Financial Freedom Update Nov 2023 – $78.8k in Dividend Income!

Welcome to the Million Dollar Journey November 2023 Financial Freedom Update – the third update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to achieving financial independence by building my passive income sources to the point where they are enough to cover our family expenses. Mostly through passive index and tax-efficient dividend investing.

Here is a little more detail on our passive income goals:

How it all Started – Original Financial Goal

I always find it interesting to look back at previous goals. Here was the big goal after hitting the Million Dollar Net Worth milestone:

Our current annual recurring expenses are in the $55k range (after-tax), but that’s without vacation costs (and no mortgage or car payments). However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury).

If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income is to have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year (after-tax) in passive income by end of the year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full-time salaries (most recently a one-income family). At that point, I would have the choice to leave full-time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

Update: As a noteworthy update, with increasing inflation and costs of keeping teenage kids in activities, our annual expenses have increased to closer to $65k/year after-tax (as of 2023).

Achieving Financial Freedom:

You may be thinking, 2020 is long gone – what has happened since then? I’m happy to report that we reached financial independence in 2020 (a little ahead of schedule)! While the goal now is to continue building and reinvesting those dividends within the portfolio I’m finding that as the years go by, more focus is being put on indexing.

Having said that, even to this day in 2023, I haven’t sold any dividend positions in favour of index ETF. At least not yet. In fact, since leaving full-time salaried work (now part-time consulting), those juicy dividends have been paying most of our bills!

While I will often say that dividend investing is not for everyone (like those who are going for a traditional retirement and/or who have high income and looking to invest in a taxable account), there is a lot of merit in dividend investing for those who aim to retire early.

Some of the benefits for early retiree’s include:

- Tax-Efficiency – Dividends as an income source are extremely tax-efficient if you have no other income.

- Reduces Sequence of Returns Risk – The stock market is volatile which is not great during the withdrawal phase of your portfolio – especially if you need to sell positions to fund your lifestyle. Dividend payments tend to come through even during the worst of bear markets (providing that you are diversified) taking the pressure off needing to sell when the market is low.

- Psychological benefits – It’s a big mind-bender going from being a saver with a regular paycheck to a spender withdrawing from a portfolio that you’ve spent years/decades building. It took me a while to make the adjustment, but one thing that did help me was seeing dividends regularly and automatically deposited into my investment accounts. Even better – getting regular raises from those dividends which has really helped during these inflationary times!

Financial Independence Update – November 2023 – Third Update of the Year

So what’s been happening in the markets in 2023? In my opinion, the story of 2023 continues to be rising interest rates! So that means companies that are highly leveraged (ie. utilities, real estate companies) typically underperform, but on the other hand, bond prices will typically find their footing.. eventually! As well, savers rejoice! Interest rates in those savings accounts (and GICs) are in the 5%-6% range which is the long-term stock market expected rate of return.

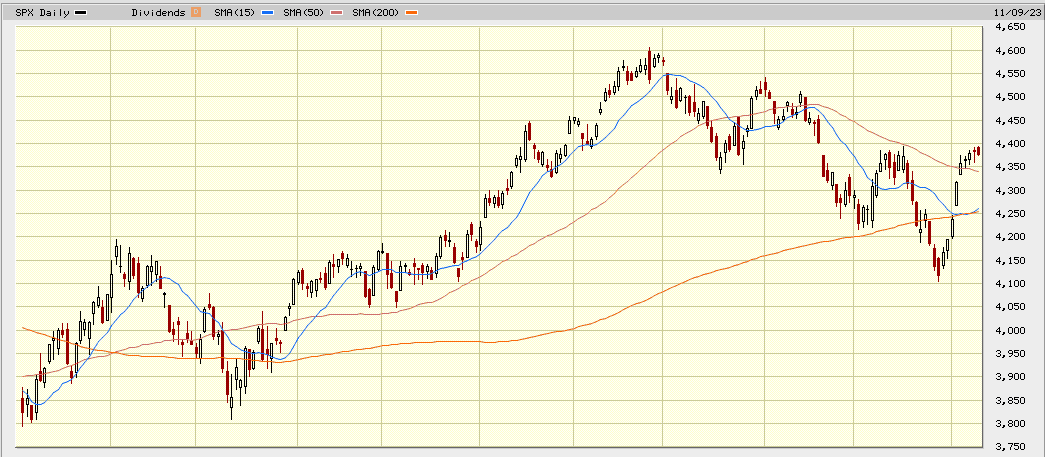

In terms of the broad market, it has really turned over since the last update. In August, the S&P500 topped out at around 4600, then bottomed in October at around the 4100 level (10.9% drop from peak). As of this week, it seems that the S&P500 has found its footing now trading at the 4400 level (~14% gain YTD not including dividends!)

Will this performance last throughout the year? Who knows, the markets still have the same headwinds: inflation (albeit growing less than last year); tightening of the money supply; and potentially higher interest rates (appear to be flattening).

