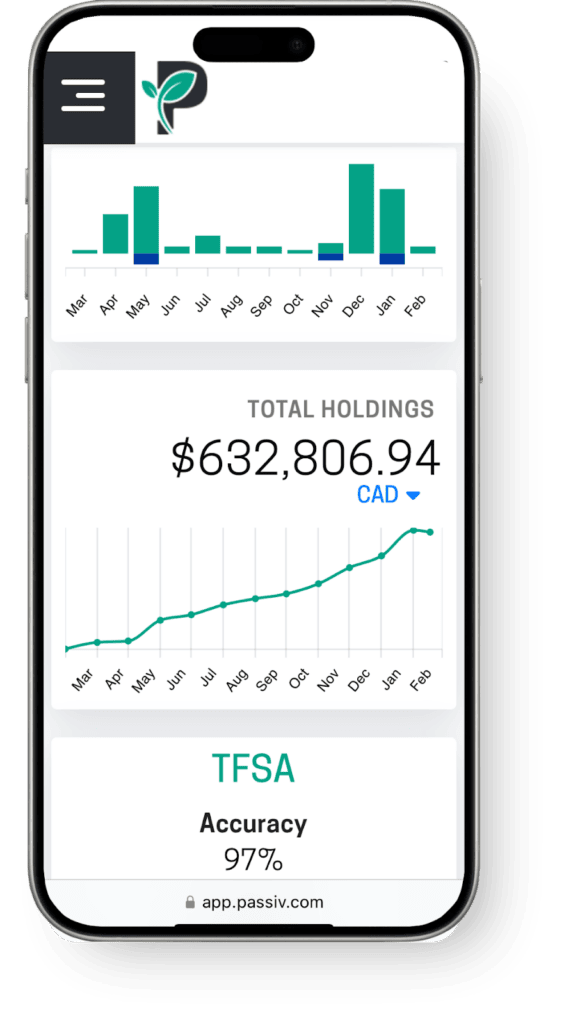

I think there is particular value to Canadian households that are juggling multiple accounts. You can see a complete, at-a-glance overview of all your investment accounts in one clean, easy-to-navigate dashboard.

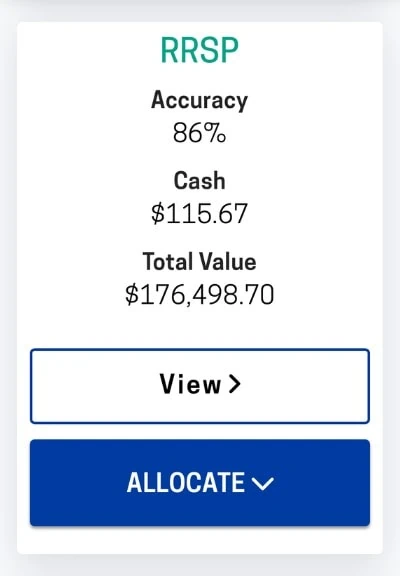

You can link multiple accounts across supported brokerages and set one target portfolio that spans all of them. So rather than rebalancing each account independently (which can get messy), you’re able to efficiently look at your household’s full investment picture and quickly rebalance.

This is a huge benefit for people juggling multiple registered accounts or managing investments across both spouses. You can decide to keep your US ETFs in your RRSP, while making sure that your fixed income investments get put in your TFSA. Once that target allocation is set, Passiv can help make sure that your overall portfolio makes sense within the tax-efficient rules that you’ve set up for it. This can be a substantial advantage over all-in-one ETFs if your portfolio is large enough.

My friend Kornel Szrejber is the host of the Build Wealth Canada Podcast, and co-hosted the Canadian Financial Summit with me for several years. He was the first mega-fan of Passive that I encountered and he continues to state that it’s his preferred portfolio management tool. You can listen to this podcast that Kornel did with the Passiv crew to find out the details on why he loves the benefits that Passiv provides.

How Does Passiv Work?

