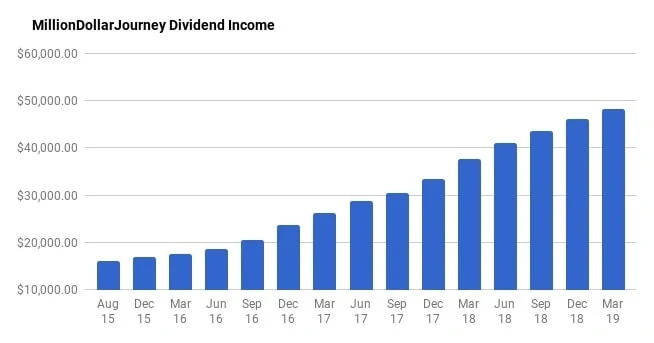

Financial Freedom Update (Q1) – March 2019 ($48,200 in Dividend Income)!

Welcome to the Million Dollar Journey March 2019 (Q1) Financial Freedom Update – the first update of 2019! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (yikes, that’s less than two years away!)

Here is a little more detail on how we came about the $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepeneurial pursuits.

Previous Update

In the 2018 year-end update, despite the stock market volatility in the last quarter of the year, we still showed solid progress in exceeding our goal of $45k/year by reaching $46k in annual dividend income. In fact, we took advantage of the market decline to add to solid dividend paying positions.

It’s motivating to see the passive income number climb closer to our “cross-over” point. That is the point in time when our passive income meets our expenses. As our annual expenses are in the $52k-$54k, we are hopefully going to hit the coveted cross-over point sometime in late 2019.

Here are the numbers in my previous financial freedom update.

December (Q4) 2018 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,200 | 4.35% |

| TFSA 1 | $3,350 | 5.03% |

| TFSA 2 | $3,500 | 5.83% |

| Non-Registered | $3,150 | 4.91% |

| Corporate Portfolio | $19,500 | 4.05% |

| RRSP 1 | $6,800 | 3.07% |

| RRSP 2 | $2,600 | 2.67% |

- Total Invested: $1,156,341

- Total Yield: 3.99%

- Total Dividends: $46,100/year (+6.10%)

Current Update

The bull market came roaring back in the first quarter of 2019, especially dividend stocks. Bull markets are great in that portfolio values jump (along with net worth).

However, while young investors are in the accumulation phase, bull markets aren’t necessarily a great thing. It means that quality dividend companies are more expensive, which may impact longer-term returns.

Personally, I like to buy quality dividend companies when their valuations are attractive. In other words, when they are being sold off (ie. dip). Although I didn’t invest a lot of capital over the past quarter, I did deploy some into the following positions:

- iShares MSCI All Country World ex-Canada (XAW)

- Canadian Apartment Properties Real Estate Investment Trust (CAR.UN)

- Bank of Montreal (BMO)

- CIBC (CM)

- TD Bank (TD)

As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts.

Already this year, there have been significant cuts in two of my positions, SNC Lavalin (SNC) and Dorel Industries (DII.B). Fortunately, these were smaller positions within my overall portfolio.

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, Q1 2019 has proven to be lucrative for dividend growth investors.

Thus far in 2019, the Canadian portion of my portfolio has received raises from:

- CU.TO (7.5% increase)

- RCI.B (4% increase)

- MRU.TO (11% increase)

- CNR.TO (18% increase)

- XTC.TO (6% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (17% increase)

- GWO.TO (6% increase)

- TRP.TO (8.7% increase)

- RY.TO (4.1% increase)

- MG (11% increase)

- BNS.TO (2.4% increase)

- CAR.UN (3.8% increase)

- TD.TO (10% increase)

- CM.TO (2.9% increase)

- ATD.B (25% increase)

- PWF.TO (5% increase)

As previously mentioned, I didn’t do a lot of buying this quarter due to the rising market. However, the dividend raises really made a difference resulting in over $1,000 in additional dividend income. To put this in context, an extra $1k in dividend income is like buying $25k worth of dividend stocks that pay a 4% dividend.

I must admit that there is great comfort in seeing dividends coming in on a consistent basis and even more gratifying in seeing a company raise their dividends.

Most of the new purchases were made in my corporate account which generates the bulk of the dividend income. For those looking for an update on my wife’s dividend account which follows pseudo dogs of the TSX strategy, there has been very little change.

