Will the AI Bubble Pop In 2025 or 2026? How About Nvidia and OpenAI?

Back in the spring I wrote about AI investing in Canada, and why I was pretty cautious about advising anyone to invest in the AI bubble.

Well, so far, you’d have been right to completely disregard that advice and go 100% in on AI stocks like Nvidia!

That said, I’ve been doing quite a bit of AI Bubble related reading in the past couple of weeks, and I’m more sure than ever that folks should be looking to at least partially diversify away from the tech craze and into low risk investments.

Once again, it’s worth pointing out right upfront that while I believe the AI bubble is real and verifiable, I have no idea whether it will “pop” tomorrow, in 6 months, or a year from now. As I write this, tech stocks have had several down days in a row, so it’s even possible that the AI bubble is deflating in real time!

As someone who uses a large language model AI (LLM) every day, I’m also quite familiar with the real productivity gains that AI offers. Investors need to understand that artificial intelligence can be both a game-changing technology AND that many companies who are involved in the AI space are completely overvalued based on their current earnings and profit potential.

What Is a Bubble in the Stock Market Anyway?

Every few years, markets decide that one idea will change everything. In 1999 it was the internet. In 2006 it was housing (and the ability to re-sell mortgage contracts). In 2017 it was crypto (for the first time). In 2021 it was SPACs and meme stocks.

Heck, in 1636 it was Dutch tulips.

In 2025 it is AI.

Some of those stories were truly world changing. Some were just world entertaining. The investment results depended on what you paid for shares of specific companies, how patient you were, and how concentrated your investment portfolio became.

Answering the question of if AI is the next stock market bubble first becomes a matter of properly defining what a bubble is. While there are many different definitions out there, I’ll go with:

A stock market bubble is when share prices disconnect from realistic future cash flows for an extended period. Usually it is the result of a great story, speculation over “easy money” to be made, and fear of missing out.

One of my favourite Canadian commentators over at The Plain Bagel likes to frame it as: narrative running ahead of numbers.

Most investment bubbles are not like the Dutch tulip crisis. Railroads did transform commerce. But it’s also true that speculation on railroad stocks also caused several massive stock market bubbles to form.

Electricity did completely change day-to-day life. The internet did reshape business. Early investors who recognized those truths were not wrong. They were just often early, over-concentrated, or paying too high a price for shares of a specific company – even though there could be substantial future growth.

Evidence We Might Be In an AI bubble

Here’s a brief look at the reasons I think the AI hype bubble is real – and why there are likely to be some very disappointed investors who are currently getting into the market. As always, check with your Canadian financial advisor before taking anyone’s free thoughts on investing!

1) AI company valuations are very high. As I write this article, the cyber defence company named Planatir has a price-to-earnings ratio of over 400x. To put it mildly… that’s insane. By comparison, our best Canadian dividend stocks generally come in at 15-20x these days (and even that is somewhat high historically). Canada’s biggest company – Shopify – isn’t a pure AI stock, but it’s certainly tied to that world. It has a P/E ratio of about 100x.

In order to live up to these crazy high future profit expectations, the companies will have to grow their revenue to insanely-high levels – and do that while keeping expenses low. The probability of being able to achieve that lofty outcome has to be less than 10% historically speaking.

Aswath Damodaran and Scott Galloway are two prominent commentators that have repeatedly asserted that the AI hype story being told about these companies doesn’t match the actual profit numbers being generated. I agree with the assertion that medium- and long-term profit potential just doesn’t justify these wild valuations.

2) Concentration risk. A handful of mega caps explain an outsized share of market returns. We saw this in the Nifty Fifty era and the Dot Com run up. When breadth narrows and indices rely on a tiny cohort, you are fine until you are not. Right now, the five largest US stocks make up about 37% of the S&P 500 (meaning they are like 25% of the entire world’s market cap).

If you were to buy $100-worth of a Canadian all-in-one ETF (see our XEQT Review for more details) about $9.40 would be going to just three companies (Nvidia, Apple, and Microsoft). You toss in a few more tech companies like Amazon, Shopify, Broadcom, Meta (Facebook), and Tesla – and now we’re talking more like $16.00.

3) Capex arms race is unsustainable. The tech ecosystem is currently spending staggering sums on GPUs, data centers, and power. That is great for the picks and shovels layer (Nvidia being the 800-pound gorilla in the proverbial room) while the virtual gold rush lasts. It becomes an issue when supply catches up and returns on incremental investment start to compress. Eventually, investors are going to get sick of burning money with no end in sight. Another capex issue is that those GPUs aren’t like railway tracks – they will need to be replaced every 3-5 years. This will present a significant obstacle to ever realizing profits!