Passive works like bumper rails at a kids’ bowling alley. If your portfolio ball starts to wander too far in one direction, Passive will redirect it back to where it should score maximum points.

Here’s the short version of what you can expect:

1) Connect to Your Brokerage Account

Passiv connects directly to your brokerage account via secure API (not your password). It currently supports several Canadian brokerages, including:

- Questrade (their flagship integration, with full one-click trading capabilities via API)

- Wealthsimple Trade (view-only functionality)

- And many others (especially via their Wealthica add-on).

If you use Questrade, Passiv can not only view your portfolio, but execute trades on your behalf with one click if you’re on the Elite plan.

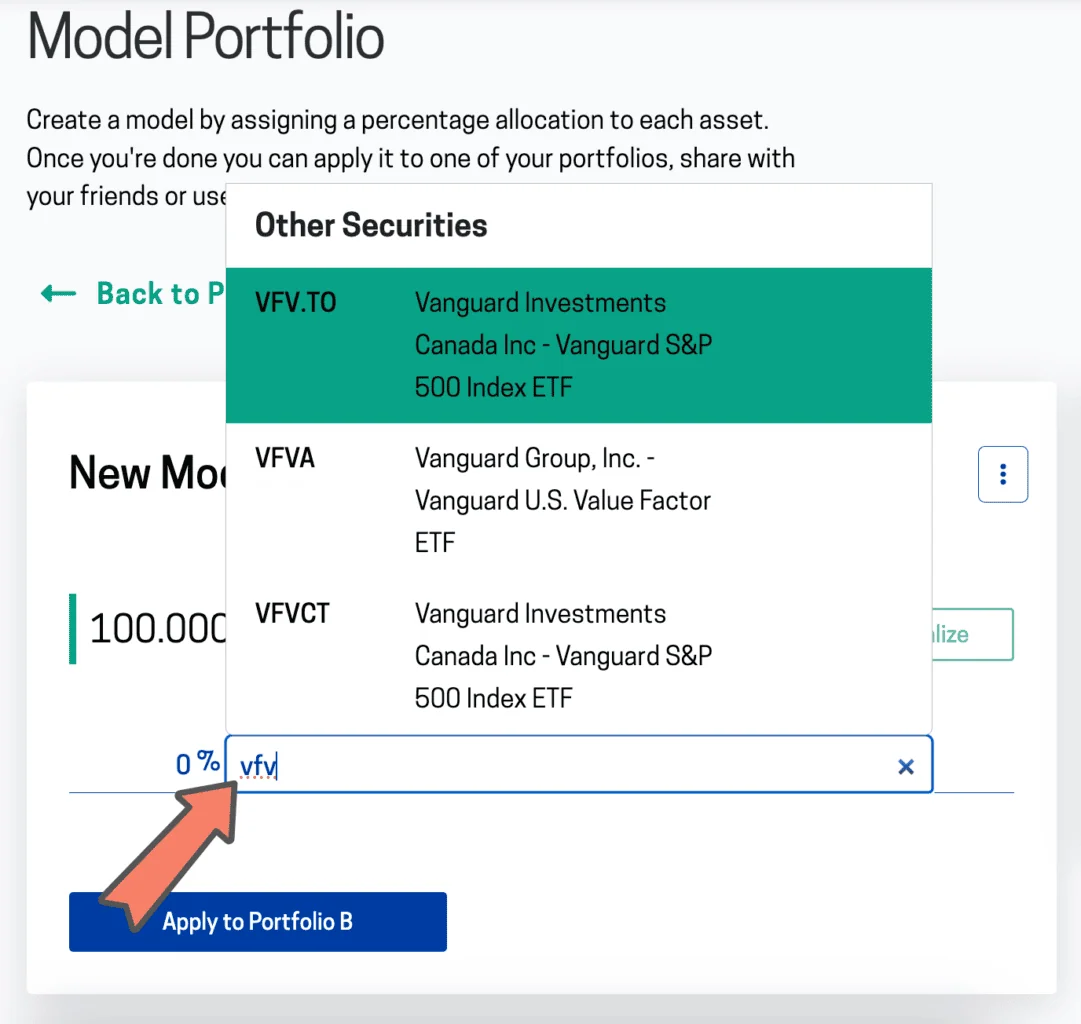

2) Set a Target Portfolio

Once connected, you set up a “model portfolio.” This is simply a list of the ETFs, index funds, or individual stocks you want to hold, along with your ideal asset allocation. Using our example from before: 40% VEQT, 40% XAW, and 20% ZAG.