With this strategy, you typically buy the highest yielding blue chip stocks on the TSX (removing old income trusts) and ride it out for the year. I will admit that I have been a bit lazy this year and have not rotated any positions. However, very little change would be involved.

Despite this, the portfolio (in case you are wondering, with Questrade), generates a consistent dividend and is currently producing $3,300/year.

As you can see in detail below, over the last quarter we have increased our dividend income from $46.1k to $48.2k which represents a 4.56% increase quarter over quarter and within 80.3% of my goal ($60k).

In our overall portfolio, here are the current top 10 largest holdings (besides cash):

- Fortis (FTS);

- Emera (EMA);

- Enbridge (ENB);

- TransCanada Corp (TRP);

- Bell Canada (BCE);

- Canadian Utilities (CU);

- Telus (T);

- Royal Bank (RY);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW); and,

- Bank of Nova Scotia (BNS).

March(Q1) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,500 | 3.96% |

| TFSA 1 | $3,500 | 4.54% |

| TFSA 2 | $3,600 | 5.03% |

| Non-Registered | $3,300 | 4.42% |

| Corporate Portfolio | $20,600 | 3.73% |

| RRSP 1 | $7,000 | 2.75% |

| RRSP 2 | $2,700 | 2.37% |

- Total Invested: $1,332,522

- Total Yield: 3.62%

- Total Dividends: $48,200/year (+4.56%)

As you can see, a strong market rally can really make an impact on a portfolio ($1,156,341 vs $1,332,522). However, as mentioned, I’m not too focused on the market value as I’m more interested in the passive income.

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been fairly productive with a 4.56% bump in dividend income. What’s really encouraging is that out of the $2k bump in dividend income, over $1k came from dividend increases alone. This is a good start to the year with the goal of exceeding our cross-over point in 2019.

Not only do I enjoy watching the dividends flow into the account, I’m also a big believer in compounding returns. In other words, the dividend cash is deployed into more income-producing stocks which then further increases the income of the portfolio, which is then used to buy even more stock. See how compounding works? It’s only a matter of time before the snowball gains momentum and develops a mind of its own.

I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index a portfolio.

There you have it, the first update for 2019. Even though we are only three months in, the portfolio continues to produce dividend increases which are proving to be significant. At this pace, we should be able to reach the coveted “cross-over” point before the end of 2019. Stay tuned!

I just recently started my investing journey and I think this blog is a gem. Besides useful also motivational. I have a couple of question: Are your accounts on this post combined with your wife or just yours? Do you self-direct all of these accounts or do you use a robo-advisor?

I’ve been reading you’re blog for a while. Congrats on your success. I don’t think there is anything wrong with being overweight in Canadian equities, I also have approximately 75% in my portfolio.

Thanks for the stopping by and for the kind feedback!

Was trying to understand the difference between your ” corporate account” and your non-registered. To me TFSA’s and RRSP’s are registered, and the rest are non registered. Also an account marked “SM “. I’ve heard of S&M but never SM, pretty sure they are not related LOL.

LOL, big difference between SM and S&M. :) SM = Smith Manoeuvre which is a non-reg dividend portfolio.

Hi,

I’m on the fence about optimizing for dividends, but I’m envious of the income you’re producing. It reads like we’re a similar profile – I just turned 40 and have a $900k portfolio. Difference is I’m all VGRO in both TFSA and RRSP and I have a mixed ETF portfolio in non-reg. I think my yield is approx 2% so I’m currently under $20k annually in income. Any tips that you think I should consider?

Thanks!

J

Hi Jeremy! Congrats on your financial success thus far! Unless you plan on retiring super early, I would just keep on doing what you are doing. If you plan on retiring in the next couple of years, you need to ask yourself if you are comfortable with selling assets to fund your retirement. Personally, it may just be a psychological thing, but just spending the dividends gives me a sense of financial security. Perhaps it has to do with my current stage in life with two youngish kids, so I’m a little more risk-averse.

Hi FT, a question, maybe a dumb one. Rather than follow dividend stocks, which is effectively stock picking, with all the associated risks, why don’t you just increase your contributions to your ETF’s? Have you ever done a comparison of how a similar amount of money invested would have performed in your indexed ETF’s over a similar period to your dividend stocks?