4) Copy & paste AI everywhere. With powerhouses like China putting out free open source AI applications such as Deep Seek, it’s doubtful that there will be many companies able to maintain large profit margins over the long term. Without those thick profit margins, the case for the high valuations goes south in a hurry. China is producing energy much much cheaper than we are in the West. That’s going to be a major AI input and choke point – so tell me again why Western AI companies are going to be so massively profitable?

5) FOMO marketing. From themed ETFs to viral threads, the sampling error of social media is large. Only the home runs get shared. Survivorship bias takes over. Kyla Scanlon is one of my favourite economic commentators (she’s probably most famous for coining the term “vibe-session”) has been clear about how emotions (aka: vibes) drive capital flows in the short term. There are very few emotional pulls out there stronger than the fear of missing out (FOMO).

6) Historical rhyme. The pattern looks familiar. Real tech, real adoption, valuations that start reasonable and drift into narratives that do not allow for normal business cycles. We have seen this movie (literally in the case of The Big Short).

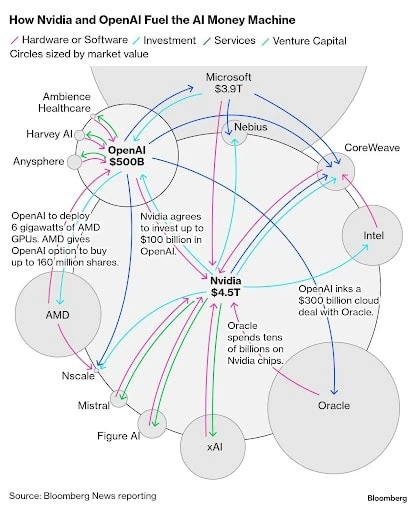

Circular AI Investment Flow Shows Systemic Risk

This Bloomberg graphic of the current AI supply chain and the money loops that keep it spinning really caught my eye recently.

Note: The circle size roughly tracks market value. The colours show relationship types: who sells hardware or software, who provides cloud services, who is investing cash or venture capital. In the middle you see the four big hubs that everything flows through right now: OpenAI, Nvidia, Microsoft, and Oracle. Around them are chip makers and up-and-comers like AMD, Intel, CoreWeave, xAI, Mistral, Figure, and a handful of AI application startups. The picture says two things at once: the AI boom is highly interconnected, and a small number of firms sit at the choke points.

The biggest arrows in the chart call out a few headline deals. Reports say OpenAI and Oracle struck a gigantic multiyear cloud agreement tied to Project Stargate, described as roughly 4.5 gigawatts of new data-center capacity and summarized by some outlets as about 300 billion dollars over five years, while the Financial Times framed it as about 30 billion dollars per year to lease capacity for 4.5 GW.

Another set of arrows shows OpenAI’s pact with AMD: OpenAI plans to deploy up to 6 GW worth of AMD Instinct GPUs and received warrants or an option to buy up to 10 percent of AMD stock (about 160 million shares) as milestones are met. Nvidia shows up as both a supplier and an investor, with coverage describing a plan to invest up to 100 billion dollars in OpenAI, while Oracle, CoreWeave, and others are shown spending tens of billions on Nvidia chips to build out AI cloud capacity.

I’d argue the graphic makes the industry look like a circular money machine: vendors invest in customers who then commit to buy the vendors’ products, sometimes with “up to” figures, milestone triggers, or non-binding frameworks that will only convert if financing, power, and permitting line up.

This diagram is either the blueprint to which companies will massively benefit from AI – or it’s a snapshot of a house of cards where power is concentrated in very few hands, and outside ecosystem revenue is counted on many different balance sheets.

The prudent approach is to watch what shows up in financial filings over the next few quarters. I’m looking at these questions specifically:

1) How much of Oracle’s cloud backlog converts to recognized revenue from OpenAI?

2) How AMD discloses any warrant exercises or dilution tied to OpenAI milestones?

3) Does Nvidia’s alleged OpenAI investment actually close or is more of a “framework of a plan”?

Evidence We Might Not Be In a Bubble

Now, to be fair, there are absolutely some good arguments that artificial intelligence is the real deal, and that it deserves all the hype and invested money. To be clear, I don’t find this side of the debate as compelling, but it’s not like there isn’t some solid rationale here.

1) Revenue is following the hype in some places. LLMs like ChatGPT are showing quickly increasing revenues. Some companies might have near-monopoly-style advantages for a while because of scale, talent, and ecosystem power. Google and Facebook have made headlines for paying AI engineers professional baseball-level salaries as trillions of dollars in infrastructure spending justify paying nearly any amount for top talent.

