Is CNR Stock A Good Buy Right Now?

If you’re considering investing in Canadian National Railway (CNR) stock in 2026, it is important to evaluate the company’s performance, dividend growth, and recent developments in the railway industry. Staying informed about CNR’s recent advancements and industry trends is crucial in determining whether it is a wise investment choice. Additionally, comparing CNR with other Canadian railway stocks can provide valuable insights for investors and help make your final decision.

If you’re interested in diversifying your portfolio with more dividend stocks with a similar risk/reward and geographical profile as Canadian National Railway, I recommend exploring our article on Top Canadian Dividend Stocks. This resource offers insights into reputable Canadian companies renowned for their consistent dividend growth, including those in the transportation and logistics sectors like CNR.

Want To Buy Canadian National Railway Shares? Price, Performance & Analysis

- CNR.TO Stock Price: 173.12

- Dividend Yield: 1.93%

- Price-to-Earnings (P/E) Ratio: 20.45

- 5yr Earnings Per Share Growth: 7.76%

- 5yr Dividend Growth: 11.67%

- Payout Ratio: 36.82%

Our CNR Stock Analysis

- The CNR stock has consistently outperformed earnings estimates in the recent past.

- In the first quarter of 2023, CNR recorded an impressive operating income of $1.66 billion, demonstrating a remarkable 35% year-over-year growth.

- Over the last 10 years, CNR stock has delivered a solid return of 14%, outperforming the average on the TSX.

- Revenues have surged by over $600 million compared to the same quarter last year.

Our assessment of CNR stock indicates a compelling buying opportunity for investors given its current valuation (despite its relatively high P/E ratio). As a prominent player in the Canadian railway industry, CNR holds a strategic position within the railway oligopoly, making it an appealing option for long-term investment. Despite overall market challenges and conditions, we are confident in CNR’s management team and their adeptness in navigating these obstacles.

Notably, CN Rail made a strategic decision not to pursue the acquisition of a rail line that its competitor CP Rail bought last year. This move exemplifies CNR Rail’s prudent approach to growth and capital allocation.

Instead of engaging in a potentially costly acquisition, CNR Rail is focusing on other strategic initiatives, including stock buybacks, to enhance shareholder value and strengthen the company’s position in the market. Obviously being able to add a large rail expansion at an advantageous price would have been great, but if the price is too high, there are more simple ways to reward shareholders!

CNR Rail operates within a duopoly in the railway sector, with significant barriers to entry for potential competitors. This market structure provides CNR Rail with a stable and favorable environment, giving the company a competitive advantage and contributing to its long-term growth potential.

As a long-term investor, I find CNR Rail’s position in the industry and its proactive decisions regarding growth and capital allocation to be promising signs for the company’s future prospects.

How Can I Buy CNR Shares?

To purchase shares of Canadian National Railway (CNR), you can utilize any of the available Canadian online brokerage services. At MDJ, we prioritize guiding our readers in selecting discount brokerages that align with their needs. Our list of Top Online Brokerages in Canada is regularly updated to provide our readers with the best recommendations and current promotions.

Once you have successfully registered for an online brokerage account, buying CNR shares is a straightforward process. Use the search bar to find the ticker symbol “CNR” and determine the number of shares you wish to purchase.

For instance, if you plan to invest $1,000 in CNR shares and the current stock price is $100, you would enter “10” and select the “market limit” option. The online brokerage platform will present you with a confirmation prompt: “Do you want to buy 10 shares of CNR at $100 each, totaling $1,000?”. Once you confirm the order, the online broker will handle the necessary transactions.

