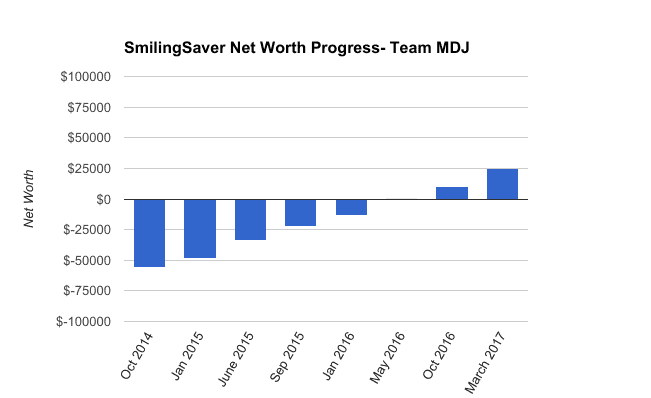

Net Worth Update March 2017 – SmilingSaver – The Big Move (+140%)

Welcome to the Million Dollar Journey March 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. SmilingSaver was selected as a team member and will post net worth updates on a regular basis. Here is more about him.

Profile:

- Name: SmilingSaver

- Age: 31

- Net Worth: $25,012.42

- Day Job: Engineer

- Family Income: My main salary: $95,000; Spouse salary: $ 45,000 (Full time)

- Goals: New Goal: Have Net Worth equal to the value of the primary residence Oct 2021.

- Notes: Married in May 2015. Wife graduated from school with a second degree in May 2015. Immigrated to Canada 16 years ago (full story here). Debt free May 2016.

Hello Everyone,

Big update this time around, because as they say in the song “Go west, life is peaceful there” – I have now gone west for the third time of my life. What makes it even more special is that we accepted our job offers on the same date as my arrival in Canada 16 years ago. The new job required us to move from Alberta to British Columbia.

Over the last month, Kijiji and Craiglist were essential as I started selling extras from our place in Alberta and buying the necessities for the new place in BC. Moving is easy without a big family and a house to sell. All we had to do was give our landlord notice and find another rental place in the new city.

Finding the rental was also not as hard as we imagined. My wife flew to Vancouver and found us a rental within a week. As you can imagine, prices of property in Vancouver are through the roof. However, the rental market is actually not that bad, about $100-$200 more per month depending on various features.

Another change in our lifestyle is that we bought two bicycles and we are actually biking to work every day. British Columbia does not charge provincial tax on anything bicycle related which is an interesting incentive. So far, there have been a few minor setbacks with cycling: blown tire on the way to work and a lot of rain (who would have thought in Vancouver).

So few things I have noticed so far since the big move:

- Alberta beef is cheaper in BC.

- Insurance is at least a double of what I was paying in Alberta and is actually more than in Ontario.

- Income tax is actually less in BC – something I did not realize.

- Rental housing is on par with Calgary and I believe is cheaper than in Ontario.

- There are insane incentives to sell old vehicles to buy a new electric vehicle. I am actually contemplating this incentive, but I love my old car too much, plus it passed inspection with flying colors.

- Talking about the vehicles, if you are moving from Alberta to British Columbia you can do out of province inspection with your mechanic in Alberta, something I wish I knew before the move.

- OMG FISH and seafood – I really did not realize how much I missed fresh fish and seafood.

As for our financials. I have received last year’s bonus in my defined contribution pension from my previous company. I convinced them to deposit my bonus that way, which helped as a tax deduction for 2016. So now I am in process of opening a LIRA account with Questrade. I chose Questrade because I am planning on opening an RRSP there funded by our savings.

On the topic of home buying – my wife and I went to the open house for a condo we really liked but later sold for $315 000. So we have ball park figure for our home buying goal (too overpriced in my opinion). My wife and I also received relocation funds which was spent on purchasing furniture, bikes, and inspections but also boosted our savings a bit.

Now to the actual numbers:

Assets: $25,012.42 (+140%)

- Cash: $4,560 (+9.1%)

- Registered/Retirement Investment Accounts (RRSP): $2,319.42 (+100.00%)

- Tax Free Savings Accounts (TFSA) : $18,133 (+191%)

Liabilities: $0 (0.0%)

- We do not have any liabilities: $0.0 (0.00%)

Total Net Worth: $25,012.42 (vs. $10,410.40) (+140%)

Some quick notes and explanations to common questions:

The Cash

We have $4,560.24 in Tangerine Savings Account. It includes money that will be required for rent, cellphones, Insurance, and minor emergencies.

Savings

- $18,133.37 in TFSA – Invested in Tangerine Balanced Growth Funds.

- $2,319.42 in DCPP with SunLife that will be moved to LIRA Questrade (Questrade review) within 3 weeks.

@ Matt – Thank you so much for this timbit of information, i was able to transfer the funds from LIRA account into my RRSP account.

@ Pat – great job my friend. I really hope to retire around the same timeline, I think it will only be possible without kids. And I do want kids :)

@ Everyone else – Thank you for warm wishes.

Great progress on increasing your net worth smilingsaver. Nothing beats the feeling of seeing a negative net worth to a positive one. Good luck in BC and hopefully the lower tax rate will help you save even more. I would love to read about your house hunting experience in BC. Hopefully, it’s not as crazy as Ontario.

Congrats on the new job and great progress this month. Wish you guys all the best. Never been to b.c I would love to go sometime

Hey great work and thanks for the updates and sharing the funny details of moving provinces.

We couldn’t believe how much cheese cost in Edmonton when we moved lived there (2001-2002)!

I think you two are going to do great — looking forward to seeing the progress.

I admire your drive & will certainly enjoy watching your progress.

Also, an immigrant to Canada (’81 as an M.Eng), I spent everything I could spare foolishly accumulating rental properties while interest rates hovered around 18-19%.

Amused by my drive for ‘blood, sweat & tears equity’, my colleagues invested in large homes, new vehicles, vacations & failed marriages.

The rest is history & I retired at 49 with a healthy portfolio of properties all free & clear.

It was a tough, frugal, exhausting grind but worth the ultimate freedom from a JOB & worrying about ever having enough for retirement.

Taking full advantage of the maximum tax deductions of an RRSP, my Questrade RRSP generates in excess of $40k/yr in dividends.

Good luck & enjoy your journey to financial freedom !!!

Hello Pat,

I love hearing success stories from people who make good financial decisions. I know this is SmilingSavers page (who is doing a great job) but, I’d like to know how many rentals you acquired and what type. Was it the rentals or the dividend investments that were more advantageous for your success?

You should be able to move the LIRA funds into an RRSP because its under $10,000. Which should be easier down the road should you needs funds, and especially if there are account minimum fees.