2) Unit economics are improving. Token costs, inference optimization, and model efficiency keep getting better. The more people use AI, the better it should get. (It’s worth pointing out that China’s token costs are substantially lower than the American AI giants’ cost right now.)

3) Companies are using AI. Many CIOs are rolling AI into concrete workflows where ROI is measurable. AI isn’t just for kids cheating on homework. Paying fewer employees means increased profits.

4) Policy tailwinds. It could certainly be argued that while many governments around the world are pro-AI, the Trump government in particular seems willing to give the big tech CEOs more or less whatever they want at this point. They also want semiconductor supply onshore, resilient electricity grids, and data security. Scanlon has written extensively about how the AI-powered stock market is absolutely essential to confidence in the government. This has created a mutually-reinforcing cycle for the industry.

5) Not all investment multiples are crazy. There are profitable, cash rich companies tied to AI trading at premiums, sure, but not face melting ones relative to their recent growth. That is different from 1999. The dot-com companies had very little profits and borrowed a ton of money. Google, Microsoft, Meta, et. al are cash-rich companies that can soak up a lot of losses due to their gobbling of the entire advertising world over the last couple of decades.

Detour On Diffusion

New technologies tend to follow S curves as they diffuse into the real world.

Slow early adoption. A sharp middle spike once the tech is proven. Then a long flattening as the efficiencies are gradually found implemented. Investors tend to project the steep middle forever. That is where bubbles live.

Scanlon’s read is that we are in the middle of that S curve emotionally, while physically we are still building the plumbing. Power, compute, and data center capacity have to catch up to the hype. I honestly am not sure that they ever will! There are increasing stories about big chip data centres sitting dark because utilities can’t book up the electrical grid to them. With electricity prices going through the roof in some areas, there will be considerable political pressure to address the issue. When you consider the Chinese competitive advantage here, the situation gets even more muddled.

That is consistent with Damodaran’s reminder that growth, margins, and reinvestment are linked. If you want to grow faster, you have to feed the beast. That usually dents margins until scale efficiency shows up.

Is Nvidia a Bubble?

No matter what else one believes about the AI bubble, one staggering truth is that there has never been a company like Nvidia. The combination of incredibly-quick risking revenues combined with a massive profit margin (although slowly shrinking as others catch up) makes this company an absolute juggernaut.

However – at some point, the price becomes too high – even for a juggernaut.

Nvidia is different from the companies like Google, OpenAI, and Anthropic, in that they don’t have to invent uses for AI or make AI better in order to make money. They are the proverbial picks and shovels sellers to the AI gold rush. Obviously the more gold that is “found in them there hills” the more picks and shovels will be needed. But for now, as long as the biggest companies in the world (American tech companies) continue to buy Nvidia chips as fast as they can make them, the company can basically print money.

And they’re printing A LOT of money! Nvidia just released results from another monster quarter. (Unlike OpenAI Nvidia is a publicly-traded company, so they have to release their financials every 3 months.) Revenue came in at about $57.0B vs $54.9B expected, with EPS beating predictions as well. Management said cloud GPUs are effectively sold out.

So, how can a company that is making like $30 billion in annual profits (and quickly growing) be in a bubble?! This isn’t exactly Pets.com we’re talking about here!

Let’s quickly look at two realities to determine if the Nvidia AI bubble story has legs:

Multiples: Nvidia’s trailing P/E sits around 53 today. That headline number is going to swing a lot this year because both the numerator (price) and the denominator (earnings) are moving fast. Even if you prefer forward P/E (around 28x), the key is not the exact digit. It’s the path of earnings that has to keep compounding at an extraordinary clip for this valuation to make sense. That is possible when you are the toll road for a once-in-a-generation buildout. It is also how bubbles form when expectations outrun physics or budgets.

Scale: Nvidia’s market cap has been hovering in the multi-trillion range in late 2025, briefly topping $5 trillion. That’s an impossibly-large number to wrap your heads around. For context, the entire Canadian stock market is worth about $3.6 trillion. That includes all of the Canadian Dividend Kings (think about all the pipelines, all the railways tracks, all the banks, etc)! Nvidia’s market cap is bigger than Germany and Australia’s combined! That’s just wild to think about. That’s a huge price to pay – even for a company that is printing money!

Back to the fundamentals. A few details from the latest update matter for valuation:

So is Nvidia ultimately in a bubble? Nvidia’s earnings justify a premium so long as AI capex keeps compounding and Nvidia is able to maintain their massive cutting edge advantage. The moment the buildout slows or other companies begin to eat away at Nvidia’s market share, the multiple will compress first and the narrative will follow. That is how every hot-growth cycle cools off.