S&P500 YTD Chart

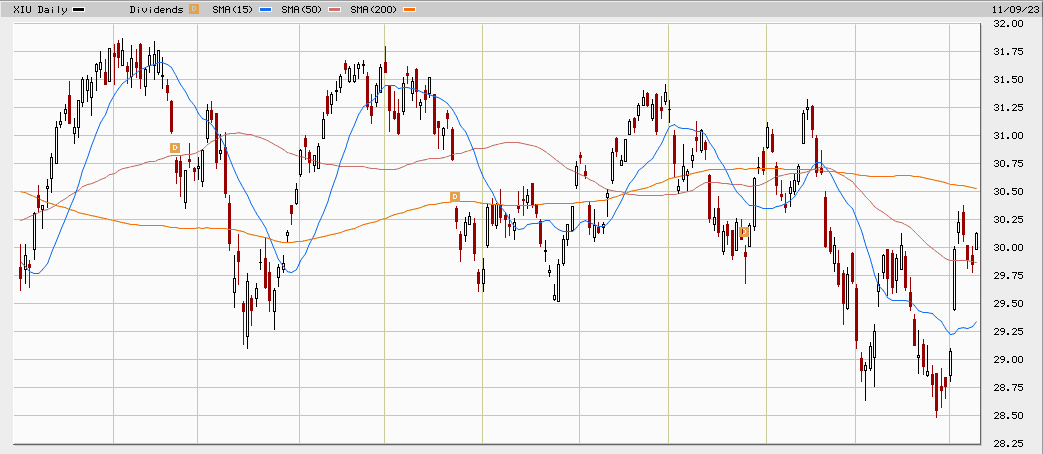

The TSX has also been fairly flat so far in 2023. While it has been a bit of a see-saw ride over the last few months, the main Canadian index is up about 1% YTD (not counting dividends). If oil prices continue to gain strength, then I suspect the TSX will follow suit.

TSX 1-year Chart

What should a young investor do? When you have cash available, close your eyes and continue buying. Research shows that if your time horizon is long enough, it’s not about timing the market, but time in the market.

How Often and When Do I Make the Decision to Buy?

I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

As I’ve mentioned in previous updates, I’ve left full-time salaried work which means I’m spending those dividends that I’ve grown and nurtured over the last 15+ years. As a result, my investment cash position has dwindled down over the years, so no more large investment purchases – at least for now!

Most of the portfolio additions are driven by reinvesting those growing dividends. In 2023 thus far, I have deployed modest amounts of capital into the following Canadian dividend positions:

- TD Bank (TD)

- Emera (EMA)

- Capital Power (CPX)

- BCE (BCE)

- Waste Connections (WCN)

- Brookfield Infrastructure (BIP.UN/BIPC)

- Brookfield Renewable Corp (BEPC)

- TC Energy Corporation (TRP)

- Canadian Natural Resources (CNQ)

- Telus (T)

- National Bank (NA)

- Canadian Tire (CTC.A)

- Index ETFs (not quite dividend stocks but they are likely held within the indexes)

The dividend growth strategy aims to pick strong companies with a long track record of dividend increases. Since the last update, there have been more dividend increases – check them out below.

2023 Dividend Raises

So far in 2023, the Canadian portion of my portfolio has already received dividend raises from the following companies:

- CU.TO (1% increase)

- MRU.TO (10% increase)

- CNR.TO (8% increase!)

- BIP.UN/BIPC (6.3% increase)

- CNQ.TO (5.9% increase!)

- NTR.TO (10% increase)

- BCE.TO (5.2% increase)

- BEPC.TO (5.5% increase)

- TRP.TO (3.3% increase)

- ENGH.TO (18% increase!)

- TRI.TO (10% increase)

- T.TO (3.56% increase)

- L.TO (10% increase)

- WN.TO (8% increase)

- FTT.TO (5.9% increase)

- H.TO (6% increase)

- SLF.TO (4% increase)

- BNS (2.9% increase)

- BMO (2.8% increase)

- CM (2.35% increase)

- RY (2.27% increase)

- NA (5.2% increase)

- IMO (13.6% increase)

- EMP.A (16.6% increase)

- NWC (2.6% increase)

- CPX (6% increase)

- WCN (11.76% increase)

- CNQ (11% 2nd increase of the year)

Top 10 Holdings

Our top 10 holdings move around quite a bit. This time, it’s a good mix of industrials, infrastructure, utilities, energy, telecom, and bank stocks.

In our overall portfolio, here are the current top 10 largest dividend holdings:

- Fortis (FTS)

- TD Bank (TD)

- Canadian National Railway (CNR)

- Royal Bank (RY)

- Canadian Natural Resources (CNQ)

- Telus (T)

- Emera (EMA)

- Thompson Reuters (TRI)

- Bank of Montreal (BMO)

- Enbridge (ENB)

*not counting index ETFs (they are my largest holding).