This model can span across multiple accounts (TFSA, RRSP, non-registered) or even across different brokerages if you’re using Wealthica. It’s worth putting some serious thought into this initial asset allocation up front, because once you set it, a lot can be automated.

3) Get Rebalancing Trade Suggestions

When you deposit new money into your brokerage account or receive dividends, Passiv automatically calculates what trades need to happen to bring your account back in line with your target allocation. Instead of trying to remember which ETF is underweight, Passiv tells you exactly how many units of each asset to buy.

4) Handle Rebalancing with Ease

Beyond new contributions, Passiv is a great tool for regular rebalancing. It lets you know when your portfolio drifts away from your target and shows you exactly what to buy or sell to bring it back into alignment.

You can even set thresholds, like “alert me if my Canadian ETF (VCN) is more than 5% from its target allocation.”

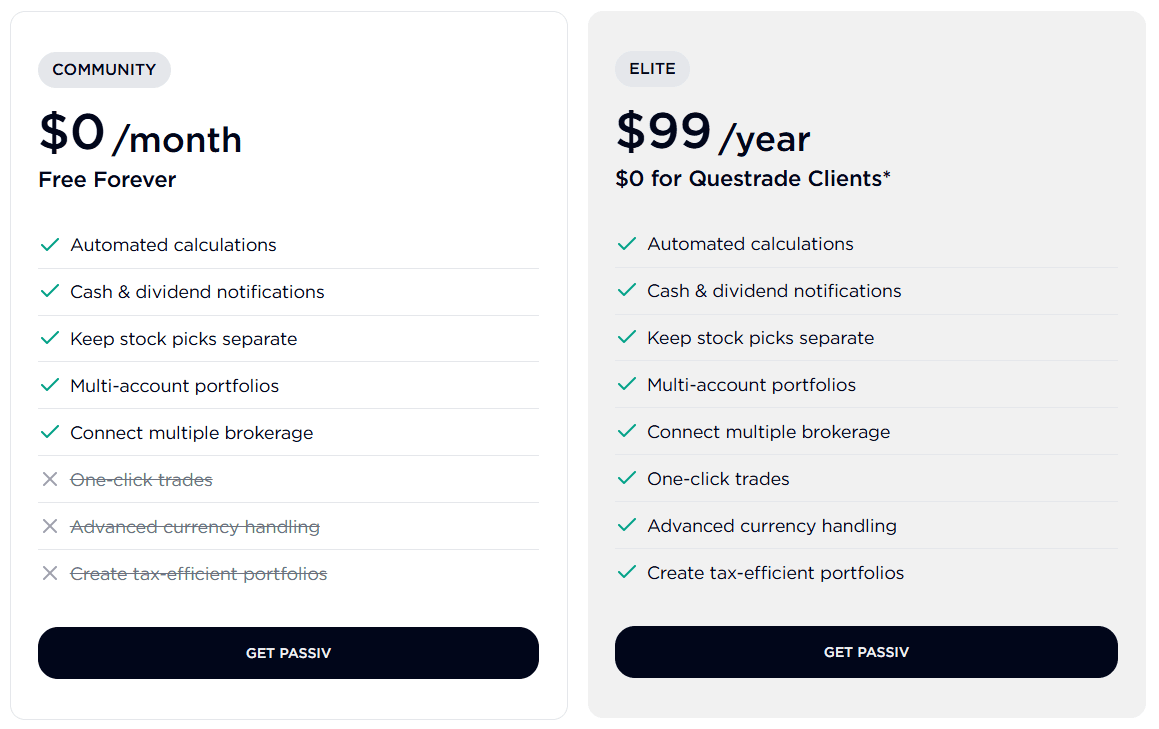

Forever Free vs Elite

Passive’s two platform options are Forever Free and Elite. Both are great tools for DIY investors, but depending on how hands-on (or hands-off) you want to be, the differences are worth understanding.

