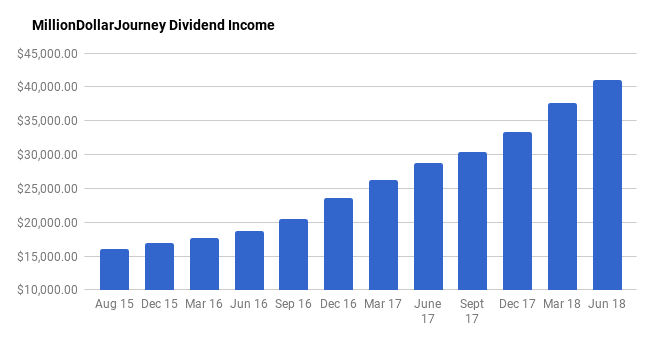

Financial Freedom Update (Q2) – June 2018 ($41,050 in Dividend Income)

Welcome to the Million Dollar Journey June 2018 Financial Freedom Update – the halfway mark of the year! For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (yikes, that’s only a little over two years away!)

If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter (where I have been more active lately) and/or you can sign up for the monthly Million Dollar Journey Newsletter.

In my first few Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepeneurial pursuits.

Previous Update

In the last update, we showed good progress in reaching $37,550 in annual dividend income. While it represents 63% of our financial goal, it also means that we hit another major milestone of reaching over $1M invested across our portfolios.

Here are the numbers in my previous financial freedom update.

March 2018 (Q1) Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $6,850 | 3.86% |

| TFSA 1 | $3,000 | 4.93% |

| TFSA 2 | $3,200 | 5.15% |

| Non-Registered | $2,300 | 5.15% |

| Corporate Portfolio | $14,000 | 3.73% |

| RRSP 1 | $6,400 | 2.94% |

| RRSP 2 | $1,800 | 2.43% |

- Total Invested: $1,011,819

- Total Yield: 3.71%

- Total Dividends: $37,550/year (+12.44%)

Current Update

In the last update, I wrote about how I managed to land a position back with the technology industry (I was with the government for many years prior). It has been a fun change thus far with a lot of new challenges. I’m still in heavy learning mode, which might be my favorite phase when it comes to anything new.

Up until this point, I’ve always been a team member, rather than the team leader. Lately, I’ve been thinking about what it would be like to be part of the management team. The pay may be better, but at this point in my life, a higher salary is nice but not my first priority. Perhaps it’s my desire to continue growing with new experiences and the desire of having an impact. For those of you in management roles, what are your thoughts?

Career aside, what about my financial freedom aspirations? Let’s talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, 2018 has already proven to be a successful year for dividend growth seekers.

Thus far in 2018, my portfolio has received raises from:

- Riocan (REI.UN); Telus (T); Canadian Utilities (CU); Canadian National Railway (CNR); Kimberly Clark (US: KMB); Metro (MRU); Chevron (US: CVX); Exco Technologies (XTC); Manulife (MFC); Suncor (SU); Bell Canada (BCE); Great-West Life (GWO); Brookfield Infrastructure Partners (BIP.UN); Coca Cola (US: KO); AbbVie Inc (ABBV); TransCanada Corp (TRP); Walmart (US: WMT); Magna (MG); CIBC (CM); Scotiabank (BNS); Bank of Montreal (BMO); TD Bank (TD); Husky Energy (HSE); Canadian Western Bank (CWB); AT&T (US:T); Visa (US: V); Abbot Labs (US: ABT); Wells Fargo (US: WFC); Power Financial (PWF); Transcontinental (TCL.A); Procter & Gamble (PG); Unilever (UL); Exxon (XOM); Johnson and Johnson (JNJ); Loblaws (L); Canadian Pacific Railway (CP); Sunlife (SLF); Apple (AAPL); Caterpillar (CAT).

In addition to the dividend raises, I’ve continued to deploy cash into dividend stocks. In late 2017, I created a non-registered dividend portfolio for my spouse (opened another account with MDJ reader favorite Questrade).

There was some cash savings in her account that needed to be deployed, and I was able to get it invested in short order. We recently deposited more money into the Questrade account to continue the dividend train.

As one of the goals of this particular account is to generate a high and reliable yield (spouse is in lower tax bracket), I am experimenting with the Dogs of the TSX strategy.

What also has boosted the dividend income over the past quarter is the volatility in the market. With higher interest rates (and more to come), dividend stocks have been hammered. I get excited and go shopping when the market gets volatile, especially when strong dividend stocks are sold off with market panic.

