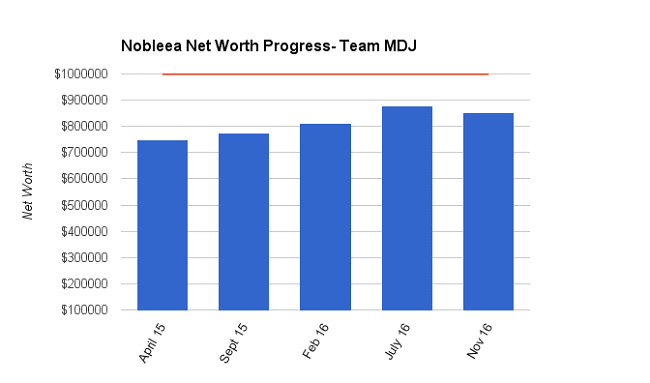

Net Worth Update Nov 2016 – Nobleea the Oil and Gas Engineer (-3.2%)

Welcome to the Million Dollar Journey November 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team member and will post net worth updates on a quarterly basis. Here is more about Nobleea.

- Name: nobleea

- Age: 38

- Net Worth: $850,844

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $130,000 (main job), $10,000 (part time job), $80,000 (wife main job), $5,000 (wife part time job)

- Goals: Million dollar family net worth before 40, Retirement from primary job at 50 (for me)

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe. We moved in to our new custom built house a few months ago and are just getting all the final bills cleared up now.

Our goals for 2016 are varied, but our financial ones include: contributing 30K to our TFSA; moving in to our new house and selling our old one for $475K or more; tracking utility consumption on the current and new house; and, tracking and reducing our monthly spend in a variety of categories. The end goal is to have a reasonable budget by the middle of the year. The TFSA is invested in a mix of 85% couch potato ETF’s and the remaining blue chip stocks. Looking at these goals, we have already completed the majority of them.

Since the last update, we’ve moved some of the TFSA money around. Part of it was contributed to an RRSP and part was used to pay the final house build bill which was more than we were expecting; though I understand that is par for the course for a custom build. Our final tally was about 14% higher than the original estimate and maybe 1 month behind the original scheduled. On the RRSP, we can expect a tax refund on the order of $16K next March.

One of our goals for the year was tracking utility consumption in our old and new house. There was a fair amount of design and construction modifications to make the new house more energy efficient. Our 5 year average consumption in our old house were Power 513kWh/month, Water 12m3/month, Natural Gas 6GJ/month. The average Edmonton household uses 600kWh/mo, 16m3/month water, and 10GJ/month so I was happy to see were were under those.

Our new house is significantly larger, but much better insulated, sealed, constructed, and designed with passive solar concepts in mind. I am hoping for a drop in our utility consumption. Three months in, it looks like we will certainly be dropping our water consumption. Power looks to be the same or marginally lower. Gas consumption is hard to tell as there’s been a lot of variation since the start. We’ll have a better picture by the time the next net worth update rolls around.

We are still on single furlough at work (10% reduction), but they’ve indicated it will end this year, so that will help offset the reinstatement of full CPP and EI deductions that starts in January. Our business is healthy and we have started hiring again.

The drop in the net worth for this update is almost exclusively due to the final bill for the house. Additionally, we booked a holiday to Hawaii for February, so flights and accommodations are paid for and that is not an insignificant amount.

We are still waiting for our second child to show up. He/she is due this week. Our daughter’s RESP is healthy and has a balance of about $11,650 though the value is not included below. It is invested in TD e-series. She is almost 3.

It looks like we will pass the Million dollar mark late next year (2017), which would be before my stated goal of age 40. In May 2009, when we started tracking net worth in earnest, the value was

$136,377.

Net worth numbers (Quarter/Quarter):

Assets: $1,623,264 (-11.78%)

- Cash: $5,781

- Registered/Retirement Investment Accounts (RRSP): $204,701 (+40%)

- Non-Registered Accounts: $65,000 (new)

- Tax Free Savings Accounts (TFSA): $0 (-100%)

- Defined Benefit Pension: $172,000 (+13.1%)

- Principal Residence: $1,130,000 (new)

- Vehicles/Other: $45,782 (-3.0%)

Liabilities: $772,420 (-19.6%)

- Mortgage: $760,500 (-18.7%)

- Credit Cards: $11,920 (-53%)

Total Net Worth: $850,844 (-3.2%)

- Started 2015 with Net Worth: $717,634

- Gain/Loss to Date: +18.5%

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. When not building a house, we use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills in to account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time.