With the Forever Free version of the platform literally costing nothing to try – I’d definitely recommend starting there, and then eventually you can see if you need the Elite version of the tool.

Here’s a breakdown of what each tier offers:

With the free version of Passiv, investors can:

- Get automated calculations of what to buy based on their ideal portfolio, making it easier to stay on track with their investment strategy

- Manually place trades based on Passiv’s trade calculations

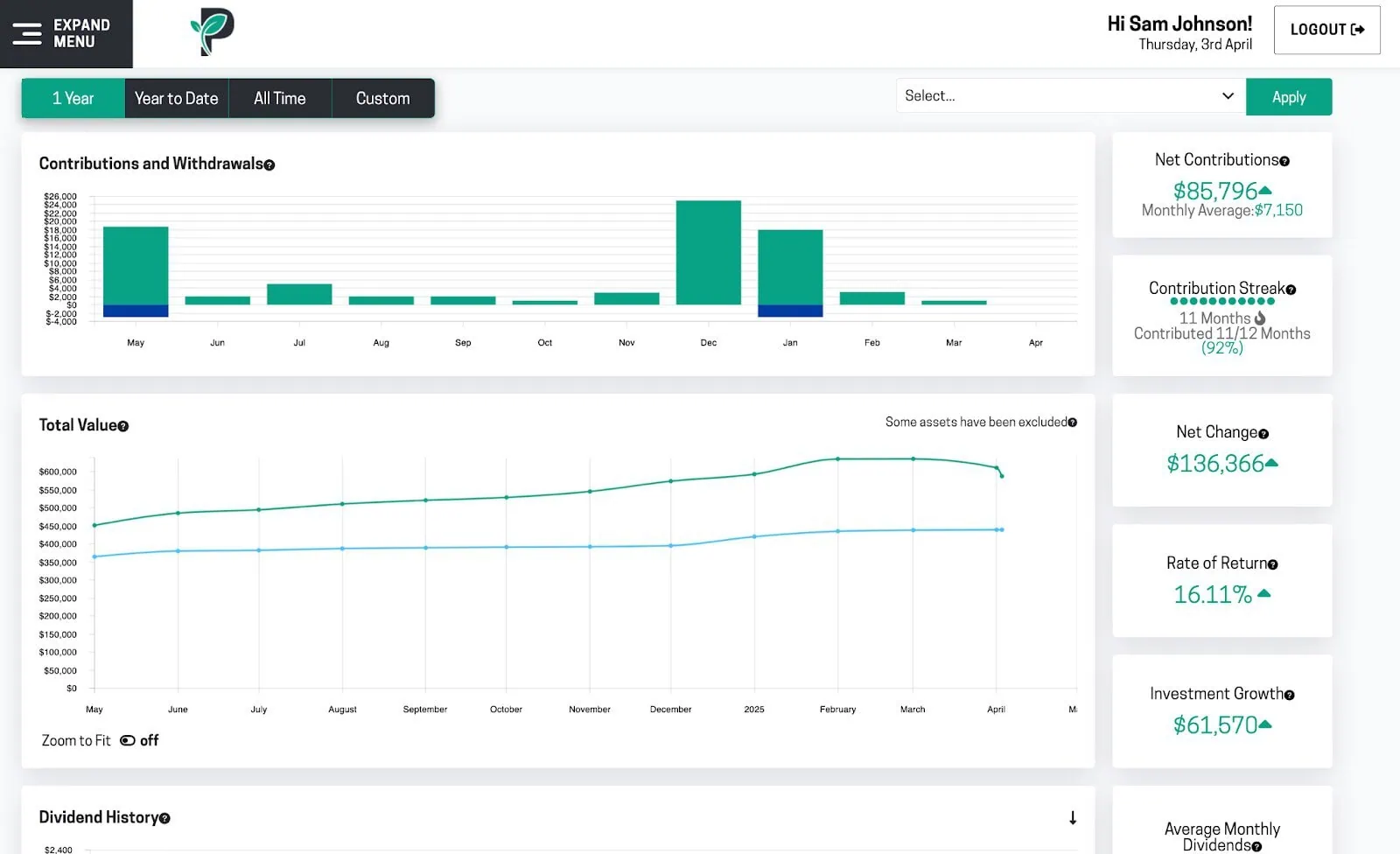

- Track their portfolio in one dashboard without switching between accounts

- Track dividends, including monthly averages and fund breakdowns

- Easily rebalance with alerts and trade recommendations to balance your account

- Receive cash notifications when dividends or deposits are available to invest

- Get clear reports with key investing metrics like rate of return, portfolio growth, and a breakdown of total contributions vs. overall portfolio value.

- See a complete overview of all investment accounts in the Passiv dashboard, including multiple brokers and their partner’s accounts, for seamless household portfolio management

Creating and setting up your Forever Free account takes just minutes. Click here to get started.

Passive Isn’t Perfect: Drawbacks

While Passiv is a fantastic tool for many DIY investors, it’s not for everyone. It’s not a “silver bullet” and it does have a few limitations. Here’s the general criticisms that I have – or that I found from users online.

1) Brokerage Support Is Limited

The biggest drawback for most Canadians is that Passiv only has full operability with a few online brokerages. If you’re a fan of Questrade or Wealthsimple Trade then you’re in luck! If not, you won’t be able to fully benefit from all that Passiv brings to the table.

2) Passiv is aimed primarily at index ETF investors

If you hold individual bonds, options, or GICs in your portfolio, you won’t be able to include them in your model allocation. It’s not a dealbreaker for most, but it’s something to be aware of.

3) Only Elite Users Can Automate Trades