As you can see in detail below, over the last quarter we have increased our dividend income from $37.5k to $41k which represents a 9.32% increase quarter over quarter and 68% of my goal. Crossing the $40k dividend income is a big mental milestone which will help me continue chugging forward.

In our overall portfolio, here are the current top 10 largest holdings (besides cash):

- Bell Canada (BCE);

- Fortis (FTS);

- TransCanada Corp (TRP);

- Bank of Nova Scotia (BNS);

- Enbridge (ENB);

- Emera (EMA);

- Canadian Utilities (CU);

- Nutrien (NTR – merger between AGU and POT)

- Telus (T);

- iShares Core S&P U.S. Total Market Index ETF (XUU).

June 2018 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $6,950 | 3.70% |

| TFSA 1 | $3,200 | 4.97% |

| TFSA 2 | $3,300 | 5.19% |

| Non-Registered | $2,900 | 4.67% |

| Corporate Portfolio | $16,000 | 3.56% |

| RRSP 1 | $6,500 | 2.81% |

| RRSP 2 | $2,200 | 2.36% |

- Total Invested: $1,151,961

- Total Yield: 3.56%

- Total Dividends: $41,050/year (+9.32%)

Through a combination of deploying cash, continuing to build a new non-registered portfolio with savings, and collecting those juicy dividend increases, this quarter has been productive with a 9.32% bump in dividend income. I really do enjoy watching those dividends flow into the accounts.

Not only do I enjoy watching the dividends flow into the account, I’m a big believer in compounding returns. In other words, the dividend cash is deployed to income-producing stocks which then further increases the income of the portfolio, which is then used to buy even more stock. See how compounding works? It’s only a matter of time before the snowball grows a mind of its own.

As previously mentioned, I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns. My plan is to continue this pace and hit at least $43k in dividend income for the next update and $45k by the end of 2018. We shall see!

If you are also interested in the dividend growth strategy, here is a recent post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios. If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio.

Why do you include RRSP dividend income in your annual dividend income goal of $60,000? I understand that eventually you will have that money (transferred to a non-registered account) but I’m assuming that you won’t take it all out the year you retire and therefore won’t really be able to use it, at least for a few years.

Regards, Sarah

Hi Sarah, the dividends generated from the RRSP are fairly small relative to dividends generated ($6500 per year right now). If we do retire early, I wouldn’t have any issue with withdrawing RRSP generated dividends. Are you assuming that there are restrictions in RRSP withdrawals?

No, I know that there aren’t any legal restrictions on RRSP withdrawal amounts.

I’m all about paying the least tax as legally possible but still having enough to live. I’m guesstimating that you have around $175,000 in your RRSP and, I believed that you were going to take it out all at once. Which is fine, my question just assumed that you would take it over a period of time (years).

But, that’s why they call it “personal” finance because it’s so personal.

Thanks for sharing your thoughts.

Hi, I’ve been following your journey for a few years. I check your progress like once a year or so. I kind of missed that you’ve already reached your goal and I was reading this page about passive income. I was holly eff, 40K passive income.. amazing, until I realized that was 40K a year… omg, that’s bad :) What’s the point to accumulate 1M+ and barely get by and to sacrifice vacations? I think a better strategy is to invest in yourself. For example, if in 2006 you managed somehow to start medical degree you’d probably be making 200K+ in salary today. In my case 15 years ago I was homeless, but I liked computers and this became my profession now. I make 300K/yr base salary as an employee for 40hrs a week and I’m also building some kind of networth to be able to live life I want without needing to work. My goal is to have 10-20M in 3-4 years before I turn 40… sounds crazy, yes, but I’ll probably make it :) the thing is that I love my job and even if I reach my goal I’ll probably still keep my job, but I’ll arrange so that I could work from any place on the planet (I’ve done that for a year already).

So.. in the long run investment in yourself is probably a better strategy. In a few years I’ll pass by and update about my progress :)

Hey Pablo! Thanks for stopping by. You make some good points, I agree that investing in yourself is likely a good bet for long-term wealth. That is providing that you maintain a high savings rate and invest the savings for the long term. I also agree that it’s ideal to find a job that you love so that it doesn’t seem like “work”. Even if you have all the money in the world, after some leisure time, you’ll want to do something useful eventually.

So you are 35 now with a goal of $10M to $20M in 3-4 years, have you started a company? Where are you now in terms of net worth? With a $300k base salary, how much are you saving a year?

