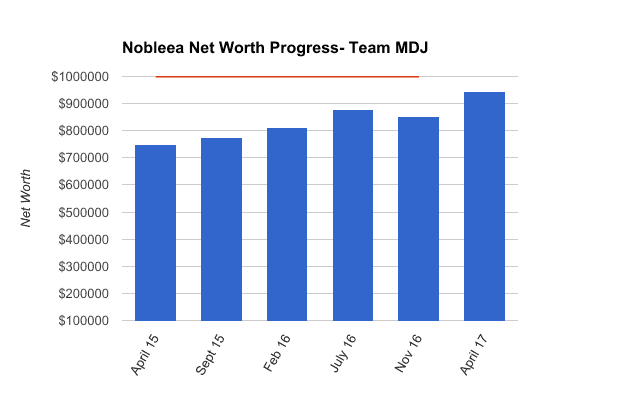

Net Worth Update April 2017 – Nobleea the Oil and Gas Engineer (+10.8%)

Welcome to the Million Dollar Journey April 2017 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team member and will post net worth updates on a quarterly basis. Here is more about Nobleea.

- Name: Nobleea

- Age: 38

- Net Worth: $943,034

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $135,000 (main job), $10,000 (part time job), $80,000 (wife main job – Maternity leave)

- Goals: Million dollar family net worth before 40, Retirement from primary job at 50 (for me)

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe.

We welcomed our second child, a boy, in November and have been adjusting to having two kids under 3 in the household.

One of our goals for the last year was tracking utility consumption in our old and new house. There was a fair amount of design and construction modifications to make the new house more energy efficient. Our 5-year average consumption in our old house was Power 513kWh/month, Water 12m3/month, Natural Gas 6GJ/month. The average Edmonton household uses 600kWh/month power, 16m3/month water, and 10GJ/month natural gas so I was happy to see were under those. For our new house, it looks like we’re going to be at 575kWh/month Power, 8.6m3/month Water, 9.6GJ/month Gas. This includes some amounts for a rental suite above our detached garage that is not yet occupied but is heated.

For our new house, it looks like we’re going to be at 575kWh/month Power, 8.6m3/month Water, 9.6GJ/month Gas. This includes some amounts for a rental suite above our detached garage that is not yet occupied but is heated. For power, I think we can drop to 500kWh/month or at least lower than it was in our old house. For gas, we may be able to drop a bit, but it’s still going to be high. Water I continue to be shocked at how little we use compared to the average household. And that is with a large irrigated lawn.

As per the company’s plan, our furlough program ended at the start of 2017. They have not restarted the matching RRSP contributions yet, but I think that is going ahead in late summer.

Gains in our net worth since the last update came from saving money up in our non-registered accounts, significant gains in the commuted value of the DB pension plan, and market gains in registered accounts, as well as a reduction in debt.

We started an RESP for our son as soon as we could. Combined, the two kids have a total RESP balance of about $15,200 though the value is not included below. It is invested in TD e-series. Our eldest is 3 and youngest is 4 months. When the balance exceeds $35,000, we will likely move it to a self-directed brokerage to save on fees.

It looks like we will pass the Million dollar mark mid- to late this year, which would be before my stated goal of age 40. In May 2009, when we started tracking net worth in earnest, the value was $136,377.

Net worth numbers (Quarter/Quarter):

Assets: $1,696,945 (+4.5%)

- Cash: $3,382

- Registered/Retirement Investment Accounts (RRSP): $222,771 (+8.8%)

- Non-Registered Accounts: $76,044 (+17%)

- Tax Free Savings Accounts (TFSA): $0 (0%)

- Defined Benefit Pension: $219,000 (+27%)

- Principal Residence: $1,130,000 (new)

Home Maintenance Account: $2,048 (new)- Vehicles/Other: $43,700 (-4.8%)

Liabilities: $753,911 (-2.4%)

- Mortgage: $749,126 (-1.5%)

- Credit Cards: $4,785 (-59.9%)

Total Net Worth: $943,034 (+10.8%)

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. We use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills into account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time.

Savings

TFSA’s will need to be replenished over the next 5 years.