I definitely like the short- and medium-term math behind Nvidia more than I do the newer AI companies. The huge companies in the US such as Meta and Google have committed to buying massive amounts of chips in the next few years. I don’t see any reason why that won’t happen. Beyond that though… the stock is currently priced for the incredible growth story to continue for many years. That’s a super-tall order.

Let’s say Nvidia maybe isn’t a bubble compared to some of the other froth out there… but it’s definitely not underpriced!

Is OpenAI a Bubble?

For many many companies, we’d use publicly-available information to determine if they were in a bubble. But without sales and profit numbers, it’s impossible to “see under the hood” and know what anyone is paying for equity in a company – let alone if that’s a good deal.

OpenAI isn’t a publicly traded company, so they don’t have to release their latest numbers anywhere. Just to clarify, that means if you login into your online brokerage account, you won’t be able to find an OpenAI ticker anywhere. There’s also no real-time way to determine the value of a company like there is when you have a handy stock ticker moving up and down. That said, there are a few clues we can use to give us some big picture answers.

Private-market marks have moved wildly in 2025. Reuters reported in July that OpenAI was exploring a primary raise at roughly a $300 billion valuation, off the back of enterprise growth and rising ChatGPT revenue. A few months later, Bloomberg and the Financial Times both wrote that a secondary sale cleared at an even higher ~$500 billion headline valuation, which tells you how frothy late-stage demand has been this year. Treat these as guideposts, not gospel. Different deal structures, preferences, and timing can put two very different price tags on the same company. Many market watchers believe that if OpenAI went public today, it would have a valuation of close to $1 trillion (all numbers USD).

As the hilarious show Silicon Valley taught us years ago in this NSFW clip, tech companies don’t want to show a profit. If they show a profit, then guys like me put a P/E ratio on it (like I did with Palantir at the start of this article) and say it’s in a bubble. But as long as you never make money, then you can cash in on the dream of endless potential! It will likely be a very very long time before OpenAI makes a profit – and yet somehow it’s worth between $500 billion and a trillion dollars?!

Reuters reported that OpenAI had revenues of “more than $10 billion” in mid-2025 and said management was targeting roughly $12.7 billion for full-year 2025. That’s a massive jump from late-2024 snapshots. Recently the company has claimed that it is running ahead of those numbers. That said, when asked directly about revenues and massive losses for the next few years, CEO Sam Altman walked off of Brad Gerstner’s “Enough” podcast. Not a great look.

The Wall Street Journal has been blunt about the math: even with revenue compounding, capital spending and compute costs are dramatically outpacing sales. Training and buying new GPU models is a furnace that eats cash and electricity (and will in perpetuity from what we can see). That makes sustainable gross margins and capacity planning the whole ball game.The Financial Times added another cold-water stat this fall – profitability for OpenAI isn’t expected until around 2029.

So is OpenAI in a bubble? The honest answer is that you can’t buy it directly so it’s impossible to know for sure. Instead we’re stuck looking in Microsoft’s quarterly reports for clues (as they own a large chunk of OpenAI). What we can say is that OpenAI isn’t making any money this year. Or next year. Or maybe for the next 10 years.

But for that potential to make a lot of money one day in the future, private investors are willing to pay $500 billion today. Sounds like a probable-bubble to me, but what do I know?

Scanlon has pointed out that OpenAI can be world-changing and over-valued at the same time. The credible path out of “bubble” territory is kind of a boring grey area. It would go something along the lines of more enterprise sales, a more clear gap between ChatGPT and other LLMs, model cadence that doesn’t blow up serving costs, and a clear plan to control electricity and chip costs.

Is the AI Bubble Different?

“This time is different” – famous last words when discussing the stock market.

AI is a general purpose technology. It will help many companies increase their profits. That means that it is a valuable new invention – but it doesn’t guarantee that specific companies will generate profits from it.

Airplanes were an incredible invention that greatly improved productivity around the world. Yet very few airlines have ever managed sustainable profits. It’s worth noting here that Nvidia is worth about 4.5x what the entire aviation industry is worth (if we assume that the IATA’s estimate is correct – with Delta airlines being the biggest in the world at about $40 billion, compared to Nvidia’s $4 trillion+ valuation).

Electricity, railways, telecommunications, the internet – all major game changers that allowed companies to make more money. All of them generated investment bubbles.

Red Flags to Watch in 2025 and 2026

These are practical signals, not trading calls.

1) Watch OpenAI closely. Any sign of shakiness there is going to be somewhat hidden – but when uncovered, it’s going to rapidly affect that entire circular diagram we mentioned earlier.