Savings

TFSA’s will need to be replenished over the next 5 years.

Real Estate

We moved in to our new build in July and have been settling in. I still have to finish out the suite above the detached garage to get it ready for rental. The near/mid term plan is to do some spec infill in and around our neighbourhood. The non-registered account is considered seed money for this. It is something I have always wanted to do. I would need some more seed money to do it properly, or partner with a friend.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Nice work and congrats on the house. Fantastic to read you will be a millionaire the end of this yr and possible rental income and solar panels. How much are you bringing in with the panels? Seems like you are really looking into the numbers well. Like your journey although I’m reading it in the wrong order =)

I think that you’re doing great financially, but more importantly, you understand that money is just the means to achieve much more important goals.

(Not to be too critical, but I’m contrasting with the heavy saver who lives in his own basement and survives on kraft dinner.)

Not sure such a large mortgage was prudent. Especially in Alberta, the opportunity and cost of renting is SUBSTANTIALLY lower than owning. Invest the difference and you’re likely way ahead in the end. Unconventional I know but this housing obsession where young people are indebting themselves for the rest of their lives is nearing it’s end imo. Pick up a copy of “the wealthy renter” all the points are summed up in there.

You bring up two, unrelated comments. One is owning vs renting, the other is the size of the mortgage.

On owning vs renting it’s not really an option. We want to live centrally. We also want a house that is renovated with high efficiency features. There is almost nothing available centrally that would fit those requirements. 99% of rentals are leaky bungalows that the landlord does the bare minimum in terms of upkeep and maintenance.

The other discussion, at least for us, is that I love homes. I’ve been designing them for decades, well before I could drive. As a teenager, I was more likely to browse through show homes and home reno books than watch action movies. And this was before HGTV was a thing. So the large house (and mortgage) is related to a lifestyle/hobby decision.

I agree that a disciplined renter can make off handsomely by investing the difference. They just have to be prepared to get kicked out once in a while when the owner sells or redevelops (happens a lot in the core and tough with a family). Very few are disciplined enough to actually invest the difference. To boot, our current home would likely rent for between 3-4K. When you add in the rent we are going to net from our garage suite, there’s not much of a difference in renting.

Just curious,

Why don’t you move all the funds from the Non-Registered accounts into TFSA? You must have room to do this?

I was wondering the same thing. (Better yet, why not use that to pay off the credit cards, then move the remainder to the RRSP or TFSA?)

I was also wondering, do you plan on paying of the mortgage before you retire? It would require at least $70K worth of payments annually in order to do this. Given your income, that should be possible, but wouldn’t that make it difficult to save for retirement?

The non-registered funds are on hand for a potential spec infill opportunity. If nothing materializes in 2017, then it will go against the mortgage. I could certainly move it to the TFSA, but the savings are negligible since it’s just being held in easy to access HISA funds. Getting funds sold and out of the TFSA in to an accessible bank account takes just under 2 weeks at BMO Investorline.

We do not have a credit card balance. All cards are paid off in full every month and we pay no interest. One who does not include the actual debits on all their credit cards in a net worth statement is not being entirely honest with themselves since it is an active liability, even if it is not due yet.

Interesting comment about cc debt. I thought the exact opposite, you are misleading yourself by recording it. Small scale micro managing not adding value. With a high amount of cc debt, subtract it from an account that is paying the debt, or in your case pay it off before recording net worth. I am under the impression a 30 percent utilization rate or below is optimal for a credit score.

I think it’s just semantics whether it’s recorded directly as I’ve done, or indirectly, as you suggest. I find my way more convenient since there are several CCs all with different due dates, plus I include the actual debit on the CC’s at the date of NW calculation, not just the most recent statement amount. Yes, we are under 30% utilization rate on all the CC’s, though there was probably a couple months during house construction that we were well over that.

RE: mortgage payoff. At the moment, we plan on paying off the mortgage before my wife retires, but not before I retire. I can see a few scenarios where we manage to pay it off before I retire.

Great increase! With any luck for everyone in Alberta we’ll see the economy turn around a bit in 2017.

Clearly I can’t read, I saw the gain/loss to date. Missed the -3.2 in the title and brackets…