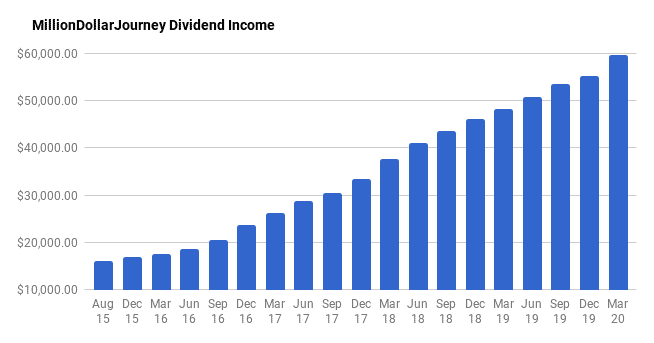

Financial Freedom Update (Q1) 2020 – Bear Market Edition ($59,500 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q1) Financial Freedom Update – the Bear Market Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (less than one year remaining!).

Here is a little more detail on how we came about the $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

The Previous Update

In the previous Q4 2019 year-end update, I wrote about the continued bull market of 2019 and how dividend stock valuations were a little on the high side. While a bull market is great for net worth numbers, it also means it’s more expensive to buy quality dividend stocks.

2019 was a strong year ending with just over $55k/year in dividend income. This is approximately the amount that our family of 4 spends on an annual basis (when passive income = annual expenses, this is called the cross-over point).

While it was a slow start, the train has been building momentum over the last few years, and today, finally achieving a big milestone by generating enough passive income to meet our recurring expenses. While nailing the cross over point is satisfying, my passive-income goal of $60k will provide a bit of a buffer, and hopefully will be achieved sometime in the next 12 months.

While I plan to work in some capacity for the foreseeable future, achieving financial independence is like the ultimate financial insurance as we are a single income family.

Here is a summary of the last update:

December(Q4) 2019 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,800 | 3.96% |

| TFSA 1 | $4,000 | 4.72% |

| TFSA 2 | $3,800 | 4.75% |

| Non-Registered | $3,500 | 4.22% |

| Corporate Portfolio | $25,200 | 3.77% |

| RRSP 1 | $7,800 | 2.59% |

| RRSP 2 | $3,100 | 2.44% |

- Total Portfolio Value: $1,541,602

- Total Yield: 3.58%

- Total Dividends: $55,200/year (+3.3%)

Current Update

Oh, how times have changed since the last update! With the novel Coronavirus (COVID19) impact and the ensuing panic, it has resulted in the fastest 35% stock market correction in history. As a little bit of background, anything past a 20% correction is considered a bear market. I’ve read that an average bear market corrects between 30-35%, while the more severe bear markets (like the financial crisis) can reach 50%.

This correction has been a good gut check for not only new investors but even for experienced investors like myself. It never feels good to see your portfolio value drop by a large percentage. In fact, there have been days where I saw my portfolio value drop by many multiples of my annual salary.

Volatility is normal for the stock market. This is one of the reasons why you may want to increase your bond exposure as you approach retirement as it will reduce volatility and help reduce the impact of withdrawing during an inevitable market correction.

I’ve been through a couple of major corrections in my investing lifetime, and the best advice I can give is to keep your eye on the horizon and keep investing for the long term. I would suggest not selling your holdings, but do the opposite and look at this as an opportunity to add to your quality holdings at fire-sale prices. In the future, 20-30 years from now, the market will be higher and you’ll be thankful that you had the foresight that you were buying while everyone else is selling.

Speaking of opportunity, over the past couple of weeks, the broad-based sell-off has resulted in even quality company stock prices drop which has resulted in sky-high yields. While chasing yields is not advisable without more research, there are some companies (preferably non-cyclical like energy) that are committed to their dividend and have a long history of increases.

For example:

- Scotia Bank and Bank of Montreal reached 7%

- CIBC reached 8.5%

- TC Energy reached 6.5%

- Enbridge reached 9%+

- Manulife reached 8.5%

- Canadian Utilities reached 6.5%+

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). I’ve been buying this correction even if we haven’t reached a bottom (which is almost impossible to know). The only thing I know is when quality companies/indexes appear cheap.