One of the most powerful features of Passiv – the ability to make one-click trades – is exclusive to Elite users. If you’re using the free version, you’ll still need to place trades manually, even if Passiv tells you exactly what to buy and sell.

4) Still Requires Some Financial KnowledgePassiv isn’t a robo advisor. It won’t pick your ETFs for you, and it won’t tell you what your asset allocation should be. If you’re new to investing, you’ll still need to do some upfront homework – or work with a Canadian financial planner – to decide what kind of portfolio you want to build. Passiv is for automating execution and tracking not advice.

Why Use Passiv?

If you’re serious about cutting fees to the absolute bone as you embrace passive investing, then Passiv can be a valuable tool in your DIY toolbox.

At its core, Passiv is about rebalancing your asset allocation quickly and efficiently. It saves time, eliminates manual busywork, and makes sure your portfolio stays aligned with your goals – all without relying on spreadsheets, guesswork, or outdated sticky notes. Using individual ETFs instead of an all-in-one ETF allows you a higher degree of portfolio customization, and slightly lower MER costs. Passive makes juggling a few ETFs relatively quick and painless.

And it’s not just about convenience. There’s solid behavioural data behind this: Investors who use automation and portfolio tools like Passiv tend to invest more consistently, stay engaged with their portfolios, and ultimately build more wealth over time. The combo of insights, tracking, and simple rebalancing nudges you toward making better, more informed decisions.

And Passiv Elite gives you one-click trade execution – which makes the entire rebalancing process as easy as ordering from Amazon.

To be clear, Passiv isn’t trying to be your financial advisor. It won’t recommend a new asset allocation or tell you which ETF is the hottest this week. Instead, it focuses on helping you stay the course.

Bottom line: If you’re building wealth the boring, proven, tax-efficient way – Passiv just makes it smoother, faster, and less annoying. And that’s a win.

Click here to get the Forever Free version of Passiv and make investing easier!