I’ve had a few companies (consulting), didn’t really do amazing financially (I made more than 100K/yr). I have perhaps a few hundred $K net worth, but I have stock grant (a bit less than 1/1000th) in private company that I joined a couple of years ago. My guess: it should do IPO in 3 years with $25-40B valuation. I base my guess on some public companies, on their user/client base, growth, and income. Won’t discuss it more than that. If it goes public pretty sure ticker will R%%, I’ll update in couple of years.

This chunk I expect will be my home run, but I’m also working on some personal projects that might get me there even faster.

I rent a nice place ($3K) and have a nice car, so with 300K base salary I put aside roughly 100K a year. I used to have my own fancy place, but sold it: prefer to rent instead and keep money in stocks (usual FANG stuff, and newer IPOs with $1B+ cap, lots of Chinese tech stocks).

Before joining the company where I work now I used to make even more as a consultant, but the potential at the new place seemed too good to pass on.

I agree with May, that most people don’t really have a choice and don’t have high income. I wanted to buy some rental and do smithonian stuff as I read here, but luckily I didn’t (need to) get myself involved in that stuff. I used norbert gambit a lot, and I also read about it here ;)

If I may interject. Pablo, you raise good points but let’s be sure this an apples to apples comparison. If FT quit his job, did a medical degree, and finished as a GP he might make ~ 225K. Depending on how you slice this, it might take him 6 years minimum and 10 years maximum to get there. Add another 3+ years for a specialty. Med school is a big sacrifice and would compromise time with his family and might even jeopardize his marriage. I’ll be the first to commend your strategy and success but it’s not fair to say just go do this and you’ll be probably be making X. Could he not have gone back to school for Computer Science or Software Engineering for 4-6 years and achieve the same outcome as you?

I completely agree on investing in yourself. But not everybody, no matter how hard one tried, can have a career with 300K base salary. In Canada, if one makes 200K, already in top 1%. If we also agree you work on what you love, then some careers have limitation on how much you can make. For example, an elementary teacher will hardly make more than $100K.

For normal people who are not in top 1% rank of income, what FT has done here is very impressive already.

I agree, but every person might make a radical decision and at 30 decide to do medical degree (or some other profession that makes good income). It’s hard, but doable. That’s what immigrants do: they come with no money with kids, they have to study English (or French) and then they do some kind of professional training or even university. With no money, with kids they can do it, so everybody else does. If you are stuck with crappy salary only a radical decision might change things for better.

In my case I quit working in a place where I’ve spent almost 10 years, where I was one of the top tech people (if not the best one, and I also was making there around 100K). I only regret that I didn’t do the move long time ago.

Looking good FT!

Love the portfolio construction posts.

Best

Q

Q! Good to hear from you, thanks for stopping by. Any interest in an update post?

I often drop by and lurk. :-)

Would love to do an update if you are interested.

It might be timely as I actually have an appointment today with my lawyer to sign the papers selling my last investment property (officially closes on Friday).

I could offer some comments on the thought process to get out of the landlord business despite it having been the most lucrative form of leverage investing I have done over the years.

And give an update on my portfolio.

Cheers

Q

Hey QCash, we all look forward to it! I will send you an email.

Hi FT,

For your dividends, do you DRIP them or do you build cash and then deploy?

-Andrew

Hi Andrew, I typically take dividends as cash and reploy to names that I find in value territory. I also find it a bit easier to manage than constantly tracking adjusted cost base within a non-registered account.

Wow, you are getting there in lightning speed.

Will you change your life style after you are achieving your goal? Like spending more and saving less?

Hi May! The mindset of looking for a deal whenever I make any significant purchase is a habit of mine (that I enjoy) that will be hard to change! We live a pretty balanced life right now, so I’m not sure how we would spend more. I guess we could take more vacation, but with the kids getting older, it’s getting more difficult to schedule extended vacations. Maybe when they get to University and have to fend for themselves a bit we’ll look into more vacations.

What about yourself? What is your plan when you reach FI?

I am not quite there yet, but I feel I am already relaxing a little bit when it comes to spending. Just as you, I feel it will be difficult to change the daily consuming habit. But I am spending more on vacations now already. For example, I am willing now to pay more during peak time like Christmas to take kids to vacations instead of middle of school year. I feel I can afford to arrange vacations more by convenience, less by deals.

Once we get there, hopefully at most in five years, I think if we still have a job, we will continue to work, but only if the job is not too stressful.

Also, in the next few years, if one of us is out of job, then might just retire, instead of looking for a new one.

Sounds like you have a plan. Also note though that if you start taking vacations during the school breaks, vacation spots are generally busier and more costly! But we are along the same lines that we have been spending more on vacations over the past few years.