Hey Chris, great question and one that I get often. You are right, most people should just index their Canadian exposure with XIC or similar, but I have chosen dividend stocks for my Canadian allocation. There are a few reasons, I’m going for financial freedom a little earlier than average, and plan on using the dividends to pay for my expenses. It may be a mental block, but I don’t like the idea of dipping into capital to pay for expenses, especially if I retire early and require the portfolio to last a very long time.

In terms of comparison, logging into my Smith Manoeuvre dividend portfolio account, it is showing the S&P/TSX has returned 29.51% since 2013. My portfolio is showing a return of 45.69%. Mind you, this is not a risk adjusted return. While return is nice, my personal focus is on the passive income that the portfolio generates.

Hi FT

Couple of questions for you

1. I am pursuing the dividend path as well, but I am soon realizing that either I need to get my allocation heavily in Canadian market or I forgo 15% off my dividends by buying US dividend stocks. What are your thoughts on the need to balance allocation. And is it worthwhile to sacrifice 15% dividends?

2. You are lucky to have substantial side business income through your corp. That is something that might not be true for an average investor. How would your timeline look if you were only relying on your and your wife’s job to get to 55K in dividends?

If you plan on buying us stocks, I would suggest you put them in an rrsp which has no withholding tax for us stocks .

While the side income is nice , we made more when my wife was working part-time. So income is relative . A single doctor would blow our income out of the water ! I think best to focus on your own goals and what you think is realistic for your situation.

Hello FT,

I just came across your website a few weeks ago and started following your journey to increase your net worth and now to grow your dividend = yearly expenses. I have read all of Mr. Money Mustache work however it is nice reading about a Canadians journey for a change.

It looks like most of your top holdings are Canadian companies, so I am curious, out of all your accounts, what % is allocated to Canada, US, International markets and then something like Canada Bonds for example?

Are you worried about to much being allocated to Canada?

My guess would be that you will end up needing around $1,500,000 in total investments to hit your target value. The back of the envelope equation for early retirement is Annual Expenses x 25 = $______ required in investments.

Thanks, RK

Thanks for following Rahim ! Our overall portfolio right now has a very high Canada allocation at around 70%. With my RRSP being ex Canada only , and my new job giving me rrsp room , our ex Canada allocation will continue to increase.

Yes based on a 4% yield , we will need 1.5m to reach 60k in dividend income .

Hello FT,

That is a very high allocation in Canada plus your home which is part of your overall net worth is also in Canada. I am reminded of this hedge fund manager in 2018, the chaos year ;), who said something along the lines of “Canada represents 2.4% of the overall stock market/economy and we are severely underweight in Canada.” I thought it was hilarious, we are such a small part of the overall market and yet his company found a way to still be underweight in Canada LOL.

I largely do Canadian Couch Potato (40% canada bonds, 20% equities equally in Canada, US and International). 2018 it was only down 2%, first losing year since 2008. Then I have some US equity/option stuff on the side for fun.

Lastly, my comment about the retirement calculation was generic. In your case, you are trying to get to $60,000 using dividends only. For other people, they use capital gains and dividends. Whatever works.

Yearly expenses x 25 = $______ number you need in investment accounts to retire early. Thus if your target number is $60,000 a year + inflation (2%), according to this back of the envelope calculation, you will need $1,500,000 in your investment accounts, return 6% a year with it, and that money will last forever ~

Thanks, RK

I just ran some more calculations, on a personal level (not counting the corporation), I am 40% Canada, 60% ex-Canada which is more reasonable. The corp is way overweight Canada and may be adjusted going forward.

Good stuff! A lot of people are way over allocated to Canada which isn’t optimum.

Thanks, RK

Many commentators are predicting are a major crash, are you worried how this could affect you dividends or more optimistic at the buying opportunities?

Hi Joe , for investors still in accumulation phase, a crash would be a gift ! For retirees, a sound bond allocation should help mitigate an equity crash.

I just found your blog, and find you and your story inspirational! I think one of the things I most appreciated about this post was when you said that vacations are a luxury. I think a lot of people get in the trap of believing they are necessities.

Plane vacations especially! Thanks for stopping by and for the kind feedback.

That’s a lot of dividend income, realistically enough for most people live on without ever having to work again. Congratulations!

Thanks for the feedback Leonardo!