2) If China proves to be better at AI – or even just competitive in certain areas of AI – then these American companies aren’t worth nearly what they’re priced at. If China competes at something, prices go down. Period.

3) Do we have enough electricity for these data centres? Let’s see how politicians respond.

4) Watch the boring regular companies. If Coke or Barrick or Enbridge start to scale back on AI spending because they’ve already squeezed all the juice they can out of it – then those falling sales numbers will quickly filter up the AI food chain.

How to Invest If We Are In an AI Bubble

Look, if I knew how big the AI bubble was (and could somehow quantify exactly the appropriate price for these companies) AND when the bubble would pop – then we could all be multi-millionaires together.

We could buy options and make a sequel to The Big Short. (I think Channing Tatum would be the obvious choice to play yours truly.)

The truth is that we don’t really yet know what this technology will eventually look like – let alone which companies will get the thickest profit margins from it. What we do know is that the current prices of the stocks indicate people believe an absolute best case scenario is about to occur.

I think it’s fair to say rebalancing your portfolio, or deciding to take some risk off the table is likely a good move at the moment. Low risk investments such as high interest savings accounts or GICs can appropriately balance risk alongside appropriate levels of risk taking in the stock market. You can check out our EQ Bank review for more details on where I am currently getting the best interest rates.

That said – is it possible that the Nasdaq could go up another 20% before it sees a correction? Sure.

I’d say it’s more likely we’ll see it 30% off the highs than up 20% from the highs, but one has to be aware that in the short-term, the stock market is more “animal spirits” driven than it is a sober price marking machine. Long-term, I have more confidence that all possible information will get priced in, and valuations will likely come back down to Earth.

Frequently Asked AI Bubble Questions

Final Word

As far as I can tell, we are almost certainly in a mild to moderate AI stock bubble – and it’s occurring alongside a very real productivity wave. Both predictions/observations can be true.

Let’s anchor this statement to two old-school yardsticks. First, the Shiller CAPE. As of early fall 2025, several trackers put the U.S. CAPE north of 40, which is rarified air and well above the long-run average (which is high teens). We’re not at the dot-com’s peak of ~44, but we’re in the same neighbourhood. That tells you prices already assume we’re going to see mega profits (and sooner rather later).

Second, the Buffett Indicator (defined by the total market cap of the companies in the USA divided by GDP). The idea is that the total worth of all the companies should be somewhat tied to the size and growth of the broader economy. Makes sense to me!

The long-term average for the Buffett Indicator is 80-100%. Right now the market is priced at 220%. It’s probably no coincidence that Buffett’s current investment portfolio includes a massive lump of cash.

Obviously there’s more room to go down than up judging by these metrics.

Now to the question Scott Galloway keeps raising: What happens to the whole market if everyone gets fired?

The short version is that cost cuts can boost margins for a while, but you cannot fire your way to durable growth. For valuations to make sense, you need both margin gains and real revenue growth. Company-level layoffs also ricochet through the economy by lowering aggregate demand, which in turn pressures the same revenue lines investors are modeling up and to the right. Galloway’s broader point on AI exuberance is that narratives are running ahead of unit economics, and that the last leg of a mania often leans on imagined efficiencies that cannot scale across every firm at once.

Could the AI bubble inflate further?

Absolutely.

As Keynes used to say, “The market can stay irrational longer than you can stay solvent.”

That fundamental truth makes it very difficult to predict how big the bubble can get and deciding when it will pop. While guys like Michael Burry are out there making short bets against stocks, I don’t recommend anyone try it at home.

Could the entire AI industry also slowly deflate into a long, sideways grind while earnings catch up over the next two decades? That boring outcome happens more often than headlines would have you believe (just ask Cisco).

If you came here for a bold call, I apologize. I am not ready to put my flag in the ground on the exact month an AI bubble will peak. What I can say with conviction is that great technologies and bubbly valuations often travel together. The technology can win while many excited investors lose. The way to avoid being on the wrong side of that sentence is to own enough of the winners through low cost index investing, limit your concentrated bets, and keep adding money even when the headlines are dramatic.

As The Plain Bagel likes to remind us, markets eventually weigh cash flows, not adjectives. As Damodaran would insist, you still have to tie the story to profit numbers at some point.

If AI does half of what its boosters promise, productivity will rise, costs will fall, and your diversified portfolio will benefit. But if it ONLY does half of what it promises, then the AI bubble is going to mean tech stock prices come down (whether it’s slowly or all at once). At the moment the best AI in the world can’t draw a clock… so I’m keeping my expectations in check.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?