Real Estate

We moved into our new build last July and are loving it. I spent some time over the past few months getting our rental suite finished and ready for the market (it is located above our detached garage). It is on the market now getting some very good applicants and we expect it to be rented for June at $1050/month. Continuing with our goal of trying spec residential infill, we are under contract to buy a tear down in a desirable neighbourhood. The purchase price is 440K and we are hoping to start construction in September or October. This is something I have always wanted to do. We have a partner lined up to assist with part of the build and they have a lot of experience doing it. It will show up on our NW statement later in the spring when the deal closes.

On my side, I’m 45, with a $200k family revenue and a $2M net worth, and two kids, which looks similar to you in a few years. However, you’re making the $200K income years earlier. At 38, I was making $120k, maybe? I am also making an additional 30k with my stock trading. In your revenue bracket and with your plan, it might have been better to concentrate on the TFSA, because once in retirement, the tax bracket might be high. You need a plan to see that, I just got mine recently. My own RRSP is above 500K, plus the two TFSA are full, but I’m an extreme saver. I might regret having so much in RRSP, but it does simplify some tax issues like US dividens.

It’s not clear in the article, but it looks like you put 400k in the house, and hopefully as an investment and not lifestyle because that can be clash with semi-retirement plan.

On our side, we have a 3 bedroom $400k house. The money I didn’t pay in a huge down payment has been invested and compounding, and I believe my money has grown faster than the value of the house, because of compounding, but I also don’t life in a hot area like Toronto or Vancouver.

We can retire on $2M that net worth, but what happens when you retire is you have more time and spend more money doing things you want. So for us, I estimate that $2M is not nearly enough to do that even though we live frugally and drive a used car. (My wife thinks “it’s fine”) I’m aiming for above $4M, which I think my investment can take me to.

What’s that 4,785$ credit card, btw? Is that a long term debt or just the current month’s bill?

The credit card is what would call either a short term liability or accounts payable. It’s just the amount on the CC’s since the last bill. It is always paid in full every month for no interest due, but a true snapshot of net worth has to include that.

When I say retirement, I just mean retirement from my current career. I will certainly be still working, but in a different line of work, and working only for myself and probably not full time. But if that line of work doesn’t pay well, then I plan on having enough saved up to carry us through til true retirement. When I’m 45, our RRSPs (not including the DB pension) will be just around 500K as well.

@nobleea, with less than a year away from reaching your financial goal, are you excited? That your plan after reaching a million? Going to start your journey to accumulate your second million?

For me, I don’t feel any different after reaching my first million. However, it make my journey to earn my second million a bit less challenging.

Not hugely excited. I’m confident enough that it will happen eventually. And it’s only a number, especially with a lot of it in real estate. The next goal would likely be working towards partial retirement for me between 45 and 50. Or find a way to work significantly less while making the same or more money.

” Or find a way to work significantly less while making the same or more money.” This is exactly right! I think we should all strive to do what we are passionate about in life. Even if you love what you do career-wise, the goal should always be to work because you enjoy it, not because you have to (ie to simply pay the bills!) This is why every year, in addition to updating my net worth statement, I update a passive income statement. Clearly, the two go hand in hand, but it is really the passive income that gives you the financial flexibility to pursue your interests. As long as your rely on a job for all or the majority of your income, you will always be enslaved is some way.

How are you valuing the defined benefit pension. I’ve heard of a few ways of doing this but am curious what others are doing

Once or twice a year we get a statement from the pension showing the amount we would get if we were to leave employment. For the first few years it was just contributions, but now it is the full commuted value. They’ve got it broken down in terms of how much would have to go to a LIRA, how much to a separate RRSP, and how much as cash (which I assume would be taxed). I just lump it all together for simplicity’s sake. At low interest rates like we have these days, the commuted value increases very quickly.

First off, congrats on the great progress! Always nice reading your updates.

I’m curious as to why your TFSA account is at zero while your non registered is clocking 76K? I assume that most of this is part of your emergency savings. Why not keep this amount within your TFSA (invest in something with limited risk?)

The non registered is the downpayment funds for the spec development. It’s just in a HISA. Putting it in the TFSA adds the time it takes to get it out, plus it’d have to be over a couple accounts, and we wouldn’t be able to re-contribute until 2018. All that hassle probably would save us $100 in taxes this year, so not worth it in my books.

Thanks for the reply and makes sense. Sorry, I might have missed part of the discussion/past posts where you mentioned saving up for a spec development.

That’s fantastic! Congrats you will definally be a millionaire by year end. Congrats on the new house. Never been to Edmonton would like to sometime. Go Oilers!