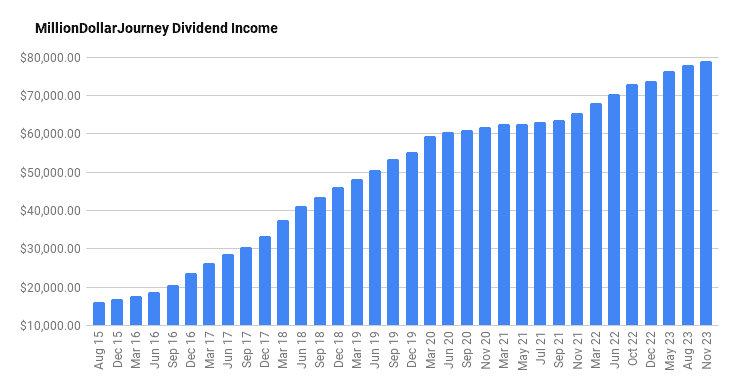

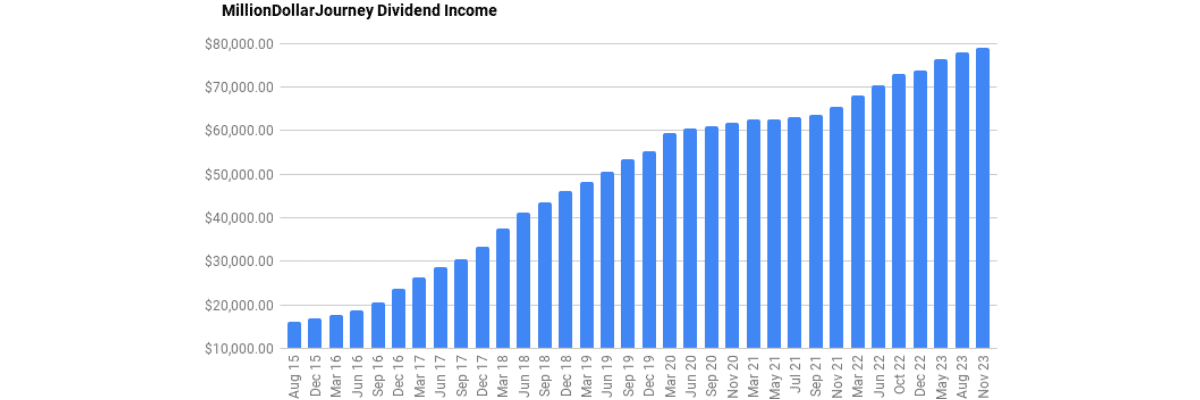

Dividend Income Update

As mentioned, there have been a number of healthy dividend increases and we managed to deploy some capital into dividend stocks.

As you can see in the chart below, the dividend increases have really made a difference in increasing our forward annual dividend income to $78,885. Given enough time for portfolios to compound, slow and steady does work!

The dividends are counted from all of our family accounts including non-registered (including leveraged account via the Smith Manoeuvre), RRSPs, corporate investment account, and TFSAs.

With higher interest rates, some of you may be thinking about my leveraged investing account (Smith Manoeuvre account). While the required payments to my HELOC have grown substantially, I have also been withdrawing the dividends to pay down the HELOC which, as of this post, is breaking even. If you count the tax break, the dividends still come out ahead (prime is currently 7.2%).

Final Thoughts

If you look at the global markets on a daily basis, the dips and sell-offs (ie. volatility) can be scary! However, if you zoom out and look at the long-term trend, the dips are more of a resting phase before moving higher.

Regardless of market conditions, what also keeps my mind at ease is that the dividends keep rolling in. This is one of the major benefits of dividends for retirees – getting paid regardless of the markets being up or down! As with most things, there is no perfect solution. As previously mentioned, dividend investing is not best for everyone.

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. $78.8k/year equates to about $39/hr in passive income (based on a 40-hour work week), and depending on how the investments are structured, most of that can be tax-free!

I wrote a post about withdrawing from your RRSP or TFSA where, with no other income in retirement, you can make up to $50k in dividend income (within a taxable investment account) and pay very little to no income tax (depending on the province). The benefits are even greater if you can split the dividend income with a partner/spouse.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all-in-one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cash flow and stick with a long-term plan. Your future wealthier self (sooner than you think!) will thank you for it.

Maybe this is on a different part of the site, but are you able to provide a breakdown of the Portfolio? E.g. ENB = 1%, CM = 2%, ZWB = 4% etc. The symbols and percentages I’ve used are just examples.

I am amazed how can you get to 1M portfolio with all the holdings that you post

TD, RY, BMO are three large Canadian bank. They are in a lot of head winds recently. The return in the last five years are negative. With all the mortgage shocks coming in 2024, 2025 and 2026. Their earnings will certainly be greatly affected. The return will not improve for sure in the next few years.

CNQ, ENB are cyclical, they depend too much on oil price.

Telus growth is finished. We can not expect Telus to repeat last decade growth.

Fts, Ema are regulated utilities. They are stable Dividend stock. But not growth stock. Will their dividend high enough to counter the high inflation in the next few years?

This is so true. I have been following for almost a decade and slowly FT stopped providing other details like portfolio breakdown , yield etc and only showing dividend amount. My guess is this portfolio other than maybe 2022, would be seriously underperforming and future looks even bleaker. I like the idea of dividend investing and this is a great website but without proper data I am unable to fathom if the portfolio is actually less volatile and generating better returns than SPY.

how much is you principal, and what is the percentage of your stock, what is percentage dividend vs index?