Thus far in this past quarter, I deployed capital into the following positions:

- iShares MSCI All Country World ex-Canada (XAW)

- Brookfield Infrastructure (BIP.UN)

- TD Bank (TD)

- Canadian National Railway (CNR)

- Capital Power (CPX)

- Canadian National Railway (CNR)

- CAE (CAE)

- Waste Connections Inc (WCN)

- Algonquin Power Utilities (AQN)

- Royal Bank (RY)

- Scotia Bank (BNS)

- Bank of Montreal (BMO)

- Sunlife (SLF)

- Enbridge (ENB)

- CIBC (CM)

- Manulife (MFC)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, this year has proven to be lucrative for dividend growth investors.

2020 Dividend Raises

So far in 2020, the Canadian portion of my portfolio received raises from:

- CU.TO (3% increase)

- MRU.TO (12.5% increase)

- CNR.TO (7% increase)

- XTC.TO (5% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (10.7% increase)

- GWO.TO (6.1% increase)

- TRP.TO (8% increase)

- RY.TO (3% increase)

- MG (9.6% increase)

- TD.TO (6.8% increase)

- CM.TO (3% increase)

- PWF.TO (10% increase)

- MFC (12% increase)

- ENB.TO (9.8% increase)

- TRI.TO (5.5% increase)

While growth in dividend income from deploying capital into new and existing positions has been aggressive this past quarter, dividend raises have really made an impact resulting in over $1,700 in additional dividend income.

The best part is getting these raises without having to do anything! To put this in context, an extra $1,700 in dividend income is like buying $42,500 worth of dividend stocks that pay a 4% dividend. That’s an extra $42,500 that I don’t need to generate from savings!

But what about dividend cuts? Inevitable with some companies, especially when the dividend reaches the stratosphere. There have been a couple of casualties so far in my portfolio namely small positions in:

- High Arctic Energy (HWO)

- NFI Group (NFI)

I expect to see more cuts in the oil and gas space coming this year.

Top 10 Holdings

In our overall portfolio, here are the current top 10 largest holdings:

- iShares Core MSCI All Country World ex Canada Index ETF (XAW)

- Emera (EMA)

- TransCanada Corp (TRP)

- Fortis (FTS)

- Enbridge (ENB)

- TD Bank (TD)

- Canadian National Railway (CNR)

- Royal Bank (RY)

- Canadian Utilities (CU)

- Bell Canada (BCE)

Dividend Income Update

As you can see in detail below, over the last quarter we have increased our dividend income from $55.2k to $59.5k which represents a 7.8% increase quarter over quarter.

With the goal of $60,000 in annual passive income, due to increased buying at higher yields and dividend increases, we are pretty much at our long-term goal of $60,000 in dividend income. By the end of the year, we hope to be in the $65,000 range.

Here are the numbers.

Q1 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| SM Portfolio | $7,900 | 3.96% |

| TFSA 1 | $4,200 | 4.72% |

| TFSA 2 | $4,000 | 4.75% |

| Non-Registered | $3,600 | 4.22% |

| Corporate Portfolio | $28,500 | 3.77% |

| RRSP 1 | $7,900 | 2.59% |

| RRSP 2 | $3,400 | 2.44% |

- Total Portfolio Value: $1,263,610

- Total Yield: 4.71%

- Total Dividends: $59,500/year (+7.8%)

Final Thoughts

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been satisfying with a 7.8% bump in dividend income.

I welcome corrections/volatility as it gives investors in the accumulation phase a chance to buy quality companies (or index ETFs) at better prices, potentially increasing long-term returns. Investors, we’ve been waiting a long time for a major correction/bear market, this is your time to buy assets at a discount!

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all-in-one ETFs in Canada. As you can tell, I’m also a fan of indexing as the iShares XAW is my top individual holding.

The broad stock market goes up over the long-term. If you have a long investment timeline before retirement, what are you waiting for?

hi FT I am a long time follower of your blog,

Have you consider selling some cover calls for the current positions or buy new positions and sell cover call right from the start?

I am trader with long term strategy of accumulating a core-portfolio and here is my strategy –> http://www.forwardtrader.com/selling-cover-calls-is-it-worth-it/

I think it all depends on your view on the markets, if you think this is a V-share recovery selling cover call might not make sense but as you can see some stocks are returning close to 10% in 69 days.

