Financial Freedom Update – June 2016 (+5.78%)

Welcome to the Million Dollar Journey June 2016 Financial Freedom Update. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 5 years. If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the Money Tips Newsletter.

In my first couple Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and other capitalistic pursuits.

Current Financial Numbers

So now that I’ve declared my financial goal, where do I stand now? Here are the annual dividends generated by account (March 2016):

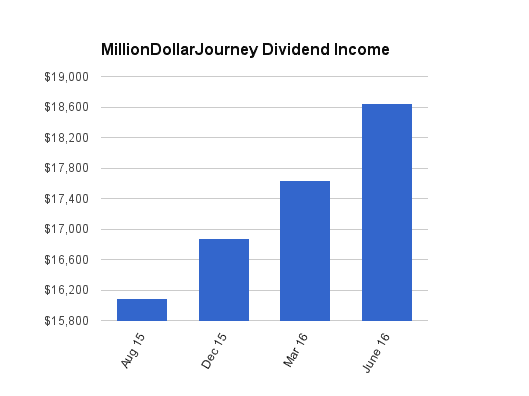

Account Dividends/year SM Portfolio $5,224.87 TFSA 1 $1,505.00 TFSA 2 $1,899.50 Non-Registered $406 Corporate Portfolio $4,800.10 RRSP 1 $3,484.69 RRSP 2 $310.95 Total Dividends: $17,631.11/year

Since March, there have been few changes to our financial situation – it’s been slow and steady. We are still living off my government salary, so we are particularly paying attention to our spending. As promised, here is a breakdown of our expenses in 2015. In the last update, I mentioned that Mrs. FT has since volunteered and substituted in a private pre-school and seems to be ready to leave her healthcare position for a career in teaching. More on this in a future post as it develops!

Now, lets talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts. The goal of the strategy is to pick strong companies with a long track record of dividend increases.

In the last update, I mentioned that the oil correction was taking a toll on the income portfolios due to significant dividend cuts. As oil prices seem to have found a bottom, dividend cuts have seemed to have subsided… for now.

To start, my leveraged Smith Manoeuvre dividend income has increased slightly since the last update due to adding to my Manulife position and a couple of dividend increases from two of the big banks. With the dividends from this portfolio churning out cash, there is now enough cash to go shopping for a new position or add to an existing one.

As it has been the trend for this year, I’ve continued to deploy some of that corporate cash into dividend stocks which has resulted in the biggest contributor to dividend income growth ($4,800 annually -> $5,200 annually) . With oil in the low 40’s and other resource/materials companies hurting, I am watching the best names and waiting to deploy more capital. I’ve also taken some idle cash from our TFSA accounts and started a couple “speculative” energy positions.

June 2016 Dividend Income Update

| Account | Dividends/year |

| SM Portfolio | $5,359.99 |

| TFSA 1 | $1,726.20 |

| TFSA 2 | $2,072.05 |

| Non-Registered | $350 |

| Corporate Portfolio | $5,200.10 |

| RRSP 1 | $3,564.26 |

| RRSP 2 | $375.25 |

Total Dividends: $18,647.85/year (+5.78%)

If you are also interested in the dividend growth strategy, here are the Canadian dividend stocks with the longest history of dividend increases. With this list, you’ll get a general idea of the names that I’ve been adding to my corporate account.

We still have a long way to go, but we are, for the most part, moving in the right direction. I hope to cross the $20,000 annual dividend income this year. I have a substantial amount of cash to deploy in both my “non-registered” account and in my corporate portfolio. You may notice that RRSP 2 is also fairly minimal in dividends, that’s because that is my wife’s RRSP, and it is 100% indexed.

Wow, you have really come a long way. I have been reading your site for many many years and I’m impressed. Thank you for all you do in helping us beginners get started, even if it is a little bit later in life for some of us :)

Hi there,

I have been reading your website, and it’s very inspirational and useful! I am a newbie to investing. I have a similar goal to yourself, to be able to live off dividend income. I was wondering what your thoughts are regarding dividend reinvestment (DRIPs) vs. taking the dividends as they are paid. Which do you recommend, if you aren’t planning to live off the dividend income until you reach financial independence?

Thanks,

Joseph

Hi Joekrak,

I like the concept of DRIP, but only for registered accounts (RRSP and TFSA). The reason is simplification. In a non-registered account, you would need to keep track of your adjusted cost base for all your positions which changes every time you DRIP which can be a hassle (at least I think so). Personally though, I wait for cash to accumulate, then add to positions as I see fit, but I know many that prefer to DRIP.

Given that your dividend income looks like its growing exponentially, that shouldn’t be too hard to do. Awesome goal, pretty much the same as mine.

My initial goal is to reach $1M so that we can semi-retire and subsequently $1.5M which would be really enough for my family to retire fully.

It has been 2 years since you reached your $1M goal. Are you thinking of doing a post to show how much progress you have made during last 2 years?

BeSmartRich

How are dividends from an RRSP taxed? Are they considered “regular income” and taxed that way, or given the fact they are generated from an RRSP change things?

Also, how much of your current monthly income are you setting aside for dividend-earning investments. The path to $1.5M from what I calculate to be about $0.5M currently in investment value would be equivalent to an investment of thousands of dollars per week, given a return of 5% for the investment, over the 4 years until 2020… that’s a lot of money, or am I missing something?

Thanks.

Hi Duncan,

RRSP dividends are only taxed when you withdraw from your RRSP. Withdrawals from RRSP are taxed as income.

As you mentioned, I require quite a bit of capital to reach my goal. I do have a lot of cash ready to be deployed, but deploying as investment opportunities come up. I will provide an updated net worth update to provide some context. The intention is to invest cash on hand, re-invest dividends generated from portfolio, and invest savings generated.

I Was going to add that the yield seems super low sub 2%. with a million dollar portfolio an income of 40-60 thousand seems pretty reasonable.

As someone commented last time this update went out, it is beneficial to know what the cost base of the portfolio is and how it has performed so far. Gaining $18,000/yr is great but how has the portfolio done? If you’ve lost 30% so far, that may be more important than how much you are getting in dividends. Also, how big is this portofio? $18,000 on a $1M portfolio is not the same as $18,000 on a $500k portfolio.

Basically I would love to know what the yield is and how the portfolio has performed so I can see whether your strategy works for me. Thanks!

Hi, I have been following your posts since 2007/8. Congratulations on achieving your goal of 1Mil net worth. My question is regarding the current goal you have written about. I don’t know if you already mentioned this and I missed it (If so, my apologies) What would be your portfolio contribution to achieve the dividend income that you are hoping to achieve? I know it is a long term goal for you and you may not be able to give an accurate figure. But it will have to be a big one and I am curious.

Thanks!

Thanks for the feedback.

@ Bee, if I had a dividend yield of around 4%, I would need a portfolio size of around $1.5M to reach $60k/year in dividends.

@ christine, great ideas. I usually post performance numbers at the end of the year, but I will gather something. As you may have noticed, I’m more concerned about the income rather than capital appreciation. But if I had a longer time frame to retirement (65 etc), I would be more concerned with total return (dividends + capital). Right now, the overall portfolio (including all accounts) is yielding around 3.7%. I will include this statistic in the future posts.