Hey FT,

Thank you for sharing. You are one of my great inspirations to start my own journey to reach my financial freedom. I am following your foot-prints :)

You will easily hit $45K by end of 2018. I do also believer in compounding power. So, hitting $60K by 2020 is not too far for you with combination of dividend growth, dividend re-investment and new capital.

Currently, my estimated yearly dividend income is around $9300 and my target is to receive $25K by end of 2024.

Best Regards,

Thanks for the kind feedback FJ! Congrats on building your own path to FI. What is your plan after you reach your “number”?

Thank you, FT !

Once I reach the number, I will slowly be building a ‘safety margin’ and start enjoying our life without worry about money or work. My financial independence doesn’t mean retirement, therefore, I will keep doing something in my interested area, rather than doing something for money.

Best Regards,

@FT – I really enjoy this site and the forum discussions, it has been an invaluable resource.

I am interested in starting the Smith Manoeuvre within the next few months with a focus on investing in CDN dividend growth stocks. The biggest hurdle is convincing my wife that this is a good idea.

I have a few questions:

1. Does anyone use the TD Home Equity Flexline product – from the TD website it appears that it is readvanceable and I do all my banking/investing with TD; however, our broker says it isn’t what I need for a SM and recommended the Scotiabank STEP.

2. Is it possible to claim dividend income under your spouse (she makes significantly less), ideally this would increase the tax refund to be applied to the Mortgage.

3. Part of my struggle is coming to grips with maintaining a HELOC balance indefinitely, just wondering how others plan to use the HELOC i.e., keep it forever to offset future income streams in retirement, pay it off with future dividends, or a lump sum sale of securities. From what I’ve read incl. from Fraser’s online comments, this is part of the strategy of the rich and you shouldn’t worry about maintaining this “good” debt.

Thanks again!

Kerrzy

Hi Kerrzy,

1. As long as the TD product readvances with every mortgage payment, then it should be fine for the SM. Did your broker say why it isn’t a good product?

2. About which spouse to claim, I would consult an accountant first. When we started the SM, we went 50/50 because our incomes were the same. I would probably set it up differently if we were to start again today, however, 50/50 would be a safe bet.

3. Kerrzy, personally I would let the portfolio grow as long as possible. After a few decades, the portfolio should be significantly larger than the HELOC balance. Perhaps in preparation for retirement, start paying off the debt with dividends from the portfolio. Or another idea is to keep the debt at a comfortable level. For me, I’m not that comfortable with a maxed out HELOC. I’m currently at about 63% of the max which is approaching the point where I may considering slowly paying down the debt. Up to this point, I’ve been capitalizing the interest and reinvesting the dividends.

This article may help answer any other questions:

https://milliondollarjourney.com/use-smith-manoeuvre-tax-deductible-dividend-investing.htm

@FT – thanks for your responses!

1. Our broker did not say exactly why TD does not work. I’m not sure if she understands the SM, no one in my circle has even heard of it and I am a CPA.

2. Thanks for the article as per Ed, you have to claim interest deductible and dividend income in only one spouses name.

3. My preference would be the same to keep the LOC at a comfortable level, I want to pay our MTG off within 8 years and use some of the LOC for a down payment on a future cottage. I would like to rent it out to keep it as an Investment property so I can continue using the SM, has anyone done this?

Thanks!

Yes, there are a number of people that leverage their homes to purchase investment properties. Technically, you could leverage the investment properties to further add to your appreciating assets.

@FT – I love your site and transparency which coupled with all the comments has only helped me move from a mutual fund investor to almost entirely dividend growth focused.

I have spent hours reading about the Smith Manoeuvre (SM), my question for you is can you claim CDN Dividend income from the SM on your wife’s tax return.

In my case, my wife makes 1/3 of my salary, reducing the “tax bleed” would increase our tax refund, which would only accelerate the Mortage paydown.

Thanks!

Do you net off the interest you pay on the Smith manoeuvre when calculating you dividend/passive income? With interest rates on the rise, I imagine that interest is not really negligible.

Hi KF, one thing to consider is that the interest is tax deductible. So prime rate (my heloc rate) would need to rise to around 6% when I hit break even point. That’s for dividends only and doesn’t count capital appreciation. If I average 7% overall return, then rates would need to be around 10% to hit the break-even point. If interest rates get out of control, I’ll probably start paying down the loan.

Hello FT , i was just curious if you could share the total amounts per month that you are putting into your investment accounts each month or is it all just dividends?

Hi Jason , I don’t have a set amount that I invest every month. Essentially if I see an attractive valuation , I buy with cash on hand . That could be from savings or dividends deposited into the account.