Looking forward for you input,

Bogdan

Hey Bogdan,

I have not looked at the covered call strategy in quite a while, but definitely something to consider. Have you ever looked at selling puts?

When you note a yield of 4.71% is that current yield or yield on cost?

Nice job!

Your dividend income looks impressive, however many companies will cut dividends by a lot in not so distant future. Look at IPL for example, they already cut their monthly dividend from $0.1425 to $0.04 – a drop of 72%. Yes, the oil crash played role in that, but other will be affected too. Canadian banks’ earnings are down in the toilet with the sharply lower interest rates. Do you think they can keep their 5-6% dividends for the next 1-3 years?

Hey Samantha – I’ll let FT chime in here as well, but the short answer is: Yes. I believe the banks can keep their dividends for the forseeable future. There are so many competitive advantages and cash cusions there that can be tapped before a dividend is cut. Look at the dividend history of those banks and tell me why you believe this time will be different?

Hi Kyle – If the recession caused by coronavirus is short-lived and everything is back to normal by July, August I think the banks will keep current dividends. Beyond that it will be very hard to do so, because their revenues are taking huge hit with the rock bottom interest rates. Look at ZWB.TO, it was trading below $11.50 two weeks ago, and although it has somewhat recovered since, I think it will revisit $11 in not so distant future.

Great Job FT on reaching your goal. I think the banks and utility companies can hang on longer that a couple of months without cutting their dividends. We expect some cuts around the fringes of our portfolio, but for the most part we hold solid companies that should stay the course. Will be interesting to see where we are at the end of the year,

+1, I also believe Canadian banks will maintain their dividend through this crisis. However, their dividend “growth” streak may be hindered for some of the banks that have not raised yet in 2020.

I love the blog,this blog originally got me into investing more then 10 years ago and I also reached 7 figure net worth at age 35. I don’t think I would of started this goal without reading this blog.

I have Canadian banks (TD and Scotia) in my portfolio, I am also concerned about their future with delinquencies and low interest rates. Banks are also being disrupted by fin-tech. Hopefully there is only a short term impact on dividend growth.

Bank Q1 Earnings reports are started this week.

Hey Goeff,

Always good to hear from long-time readers! Congrats on a 7-figure net worth by 35!

What information have you been reading that shows TD and Scotia have large exposure to risky mortgages? As far as banks being disrupted by fin-tech… banks are fin-tech! Scotia is a great example. Tangerine was the “big disruptor” for awhile – and they got bought. Heck, the largest robo advisors are now all owned to some degree by large legacy financial conglomerates. There are so many levels of protection before those dividends get chopped, but like FT says, we could see a couple of quarters without an increase for caution’s sake.

Hey FT – good work. One thing that would add value for the reader, would be if you state both your portfolio market value and book value. This will allow your readers more info on capital appreciation or depreciation.

Hey Derrick, good idea. I had book value before but some readers wanted current portfolio value. Good idea to include both.

Congratulations! I’ve been following your journey for years and it’s really nice to see what a slow and steady progress to FIRE looks like.

Question for you: Do you include the dividends from your RRSPs as a paper accounting exercise? I ask because I assume you can’t withdraw and actually spend those.

Congrats and thank you for sharing these posts! Which account(s) are you holding XAW in?

Thanks Yettie! Yes, I do count the dividends from my RRSP. Technically, yes, I could withdraw from my RRSP at any time – it’s just a matter of potentially paying more tax (depending on my other income during the current tax year).

You should look into selling covered calls against your existing positions. In Canada it’s very hard due to a lack of liquidity but with US stocks, it’s very easy. Need a lot of shares to make it sense because the trading fees add up. This way you can reduce your cost basis and you can get some monthly cashflow.

Thanks, RK

Nicely done and congrats on hitting your milestone! Very impressive stuff. We’ve been busy adding more dividend paying stocks to take advantage of the bear market. :)

Thanks Tawcan, I see that you have been very aggressive in buying this bear market – good for you!

Awesome job FT! Congrats on your milestone and getting at $60k dividend income. What percentage of cash are you keeping (forgive me if I didn’t see it in your post)?

I started a position in MFC.TO as well and added to BMO.

Thanks GYM! My cash has dwindled a lot over the past couple of years and especially this past quarter. I’m down to less than 10% cash. Do you maintain a certain percentage of cash?