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

CNR Stock Past Performance

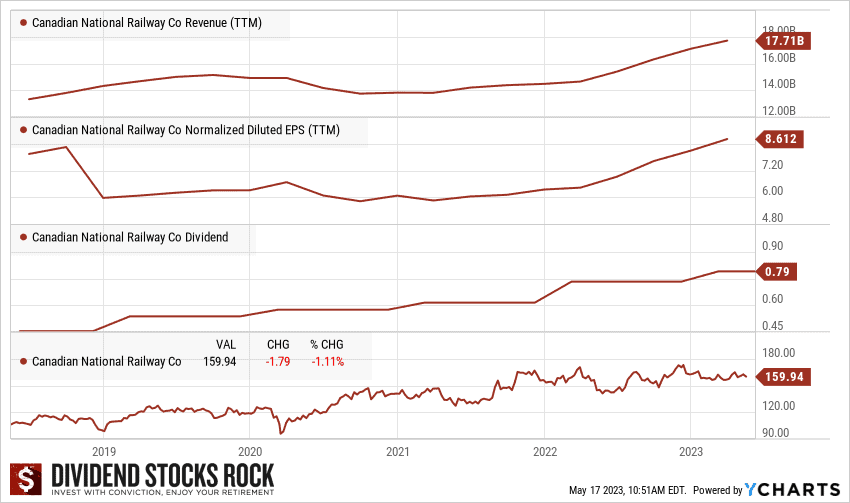

Over the past few years, CNR has demonstrated remarkable consistency in increasing both its dividend and revenues, as illustrated in the graph below. As an investor, I find confidence in CNR’s steady growth, a testament to the company’s robust management and its strong position within the railway industry.

The consistent dividend growth reflects CNR’s commitment to rewarding shareholders, making it an attractive choice for long-term investors seeking reliable income streams despite the relatively low current dividend yield. Moreover, I am optimistic about the railway sector’s overall potential to generate attractive returns, given the growing demand for efficient transportation solutions.

As a forward-thinking investor, my focus remains on steady growth rather than short-term capital gains. CNR’s impressive 11% dividend growth rate over the past three years highlights its commitment to sustaining shareholder value in the long run.

An 11% dividend growth rate over the past three years is quite remarkable and indicates a strong commitment from CNR to consistently reward its shareholders. In the world of dividend investing, a double-digit growth rate is considered high and is often a positive signal for long-term investors.

Such a growth rate not only outpaces inflation but also demonstrates the company’s ability to generate increasing profits, which allows it to share more of its earnings with its shareholders.

By prioritizing strategic investments and efficient operations, CNR has positioned itself for continued success in the railway sector.

When conducting a comprehensive analysis to compare dividend stocks, I rely on the Dividend Stocks Rock (DSR) for dividend investing. This resource provides advanced statistics and a wide range of stock options, allowing me to make well-informed decisions about my investments and align them with my long-term financial goals.

With CNR’s strong market position and consistent growth, I believe it has the potential to be a promising long-term investment choice, offering both financial rewards and stability for years to come.

CNR Stock Forecast

Canadian National Railway (CNR) reported a net income of $5.625 billion in the 2023, $507 million higher than last year. This upward trend is a testament to CNR’s resilience, even in the face of economic challenges, and reinforces its potential for long-term growth. As an investor seeking opportunities in the transportation and railway sector, this positive trajectory makes CNR an appealing choice for those looking to capitalize on the stability and reliability of the railway industry.

Being one of the two major players in the railway sector, CNR operates a crucial and efficient transportation network that plays a pivotal role in the movement of goods and commodities across Canada and the United States.

This strategic position contributes to the company’s strong market presence and underscores its significance in North America’s transportation infrastructure. CNR’s vast network, spanning thousands of miles of tracks, connects key industrial hubs, ports, and distribution centers, enabling the seamless flow of goods throughout the region. There is simply no way to duplicate these unique assets, and the barrier to entry is so massive as to essentially be insurmountable (assuming that Apple or Google don’t want to get into the railway space).

For investors considering a long-term commitment to CNR, the company’s strategic importance and continuous efforts to evolve and grow underscore the potential for satisfactory total returns over the next five years and beyond. As industries continue to rely on efficient transportation and supply chain solutions, CNR’s role as a key player in facilitating the movement of goods bodes well for its future growth and stability. An investment in CNR stock is essentially a bet on the long-term growth of Canada as a country.

Diversifying your investment portfolio is always important. If you prefer a passive investing approach and want exposure to various sectors and asset classes, we recommend exploring our compilation of the Top ETFs in Canada for 2026. These ETF options provide diversified investment opportunities, allowing you to benefit from overall market performance while managing risk.